Summary

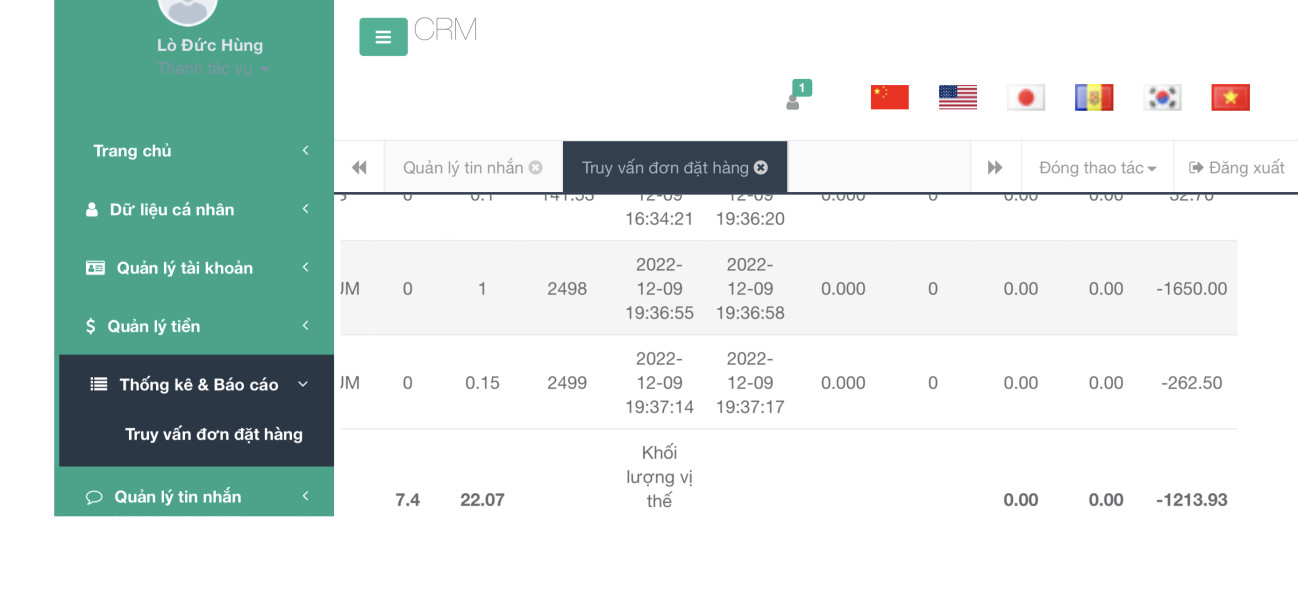

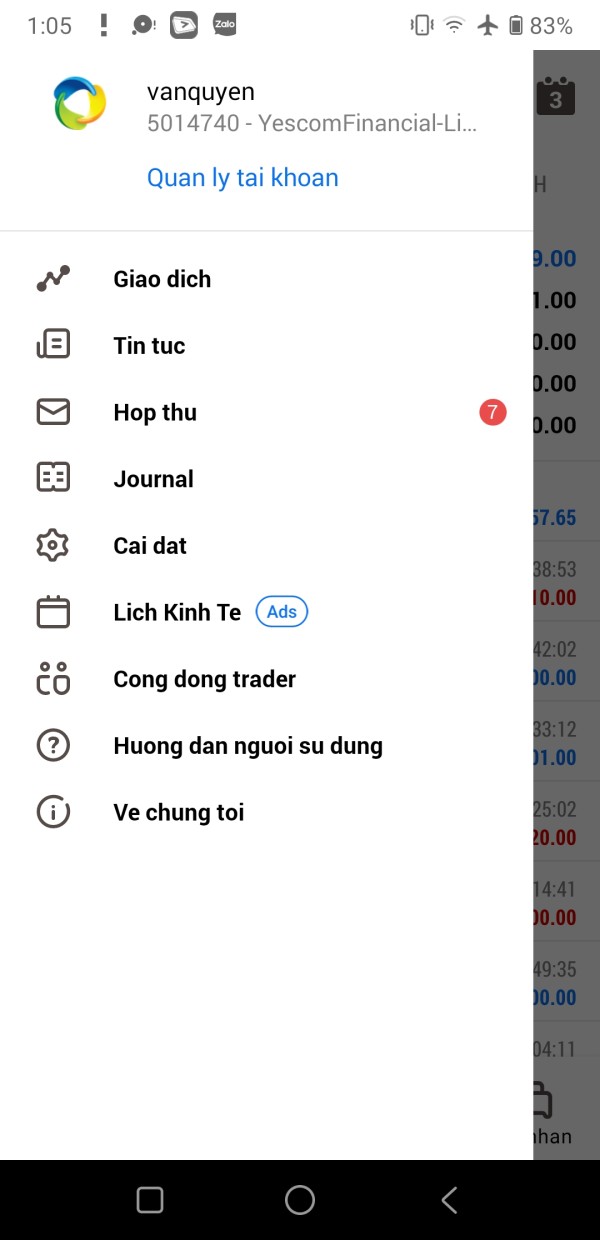

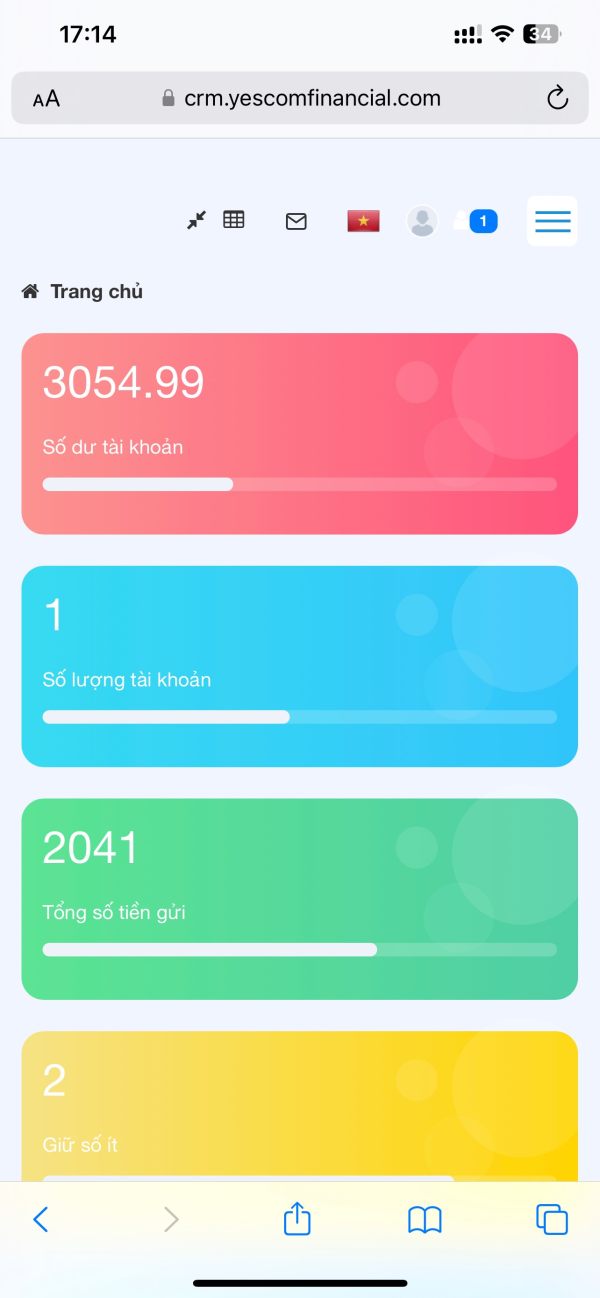

This yescom financial limited review shows major concerns about this offshore forex broker. Traders should think carefully before opening an account with them. YesCom Financial Limited started in 2021 in Hong Kong. The company works as an unregulated broker that serves Hong Kong and Vietnamese markets mainly. They offer multiple account types like Classic, PRO, and ECN accounts for different trading needs. However, the lack of rules and oversight creates big red flags.

