Is ASSOCIATE PRIME safe?

Business

License

Is Associate Prime A Scam?

Introduction

Associate Prime is a forex brokerage that positions itself within the competitive landscape of online trading, targeting primarily retail traders. As the foreign exchange market continues to grow, it becomes increasingly important for traders to conduct thorough due diligence when selecting a broker. The potential for scams and fraudulent activities in the forex industry necessitates a cautious approach, as traders' funds and personal information may be at risk. This article aims to evaluate the credibility of Associate Prime by examining its regulatory status, company background, trading conditions, client fund safety, and customer experiences. The investigation draws upon various online sources, including user reviews and regulatory databases, to provide a comprehensive assessment of whether Associate Prime is safe or a scam.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its legitimacy. A well-regulated broker is typically subject to strict oversight, ensuring that it adheres to industry standards and protects clients' interests. In the case of Associate Prime, it is essential to analyze its regulatory framework and the implications of its licensing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

As indicated in the table, Associate Prime lacks regulation from any recognized financial authority. This absence of oversight raises significant concerns regarding the safety of traders' funds and the overall trustworthiness of the brokerage. A broker that operates without regulatory supervision may engage in practices that are not in the best interest of its clients, such as manipulating spreads or failing to segregate client funds. Furthermore, the lack of a regulatory history could indicate that the firm has not undergone the necessary scrutiny to establish its credibility.

The importance of regulation cannot be overstated; it serves as a safeguard for traders, ensuring that brokers operate transparently and adhere to ethical standards. Given that Associate Prime is not regulated, it is advisable for potential clients to exercise caution and consider the risks associated with trading through an unregulated entity.

Company Background Investigation

Understanding the history and ownership structure of a brokerage can provide valuable insights into its reliability and operational integrity. Associate Prime appears to have a relatively short history in the forex market, which may raise questions about its experience and stability. The company claims to operate in various markets, yet detailed information about its founding, ownership, and management team is sparse.

The management teams background is a critical aspect to consider, as experienced leaders can enhance a brokerage's credibility. However, Associate Prime does not provide comprehensive information regarding its management or their qualifications. This lack of transparency can be a red flag for potential investors, as it may indicate that the company is not fully committed to fostering trust with its clients.

In terms of information disclosure, Associate Prime's website does not offer sufficient details about its operations, trading platforms, or client support services. A reputable broker typically provides clear and accessible information about its services, fees, and terms of service. The absence of such information can lead to uncertainty and mistrust among potential clients.

Trading Conditions Analysis

An essential factor in assessing whether Associate Prime is a safe broker is its trading conditions, including fees and spreads. The overall cost structure can significantly impact a trader's profitability, and any unusual or hidden fees may indicate a lack of transparency.

| Fee Type | Associate Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1-3 pips |

| Commission Model | TBD | Varies (usually 0-10 USD per lot) |

| Overnight Interest Range | TBD | 0.5%-2% |

The above table provides a comparative view of the trading costs associated with Associate Prime versus the industry average. However, specific figures for Associate Prime are not readily available, which raises concerns about the brokerage's transparency regarding its fee structure. A reputable broker should clearly outline its fees and commissions, allowing traders to make informed decisions.

Additionally, any discrepancies between the spreads offered by Associate Prime and the industry average could indicate potential issues. If the spreads are significantly wider than those of competitors, it may suggest that the broker is taking advantage of its clients. Moreover, the absence of a clear commission structure may lead to unexpected costs that could erode trading profits.

Client Fund Safety

The safety of client funds is paramount when evaluating a brokerage's reliability. Traders must understand how their funds are managed and what measures are in place to protect their investments. In the case of Associate Prime, there is limited information regarding its fund safety protocols.

For a broker to be deemed safe, it should implement robust measures such as segregating client funds from its operational funds, providing investor protection mechanisms, and offering negative balance protection. However, as Associate Prime lacks regulatory oversight, it is unclear whether these safety measures are in place.

