Is Tedex safe?

Pros

Cons

Is Tedex A Scam?

Introduction

Tedex is an online forex broker that has emerged in the trading landscape, primarily targeting retail traders looking for accessible trading options. Operating under the ownership of Vermillion Consulting LLC, Tedex claims to provide a range of trading instruments, including forex, commodities, indices, and shares. However, the importance of conducting thorough research before engaging with any broker cannot be overstated. The financial market is rife with unregulated entities that can pose significant risks to traders' investments. This article aims to provide a comprehensive evaluation of Tedex, examining its regulatory status, company background, trading conditions, and customer experiences, ultimately answering the question: Is Tedex safe?

To investigate the legitimacy of Tedex, we have analyzed various credible sources, including regulatory bodies, user reviews, and trading condition overviews. Our assessment framework focuses on several critical areas, including regulation and legality, company background, trading conditions, customer fund safety, user feedback, platform performance, and overall risk assessment.

Regulation and Legality

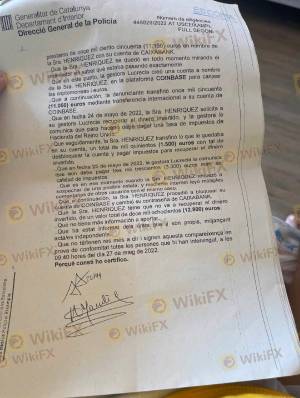

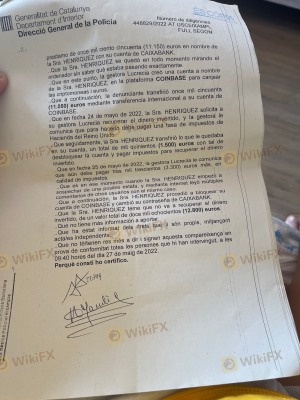

The regulatory status of a broker is paramount when determining its reliability and trustworthiness. Tedex is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lack of stringent financial regulation for forex brokers. This raises significant concerns regarding the safety and security of traders' funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

Tedex operates without any oversight from recognized regulatory authorities such as the FCA (UK), ASIC (Australia), or other tier-1 financial regulators. The absence of regulation means that Tedex is not required to adhere to strict operational standards, including the segregation of client funds and the implementation of negative balance protection. This lack of regulatory framework significantly increases the risk of fund mismanagement and potential fraud. The Spanish CNMV and the Belgian FSMA have publicly warned against Tedex, advising traders to exercise extreme caution when dealing with this broker.

Company Background Investigation

Tedex's ownership by Vermillion Consulting LLC is another area of concern. The company was established in 2021, making it relatively new in the competitive forex market. While the short history does not inherently disqualify it from being a reliable broker, the lack of transparency regarding its operational practices and management team raises red flags.

The company's website does not provide adequate information about its management or operational history, which is crucial for assessing its credibility. A transparent broker typically shares details about its team, including their professional backgrounds and relevant experience in the financial industry. The absence of such information with Tedex suggests a lack of accountability and raises questions about the integrity of its operations.

Trading Conditions Analysis

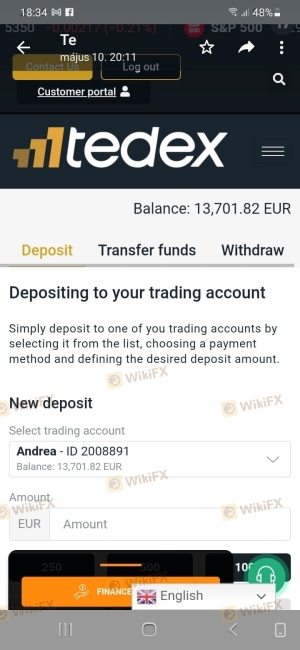

When evaluating whether Tedex is safe, understanding its trading conditions is essential. Tedex requires a minimum deposit of €250 to open an account, which is significantly higher than the industry average of around €10 for micro accounts. This high entry barrier may deter some traders but is not uncommon among brokers targeting less experienced investors.

| Fee Type | Tedex | Industry Average |

|---|---|---|

| Spread for Major Pairs | 3 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs starts at 3 pips, which is considerably higher than the industry standard. Such high spreads can erode potential profits, making it difficult for traders to succeed. Furthermore, Tedex's commission structure lacks transparency, with no fixed fee schedule available, potentially allowing the broker to impose arbitrary fees at will.

Customer Fund Safety

The safety of customer funds is a critical consideration for any trader. Unfortunately, Tedex does not provide adequate safety measures for client funds. There is no indication that client funds are held in segregated accounts, which is a standard practice among regulated brokers to ensure that clients' money is protected from the broker's operational risks. Additionally, Tedex does not offer negative balance protection, increasing the risk for traders in volatile market conditions.

Historically, unregulated brokers like Tedex have faced numerous complaints regarding fund safety. Without a regulatory body overseeing its operations, Tedex could theoretically mismanage or misappropriate client funds without consequence.

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing the reliability of a broker. Unfortunately, reviews for Tedex are predominantly negative, with numerous complaints about withdrawal issues and lack of responsiveness from customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Poor |

Many users report difficulty in withdrawing their funds, with some claiming that their requests were ignored or delayed indefinitely. The company's response to these complaints has been inadequate, further eroding trust among its user base. For instance, one user shared their experience on Trustpilot, stating, "I was promised quick withdrawals, but after multiple attempts, my funds are still stuck."

Platform and Trade Execution

The trading platform offered by Tedex is a web-based solution that lacks the sophistication and features of industry-standard platforms like MetaTrader 4 or 5. This limitation can hinder traders' ability to perform comprehensive technical analysis and implement advanced trading strategies.

Moreover, the quality of order execution is a crucial factor for traders. Reports of slippage and high rejection rates have surfaced, indicating that Tedex may not provide a reliable trading environment. Such issues can severely impact trading performance and lead to substantial financial losses.

Risk Assessment

Engaging with Tedex comes with a high level of risk due to its unregulated status and poor customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety | High | Lack of fund segregation and negative balance protection. |

| Customer Support | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough research before investing, consider using regulated brokers, and be cautious about the amount of capital they risk with unregulated entities.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Tedex is not safe and operates more like a scam than a legitimate broker. The absence of regulatory oversight, coupled with numerous complaints regarding fund safety and withdrawal issues, paints a concerning picture of this broker's operations.

Traders should exercise extreme caution and consider alternative, regulated brokers with a proven track record of reliability and customer service. Some recommended alternatives include brokers regulated by the FCA or ASIC, which offer better safety measures and trading conditions. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

Is Tedex a scam, or is it legit?

The latest exposure and evaluation content of Tedex brokers.

Tedex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tedex latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.