Primus Capital Review 1

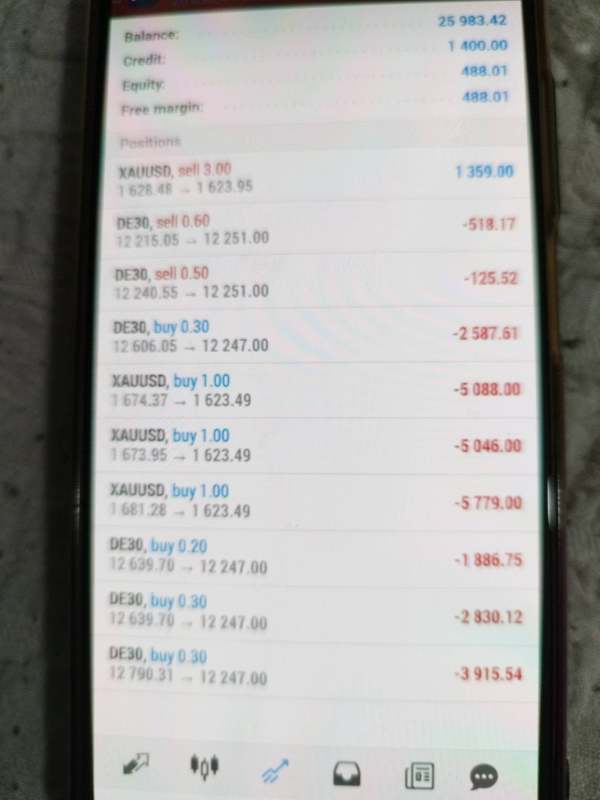

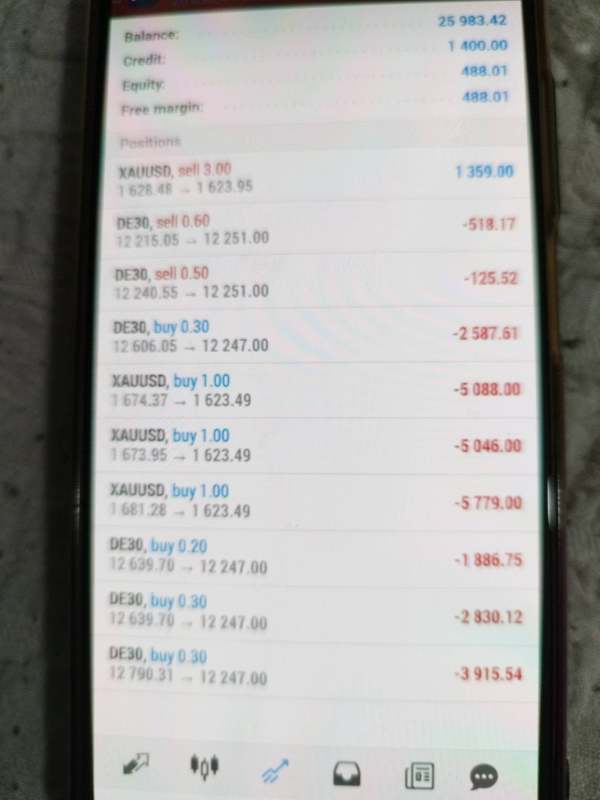

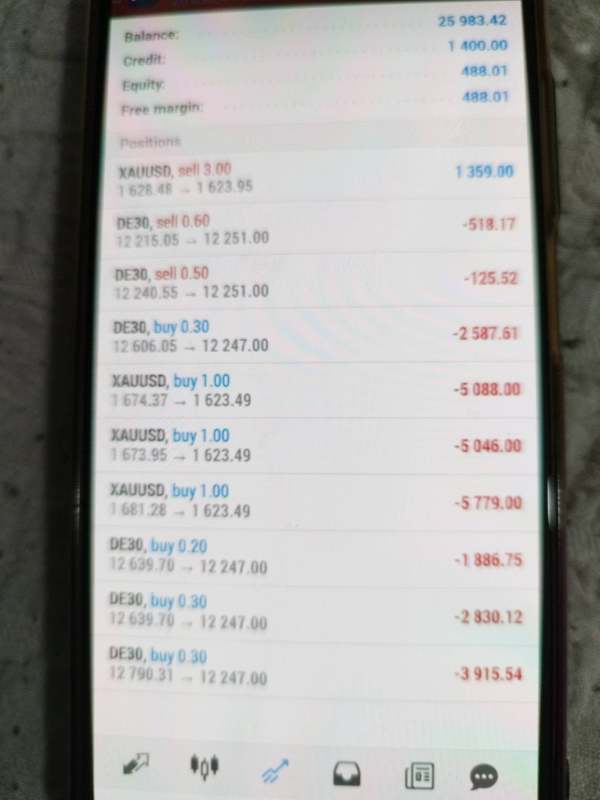

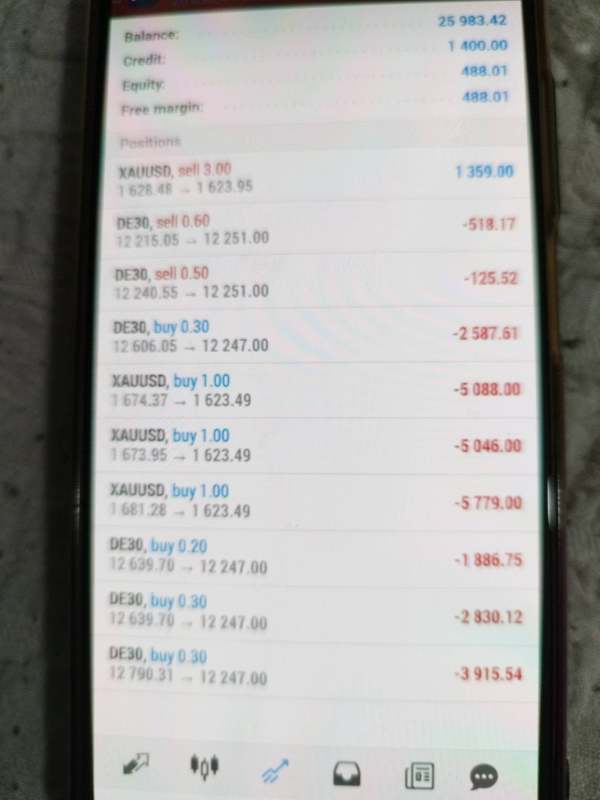

I lost the fund and he said the fund will be frozen until I deposit $2000. Is it true?

Primus Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I lost the fund and he said the fund will be frozen until I deposit $2000. Is it true?

This Primus Capital review looks at a well-known private equity firm. The firm has gotten a lot of positive attention in the investment community over the years. Primus Capital was founded in 1984 and has its main office in Cleveland. The company also has an office in Atlanta and works as a growth-focused private equity firm that puts money into technology companies. The firm has earned a 5-star rating on TrustAnalytica, which shows that users are happy with their service.

Primus Capital stands out because it focuses on lower middle market investments. The firm currently manages Primus Capital Fund VIII, which has $540 million to invest. Primus Capital looks for established businesses that make more than $10 million each year. The firm offers investment amounts from $15 million to $100 million. This approach makes Primus Capital attractive to mature companies and wealthy investors who want smart investment solutions. The firm is registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, which gives investors extra protection.

Investors should know that cross-regional operations may have different rules and services in different areas. While Primus Capital is registered with the SEC in the United States, potential clients should check the specific rules in their own regions. This review uses publicly available company information, regulatory filings, and user feedback from various review websites. Investors should do thorough research and think about their own financial situation before making investment decisions. The information here reflects what we currently know about Primus Capital's operations and may change as the firm updates its services.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A/10 | Insufficient information available in current documentation |

| Tools and Resources | N/A/10 | Specific details not provided in available materials |

| Customer Service and Support | N/A/10 | Limited information on support infrastructure |

| Trading Experience | N/A/10 | Trading platform details not specified |

| Trustworthiness | 8/10 | Strong SEC regulation and positive TrustAnalytica ratings |

| User Experience | N/A/10 | User interface details not available in current sources |

Primus Capital started in 1984, which means it has over forty years of experience in private equity. The firm is based in Cleveland, Ohio, and also operates in Atlanta. Primus Capital has built a strong reputation as a growth-focused private equity company that knows a lot about technology investments. The company finds and invests in leading technology companies that show strong growth potential and have solid positions in their markets.

