TEDX 2025 Review: Everything You Need to Know

Summary

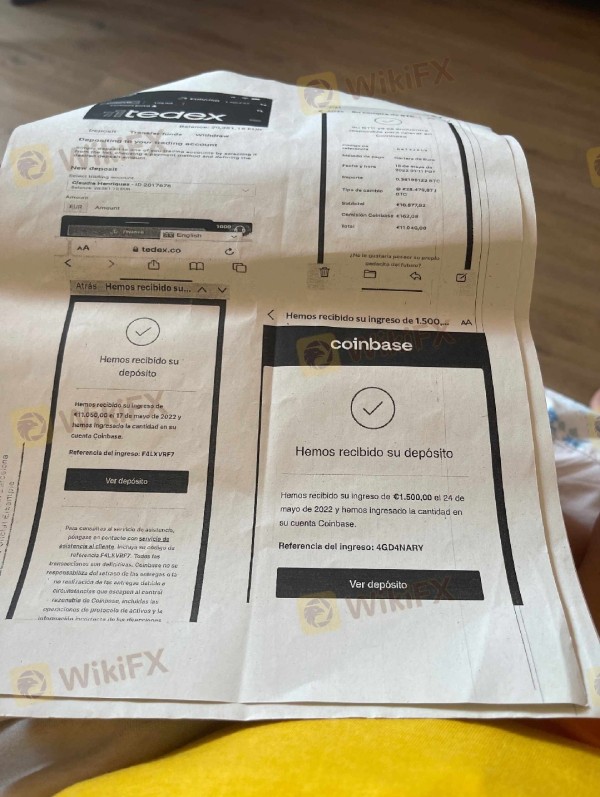

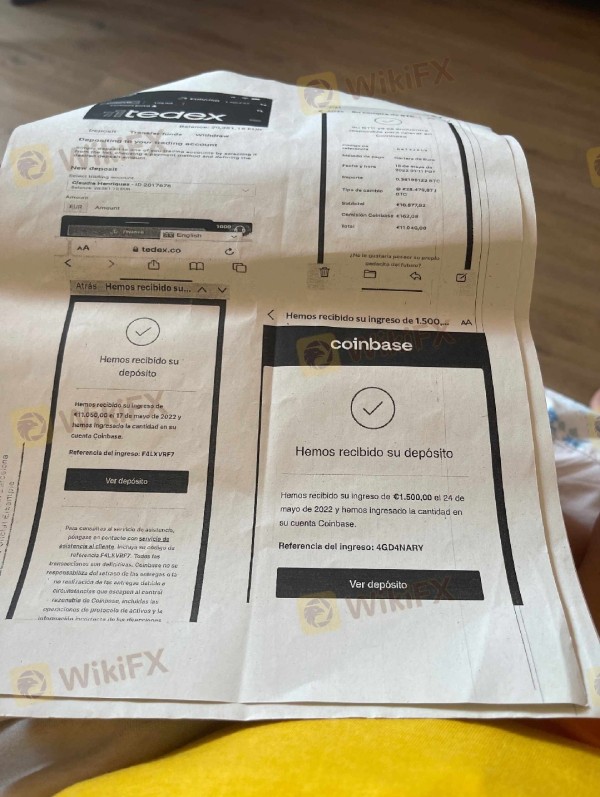

This comprehensive TEDX review evaluates TEDX Limited, a self-proclaimed legitimate UK forex broker. The company has come under scrutiny due to significant credibility concerns that raise red flags for potential investors. While the company claims regulatory oversight from the FCA, extensive analysis reveals substantial gaps in transparency and operational information that are concerning. The platform lacks essential details regarding spreads, commissions, trading conditions, and user experience metrics. These details are typically expected from reputable forex brokers in the industry.

