BS Review 1

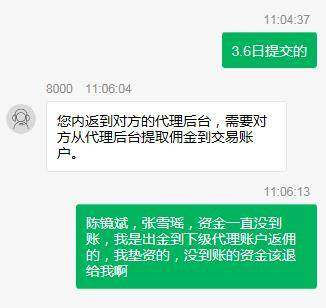

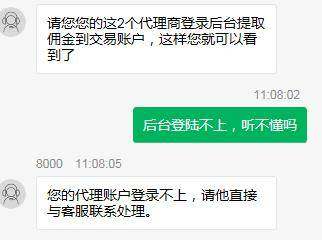

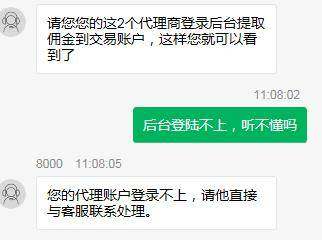

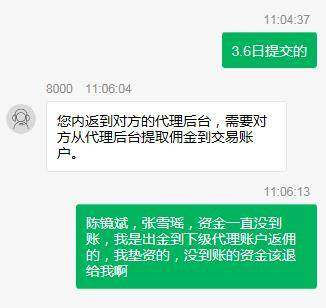

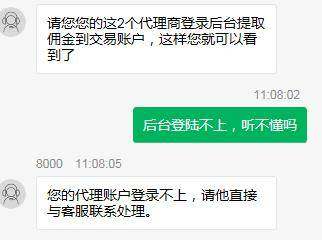

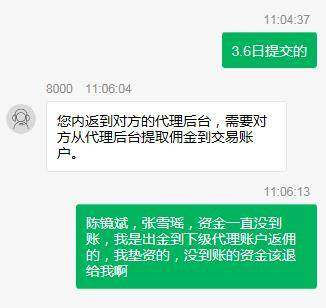

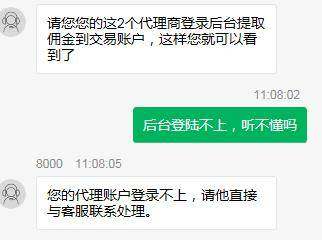

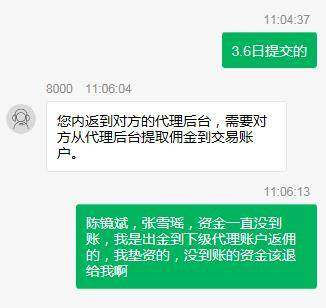

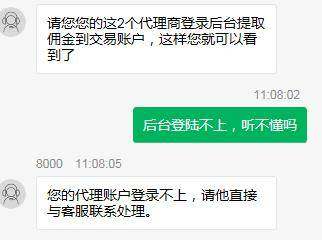

The withdrawal is unavailable for one month. The customer service keeps holding off.

BS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

The withdrawal is unavailable for one month. The customer service keeps holding off.

BS Trading is an online forex broker. The company offers investment opportunities in FX pairs and CFDs, including some cryptocurrencies that traders can access through their platform. This bs review shows a mixed picture of a broker that works under the Vanuatu Financial Services Commission, which creates concerns about regulatory standards compared to top-tier jurisdictions.

The broker has two main features that stand out. First, it requires only a $1 minimum deposit, and second, it provides access to over 50 trading assets across different categories. BS Trading focuses on new traders and investors who want easy entry into forex markets. However, users have raised concerns about the broker's reliability and service quality.

The company offers tight spreads and high leverage options. This makes it attractive for traders who want cost-effective trading conditions. Yet, the VFSC regulatory framework and mixed user feedback suggest that potential clients should be careful and research thoroughly before investing money. This evaluation provides a complete analysis of BS Trading's offerings, limitations, and suitability for different types of traders.

Regional Entity Differences: BS Trading operates in Vanuatu through the Vanuatu Financial Services Commission. This regulatory environment is less strict compared to major financial centers like the UK, US, or Australia. Traders should know that VFSC regulation may offer different levels of client protection and dispute resolution compared to more established regulatory bodies.

Review Methodology: This assessment uses publicly available information, regulatory filings, and user feedback from various sources. Given the limited transparency of some operational aspects, certain evaluations are based on industry standards and comparison with similar brokers in the market.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 8/10 | Exceptional $1 minimum deposit and high leverage options |

| Tools and Resources | 6/10 | Basic offering with limited platform information available |

| Customer Service | 5/10 | User feedback indicates concerns about service quality |

| Trading Experience | 6/10 | Tight spreads offered but platform stability unclear |

| Trust and Reliability | 4/10 | VFSC regulation presents lower-tier oversight concerns |

| User Experience | 5/10 | Mixed user feedback with notable quality concerns |

BS Trading is an online forex broker based in Vanuatu. The company focuses on providing accessible trading opportunities for retail investors through their platform. The company's business model centers around offering forex trading and CFD services with an emphasis on low-barrier entry requirements. While specific founding details are not clearly documented in available materials, the broker has positioned itself as a platform for traders seeking cost-effective market access.

