TP Global FX 2025 Review: Everything You Need to Know

Executive Summary

In this comprehensive tp global fx review, we examine a forex and CFD brokerage that has built its place in the competitive trading world since 2016. TP Global FX has its headquarters in Dubai and is registered in St. Vincent and the Grenadines, operating under multiple regulatory frameworks including VFSC oversight. The broker presents itself as a transparency-focused platform. It offers innovative trading solutions to retail and institutional clients.

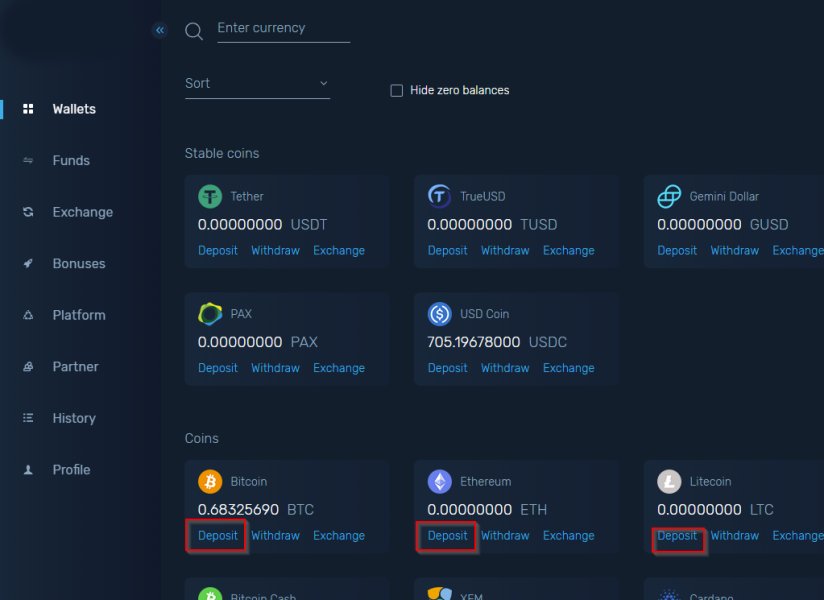

The platform stands out by providing leverage up to 1:500, variable spreads starting from competitive levels, and relatively low minimum deposit requirements of $50-$200 depending on account type. TP Global FX supports diverse funding methods. These include bank transfers, credit/debit cards, e-wallets, and cryptocurrency options, catering to modern traders' preferences for flexible payment solutions.

However, this review reveals significant concerns that potential clients must consider. According to Trustpilot data, the broker maintains a TrustScore of 3.62 out of 5, with a concerning pattern where 65% of users award 1-star ratings. User feedback consistently highlights withdrawal difficulties and slow customer service responses. These issues substantially impact the overall trading experience despite satisfactory trading conditions.

The platform primarily serves small to medium-sized investors seeking diversified asset exposure across forex, cryptocurrencies, indices, commodities, and stocks through 200+ CFD instruments.

Important Disclaimers

Regional Entity Variations: TP Global FX operates through different regulatory entities across various jurisdictions. The specific regulatory framework, terms of service, and available features may vary significantly depending on your location and the applicable regulatory authority. Traders must verify which entity serves their region. They must also understand the corresponding regulatory protections and limitations.

Review Methodology: This evaluation synthesizes information from official sources, user feedback platforms, and market data to provide comprehensive analysis. The assessment aims to present balanced perspectives based on available evidence. Individual experiences may vary though. All information reflects conditions as of early 2025 and may be subject to change.

Overall Rating Framework

Broker Overview

Company Foundation and Background

TP Global FX entered the forex and CFD brokerage market in 2016. The company established its headquarters in Dubai while maintaining regulatory registration in St. Vincent and the Grenadines. The company positions itself as a modern brokerage focused on transparency and innovation, targeting both retail and institutional clients seeking comprehensive trading solutions. According to TradingBrokers.com, the broker operates under a No Dealing Desk (NDD) model. This suggests direct market access for client orders.

The brokerage has built its reputation around providing diverse trading opportunities across multiple asset classes, emphasizing technological advancement and competitive trading conditions. However, as this tp global fx review demonstrates, the company's operational execution has faced significant challenges. These challenges are particularly evident in areas of customer service and fund management processes.

Trading Infrastructure and Regulatory Framework

TP Global FX offers three primary trading platforms: MetaTrader 4, MetaTrader 5, and their proprietary TP Global FX platform. The broker provides access to forex, cryptocurrencies, indices, commodities, and stocks through over 200 CFD instruments. According to available information, the company operates under VFSC (Vanuatu Financial Services Commission) regulation. Traders should verify specific regulatory status for their jurisdiction though.

The broker's asset coverage spans major currency pairs, popular cryptocurrency CFDs, global equity indices, precious metals, energy commodities, and individual stock CFDs. This comprehensive offering positions TP Global FX as a one-stop solution for traders. It serves those seeking portfolio diversification across multiple markets and asset classes.

Regulatory Coverage and Geographic Restrictions: TP Global FX operates under VFSC regulation along with additional oversight from SVG FSA, NFA, and CAMA Nigeria. Specific license numbers require verification through official channels though. Different regulatory frameworks may apply based on trader location, potentially affecting available services and protections.

