Is AF Markets safe?

Business

License

Is AF Markets Safe or a Scam?

Introduction

AF Markets is a forex broker that positions itself within the competitive landscape of online trading, offering a range of financial instruments including forex, commodities, and cryptocurrencies. As the forex market continues to attract traders worldwide, the importance of evaluating the legitimacy and safety of brokers becomes paramount. Traders need to be cautious, as the industry has its fair share of scams and unregulated entities that can jeopardize their investments. This article investigates the credibility of AF Markets, employing a comprehensive framework that includes regulatory status, company background, trading conditions, client security, customer feedback, platform performance, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its reliability and safety. AF Markets is currently unregulated, which raises significant concerns regarding the protection of client funds and the overall integrity of its operations. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Operating without a regulatory framework leaves traders vulnerable, as there are no oversight mechanisms to ensure fair practices or safeguard client funds. Although AF Markets previously held a license from the Australian Securities and Investments Commission (ASIC), this license has since been revoked, indicating a potential decline in compliance and operational standards. The absence of regulation is a red flag for potential investors, as it suggests a lack of accountability and recourse in the event of disputes or malpractices.

Company Background Investigation

AF Markets was established with the intent to provide trading services to a diverse clientele. However, information regarding its ownership and management team is sparse, which complicates the assessment of its credibility. The companys transparency is questionable, as it utilizes a private registration service, concealing the identities of its owners. This lack of transparency can be a tactic often employed by fraudulent entities to evade scrutiny.

The management teams qualifications and professional experience are not readily available, making it difficult for potential clients to gauge the expertise behind the broker. In the competitive forex market, a knowledgeable and experienced management team is essential for instilling confidence among traders. The limited information available about AF Markets raises concerns regarding the firm's operational integrity and commitment to ethical trading practices.

Trading Conditions Analysis

When evaluating whether AF Markets is safe, it's essential to consider its trading conditions, including fees and costs. The broker offers a variety of trading accounts, but the specifics of its fee structure are not entirely clear. Below is a comparison of core trading costs:

| Cost Type | AF Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.7 pips | 1.5 pips |

| Commission Model | Unclear | $0 - $10 |

| Overnight Interest Range | N/A | Varies |

While AF Markets advertises competitive spreads, the lack of clarity regarding commissions and overnight interest rates is concerning. Traders often face unexpected fees that can significantly impact profitability. The absence of a transparent fee structure may indicate potential hidden costs, raising further questions about the broker's reliability. This ambiguity in trading costs is a common trait among brokers that may not prioritize client interests.

Client Funds Security

The safety of client funds is a crucial aspect of any brokerage. AF Markets claims to implement various security measures, but the specifics are not well-documented. Without regulatory oversight, it's challenging to ascertain the effectiveness of these measures. Key factors to consider include:

- Fund Segregation: Whether client funds are kept separate from the company's operating funds.

- Investor Protection: Mechanisms in place to protect clients in the event of bankruptcy or operational failure.

- Negative Balance Protection: Policies that prevent clients from losing more than their account balance.

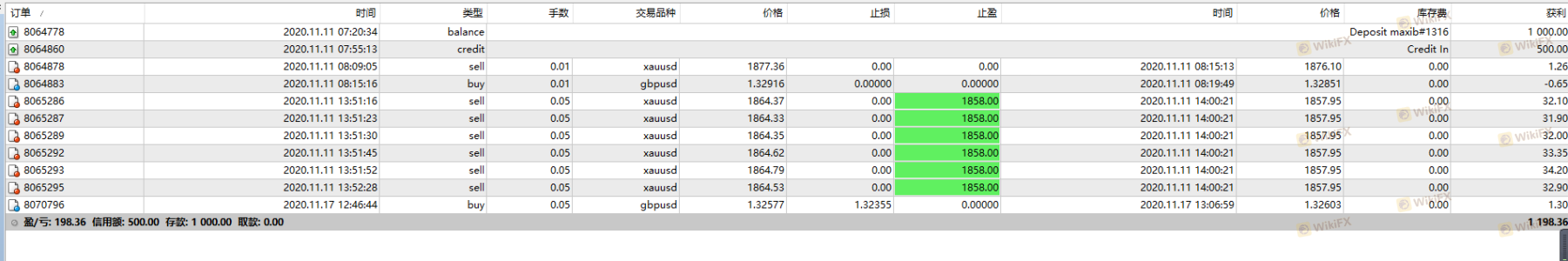

Historically, unregulated brokers like AF Markets have faced allegations of mishandling client funds. Instances of delayed withdrawals and account freezes have been reported, further emphasizing the need for caution. Without robust client fund protection policies, traders may find themselves at risk of losing their investments.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing whether AF Markets is safe. Reviews indicate a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving inadequate customer support. The following table summarizes common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Support Issues | High | Poor |

Typical cases involve clients experiencing significant delays in fund withdrawals, often citing vague explanations from customer service. Such issues can erode trust and indicate deeper operational problems. Effective customer support is crucial for resolving issues promptly, and the reported deficiencies in this area further raise concerns about the broker's commitment to client satisfaction.

Platform and Trade Execution

The trading platform provided by AF Markets is another critical aspect of its overall reliability. Users have reported mixed experiences regarding platform stability and execution quality. Key points to consider include:

- Performance: The speed and reliability of the trading platform during high market volatility.

- Slippage: Instances of orders being executed at prices different from expected.

- Rejection Rates: The frequency of rejected orders during trading sessions.

While AF Markets claims to offer popular platforms like MetaTrader 4 and 5, the user feedback suggests that execution quality may not consistently meet expectations. Reports of slippage and order rejections can be alarming, as they can lead to significant financial losses, especially for active traders.

Risk Assessment

Considering the various aspects discussed, a comprehensive risk assessment of AF Markets reveals several concerns. The following risk scorecard summarizes key areas of risk:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Potential for hidden fees and losses. |

| Operational Risk | Medium | Issues with withdrawals and support. |

| Platform Risk | Medium | Reports of slippage and rejections. |

To mitigate these risks, potential traders should conduct thorough due diligence and consider alternative brokers with established regulatory oversight and better customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that AF Markets may not be a safe trading option for many investors. The lack of regulation, transparency issues, and reported customer complaints raise significant red flags. Traders should be particularly cautious, as the potential for financial loss is heightened in an unregulated environment.

For those seeking reliable alternatives, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer greater transparency, better customer support, and enhanced security for client funds. Ultimately, thorough research and careful consideration are essential when selecting a trading platform in the forex market.

In summary, Is AF Markets safe? The answer leans towards caution, and potential traders should weigh their options carefully before proceeding.

Is AF Markets a scam, or is it legit?

The latest exposure and evaluation content of AF Markets brokers.

AF Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AF Markets latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.