Is 24 Trade safe?

Business

License

Is 24 Trade Safe or a Scam?

Introduction

In the dynamic world of forex trading, brokers play a critical role in facilitating transactions and providing access to financial markets. One such broker is 24 Trade, which has emerged in recent years as a platform for trading various assets including forex, cryptocurrencies, and CFDs. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is rife with unregulated entities and potential scams, making it essential for traders to assess the legitimacy and safety of their chosen broker. This article aims to evaluate whether 24 Trade is safe or a scam by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Our investigation is based on a comprehensive review of online resources, including user experiences, regulatory information, and expert analyses. By synthesizing this data, we aim to provide a clear picture of 24 Trade and help traders make informed decisions.

Regulatory Status and Legitimacy

The regulatory framework within which a broker operates is one of the most significant factors determining its legitimacy. A regulated broker is subject to strict oversight and must adhere to established standards, which helps protect traders' funds and ensures fair trading practices. In contrast, unregulated brokers often operate with little to no accountability, increasing the risk of fraud.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

24 Trade is currently unregulated, which raises significant concerns about its legitimacy and the safety of clients' funds. According to various sources, including the Swiss Financial Market Supervisory Authority (FINMA), 24 Trade has been flagged for operating without proper authorization. This lack of regulation means that traders have limited recourse in the event of disputes or financial losses, as there is no regulatory body to oversee the broker's practices.

The absence of a regulatory framework can lead to a host of issues, including inadequate security measures for client funds, lack of transparency in trading conditions, and the potential for fraudulent activities. Given that 24 Trade does not provide any verifiable regulatory information, it is prudent for traders to approach this broker with caution.

Company Background Investigation

Understanding a broker's background, including its history, ownership structure, and management team, is vital for assessing its credibility. 24 Trade claims to offer a platform for trading various assets, but details regarding its establishment and operational history remain vague.

24 Trade does not disclose information about its parent company or its physical address, which is a common red flag for potential scams. The broker's website lacks transparency, providing minimal information about its founders or the management team. This absence of information can lead to concerns about accountability and the overall integrity of the broker.

Furthermore, the company's operational history appears to be short, having been established in 2022. This relatively new presence in the market, combined with the lack of regulatory oversight, suggests that 24 Trade may not have a proven track record of reliability or ethical practices. Traders should be wary of investing with a broker that does not provide clear and accessible information about its operations and management.

Trading Conditions Analysis

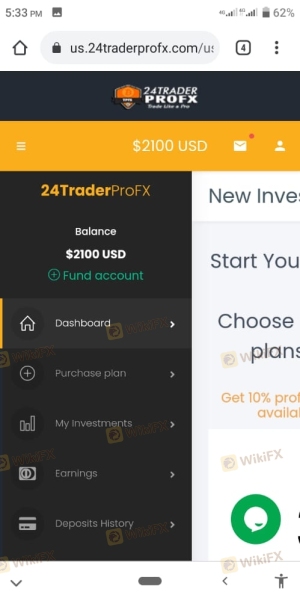

When evaluating a broker, it is essential to analyze the trading conditions it offers, as these directly impact the trading experience and potential profitability. 24 Trade has a tiered account structure with varying minimum deposit requirements and leverage options.

Trading Costs Comparison Table

| Cost Type | 24 Trade | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1.5 pips |

| Commission Structure | €3.50 per lot | €1.00 per lot |

| Overnight Interest Range | Not disclosed | 0.5% to 1% |

24 Trade requires a minimum deposit of €250 to open a standard account, which is significantly higher than many reputable brokers that allow deposits as low as $5. Additionally, while the broker advertises low spreads, user reviews indicate that spreads can be as high as 3 pips for major currency pairs, which is more than double the industry average.

Moreover, the commission structure appears to be less competitive compared to other brokers. The fees associated with trading on 24 Trade may lead to higher overall trading costs, potentially diminishing profitability for traders. Given these unfavorable trading conditions, it is crucial for potential clients to consider whether the costs align with their trading strategies and goals.

Client Funds Security

The security of client funds is paramount when choosing a broker. A reputable broker should implement robust measures to protect traders' investments, including segregated accounts, investor protection schemes, and negative balance protection policies.

Unfortunately, 24 Trade does not provide clear information regarding its security measures. The lack of regulatory oversight raises concerns about the safety of client funds. Without a regulatory body to enforce compliance, there is no assurance that client funds are held in segregated accounts or that they are protected in the event of the broker's insolvency.

Moreover, there have been reports of withdrawal issues, with clients claiming they were unable to access their funds after making requests. This lack of transparency and potential for financial loss further underscores the risks associated with trading with 24 Trade. Traders should exercise extreme caution and consider the implications of engaging with a broker that does not prioritize client security.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability and service quality. 24 Trade has received a mix of reviews, with many users expressing dissatisfaction with their experiences.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Poor Customer Support | Medium | Fair |

| Misleading Information | High | None |

Common complaints include difficulties withdrawing funds, poor customer support, and allegations of misleading information regarding trading conditions. Many clients report that once they attempt to withdraw their profits, they encounter numerous obstacles, including delayed responses and unfulfilled requests. This pattern of complaints raises significant concerns about the broker's operational practices and customer service quality.

For example, one user reported that after depositing funds and trading successfully, their withdrawal requests were met with silence, leading to frustration and financial loss. Such experiences highlight the potential risks associated with 24 Trade and suggest that traders may face significant challenges in accessing their funds.

Platform and Trade Execution

The trading platform's performance, stability, and execution quality are critical factors that can influence a trader's success. 24 Trade utilizes a web-based trading platform, which lacks the advanced features and reliability of industry-standard platforms like MetaTrader 4 or 5.

Users have reported issues with order execution, including slippage and rejections, which can adversely affect trading outcomes. The platform's stability is also a concern, as traders require a reliable environment to execute trades effectively. Furthermore, there are indications that the platform may not provide the transparency needed for traders to make informed decisions, raising suspicions of potential manipulation.

Risk Assessment

Engaging with 24 Trade involves several inherent risks that potential clients should consider.

Risk Rating Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Fund Security Risk | High | Lack of clear security measures. |

| Trading Cost Risk | Medium | High spreads and commissions. |

| Customer Service Risk | High | Poor response to complaints. |

Given the significant risks associated with 24 Trade, it is vital for traders to consider alternative options that offer better regulatory protection and customer service. To mitigate risks, traders should conduct thorough research and choose brokers with established reputations and transparent practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that 24 Trade operates as an unregulated broker with numerous red flags indicating potential scams. The lack of regulatory oversight, poor customer feedback, high trading costs, and inadequate security measures raise serious concerns about the safety and reliability of this broker.

Traders are advised to exercise extreme caution and consider alternative brokers that are regulated by reputable authorities. For those seeking a safer trading environment, options such as brokers regulated by the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) are recommended. These brokers provide better protection for client funds and a more transparent trading experience.

In summary, is 24 Trade safe? The overwhelming consensus is that it is not, and traders should prioritize their financial security by avoiding this broker.

Is 24 Trade a scam, or is it legit?

The latest exposure and evaluation content of 24 Trade brokers.

24 Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

24 Trade latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.