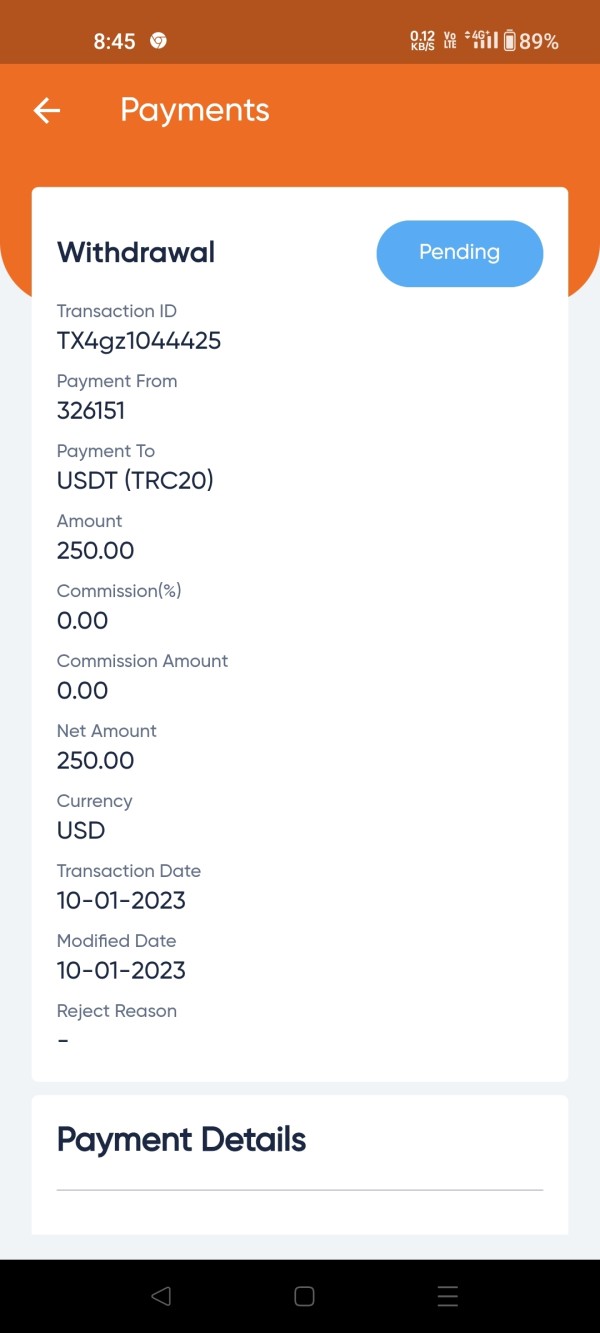

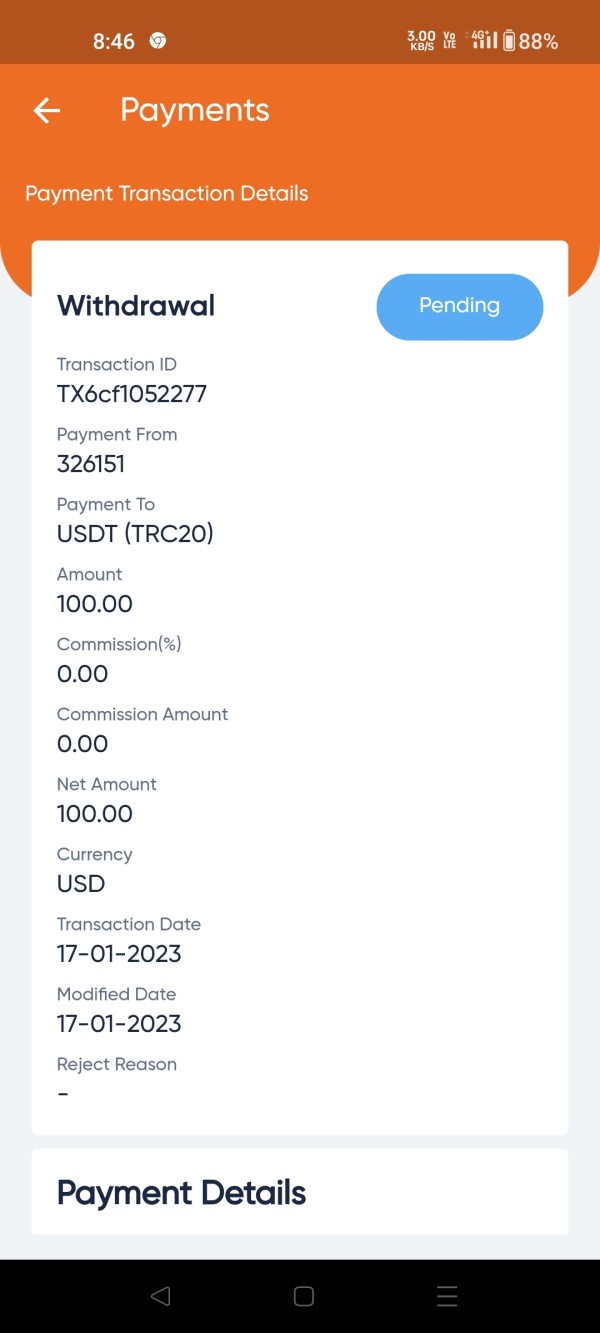

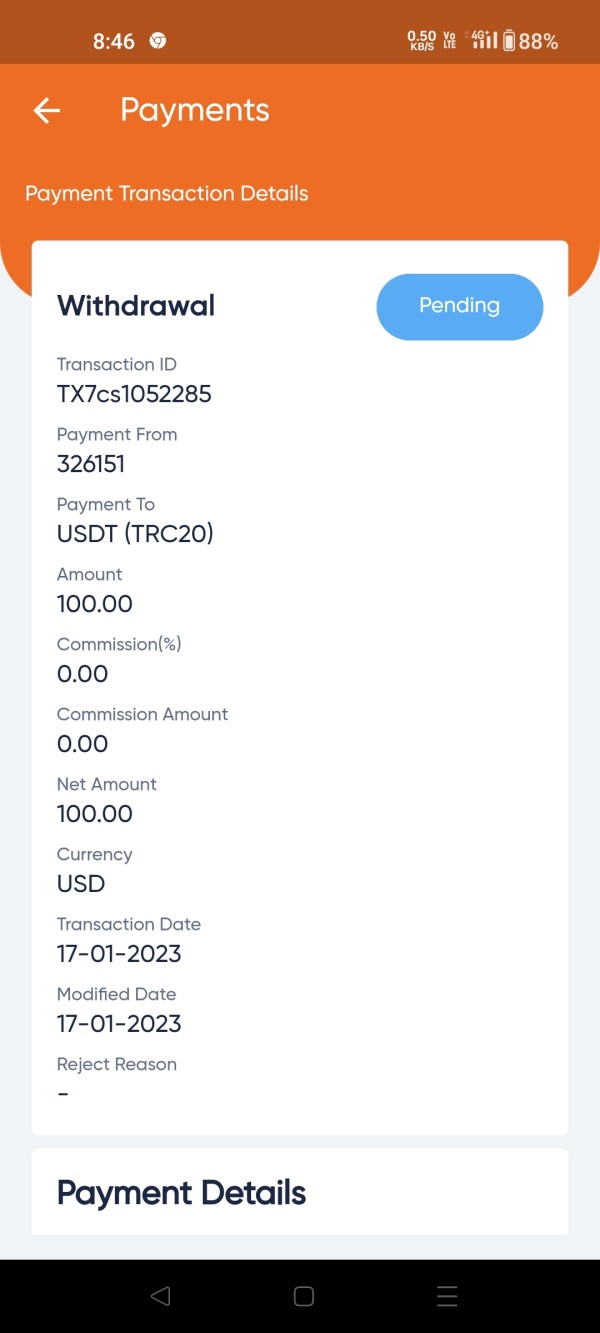

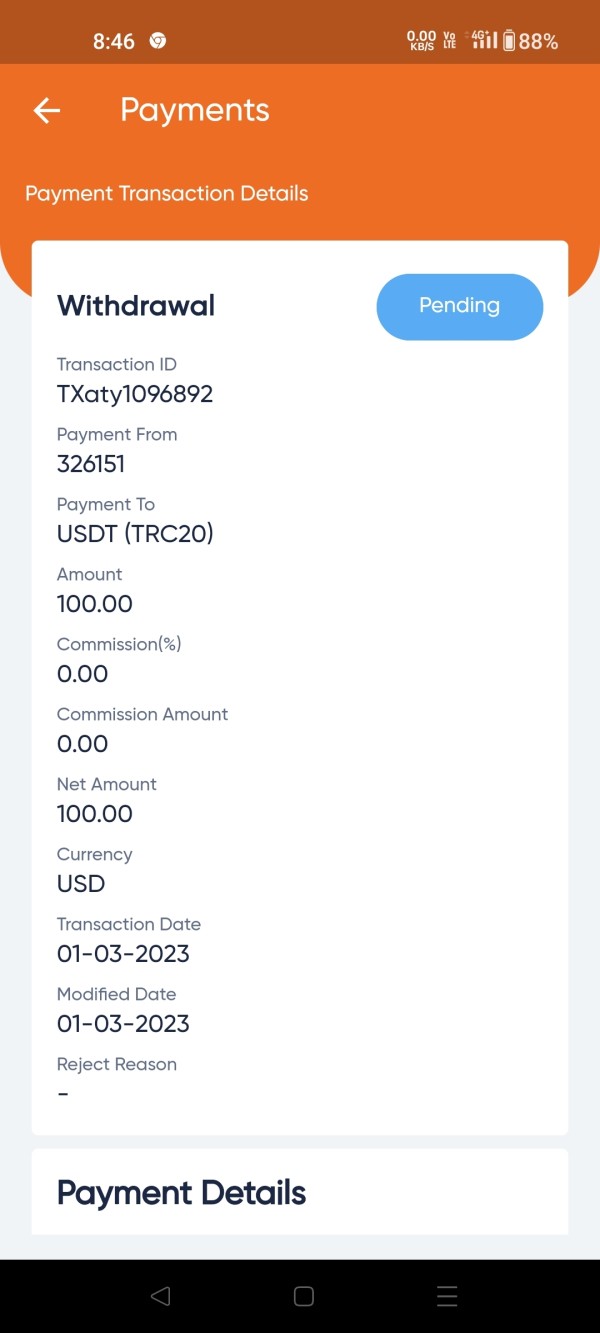

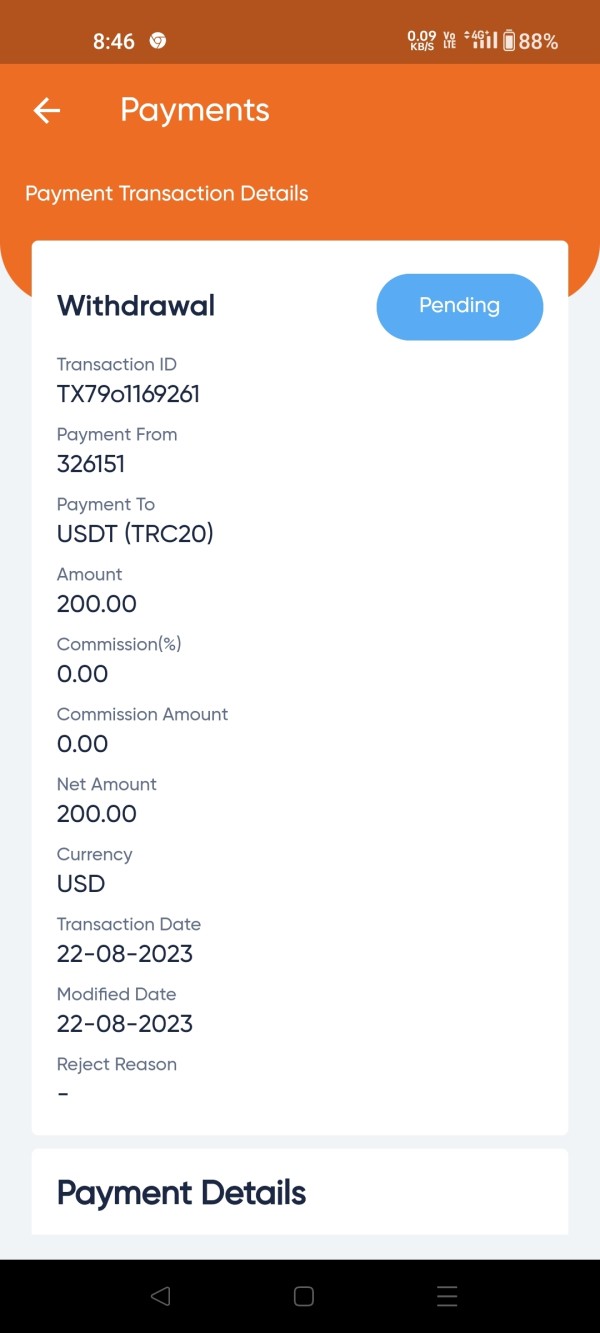

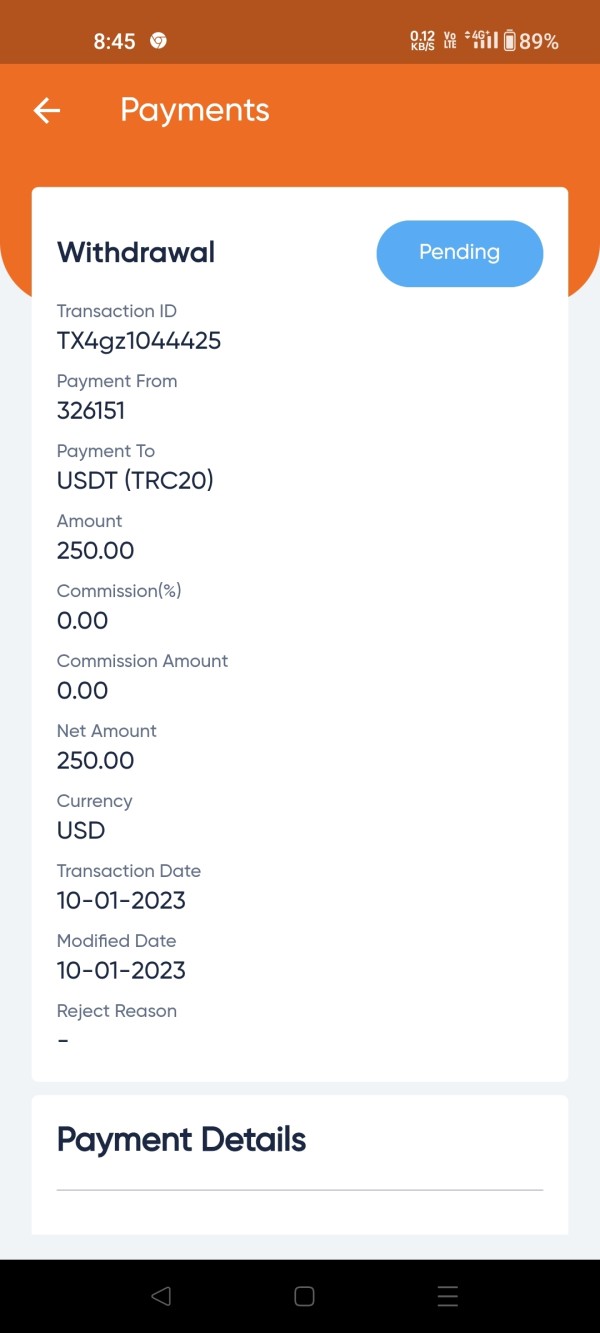

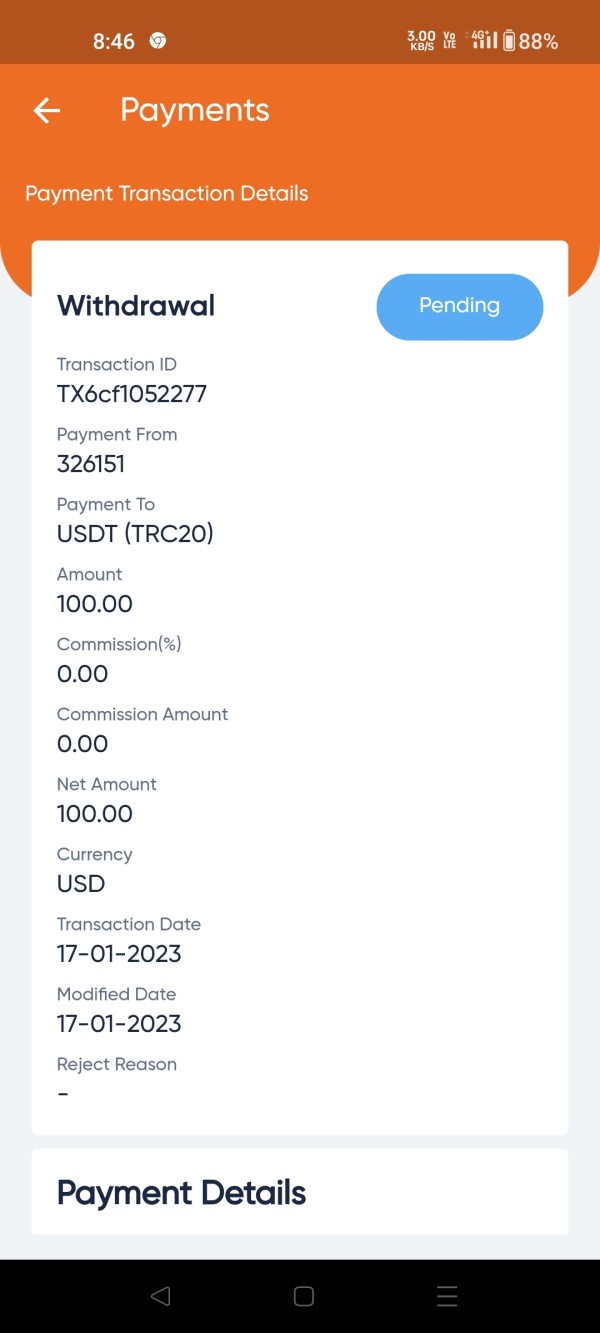

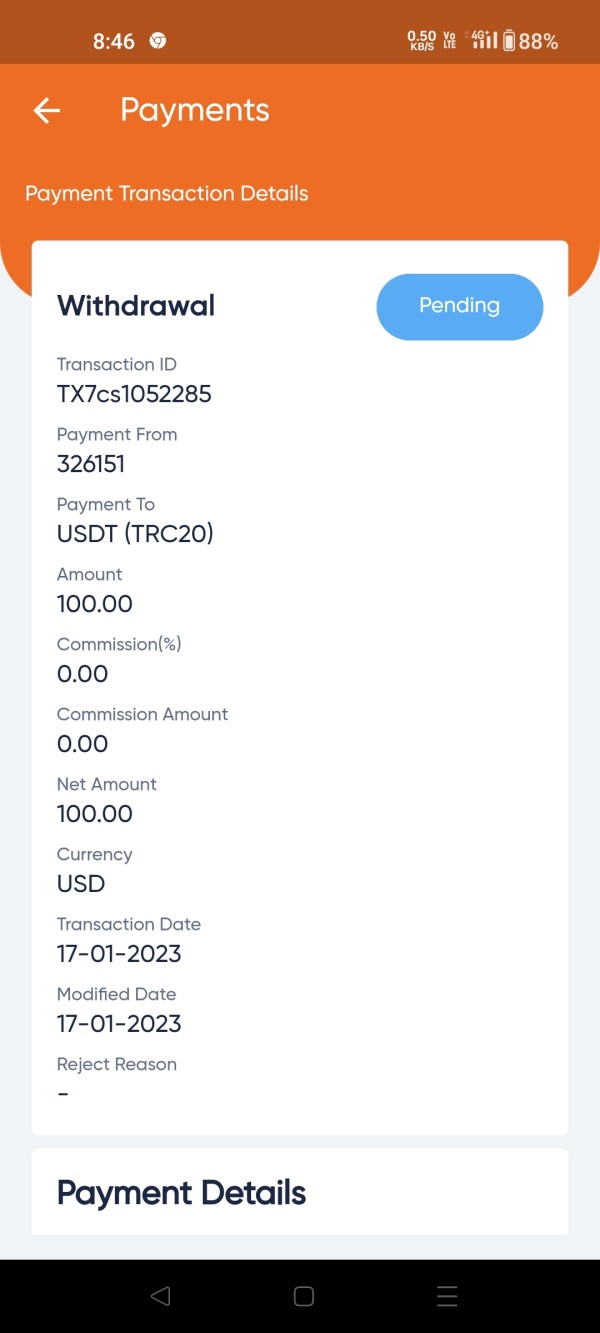

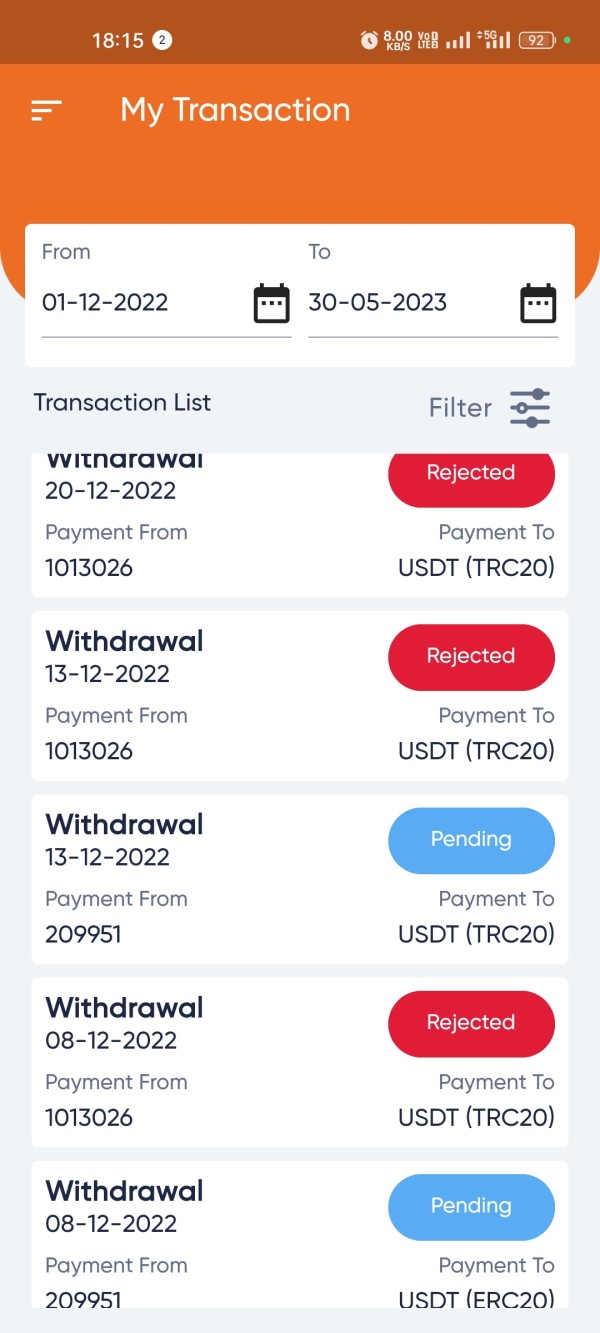

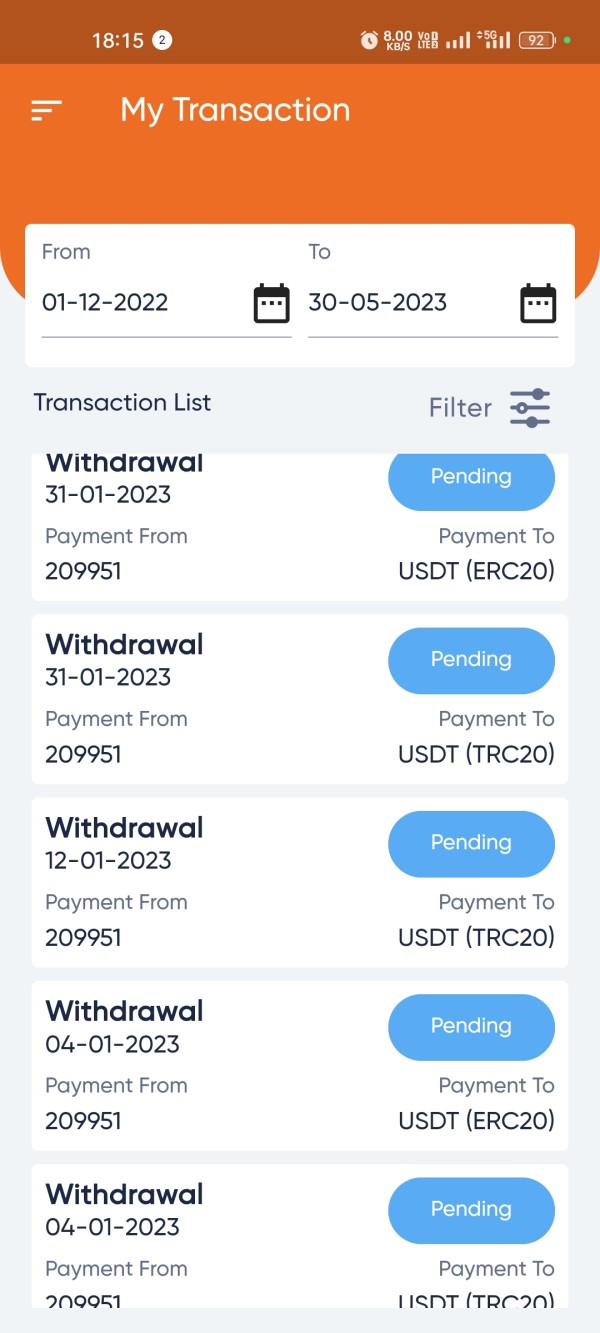

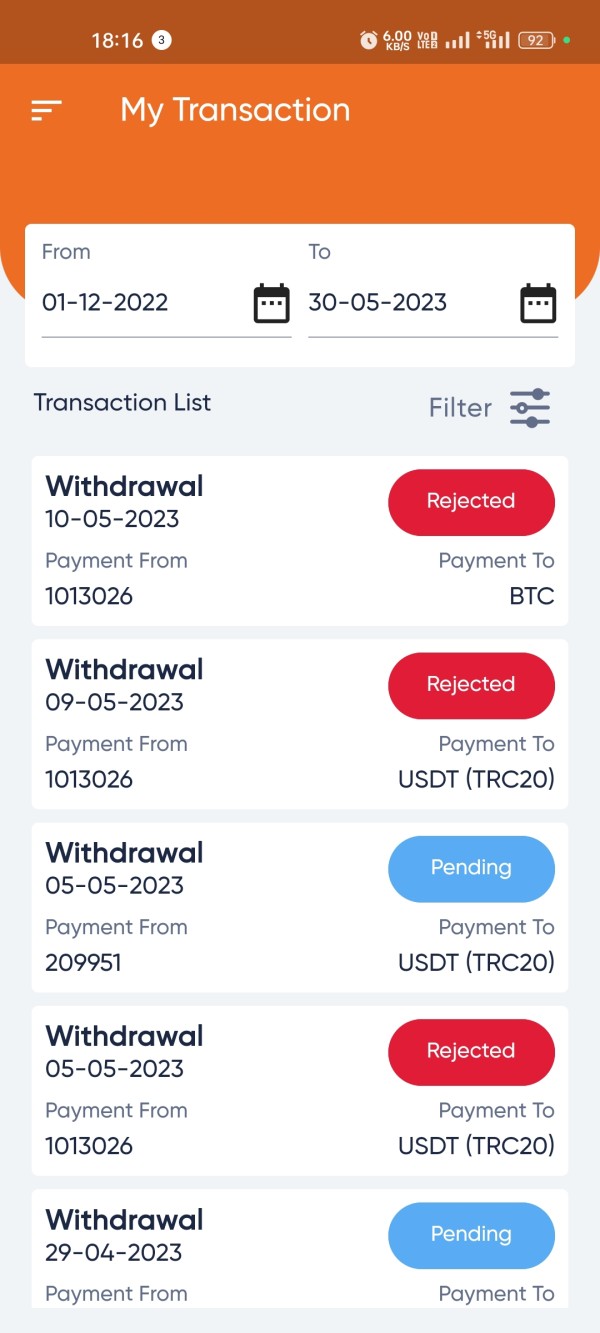

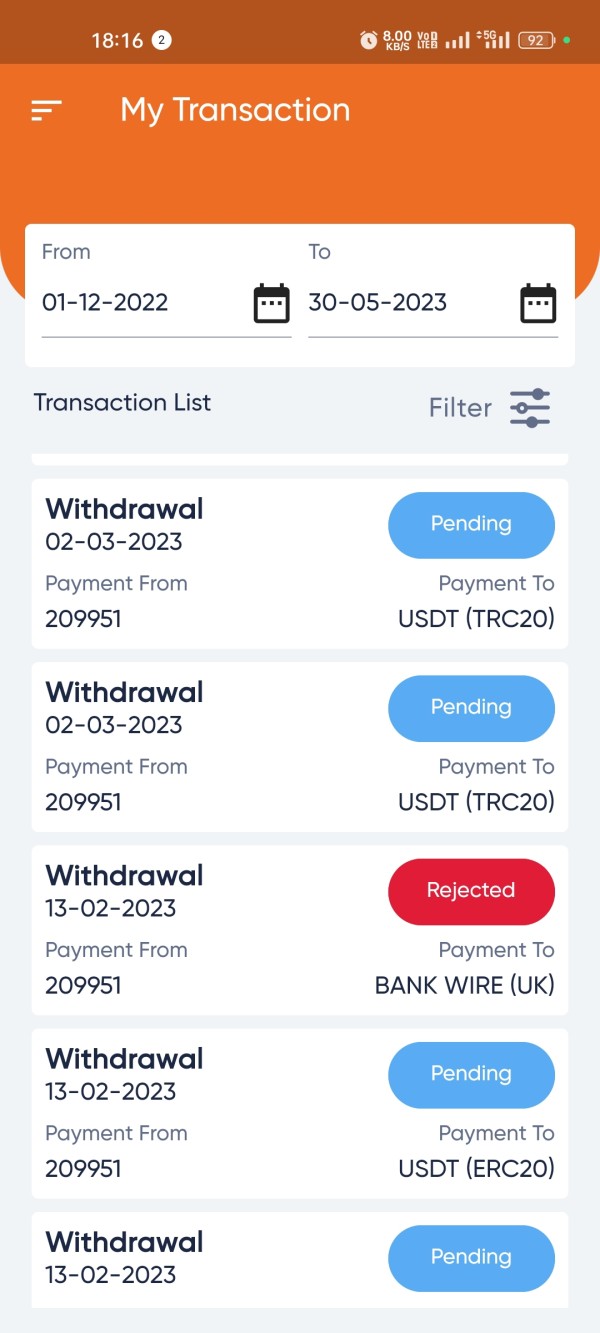

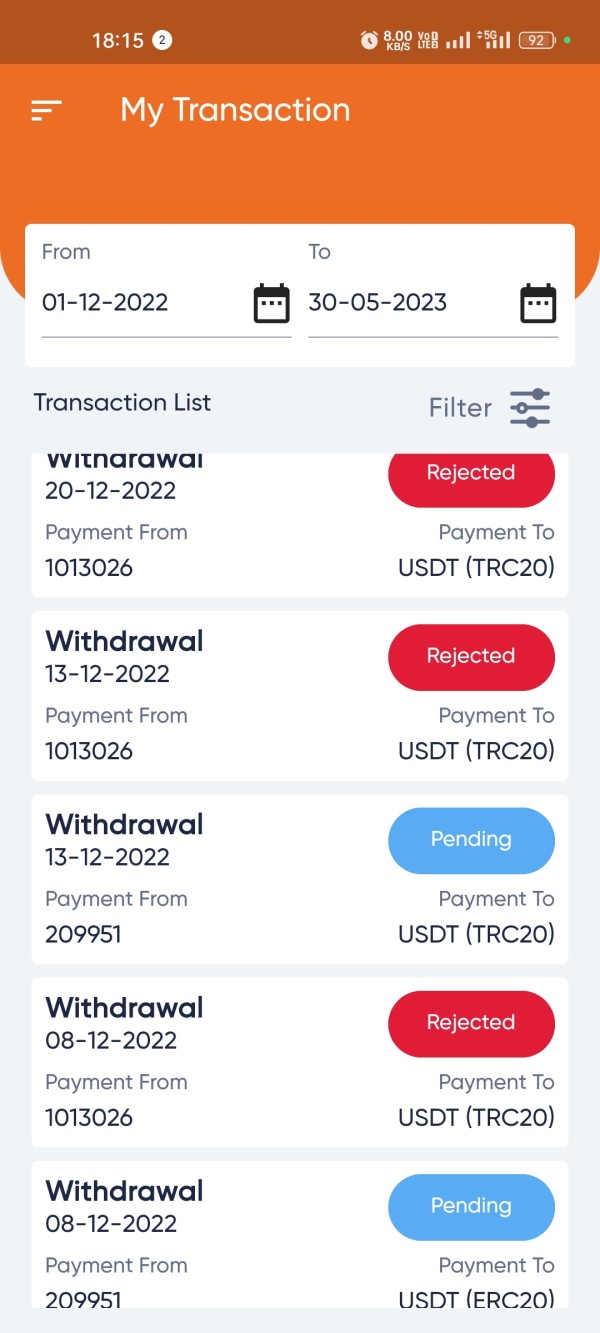

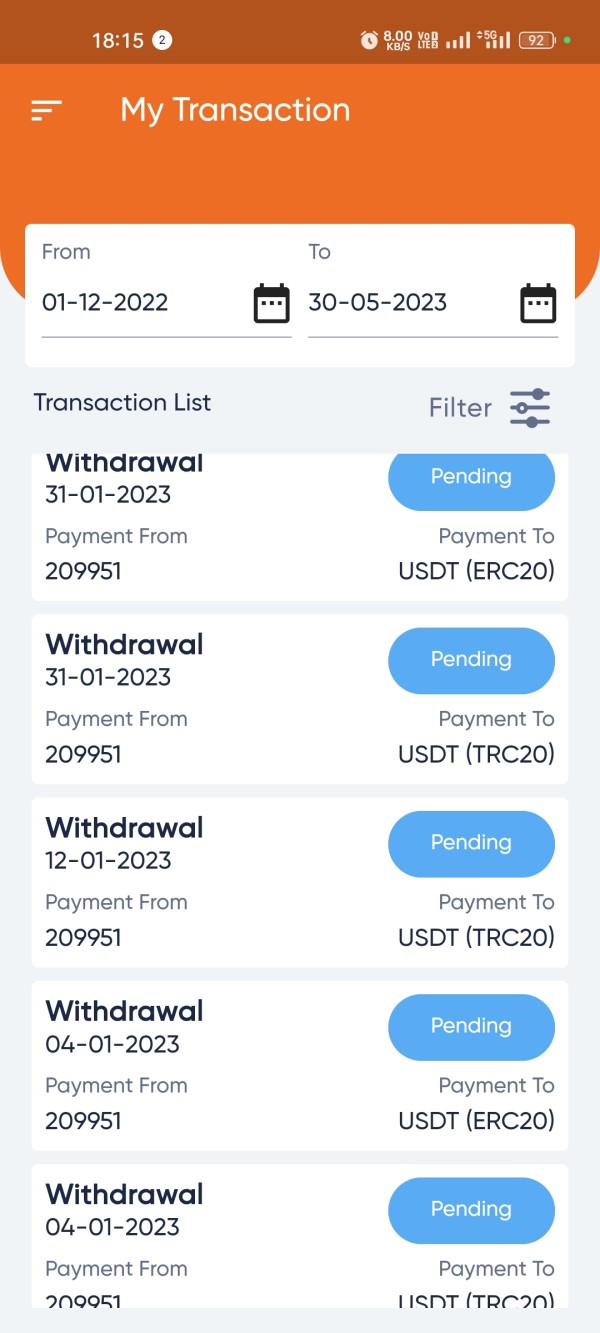

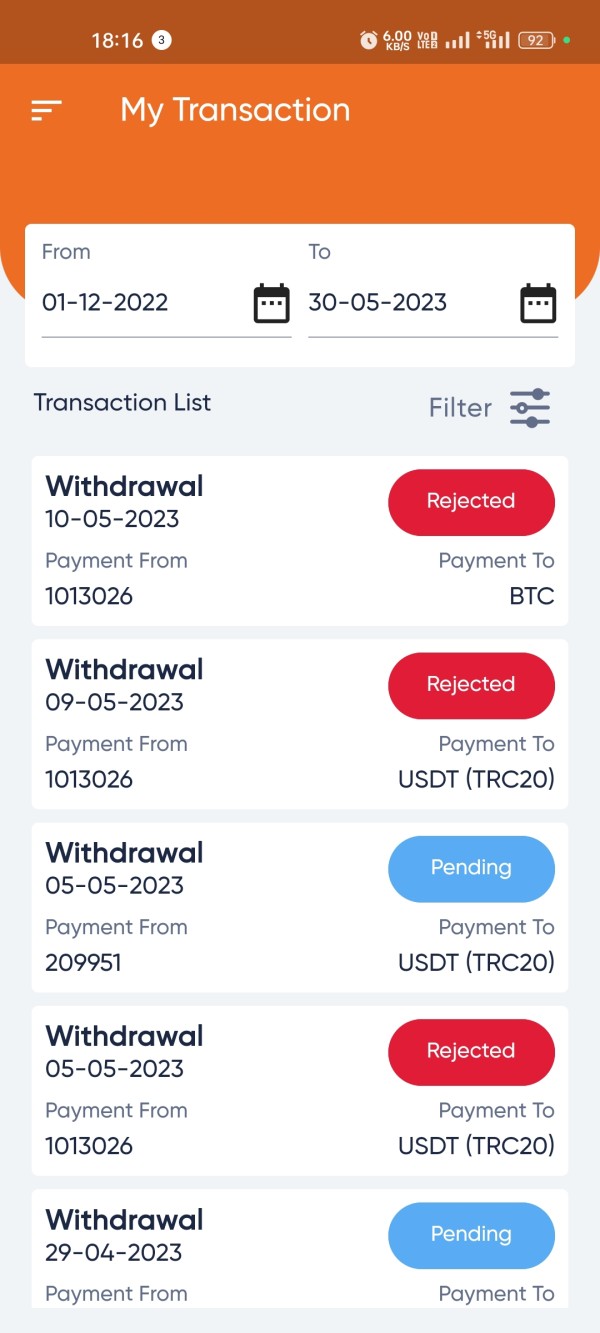

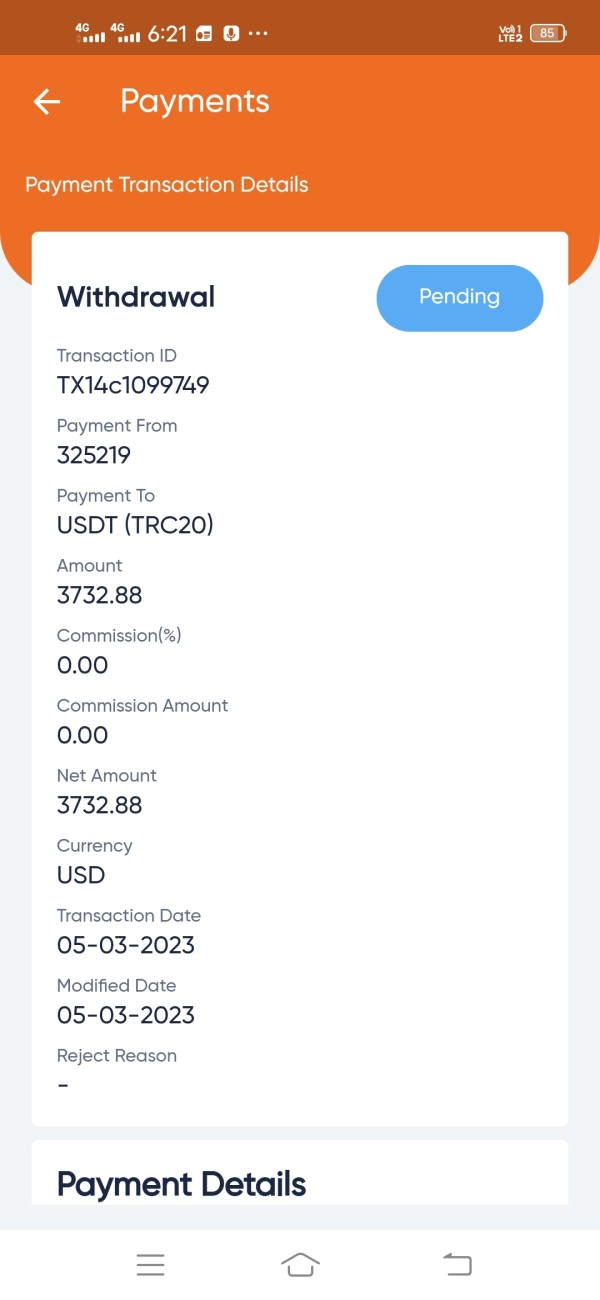

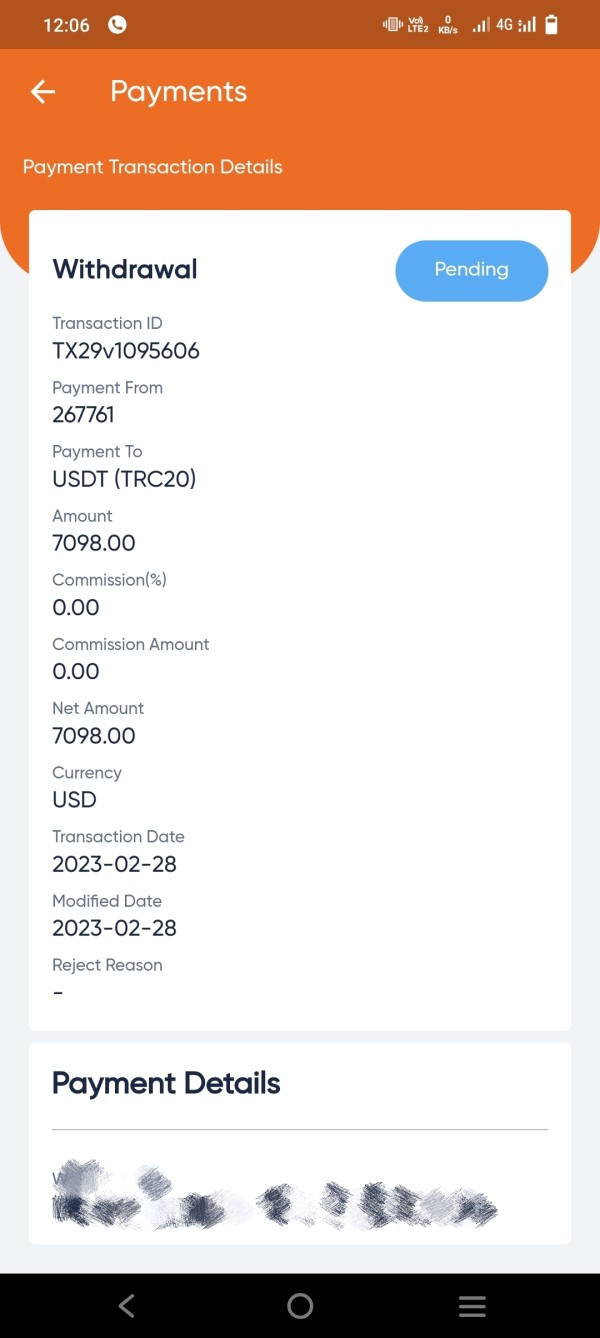

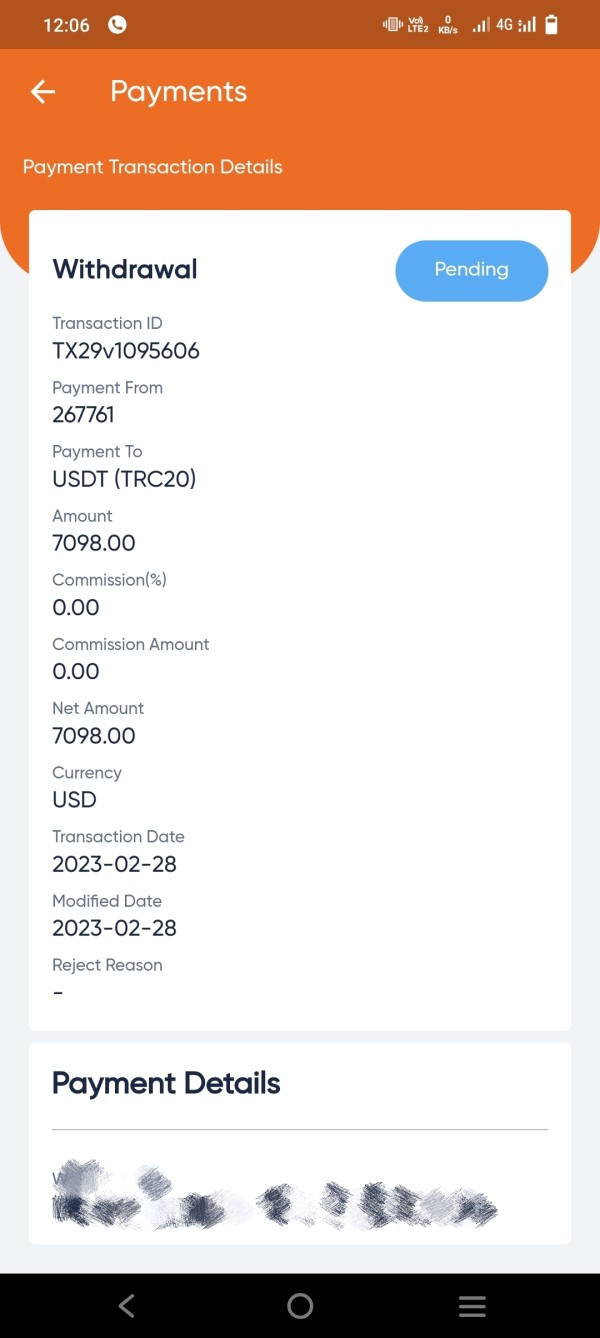

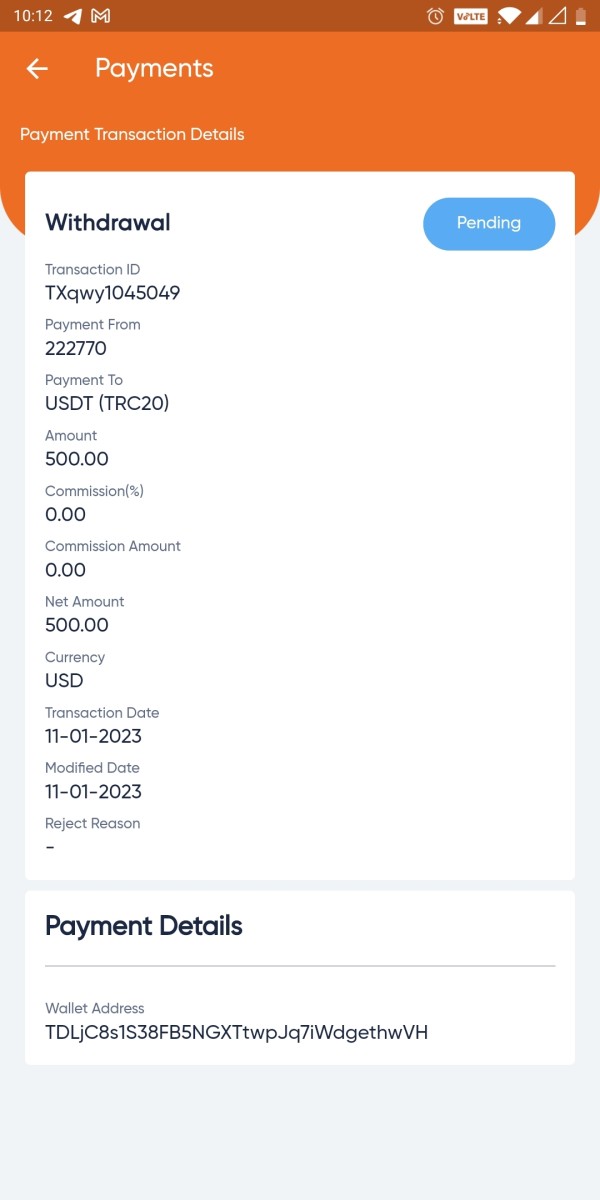

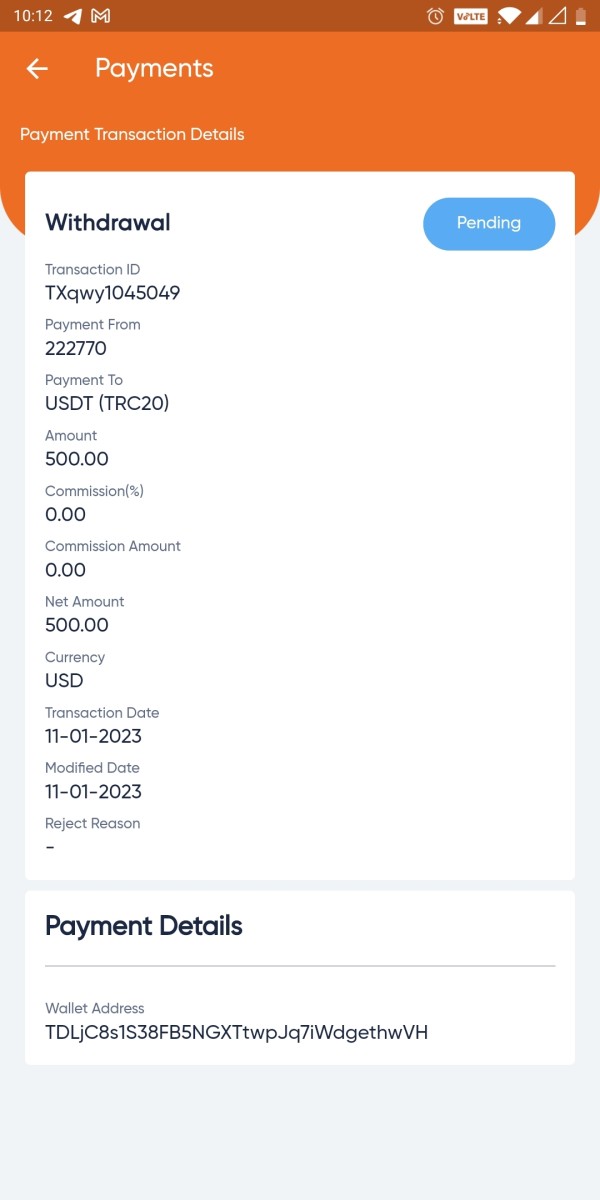

