Victoria Capital 2025 Review: Everything You Need to Know

Executive Summary

VICTORIA CAPITAL presents itself as a complete forex broker offering trading services across multiple asset classes. Our Victoria Capital review reveals serious concerns that potential traders must consider. This unregulated forex broker operates under the name VICTORIA CAPITAL FINANCIAL TRADING PTY LTD, claiming to be incorporated in Australia, yet lacks valid regulatory oversight from any recognized financial authority.

The broker advertises a complete trading platform supporting forex, commodities, indices, and stock trading. However, the absence of regulatory protection and transparency regarding trading conditions raises serious red flags. VICTORIA CAPITAL has been flagged as operating with scam-like characteristics. This makes it unsuitable for most retail traders.

This broker may only be considered by traders with exceptional risk tolerance who understand the implications of trading with an unregulated entity. The lack of investor protection, unclear fee structures, and absence of regulatory oversight make this platform particularly risky for inexperienced traders.

Important Notice

VICTORIA CAPITAL claims operation through VICTORIA CAPITAL FINANCIAL TRADING PTY LTD, allegedly incorporated in Australia. However, critical investigation reveals this entity lacks valid regulation from any recognized financial authority. The broker operates without proper licensing to conduct forex trading services.

This review is based on available public information and user feedback. Given the limited transparency from the broker, some information may be incomplete or subject to change. Potential clients should exercise extreme caution and conduct thorough due diligence before considering any engagement with this platform.

Rating Framework

Overall Rating: 3/10 - High Risk

Broker Overview

VICTORIA CAPITAL positions itself as a private registered investment advisor offering complete trading services. The company claims to provide access to global financial markets through its proprietary platform, targeting traders interested in forex, commodities, indices, and stock trading. However, the broker's actual operational history and corporate background remain largely unclear.

The platform advertises itself as offering sophisticated trading tools and complete market access. VICTORIA CAPITAL claims to serve both retail and institutional clients, though specific details about client segmentation and service differentiation are not clearly disclosed. The broker's business model appears to focus on providing direct market access across multiple asset classes.

Our Victoria Capital review investigation reveals concerning gaps in fundamental business information. The company's actual establishment date, operational track record, and management team details are not transparently disclosed. This lack of basic corporate transparency is particularly troubling for a financial services provider, where trust and accountability are paramount for client protection.

The broker operates primarily through its web-based platform, though specific technical specifications and platform capabilities remain unclear. VICTORIA CAPITAL's regulatory status represents the most significant concern, as the broker operates without valid oversight from recognized financial authorities, exposing clients to substantial risks.

Regulatory Status: VICTORIA CAPITAL operates without valid regulation from any recognized financial authority. The broker has been flagged as operating with scam-like characteristics, presenting significant risks to potential clients.