The firm's main investment fund right now is Primus Capital Fund VIII, which has $540 million to invest. This fund builds on the company's long history of successful investing over the decades. Primus Capital usually makes investments between $15 million and $100 million, but they can invest more through LP co-investment arrangements. The firm looks for established businesses that make more than $10 million each year, which ensures these companies have stable operations and good growth potential.

Primus Capital operates under SEC rules as a registered investment adviser under the Investment Advisers Act of 1940. This Primus Capital review shows that the firm's regulatory status gives investors important protections and oversight. The company focuses on lower middle market investments and offers flexible transaction types including minority investments, which makes it unique in the private equity world for serving smart institutional and individual investors.

Primus Capital works under the oversight of the Securities and Exchange Commission. The firm is registered as an investment adviser under the Investment Advisers Act of 1940, which means it follows federal rules and industry standards.

The available documents don't give specific information about how deposits and withdrawals work. Potential clients should contact Primus Capital directly to learn about their preferred methods for moving money and transferring funds.

The firm's minimum investment amount fits with its focus on big institutional clients and wealthy individuals. However, the specific minimum deposit amounts are not listed in the current available materials.

Information about promotional offers or bonus structures is not available in the current documents. As a private equity firm, Primus Capital's pay structure is probably different from regular retail investment platforms.

The available materials don't list specific asset categories, but Primus Capital focuses on technology company investments. This suggests the firm concentrates on equity positions in the technology sector across different sub-industries and growth stages.

The current documents don't provide detailed fee structure information. Private equity firms usually use management fees and carried interest arrangements, but you would need to talk directly with the firm to get specific percentages and terms.

Information about leverage ratios and borrowing capabilities is not listed in available materials. You would need to ask Primus Capital directly for accurate details about these topics.

The current documents don't outline specific trading or investment platform details. This reflects the firm's focus on direct private equity investments rather than traditional trading platforms.

This Primus Capital review shows that many operational details require direct communication with the firm to get complete information about their specific services and investment processes.

The evaluation of Primus Capital's account conditions has big limitations because there isn't enough public information about account types, structures, and specific requirements. Unlike traditional brokerage firms that offer multiple account levels, Primus Capital works as a private equity firm with custom account arrangements for each client relationship. The firm focuses on investments from $15 million to $100 million, which suggests that opening an account probably involves extensive research processes, complex paperwork requirements, and personalized service arrangements.

Without detailed information about minimum account sizes, fee structures, or specific account features, this Primus Capital review cannot give a complete assessment of account conditions. The firm targets established businesses with revenues over $10 million, which shows that account requirements are probably substantial and designed for institutional or wealthy individual needs. Potential clients would need to work directly with Primus Capital to understand specific account opening procedures, paperwork requirements, and ongoing account management protocols.

The assessment of Primus Capital's tools and resources is limited by the lack of public information about their specific analytical capabilities, research infrastructure, and client-facing tools. As a private equity firm that specializes in technology investments, Primus Capital probably has sophisticated research capabilities, industry analysis resources, and portfolio management tools. However, the specific nature of these resources, how clients can access them, and the breadth of analytical support provided are not detailed in current documents.

Private equity firms usually offer extensive research capabilities, including market analysis, competitive intelligence, and sector-specific expertise. Given Primus Capital's forty-year track record and focus on technology investments, the firm probably has deep industry knowledge and analytical resources. The absence of detailed information about educational resources, automated analysis tools, or client-accessible research platforms reflects the firm's institutional focus rather than retail-oriented service delivery. Clients who want complete information about available tools and resources would need to work directly with Primus Capital's professional team.

