Is BCR safe?

Business

License

Is BCR Safe or Scam?

Introduction

BCR, or Bacera Co Pty Ltd, is an Australian forex and CFD broker that has been operating since 2008. It has positioned itself as a reliable player in the forex market, offering a range of trading instruments and competitive conditions. However, with the proliferation of online trading platforms, traders must exercise caution and thoroughly evaluate the credibility of their chosen brokers. This article aims to assess whether BCR is a safe trading option or if it exhibits characteristics of a scam. The investigation is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer safety measures, and user feedback.

Regulation and Legitimacy

Regulation is a critical aspect of any trading platform, as it ensures that brokers adhere to strict financial standards and provides a level of protection for traders. BCR is regulated by the Australian Securities and Investments Commission (ASIC), a respected authority known for its rigorous oversight of financial institutions. Below is a summary of BCR's regulatory status:

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 328794 | Australia | Verified |

ASIC's regulation is significant for BCR, as it mandates that the broker maintains segregated client accounts and adheres to strict financial reporting standards. This regulatory framework enhances the safety of client funds, as they are kept separate from the broker's operational funds. However, it is important to note that BCR also operates offshore entities, which may have different regulatory standards. While ASIC offers a high level of client protection, the presence of offshore operations could raise concerns about oversight and compliance, making it essential for traders to be aware of the potential risks involved.

Company Background Investigation

BCR has a rich history, having been founded in 2008 with the goal of providing traders with a reliable and transparent trading environment. The company has expanded its operations globally, establishing a presence in various markets. Its ownership structure is straightforward, being a wholly-owned subsidiary of Bacera Co Pty Ltd, which is based in Australia. The management team at BCR comprises experienced professionals with backgrounds in finance and trading, contributing to the broker's credibility.

Transparency is a key factor in assessing the legitimacy of a broker. BCR has made efforts to provide clear information regarding its services, fees, and trading conditions. However, the company could improve its transparency regarding potential risks and the specifics of its offshore operations. Overall, BCR's history and management team appear to support its status as a legitimate broker, but potential investors should remain vigilant and conduct their due diligence.

Trading Conditions Analysis

The trading conditions offered by BCR are essential to evaluate its overall attractiveness to traders. BCR provides various account types, each with different fee structures and trading conditions. The overall fee structure is competitive, but there are some notable aspects that traders should be aware of. Below is a comparison of BCR's core trading costs:

| Fee Type | BCR | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $3 per side (Alpha account) | $3 - $5 per side |

| Overnight Interest Range | Varies | Varies |

While BCR offers competitive spreads, particularly for its commission-based accounts, the spreads on standard accounts may be higher than the industry average. This could affect the overall trading costs for clients, especially those who trade frequently. Additionally, BCR has a minimum deposit requirement of $300, which may be considered high for some traders. Overall, while BCR's trading conditions are reasonable, potential clients should carefully assess their trading needs and strategies before committing.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. BCR implements several measures to ensure the security of traders' capital. Client funds are held in segregated accounts, which means that they are kept separate from the broker's operational funds. This practice is crucial for minimizing the risk of misappropriation and ensuring that clients can withdraw their funds without issue. Furthermore, BCR offers negative balance protection, ensuring that clients cannot lose more than their deposited amount.

Despite these safety measures, it is important to remain cautious. There have been historical instances of regulatory scrutiny, and traders should be aware of the potential risks associated with offshore operations. Overall, BCR appears to prioritize client fund safety, but traders should remain informed about the risks and ensure they understand the broker's policies.

Customer Experience and Complaints

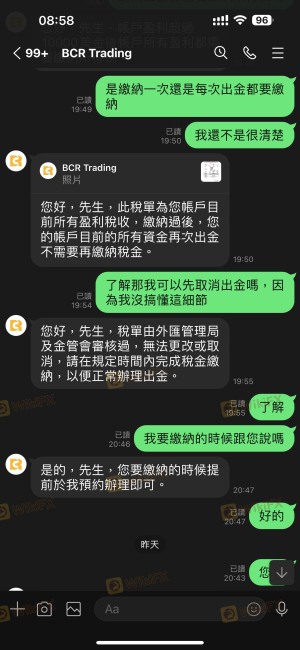

Customer feedback is a valuable indicator of a broker's reliability. BCR has received mixed reviews from users, with many praising its trading platform and customer service. However, there are also complaints regarding withdrawal delays and issues with account verification. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Account Verification Issues | High | Slow response |

| Platform Stability Issues | Moderate | Quick resolution |

One common theme among user reviews is the responsiveness of BCR's customer support team. Many traders have reported positive experiences with support staff, highlighting their professionalism and willingness to assist. However, there are notable complaints about delays in withdrawals, which could indicate potential issues with liquidity or processing times. It is essential for traders to consider these factors when evaluating whether BCR is a safe option for their trading activities.

Platform and Execution

The quality of a broker's trading platform and execution speed are critical factors for traders. BCR utilizes the popular MetaTrader 4 and MetaTrader 5 platforms, known for their reliability and advanced features. The platforms are designed to provide a seamless trading experience, with fast order execution and minimal slippage. However, there have been reports of occasional issues with order rejections, particularly during high volatility periods.

Overall, BCR's trading platforms are well-regarded, but traders should remain vigilant and monitor their execution quality. Any signs of manipulation or consistent issues with order execution could raise concerns about the broker's integrity.

Risk Assessment

Trading with BCR involves several risks that traders should be aware of. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore operations may lack stringent oversight. |

| Execution Risk | Medium | Occasional order rejections reported. |

| Financial Risk | High | High leverage can amplify losses. |

To mitigate these risks, traders should consider implementing strict risk management strategies, such as setting stop-loss orders and avoiding over-leveraging their accounts. Additionally, conducting thorough research and remaining informed about market conditions can help traders make more informed decisions.

Conclusion and Recommendations

In conclusion, BCR presents itself as a legitimate broker regulated by ASIC, with a solid reputation in the industry. However, potential traders should be cautious and consider the mixed reviews regarding customer experience, particularly concerning withdrawal delays. While BCR has implemented measures to ensure client fund safety, the presence of offshore operations may raise concerns about oversight.

For traders considering BCR, it is advisable to conduct thorough research and assess personal trading needs. Those seeking a broker with a strong regulatory background and reliable customer support may find BCR a suitable option. However, for traders prioritizing lower costs or more diverse trading instruments, alternative brokers may be more appropriate. Overall, BCR is not a scam, but it is essential for traders to remain informed and vigilant to ensure a safe trading experience.

Is BCR a scam, or is it legit?

The latest exposure and evaluation content of BCR brokers.

BCR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BCR latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.