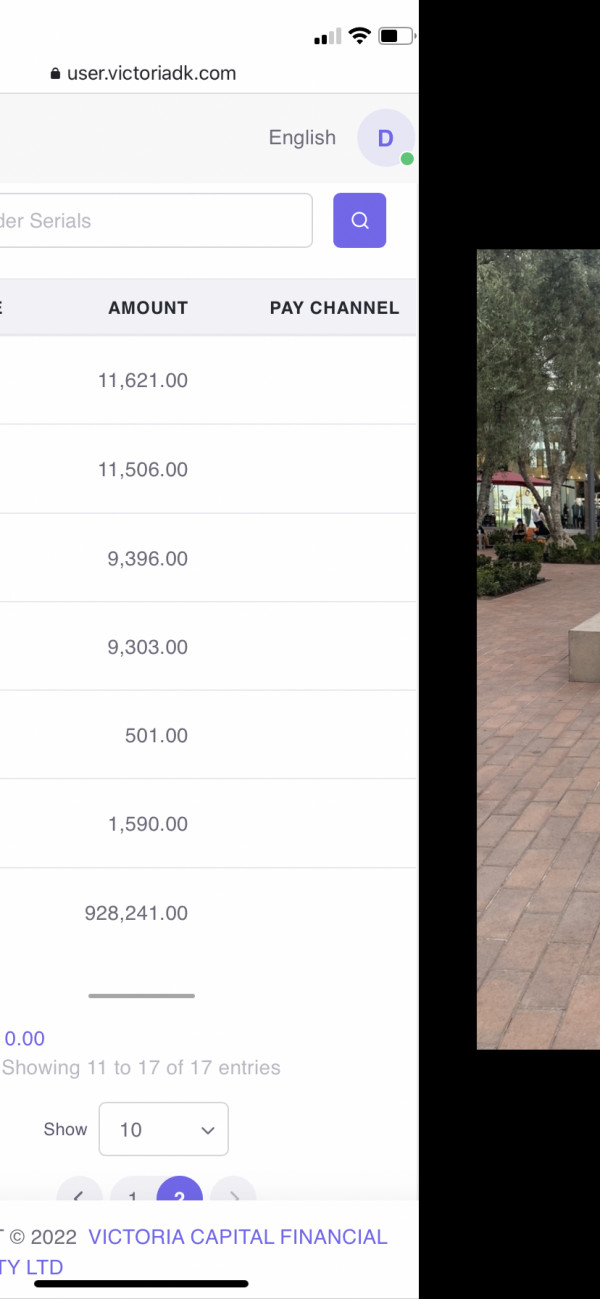

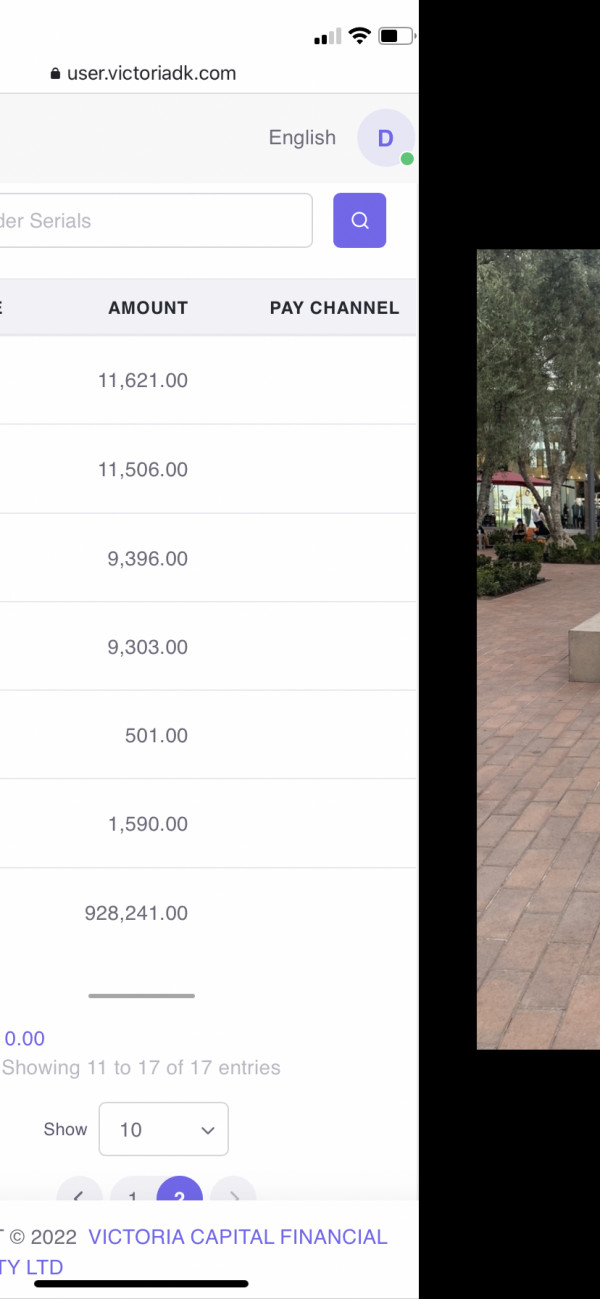

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available materials. This raises concerns about operational transparency.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in publicly available information. This makes it difficult for potential clients to assess accessibility.

