Tallinex 2025 Review: Everything You Need to Know

Executive Summary

Tallinex is a good forex broker. The company specializes in risk mitigation strategies for currency trading and has developed a unique trading method based on conservative human expertise fundamentals. This approach sets it apart from many automated trading systems in the market. With a minimum deposit requirement of just $100 USD, Tallinex offers an accessible option for traders seeking low-barrier entry into the forex market.

This Tallinex review shows that the broker focuses on providing forex trading services with an emphasis on risk management. The company's conservative approach to trading appeals to traders who prefer human expertise over computer trading systems. However, our research shows limited public information about specific regulatory details, trading platforms, and comprehensive service offerings. This may concern potential clients seeking full transparency.

The broker works well for traders looking for affordable entry points into forex trading. It particularly suits those who value conservative trading approaches and risk mitigation strategies.

Important Notice

This review is based on available information from various external sources and market research. Readers should note that specific regulatory information and detailed service specifications were not fully available in the source materials reviewed. Trading conditions, fees, and services may vary across different regions and are subject to change. Potential clients should verify all information directly with Tallinex and ensure compliance with local regulations before opening any trading account.

Rating Framework

Broker Overview

Tallinex operates as a forex broker with a focus on risk mitigation and conservative trading approaches. The company has positioned itself in the competitive forex market by developing what it describes as a unique trading method based on conservative human expertise fundamentals. This approach suggests the broker values experienced human analysis over computer trading systems, which may appeal to traders who value traditional market analysis methods.

The broker's business model centers around providing forex trading services with an emphasis on risk management strategies. According to available information, Tallinex has designed its services to cater to traders who appreciate conservative approaches to currency trading. The company's method appears to combine human expertise with fundamental analysis principles, potentially offering a more traditional approach to forex trading compared to brokers that rely heavily on automated systems.

While specific details about the company's founding date and comprehensive corporate background were not detailed in available sources, the broker's focus on risk mitigation suggests a mature approach to market volatility management. This Tallinex review indicates that the company operates primarily in the forex trading space. However, specific information about additional asset classes or diversified trading instruments remains limited in publicly available materials.

Regulatory Status: Specific regulatory information was not detailed in the available source materials. This represents a significant information gap for potential clients seeking regulatory transparency.

