Bofu 2025 Review: Everything You Need to Know

Executive Summary

This bofu review gives you a complete look at Bofu as a forex broker based on what we know from the market. Bofu calls itself a multi-asset trading platform that lets you trade many different financial tools like forex, precious metals, natural gas, crude oil, and farm products. The broker uses MetaTrader trading platforms and also has web-based trading options, which helps traders who want different investment choices.

But our review shows big gaps in information about rules, account details, and what users think. We don't have clear information about regulations, which makes us wonder about how the broker follows rules and protects investors. Bofu seems to offer many trading assets and platform choices, but without detailed information, it's hard to say if their services are good.

This review is for investors who want multi-asset trading and care about having different platforms and tools. But potential clients should be careful because we don't know much about their regulatory status and how they operate.

Important Disclaimers

The information in this bofu review comes from public data and market analysis. We couldn't find specific regulatory information in the sources we checked, and services might be different in different regions. Readers should check all broker details themselves, including licenses, terms of service, and features available where they live.

This evaluation shows what we know right now and might not tell the whole story about how Bofu operates. Trading has big risks, and potential clients should think carefully about their investment goals and how much risk they can handle before choosing any broker.

Rating Framework

Broker Overview

Bofu works as a forex and multi-asset broker, but we don't know when it started or much about its background. The company's business model and how it operates are unclear based on what we know, which shows they need to be more open about their business.

The broker seems to focus on giving access to different financial markets through well-known trading platforms. But without detailed company information like when it was founded, who runs it, and how it's managed, potential clients can't easily figure out if the broker is trustworthy and has a solid foundation.

For platforms, Bofu supports MetaTrader trading platforms and web-based trading solutions, giving traders familiar and widely-used trading environments. The broker offers many different assets including foreign exchange, precious metals, energy commodities like natural gas and crude oil, and agricultural products. This variety suggests they're trying to help traders with different investment preferences and strategies.

The fact that we can't find specific regulatory information is a big concern for this bofu review. Regulatory oversight protects traders and makes sure operations are legitimate, so this missing information is a big problem when judging how the broker stands in the financial services industry.

Regulatory Jurisdiction: We couldn't find specific regulatory information in available sources, which worries us about transparency and compliance oversight.

Deposit and Withdrawal Methods: Payment processing options and procedures are not detailed in available information sources.

Minimum Deposit Requirements: We don't know the specific minimum deposit amounts from current data.

Bonus and Promotions: Information about promotional offers or bonus programs is not available in current sources.

Tradable Assets: The broker lets you access forex markets, precious metals trading, natural gas, crude oil, and agricultural commodity markets, giving you many different investment opportunities.

Cost Structure: We don't have detailed information about spreads, commissions, and other trading costs in available sources, making it hard to compare costs.

Leverage Ratios: Specific leverage offerings are not detailed in current information.

Platform Options: Bofu supports MetaTrader trading platforms and web-based trading interfaces, offering familiar trading environments.

Geographic Restrictions: We don't know about regional limitations and service availability in available information.

Customer Support Languages: Language support options are not mentioned in current data sources.

This bofu review shows the big information gaps that potential clients should think about when looking at this broker option.

Detailed Rating Analysis

Account Conditions Analysis

Looking at Bofu's account conditions is hard because we don't have specific information in available sources. We don't know about account types, their special features, and benefits, so we can't see how the broker compares to others in this important area.

We don't know the minimum deposit requirements, which really matters for different types of traders. This information gap stops potential clients from understanding how much money they need to start trading with Bofu. We also don't have details about the account opening process, including what verification they need, what documents you need, and how long it takes.

Special account features for specific trader needs, like Islamic accounts for Sharia-compliant trading, VIP accounts with better benefits, or professional accounts with different regulatory treatment, are not covered in available information. These account types are becoming more important in the competitive forex market.

We also don't have user feedback about account experiences, which makes the assessment harder. Trader reviews about how easy account setup is, feature satisfaction, and overall account management experience would give valuable insights for this bofu review. Without this information, potential clients can't judge real-world account performance and user satisfaction levels.

Bofu shows strength in platform variety by supporting MetaTrader, one of the industry's most recognized and feature-rich trading platforms. MetaTrader's complete charting capabilities, technical analysis tools, and automated trading support give real value to traders who want professional-grade trading environments. Having web-based trading platforms also provides extra accessibility and convenience for users who prefer browser-based solutions.

