Cash Forex Group 2025 Review: Everything You Need to Know

Executive Summary

Cash FX Group has been blacklisted and identified as a fraudulent platform that investors should avoid at all costs. Despite claims of providing forex education and automated trading services that allow users to generate passive income, the platform operates without proper regulatory oversight and has been shutting down operations since 2019. According to multiple sources, Cash FX Group primarily targeted investors seeking passive income through forex trading while marketing itself as an educational and automated trading service provider.

However, regulatory authorities across Europe have flagged Cash FX Group as a scam operation and placed it on official blacklists. User reviews on platforms like Trustpilot consistently reflect poor experiences and widespread dissatisfaction with the service, showing a clear pattern of problems. This comprehensive cash forex group review reveals significant red flags that potential investors must be aware of before considering any involvement with this platform.

The evidence overwhelmingly suggests that Cash FX Group lacks the fundamental regulatory protections and transparency that legitimate forex brokers provide. This makes it an unsuitable choice for serious forex trading or investment activities.

Important Disclaimer

Cash FX Group's regulatory status varies significantly across different jurisdictions, with European markets having officially blacklisted the platform as fraudulent. This review is based entirely on publicly available information, user feedback from verified review platforms, and regulatory warnings issued by financial authorities, without any independent verification or testing of the platform's services. We have not conducted our own testing because the company's questionable regulatory status and widespread warnings make such engagement inadvisable.

Potential investors should be aware that the information presented reflects the platform's status as of the review date. Given the company's history of operational changes and regulatory issues, circumstances may have evolved further since publication.

Overall Rating Framework

Broker Overview

Cash FX Group was established in 2019 with headquarters located in Panama City, Panama. The company positioned itself as a forex education and trading platform, claiming to offer users opportunities to generate passive income through automated forex trading systems that required no extensive trading knowledge. The platform marketed itself primarily to retail investors seeking alternative income streams without requiring active market participation.

The company's business model centered around providing forex education combined with automated trading services. However, the lack of transparent operational details and verifiable track records raised immediate concerns within the forex trading community about the platform's legitimacy and effectiveness.

From a regulatory perspective, Cash FX Group operates without oversight from major financial regulatory bodies and faces blacklist status across European markets. The platform primarily focused on forex trading activities, though specific details about available trading instruments, platform technology, and execution capabilities remain largely undisclosed and unverified. This cash forex group review highlights the significant gaps in transparency that characterize the platform's operations. These gaps make it impossible for potential users to make informed decisions based on concrete information about services and capabilities.

Regulatory Status: Cash FX Group has been blacklisted across European jurisdictions and operates without supervision from recognized financial regulatory authorities. No valid regulatory licenses have been identified for the platform's operations, creating significant legal and safety concerns for potential users.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods has not been detailed in available documentation. This raises concerns about fund accessibility and transaction transparency for users who need to understand how they can move money in and out of their accounts.

Minimum Deposit Requirements: The platform has not disclosed minimum deposit requirements in publicly available materials. This makes it difficult for potential users to understand entry-level investment expectations and plan their initial funding accordingly.

Promotional Offers: No specific bonus or promotional structures have been documented in available sources. This suggests either absence of such programs or lack of transparency in marketing practices that users would typically expect from legitimate platforms.

Available Trading Assets: While the platform claims to focus on forex trading, specific currency pairs, asset classes, and trading instruments have not been comprehensively detailed in available documentation. Users cannot determine what markets they would have access to or what trading opportunities might be available through the platform.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents potential users from understanding the true cost of platform participation and represents a significant red flag for any trading platform.

Leverage Options: Specific leverage ratios and margin requirements have not been documented in available sources. This makes it impossible to assess risk management parameters that are crucial for forex trading safety and strategy planning.

Platform Technology: The trading platform technology, whether proprietary or based on established systems like MetaTrader, has not been clearly specified in available materials. Users cannot evaluate the technical capabilities or reliability of the systems they would be using for their trading activities.

Geographic Restrictions: Specific regional limitations and availability restrictions have not been comprehensively documented in accessible sources. This creates uncertainty about whether the platform is legally available in different countries and jurisdictions.

Customer Support Languages: Available customer service languages and communication options have not been detailed in publicly available information. This cash forex group review reveals concerning gaps in basic operational transparency that legitimate brokers typically provide as standard information.

