Is SCBS safe?

Pros

Cons

Is SCBS Safe or Scam?

Introduction

SCBS, or SCB Securities Co., Ltd., is one of Thailand's leading securities firms, operating under the umbrella of Siam Commercial Bank, one of the most established financial institutions in Thailand. Founded in 1995, SCBS aims to provide a comprehensive range of financial services, including equity brokerage, futures and options trading, and investment advisory. Given the rapid growth of the forex market and the increasing number of online brokers, it is crucial for traders to carefully assess the credibility and safety of their chosen trading platforms. This article investigates whether SCBS is a safe choice for traders or if it raises any red flags suggesting potential scam-like behavior. Our evaluation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is a key indicator of its legitimacy and safety. SCBS operates under the supervision of the Securities and Exchange Commission of Thailand (SEC), which is known for its stringent regulatory standards. The importance of regulation cannot be overstated, as it provides a layer of protection for investors by ensuring that brokers adhere to established guidelines and practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SEC Thailand | N/A | Thailand | Verified |

The SEC Thailand has a solid reputation for enforcing compliance among brokers, including SCBS. The regulatory authority conducts regular audits and has the power to impose penalties for non-compliance. Historically, SCBS has maintained a good standing with the SEC, indicating a commitment to regulatory compliance. This regulatory oversight is essential for traders looking to ensure their investments are safe.

Company Background Investigation

SCBS has a rich history dating back to its establishment in 1995. As a 100% subsidiary of Siam Commercial Bank, the company benefits from the bank's extensive experience and resources. The ownership structure provides a level of stability and trustworthiness, as SCBS is backed by one of Thailand's largest financial institutions.

The management team at SCBS comprises seasoned professionals with extensive backgrounds in finance and investment. Their expertise contributes to the firm's reputation as a reliable broker. SCBS has also been recognized for its commitment to transparency and information disclosure, regularly publishing performance reports and updates for its clients.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is crucial. SCBS offers a competitive fee structure, but it is important to analyze any hidden costs or unusual policies that may affect traders.

| Fee Type | SCBS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | 0.5% | 0.4% |

SCBS's spread for major currency pairs is slightly higher than the industry average, which may be a concern for high-frequency traders. However, the absence of commissions can be appealing for those looking to minimize trading costs. It is essential for traders to be aware of these costs when assessing whether SCBS is safe for their trading activities.

Client Fund Safety

The security of client funds is a paramount concern for any trader. SCBS implements several measures to ensure the safety of its clients' investments. The company segregates client funds from its operational accounts, which is a standard practice in the industry to protect investors in case of insolvency. Additionally, SCBS adheres to investor protection regulations set forth by the SEC.

However, it is important to note that while SCBS has robust safety measures, there have been historical instances in the broader market where brokers faced liquidity issues. Therefore, traders should remain vigilant and regularly monitor the financial health of their chosen broker.

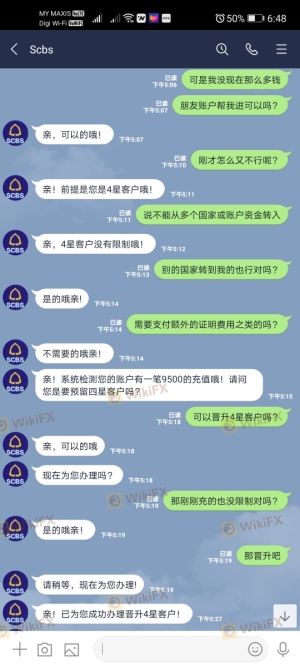

Customer Experience and Complaints

Customer feedback plays a significant role in evaluating the performance of a brokerage. SCBS generally receives positive reviews for its customer service and trading platforms. However, like any broker, it has faced complaints from clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Delayed Withdrawals | Medium | Addressed within 48 hours |

| Platform Downtime | High | Investigated and resolved promptly |

Common complaints include delays in withdrawals and occasional platform downtime. SCBS has shown responsiveness to these issues, often resolving them within a reasonable timeframe. However, potential clients should consider these factors when determining if SCBS is safe for their trading needs.

Platform and Execution

The trading platform offered by SCBS is known for its stability and user-friendly interface. Users report a generally smooth trading experience, with minimal slippage and a low rejection rate for orders. These factors contribute to a positive trading environment.

However, it is essential to remain cautious about any signs of platform manipulation. Although there have been no significant reports of such behavior at SCBS, traders should always be aware of the risks associated with trading platforms and monitor their execution quality closely.

Risk Assessment

Using SCBS as a forex broker presents certain risks that traders should be aware of. While the regulatory framework and company background suggest a safe environment, the inherent risks of trading forex must be considered.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong oversight from SEC Thailand |

| Market Risk | High | Volatility inherent in forex trading |

| Operational Risk | Medium | Potential for platform issues |

To mitigate these risks, traders should employ sound risk management practices, such as setting stop-loss orders and diversifying their trading portfolio.

Conclusion and Recommendations

In conclusion, SCBS is generally considered safe for traders, given its strong regulatory framework, reputable backing, and positive customer feedback. However, potential clients should be aware of the slightly higher trading costs and common complaints related to withdrawals and platform performance. For traders seeking a reliable broker, SCBS represents a solid option, but it is essential to remain vigilant and proactive in managing risks.

For those who may have concerns about SCBS, it is advisable to explore alternative brokers that are also well-regulated and have a proven track record of customer satisfaction. Ultimately, the decision should align with individual trading preferences and risk tolerance.

Is SCBS a scam, or is it legit?

The latest exposure and evaluation content of SCBS brokers.

SCBS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SCBS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.