Is CCF Markets safe?

Business

License

Is CCF Markets Safe or a Scam?

Introduction

CCF Markets is a relatively new player in the forex trading arena, having been established in 2022. Operating primarily as an online trading platform, it claims to offer a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies. However, as with any trading platform, it is crucial for traders to conduct thorough due diligence before investing their hard-earned money. The forex market is rife with brokers that may not have the best interests of their clients at heart, making it essential for potential investors to assess the credibility and safety of any broker they consider. This article aims to evaluate whether CCF Markets is a safe trading option or if it raises red flags that could indicate a scam. Our analysis is based on a comprehensive review of available data, including regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. CCF Markets claims to be registered in St. Vincent and the Grenadines (SVG) and also states that it has a license from the U.S. Financial Crimes Enforcement Network (FinCEN). However, the lack of a solid regulatory framework in SVG raises concerns about the broker's legitimacy. The table below summarizes the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | St. Vincent | Not Verified |

The absence of a reputable regulatory body overseeing CCF Markets is alarming. Regulated brokers are required to adhere to strict compliance and transparency standards, which protect investors' funds and ensure fair trading practices. The lack of oversight means that CCF Markets is not held accountable to any financial authority, increasing the risk of potential fraud or mismanagement of client funds. Furthermore, there are numerous reports of clients facing difficulties in withdrawing their funds, which further compounds the concerns regarding CCF Markets' regulatory status. Thus, it is essential for traders to consider these factors carefully when evaluating the question, "Is CCF Markets safe?"

Company Background Investigation

CCF Markets was founded in 2022, and its ownership structure is somewhat opaque, with limited information available about its management team and operational history. Transparency is a vital aspect of any trading platform, as it allows traders to understand who is managing their funds and the experience they bring to the table. The lack of detailed information about CCF Markets management raises questions about its credibility.

The company claims to serve clients in over 170 countries, yet it does not provide clear insights into its operational history or the qualifications of its team members. This lack of transparency can be a significant warning sign for potential investors. A reputable broker typically provides information about its founders, management team, and the experience they bring to the trading environment. The absence of this information makes it difficult to assess whether CCF Markets is a trustworthy platform or if it is merely a facade for fraudulent activities.

Trading Conditions Analysis

When evaluating whether CCF Markets is safe, it is crucial to examine its trading conditions, including fees, spreads, and overall cost structure. CCF Markets claims to offer competitive trading conditions, but there are several concerns regarding its fee policies. The following table compares the core trading costs associated with CCF Markets against industry averages:

| Fee Type | CCF Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.5 - 1.5 pips |

| Commission Model | None | $3 - $7 per lot |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads and commissions is concerning. Typically, a reputable broker will provide clear information about its fee structure, allowing traders to make informed decisions. The absence of this information could indicate that CCF Markets may impose hidden fees or unfavorable trading conditions that could erode traders' profits. Furthermore, the absence of a demo account is another red flag, as it prevents potential clients from testing the platform before committing their funds. This lack of flexibility raises the question: "Is CCF Markets safe for new traders?"

Client Fund Safety

The safety of client funds should be a priority for any trading platform. CCF Markets claims to implement various security measures, but the lack of regulatory oversight raises significant concerns regarding the actual safety of client funds. The following aspects are crucial for evaluating fund safety:

Segregation of Funds: Regulated brokers are often required to keep client funds in segregated accounts, ensuring that they are not used for company operations. CCF Markets has not provided any information on whether it follows this practice.

Investor Protection: In many jurisdictions, regulated brokers are required to have investor protection measures in place, such as compensation schemes. CCF Markets does not appear to offer any such protections, leaving clients vulnerable in the event of financial issues.

Negative Balance Protection: This feature ensures that traders cannot lose more than their initial investment. There is no indication that CCF Markets provides this safeguard, which could lead to significant financial losses for traders.