Account Conditions Analysis

The account conditions offered by Cash FX Group remain largely opaque, with no clear documentation of different account types, tier structures, or specific features available to users. This lack of transparency represents a fundamental problem for potential investors who need to understand what services they would receive at different investment levels and how the platform structures its offerings. Legitimate forex brokers typically provide detailed breakdowns of account categories, minimum deposit requirements, and associated benefits for each tier.

The absence of information about account opening procedures, verification requirements, and ongoing account maintenance policies creates significant uncertainty for potential users. Without clear documentation of how accounts function, users cannot make informed decisions about platform suitability for their trading needs and risk tolerance levels, which is essential for responsible investing.

Special account features that are standard in the industry, such as Islamic accounts for Sharia-compliant trading, demo accounts for practice, or institutional accounts for larger investors, have not been documented in available materials. This suggests either that such options are not available or that the platform lacks the sophistication to provide diverse account solutions that meet different user needs.

The platform's failure to provide transparent account condition information aligns with broader concerns about operational legitimacy and regulatory compliance. Professional forex brokers maintain clear, accessible documentation about account structures as part of their commitment to transparency and regulatory requirements, which helps build trust with potential clients. The absence of such information in this cash forex group review reinforces warnings about the platform's suitability for serious forex trading activities.

Cash FX Group's trading tools and resources appear limited based on available information, with the platform primarily claiming to offer automated trading services without providing substantial details about the underlying technology or methodology. The lack of comprehensive tool documentation raises questions about the platform's ability to support serious trading activities or provide value-added services that professional traders expect from legitimate brokers.

Educational resources, while mentioned as part of the platform's offerings, lack detailed curriculum information, instructor credentials, or learning outcome specifications. Legitimate forex education providers typically offer structured learning paths, certified instructional content, and measurable skill development programs that help users build real trading knowledge and skills.

The absence of such details suggests that educational offerings may be superficial or inadequately developed. Research and analysis resources, which are fundamental to successful forex trading, have not been documented in available materials, creating concerns about the platform's ability to support informed trading decisions.

Professional trading platforms typically provide market analysis, economic calendars, technical indicators, and expert commentary to support informed trading decisions. The apparent absence of these resources indicates significant limitations in the platform's ability to support comprehensive trading strategies that users need for success.

The automated trading services, while prominently marketed, lack transparency regarding strategy methodology, historical performance data, risk management protocols, and ongoing monitoring procedures. Without such information, users cannot assess the viability or safety of automated trading systems, which is crucial for making informed investment decisions.

