YUNHE Review 1

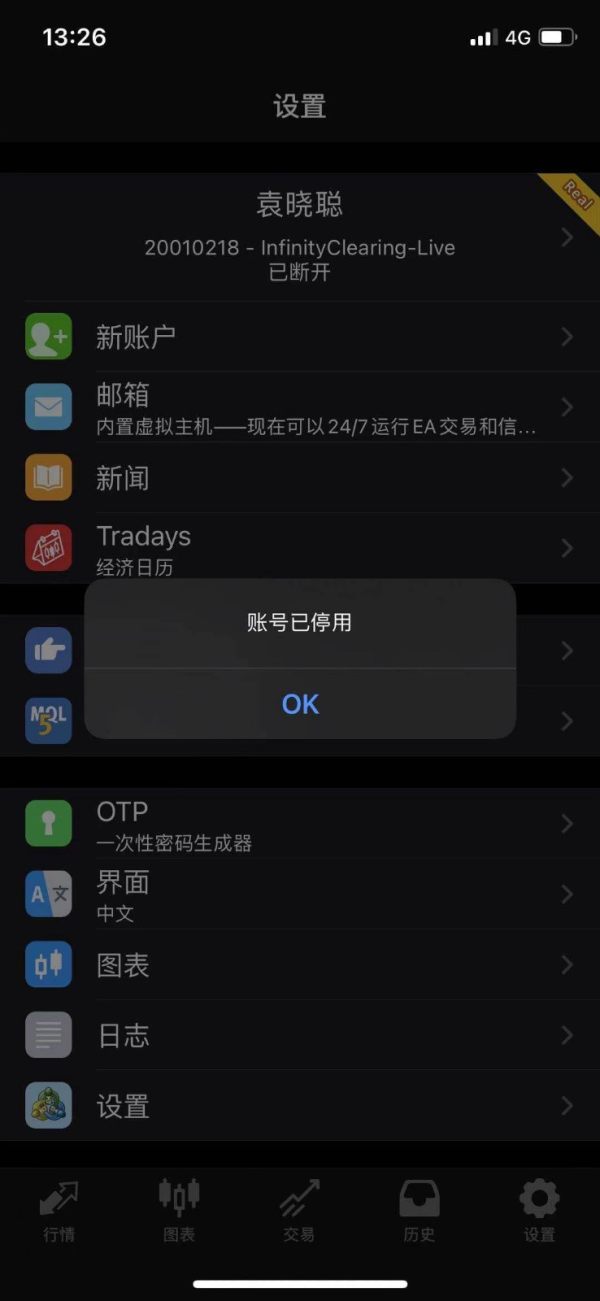

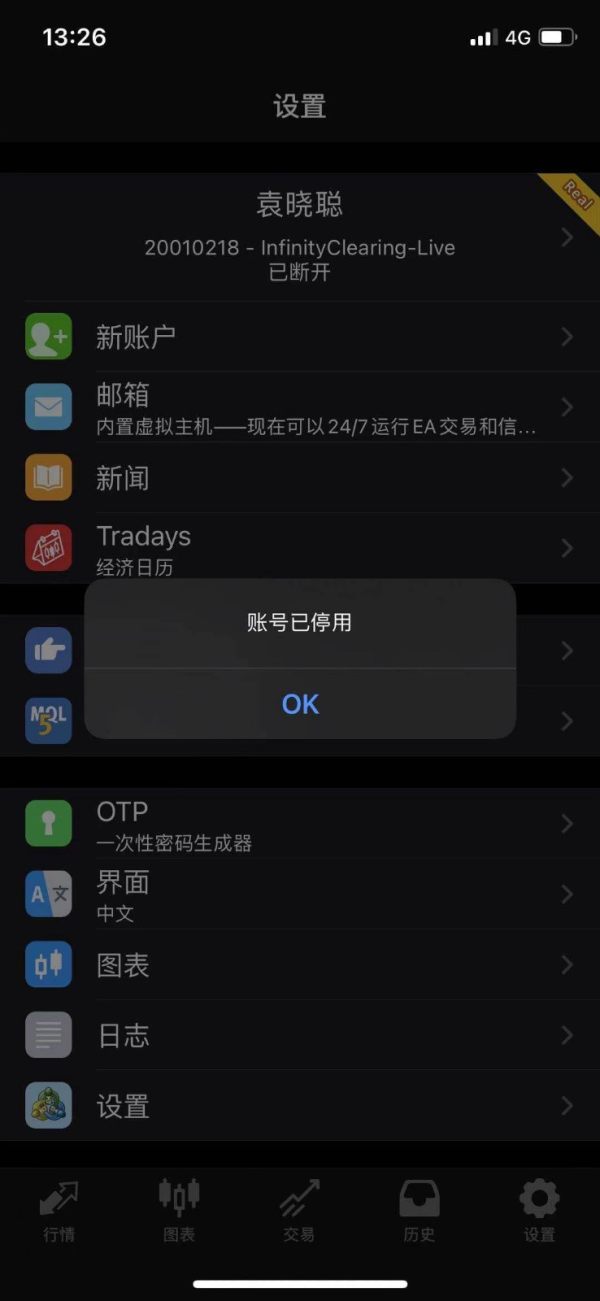

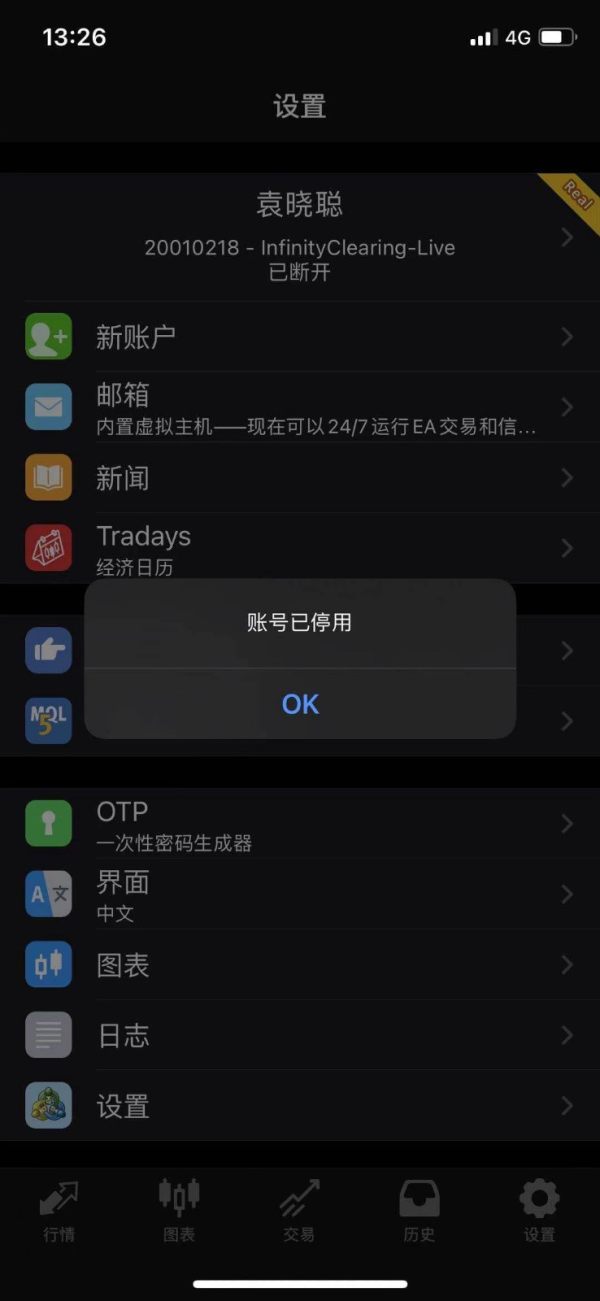

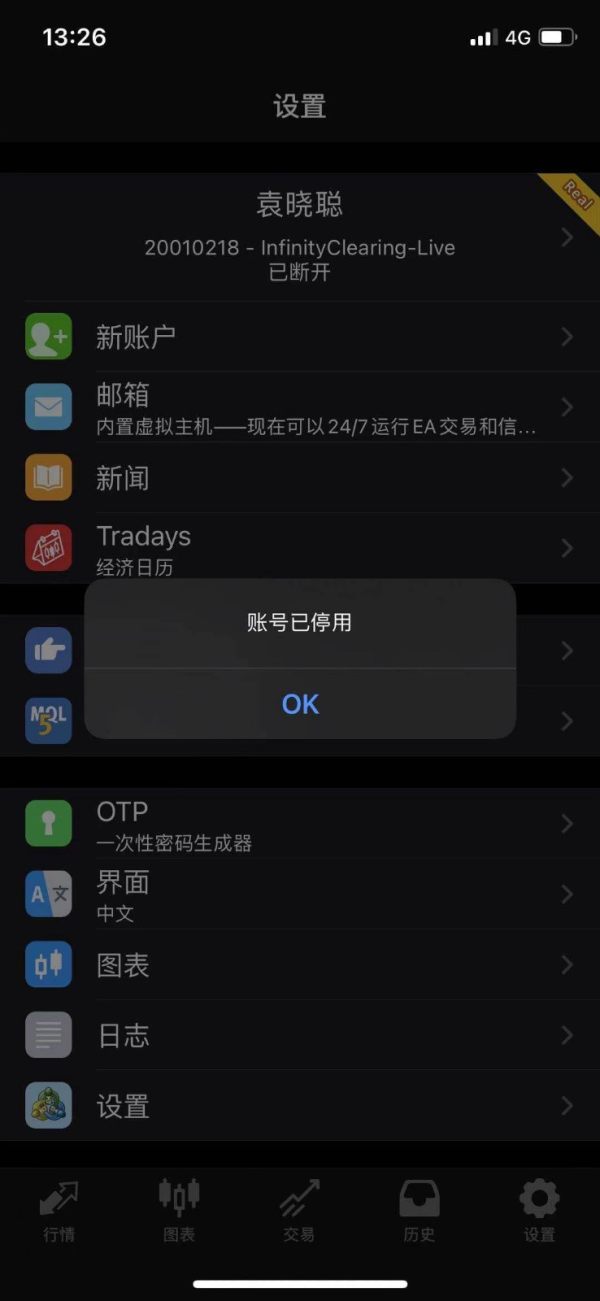

I don’t know why the account was disabled yesterday, and it just disappeared without receiving the notification.

YUNHE Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I don’t know why the account was disabled yesterday, and it just disappeared without receiving the notification.

Yunhe has emerged as a broker with considerable appeal for cost-conscious traders, offering competitive pricing and a diverse range of trading platforms. The firm attracts novice traders and seasoned professionals alike with its low-cost trading options and multiple market access points, permitting users to engage in global financial markets with greater ease. However, potential investors should tread with caution. Concerns regarding Yunhe's regulatory compliance and customer service are significant, casting a shadow over its otherwise attractive offerings. Reports of negative feedback among users, particularly regarding withdrawal processes and customer support, suggest that while the broker has the potential for gains, it may pose significant risks, especially for those new to trading.

| Aspect | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 2.5 | Mixed reviews; significant concerns regarding regulation and user feedback. |

| Trading Costs | 4.0 | Competitive pricing appealing to cost-conscious traders. |

| Platforms & Tools | 3.5 | Varied platforms available, though some user interfaces lack sophistication. |

| User Experience | 3.0 | Average experiences reported, with some complaints about clarity and access. |

| Customer Support | 2.0 | Major negative feedback about responsiveness and assistance quality. |

| Account Conditions | 3.5 | Fair conditions for account opening, but concerns about withdrawal processes. |

Yunhe, founded in 2015, is headquartered in the bustling financial district of Beijing, China. As a relatively new player in the trading space, it has positioned itself to cater primarily to cost-sensitive traders providing a blend of competitive pricing and user-friendly platforms. However, its rapid ascendance is accompanied by lingering scrutiny over operational practices and regulatory adherence, which could deter potential clients from investing their capital.

