Regarding the legitimacy of BYFX HK forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is BYFX HK safe?

Business

License

Is BYFX HK markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

SBI FX Co., Limited

Effective Date:

2016-07-21Email Address of Licensed Institution:

cs@sbifx.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.sbifx.com.hkExpiration Time:

--Address of Licensed Institution:

香港尖沙咀海港城港威大廈第6座27樓02-04室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is BYFX HK Safe or Scam?

Introduction

BYFX HK, a subsidiary of the Japanese SBI Group, positions itself as a provider of liquidity management solutions and online trading services in the foreign exchange (forex) market. Established in 2015, it has made strides in catering to both institutional clients and retail traders. However, the forex market is fraught with risks, and traders must exercise caution when evaluating brokers. This is particularly true in an industry where fraudulent practices can lead to significant financial losses.

This article aims to provide a comprehensive analysis of BYFX HK, focusing on its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment. The information is gathered from multiple credible sources, including regulatory filings, customer reviews, and industry reports, ensuring an objective and thorough evaluation of whether BYFX HK is safe or potentially a scam.

Regulatory and Legitimacy

The regulatory environment in which a broker operates is crucial for determining its legitimacy and trustworthiness. BYFX HK claims to be regulated by the Hong Kong Securities and Futures Commission (SFC), which is known for its stringent regulatory standards. The importance of regulation cannot be overstated, as it serves as a safeguard for investors against fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | BHK 360 | Hong Kong | Verified |

Despite its claims of regulation, there are concerns about the quality of oversight provided by the SFC. Some sources have raised red flags about the broker's operational practices, suggesting that its regulatory status may not fully protect traders. Additionally, the broker has faced scrutiny regarding its compliance history, with some reports indicating a lack of transparency in its operations. Traders should be aware of these factors when considering whether BYFX HK is safe for their investments.

Company Background Investigation

BYFX HK was founded in 2015 and is a subsidiary of SBI Holdings, a well-established financial conglomerate in Japan. The parent company has a solid reputation in the fintech space, which could lend some credibility to BYFX HK. However, the operational history of BYFX HK itself is relatively short, and there are concerns regarding its transparency and disclosure of ownership structures.

The management team of BYFX HK consists of professionals with experience in finance and trading, but detailed information about their backgrounds is limited. This lack of transparency raises questions about the broker's accountability and governance. Investors should consider whether the management team has the necessary expertise to navigate the complexities of the forex market effectively.

In terms of information disclosure, BYFX HK has been criticized for not providing sufficient details about its operations, which can be a red flag for potential investors. The absence of clear communication can create a sense of uncertainty, making it essential for traders to conduct their due diligence before engaging with this broker.

Trading Conditions Analysis

When assessing a broker's trading conditions, it's essential to evaluate its fee structure, spreads, and overall trading environment. BYFX HK offers a range of trading instruments, including forex pairs, commodities, and indices. However, the overall fee structure is not entirely transparent, which is a potential concern for traders.

| Fee Type | BYFX HK | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1-2 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The lack of clarity regarding spreads and commissions can lead to unexpected costs for traders, which is particularly concerning in a market where profit margins can be razor-thin. Additionally, any unusual fees or withdrawal conditions should be scrutinized, as these can often signal potential issues with a broker's practices.

Client Funds Safety

The safety of client funds is a critical aspect of evaluating whether BYFX HK is safe. The broker claims to implement various security measures, including segregated accounts for client funds. This is a standard practice among reputable brokers, as it helps protect clients' investments in the event of the broker's insolvency.

However, there is limited information available regarding investor protection schemes or negative balance protection policies. The absence of such safeguards can expose traders to significant risks, especially during volatile market conditions. Historical issues related to fund security have also been reported, further raising concerns about the broker's reliability.