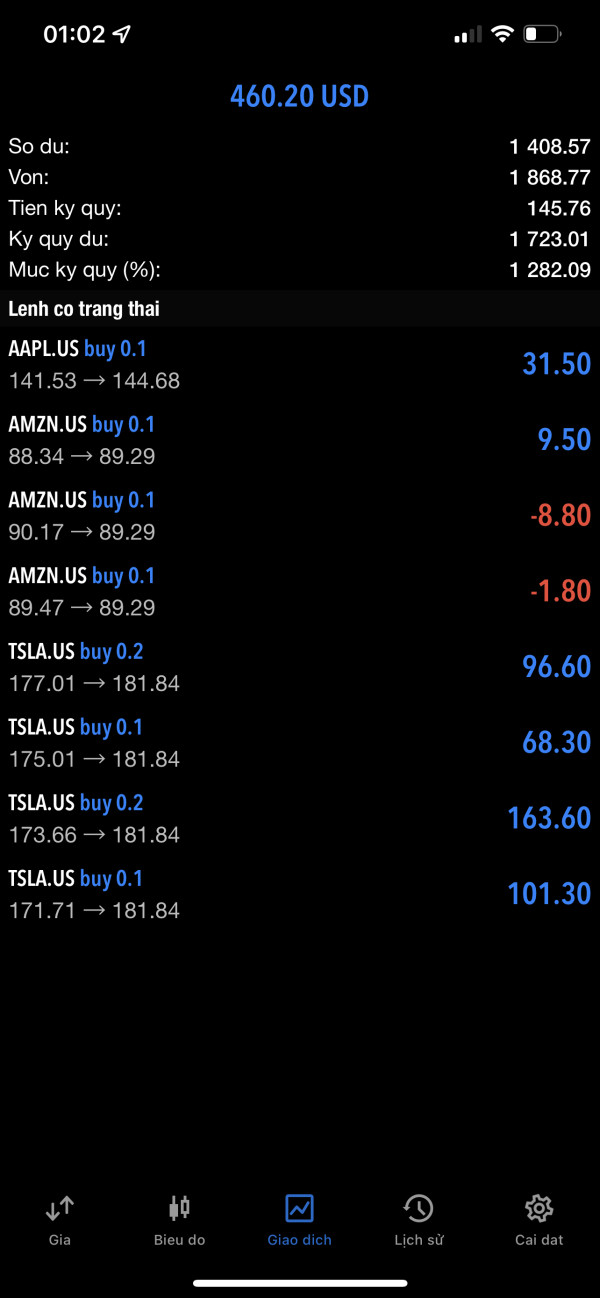

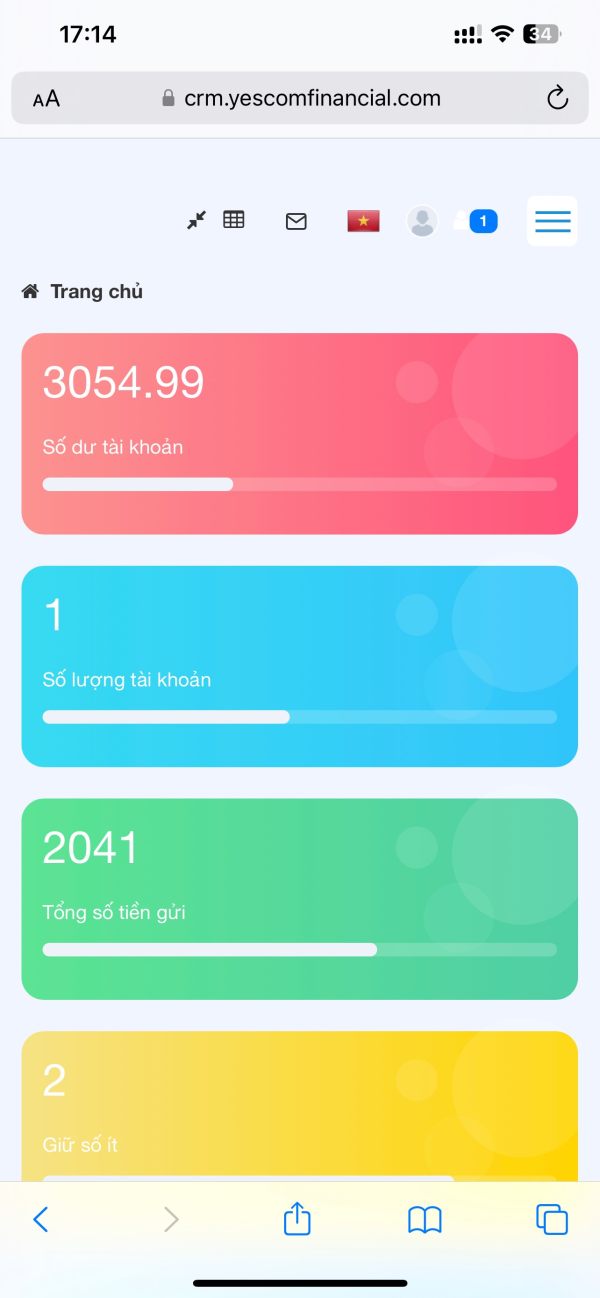

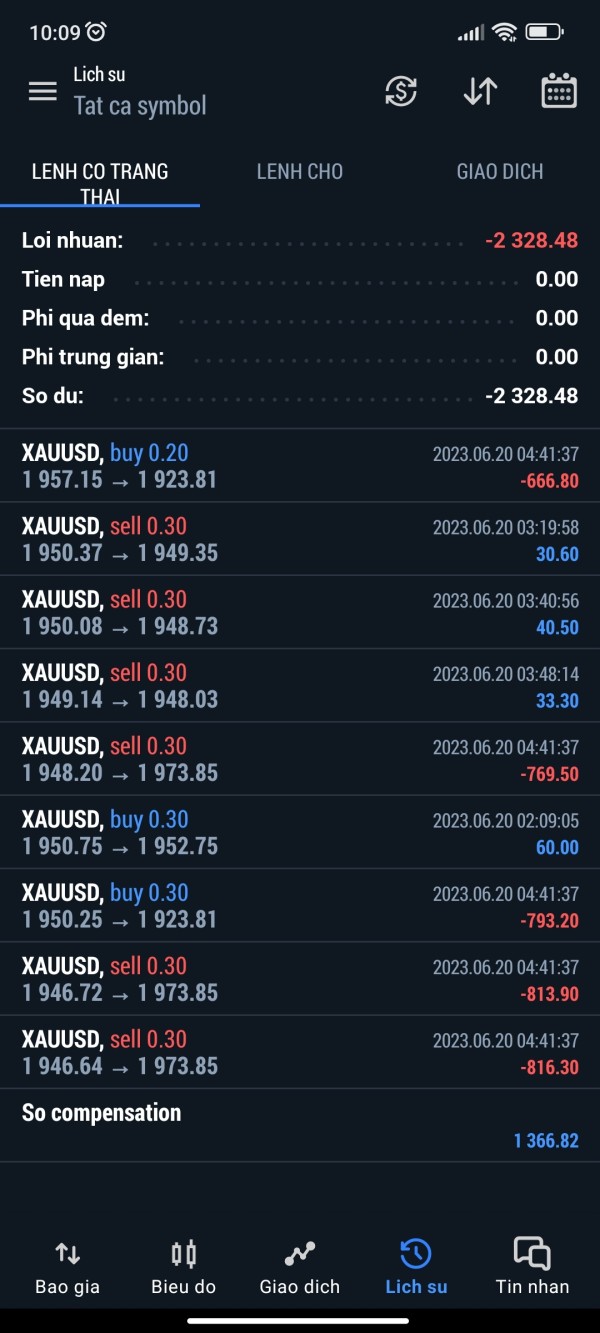

The broker gives access to forex, precious metals, stock indices, individual stocks, and CFDs. User feedback shows troubling problems with how the company works. WikiFX ratings give YesCom Financial Limited only 1.32 out of 10 points. This score shows serious trust and reliability problems. User reports suggest possible fraud activities with 25 negative reports compared to just one positive review. The company targets beginners and traders who want different account choices. But the major risks with this unregulated broker make it wrong for most retail traders, especially those who want low risk.

Important Notice

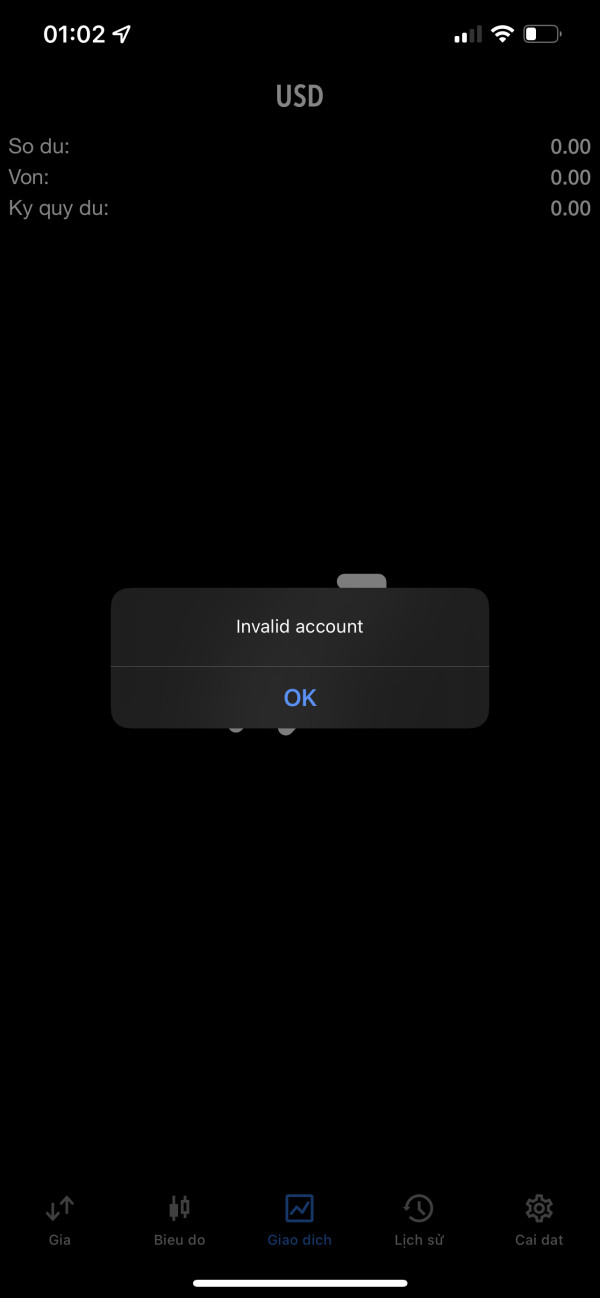

YesCom Financial Limited works as an offshore broker without rules from recognized financial authorities. This creates big legal and financial risks for traders since there are no investor protection programs or regulatory oversight to ensure fair trading. The absence of regulation means client funds may not be separated or protected like industry standards require.

This review uses available user feedback, public information, and third-party assessments. The broker itself provides limited transparency, so some information may be incomplete or missing. Traders should be very careful and do thorough research before considering any engagement with unregulated brokers. The evaluation here reflects current available information and should not be considered investment advice.

Rating Framework

Broker Overview

YesCom Financial Limited started in the forex market in 2021 as a Hong Kong-based offshore broker. The company says it provides financial services with multi-asset trading opportunities to clients mainly in Asian markets, focusing on Hong Kong and Vietnam. As an offshore entity, the broker works outside the regulatory framework of major financial areas, which greatly affects its credibility and client protection.

The company's business model focuses on providing access to global financial markets through different account types for various trading styles and experience levels. However, the lack of specific information about the company's management team, financial backing, or operational transparency creates concerns about its legitimacy and long-term survival.

The broker offers trading services across multiple asset classes including foreign exchange pairs, precious metals like gold and silver, stock indices, individual stocks, and contracts for difference. Despite this diverse offering, the absence of detailed information about trading platforms, specific trading conditions, and regulatory compliance creates uncertainty for potential clients. According to available sources, the company's operational focus stays mainly on the Asian market, though specific details about its yescom financial limited review processes and client onboarding procedures remain largely unknown.

Regulatory Status

Available information shows that YesCom Financial Limited works without oversight from recognized financial regulatory authorities. This unregulated status means the broker does not follow standard industry requirements for client fund protection, fair trading practices, or operational transparency.

