Is Cboe Digital safe?

Pros

Cons

Is Cboe Digital A Scam?

Introduction

Cboe Digital is a cryptocurrency exchange and clearinghouse that aims to provide a regulated environment for trading digital assets. As part of the Cboe Global Markets, it offers a platform for spot and futures trading, leveraging the company's extensive experience in traditional financial markets. Given the volatile nature of the forex and cryptocurrency markets, traders must exercise caution when selecting a broker. This article examines the legitimacy of Cboe Digital by analyzing its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The findings are based on a thorough review of available online resources and user feedback.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of traders' funds and maintaining market integrity. Cboe Digital claims to be regulated by the Commodity Futures Trading Commission (CFTC). However, several reviews indicate that it lacks valid regulatory oversight for forex trading, raising concerns about the safety of investor funds. The following table summarizes the core regulatory information for Cboe Digital:

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| CFTC | Not Applicable | United States | Unverified |

The absence of a valid regulatory license is a significant red flag. Regulatory bodies like the CFTC are responsible for enforcing compliance and protecting traders from fraudulent practices. Cboe Digital's claims of regulation appear unsubstantiated, leading to questions about its operational legitimacy. Moreover, the lack of transparency in its regulatory status suggests a potential risk for traders, making it essential to investigate further before committing any funds.

Company Background Investigation

Cboe Digital was established as a subsidiary of Cboe Global Markets, which has a long-standing reputation in the financial sector. The company transitioned from ErisX to Cboe Digital following its acquisition by Cboe in 2021. The management team consists of experienced professionals with backgrounds in finance and technology, which theoretically supports the company's credibility. However, the lack of detailed information about the company's ownership structure and operational transparency raises concerns.

Cboe Digital's commitment to transparency is questionable, as it does not provide comprehensive information about its operations or the identities of its key personnel. This lack of clarity can lead to mistrust among potential users. Furthermore, the absence of a clear history of compliance with regulatory requirements increases the skepticism surrounding its legitimacy. Therefore, understanding the company's operational framework and management is vital when assessing whether Cboe Digital is safe or a potential scam.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. Cboe Digital's fee structure is reportedly competitive, but the specifics can vary significantly. The following table outlines the core trading costs associated with Cboe Digital:

| Fee Type | Cboe Digital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Varies | 1-2 pips |

| Commission Structure | Not specified | Typically low |

| Overnight Interest Rates | Varies | 2-5% |

While Cboe Digital claims to offer competitive spreads, the lack of detailed information regarding commissions and overnight interest raises concerns. Traders should be wary of hidden fees that might not be immediately apparent. Moreover, the absence of clarity in the fee structure could lead to unexpected costs, making it essential for traders to read the fine print before engaging with the platform.

Customer Funds Safety

The safety of customer funds is paramount in the trading environment. Cboe Digital asserts that it implements robust security measures, including the segregation of client assets from its operational funds. However, the effectiveness of these measures is questionable given the lack of regulatory oversight. The following points summarize the key aspects of Cboe Digital's customer funds safety:

- Asset Segregation: Cboe Digital claims to keep client funds separate from its own, which is a standard practice among reputable brokers.

- Investor Protection: There is no clear information on whether Cboe Digital offers any form of investor protection or compensation schemes.

- Negative Balance Protection: The platform does not appear to provide negative balance protection, which could expose traders to significant losses.

The absence of a history of fund security incidents is a positive aspect, but it does not guarantee future safety. Traders should remain vigilant and consider the potential risks associated with using Cboe Digital, particularly in light of its unverified regulatory status.

