Regarding the legitimacy of TP Global FX forex brokers, it provides VFSC and WikiBit, (also has a graphic survey regarding security).

Is TP Global FX safe?

Pros

Cons

Is TP Global FX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

HNT GROUP LIMITED

Effective Date:

2020-05-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TP Global FX A Scam?

Introduction

TP Global FX is a forex broker that has garnered attention in the trading community since its inception in 2017. Based in Saint Vincent and the Grenadines, with additional offices in Dubai, Cyprus, and Vanuatu, it positions itself as an innovative and transparent brokerage firm. However, as the forex market continues to grow, so does the necessity for traders to critically evaluate their trading partners. The potential for scams and fraudulent activities looms large in the online trading world, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive assessment of TP Global FX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment in which a broker operates is critical to ensuring the safety and security of its clients' funds. TP Global FX claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and is also associated with the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA). However, the credibility of these regulatory bodies has been questioned due to their lenient licensing requirements.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 40409 | Vanuatu | Suspicious |

| SVG Financial Services Authority (SVG FSA) | 25274 BC 2019 | Saint Vincent and the Grenadines | Unreliable |

The VFSC and SVG FSA are often criticized for their lack of stringent oversight, which raises concerns about the protection of clients' investments. Brokers operating under these jurisdictions often lack the robust consumer protections found in more reputable regulatory environments, such as those overseen by the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC). The absence of a central regulatory authority supervising TP Global FX further complicates its legitimacy, leading to skepticism among potential investors.

Company Background Investigation

Founded in 2017, TP Global FX has positioned itself as a forward-thinking brokerage firm aiming to revolutionize the forex trading experience. The company operates under the ownership of TP Global Services Limited and has expanded its reach through multiple offices in various countries. However, the transparency regarding its ownership structure and management team is limited, which can be a red flag for potential investors.

The management team‘s experience and qualifications are not prominently disclosed on the company’s website, which diminishes trust. A lack of transparency in leadership raises concerns about the accountability of the broker. Furthermore, the company's history is relatively short, which may deter seasoned traders looking for a broker with a longstanding reputation in the industry.

Trading Conditions Analysis

TP Global FX offers a variety of trading accounts, including standard, pro, and institutional accounts. The broker claims to provide competitive spreads and an array of trading instruments. However, a closer examination of their fee structure reveals potential pitfalls that traders should be aware of.

| Fee Type | TP Global FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.2 pips | From 0.5 pips |

| Commission Model | $8 - $15 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

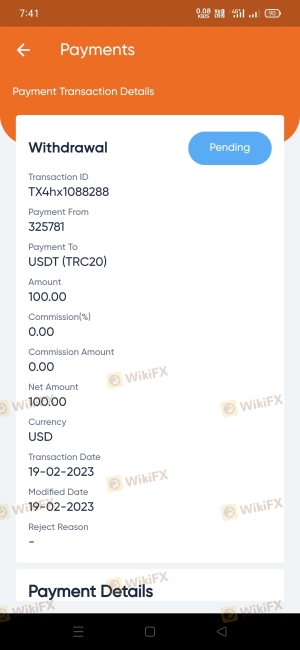

While the broker advertises low minimum deposits and no inactivity fees, the commissions charged, particularly on pro and institutional accounts, are relatively high compared to industry standards. This could significantly affect profitability, especially for active traders who execute multiple trades daily. Moreover, the high withdrawal limit of $1,000 may pose accessibility issues for smaller traders looking to manage their capital more flexibly.

Customer Funds Security

The safety of customer funds is paramount in the forex trading environment. TP Global FX claims to implement several measures to ensure the security of client deposits, including segregated accounts and encryption technologies. However, the lack of a solid regulatory framework diminishes the effectiveness of these measures.

The broker does not provide negative balance protection, which can expose traders to significant financial risks. Furthermore, historical complaints regarding withdrawal issues and fund accessibility raise additional concerns. Traders should be cautious and consider the potential risks associated with depositing funds in a broker that operates under lax regulatory oversight.

Customer Experience and Complaints

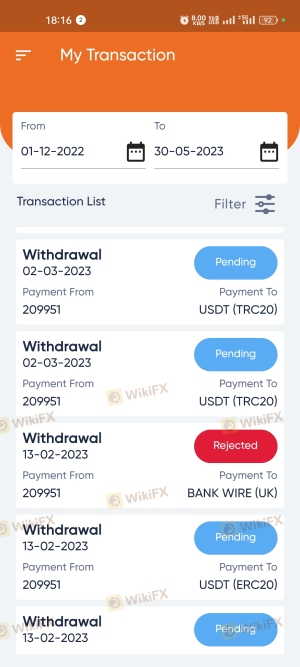

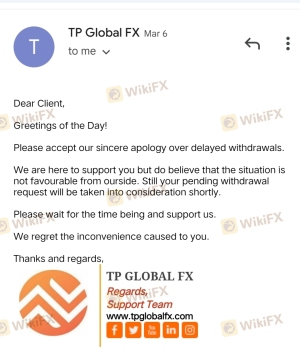

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of TP Global FX reveal a mixed bag of experiences, with some users praising its trading conditions and educational resources, while others report significant issues, particularly concerning withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow and unresponsive |

| Poor Customer Support | Medium | Inconsistent and lacking |

| Account Verification Issues | Medium | Lengthy and unclear process |

Many clients have voiced frustrations over prolonged withdrawal processes, with some waiting weeks or even months to access their funds. In some cases, users have reported that their withdrawal requests were ignored or met with vague responses from customer support. These recurring complaints indicate a systemic issue within the broker's operational framework that could deter potential clients.

Platform and Execution

The trading platforms offered by TP Global FX, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are widely regarded in the trading community for their reliability and functionality. However, the overall performance and execution quality of trades are critical factors that can influence a trader's experience.

Reports of slippage and order rejections have surfaced, raising concerns about the broker's execution quality. Traders expect seamless order execution, especially in fast-moving markets, and any signs of manipulation or inefficiencies can lead to significant losses.

Risk Assessment

Trading with TP Global FX carries inherent risks, primarily due to its regulatory status and the complaints surrounding its operations.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under weak regulatory frameworks |

| Withdrawal Risk | High | Frequent complaints about delays and issues |

| Transparency Risk | Medium | Limited information about management and operations |

Traders should exercise caution when dealing with TP Global FX, particularly regarding fund allocation and withdrawal processes. It is advisable to limit exposure and consider alternative, more reputable brokers that offer better regulatory protections and customer service.

Conclusion and Recommendations

In summary, while TP Global FX offers a range of trading instruments and competitive trading conditions, the lack of robust regulation and the prevalence of customer complaints concerning withdrawals raise significant red flags. The potential for fraud and operational inefficiencies suggests that traders should approach this broker with caution.

For those seeking reliable trading options, it is recommended to consider well-regulated alternatives such as brokers licensed by the FCA or ASIC. These brokers typically provide better consumer protections, transparent fee structures, and a more trustworthy trading environment. Always conduct thorough research and consider personal risk tolerance before engaging with any forex broker.

Is TP Global FX a scam, or is it legit?

The latest exposure and evaluation content of TP Global FX brokers.

TP Global FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TP Global FX latest industry rating score is 1.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.