Bonus and Promotions: No specific information about bonus offerings or promotional programs is available in current materials.

Tradeable Assets: VICTORIA CAPITAL claims to offer trading across forex, commodities, indices, and stocks. However, specific instruments and market coverage details are not comprehensively disclosed.

Cost Structure: The broker has not provided transparent information about spreads, commissions, or other trading costs. This is a significant red flag for potential clients seeking to understand total trading expenses.

Leverage Ratios: Specific leverage offerings are not detailed in available materials. This prevents proper risk assessment.

Platform Options: The broker claims to provide a complete trading platform. However, specific technical details and platform features are not clearly outlined.

Geographic Restrictions: Information about geographic restrictions and service availability is not specified in available materials.

Customer Service Languages: Specific language support information is not provided in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

VICTORIA CAPITAL's account conditions receive a poor rating due to the complete lack of transparency regarding fundamental trading parameters. The broker fails to disclose specific account types, minimum deposit requirements, or account features that would allow potential clients to make informed decisions. This opacity is particularly concerning in an industry where clear terms and conditions are essential for trader protection.

The absence of detailed information about account opening procedures raises additional red flags. Professional forex brokers typically provide complete account documentation, including terms of service, risk disclosures, and clear fee structures. VICTORIA CAPITAL's failure to provide such basic information suggests either poor operational standards or deliberate hiding of important details.

Without regulatory oversight, clients have no protection regarding account conditions or dispute resolution. The lack of segregated account information means client funds may not be properly protected from operational risks. This Victoria Capital review finds that the broker's account conditions fail to meet basic industry standards for transparency and client protection.

The scoring reflects the severe deficiencies in account condition transparency and the absence of regulatory protection that would typically govern account terms and client rights.

VICTORIA CAPITAL claims to offer a complete trading platform supporting multiple asset classes. This provides some foundation for trading operations. The broker advertises access to forex, commodities, indices, and stocks, suggesting a reasonably broad market coverage that could appeal to diversified traders.

However, specific details about trading tools, analytical resources, and platform capabilities remain unclear. Professional trading platforms typically offer advanced charting tools, technical indicators, market analysis, and automated trading capabilities. The lack of detailed information about these features makes it difficult to assess the platform's actual utility for serious traders.

Educational resources and market research capabilities are not clearly outlined in available materials. Quality brokers typically provide complete educational content, market analysis, and trading guides to support client development. The absence of such information suggests limited commitment to client education and support.

The moderate scoring reflects the claimed platform completeness while acknowledging the significant lack of specific details about tools and resources that would enable proper evaluation.

