Is Avx Broker safe?

Business

License

Is Avx Broker Safe or Scam?

Introduction

Avx Broker, a relatively new player in the forex and cryptocurrency trading market, claims to offer a modern trading platform with low initial deposits. However, as with any financial service, it is crucial for traders to thoroughly evaluate the legitimacy and safety of such brokers before investing their hard-earned money. The forex market is rife with both reputable brokers and scams, making it essential for traders to be vigilant. This article aims to investigate whether Avx Broker is a safe option or a potential scam by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

To conduct this assessment, we analyzed various online sources, including user reviews, regulatory databases, and expert opinions. The evaluation framework includes a detailed look at regulatory compliance, company transparency, trading costs, customer experiences, and the security measures in place for client funds.

Regulation and Legitimacy

An important aspect of evaluating any broker is understanding its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to strict standards and practices. Avx Broker, unfortunately, does not appear to be regulated by any recognized financial authority, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Avx Broker operates without the oversight of any financial authority, increasing the risk for traders. Regulated brokers are required to maintain client fund segregation and adhere to strict reporting standards, which are not applicable to unregulated entities. This lack of oversight can lead to unethical practices, including difficulties in withdrawing funds and potential fraud.

Company Background Investigation

Understanding the history and ownership structure of Avx Broker is essential in assessing its credibility. Unfortunately, there is limited information available about the companys origins, ownership, or management team. This lack of transparency is a red flag, as reputable brokers typically provide detailed information about their history and key personnel.

The absence of a clear company structure and ownership details raises questions about the broker's accountability. Without knowing who is behind the operations, traders may find it difficult to seek recourse in case of issues or disputes. Moreover, the lack of information regarding the management teams qualifications and experience further diminishes trust in the broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading costs and conditions is vital. Avx Broker claims to offer competitive spreads and low fees; however, the lack of transparency regarding its fee structure is concerning. Traders should be cautious of hidden fees that could significantly impact their profitability.

| Fee Type | Avx Broker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of specific figures for spreads and commissions indicates a potential lack of transparency, which is often a tactic used by unregulated brokers to lure in unsuspecting traders. Traders should be wary of any broker that does not clearly disclose its fee structure, as this could lead to unexpected costs and diminished returns.

Customer Funds Security

The safety of customer funds is a primary concern for any trader. Avx Broker has not provided sufficient information regarding its security measures for client funds. Key aspects to consider include whether client funds are kept in segregated accounts, the presence of investor protection schemes, and whether there is a negative balance protection policy in place.

Historically, unregulated brokers have been known to mishandle client funds, leading to significant financial losses for traders. The lack of information on Avx Broker's fund security measures suggests that traders may be at risk of losing their investments without any means of recovery.

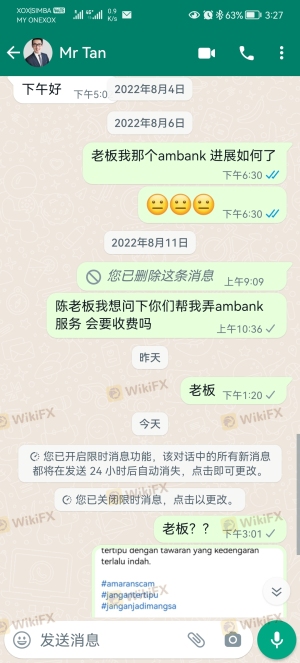

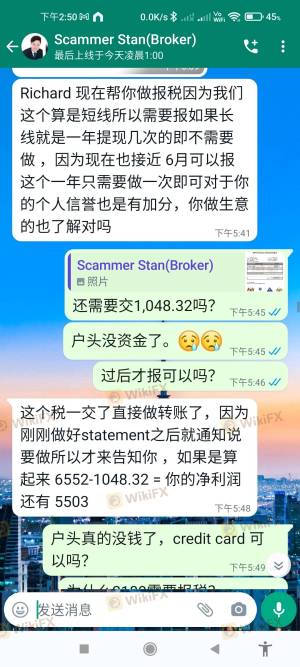

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. A review of user experiences with Avx Broker reveals a pattern of complaints, primarily concerning withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds and a lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

Typical cases involve users who have invested funds but faced significant delays or outright refusals when attempting to withdraw their money. This pattern of complaints raises serious concerns about the broker's integrity and reliability.

Platform and Trade Execution

The performance of a trading platform is another critical factor in assessing a broker's credibility. Avx Broker claims to offer a proprietary trading platform; however, there are limited reviews detailing its performance and user experience. Traders should be wary of platforms that lack established reputations.

Furthermore, issues such as order execution quality, slippage, and the frequency of rejected orders are vital to consider. If a broker's platform exhibits signs of manipulation or poor execution, it can lead to significant financial losses for traders.

Risk Assessment

Using an unregulated broker like Avx Broker presents various risks. The lack of oversight increases the potential for fraudulent practices, while the absence of clear information about the company heightens the uncertainty for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation increases risk. |

| Fund Security Risk | High | Lack of information on fund safety. |

| Withdrawal Risk | High | Reports of withdrawal issues are common. |

To mitigate these risks, traders should consider using regulated brokers that offer transparency and accountability. Seeking out brokers with solid reputations and positive user feedback can help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the investigation into Avx Broker raises several red flags regarding its legitimacy and safety. The absence of regulation, coupled with a lack of transparency and numerous customer complaints, strongly suggests that traders should exercise extreme caution when considering this broker.

For those looking to engage in forex trading, it is advisable to choose regulated brokers with a proven track record. Brokers such as IG, OANDA, and Forex.com offer safer alternatives with robust regulatory oversight and positive customer feedback. Ultimately, the question remains: Is Avx Broker safe? Based on the available evidence, it appears that traders should be wary and consider other options to protect their investments.

Is Avx Broker a scam, or is it legit?

The latest exposure and evaluation content of Avx Broker brokers.

Avx Broker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Avx Broker latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.