Funding and Withdrawal Methods: The platform supports bank transfers, credit/debit cards, electronic wallets, and cryptocurrency deposits and withdrawals. However, user feedback consistently highlights withdrawal processing delays and difficulties. These issues are primary concerns affecting the overall service quality.

Minimum Investment Requirements: Minimum deposit requirements vary between $50 and $200 depending on account type and source information. This makes the platform accessible to smaller investors. This relatively low barrier to entry aligns with the broker's positioning toward retail traders.

Promotional Offerings: Specific bonus and promotional information was not detailed in available materials. This suggests either limited promotional activities or lack of transparency in marketing such offerings.

Available Trading Assets: The broker provides access to major and minor currency pairs, popular cryptocurrency CFDs including Bitcoin and Ethereum, global stock indices, precious metals like gold and silver, energy commodities, and individual stock CFDs from major exchanges.

Cost Structure Analysis: TP Global FX implements variable spreads with commissions starting from $0. Specific spread ranges and commission structures require verification through direct broker contact though. The variable spread model suggests costs may fluctuate based on market conditions and volatility.

Leverage Specifications: Maximum leverage reaches 1:500, providing significant capital amplification opportunities while requiring careful risk management. Such high leverage levels necessitate thorough understanding of margin requirements and potential losses.

Platform Technology: Traders can choose between industry-standard MetaTrader 4 and 5 platforms or the broker's proprietary trading interface. Each offers different features and capabilities suited to various trading styles and experience levels.

