Zirve Global 2025 Review: Everything You Need to Know

Summary

This zirve global review shows major concerns about this forex broker. Based on user feedback and available information, Zirve Global has some features that might look good, but serious trust and service problems overshadow these benefits. The broker offers zero spread costs, which traders who watch their money might like. However, this advantage gets ruined by the complete lack of regulatory information and very poor user ratings.

The platform gives access to multiple asset classes including currency pairs, stocks, commodities, and gold. This shows some variety in trading opportunities. However, the high minimum deposit requirements from $2,000 to $10,000 may keep many retail traders away from these services. The most worrying issues are the ongoing user complaints about withdrawal problems and investment advisory services, which have led to an overall user rating of just 1.00 out of 10.

This zirve global review shows that the broker may only work for very experienced traders with lots of money who are willing to take big risks. The lack of regulatory oversight and poor customer service history make this broker wrong for most retail traders who want reliable and trustworthy trading conditions.

Important Notice

The information in this review comes from public data and user feedback. Since Zirve Global has no clear regulatory information, traders should be very careful when thinking about this broker. Different regional entities may work under different conditions and risk levels, which could greatly affect user experience and fund security.

This evaluation method uses available public information, user stories, and industry standards. Given the limited regulatory transparency, potential users should do more research and think about other brokers with established regulatory credentials before making any financial commitments.

Rating Framework

Based on our complete analysis, here are the ratings for Zirve Global across six important areas:

Broker Overview

Zirve Global works as a forex and multi-asset broker. Specific information about when it started and detailed company background stays unclear from available sources. The company presents itself as a provider of diverse trading opportunities across multiple asset classes, offering various account types designed to serve different trading needs and experience levels. However, the lack of complete company information raises immediate concerns about transparency and corporate governance.

The broker's business model seems focused on providing access to global financial markets through multiple account structures. The specific details of their operational framework and corporate structure are not well-documented in available materials. This lack of clarity in basic business information represents a major red flag for potential clients seeking reliable trading partnerships.

About trading infrastructure, Zirve Global provides access to currency pairs, stocks, commodities, and gold markets. This suggests a multi-asset approach to trading services. However, the absence of detailed information about trading platforms, execution models, and technological infrastructure makes it hard to judge the quality and reliability of their trading environment. Most notably, no specific regulatory authority oversight has been identified in available documentation, which represents a critical concern for trader fund safety and operational legitimacy.

Regulatory Status: Available information does not mention any specific regulatory authorities watching over Zirve Global's operations. The license index shows zero regulatory coverage, which is a major concern for trader protection.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current documentation. User complaints suggest big issues with withdrawal processes.

Minimum Deposit Requirements: The broker requires minimum deposits ranging from $2,000 to $10,000. This is much higher than many industry competitors and may limit access for retail traders.

Bonus and Promotional Offers: No specific information about bonus programs or promotional offers is available in current documentation.

Tradeable Assets: The platform provides access to currency pairs, stocks, commodities, and gold. This offers reasonable variety for multi-asset trading strategies.

Cost Structure: The broker advertises zero spread costs, which could be attractive for frequent traders. Commission structures and other fee information are not clearly specified.

Leverage Ratios: Specific leverage information is not mentioned in available documentation. This makes it hard to assess risk management parameters.

