Is VICTORIA CAPITAL safe?

Business

License

Is Victoria Capital Safe or Scam?

Introduction

Victoria Capital is an online forex broker that claims to provide a comprehensive trading platform for forex, commodities, indices, and stocks. Operating under the banner of Victoria Capital Financial Trading Pty Ltd, it positions itself as a competitive player in the forex market, appealing to both novice and experienced traders. However, the forex trading landscape is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams in this industry is significant, making it essential to thoroughly investigate any broker's legitimacy. This article aims to analyze the safety and reliability of Victoria Capital through a detailed examination of its regulatory status, company background, trading conditions, client fund security, and customer experiences. Our investigation is based on a review of multiple sources, including user feedback, regulatory databases, and financial analysis.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor that determines its legitimacy and operational integrity. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client funds and provide avenues for recourse in case of disputes. In the case of Victoria Capital, the broker claims to be registered in Australia, which is known for its stringent regulatory framework overseen by the Australian Securities and Investments Commission (ASIC). However, our investigation reveals that Victoria Capital does not hold a valid license from ASIC, raising serious concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Regulated |

The absence of a valid license indicates that Victoria Capital operates without the oversight that is typically expected from reputable brokers. This lack of regulation not only puts traders at risk but also raises questions about the broker's accountability and transparency. Furthermore, the broker's history of compliance is questionable, as it has been flagged by multiple sources as a potential scam, with numerous complaints regarding withdrawal issues and lack of responsiveness.

Company Background Investigation

Victoria Capital Financial Trading Pty Ltd presents itself as a legitimate entity, but a closer look at its company history and ownership structure reveals a different story. The broker claims to have been established in Australia, yet there are no verifiable records to substantiate this claim. Moreover, the management team behind Victoria Capital lacks publicly available information, which is a red flag in the brokerage industry. Transparency is vital for building trust, and the absence of detailed information about the company's leadership and operational history raises concerns about its credibility.

The broker's website is also sparse in terms of information disclosure, failing to provide comprehensive details about its services, trading conditions, or contact information. This lack of transparency is further compounded by the fact that Victoria Capital has changed its name from Rui Win Capital, a move often associated with brokers attempting to distance themselves from negative reputations. Such practices are common among fraudulent brokers, indicating that Victoria Capital may not be a trustworthy option for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall value proposition. Victoria Capital's fee structure appears to be opaque, with limited information available on its website regarding spreads, commissions, and other trading costs. The absence of clear and accessible information about trading conditions can be indicative of a broker that lacks transparency and may impose hidden fees on its clients.

| Fee Type | Victoria Capital | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-2% |

The lack of specified trading costs is concerning, as it makes it difficult for traders to assess the true cost of trading with Victoria Capital. Furthermore, the broker has received complaints regarding unexpected fees and withdrawal charges, which can significantly impact a trader's profitability. Such practices are not only unprofessional but also suggest a potential intent to exploit clients.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Victoria Capital's approach to fund security raises several alarms. The broker does not appear to segregate client funds, which is a standard practice among reputable brokers to ensure that client deposits are kept separate from the company's operational funds. This lack of segregation increases the risk of loss in the event of financial difficulties faced by the broker.

Additionally, there is no evidence that Victoria Capital offers any form of investor protection or negative balance protection, which are critical safeguards for traders. The absence of these measures further compromises the safety of client funds, leaving traders vulnerable to potential losses. Historically, there have been reports of clients experiencing difficulties in withdrawing their funds, which underscores the risks associated with trading with an unregulated broker like Victoria Capital.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. In the case of Victoria Capital, numerous negative reviews and complaints have surfaced, highlighting significant issues with the broker's operations. Common complaints include difficulties in fund withdrawals, lack of responsive customer support, and unclear trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Transparency Concerns | High | None |

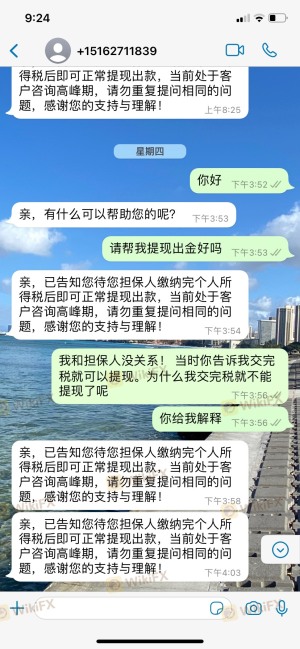

Many users report being unable to access their funds or facing unreasonable demands for additional fees before withdrawals can be processed. These experiences are indicative of a broker that may be operating with questionable practices. For instance, one user reported being asked to pay a "tax fee" before they could withdraw their profits, a tactic commonly employed by scam brokers to prevent clients from accessing their funds. Such patterns of behavior raise serious concerns about Victoria Capital's intentions and operational integrity.

Platform and Trade Execution

The trading platform provided by a broker is a critical component of the trading experience. Victoria Capital claims to offer the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, user reviews indicate that the platform may not perform as expected, with reports of slippage and rejected orders. These issues can significantly impact a trader's ability to execute trades effectively and profitably.

Furthermore, there are concerns about potential platform manipulation, where brokers may interfere with trade execution to benefit themselves at the expense of their clients. This practice is particularly prevalent among unregulated brokers, and the lack of oversight for Victoria Capital raises the likelihood of such manipulative practices occurring.

Risk Assessment

Engaging with Victoria Capital involves a range of risks that traders must carefully consider. The absence of regulation, coupled with numerous complaints and issues related to fund security, creates a high-risk environment for potential investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, no oversight |

| Fund Security Risk | High | No segregation of client funds |

| Withdrawal Risk | High | Complaints about withdrawal issues |

| Transparency Risk | Medium | Lack of clear information |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to seek out regulated alternatives that offer greater transparency, security, and customer support.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Victoria Capital is not a safe broker. The lack of regulation, combined with numerous complaints regarding fund withdrawals and poor customer support, raises significant red flags. Traders should approach this broker with extreme caution, as the potential for scams and fraudulent practices is high.

Given the risks associated with Victoria Capital, it is recommended that traders consider reputable alternatives that are regulated by recognized authorities. Brokers such as IG, OANDA, and Forex.com offer robust regulatory oversight, transparent trading conditions, and reliable customer support, making them safer options for traders looking to engage in the forex market. Always prioritize safety and due diligence when selecting a broker to ensure a secure trading experience.

Is VICTORIA CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of VICTORIA CAPITAL brokers.

VICTORIA CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VICTORIA CAPITAL latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.