Evaluation of Primus Capital's customer service and support capabilities is limited by the absence of detailed information about their client service infrastructure, response protocols, and support availability. As a private equity firm serving institutional clients and wealthy individuals, Primus Capital probably provides personalized, relationship-based service rather than traditional customer support channels. The firm focuses on substantial investment amounts and sophisticated clients, which suggests a model that emphasizes direct relationship management and customized support.

The lack of information about customer service hours, communication channels, multilingual support, or response time metrics reflects the firm's institutional orientation rather than retail customer service models. Private equity firms usually assign dedicated relationship managers to client accounts, providing direct access to investment professionals rather than traditional customer service representatives. Without specific user feedback or documented service protocols, this assessment cannot provide definitive insights into service quality or client satisfaction levels beyond the positive TrustAnalytica ratings.

The trading experience evaluation for Primus Capital requires understanding that the firm operates in the private equity space rather than providing traditional trading platforms or services. Unlike conventional brokers offering real-time trading capabilities, platform stability metrics, or order execution statistics, Primus Capital's "trading experience" relates to private equity transaction execution, deal structuring, and investment management processes. The firm handles complex, customized transactions rather than standardized market trades.

Without information about transaction processing capabilities, deal execution timelines, or client-facing investment platforms, this Primus Capital review cannot assess traditional trading experience metrics. The firm focuses on private equity investments, which means that "trading" involves complex, customized transactions rather than standardized market trades. Client experience would probably center on deal origination quality, transaction execution expertise, and ongoing portfolio management capabilities rather than platform functionality or order execution speed.

Primus Capital shows strong trustworthiness credentials through its comprehensive regulatory compliance and positive third-party evaluations. The firm is registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940, which provides significant regulatory oversight and investor protection mechanisms. This federal registration requires following fiduciary standards, regular compliance examinations, and detailed reporting requirements that enhance transparency and accountability.

The firm's 5-star rating on TrustAnalytica represents positive user feedback and professional recognition within the investment community. Established in 1984, Primus Capital's forty-year operational history shows institutional stability and longevity that supports investor confidence. The firm manages a substantial $540 million fund vehicle, which indicates successful fundraising capabilities and investor trust from sophisticated institutional partners. While specific information about client fund protection measures, insurance coverage, or dispute resolution procedures is not available, the combination of SEC oversight and positive industry recognition supports a strong trustworthiness assessment.

Assessment of Primus Capital's user experience is mainly supported by the firm's 5-star TrustAnalytica rating, which indicates high levels of client satisfaction and positive user feedback. However, detailed information about interface design, user interaction processes, or specific client experience metrics is not available in current documents. As a private equity firm, Primus Capital's user experience differs significantly from traditional investment platforms, focusing on relationship-based service delivery rather than self-service digital interfaces.

The user experience for Primus Capital clients probably emphasizes personalized service, direct access to investment professionals, and customized reporting rather than standardized platform functionality. Without specific user testimonials, interface descriptions, or detailed service process information, this evaluation cannot provide comprehensive insights into day-to-day user interactions or satisfaction levels. The positive TrustAnalytica rating suggests favorable user experiences, but the specific elements contributing to user satisfaction require further investigation through direct client feedback or detailed service descriptions.

This comprehensive Primus Capital review reveals a well-established private equity firm with strong regulatory credentials and positive industry recognition, though detailed operational information remains limited in publicly available sources. Primus Capital's forty-year track record, SEC registration, and 5-star TrustAnalytica rating indicate a trustworthy and professionally managed investment firm. The company appears particularly well-suited for wealthy investors and mature enterprises seeking sophisticated private equity investment opportunities in the technology sector.

The primary strengths identified include strong regulatory oversight, positive user evaluations, and substantial fund management capabilities demonstrated through the $540 million Fund VIII vehicle. However, the limited availability of detailed information about account conditions, service offerings, and operational procedures represents a significant constraint for comprehensive evaluation. Prospective clients should work directly with Primus Capital to get detailed information about investment processes, fee structures, and service capabilities before making investment decisions.

FX Broker Capital Trading Markets Review