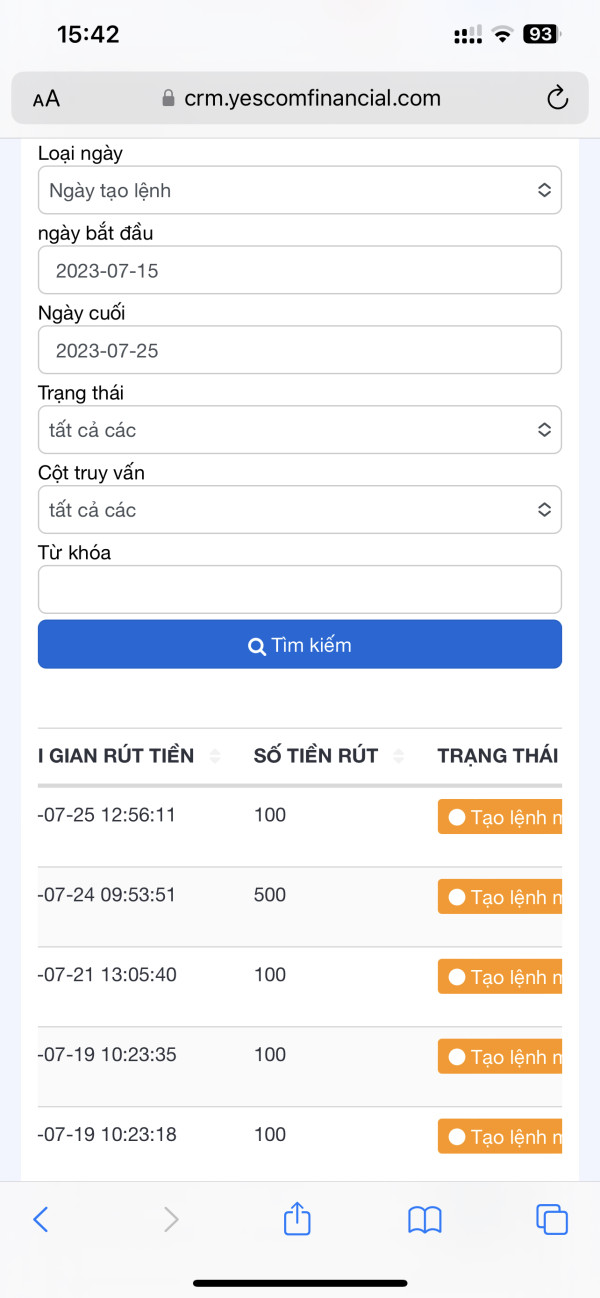

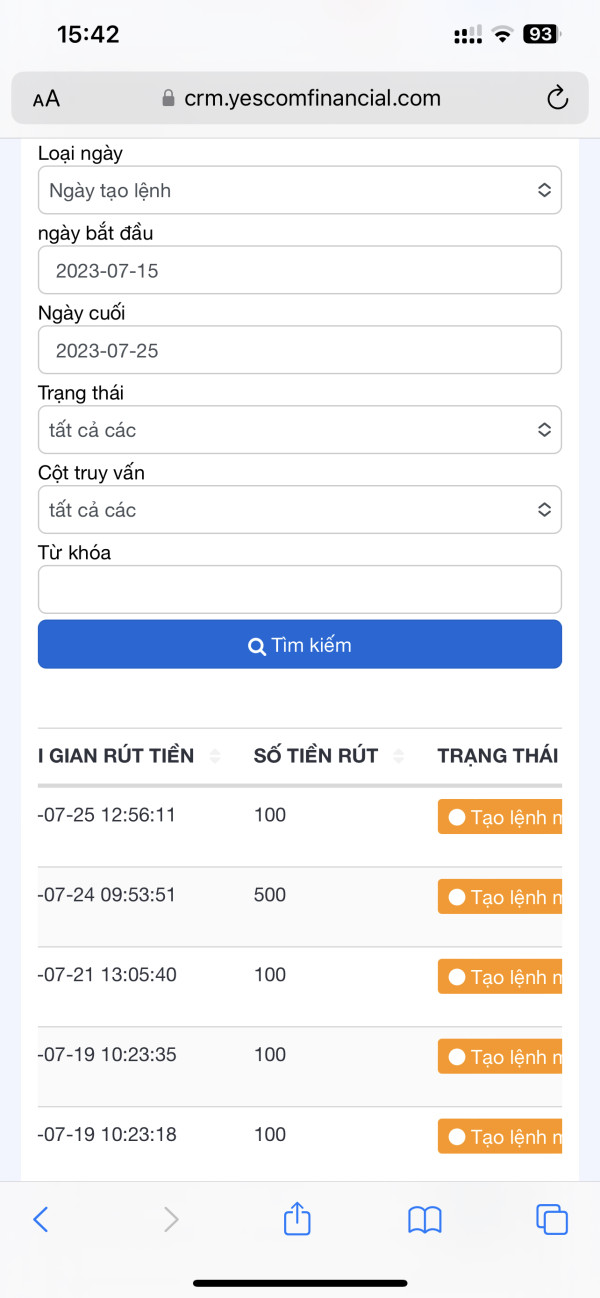

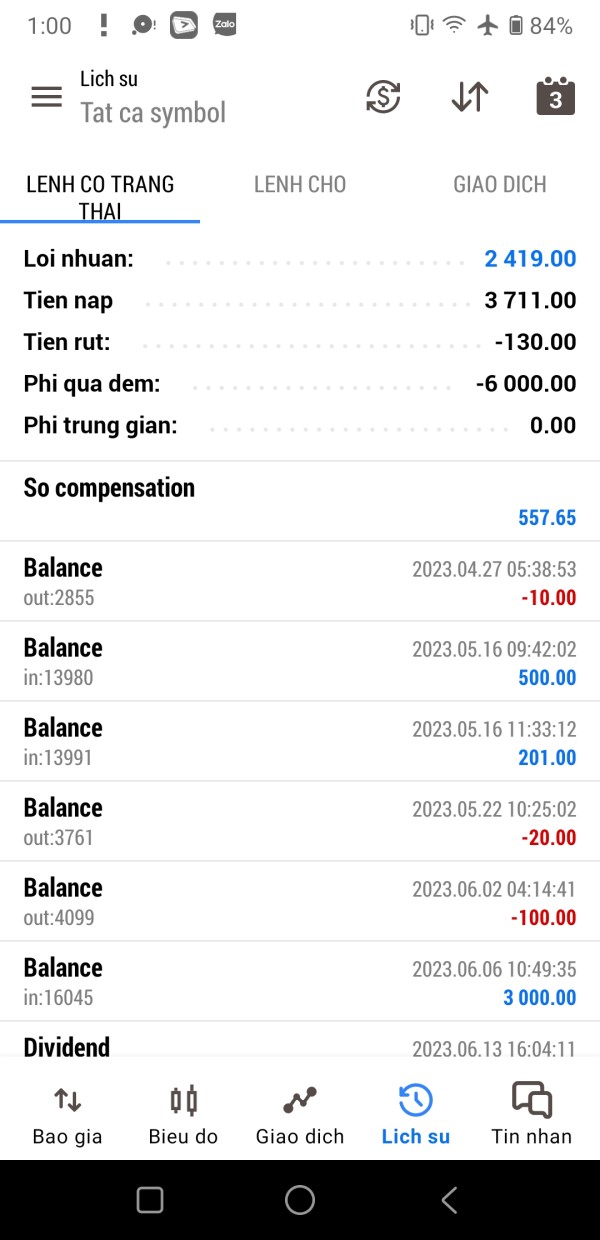

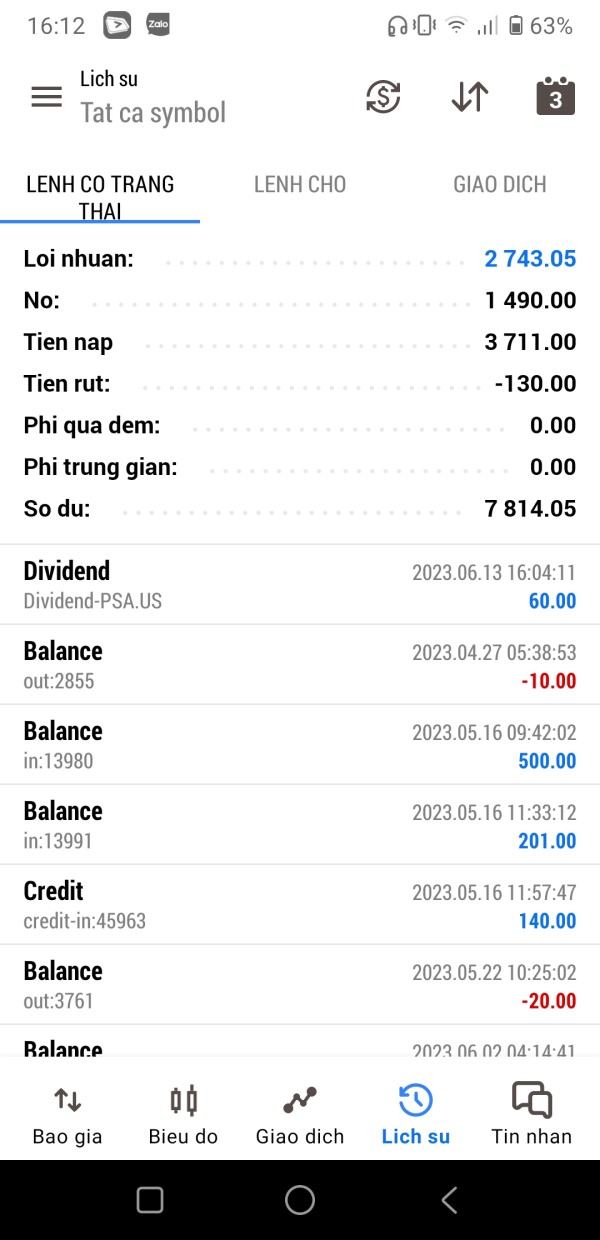

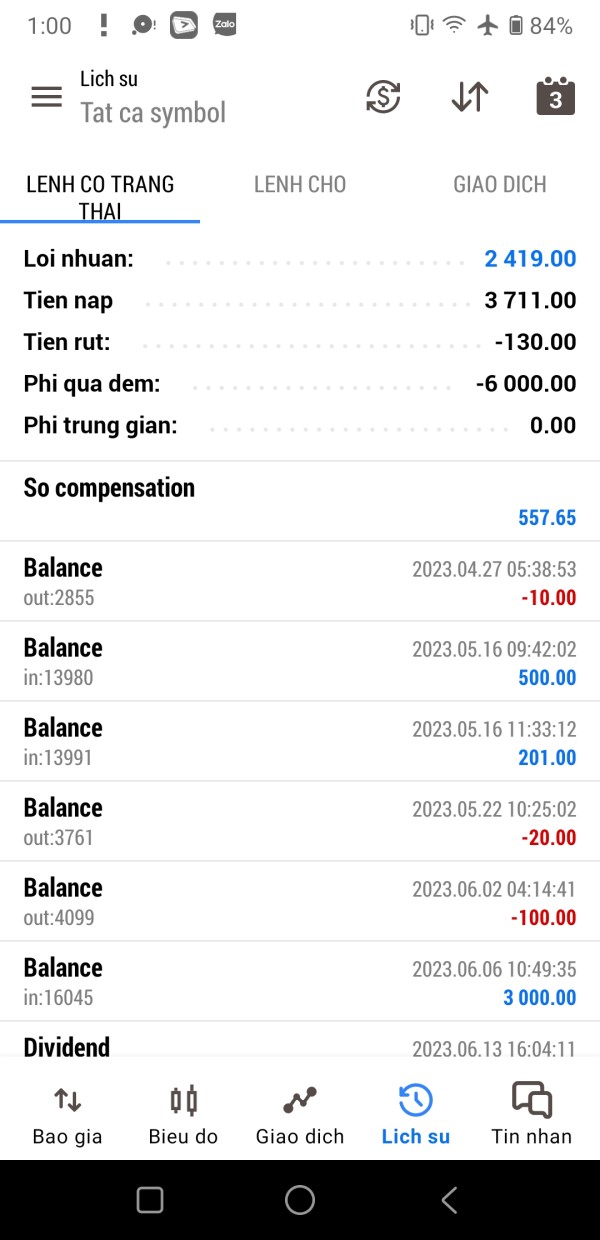

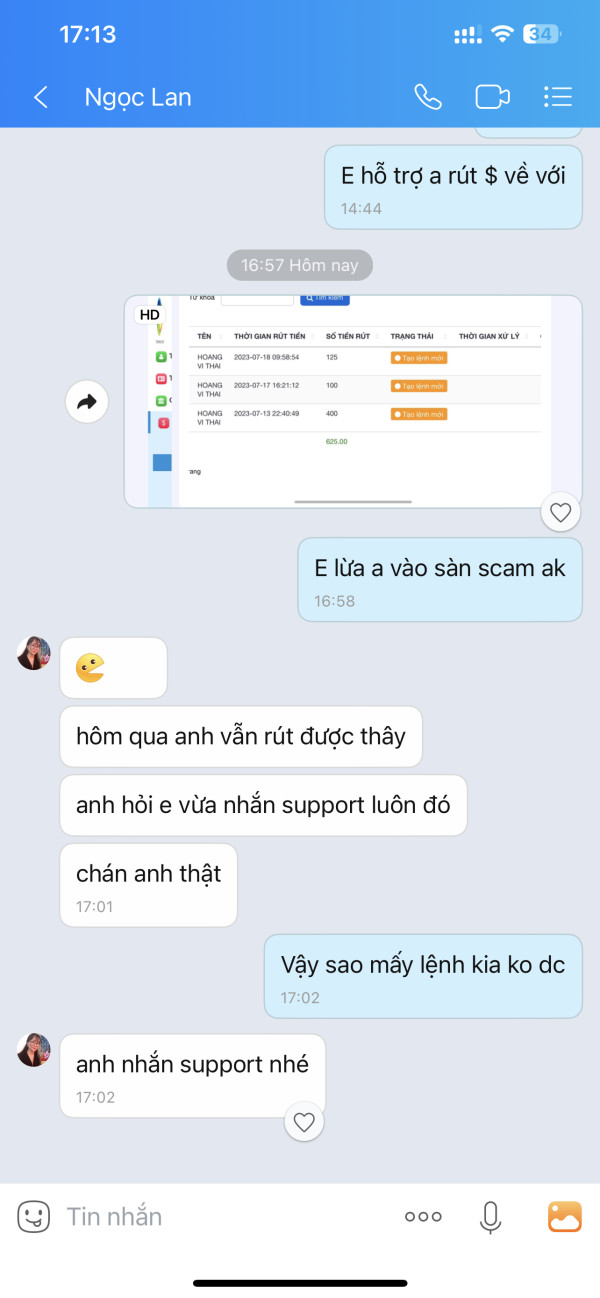

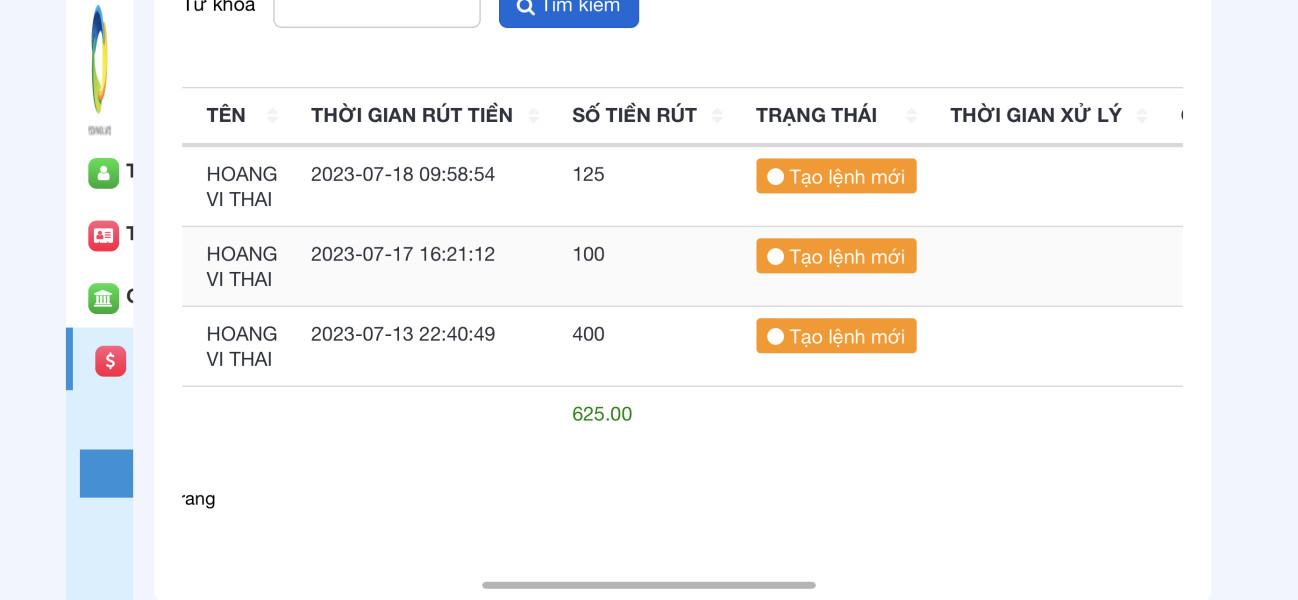

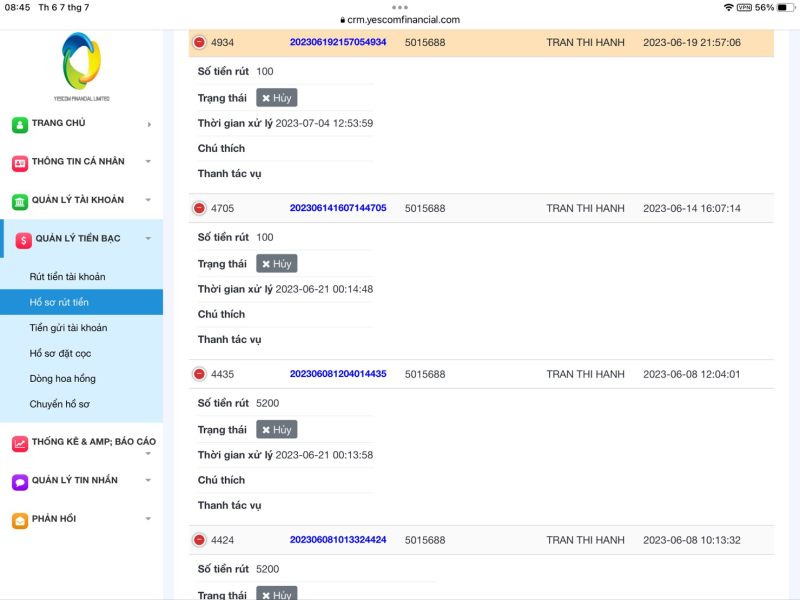

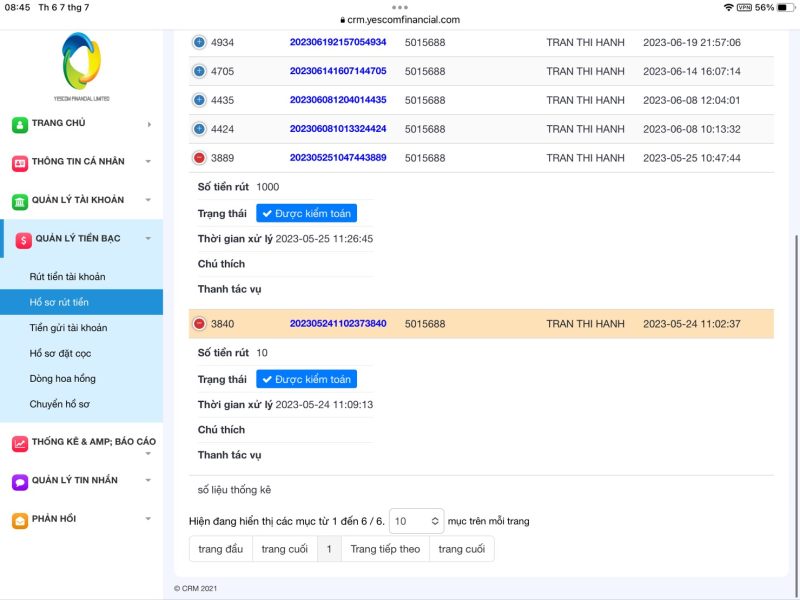

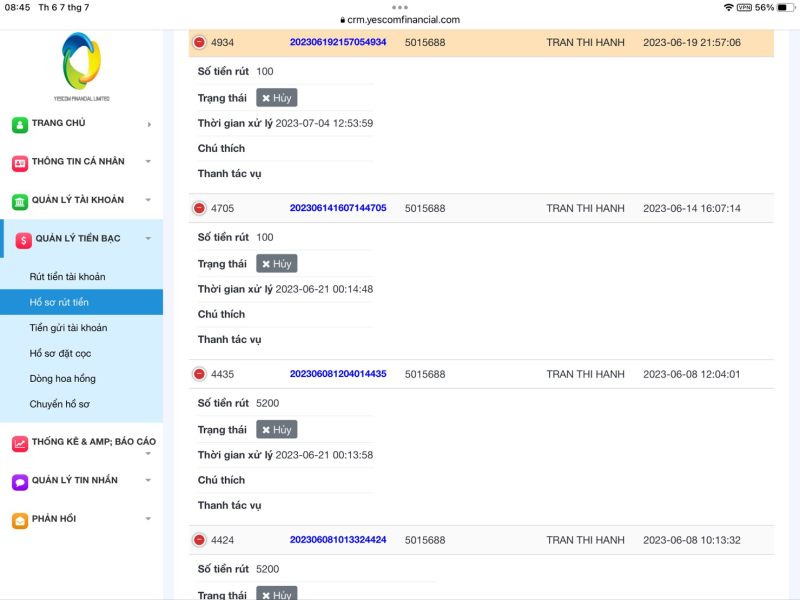

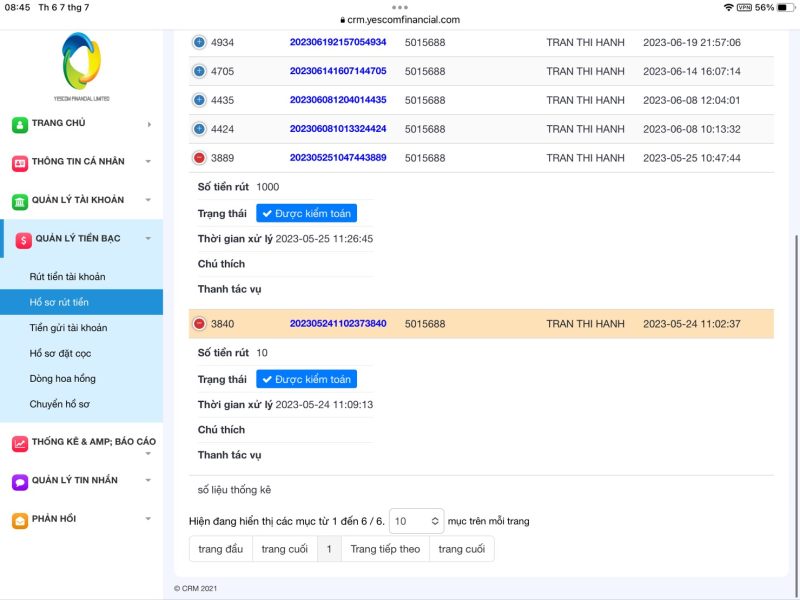

Deposit and Withdrawal Methods

Specific information about available deposit and withdrawal methods is not detailed in current sources. The absence of clear information about payment processing options and timeframes represents a major transparency concern for potential clients.

Minimum Deposit Requirements

The exact minimum deposit amounts for different account types are not specified in available documentation. This makes it difficult for traders to assess how accessible the broker's services are.

Current sources do not mention any specific bonus programs or promotional offers provided by YesCom Financial Limited. This suggests either the absence of such programs or lack of marketing transparency.

Tradeable Assets

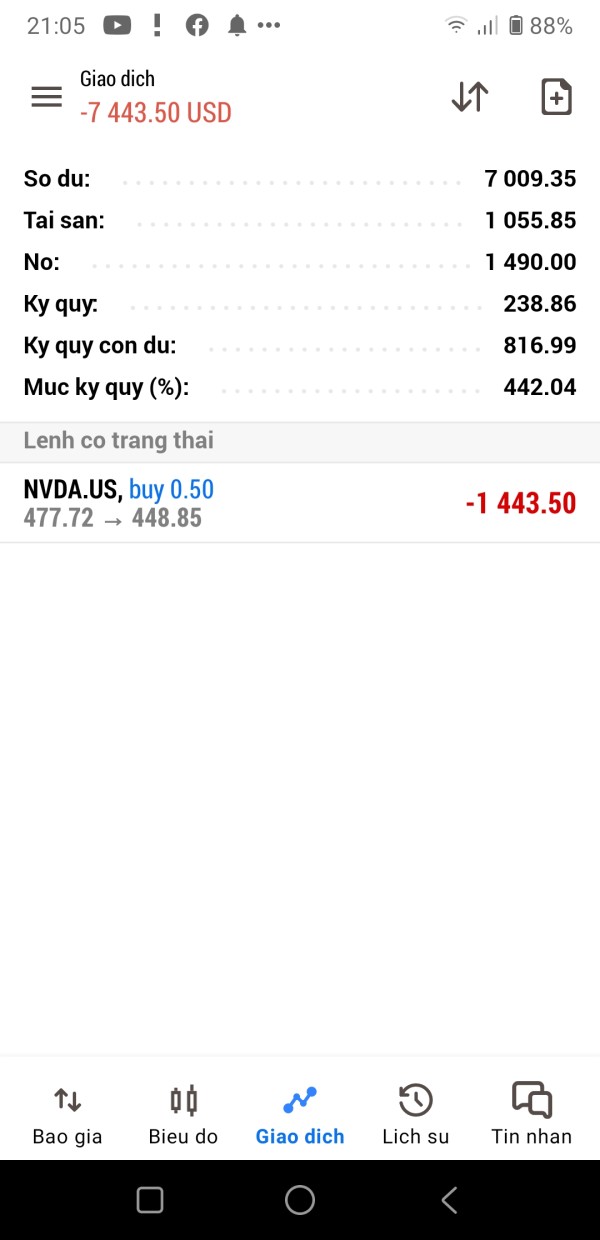

The broker provides access to multiple asset classes including foreign exchange currency pairs, precious metals with emphasis on gold and silver trading, stock indices from various global markets, individual stock trading opportunities, and CFD instruments across different sectors.

Cost Structure

Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in current sources. This lack of fee transparency makes it challenging for traders to evaluate the true cost of trading with this yescom financial limited review entity.

Leverage Ratios

Specific leverage offerings for different account types and asset classes are not detailed in available information. This represents another area where transparency is lacking.

The trading platforms offered by YesCom Financial Limited are not specifically mentioned in current sources. This leaves questions about the technological infrastructure and trading tools available to clients.

Geographic Restrictions

The broker's services appear to be primarily targeted at clients in Hong Kong and Vietnam. However, specific geographic restrictions or limitations are not clearly outlined.

Customer Support Languages

Information about the languages supported by customer service representatives is not specified in available sources.

Detailed Rating Analysis

Account Conditions Analysis

YesCom Financial Limited offers three account types: Classic, PRO, and ECN, designed for different trading preferences and experience levels. The Classic account targets beginner traders, while the PRO account is for more experienced users, and the ECN account suggests direct market access capabilities. However, the lack of detailed information about minimum deposit requirements, specific trading conditions, and account features greatly undermines the value proposition.