Geographic Availability: Certain regions may face restrictions based on local regulatory requirements and the broker's compliance capabilities. Prospective clients must verify service availability in their jurisdiction.

Customer Support Languages: The platform provides multilingual customer support. Specific language availability and support quality vary according to user feedback and operational capacity though.

This comprehensive tp global fx review continues with detailed analysis of each evaluation criterion to provide thorough assessment guidance for potential clients.

Account Conditions Analysis

TP Global FX offers multiple account types designed to accommodate different trader profiles and investment levels. The broker's account structure features relatively accessible minimum deposit requirements, with sources indicating thresholds of $50 to $200 depending on the specific account tier selected. This competitive entry point makes the platform particularly attractive to smaller investors. It also appeals to those beginning their trading journey.

The commission structure starts from $0 for certain account types, though the specific conditions and trading volumes required to maintain zero-commission status require clarification through direct broker contact. Variable spreads apply across all account types. This means trading costs fluctuate based on market conditions and liquidity levels. While this can provide opportunities for tighter spreads during optimal market conditions, it also introduces uncertainty in cost planning for active traders.

Account opening procedures appear streamlined based on available information, though verification requirements and processing times vary. The broker accepts various identification documents and proof of address materials standard in the industry. However, user feedback consistently highlights significant issues with account management. These issues particularly involve withdrawal processing and fund access.