TEDX appears to target forex traders seeking UK-regulated services. However, multiple sources indicate the platform should be approached with extreme caution due to various operational deficiencies. User feedback consistently warns against engaging with this broker. The feedback cites it as a high-risk and untrustworthy investment platform that fails to meet basic industry standards. The absence of crucial operational details, combined with negative user sentiment, raises serious questions about the broker's legitimacy. These factors also call into question the broker's operational capacity to serve clients effectively. Potential clients are strongly advised to conduct thorough due diligence before considering any engagement with TEDX Limited.

Important Notice

Regional Entity Differences: TEDX Limited presents itself as a legitimate UK-based forex broker operating under FCA regulation. However, significant discrepancies exist between the company's claims and available verification data that cannot be ignored. Different jurisdictions may have varying regulatory requirements. Traders should verify the specific regulatory status applicable to their region before making any investment decisions.

Review Methodology: This evaluation is based on publicly available information, regulatory databases, user feedback, and industry analysis. Due to limited transparency from TEDX Limited, some assessments rely on the absence of typically expected information from established brokers in the market.

Overall Rating Framework

Broker Overview

TEDX Limited positions itself as an established UK forex broker. Specific founding details and company history remain undisclosed in available materials, which raises immediate concerns about transparency. The company claims to operate as a legitimate financial services provider under UK jurisdiction. However, comprehensive background verification reveals concerning gaps in operational transparency that potential clients should be aware of. Unlike established brokers that provide detailed company histories, TEDX Limited offers minimal information about its corporate structure, leadership team, or operational track record.

The broker's business model appears to focus on forex trading services. Specific operational frameworks, execution methods, and service delivery mechanisms are not clearly articulated to potential clients. This lack of transparency contrasts sharply with industry standards where reputable brokers provide comprehensive information about their operational approaches. According to available information, TEDX Limited holds FCA regulation, which should provide certain regulatory protections for investors. However, the overall TEDX review landscape suggests significant operational and credibility challenges. Potential clients must carefully consider these factors before engagement with this platform.

Regulatory Jurisdiction: TEDX Limited operates under FCA regulation in the United Kingdom. This regulation typically provides investor protection and operational oversight for legitimate brokers.