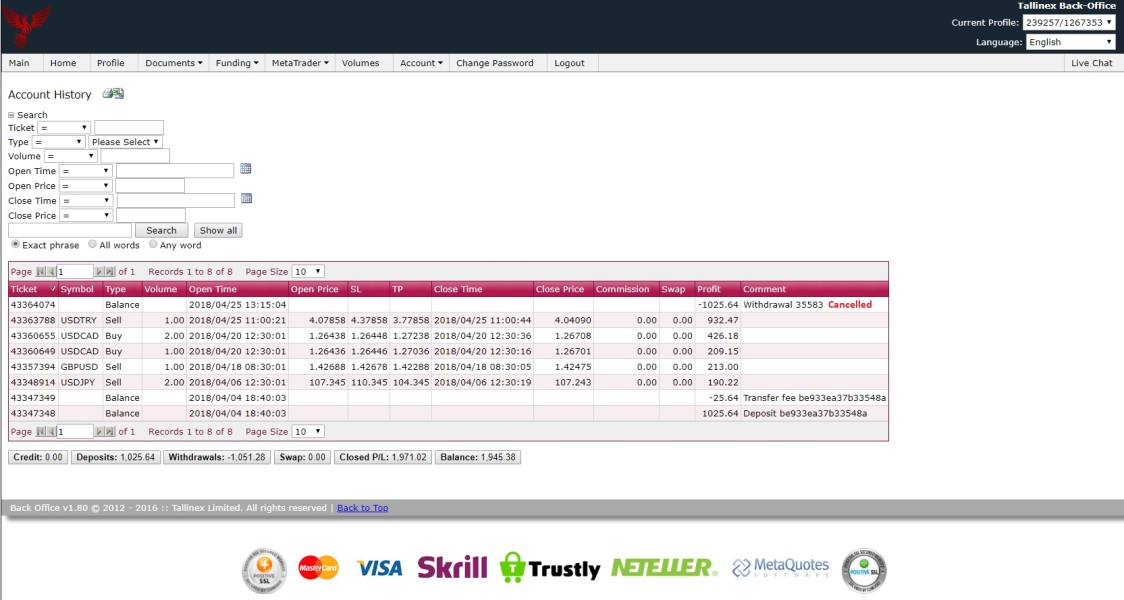

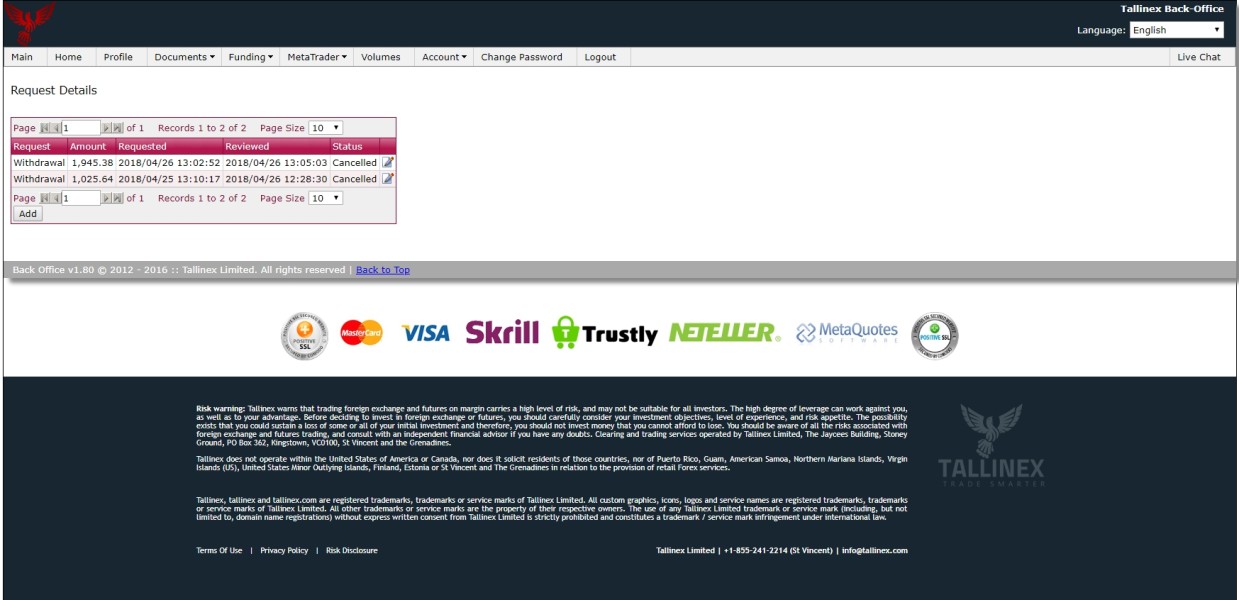

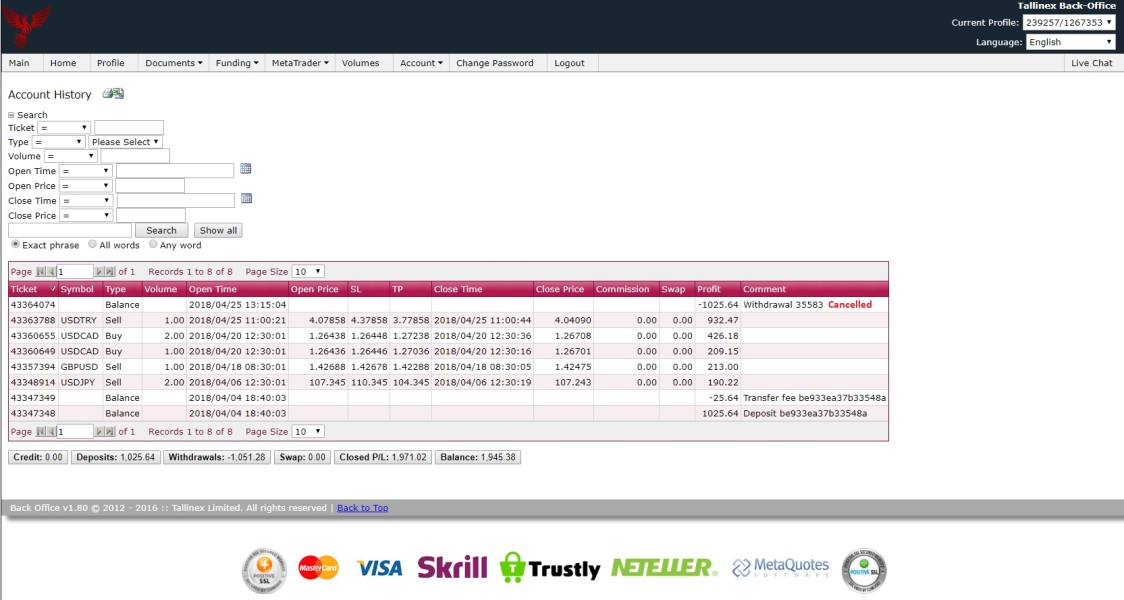

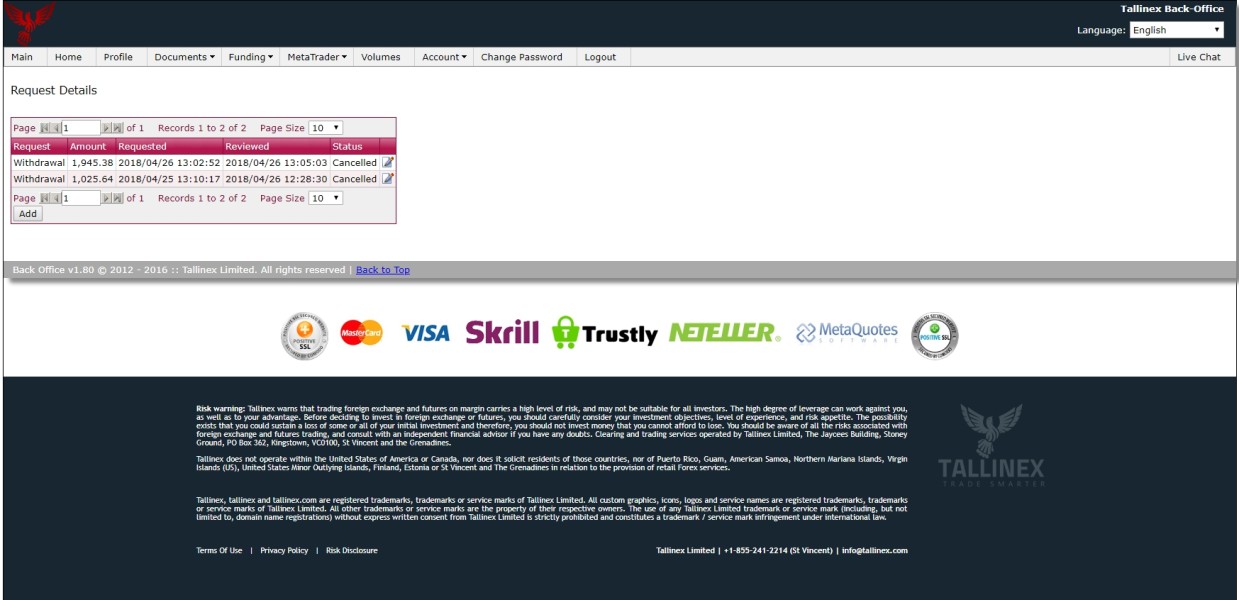

Deposit and Withdrawal Methods: While the minimum deposit requirement is clearly stated at $100 USD, specific information about supported payment methods and withdrawal processes was not fully detailed in the reviewed sources.

Minimum Deposit Requirements: Tallinex sets its minimum deposit at $100 USD. This makes it accessible for traders with limited initial capital.

Promotions and Bonuses: Information about promotional offers, welcome bonuses, or ongoing incentives was not specified in the available materials.

Trading Assets: The broker primarily focuses on forex trading. However, specific details about currency pairs, exotic options, or additional asset classes were not fully outlined.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs was not available in the reviewed sources. This represents a transparency gap.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in the available information.

Platform Selection: Trading platform specifications and available software options were not clearly outlined in the source materials.

Geographic Restrictions: Information about regional limitations or restricted territories was not specified.

Customer Support Languages: Available customer service languages were not detailed in the reviewed materials.

This Tallinex review highlights several information gaps that potential clients should clarify directly with the broker.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Tallinex demonstrates strong accessibility in its account conditions. This is primarily through its low minimum deposit requirement of $100 USD, which makes the broker particularly attractive for new traders or those with limited initial capital who want to explore forex trading without substantial financial commitment. The low barrier to entry aligns well with the broker's apparent focus on making forex trading accessible to a broader range of participants.

However, specific information about different account types, their respective features, and any tiered benefits based on deposit levels was not detailed in available sources. The account opening process, required documentation, and verification procedures also lack detailed public information. Additionally, specialized account options such as Islamic accounts for Muslim traders or professional accounts for experienced traders were not mentioned in the reviewed materials.

The absence of detailed account structure information represents a limitation in fully evaluating this category. While the low minimum deposit is commendable, potential clients would benefit from more comprehensive information about account variations, features, and progression opportunities. This Tallinex review suggests that while the basic entry requirements are favorable, more transparency about account options would strengthen the overall offering.

The available information about Tallinex's trading tools and resources presents a mixed picture. While the broker mentions developing a unique trading method based on conservative human expertise fundamentals, specific details about trading platforms, analytical tools, and research resources are notably absent from publicly available sources.