The absence of transparent pricing information makes it impossible for potential clients to make informed decisions about which account type might suit their needs. Unlike regulated brokers that provide comprehensive account specifications including spreads, commissions, and minimum deposits, YesCom Financial Limited's opacity in this area raises red flags. User feedback suggests that the promised account benefits may not align with actual trading conditions experienced by clients.

The account opening process details are not clearly outlined, and there's no mention of whether Islamic accounts are available for traders requiring Sharia-compliant trading conditions. This lack of inclusivity and transparency in account offerings contributes to the below-average rating. When compared to established, regulated brokers that provide detailed account specifications and transparent terms, YesCom Financial Limited falls short of industry standards. The yescom financial limited review feedback from users shows dissatisfaction with account conditions and unexpected changes to trading terms.

The broker claims to support trading across multiple asset classes including forex, precious metals, stocks, and CFDs, suggesting reasonable breadth of trading opportunities. However, the quality and depth of trading tools and analytical resources remain unclear due to limited available information. Modern traders expect comprehensive charting tools, technical indicators, economic calendars, and market analysis resources, but YesCom Financial Limited's offerings in these areas are not well documented.

The absence of information about research and analysis resources is particularly concerning for traders who rely on market insights to make informed decisions. Established brokers typically provide daily market analysis, economic calendars, trading signals, and educational content to support their clients' trading activities. The lack of such resources suggests either their absence or poor marketing communication about available tools.

Educational resources, which are crucial for beginner traders who appear to be part of the target market, are not mentioned in available sources. This gap is significant considering that reputable brokers invest heavily in trader education through webinars, tutorials, and comprehensive learning materials. User feedback shows that traders feel under-supported in terms of tools and resources, which impacts their trading experience and success rates. The platform's technological capabilities and automated trading support remain unclear, further contributing to the average rating in this category.