Customer Service and Support Analysis

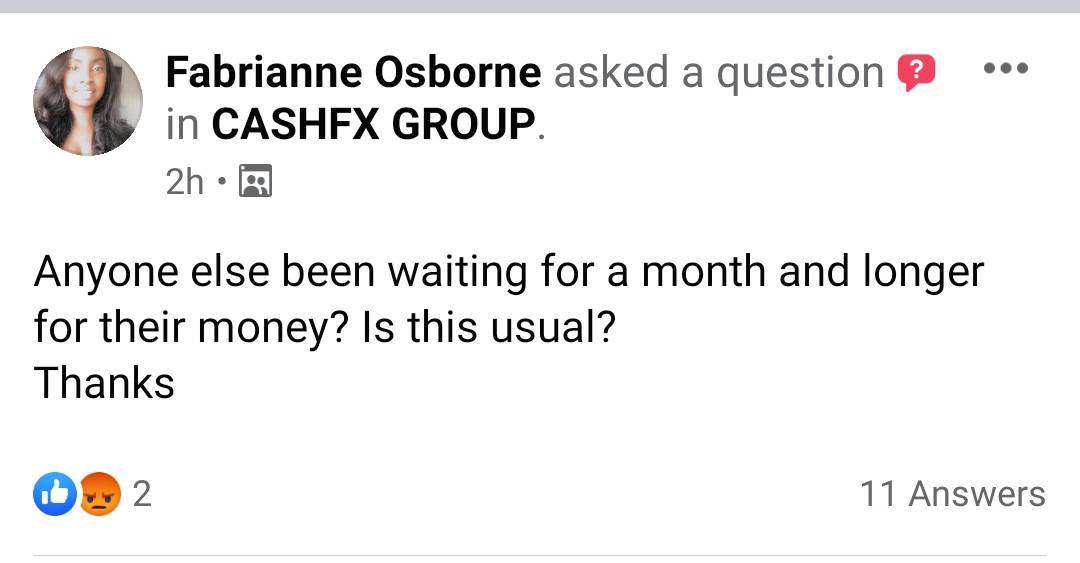

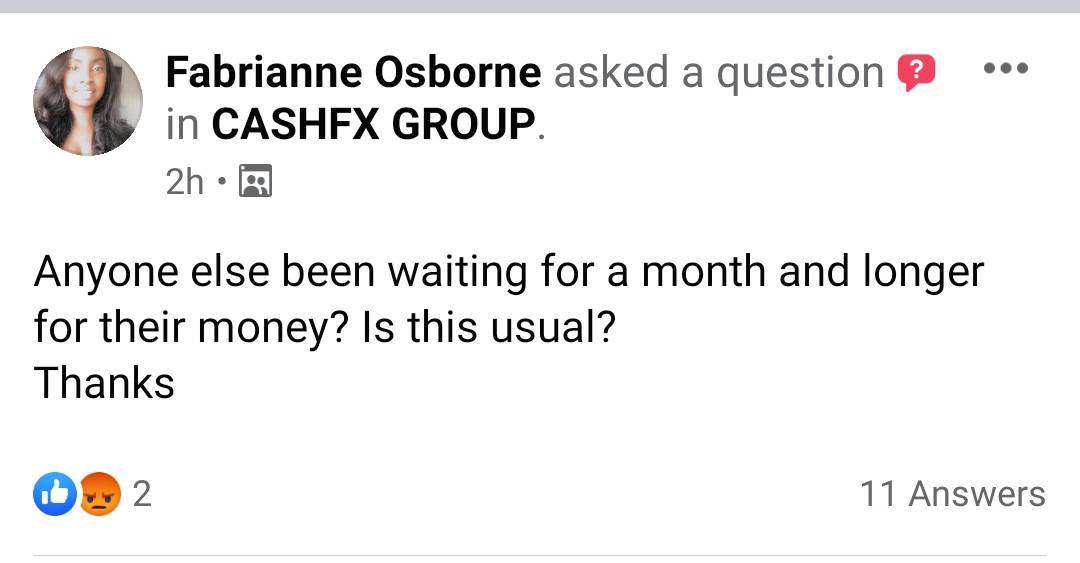

Customer service quality appears to be a significant weakness for Cash FX Group, based on user feedback available through review platforms like Trustpilot. The consistently poor ratings suggest systemic issues with support responsiveness, problem resolution capabilities, and overall service quality that users depend on when they encounter difficulties.

Professional forex brokers typically maintain robust customer support systems to address user concerns promptly and effectively. The availability of customer service channels, response time expectations, and escalation procedures have not been clearly documented in available materials, creating uncertainty for users who may need assistance.

This lack of transparency about support processes creates uncertainty for users who may need assistance with account issues, technical problems, or trading-related questions. Legitimate brokers typically provide multiple contact methods, published response time commitments, and clear escalation paths for complex issues that require specialized attention.

Multilingual support capabilities, which are essential for international forex platforms, have not been specified in available documentation. Given the global nature of forex trading, the absence of clear language support information suggests potential limitations in serving diverse international user bases effectively and professionally.

The negative user feedback patterns visible on review platforms indicate that when users do encounter problems, the resolution process may be inadequate or unsatisfactory. This creates significant concerns about the platform's ability to maintain positive client relationships and address legitimate user concerns in a professional manner that protects user interests.

Trading Experience Analysis

The trading experience offered by Cash FX Group remains largely undocumented, with critical information about platform stability, execution speed, and order processing quality absent from available materials. Professional trading platforms typically provide detailed specifications about system uptime, execution statistics, and performance metrics that allow users to assess platform reliability and suitability for their trading strategies and risk management needs.

Order execution quality, including fill rates, slippage statistics, and rejection rates, has not been documented or verified through independent testing. These metrics are crucial for traders to understand how effectively they can implement trading strategies and achieve desired market entry and exit points, which directly impacts profitability.

The absence of such information makes it impossible to assess the platform's technical capabilities or competitive positioning relative to established brokers. Platform functionality, including charting capabilities, technical analysis tools, and order management features, has not been comprehensively detailed in available sources, leaving users without essential information about system capabilities.

Modern forex trading requires sophisticated platform capabilities to support various trading strategies and risk management approaches. Without clear documentation of available features, potential users cannot determine whether the platform meets their technical requirements or provides the tools necessary for successful trading.

