Is BrokerXP safe?

Business

License

Is BrokerXP Safe or Scam?

Introduction

BrokerXP is an online forex and CFD trading platform that has emerged in the crowded landscape of the financial markets. Established in 2018, it has positioned itself as a potential option for traders looking for a diverse range of trading instruments. However, as with any trading platform, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and safety of the broker before committing their funds. In this article, we will investigate whether BrokerXP is safe or a scam by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our investigation is based on a comprehensive review of multiple sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its safety. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards to protect clients' interests. Unfortunately, BrokerXP operates without any regulation from recognized financial authorities.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation means that BrokerXP does not have to comply with any stringent operational standards or investor protection measures. This raises significant concerns about the safety of funds and the overall credibility of the broker. Unregulated brokers are often associated with higher risks, including the potential for fraudulent practices, lack of transparency, and difficulties in fund recovery. Given its unregulated status, it is advisable for potential traders to approach BrokerXP with caution.

Company Background Investigation

Understanding the company's background is essential when assessing its credibility. BrokerXP is operated by a firm known as Mergers and Acquisitions Consultancy LP, based in Edinburgh, Scotland. However, there is little publicly available information about the ownership structure or the management team behind BrokerXP. This lack of transparency can be a red flag for potential investors.

The company's history is relatively short, having been established in 2018. While a longer operational history can often provide some assurance of stability, the absence of regulatory oversight and the limited information available about the company's management team raises concerns about its legitimacy. Furthermore, the lack of clear disclosures regarding the company's operations and ownership further complicates the assessment of BrokerXP's trustworthiness.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly impact the overall trading experience. BrokerXP has set a minimum deposit requirement of $500, which is relatively high compared to many other brokers that allow traders to start with as little as $100.

Core Trading Costs Comparison Table

| Cost Type | BrokerXP | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1.1 - 1.5 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The spreads offered by BrokerXP are notably higher than the industry average, which could erode potential profits for traders. High spreads can be a disadvantage, especially for those who engage in frequent trading. Additionally, the lack of a clear commission structure may lead to confusion regarding the overall cost of trading. Such pricing policies can be indicative of a broker that may not prioritize transparency and fairness in its dealings.

Client Fund Safety

The safety of client funds is paramount when trading online, and BrokerXP's approach to fund security raises several concerns. The absence of regulatory oversight means that there is no requirement for the broker to maintain segregated accounts for client funds. This lack of segregation puts clients at risk, as their funds could be used for other purposes by the broker.

Furthermore, BrokerXP does not appear to offer any investor protection measures, such as compensation schemes or negative balance protection. In the event of financial difficulties or disputes, traders may find it challenging to recover their funds. The combination of these factors raises significant concerns about the safety of funds deposited with BrokerXP.

Customer Experience and Complaints

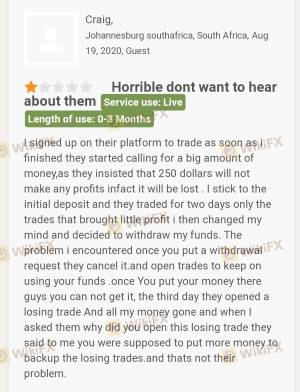

Customer feedback is a vital indicator of a broker's reliability and service quality. A review of user experiences with BrokerXP reveals a mixed picture, with several complaints regarding withdrawal issues and customer service responsiveness.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Denials | High | Poor |

| Lack of Customer Support | Medium | Fair |

Many users have reported difficulties in withdrawing their funds, with claims that the broker provides vague or false reasons for the delays. Such complaints are serious and suggest potential issues with the broker's operational integrity. Furthermore, the overall customer service experience appears to be lacking, with reports of slow response times and inadequate support for traders facing issues.

Platform and Trade Execution

The trading platform is another critical aspect to consider when evaluating a broker. BrokerXP offers the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and robust trading features. However, the performance and reliability of the platform are essential for a positive trading experience.

Users have reported varying experiences with order execution quality, including instances of slippage and order rejections. These issues can significantly impact trading outcomes, particularly for those engaged in high-frequency trading strategies. Furthermore, the absence of a demo account limits traders' ability to test the platform before committing real funds, which is another potential drawback.

Risk Assessment

Using BrokerXP presents several risks that potential traders should be aware of. The lack of regulation, high trading costs, and customer complaints all contribute to a heightened risk profile.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation means higher risk of fraud. |

| Financial Risk | Medium | High spreads can erode profits. |

| Operational Risk | High | Customer complaints about withdrawals. |

To mitigate these risks, potential traders should consider using well-regulated brokers with established reputations, lower trading costs, and strong customer support. Researching user reviews and regulatory compliance is crucial before making any financial commitments.

Conclusion and Recommendations

In conclusion, the evidence suggests that BrokerXP may not be a safe choice for traders. The lack of regulation, high trading costs, and numerous customer complaints raise significant red flags. While some users have reported positive experiences, the overall risk profile of BrokerXP indicates that potential traders should proceed with caution.

For those seeking reliable trading options, it is advisable to explore brokers that are regulated by reputable authorities, such as the FCA or ASIC, which offer better protection for clients' funds and a more transparent trading environment. Given the potential risks associated with BrokerXP, it may be wise to consider alternative brokers that prioritize safety and regulatory compliance.

In summary, while BrokerXP may offer appealing features, the risks involved suggest it is prudent to ask, "Is BrokerXP safe?" and to seek safer alternatives in the forex trading landscape.

Is BrokerXP a scam, or is it legit?

The latest exposure and evaluation content of BrokerXP brokers.

BrokerXP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BrokerXP latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.