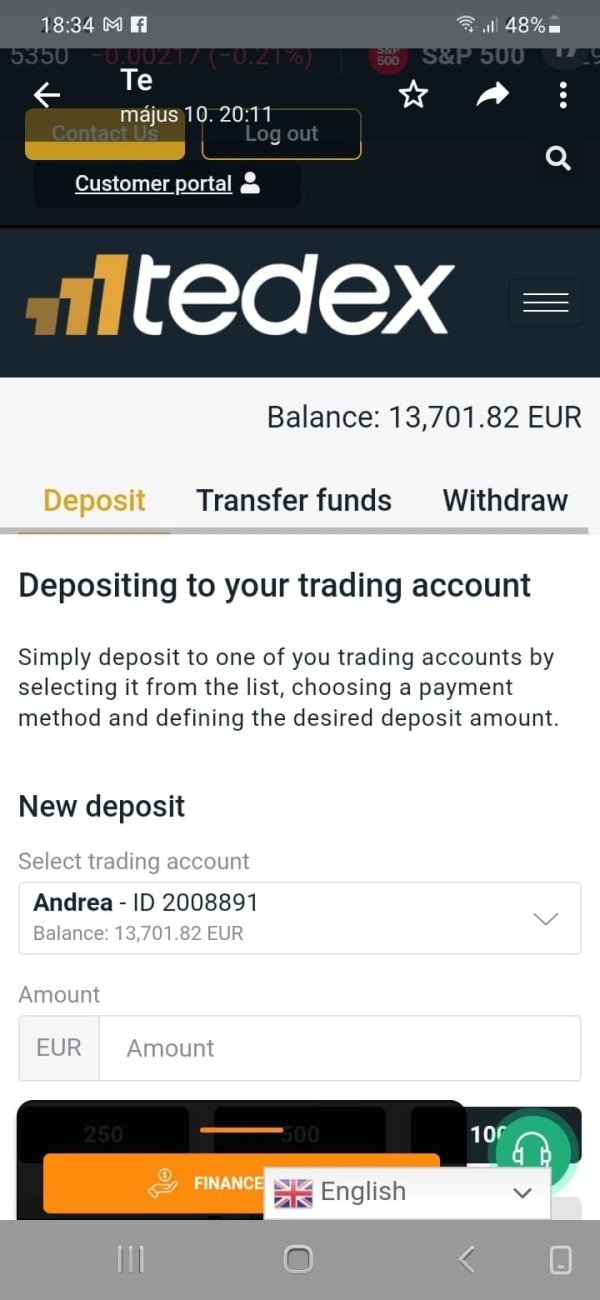

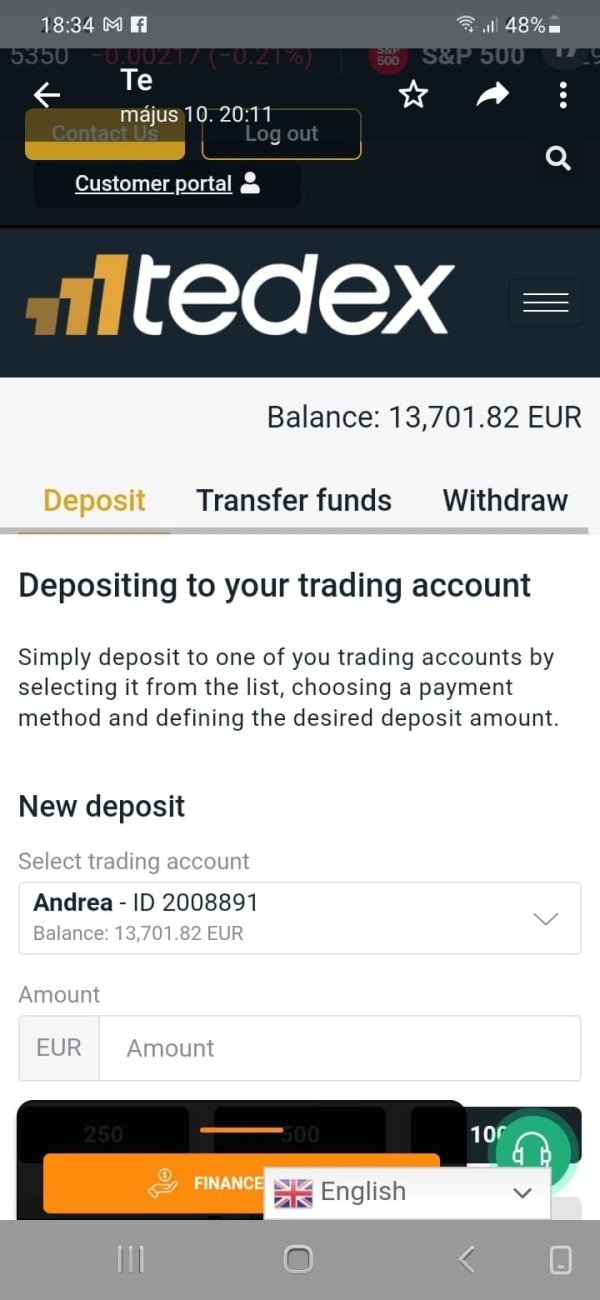

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees is not disclosed in available materials.

Minimum Deposit Requirements: The broker has not published minimum deposit thresholds or account funding requirements for potential clients.

Bonus and Promotional Offers: No information is available regarding welcome bonuses, promotional campaigns, or client incentive programs.

Tradeable Assets: The range of available instruments, including forex pairs, commodities, indices, or other financial products, is not specified in accessible documentation.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains undisclosed. This makes cost comparison impossible for potential clients.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in this TEDX review analysis.

Platform Options: Trading platform availability, including MetaTrader support or proprietary platform features, is not detailed in available resources.