Mobile trading capabilities, which are essential for contemporary forex trading, have not been specified in available materials. The ability to monitor positions, execute trades, and manage risk through mobile devices is now considered standard functionality for professional trading platforms that serve active traders.

The overall trading environment, including market depth information, liquidity providers, and execution models, remains undisclosed. This prevents users from understanding how their trades would be processed and what market conditions they might encounter during their trading activities.

Trust and Safety Analysis

Trust and safety represent the most critical concerns regarding Cash FX Group, with the platform's blacklist status across European jurisdictions serving as a primary warning signal for potential investors. Regulatory blacklisting typically occurs when authorities identify patterns of fraudulent activity, inadequate consumer protection, or violations of financial services regulations that pose risks to public investors.

This official recognition of problematic operations represents the strongest possible warning about platform legitimacy. The absence of regulatory oversight from recognized financial authorities means that users lack fundamental protections that legitimate forex brokers provide through regulatory compliance and government supervision.

These protections typically include segregated client funds, dispute resolution mechanisms, compensation schemes, and operational transparency requirements. Without such safeguards, users face significantly elevated risks regarding fund security and recourse options if problems arise with their accounts or investments.

Company transparency issues extend beyond regulatory compliance to include basic operational disclosure. Legitimate financial services providers maintain clear documentation about company structure, management teams, operational procedures, and financial stability that helps users make informed decisions about platform trustworthiness.

The lack of such transparency creates uncertainty about the platform's actual capabilities and long-term viability. Industry reputation, as reflected in user reviews and expert assessments, consistently indicates negative experiences and widespread distrust among users who have attempted to use the platform's services.

The pattern of poor user feedback across multiple review platforms suggests systemic issues with platform operations and client treatment. Professional forex brokers typically maintain positive industry relationships and user satisfaction levels as essential business requirements for long-term success.

User Experience Analysis

User experience with Cash FX Group appears consistently negative based on available feedback from review platforms and user testimonials. The overall satisfaction levels reported by users indicate significant problems with service delivery, platform functionality, and client relationship management that create frustration and financial losses for users.

Professional forex brokers typically maintain high user satisfaction levels through responsive service, reliable platform performance, and effective problem resolution. Interface design and platform usability have not been comprehensively documented, but user feedback suggests potential issues with platform accessibility and functionality that make trading difficult.

Modern trading platforms require intuitive design, responsive performance, and comprehensive feature sets to support effective trading activities. The apparent absence of positive user feedback about platform experience raises concerns about technical quality and user-centered design that prioritizes customer needs.

Registration and account verification processes have not been clearly documented, creating uncertainty about onboarding procedures and identity verification requirements. Professional platforms typically maintain streamlined, secure registration processes that comply with regulatory requirements while providing efficient user access to services without unnecessary complications.

Fund operation experiences, including deposit and withdrawal procedures, appear problematic based on user feedback patterns. The ability to efficiently and securely transfer funds represents a fundamental requirement for any financial services platform that handles user money.

Reports of difficulties with fund operations create serious concerns about platform reliability and user fund security. Common user complaints appear to center around service quality, platform reliability, and difficulty obtaining satisfactory resolution to problems that affect their trading and financial interests.

The consistency of negative feedback across multiple review platforms suggests systemic issues rather than isolated incidents. This cash forex group review indicates that the platform may not meet basic user expectations for professional forex trading services that protect user interests and provide reliable functionality.

Conclusion

This comprehensive cash forex group review reveals significant concerns that make the platform unsuitable for serious forex trading or investment activities. The combination of regulatory blacklisting, poor user feedback, lack of operational transparency, and absence of fundamental trading platform documentation creates an overwhelming case against platform usage for any investor category.

While Cash FX Group may appeal to users seeking passive income through automated forex trading, the extremely high risk profile and questionable legitimacy make it an inappropriate choice for responsible investing. The platform's inability to provide basic transparency about operations, costs, and services represents fundamental failures that legitimate forex brokers routinely address through proper documentation and regulatory compliance.

The primary advantages claimed by the platform - automated trading and passive income generation - are overshadowed by critical disadvantages including regulatory warnings, poor user experiences, and lack of operational transparency. Investors seeking forex trading opportunities would be better served by exploring regulated, transparent brokers with verified track records and positive user feedback that demonstrate real value and safety for user funds.