Is AM Tradex safe?

Business

License

Is AM Tradex Safe or a Scam?

Introduction

AM Tradex is an offshore forex broker that has emerged in the trading market, promising various financial instruments and enticing trading conditions. As with any financial service provider, it is crucial for traders to carefully evaluate AM Tradex to determine its legitimacy and safety. The forex market is rife with opportunities, but it also harbors risks, including potential scams. For traders, understanding the regulatory environment, company background, trading conditions, and customer experiences is vital in making informed decisions. This article employs a comprehensive investigative approach, analyzing AM Tradex's regulatory status, company history, trading conditions, customer feedback, and overall risk profile to assess whether AM Tradex is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most significant indicators of its reliability. AM Tradex claims to operate under the jurisdiction of Saint Vincent and the Grenadines, a location known for its lenient regulatory framework. However, this raises concerns about the broker's legitimacy. The absence of stringent regulatory oversight can expose traders to various risks, including the misappropriation of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | N/A | Saint Vincent and the Grenadines | Not Verified |

The table above highlights the lack of a valid license for AM Tradex. The FSA does not regulate forex brokers, which means AM Tradex is not subject to any oversight. This absence of regulation is alarming, as it implies that the broker operates without accountability, potentially leading to fraudulent activities. The lack of a credible regulatory body overseeing AM Tradex means that traders have limited recourse in case of disputes or fund mismanagement, raising the question: Is AM Tradex safe?

Company Background Investigation

AM Tradex's history is relatively short, having been established in the last few years. The broker is registered in Saint Vincent and the Grenadines, which is often considered a tax haven for unregulated brokers. This lack of transparency regarding company ownership and management raises further concerns. The absence of publicly available information about the management team and their professional backgrounds adds to the skepticism surrounding AM Tradex.

A reliable broker typically provides clear information about its leadership and operational structure. In the case of AM Tradex, the anonymity of its operators is a red flag. Traders are left with little knowledge of who is managing their funds, which can lead to significant risks. Therefore, the question of whether AM Tradex is safe becomes increasingly pertinent as potential clients weigh their options.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. AM Tradex presents a range of trading instruments, including forex pairs, commodities, and indices. However, the overall fee structure and potential hidden costs warrant scrutiny.

| Fee Type | AM Tradex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The table above indicates that AM Tradex's spreads are higher than the industry average, which may impact profitability. Additionally, the lack of transparency regarding overnight interest rates raises questions about potential costs that traders might encounter. Such fee structures can be indicative of a broker trying to maximize profits at the expense of traders, leading to the conclusion that AM Tradex may not be safe for all traders.

Customer Funds Security

The safety of customer funds is a critical aspect of any forex broker. AM Tradex claims to implement basic security measures, but there is a lack of information regarding fund segregation and investor protection policies.

Traders should be aware that reputable brokers typically segregate client funds from their operational funds, ensuring that customer deposits are protected even in the event of bankruptcy. Furthermore, many regulated brokers offer compensation schemes to protect investors in case of insolvency. Unfortunately, AM Tradex does not provide any such assurances, which raises concerns about the security of client funds. Given these factors, it is reasonable to question whether AM Tradex is safe for traders looking to protect their investments.

Customer Experience and Complaints

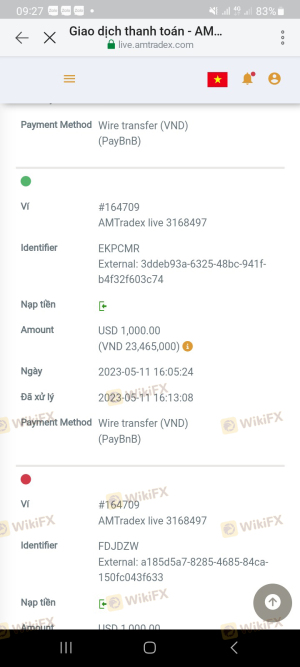

Customer feedback is a vital indicator of a broker's reliability. Numerous reviews and reports suggest that AM Tradex has garnered a significant number of complaints, particularly regarding withdrawal issues and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Poor |

The table above summarizes the prevalent issues faced by traders. Many users have reported difficulties in withdrawing their funds, often encountering excuses or delayed responses from customer support. This pattern of complaints raises serious concerns about the broker's operational integrity. If traders find themselves unable to access their funds, it significantly undermines the safety of investing with AM Tradex. Thus, the question remains: Is AM Tradex safe for traders?

Platform and Execution

The trading platform offered by AM Tradex is another crucial factor in assessing its reliability. A robust and stable platform is essential for executing trades effectively. However, reports indicate that users have experienced issues with order execution, including slippage and rejections.

Furthermore, any signs of platform manipulation can severely affect a trader's experience and profitability. The lack of transparency regarding the platform's performance raises additional concerns. If traders encounter consistent issues with execution quality, it can lead to significant financial losses, further questioning whether AM Tradex is safe for trading.

Risk Assessment

Engaging with AM Tradex presents several risks that traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker operating in a lax jurisdiction. |

| Financial Risk | High | High spreads and potential hidden fees. |

| Operational Risk | Medium | Complaints about withdrawal issues and poor customer support. |

The table above summarizes the key risks associated with trading with AM Tradex. Traders should be vigilant and consider these risks when deciding whether to engage with this broker. To mitigate these risks, it is advisable to conduct thorough research and consider trading with regulated brokers that offer greater security and transparency.

Conclusion and Recommendations

In light of the evidence presented, it is clear that AM Tradex raises several red flags. The lack of regulation, transparency issues, high trading costs, and numerous customer complaints suggest that traders should exercise extreme caution.

For those considering trading with AM Tradex, it is crucial to weigh the risks and potential consequences carefully. If you value the safety of your trading capital, it may be wise to seek alternatives that are regulated and provide robust investor protections.

In conclusion, the question of whether AM Tradex is safe can be answered with a cautious "no." Traders are encouraged to explore reputable brokers that adhere to strict regulatory standards to ensure their investments are secure and their trading experience is positive.

Is AM Tradex a scam, or is it legit?

The latest exposure and evaluation content of AM Tradex brokers.

AM Tradex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AM Tradex latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.