Given these factors, it is difficult to conclude that CCF Markets offers a secure environment for trading. Historical reports of clients experiencing withdrawal issues further exacerbate these concerns. Thus, the question remains: "Is CCF Markets safe for your investments?"

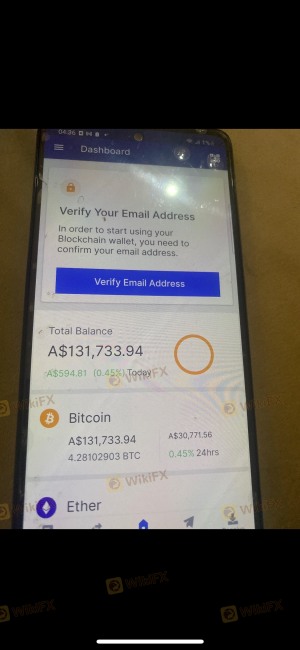

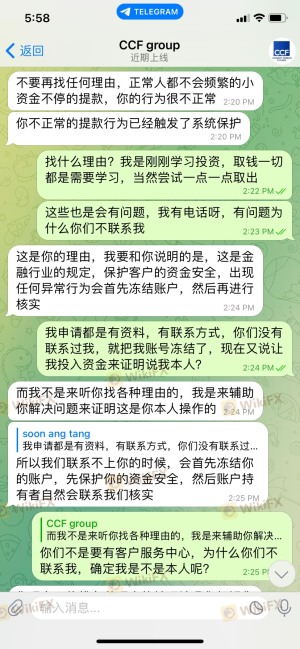

Customer Experience and Complaints

An essential aspect of evaluating a broker's credibility is analyzing customer feedback and complaints. Reviews of CCF Markets reveal a troubling trend, with numerous clients reporting significant issues, particularly regarding fund withdrawals. The following table summarizes the major complaint types along with their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Suspension | High | Poor |

| Lack of Communication | Medium | Poor |

Many users have reported that their accounts were suspended when they attempted to withdraw funds, with the company often citing vague reasons. This pattern indicates a lack of responsiveness from CCF Markets, which is a significant red flag for potential clients. For instance, one user reported that their account was frozen after they requested a withdrawal, leading them to suspect fraudulent activity. These experiences highlight a concerning trend that raises the question: "Is CCF Markets safe for traders?"

Platform and Trade Execution

The trading platform offered by CCF Markets is a critical component of the trading experience. The platform is said to support the popular MetaTrader 5 (MT5), which is known for its advanced features and user-friendly interface. However, user experiences indicate that the platform may not perform as expected. Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, the lack of transparency regarding the platforms operational stability raises concerns about potential manipulation or unfair trading practices. If a broker does not provide a reliable and efficient trading environment, it can lead to significant financial losses for traders. Therefore, it is essential to ask: "Is CCF Markets safe for executing trades?"

Risk Assessment

When considering whether to engage with CCF Markets, it is crucial to evaluate the inherent risks involved. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Fund Safety Risk | High | Lack of protection for client funds |

| Operational Risk | Medium | Reports of withdrawal difficulties |

| Customer Service Risk | High | Poor response to complaints |

Given these risk factors, it is clear that engaging with CCF Markets carries significant risks. To mitigate these risks, traders should conduct thorough research and consider alternative, well-regulated brokers that offer better protection and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that CCF Markets is not a safe trading option. The lack of regulation, transparency issues, and numerous complaints regarding fund withdrawals raise significant red flags. As such, potential traders should exercise extreme caution when considering this broker.

For those seeking reliable alternatives, it is advisable to explore well-regulated brokers that offer robust investor protections and transparent trading conditions. Some recommended options include brokers regulated by reputable authorities like the FCA, ASIC, or CySEC, which provide a safer trading environment.

Ultimately, the question remains: "Is CCF Markets safe?" Based on the analysis presented, it appears that caution is warranted, and traders should look for more secure and transparent options in the forex market.

Is CCF Markets a scam, or is it legit?

The latest exposure and evaluation content of CCF Markets brokers.

CCF Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CCF Markets latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.