The broker's multi-asset approach, including forex, precious metals, energy commodities, and agricultural products, gives traders many diversification opportunities. This range allows for portfolio diversification and exposure to various market sectors, potentially appealing to traders with diverse investment strategies and risk management approaches.

But we don't have specific details about research and analysis resources in available information. Modern traders increasingly rely on market analysis, economic calendars, trading signals, and educational content to make their decisions. Not having information about such resources is a notable gap in understanding Bofu's value proposition.

We don't know about educational resources, including webinars, tutorials, trading guides, and market commentary, in current data. These resources are particularly valuable for developing traders and help brokers stand out in competitive markets.

Customer Service and Support Analysis

Looking at customer service for Bofu is hard because we have no relevant information in available sources. We don't know about support channels, including live chat, email, telephone support, and social media assistance. This lack of transparency about customer service infrastructure makes us worry about the broker's commitment to client support.

We don't know about response time expectations, service quality standards, and problem resolution procedures in current information. These factors are crucial for trader satisfaction, particularly during market volatility when timely support can be essential for account management and technical issue resolution.

We don't know about multilingual support capabilities, which are increasingly important for international brokers, in available data. Language support affects accessibility for diverse client bases and reflects the broker's commitment to serving global markets effectively.

We don't know about customer service availability hours, including weekend and holiday support. Forex markets operate continuously during weekdays, making extended support hours valuable for active traders across different time zones.

Not having user feedback about customer service experiences prevents us from judging real-world service quality and client satisfaction levels.

Trading Experience Analysis

Looking at the trading experience for Bofu relies mainly on platform support information, since we don't have specific performance data in available sources. MetaTrader platform support suggests access to professional trading tools, advanced charting capabilities, and automated trading functionality through Expert Advisors.

We don't know about platform stability and execution speed, which are critical factors for trading success, in current information. These technical performance aspects directly impact trading outcomes and user satisfaction, making their absence a significant evaluation limitation.

We don't have detailed coverage of order execution quality, including fill rates, slippage characteristics, and requote frequency, in available data. These factors are essential for understanding the actual trading environment and cost implications beyond stated spreads and commissions.

We don't specifically know about mobile trading capabilities, which are increasingly important for modern traders, in current information. Mobile platform functionality affects trading flexibility and market access convenience.

We don't know about the trading environment characteristics, including market depth, liquidity provision, and execution model details. This bofu review cannot give a complete trading experience assessment without such fundamental operational information.

Trust and Reliability Analysis

Looking at trust for Bofu is hard because we don't have regulatory information in available sources. Regulatory oversight represents the foundation of broker credibility and client protection, making this information gap a critical concern for potential clients.

Regulatory licensing provides essential safeguards including segregated client funds, compensation schemes, and operational oversight by financial authorities. Without specific regulatory details, clients cannot assess the protection levels and recourse options available in case of disputes or operational issues.

We don't have details about fund safety measures, including client money segregation, bank partnerships, and insurance coverage, in current information. These protections are fundamental for trading account security and represent key differentiators among brokers.

We don't know about company transparency, including ownership structure, financial reporting, and operational history, in available data. Transparency builds client confidence and demonstrates commitment to professional standards and accountability.

We don't know about industry reputation and third-party recognition in current sources, which prevents us from judging peer recognition and market standing.

User Experience Analysis

Looking at user experience for Bofu has big limitations because we don't have specific feedback and usability information in available sources. We can't assess overall user satisfaction levels, based on client testimonials and review aggregation, without relevant data.

We don't know about interface design and usability characteristics, including platform navigation, feature accessibility, and visual design quality, in current information. These factors significantly impact daily trading experience and user adoption rates.

We don't have detailed descriptions of registration and verification processes, including account setup complexity, documentation requirements, and approval timelines. Streamlined onboarding processes contribute to positive initial user experiences and reflect operational efficiency.