Historically, unregulated brokers have been known to mishandle client funds, leading to significant losses for traders. Without a transparent account of how Associate Prime manages its clients' money, potential investors should be wary of the risks involved. The absence of a credible safety framework may indicate that traders could face challenges in retrieving their funds in case of disputes or insolvency.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a brokerage's reliability and service quality. Analyzing user experiences can help identify common issues and the brokerage's responsiveness to complaints. In the case of Associate Prime, reviews from clients reveal a mixed bag of experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Limited availability |

| Account Management | Medium | Inconsistent service |

The table above summarizes the primary complaints associated with Associate Prime. Notably, withdrawal issues have been highlighted as a significant concern, indicating that clients may struggle to access their funds in a timely manner. Additionally, the brokerage's customer support has been criticized for its limited availability, which can exacerbate frustrations for traders seeking assistance.

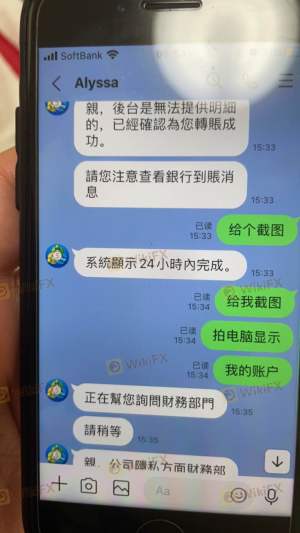

A couple of typical cases illustrate these complaints. One user reported significant delays in processing withdrawals, leading to concerns about the safety of their funds. Another client expressed dissatisfaction with the quality of customer support, stating that their inquiries often went unanswered for extended periods. These experiences suggest that the brokerage may not prioritize effective communication or client care.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Traders rely on the platform for executing trades, monitoring market conditions, and managing their accounts. In evaluating Associate Prime, it is essential to assess the platform's reliability, stability, and user experience.

While specific details about the trading platform offered by Associate Prime are limited, user feedback indicates mixed reviews regarding its performance. Traders have reported issues with order execution quality, including instances of slippage and rejected orders. Such issues can significantly impact a trader's ability to capitalize on market opportunities and can lead to frustration.

Moreover, any signs of platform manipulation, such as artificially widening spreads or unfair trade practices, raise red flags about the broker's integrity. A reputable broker should provide a transparent trading environment with reliable execution and minimal slippage.

Risk Assessment

When considering whether Associate Prime is a safe broker, it is essential to evaluate the overall risk profile associated with trading through the firm. Several key risk factors should be taken into account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund protection measures |

| Execution Risk | Medium | Issues with order execution |

The table summarizes the main risk areas associated with Associate Prime. The absence of regulation poses a high risk for traders, as they have no recourse in the event of disputes or misconduct. Additionally, the lack of information regarding fund safety measures further compounds this risk.

To mitigate these risks, potential clients should conduct thorough research before engaging with Associate Prime. Seeking out well-regulated alternatives and ensuring that funds are managed securely can help protect investments.

Conclusion and Recommendations

In conclusion, the investigation into Associate Prime raises significant concerns regarding its legitimacy and safety. The lack of regulation, transparency, and issues related to customer experiences suggest that traders should exercise extreme caution when considering this broker. The absence of credible oversight and protective measures indicates that there may be a higher risk of encountering fraudulent practices.

For traders seeking a reliable forex broker, it is advisable to explore options that are well-regulated and have established a positive reputation within the industry. Brokers regulated by top-tier authorities, such as the FCA or ASIC, typically offer greater protection and transparency. Some recommended alternatives include well-known brokers with a proven track record of reliability and client satisfaction.

In summary, potential clients should be wary of Associate Prime and consider the risks involved. Conducting thorough research and opting for regulated brokers can help ensure a safer trading experience.

Is ASSOCIATE PRIME a scam, or is it legit?

The latest exposure and evaluation content of ASSOCIATE PRIME brokers.

ASSOCIATE PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASSOCIATE PRIME latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.