Geographic Restrictions: Information regarding service availability in different countries or jurisdictions is not provided.

Customer Support Languages: Multilingual support options and communication channels are not specified in accessible materials.

Account Conditions Analysis

The evaluation of TEDX Limited's account conditions reveals a concerning absence of fundamental information. Potential clients require this information for informed decision-making about their trading activities. Standard account types, whether basic, premium, or professional classifications, are not detailed in any accessible documentation. This lack of transparency extends to account opening requirements, verification processes, and the specific features associated with different account tiers.

Minimum deposit requirements serve as crucial entry barriers for different trader segments. These requirements remain completely undisclosed by TEDX Limited, which is highly unusual in the industry. Reputable brokers typically offer clear information about funding thresholds to help potential clients understand accessibility. The absence of such basic information in this TEDX review raises significant concerns about operational transparency. It also raises questions about client communication standards that should be expected from any legitimate broker.

Account opening procedures, document requirements, and verification timelines are not specified anywhere in available materials. This makes it impossible for potential clients to understand the onboarding process or prepare necessary documentation. Additionally, specialized account features such as Islamic accounts for Sharia-compliant trading, demo account availability, or educational account options are not mentioned. This comprehensive lack of account-related information significantly impacts the broker's credibility and user accessibility for traders of all experience levels.

TEDX Limited's trading tools and resources portfolio remains largely undocumented. This presents significant challenges for traders who rely on comprehensive analytical and educational support for their trading activities. Standard trading tools such as economic calendars, market analysis, technical indicators, and charting capabilities are not detailed in available information. This absence of tool specifications makes it impossible to assess the platform's analytical capabilities or trading support infrastructure.

Research and market analysis resources are essential for informed trading decisions. These resources are not described in accessible documentation from TEDX Limited, which is concerning for potential clients. Established brokers typically provide daily market commentary, economic analysis, and expert insights to support client decision-making. The lack of such resources in TEDX Limited's offering suggests limited support for trader education and market understanding.

Educational resources, including webinars, tutorials, trading guides, and market education materials, are not mentioned in available materials. For new traders, educational support often determines platform selection and long-term success in the forex market. The absence of educational infrastructure indicates potential limitations in client development and support services. Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, and API access, is not specified in this comprehensive analysis. Modern traders often require automated trading capabilities for efficient portfolio management. The lack of such information suggests potential technological limitations in TEDX Limited's platform infrastructure.

Customer Service and Support Analysis

Customer service evaluation for TEDX Limited faces significant limitations. The absence of detailed support information in available documentation makes assessment nearly impossible. Standard customer service channels such as live chat, telephone support, email assistance, and help desk availability are not specified. This makes it impossible to assess support accessibility and responsiveness for potential clients.

Response time commitments indicate service quality standards that clients can expect. These commitments are not published or documented by TEDX Limited, which is unusual for legitimate brokers. Reputable brokers typically provide clear service level agreements and response time expectations for different inquiry types. The absence of such commitments raises questions about service reliability and client support prioritization.

Service quality indicators, including support team expertise, problem resolution capabilities, and escalation procedures, cannot be evaluated. This is due to insufficient available information from the company itself. Client testimonials regarding support experiences are notably absent, preventing assessment of real-world service delivery and satisfaction levels. Multilingual support capabilities, operating hours, and regional support availability are not detailed in accessible materials. For international clients, language support and timezone coverage are crucial factors in broker selection. The lack of such specifications suggests potential limitations in global client service capabilities and accessibility for diverse trader populations.

Trading Experience Analysis

The trading experience evaluation for TEDX Limited encounters substantial limitations. The absence of platform-specific information and user experience data makes comprehensive assessment nearly impossible. Platform stability, execution speed, and technical performance metrics are not documented in available materials. This makes it impossible to assess the fundamental technical aspects that determine trading quality.