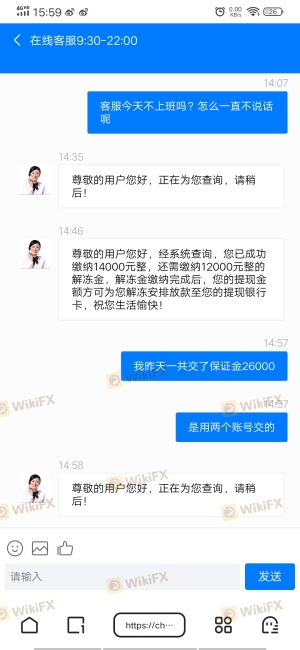

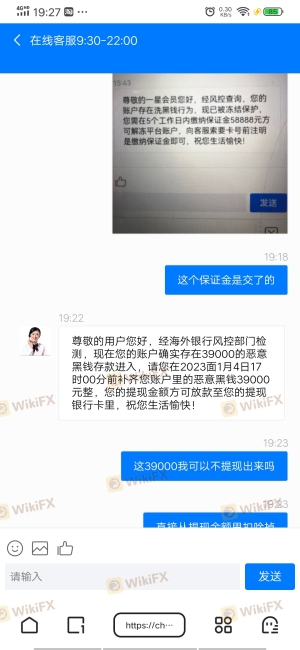

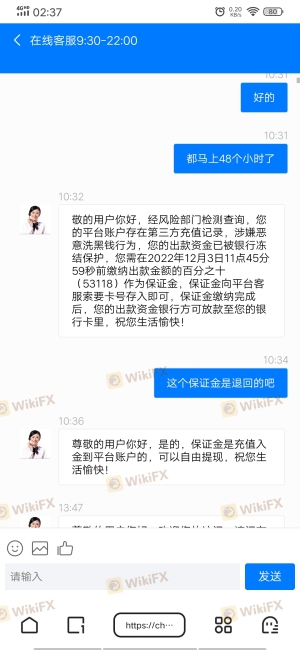

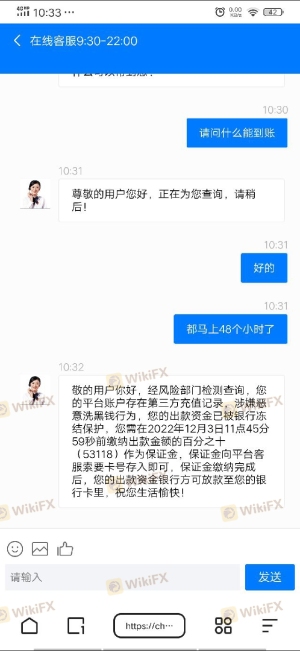

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of BYFX HK, there have been numerous complaints related to withdrawal difficulties, lack of responsiveness from customer service, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Quality | Medium | Poor Communication |

| Account Management | High | Unresolved Issues |

Several users have reported being unable to withdraw their funds, which is a significant red flag. In some cases, clients have alleged that they were pressured into making additional deposits before being allowed to withdraw their original investments. This pattern of complaints raises serious concerns about whether BYFX HK is safe for traders looking to invest their money.

Platform and Trade Execution

The trading platform provided by BYFX HK is a crucial element of the trading experience. Traders expect a stable and efficient platform that allows for seamless execution of trades. However, user reviews indicate varying experiences regarding platform performance, with some users reporting issues related to slippage and order rejections.

The quality of order execution is another critical aspect to consider. Traders have reported instances of significant slippage during volatile market conditions, which can lead to unexpected losses. Additionally, any signs of potential platform manipulation should be closely monitored, as this can severely impact a trader's experience.

Risk Assessment

Using BYFX HK involves several risks that traders should be aware of before committing their funds. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Potential lack of oversight and compliance issues. |

| Fund Security Risk | Medium | Limited information on investor protection and fund segregation. |

| Customer Service Risk | High | Numerous complaints regarding withdrawal difficulties and poor responsiveness. |

To mitigate these risks, traders should consider diversifying their investments across multiple brokers and conducting thorough research before making any commitments.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should exercise caution when considering BYFX HK as a trading option. While the broker has some elements of legitimacy, such as its affiliation with the SBI Group, the numerous complaints and concerns about its operational practices raise significant red flags.

Traders should be particularly wary of withdrawal issues and the lack of transparency regarding fees and fund security measures. For those seeking safer alternatives, it may be prudent to explore brokers with a strong regulatory track record, transparent fee structures, and positive customer feedback.

In summary, while BYFX HK may offer some trading opportunities, the potential risks associated with this broker suggest that it may not be the safest choice for all traders.

Is BYFX HK a scam, or is it legit?

The latest exposure and evaluation content of BYFX HK brokers.

BYFX HK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BYFX HK latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.