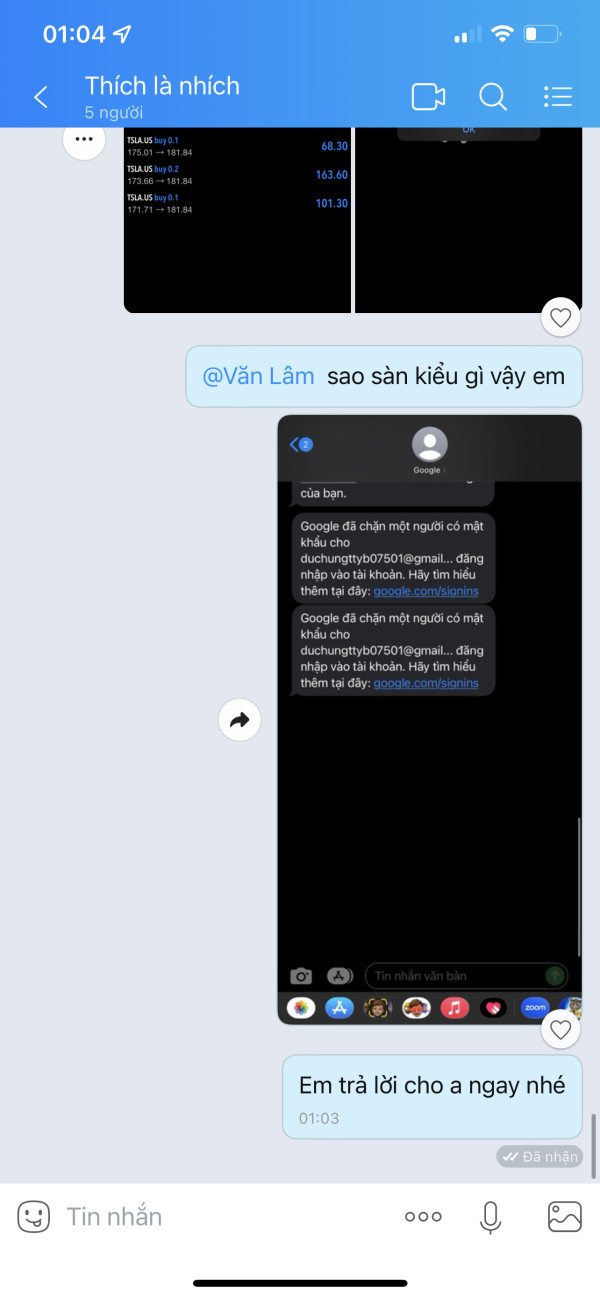

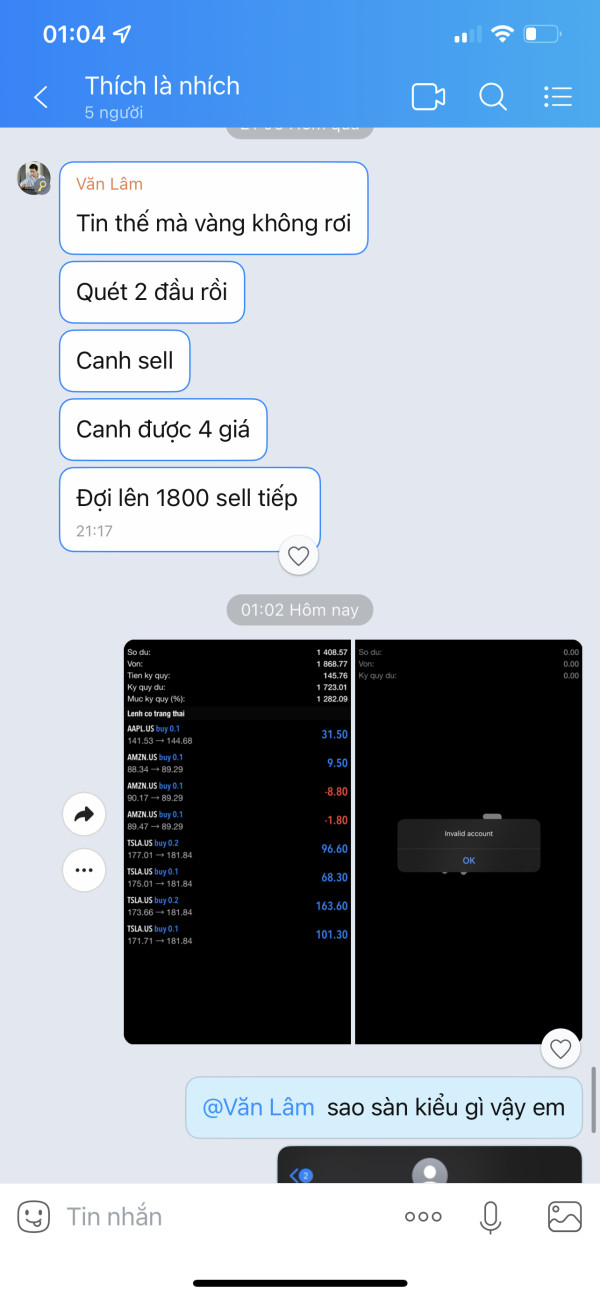

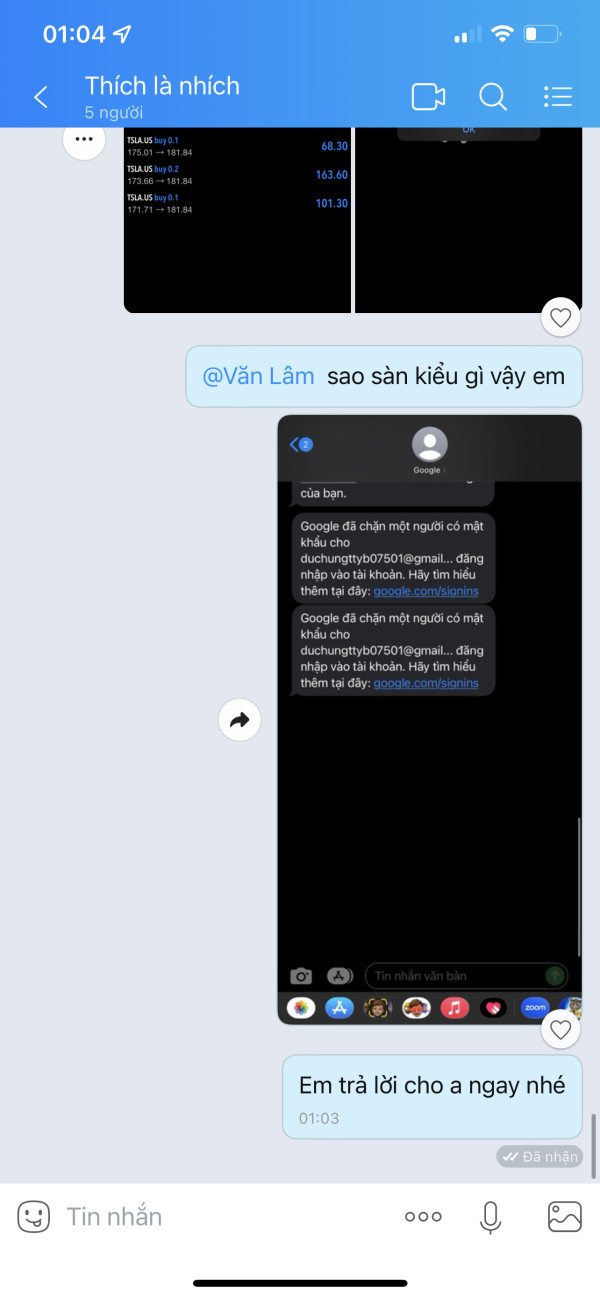

Customer Service and Support Analysis

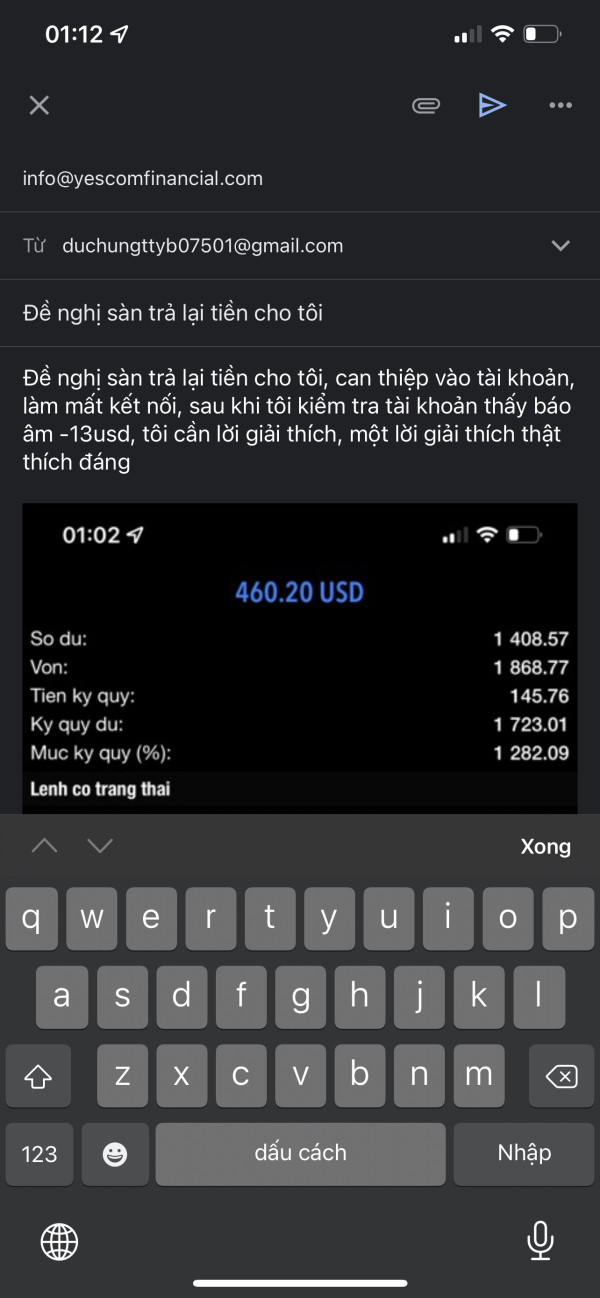

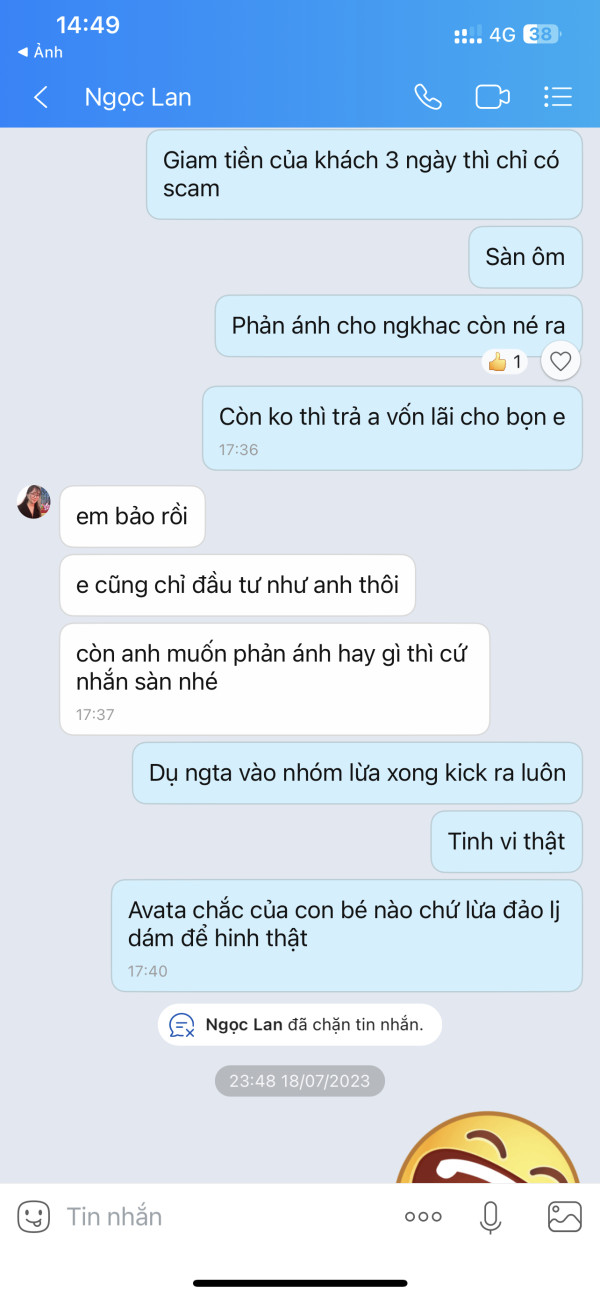

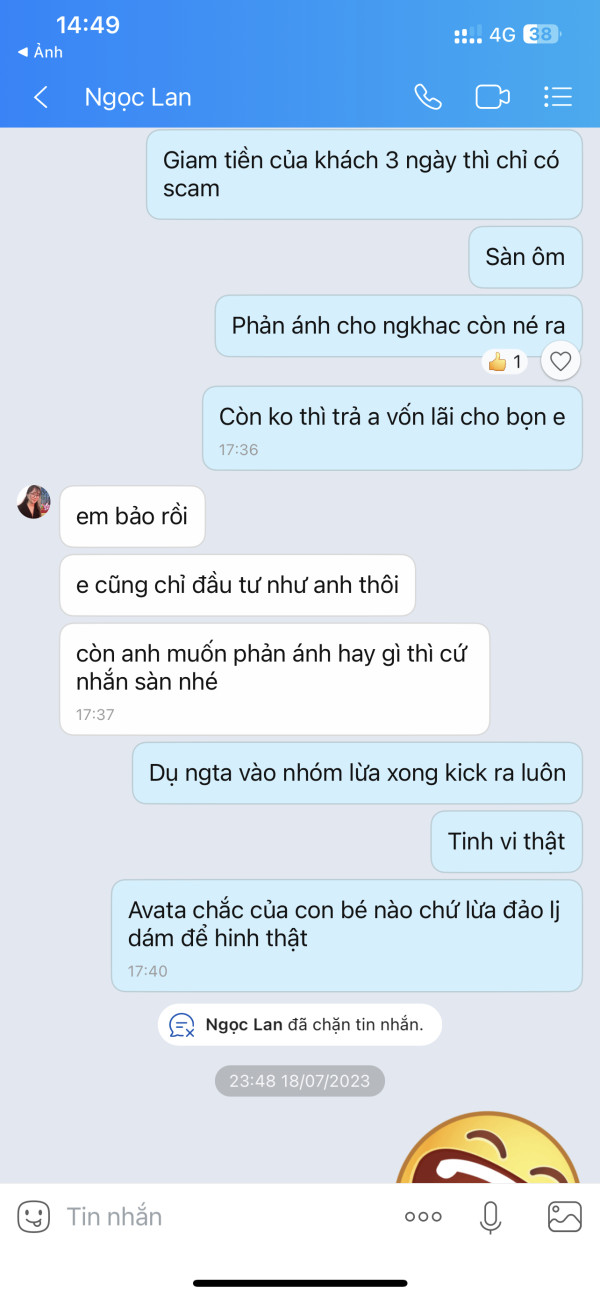

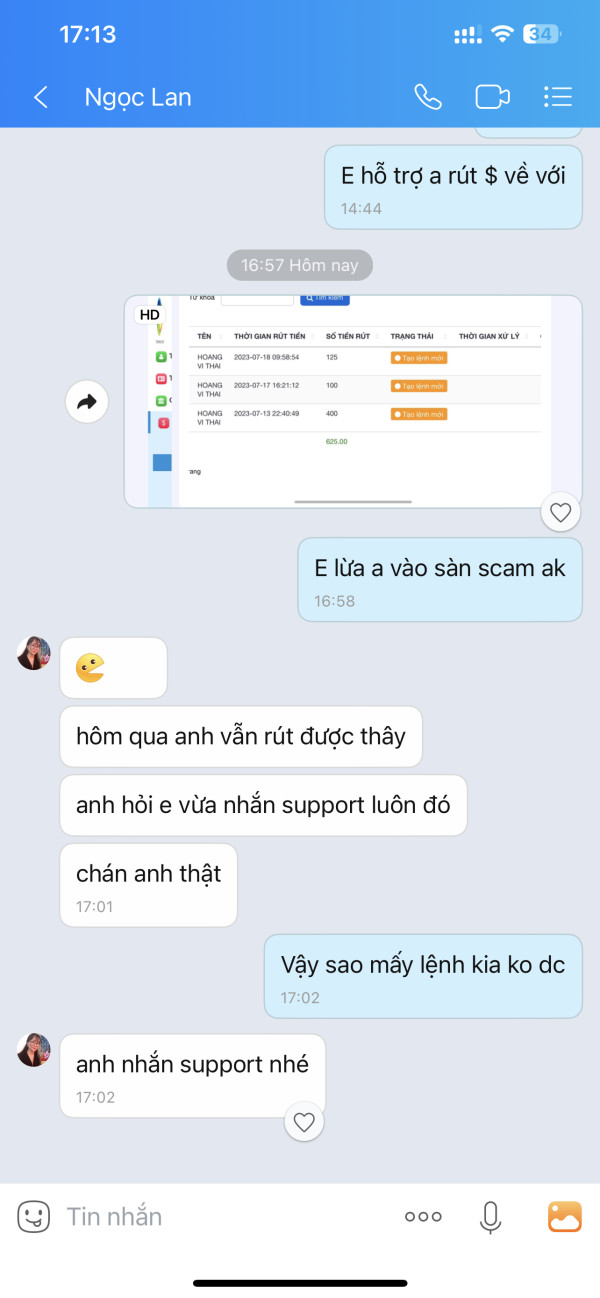

Customer service quality emerges as a major weakness based on available user feedback. While the broker appears to offer customer support, the effectiveness and responsiveness of these services are questionable according to user reports. Multiple complaints show slow response times and inadequate problem resolution, which are critical issues for traders who may need urgent assistance, especially during volatile market conditions.

The lack of information about available customer service channels raises concerns about accessibility. Modern brokers typically offer multiple contact methods including live chat, phone support, email, and sometimes social media channels. The absence of clear information about these options suggests limited customer service infrastructure or poor communication about available support methods.

User feedback consistently points to poor service quality, with traders reporting difficulty in reaching support representatives and unsatisfactory responses to their queries. The handling of withdrawal requests and account-related issues appears to be particularly problematic based on user complaints. Language support information is not available, which could be a barrier for the broker's target markets in Hong Kong and Vietnam where multiple languages might be expected. The overall customer service experience appears to fall well below industry standards, contributing to the low trust ratings and negative user feedback patterns.