Order execution quality, including fill rates, slippage characteristics, and rejection rates, cannot be evaluated. This is due to insufficient performance data being made available by the company. These metrics are crucial for active traders who require reliable and efficient order processing. The absence of execution statistics raises concerns about platform performance and trading reliability.

Platform functionality assessment faces similar constraints. User interface design, feature availability, and navigation efficiency remain undocumented by TEDX Limited. Modern trading platforms require comprehensive functionality to support diverse trading strategies and user preferences. The lack of platform details in this TEDX review prevents meaningful functionality evaluation. Mobile trading experience, including app availability, mobile platform features, and cross-device synchronization, is not addressed in available documentation. Given the increasing importance of mobile trading in today's market, the absence of mobile-specific information suggests potential limitations. These limitations may affect platform accessibility and modern trading support capabilities.

Trustworthiness Analysis

Trustworthiness evaluation reveals mixed signals regarding TEDX Limited's credibility and operational legitimacy. The company claims FCA regulation, which typically provides regulatory oversight and investor protection through the UK's established financial regulatory framework. However, the regulatory status requires independent verification to confirm active compliance and good standing.

Fund security measures, including client fund segregation, deposit protection schemes, and financial safeguards, are not detailed in available documentation. Reputable brokers typically provide comprehensive information about client fund protection to build trust. They also demonstrate commitment to financial security through transparent policies and procedures. The absence of such details raises concerns about fund safety and protection protocols.

Company transparency presents significant challenges for potential clients. Limited information is available about corporate structure, management team, operational history, and business practices. This lack of transparency contrasts sharply with industry standards where established brokers provide comprehensive corporate information. Such information is typically provided to build client confidence and demonstrate operational legitimacy. Industry reputation analysis indicates substantial concerns that cannot be ignored. User feedback consistently characterizes TEDX Limited as a high-risk and untrustworthy investment platform. Such negative sentiment typically reflects broader operational or service issues that potential clients should carefully consider before engagement.

User Experience Analysis

User experience evaluation for TEDX Limited faces substantial constraints. Limited available feedback and operational information make comprehensive assessment challenging. Overall user satisfaction metrics cannot be accurately assessed due to the absence of comprehensive user reviews and experience documentation. This lack of user feedback prevents meaningful analysis of client satisfaction and platform performance from real-world usage perspectives.

Interface design and usability assessment cannot be conducted. Access to platform demonstrations or user interface documentation is not available from the company. Modern trading success often depends on intuitive platform design and efficient navigation. This makes the information gap particularly significant for potential users evaluating platform suitability.

Registration and verification process evaluation is hindered by the absence of detailed onboarding information. User experience during account opening significantly impacts first impressions and overall satisfaction with any trading platform. However, specific process details remain undocumented in available materials from TEDX Limited. The most significant user experience indicator comes from consistent warnings. These warnings advise potential clients to avoid using the platform entirely. Such widespread cautionary advice suggests fundamental issues with user experience, service delivery, or operational reliability. Potential clients should seriously consider these warnings before engagement with this platform.

Conclusion

This comprehensive TEDX review reveals significant concerns about TEDX Limited's operational transparency, service quality, and overall credibility as a forex broker. While the company claims FCA regulation, the substantial absence of essential information raises serious questions. These information gaps include account conditions, trading tools, customer service details, and user experience data. Such gaps raise serious questions about operational legitimacy and client service capability.

The consistent characterization of TEDX Limited as a high-risk and untrustworthy platform is concerning. Users and industry observers have made this characterization repeatedly, suggesting fundamental operational issues. Potential clients should carefully consider these warnings before making any investment decisions. The lack of transparency regarding basic operational elements contrasts sharply with established industry standards and reputable broker practices.

Based on this analysis, TEDX Limited cannot be recommended for any trader category. Insufficient transparency, negative user feedback, and operational uncertainty make this platform unsuitable for trading activities. Potential clients are strongly advised to consider established, fully transparent brokers with comprehensive service documentation. These alternative brokers should have positive user feedback before making trading platform decisions.