The regulatory framework under the Vanuatu Financial Services Commission represents a key characteristic of BS Trading's operational structure. This jurisdiction is known for more relaxed regulatory requirements compared to major financial centers, which can present both opportunities and risks for traders who choose to work with them. BS Trading offers investment options across multiple asset classes, though the depth and quality of these offerings require careful examination.

BS Trading provides access to over 50 different trading instruments. These include forex pairs, CFDs, spot metals, indices, and select cryptocurrencies that traders can access through their platform. The broker's approach targets newer traders through its minimal deposit requirements and simplified account structures. However, this bs review notes that specific details about trading platforms, advanced features, and comprehensive service offerings remain limited in publicly available documentation.

Regulatory Status: BS Trading operates under the oversight of the Vanuatu Financial Services Commission. This regulatory body provides a more permissive framework compared to tier-one regulators, which may impact client protection standards and dispute resolution processes.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in current available materials. Prospective traders should verify supported payment systems and associated processing times directly with the broker before opening an account.

Minimum Deposit Requirements: The broker offers an exceptionally low minimum deposit of $1. This makes it accessible for traders with limited initial capital or those testing the platform's services.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available documentation. Traders interested in incentive programs should inquire directly about current offers and their terms with the broker.

Tradeable Assets: BS Trading provides access to forex pairs, CFDs, spot metals, indices, and select cryptocurrencies. The platform totals over 50 trading instruments across these categories.

Cost Structure: The broker advertises tight spreads as a key feature. However, specific spread ranges and commission structures are not detailed in available materials. Additional costs such as overnight fees, withdrawal charges, and inactivity fees require direct verification with the broker.

Leverage Options: High leverage options are available through the platform. However, specific ratios and their application across different asset classes are not clearly specified in current materials.

Platform Selection: Trading platform information is not comprehensively detailed in available sources. This requires direct inquiry with the broker for platform specifications and features.

Geographic Restrictions: Specific regional limitations and restricted territories are not outlined in current documentation. Traders should verify their eligibility before attempting to open an account.

Customer Support Languages: Available support languages are not specified in accessible materials. International traders should confirm language support before proceeding with account registration.

BS Trading's account structure centers around accessibility. The $1 minimum deposit represents one of the lowest entry barriers in the forex industry. This approach clearly targets novice traders and those seeking to test trading strategies with minimal financial commitment. However, this bs review notes that specific account types and their distinct features are not clearly outlined in available documentation.

The low minimum deposit requirement raises questions about the broker's business model sustainability and service quality standards. Industry experience suggests that brokers with extremely low deposit requirements may compensate through other fee structures or may have limitations in service quality. The absence of detailed information about account tiers, special features, or premium services makes it difficult to assess the complete value proposition.

User feedback indicates concerns about overall service quality. This may impact the account opening and management experience for new and existing clients. Prospective traders should carefully consider whether the low deposit requirement aligns with adequate service standards and platform functionality. The lack of information about Islamic accounts, professional trading accounts, or institutional services suggests a basic account structure that may not accommodate diverse trading needs.

Account verification and onboarding processes are not detailed in available materials. This makes it important for potential clients to understand these requirements before initiating the registration process.

The trading tools and resources offered by BS Trading appear limited based on available information. While the broker provides access to multiple asset classes, specific details about analytical tools, charting capabilities, and research resources are not comprehensively documented. This limitation makes it challenging to assess the platform's suitability for traders requiring advanced technical analysis or market research capabilities.

Educational resources are crucial for the novice trader demographic that BS Trading appears to target. However, these resources are not detailed in current materials. The absence of information about webinars, tutorials, trading guides, or market analysis suggests either limited educational support or poor documentation of available resources. For a broker targeting new traders with a $1 minimum deposit, comprehensive educational materials would be expected.

Automated trading support, expert advisors, and algorithmic trading capabilities are not mentioned in available documentation. This may indicate limited platform sophistication or simply inadequate information disclosure. Advanced traders seeking automated strategies or sophisticated trading tools may find the offering insufficient for their needs.

User feedback suggests concerns about the overall quality of tools and resources. However, specific deficiencies are not clearly articulated in available reviews. The lack of detailed platform information makes it difficult to verify the actual capabilities and limitations of the trading environment.

Customer service quality emerges as a significant concern in this evaluation. User feedback indicates questions and doubts about BS Trading's service standards, though specific incidents or systematic issues are not detailed in available materials. The absence of clear information about customer support channels, response times, and service quality metrics raises red flags for potential clients.

Support channel availability is not specified in current documentation. This leaves uncertainty about whether traders can access help through phone, email, live chat, or other communication methods. For a broker targeting novice traders, comprehensive and responsive customer support would be essential for addressing questions and resolving issues promptly.