Yunhe primarily operates as a Forex broker specializing in various asset classes, including futures and options. The broker is known for low transaction costs and a user-friendly interface intended to attract novice traders. However, concerns regarding its regulatory compliance are persistent, with inconsistent claims about oversight from recognized regulatory bodies, casting doubt on its seriousness regarding adhering to international trading standards.

| Detail | Description |

|---|---|

| Regulation | Multiple mixed reports; unclear |

| Minimum Deposit | $100 |

| Leverage | Up to 1:500 |

| Major Fees | Low trading commissions; unclear withdrawal fees |

In examining Yunhe's trustworthiness, it becomes essential to address inherent uncertainties surrounding regulatory compliance. Many potential clients have expressed concerns regarding the broker's claimed regulatory affiliations, leading to a troubling narrative of conflicting information. It is essential for prospective traders to oversee their due diligence and pursue verification:

The brokers reputation has also been marred by considerable user complaints regarding withdrawal issues and overall service quality, demonstrating the importance of solid research before investing with Yunhe.

Yunhe presents itself as a viable option in terms of trading costs, boasting minimal commission fees compared to many industry competitors, which is an alluring feature for cost-sensitive users. Here's a closer look at the implications:

"Getting my funds out has been a nightmare; I faced delays and fees I wasn't informed about initially."

When it comes to platforms and tools, Yunhe offers a variety of choices catering to different trader levels. Key elements are:

"While I managed to place trades easily, the lack of support when I had questions about the platform was frustrating and led me to wonder if I should switch brokers."

User experience with Yunhe remains uneven, drawing contrasting reviews from clientele:

Traders have found the registration process straightforward, yet the clarity of ongoing support and resource availability is a recurring point of contention.

Personal anecdotes shared online reveal frustrations related to navigating the trading platform, with a significant portion of users noting that trading conditions can be less friendly compared to competitors.

The feedback on user experience emphasizes the need for an overhaul, particularly to focus on providing proper onboarding for new traders unfamiliar with the platform.

Customer support proves to be one of Yunhes most significant weaknesses. Notable issues include:

Comprehensive negative feedback concerning response times during critical outreach has been reported. Many users expressed dissatisfaction over the time it takes to receive assistance for pressing queries.

It is clear that investors value robust customer support; hence Yunhe's ongoing challenges in this department can lead to potential trader dissatisfaction. One user lamented:

"When I needed help for urgent issues, I was left without a response for days—definitely not what I expected from a broker."

Yunhe's account conditions come across as generally favorable; however, clarity on specifics remains a concern:

Users can open accounts at a relatively low barrier, which could appeal to beginners looking to dip into trading without making significant financial commitments.

While the conditions appear fair superficially, the reality is muddied by withdrawal issues, user confusion over requirements, and the lack of guidance on fee structures.

The feedback loop regarding account conditions points towards the need for clearer communication from Yunhe about the nuances involved in maintaining an account.

Yunhe presents a mixed bag of opportunities for traders, particularly those keen on capitalizing on low trading costs. While its platform variety and competitive pricing may attract traders, both novice and experienced are advised to tread cautiously. Alarm bells regarding customer support and regulatory credibility are significant, indicating a need for thorough self-research before engagement. The potential for gains exists, but so does the risk of significant challenges, particularly for the uninformed or inexperienced trading audience.

Yunhes standing in the trading community speaks to the necessity of balancing opportunity and caution: potentially rewarding for those well-researched, yet perhaps a trap for the careless.

FX Broker Capital Trading Markets Review