Is Bofu safe?

Business

License

Is Bofu Safe or Scam?

Introduction

Bofu is a relatively new player in the forex market, having been established in 2020. Positioned as a broker targeting traders primarily in China, it offers a range of trading instruments, including forex, commodities, and indices. Given the rapid growth of the online trading industry, it is crucial for traders to carefully evaluate brokers like Bofu before committing their funds. The foreign exchange market is rife with opportunities, but it also attracts unscrupulous entities that can jeopardize traders' investments. Therefore, assessing the credibility and safety of a broker is paramount.

This article aims to provide a comprehensive evaluation of Bofu, focusing on various critical aspects such as regulatory status, company background, trading conditions, customer safety, and user experiences. The investigation is based on data collected from multiple reputable sources, including regulatory databases and user reviews, ensuring a balanced and objective analysis.

Regulatory Status and Legitimacy

The regulatory status of a broker is one of the most significant factors in determining its legitimacy. Bofu claims to be registered with the National Futures Association (NFA) in the United States, but there are concerns regarding its actual regulatory status. Reports indicate that Bofu may be operating as a "suspicious clone," which raises red flags about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0538843 | United States | Suspicious Clone |

The importance of robust regulation cannot be overstated. Regulated brokers are subject to strict compliance standards, which protect traders' interests and ensure fair trading practices. However, Bofu's classification as a suspicious clone suggests that it may not adhere to these standards, potentially exposing traders to significant risks. Additionally, the lack of a solid regulatory history raises concerns about the broker's compliance with industry norms and its overall transparency.

Company Background Investigation

Bofu operates under the name Nobel Fortune Worldwide LLC and is based in China. The company has only been in operation for a short time, which can be a concern for potential investors. A broker's history, ownership structure, and management team are critical factors to consider when assessing its reliability.

The management team behind Bofu lacks publicly available information, making it difficult to evaluate their experience and qualifications. Transparency is essential in the financial services industry, and the absence of clear information about the company's leadership raises questions about its operational integrity. Moreover, the company's limited history means it has not yet had the opportunity to establish a solid reputation in the market.

Trading Conditions Analysis

Bofu offers a variety of trading instruments and claims to provide competitive trading conditions. However, a closer examination of its fee structure reveals several concerning aspects. Traders should be aware of any unusual or hidden fees that could affect their profitability.

| Fee Type | Bofu | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | -3.2% to 0.1% | -2.5% to 0.5% |

While Bofu's spreads may seem competitive, the overnight interest rates are significantly higher than industry averages, which could lead to substantial costs for traders holding positions overnight. Additionally, the variable commission model may create confusion and lead to unexpected charges, making it essential for traders to review the fee structure carefully before engaging with the broker.

Customer Fund Safety

When it comes to trading, the safety of customer funds is of utmost importance. Bofu claims to implement various safety measures, including segregating client funds from company funds. This practice is critical in ensuring that traders' money is protected in the event of the broker's insolvency.

However, the lack of detailed information regarding Bofu's investor protection policies raises concerns. For instance, it is unclear whether Bofu participates in any investor compensation schemes that could provide additional security for traders. Furthermore, there have been no reported incidents of fund security breaches, but the absence of complaints does not necessarily imply that the broker is safe.

Customer Experience and Complaints

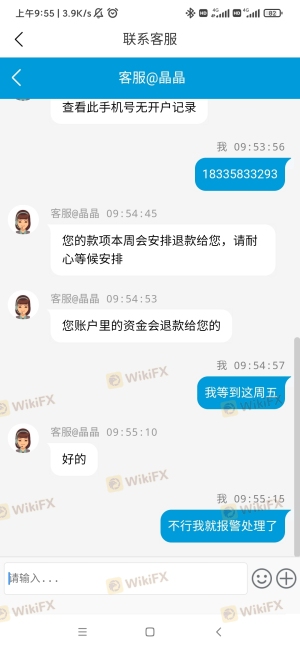

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Bofu reveal mixed experiences among users. While some traders report satisfactory experiences with customer service, others have highlighted issues related to withdrawal delays and lack of responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support Delays | Medium | Inconsistent |

Typical complaints include difficulties in withdrawing funds and slow customer support responses. Such issues can significantly impact a trader's experience and raise concerns about the broker's operational efficiency. A thorough investigation into these complaints is essential for potential clients considering Bofu as their trading partner.

Platform and Execution

The performance and stability of a trading platform are crucial for a seamless trading experience. Bofu offers a web-based trading platform, which is generally user-friendly. However, there are reports of execution delays and slippage, which can affect traders' ability to enter or exit positions at their desired prices.

The overall user experience on Bofu's platform is mixed, with some users praising its functionality while others express dissatisfaction with execution quality. Any signs of platform manipulation or unfair trading practices must be carefully scrutinized to ensure that traders can trust the broker.

Risk Assessment

Using Bofu comes with several risks that potential traders should be aware of. The combination of its suspicious regulatory status, limited company history, and mixed customer feedback creates an environment of uncertainty.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unclear regulatory status raises concerns |

| Fund Security | Medium | Lack of investor protection information |

| Customer Support | Medium | Mixed reviews on responsiveness |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with Bofu. It may also be prudent to start with a small investment to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bofu presents several red flags that warrant caution. The broker's suspicious regulatory status, limited transparency, and mixed customer feedback indicate potential risks for traders. While Bofu may offer appealing trading conditions, the lack of a solid regulatory framework and concerns about customer experience make it a broker to approach with caution.

For traders seeking safety and reliability, it may be wise to consider alternative brokers that are well-regulated and have established reputations in the forex market. Brokers regulated by top-tier authorities such as the FCA or ASIC typically offer better protection for traders' funds and a more reliable trading environment.

In summary, while Bofu may provide opportunities for trading, the risks associated with its use cannot be ignored. Traders should carefully weigh their options and consider more reputable alternatives to ensure the safety of their investments.

Is Bofu a scam, or is it legit?

The latest exposure and evaluation content of Bofu brokers.

Bofu Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bofu latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.