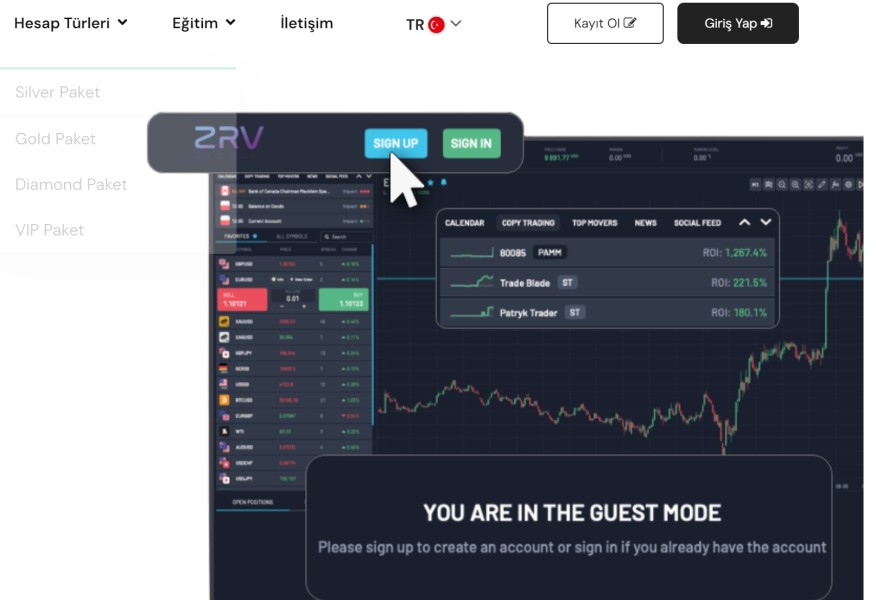

Platform Options: Trading platform details are not specified in current available information. This limits assessment of technological capabilities.

Geographic Restrictions: Information about regional restrictions or availability is not detailed in current documentation.

Customer Support Languages: Specific language support information is not available in current materials.

This zirve global review highlights major information gaps that potential traders should consider carefully before working with this broker.

Detailed Rating Analysis

Account Conditions Analysis

Zirve Global's account conditions present several challenges that greatly impact its appeal to retail traders. The broker offers multiple account types according to available information. This suggests some attempt to serve different trader groups. However, the lack of detailed specifications about these account types makes it hard for potential clients to understand what features and benefits each level provides.

The most significant barrier is the high minimum deposit requirement, ranging from $2,000 to $10,000. This represents a big entry threshold that effectively keeps out many retail traders who typically start with smaller amounts. Compared to industry standards where many good brokers offer accounts starting from $10-$100, Zirve Global's requirements suggest targeting only well-funded traders.

The account opening process and verification procedures are not clearly documented in available materials. This raises questions about operational transparency. Additionally, no information is available about special account features, trading conditions differences between account types, or any premium services that might justify the high minimum deposits.

User feedback shows major dissatisfaction with account conditions, as shown by the extremely low overall rating of 1.00. This suggests that even traders who meet the high deposit requirements find the actual account experience disappointing. The combination of high barriers to entry and poor user satisfaction makes the account conditions particularly unattractive in this zirve global review.

The trading tools and resources offered by Zirve Global appear limited based on available information. While the broker provides access to multiple asset classes including currency pairs, stocks, commodities, and gold, the specific trading tools and analytical resources supporting these markets are not well-documented. This lack of clarity about available tools represents a big disadvantage for traders who rely on complete market analysis and trading utilities.

Research and analysis resources, which are important for informed trading decisions, are not mentioned in available documentation. Modern forex brokers typically provide economic calendars, market news, technical analysis tools, and research reports, but Zirve Global's offerings in these areas remain unclear. This absence of documented analytical support suggests either limited resources or poor communication of available services.

Educational resources, another critical component for trader development, are not specified in current materials. The lack of educational support is particularly concerning given the high minimum deposit requirements, as traders investing significant amounts typically expect complete learning and development resources.

Automated trading support and third-party tool integration information is also absent from available documentation. In today's trading environment, where algorithmic and automated trading strategies are increasingly important, the lack of clear information about these capabilities represents a major limitation. The overall tools and resources offering appears insufficient for serious trading activities.

Customer Service and Support Analysis

Customer service represents one of Zirve Global's most significant weaknesses based on available feedback and documentation. User reports consistently highlight problems with withdrawal processes and concerns about investment advisory services. This suggests systematic issues with customer support quality and responsiveness. The extremely low user rating of 1.00 strongly indicates widespread dissatisfaction with service levels.

Specific customer service channels and availability information are not clearly documented. This makes it hard for potential clients to understand how to access support when needed. The absence of clear communication about support options, operating hours, and response time commitments suggests either inadequate service infrastructure or poor transparency about available support.

Response times appear problematic based on user complaints, particularly regarding withdrawal requests and account management issues. These types of delays can greatly impact trader confidence and operational efficiency, especially for active traders who require prompt resolution of account-related matters.

The lack of information about multilingual support capabilities further limits the broker's appeal to international traders. Additionally, no documented escalation procedures or complaint resolution processes are available, which adds to concerns about service quality. The combination of user complaints and limited service transparency makes customer support a major weakness in this evaluation.

Trading Experience Analysis

The trading experience with Zirve Global shows mixed characteristics based on available information. The reported average trading speed of 0 milliseconds suggests potentially excellent execution performance. This would be a significant advantage for active traders requiring fast order processing. However, the lack of additional execution quality metrics such as slippage rates and requote frequency makes it hard to fully assess trading conditions.