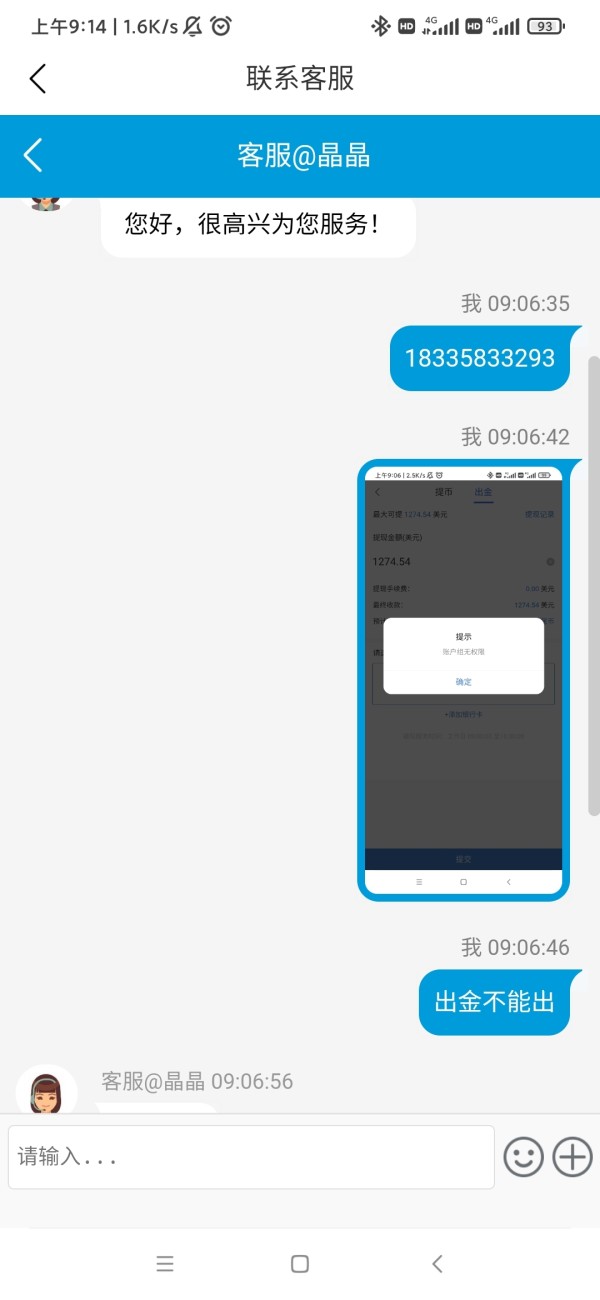

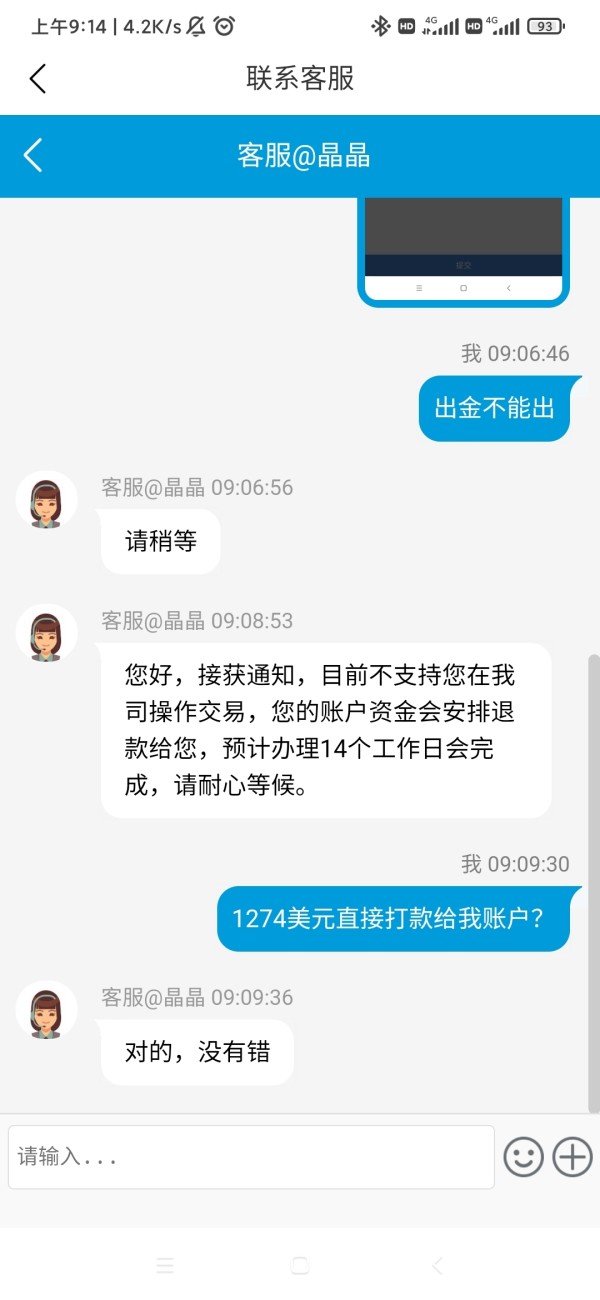

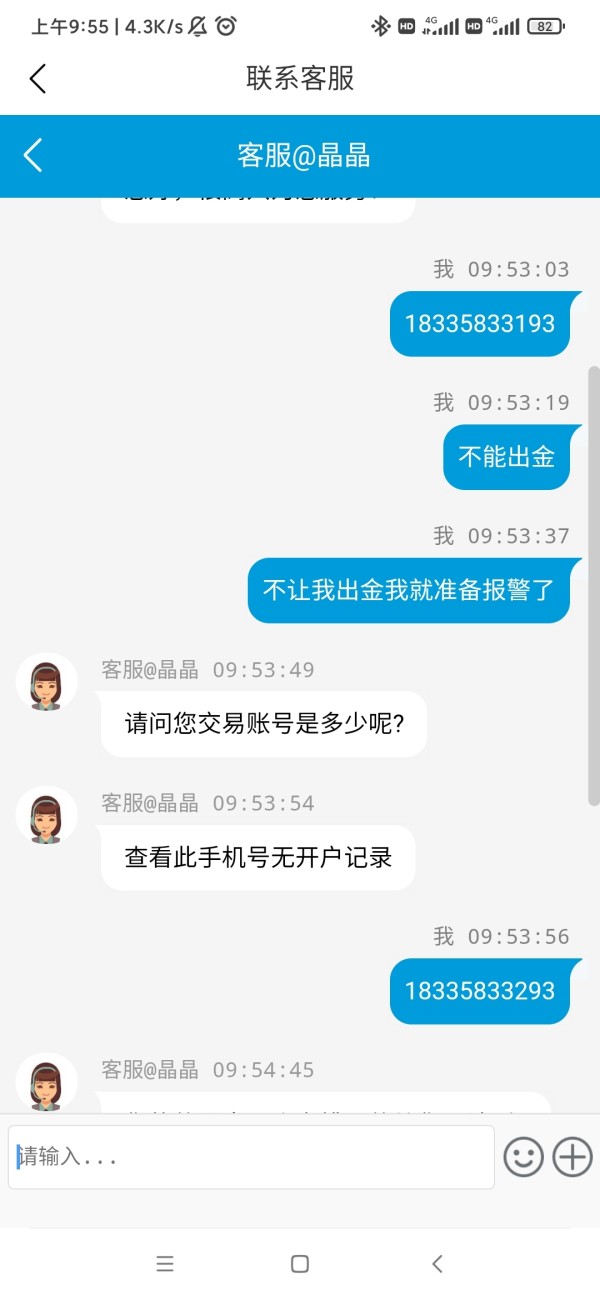

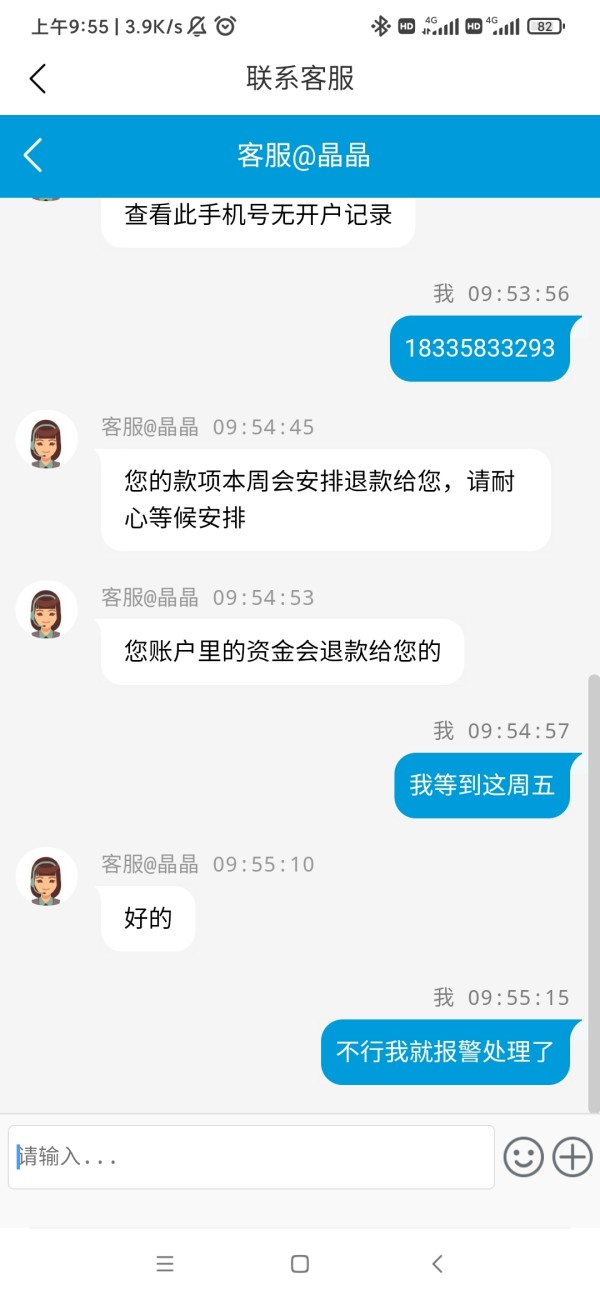

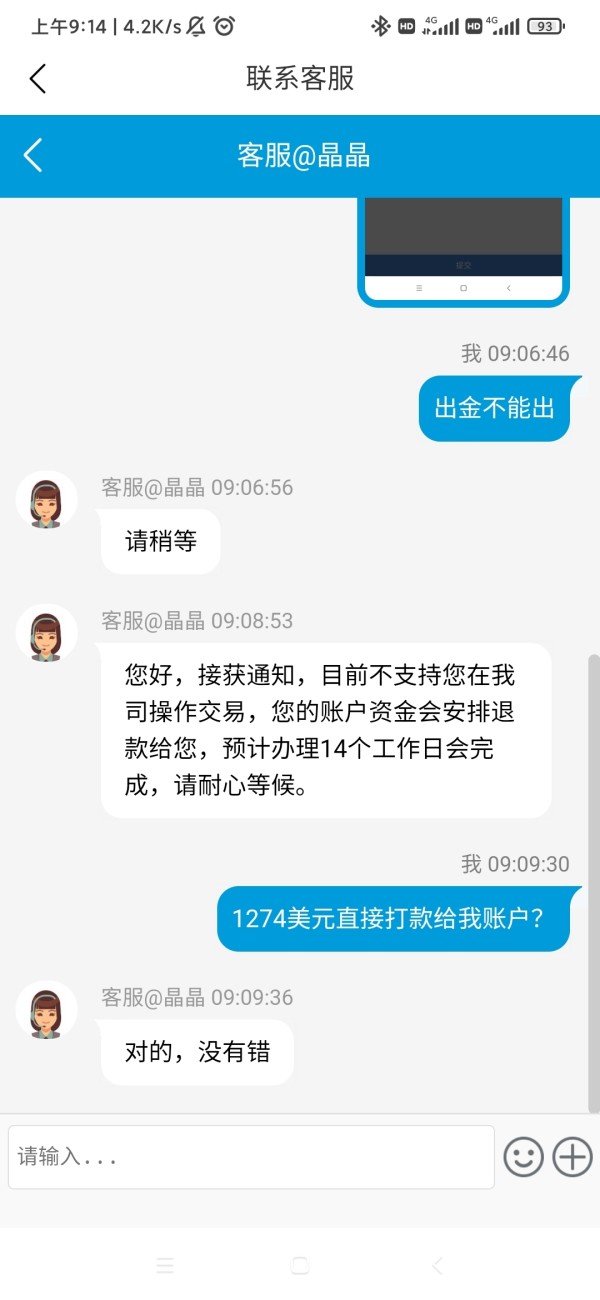

We don't know about fund operation experiences, including deposit processing times, withdrawal procedures, and payment method reliability, in available data. These operational aspects directly affect user satisfaction and trading account management convenience.

We don't have common user complaints and praise patterns, which would inform potential clients about typical experience expectations, in current sources for this bofu review.

Conclusion

This bofu review shows a broker with limited publicly available information, making complete evaluation challenging. While Bofu appears to offer multi-asset trading opportunities through established platforms like MetaTrader, significant information gaps regarding regulatory oversight, operational details, and user experiences create uncertainty about the broker's overall reliability and service quality.

The broker may suit traders interested in diversified asset access and familiar trading platforms, particularly those comfortable with MetaTrader environments. However, the absence of regulatory transparency and detailed operational information suggests that potential clients should exercise considerable caution and conduct thorough independent research before committing funds.

The primary advantages appear to be platform variety and asset diversification, while the main concerns center on transparency limitations and regulatory uncertainty. Prospective traders should prioritize brokers with clear regulatory status and comprehensive operational transparency for optimal account security and trading experience.