Is BOP GLOBAL safe?

Business

License

Is BOP Global A Scam?

Introduction

BOP Global is a forex broker that has garnered attention in the trading community, positioning itself as a platform for both novice and experienced traders. However, with the rise of online trading, the need for traders to carefully assess the legitimacy of forex brokers has become increasingly crucial. The forex market is rife with scams, and choosing an unregulated or dubious broker can lead to significant financial losses. In this article, we will investigate the safety and reliability of BOP Global by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our evaluation will be based on a comprehensive analysis of available data, user reviews, and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy. BOP Global claims to operate under certain licenses; however, the details surrounding these licenses raise concerns. The absence of clear regulatory oversight from recognized authorities significantly undermines the broker's credibility.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

BOP Global does not appear to be regulated by any top-tier financial authority, which is a red flag for potential investors. Without proper regulation, there is little to no oversight of the broker's operations, increasing the risk of fraud. Regulatory quality is essential, as it ensures that brokers adhere to strict standards designed to protect traders. The lack of a regulatory framework means that BOP Global may not have the necessary safeguards in place to protect client funds or ensure fair trading practices.

Company Background Investigation

BOP Global's company history and ownership structure reveal a lack of transparency, which is concerning for potential clients. Established relatively recently, the broker has not built a long-standing reputation in the forex market. The absence of detailed information regarding its management team further complicates the assessment of its reliability. A reputable broker typically provides information about its founders and key personnel, showcasing their experience and qualifications in the financial industry.

Moreover, the companys transparency regarding its operations and financial disclosures is minimal. This lack of information can be indicative of underlying issues, as legitimate brokers are usually open about their business practices and provide comprehensive details about their operations. A broker's transparency is crucial, as it builds trust and assures clients that their funds are managed responsibly.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer are a critical aspect. BOP Global's fee structure and trading conditions have been scrutinized, with several users reporting unexpected fees that were not clearly disclosed. Such practices can be detrimental to traders, especially those who are new to the market and may not be aware of the typical costs associated with trading.

| Fee Type | BOP Global | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Structure | Unclear | Clear |

| Overnight Interest Range | High | Average |

The table above highlights that BOP Global's spreads on major currency pairs are significantly higher than industry averages, which could erode traders' profits. Additionally, the lack of clarity regarding their commission structure raises concerns about hidden fees that could impact trading profitability. High trading costs can deter traders, especially those with smaller accounts or those who engage in frequent trading.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. BOP Global's measures regarding fund security are unclear, as there is limited information available on how they handle client funds. A reputable broker typically segregates client funds from its operational funds and offers investor protection measures. However, without clear policies in place, traders may find themselves at risk.

The absence of negative balance protection is another significant issue. This policy is crucial for preventing clients from losing more than their initial investment, especially in volatile market conditions. Historical incidents involving fund security issues with BOP Global further exacerbate the concerns surrounding this broker. The importance of fund safety cannot be overstated, as it directly impacts traders' trust and willingness to engage with a broker.

Customer Experience and Complaints

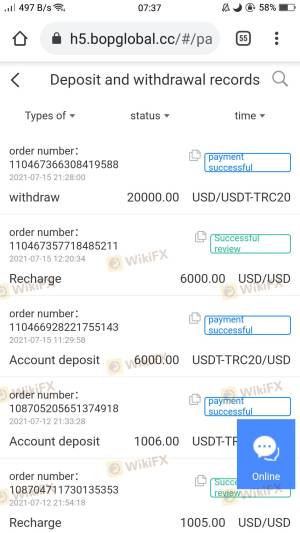

Customer feedback is an essential indicator of a broker's reliability. Reviews of BOP Global reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds. This situation is often a significant red flag, as it suggests potential issues with the brokers financial practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Unclear Fee Structures | High | Poor |

The table illustrates that withdrawal issues are the most severe complaints against BOP Global, with many users expressing frustration over their inability to access their funds. The company's response to these complaints has been notably poor, which further erodes trust among its client base. A broker's responsiveness to complaints is crucial, as it reflects their commitment to customer service and transparency.

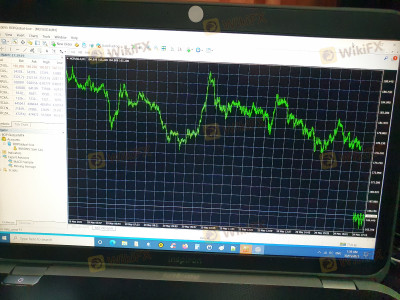

Platform and Execution

The trading platform offered by BOP Global is another critical factor in assessing its reliability. Users have reported mixed experiences regarding the platform's performance, with some experiencing slippage and execution issues. High slippage can significantly affect trading outcomes, especially for those employing strategies that rely on precise entry and exit points.

Additionally, any signs of platform manipulation could indicate deeper issues within the broker's operations. Traders should be cautious if they notice unusual patterns in order execution or discrepancies in pricing. The quality of a trading platform is essential for a seamless trading experience, and any shortcomings in this area can lead to significant trading losses.

Risk Assessment

Using BOP Global poses several risks that traders should be aware of. The absence of regulatory oversight, combined with high trading costs and withdrawal issues, creates a concerning risk profile for potential clients.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Financial Risk | High | High fees and withdrawal issues. |

| Operational Risk | Medium | Platform performance concerns. |

The risk assessment highlights the significant concerns associated with trading with BOP Global. To mitigate these risks, traders are advised to conduct thorough research, start with small deposits, and consider using brokers with established reputations and regulatory backing. Awareness of potential risks is crucial for protecting investments in the forex market.

Conclusion and Recommendations

In conclusion, the investigation into BOP Global raises several red flags that suggest it may not be a safe trading option. The lack of regulatory oversight, high trading costs, and numerous customer complaints indicate a potentially unsafe trading environment. Traders should approach BOP Global with caution and consider alternative brokers that are regulated and have a proven track record of reliability.

For those seeking safer trading options, it is advisable to consider brokers regulated by recognized authorities such as the FCA or ASIC. These brokers typically offer better protections and a more transparent trading environment. In summary, the evidence suggests that BOP Global may not be safe, and traders should remain vigilant and informed when choosing a forex broker.

Is BOP GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of BOP GLOBAL brokers.

BOP GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOP GLOBAL latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.