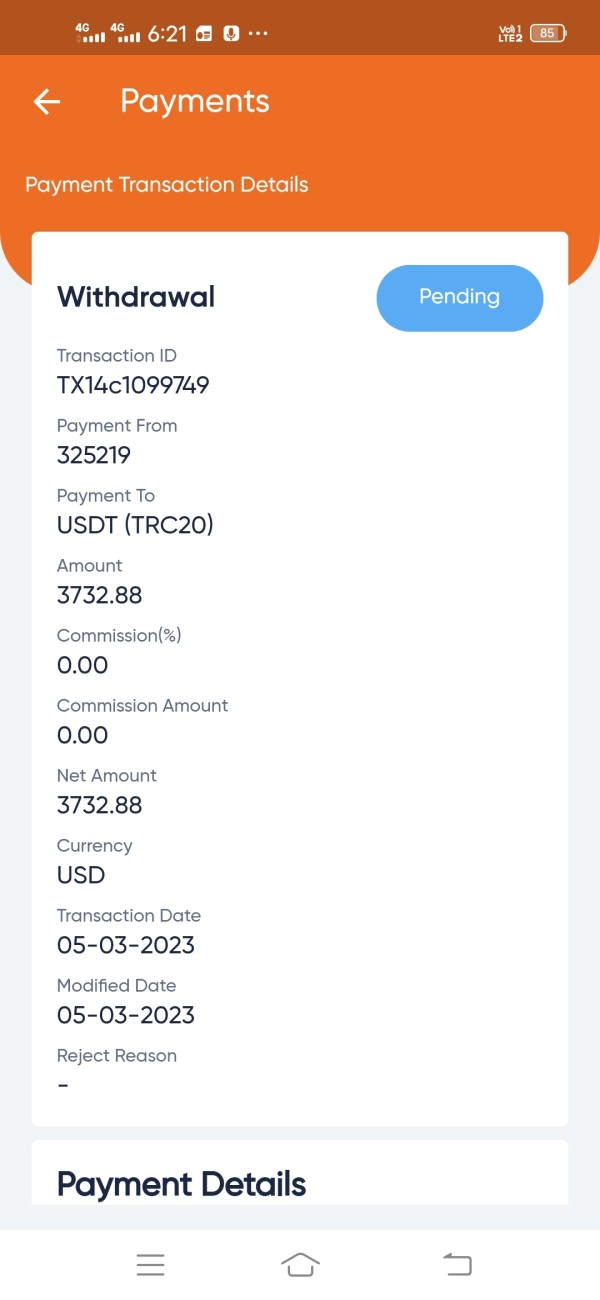

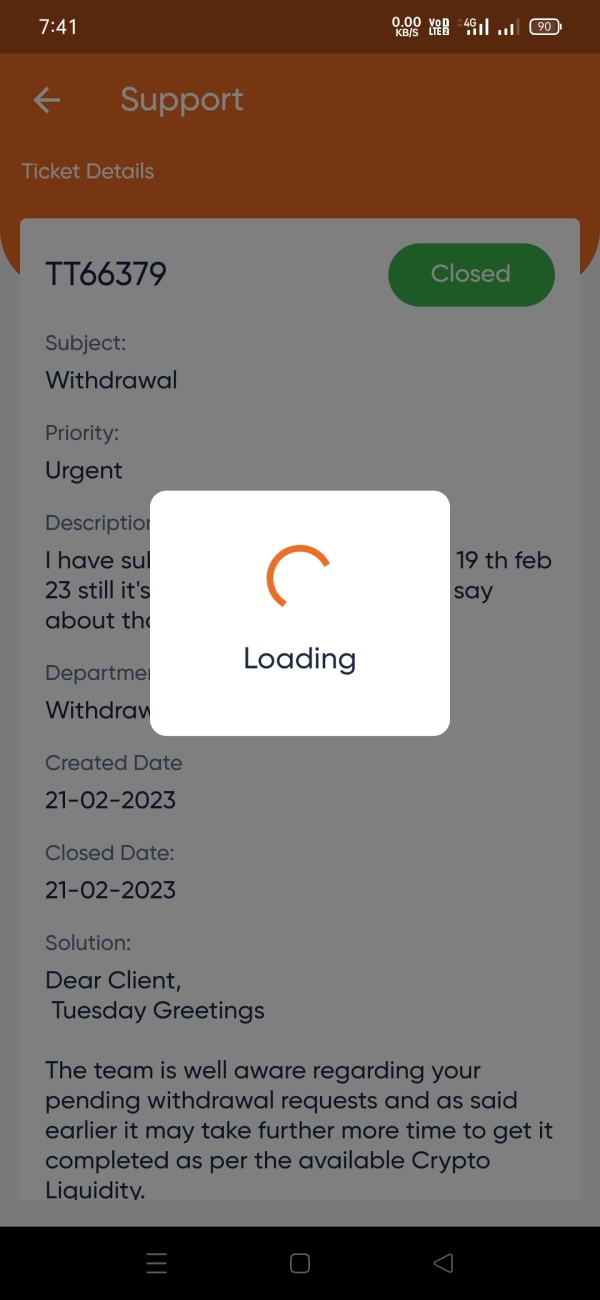

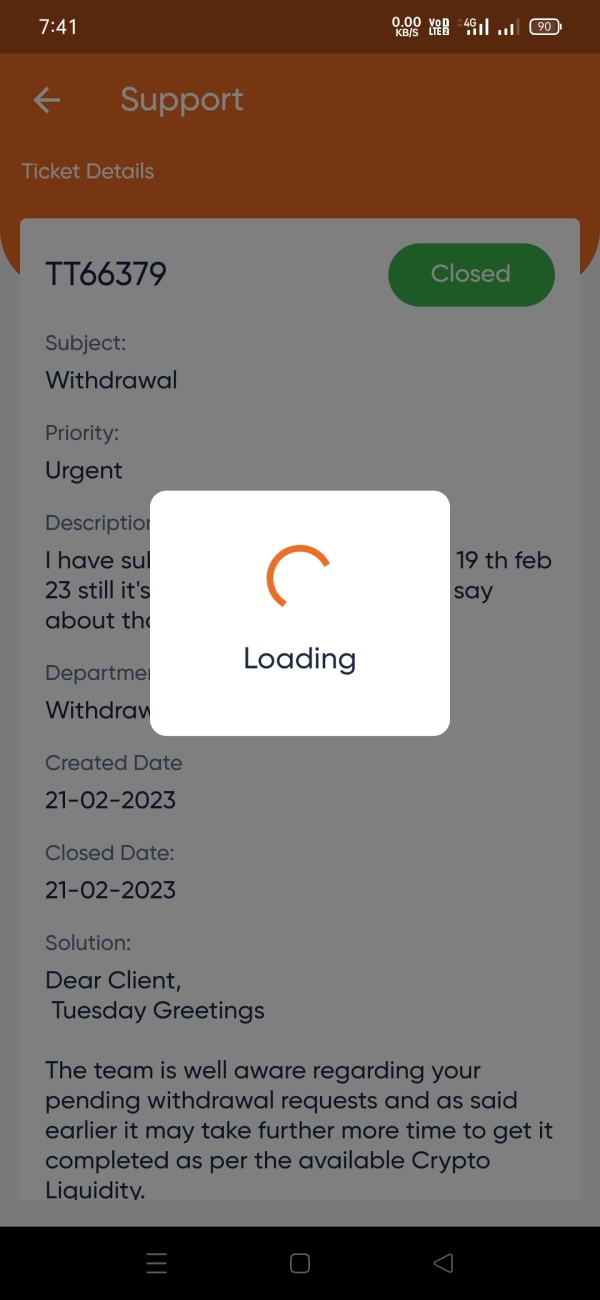

Customer complaints frequently center on withdrawal delays and difficulties, with many users reporting extended waiting periods and communication challenges when attempting to access their funds. These operational issues substantially impact the overall account experience despite competitive initial conditions. According to Trustpilot reviews, withdrawal problems represent the most common source of user dissatisfaction. They affect the practical utility of otherwise attractive account terms.

The availability of Islamic accounts and other specialized account features remains unclear in available documentation. This requires direct inquiry with the broker for specific religious or regulatory accommodation needs.

TP Global FX demonstrates strong performance in trading tools and available instruments, offering access to over 200 CFD products across multiple asset categories. The broker's instrument selection spans major and minor currency pairs, popular cryptocurrency CFDs, global equity indices, commodity futures, and individual stock CFDs from major international exchanges. This comprehensive coverage enables portfolio diversification. It provides exposure to various market sectors through a single trading account.

The platform selection includes industry-standard MetaTrader 4 and MetaTrader 5, both renowned for their advanced charting capabilities, technical analysis tools, and automated trading support. Additionally, TP Global FX provides its proprietary trading platform. Specific features and advantages of this custom solution require further investigation though. The availability of multiple platform options allows traders to select interfaces that best match their trading styles and technical requirements.

Technical analysis capabilities appear robust across supported platforms, with standard indicators, drawing tools, and chart types available for market analysis. The MetaTrader platforms support Expert Advisors (EAs) and algorithmic trading strategies. This enables automated execution for systematic trading approaches. Signal services and copy trading functionality may be available, though specific details regarding these features need verification through direct platform examination.

However, available information does not detail specific educational resources, market research offerings, or fundamental analysis tools that many traders consider essential for informed decision-making. The absence of clear information about economic calendars, market commentary, or educational webinars suggests potential gaps in trader support resources. This compares unfavorably to more comprehensive brokerage offerings.

Mobile trading capabilities likely exist through MetaTrader mobile applications, providing on-the-go access to positions and market monitoring. The quality and functionality of mobile experiences require hands-on evaluation to assess properly though.

Customer Service and Support Analysis

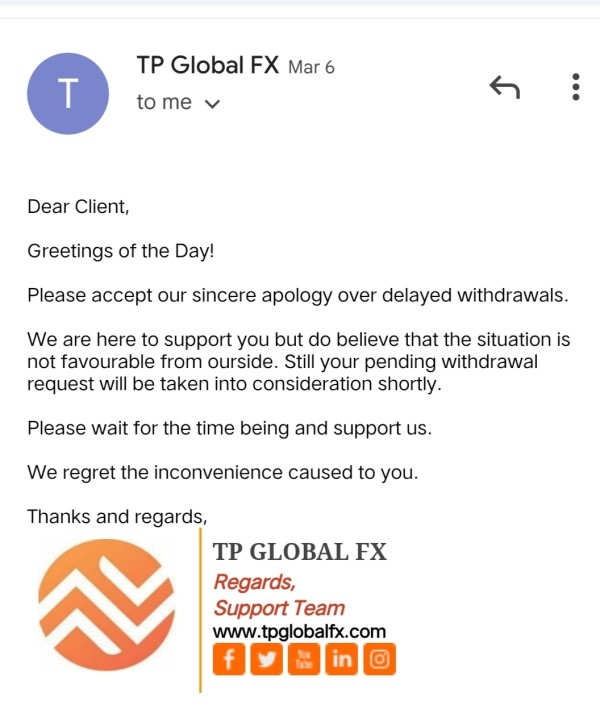

Customer service represents a significant weakness in TP Global FX's operational framework, with user feedback consistently highlighting poor support quality and responsiveness. According to Trustpilot reviews and other feedback platforms, customers frequently experience slow response times when contacting support channels. This creates frustration during urgent trading situations or account issues.