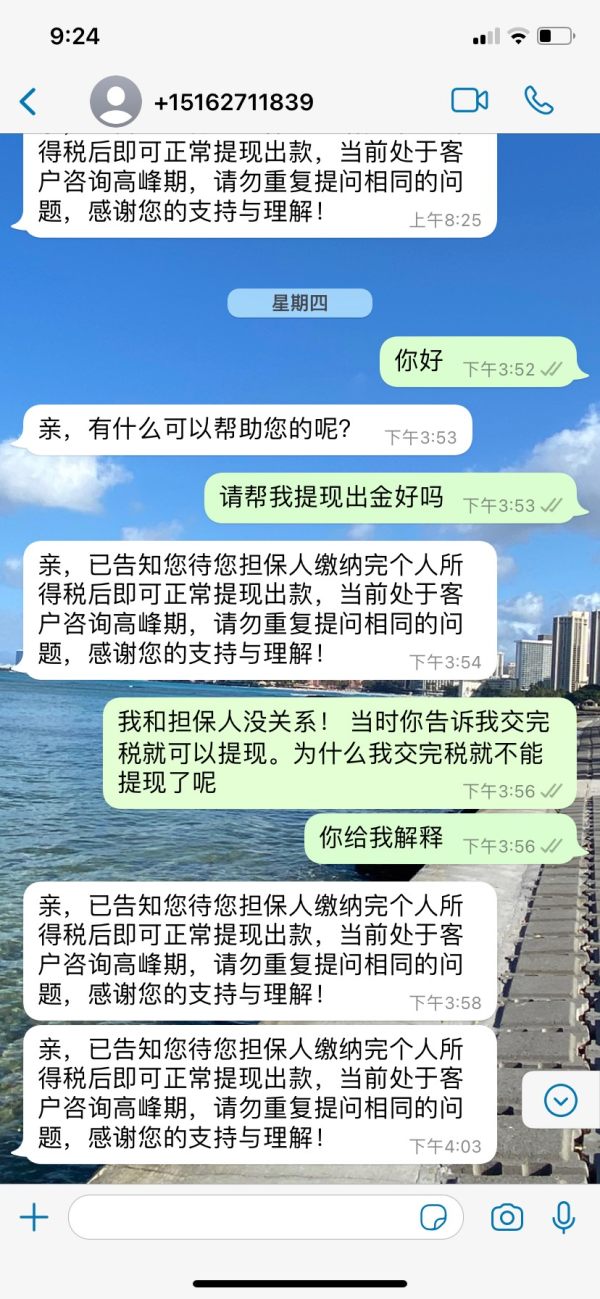

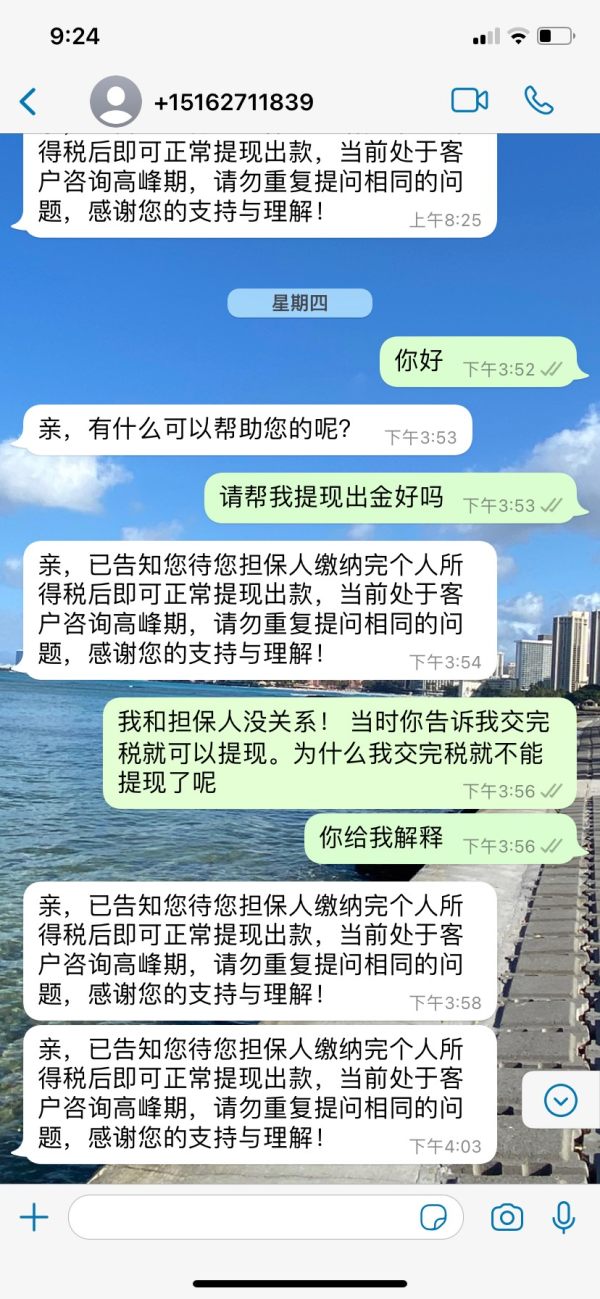

Customer Service and Support Analysis (Score: 3/10)

Customer service information for VICTORIA CAPITAL is notably absent from available materials. This raises serious concerns about client support capabilities. Professional forex brokers typically provide multiple contact channels, including phone, email, live chat, and complete FAQ sections. The lack of clear customer service information suggests potential difficulties in obtaining support when needed.