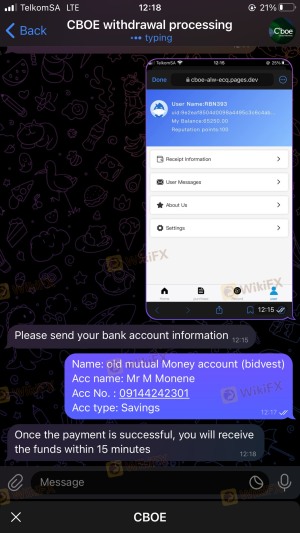

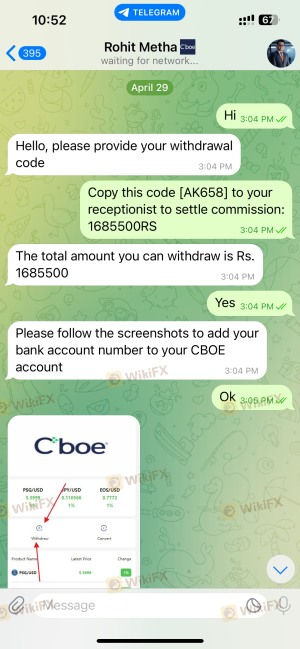

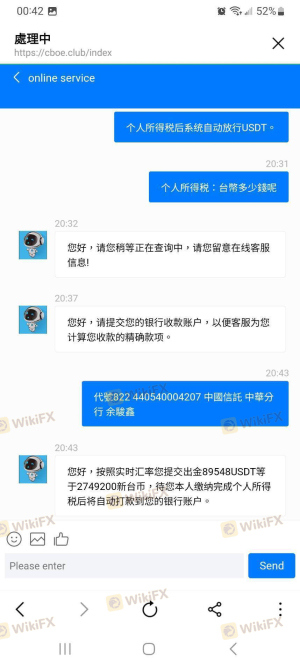

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the reliability of a trading platform. Cboe Digital has received mixed reviews from users, with several complaints highlighting issues such as withdrawal delays and poor customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Lack of Customer Support | Medium | Inconsistent |

| Transparency Issues | High | Minimal information |

Common complaints include difficulties in withdrawing funds, which is a significant concern for traders. The slow response time from customer support exacerbates these issues, leading to frustration among users. While some users report satisfactory experiences, the overall sentiment leans towards caution. A few case studies reveal instances where traders faced significant challenges in retrieving their funds, raising questions about the platform's reliability and safety.

Platform and Execution

The performance and reliability of a trading platform are critical for user satisfaction. Cboe Digital's platform is designed to facilitate efficient trading, but user experiences suggest a mixed execution quality. Reports of slippage and order rejections have surfaced, indicating potential issues in the trading environment. Factors to consider include:

- Platform Stability: Users have reported occasional downtime, which can hinder trading activities.

- Order Execution Quality: Slippage has been noted, particularly during high volatility periods, affecting trade profitability.

- Manipulation Concerns: While no substantial evidence of manipulation has been found, the lack of transparency raises suspicions.

The platform's overall performance appears to be adequate, but traders should be aware of potential execution issues that could impact their trading experience.

Risk Assessment

Using Cboe Digital involves various risks that traders must consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of verified oversight |

| Financial Risk | Medium | Potential hidden fees |

| Operational Risk | Medium | Platform stability issues |

Traders should implement risk management strategies, such as starting with smaller investments and testing withdrawal processes before committing larger sums. Additionally, conducting thorough research and remaining updated on market conditions can help mitigate potential risks associated with trading on Cboe Digital.

Conclusion and Recommendations

Based on the analysis presented, it is evident that Cboe Digital raises several red flags regarding its legitimacy and safety. The lack of verified regulatory oversight, combined with customer complaints about withdrawal issues and inadequate support, suggests that traders should exercise caution. While Cboe Digital has the potential to provide a reliable trading experience, the current evidence points towards a higher risk profile.

For traders considering engaging with Cboe Digital, it is advisable to start with minimal investments and remain vigilant about the platform's operational practices. If you are looking for alternatives, consider brokers that are well-regulated and have a proven track record of customer satisfaction. Options such as Forex.com, IG, or OANDA may provide a safer trading environment with more robust customer support and clearer regulatory oversight. Always prioritize security and transparency when choosing a trading platform, as these factors are crucial for a successful trading experience.

Is Cboe Digital a scam, or is it legit?

The latest exposure and evaluation content of Cboe Digital brokers.

Cboe Digital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cboe Digital latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.