The broker appears to offer multiple communication channels including email, phone, and potentially live chat support, though the effectiveness and availability of these channels receive poor ratings from users. Response times reportedly extend well beyond industry standards. Some customers wait days for resolution of basic account inquiries or technical issues.

Most concerning are the numerous reports of inadequate assistance with withdrawal requests and fund access issues. Users consistently report that customer service representatives provide insufficient help when addressing payment processing delays or account restrictions. This pattern suggests systemic issues in both support training and operational procedures. It indicates more than just isolated incidents.

Language support capabilities exist for multiple languages, reflecting the broker's international client base, though the quality and availability of non-English support may vary significantly. Time zone coverage and 24/7 availability remain unclear from available information. This potentially limits support access for traders in certain geographic regions.

The combination of slow response times, poor issue resolution capabilities, and inadequate assistance with critical functions like fund withdrawals creates a support environment that fails to meet reasonable customer expectations. These service deficiencies significantly impact the overall trading experience. They contribute to the broker's poor reputation scores across review platforms.

Problem resolution procedures appear inadequate based on user experiences, with many customers reporting that initial support contacts fail to address their concerns effectively. This requires multiple follow-up attempts and extended resolution timeframes that create additional stress and uncertainty.

Trading Experience Analysis

The trading experience at TP Global FX presents a mixed picture, with users generally expressing satisfaction with core trading conditions while encountering significant operational challenges that affect overall platform utility. Platform stability receives generally positive feedback. Traders report consistent access to markets and reliable order execution during standard trading hours.

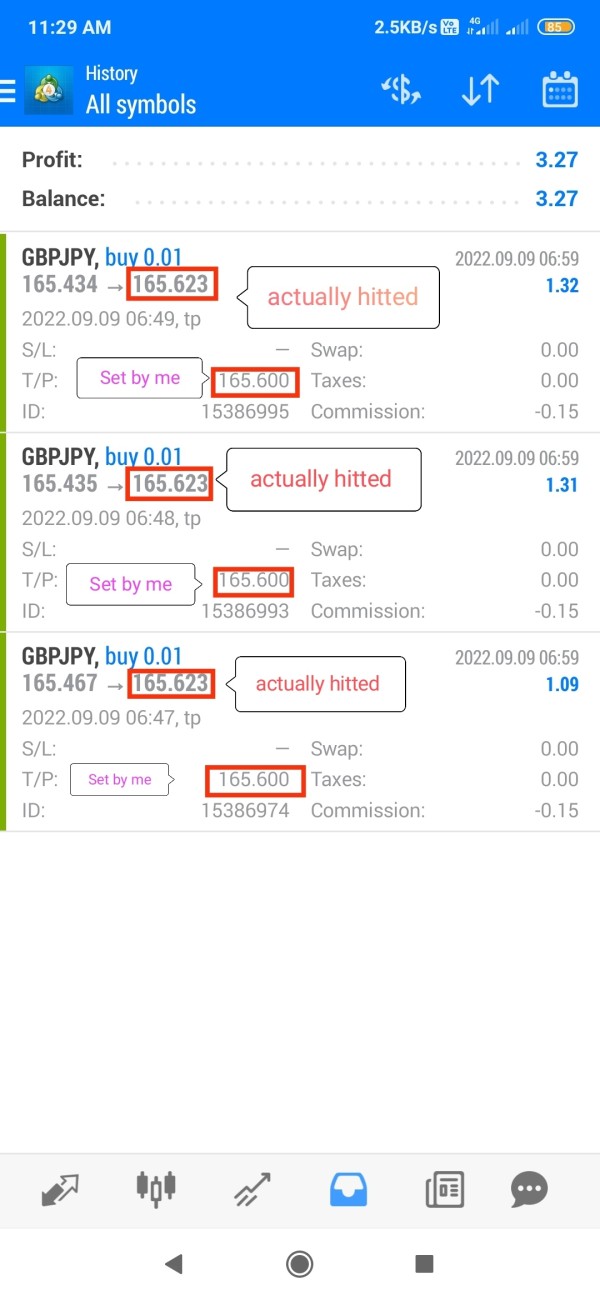

Order execution quality appears satisfactory based on available user feedback, with traders noting competitive spreads and reasonable fill rates for standard market orders. The variable spread structure provides opportunities for cost savings during periods of high liquidity. Traders must account for potential spread widening during volatile market conditions or news events though.

Platform functionality across MetaTrader 4 and 5 meets industry standards, offering comprehensive charting tools, technical indicators, and automated trading capabilities that experienced traders expect. The platforms support various order types including market orders, pending orders, and stop-loss/take-profit configurations essential for risk management strategies.

However, the positive trading environment becomes overshadowed by significant operational issues, particularly regarding fund management and customer service interactions. While users can execute trades effectively, the difficulties encountered when attempting to withdraw profits or resolve account issues create substantial anxiety. This undermines confidence in the platform's reliability.

Mobile trading experiences through MetaTrader applications generally function as expected, providing basic position monitoring and trade execution capabilities for traders requiring market access while away from their primary trading stations. The proprietary platform's mobile functionality requires separate evaluation. This is needed to assess its comparative performance and feature set.

Slippage and requote incidents appear within normal ranges for variable spread brokers, though specific performance metrics during high-impact news events or market volatility periods require additional verification through extended platform testing.

The overall tp global fx review of trading experience reveals a platform capable of supporting effective trading activities when functioning properly. It is undermined by operational deficiencies that create significant user frustration and trust issues though.

Trust and Safety Analysis

Trust and safety concerns represent the most significant challenges facing TP Global FX, as evidenced by poor ratings across multiple review platforms and consistent user complaints regarding fund security and withdrawal processing. The broker's TrustScore of 3.62 on Trustpilot reflects widespread user dissatisfaction. 65% of reviewers award the minimum 1-star rating.

Regulatory oversight through VFSC and other claimed regulatory bodies provides some framework for operational standards, though the effectiveness of these regulatory protections remains questionable given the volume of user complaints regarding fund access and withdrawal processing. Traders should verify current regulatory status. They must understand the specific protections available under each jurisdiction's regulatory framework.

The company's claims of transparency and innovation contrast sharply with user experiences suggesting opacity in operational procedures, particularly regarding withdrawal processing timelines and requirements. Many users report unexpected delays, additional verification requests, and communication breakdowns when attempting to access their funds. This creates significant trust deficits.

Fund segregation and client money protection measures are not clearly detailed in available information, representing a significant transparency gap for a broker claiming to prioritize client protection. The absence of clear information about client fund handling procedures raises additional concerns. These involve operational standards and regulatory compliance.

Negative incident handling appears inadequate based on user feedback patterns, with many complaints remaining unresolved or receiving unsatisfactory responses from the broker's support team. This pattern suggests systemic issues in complaint resolution procedures and customer relationship management. It indicates more than isolated operational problems.

The broker's industry reputation suffers from the accumulation of negative user experiences and poor review platform performance, creating challenges for potential clients seeking reliable trading partnerships. The disconnect between marketing claims of transparency and actual user experiences significantly undermines the broker's credibility. This is particularly evident in the competitive forex market.

User Experience Analysis

Overall user satisfaction with TP Global FX presents a complex picture characterized by acceptable trading conditions undermined by significant operational failures that substantially impact the complete user journey. While traders generally express satisfaction with basic trading functionality, withdrawal difficulties and poor customer service create overwhelming negative experiences. These overshadow any positive platform aspects.

Interface design across supported platforms appears adequate, with MetaTrader 4 and 5 providing familiar environments for experienced traders and reasonable learning curves for newcomers. The proprietary platform's design quality and usability require separate evaluation. No specific user feedback regarding its interface was available in reviewed materials though.

Registration and account verification processes appear straightforward initially, though users report complications and delays during later stages of account management, particularly when attempting to withdraw funds or modify account settings. The contrast between smooth onboarding and problematic ongoing account management creates user frustration. It also creates trust issues.

Fund operation experiences represent the most significant source of user dissatisfaction, with deposit processing generally functioning adequately while withdrawal processing faces extensive delays and complications. Users consistently report that withdrawal requests trigger additional verification requirements, extended processing times, and poor communication from support staff. This creates anxiety and financial planning difficulties.

The most common user complaints center on withdrawal processing delays, unresponsive customer service, and unexpected account restrictions or verification requests. These operational issues affect users across different account types and investment levels. This suggests systemic rather than isolated problems.

User demographics appear to include small to medium-sized retail traders seeking diversified asset exposure and competitive trading conditions. However, the operational challenges make the platform unsuitable for traders requiring reliable fund access and responsive customer support. This applies regardless of their trading experience or investment capital levels.

Improvement recommendations from user feedback consistently emphasize the need for faster withdrawal processing, improved customer service responsiveness, and greater transparency in operational procedures and requirements.

Conclusion

This comprehensive tp global fx review reveals a brokerage with competitive trading conditions undermined by significant operational deficiencies that severely impact user experience and trust. While TP Global FX offers attractive features including low minimum deposits, diverse asset selection, and high leverage ratios, these advantages are overshadowed by consistent user reports of withdrawal difficulties and poor customer service quality.

The platform may suit traders prioritizing diverse asset exposure and competitive trading costs who can tolerate operational uncertainties and potential fund access delays. However, the significant trust and safety concerns, evidenced by poor review platform ratings and widespread user complaints, make TP Global FX unsuitable for traders requiring reliable fund access and responsive customer support.

Key advantages include low entry barriers, comprehensive asset selection, and competitive leverage offerings, while major disadvantages encompass withdrawal processing issues, slow customer service responses, and poor overall reputation management. Potential clients should carefully weigh these factors. They should consider alternative brokers with stronger operational track records and better user satisfaction ratings.