Response time commitments, service quality standards, and support availability hours are not specified. This absence of basic service information is particularly problematic for forex trading, where markets operate continuously and traders may require urgent assistance with account or trading issues.

Multi-language support capabilities are not detailed. This could limit accessibility for international clients. Professional brokers typically provide support in multiple languages to serve diverse client bases effectively.

The poor scoring reflects the complete absence of customer service information and the implications this has for client support and issue resolution capabilities.

Trading Experience Analysis (Score: 4/10)

VICTORIA CAPITAL claims to provide a complete trading platform, but specific performance metrics and user experience data are not available. Platform stability, execution speed, and order processing capabilities are fundamental aspects of trading experience that remain undisclosed.

The broker's claimed support for multiple asset classes suggests potential for diverse trading strategies. However, without specific platform features or execution quality data, it's impossible to assess actual trading conditions. Professional platforms typically provide detailed information about execution models, latency, and order types supported.

Mobile trading capabilities and platform accessibility across different devices are not specified. Modern traders expect seamless access across desktop and mobile platforms with consistent functionality and performance.

This Victoria Capital review finds that while the broker claims complete platform capabilities, the lack of specific performance data and user feedback makes it impossible to verify actual trading experience quality. The below-average scoring reflects these uncertainties and the absence of verifiable performance metrics.

Trust and Safety Analysis (Score: 1/10)

VICTORIA CAPITAL receives the lowest possible trust rating due to its complete lack of regulatory oversight and flagging as operating with scam-like characteristics. The broker operates without valid regulation from any recognized financial authority, leaving clients without essential protections typically provided by regulatory frameworks.

Fund safety measures, including client fund segregation and deposit protection schemes, are not disclosed. Regulatory oversight typically ensures client funds are held separately from operational funds and may provide compensation schemes in case of broker failure. The absence of such protections exposes clients to total loss risk.

Corporate transparency is severely lacking, with limited information about company management, operational history, or financial stability. Professional brokers typically provide complete corporate information and may publish audited financial statements to demonstrate operational integrity.

The unacceptable scoring reflects the fundamental absence of regulatory protection and the significant risks this poses to client funds and trading operations.

User Experience Analysis (Score: 3/10)

Overall user satisfaction data for VICTORIA CAPITAL is not available in current materials. This makes it difficult to assess actual client experiences. The absence of user reviews and testimonials is concerning, as established brokers typically have substantial user feedback available across various platforms.

Interface design and platform usability information is not provided. This prevents assessment of user-friendliness and accessibility. Modern trading platforms require intuitive design and efficient navigation to support effective trading operations.

Registration and account verification processes are not detailed. However, the lack of regulatory compliance suggests these procedures may not meet standard industry requirements for client identification and verification.

Common user complaints center on the broker's unregulated status and associated risks. The poor scoring reflects the absence of positive user feedback and the concerns raised about the broker's operational legitimacy and safety.

Conclusion

This Victoria Capital review concludes that VICTORIA CAPITAL presents unacceptable risks for most traders due to its unregulated status and lack of operational transparency. The broker's flagging as operating with scam-like characteristics, combined with the absence of basic business information, makes it unsuitable for serious trading activities.

While the broker claims to offer complete trading platforms and multiple asset classes, these claimed benefits are overshadowed by fundamental safety and transparency concerns. The lack of regulatory oversight means clients have no protection for their funds or recourse in case of disputes.

VICTORIA CAPITAL is not recommended for any traders, regardless of experience level. The combination of regulatory absence, operational opacity, and safety concerns creates an unacceptable risk profile that outweighs any potential trading benefits the platform might offer.