Platform stability and functionality details are not well-documented in available materials. This limits the ability to evaluate the overall trading environment quality. Modern traders expect robust, feature-rich platforms with advanced charting capabilities, order management tools, and reliable connectivity, but Zirve Global's platform specifications remain unclear.

The zero spread cost structure could provide cost advantages for frequent traders. The absence of information about commission structures and other potential fees makes it hard to calculate total trading costs. Additionally, without clear information about spread stability during different market conditions, the practical value of this feature remains uncertain.

Mobile trading capabilities and cross-platform synchronization are not specified in available documentation. This is concerning given the importance of mobile trading in today's market. The lack of complete trading environment information, combined with negative user feedback, suggests that despite some potentially positive features, the overall trading experience may not meet modern trader expectations. This zirve global review indicates significant room for improvement in trading experience transparency and documentation.

Trust and Reliability Analysis

Trust and reliability represent the most critical concerns in this Zirve Global evaluation. The complete absence of regulatory information and a license index of zero indicate that the broker operates without oversight from recognized financial authorities. This lack of regulatory supervision creates big risks for trader fund safety and legal recourse options.

The regulatory framework is essential for broker accountability, client fund protection, and dispute resolution mechanisms. Without clear regulatory oversight, traders have limited protection against potential operational issues, fund mismanagement, or business closure scenarios. This fundamental weakness makes Zirve Global unsuitable for risk-conscious traders regardless of other potential advantages.

Fund safety measures and client money protection protocols are not documented in available materials. This further adds to trust concerns. Good brokers typically maintain segregated client accounts, provide deposit insurance, and operate under strict regulatory capital requirements, but no such protections are evident with Zirve Global.

Company transparency regarding ownership structure, financial statements, and operational procedures is notably absent. The extremely low user rating of 1.00 and persistent complaints about withdrawal issues suggest systematic trust problems that extend beyond regulatory concerns into operational reliability.

The handling of negative events and user complaints appears inadequate based on available feedback. Withdrawal problems represent a particularly serious red flag. These trust and reliability issues make Zirve Global unsuitable for most traders seeking secure and dependable trading relationships.

User Experience Analysis

Overall user satisfaction with Zirve Global is extremely poor, as reflected in the 1.00 user rating that indicates widespread dissatisfaction across multiple service areas. This exceptionally low rating suggests fundamental problems with the broker's service delivery and customer relationship management that affect virtually all aspects of the trading experience.

Interface design and platform usability information are not available in current documentation. This makes it impossible to assess whether technological factors contribute to user dissatisfaction. However, given the consistently negative feedback, it's reasonable to assume that user interface and platform experience may also be problematic.

The registration and account verification processes are not clearly documented. The high minimum deposit requirements suggest that even the initial client onboarding experience may be challenging for many potential traders. Unclear procedures and high barriers to entry likely contribute to overall user frustration.

Fund operation experiences appear particularly problematic based on user feedback highlighting withdrawal issues. These operational problems represent serious concerns that directly impact trader confidence and financial security. When traders cannot reliably access their funds, it creates fundamental trust issues that undermine the entire trading relationship.

Common user complaints focus primarily on investment advisory services and withdrawal processes. This suggests systematic problems in these critical service areas. The concentration of complaints in fund access areas represents the most serious type of broker problems that traders can encounter. Based on this feedback pattern, Zirve Global appears suitable only for traders with high risk tolerance and substantial experience who can navigate these operational challenges.

Conclusion

This complete zirve global review reveals a broker with major operational and trust issues that outweigh any potential advantages. While the zero spread offering might appear attractive and the multi-asset access provides trading variety, the fundamental problems with regulatory oversight, customer service, and user satisfaction make Zirve Global unsuitable for most traders.

The complete absence of regulatory information combined with extremely poor user ratings creates an unacceptable risk profile for retail traders seeking reliable trading partnerships. The high minimum deposit requirements further limit accessibility while the documented withdrawal issues represent serious operational red flags that cannot be overlooked.

This broker might only be considered by highly experienced traders with substantial capital reserves who fully understand and accept the significant risks involved. However, for the vast majority of traders seeking trustworthy, well-regulated brokers with strong customer service and transparent operations, Zirve Global does not meet these essential requirements and should be avoided in favor of better-regulated alternatives.