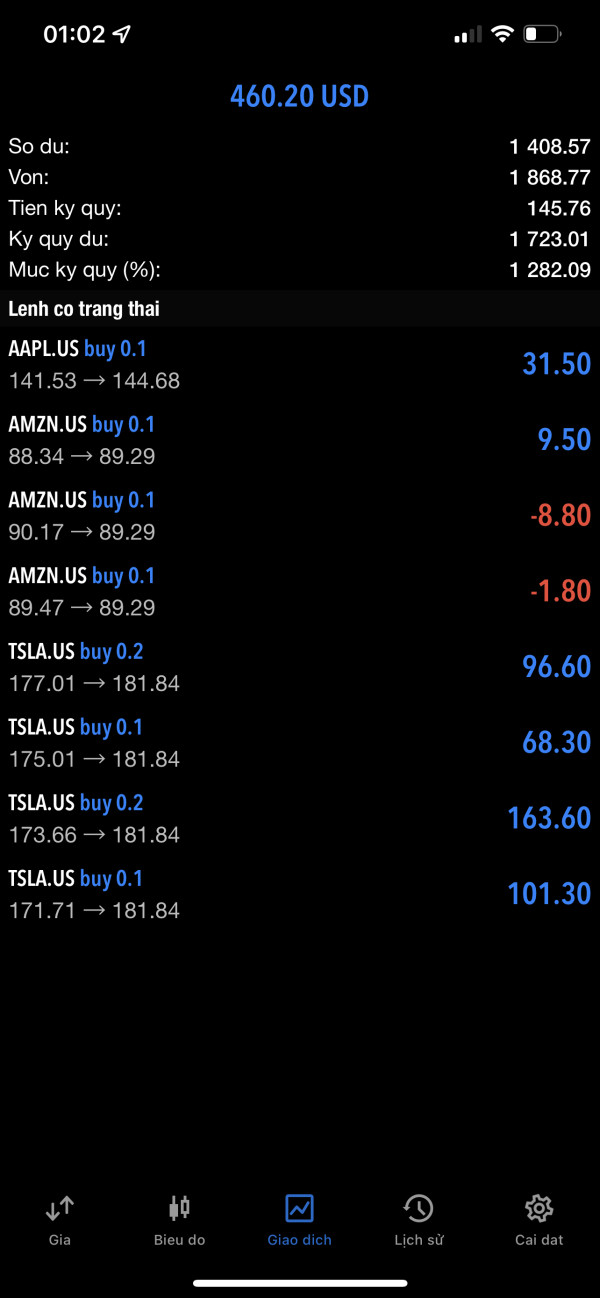

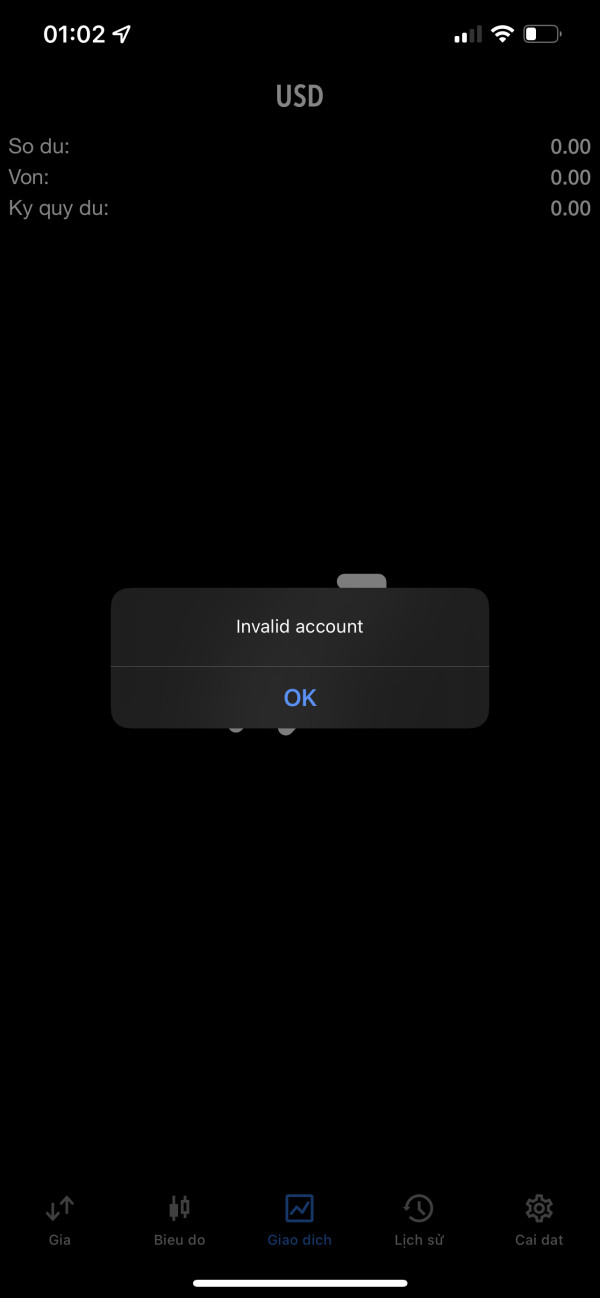

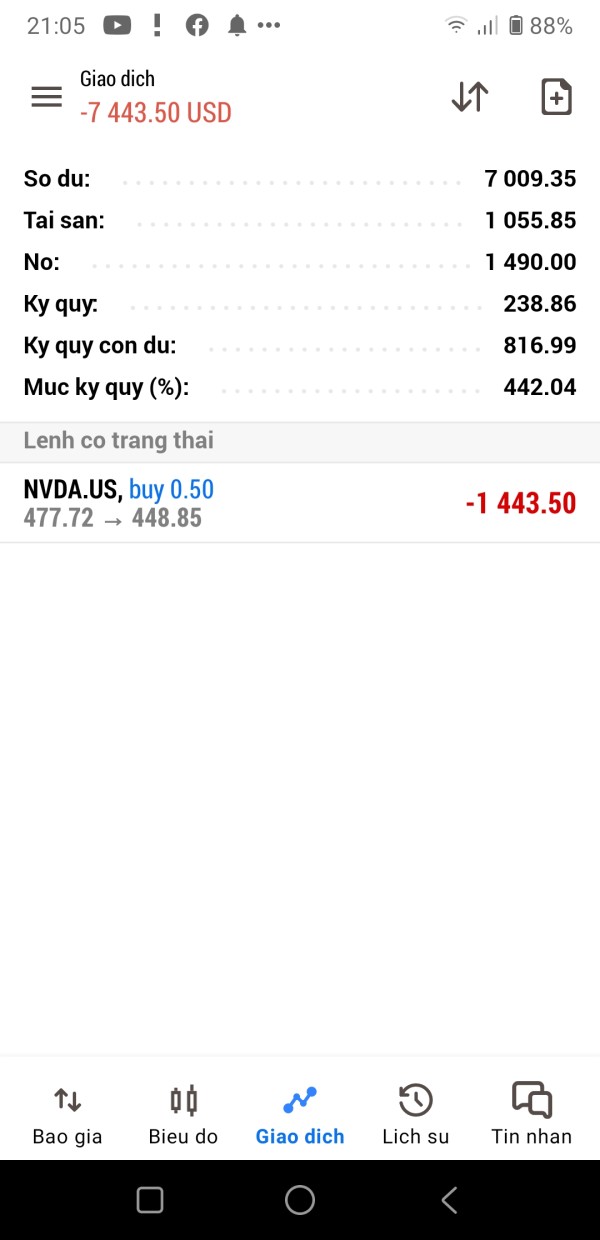

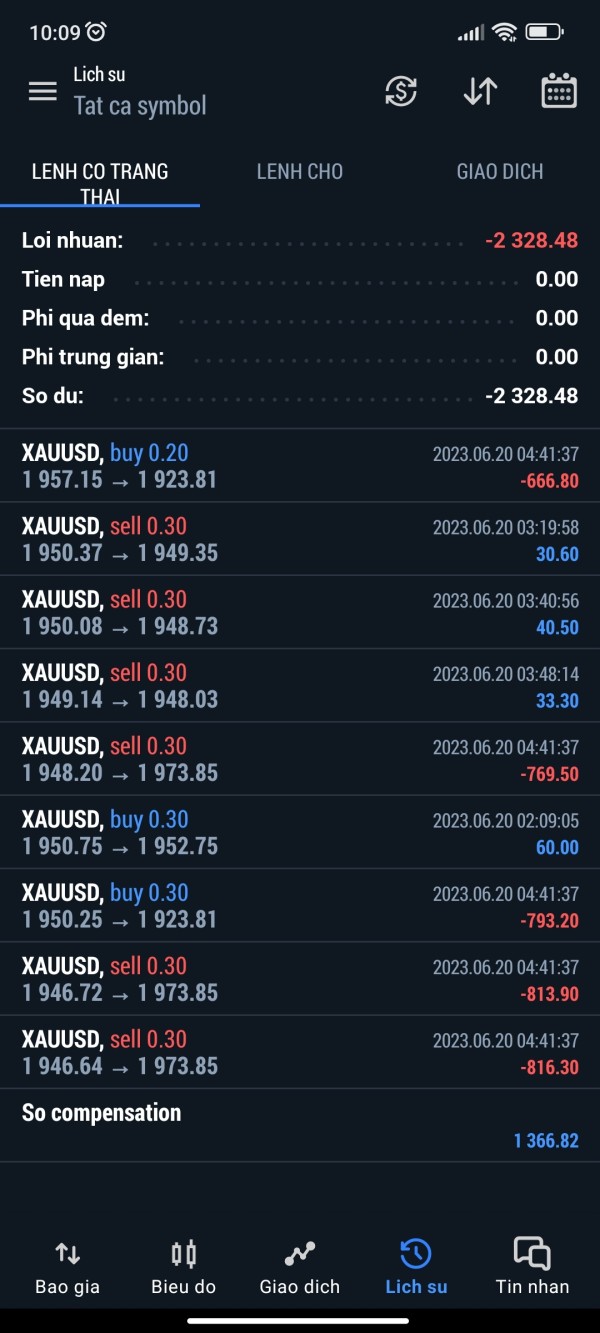

Trading Experience Analysis

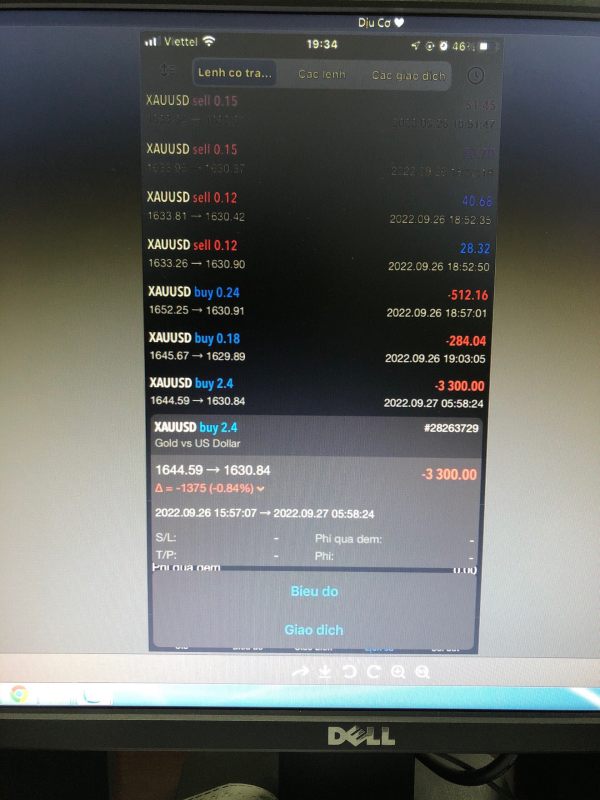

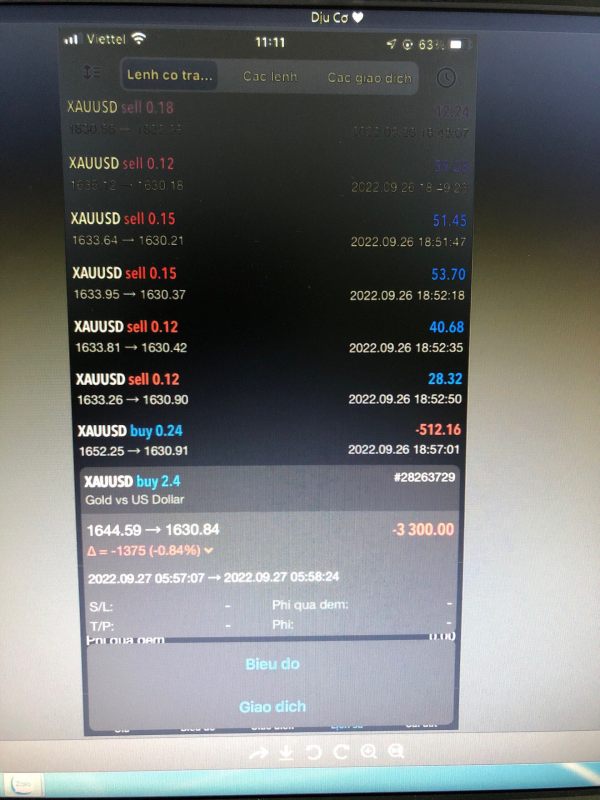

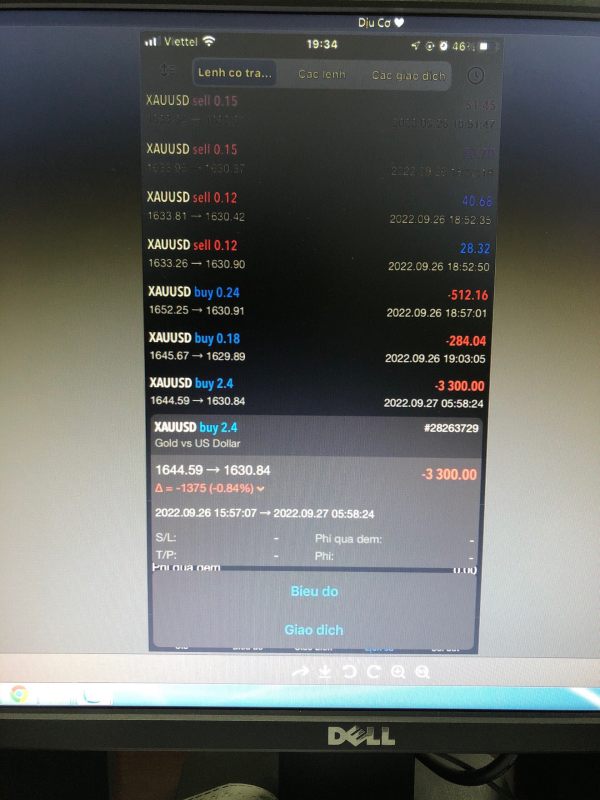

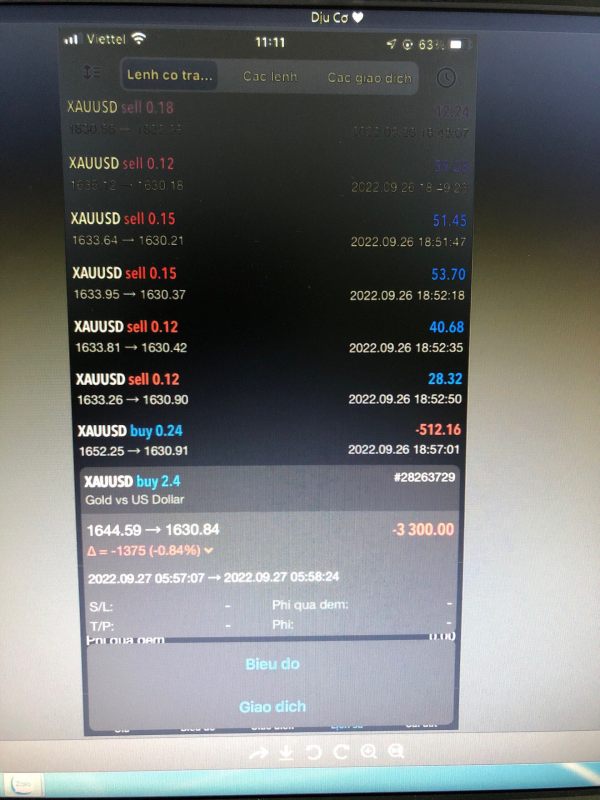

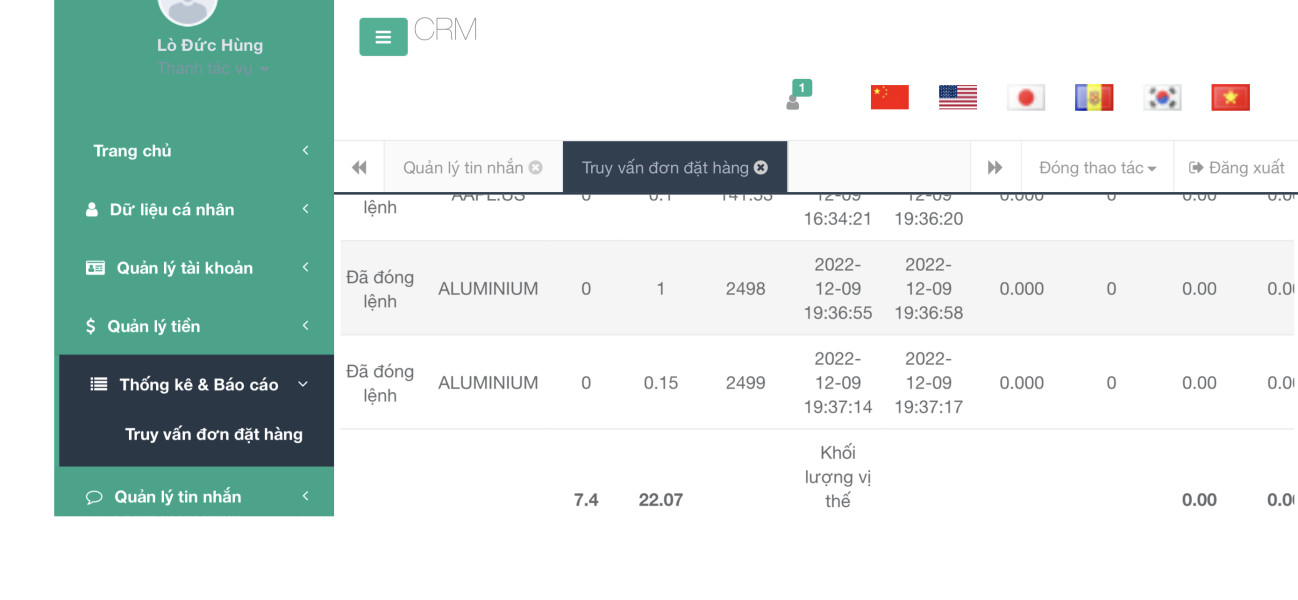

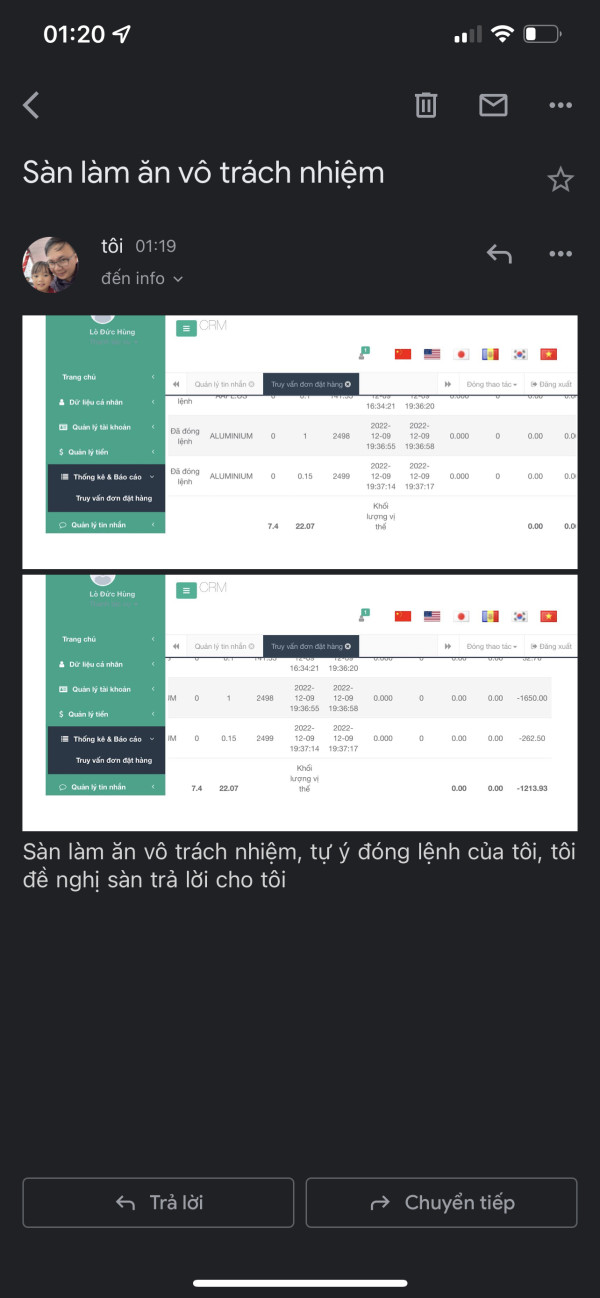

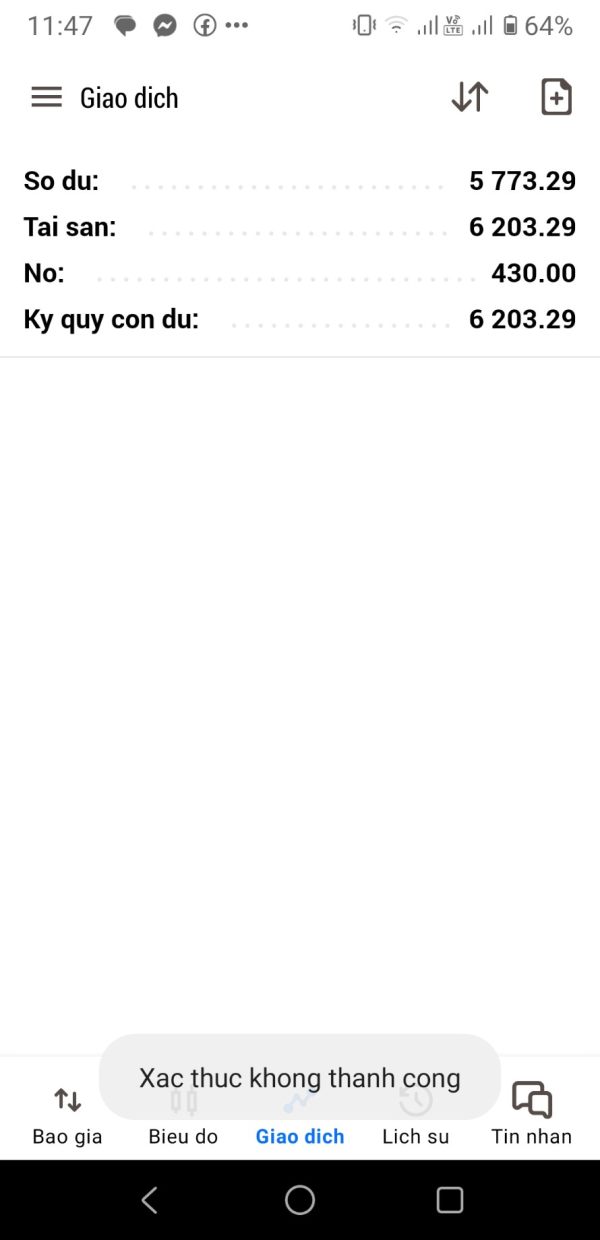

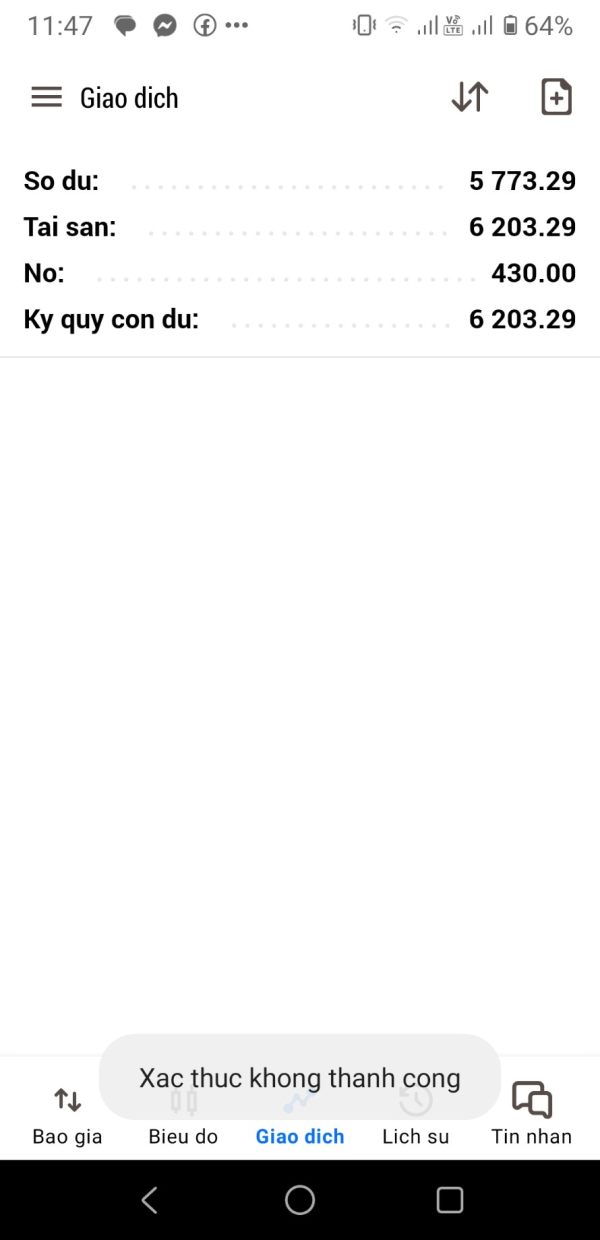

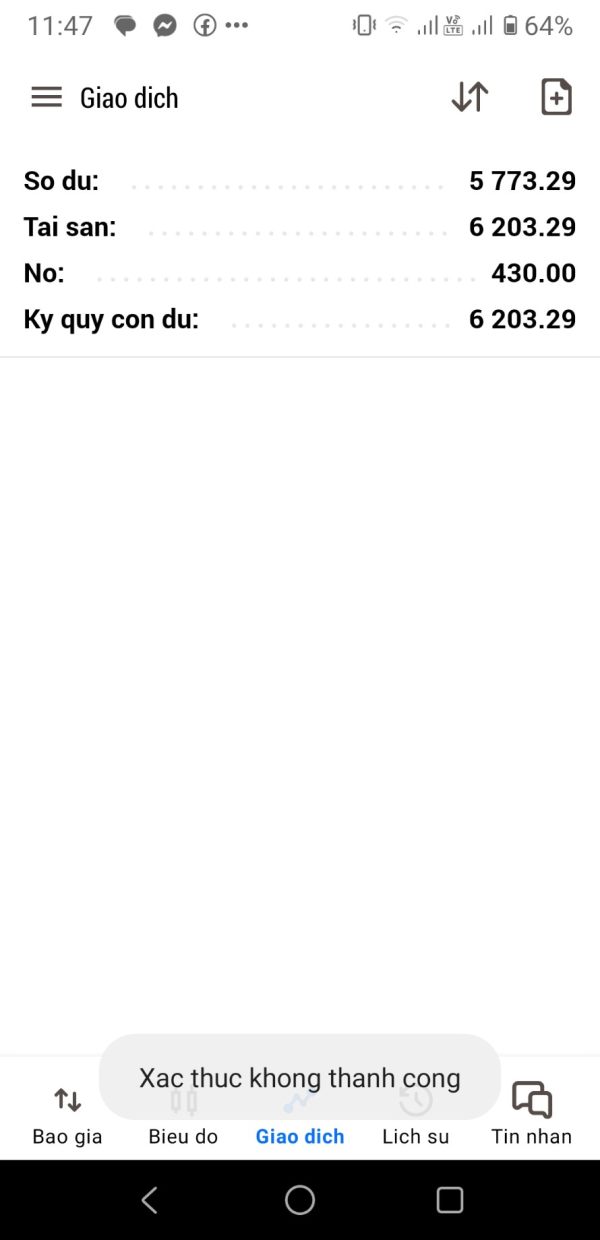

The trading experience with YesCom Financial Limited appears to be greatly compromised based on user feedback and the lack of transparent information about trading conditions. Platform stability, which is crucial for successful trading operations, receives poor reviews from users who report technical issues and unreliable performance during critical trading moments.

Order execution quality is a fundamental aspect of trading experience, yet specific information about slippage rates, requotes, and execution speeds is not available. User feedback suggests inconsistent execution and unexpected price movements that may not reflect actual market conditions. The absence of detailed information about the trading environment, including average spreads and liquidity provision, makes it difficult for traders to plan their strategies effectively.

Platform functionality appears limited based on user reports, with traders expressing frustration about the lack of advanced trading features and analytical tools. Mobile trading capabilities, which are essential in today's fast-paced trading environment, are not well documented, suggesting either limited mobile support or poor communication about available features. The overall trading environment seems to suffer from instability in spreads and liquidity, which can greatly impact trading outcomes. These factors combine to create a yescom financial limited review experience that falls well below professional trading standards, resulting in the poor rating for this dimension.

Trust and Reliability Analysis

