Regarding the legitimacy of ASHOKFX forex brokers, it provides VFSC and WikiBit, .

Is ASHOKFX safe?

Business

License

Is ASHOKFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Ashok Capital Ltd

Effective Date:

2016-06-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is AshokFX Safe or Scam?

Introduction

In the vast landscape of the forex market, AshokFX positions itself as a broker offering a range of trading services to retail traders. Established in 2016, the broker aims to provide access to various trading instruments, including forex pairs, commodities, and indices. However, the forex market is notoriously complex, and traders must exercise caution when selecting a broker. The potential for scams is high, and many traders have fallen victim to fraudulent practices. Thus, evaluating the credibility of brokers like AshokFX is paramount. This article employs a comprehensive investigation method, analyzing regulatory compliance, company background, trading conditions, customer experiences, and risk assessments to ascertain whether AshokFX is safe or a scam.

Regulation and Legitimacy

A broker's regulatory status is crucial in determining its legitimacy. Regulatory bodies enforce rules that protect traders and ensure fair trading practices. AshokFX claims to be regulated by the Financial Services Commission (FSC), but skepticism surrounds its regulatory compliance. The following table summarizes key regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC | Not specified | Vanuatu | Unverified |

The lack of a clear license number and the unverified status raise red flags about AshokFX's regulatory adherence. A broker operating without stringent regulation is more likely to engage in questionable practices, making it essential for traders to be cautious. Furthermore, the company's registration in Vanuatu, a known offshore jurisdiction, can often indicate a higher risk of encountering fraud. While offshore brokers can operate legitimately, they may also evade strict regulatory scrutiny, leading to concerns regarding the safety of client funds and overall business practices.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. AshokFX is operated by Ashok Capital Ltd., which has undergone several name changes, including Ashok Tech. This inconsistency can be indicative of a lack of transparency. The management team, led by Thomas Mathew Ashok Kumar, has faced allegations of misconduct in other jurisdictions, raising further concerns about the broker's integrity.

The company's history reveals that it was founded in 2016 but has not established a strong reputation in the forex community. Many traders have reported difficulties in withdrawing funds, and the lack of comprehensive information about the company's operations and ownership structure diminishes trust. Transparency is crucial for building confidence among traders, and AshokFX's failure to provide clear information about its management and operational practices warrants caution.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. AshokFX advertises competitive spreads and access to various trading instruments, but scrutiny of their fee structure is necessary. The following table compares core trading costs:

| Fee Type | AshokFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3-5 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by AshokFX are notably higher than the industry average, which can erode potential profits for traders. Additionally, the absence of a clear commission model raises questions about hidden fees that may be applied during trading. Such practices can lead to unexpected costs, further complicating the trading experience. Traders should be wary of brokers with opaque fee structures, as this can be a tactic used by less reputable firms to exploit clients.

Customer Funds Security

The safety of customer funds is a primary concern for any trader. AshokFX claims to implement measures for fund security, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

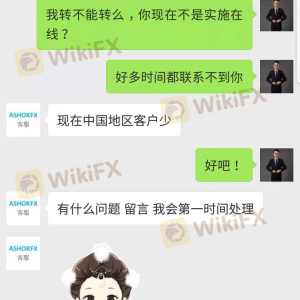

Traders should be aware that if a broker is unregulated, there is no guarantee of fund protection. Historical complaints against AshokFX regarding delayed withdrawals and unresponsive customer service highlight potential issues with fund security. Traders must conduct thorough research to ensure that their funds are protected and that the broker adheres to industry standards for safeguarding client assets.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of AshokFX reveal a mixed bag of experiences, with many users expressing dissatisfaction over withdrawal issues and poor customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Spreads | Medium | Average |

| Customer Support Issues | High | Poor |

Common complaints include prolonged withdrawal processes, which can take weeks to resolve, leaving traders frustrated and without access to their funds. Additionally, the high spreads and inadequate customer support further exacerbate the negative experience for users. A broker's response to complaints is a critical factor in assessing its reliability, and AshokFX's inability to effectively address these issues raises concerns about its overall trustworthiness.

Platform and Trade Execution

The performance of a trading platform is essential for a seamless trading experience. AshokFX offers the widely used MetaTrader 4 platform, which is known for its user-friendly interface and robust trading tools. However, reports of slippage and order rejections have surfaced among users, indicating potential issues with trade execution quality.

Traders have noted that slippage occurs frequently, particularly during volatile market conditions, which can significantly impact trading outcomes. Furthermore, any signs of platform manipulation, such as inconsistent price feeds, should be taken seriously. Traders need to ensure that their chosen broker provides a reliable trading environment to minimize execution-related risks.

Risk Assessment

Using AshokFX involves various risks that traders should carefully consider. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unverified regulatory status |

| Financial Risk | Medium | High spreads and unclear fee structures |

| Operational Risk | High | Poor customer service and withdrawal issues |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with AshokFX. Seeking brokers with strong regulatory oversight and transparent practices can help protect against potential fraud and financial loss.

Conclusion and Recommendations

Based on the comprehensive analysis of AshokFX, it is evident that the broker presents several red flags that warrant caution. The lack of clear regulatory oversight, high trading costs, and numerous customer complaints suggest that traders should be wary of engaging with this broker. While some users report satisfactory experiences, the overall sentiment leans towards skepticism regarding the broker's reliability.

For traders seeking a trustworthy forex broker, it is advisable to consider alternatives with robust regulatory frameworks, transparent fee structures, and positive customer feedback. Brokers regulated by top-tier authorities, such as the FCA or ASIC, are generally safer options. Ultimately, traders must prioritize their safety and be diligent in their research to avoid potential scams in the forex market.

In conclusion, the question "Is AshokFX safe?" leans towards a cautious "no," and potential users should exercise extreme caution or seek more reputable alternatives in their trading endeavors.

Is ASHOKFX a scam, or is it legit?

The latest exposure and evaluation content of ASHOKFX brokers.

ASHOKFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ASHOKFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.