The emphasis on human expertise suggests that the broker may provide some form of analysis or guidance based on traditional market research methods. However, without specific information about trading platforms, charting tools, technical indicators, or market research publications, it's challenging to fully assess the quality and comprehensiveness of available resources. The platforms could be MetaTrader, proprietary platforms, or web-based solutions, but this information was not available.

Educational resources, which are crucial for new traders, were not detailed in the reviewed materials. Similarly, information about automated trading support, expert advisors, or computer trading capabilities was not available. The lack of detailed information about research and analysis tools, market news feeds, economic calendars, or educational webinars represents a significant transparency gap that could concern potential clients seeking comprehensive trading support.

Customer Service and Support Analysis (6/10)

Customer service information for Tallinex presents significant gaps in publicly available materials. Essential details about support channels, availability hours, response times, and service quality were not fully outlined in the reviewed sources. This lack of transparency about customer support represents a notable concern for potential clients who value reliable assistance.

The absence of information about available communication methods makes it difficult to assess the broker's commitment to customer service excellence. We don't know about live chat, email, phone support, multilingual capabilities, and regional support coverage. Additionally, details about account management services, technical support quality, and problem resolution procedures were not available.

For traders, especially beginners who may require frequent assistance, the lack of detailed customer service information could be a deciding factor. Professional traders also value efficient support for technical issues or account-related queries. Without specific information about support team expertise, training levels, or specialization in forex-related issues, potential clients cannot adequately evaluate this crucial service aspect.

Trading Experience Analysis (7/10)

Tallinex's trading experience evaluation benefits from the mention of their unique trading method based on conservative human expertise fundamentals. This approach suggests a potentially sophisticated trading environment that values traditional market analysis over purely computer systems. However, the lack of specific platform information limits a comprehensive assessment of the actual trading experience.

Without details about trading platform stability, execution speeds, order types, or mobile trading capabilities, it's challenging to evaluate the technical quality of the trading environment. Information about slippage rates, execution quality during high volatility periods, or platform uptime statistics was not available in the reviewed sources.

The conservative method mentioned could appeal to traders who prefer fundamental analysis and human judgment in their trading decisions. However, the absence of specific information about platform features, customization options, or advanced trading tools represents a limitation. This Tallinex review indicates that while the underlying method may be sound, the lack of technical specifications about the trading environment prevents a more favorable rating.

Trust and Safety Analysis (5/10)

The trust and safety evaluation for Tallinex reveals significant concerns. These concerns are primarily due to the absence of clear regulatory information in publicly available sources. Regulatory oversight is fundamental to broker credibility and client protection, making this information gap particularly concerning for potential traders.

Without specific details about licensing jurisdictions, regulatory compliance measures, or supervisory authorities, it's difficult to assess the broker's commitment to industry standards and client protection. Information about fund segregation practices, investor compensation schemes, or third-party auditing was not available in the reviewed materials.

The lack of regulatory transparency raises questions about client fund security, dispute resolution mechanisms, and adherence to industry best practices. Professional traders and institutional clients typically require clear regulatory information before considering any broker relationship. Additionally, the absence of information about company ownership, financial backing, or corporate governance structures further limits the ability to assess trustworthiness comprehensively.

User Experience Analysis (6/10)

User experience evaluation for Tallinex faces limitations due to the absence of specific user feedback data and detailed interface information in available sources. While the broker receives a general positive assessment, the lack of comprehensive user testimonials, satisfaction surveys, or detailed usability information prevents a more thorough evaluation.

The low minimum deposit requirement suggests an attempt to create positive user experience through accessibility, particularly for new traders. However, without specific information about website navigation, account dashboard design, mobile app functionality, or overall user interface quality, it's challenging to assess the complete user journey.

Information about the registration process complexity, account verification procedures, fund deposit and withdrawal experiences, or common user challenges was not detailed in the reviewed materials. Additionally, data about user retention rates, satisfaction scores, or comparative user feedback against other brokers was not available. This limits the ability to provide a comprehensive user experience assessment.

Conclusion

This Tallinex review reveals a forex broker with some appealing features, particularly its low $100 minimum deposit requirement and focus on conservative, human expertise-based trading method. However, significant information gaps about regulatory status, platform specifications, and comprehensive service details limit the ability to provide a fully confident recommendation.

Tallinex appears most suitable for new traders seeking affordable entry into forex markets and those who appreciate traditional, conservative approaches to trading. The broker's emphasis on risk mitigation and human expertise may appeal to traders who prefer fundamental analysis over automated systems.

The main advantages include accessible entry requirements and a stated focus on risk management. However, the primary concerns center around limited regulatory transparency and insufficient publicly available information about trading conditions, platforms, and comprehensive service offerings. Potential clients should conduct thorough research and seek detailed information directly from the broker before making any trading decisions.