Trust and reliability represent the most critical weaknesses in YesCom Financial Limited's profile. The broker's unregulated status immediately undermines confidence, as there are no regulatory safeguards to protect client interests or ensure fair trading practices. The absence of oversight from recognized financial authorities means that standard industry protections such as segregated client funds, compensation schemes, and dispute resolution mechanisms are not available.

The company's transparency levels are extremely poor, with minimal information available about its management team, financial backing, operational procedures, or business practices. Legitimate brokers typically provide comprehensive information about their corporate structure, regulatory compliance, and operational transparency to build client confidence. The lack of such information raises serious questions about the company's legitimacy and long-term viability.

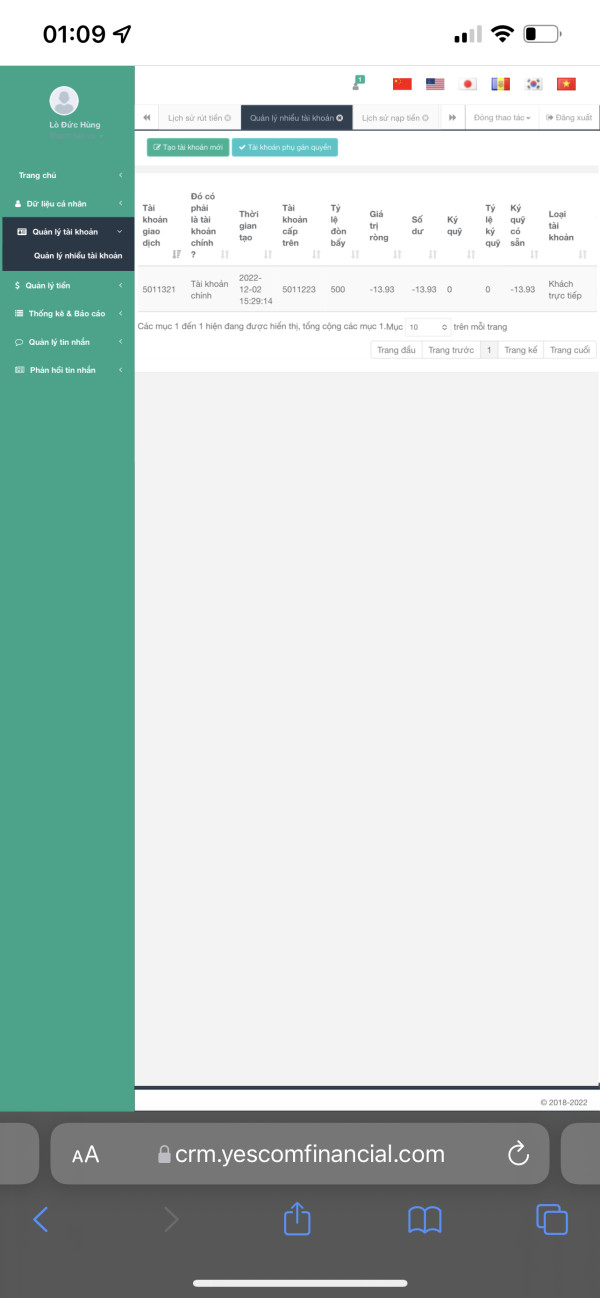

Third-party assessments, particularly the WikiFX rating of only 1.32 out of 10, reflect severe trust issues within the trading community. User feedback overwhelmingly shows negative experiences, with multiple reports suggesting potential fraudulent activities. The ratio of negative exposure reports to positive reviews presents a stark picture of user dissatisfaction and potential misconduct. The broker's handling of client complaints and dispute resolution appears inadequate, further eroding trust. These factors combine to create a trust profile that poses major risks to potential clients, warranting the very poor rating in this critical dimension.

User Experience Analysis

Overall user satisfaction with YesCom Financial Limited is notably poor based on available feedback and assessment data. The limited positive reviews compared to numerous complaints suggest that the majority of users experience major problems with the broker's services. User satisfaction appears to be compromised across multiple touchpoints including account management, trading platform performance, and customer service interactions.