Multilingual support capabilities are not documented in available materials. This may limit accessibility for international traders who require assistance in their native language. Given the global nature of forex trading and the broker's online presence, language support limitations could significantly impact user experience for non-English speaking clients.

The regulatory environment under VFSC may also impact dispute resolution and customer protection mechanisms. Traders should understand that customer service standards and regulatory recourse may differ significantly from those available with brokers under more stringent regulatory oversight.

Operating hours and geographic coverage of customer support services are not specified in current documentation. This makes it difficult for traders to understand when assistance will be available, particularly important for global markets that operate across multiple time zones.

The trading experience with BS Trading presents a mixed picture based on available information. While the broker advertises tight spreads as a key feature, comprehensive details about execution quality, platform stability, and overall trading conditions are not thoroughly documented. This bs review finds that critical aspects of the trading experience require further verification from potential users.

Platform stability and execution speed are fundamental to successful trading. However, specific performance metrics or user experience data are not available in current materials. The absence of information about slippage rates, requotes, or execution statistics makes it difficult to assess the actual trading conditions traders can expect.

Order execution quality depends heavily on the broker's technology infrastructure and liquidity arrangements. These technical aspects are not detailed in available documentation. For active traders, particularly those using scalping or high-frequency strategies, execution quality becomes crucial for profitability.

Mobile trading capabilities and platform accessibility across different devices are not specified in current materials. This may impact traders who require flexibility in their trading approach. Modern traders often expect seamless experiences across desktop and mobile platforms.

User feedback suggests concerns about the overall trading experience with BS Trading. However, specific issues such as platform downtime, execution problems, or technical difficulties are not clearly documented. The regulatory environment under VFSC may also impact the standards and oversight of trading conditions.

Trust and reliability represent significant concerns in this evaluation of BS Trading. The broker operates under the Vanuatu Financial Services Commission, which provides a regulatory framework that is considerably less stringent than major financial regulatory bodies such as the FCA, SEC, or ASIC. This regulatory environment may offer limited client protection and recourse mechanisms compared to more established jurisdictions.

Fund safety measures and client money protection protocols are not detailed in available materials. The absence of information about segregated accounts, deposit insurance, or compensation schemes raises concerns about client fund security. Traders should understand that VFSC regulation may not provide the same level of financial protection as tier-one regulatory bodies.

Company transparency appears limited throughout their operations. Minimal information is available about management, financial statements, or corporate structure. This lack of transparency makes it difficult for potential clients to assess the broker's financial stability and operational integrity. Established brokers typically provide comprehensive information about their corporate background and financial standing.

User feedback indicates concerns and skepticism about BS Trading's reliability. However, specific incidents or systematic issues are not detailed in available reviews. The combination of limited regulatory oversight, minimal transparency, and user concerns creates a challenging trust environment for potential clients.

Industry reputation and third-party assessments are not readily available for verification. This makes it difficult to verify the broker's standing within the forex industry or among professional trading communities.

User experience with BS Trading appears to be a significant concern based on available feedback and documentation. While the broker targets novice traders through its low minimum deposit requirement, user reviews suggest that the overall experience may not meet expectations for quality and reliability. The platform's user interface and ease of navigation are not detailed in available materials, making it difficult to assess whether the broker provides an intuitive experience for its target demographic of new traders.

Registration and account verification processes are not comprehensively documented in current materials. However, the simplicity suggested by the low deposit requirement may indicate streamlined onboarding. Regulatory compliance requirements under VFSC should still necessitate proper identity verification and documentation procedures.

Funding and withdrawal experiences are not detailed in current materials available for review. These processes significantly impact overall user satisfaction. The absence of information about processing times, fees, and available methods makes it difficult to assess this crucial aspect of the user experience.

User feedback compilation reveals concerns about BS Trading's services. However, specific complaints or systematic issues are not clearly articulated in available reviews. The pattern of user skepticism suggests potential problems with service delivery, platform functionality, or customer support quality that prospective traders should carefully consider.

BS Trading presents a mixed proposition in the forex broker landscape. The exceptionally low $1 minimum deposit and access to over 50 trading assets may appeal to novice traders and those seeking low-barrier market entry. However, significant concerns about regulatory oversight, service quality, and user satisfaction create substantial reservations about recommending this broker.

The regulatory framework under the Vanuatu Financial Services Commission provides less stringent oversight compared to major financial centers. This potentially impacts client protection and dispute resolution capabilities. Combined with user feedback indicating concerns about service quality and limited transparency about operational details, BS Trading appears suitable primarily for traders willing to accept higher risks in exchange for low entry requirements.

This bs review suggests that BS Trading may serve as an entry point for new traders testing forex markets with minimal capital. However, serious traders should carefully consider the limitations in regulatory protection, service quality concerns, and limited transparency before committing significant funds to this platform.

FX Broker Capital Trading Markets Review