Interface design and platform usability information is scarce, but user feedback suggests that the trading environment may not meet modern standards for user-friendly design and intuitive navigation. The registration and account verification processes are not well documented, which can create uncertainty and frustration for new users trying to onboard with the platform.

Fund management operations, including deposit and withdrawal processes, appear to be problematic based on user complaints. Efficient and transparent money management is crucial for user satisfaction, and difficulties in these areas can severely impact the overall user experience. Common user complaints focus on customer service responsiveness, platform reliability, and transparency in trading conditions. The user demographic appears to include many beginners attracted by the multiple account types, but the high risk associated with the unregulated status makes this broker unsuitable for inexperienced traders who may be more vulnerable to potential losses. The overall user experience falls greatly short of industry standards, contributing to the poor rating and negative community perception.

Conclusion

Based on this comprehensive analysis, YesCom Financial Limited presents major risks that outweigh any potential benefits for most traders. The broker's unregulated status, combined with poor user feedback and lack of transparency, creates an environment unsuitable for serious trading activities. While the company offers multiple account types that might initially appear attractive, the absence of regulatory protection and the overwhelmingly negative user experiences suggest potential fraudulent operations.

The broker is not recommended for any trader category, particularly those with low risk tolerance or limited trading experience. The main advantages, such as diverse account options and multi-asset trading capabilities, are overshadowed by critical disadvantages including lack of regulation, poor customer service, unreliable trading conditions, and serious trust issues. Traders seeking legitimate forex and CFD trading opportunities should consider well-regulated alternatives that provide proper client protection and transparent operations.