Supreme Forex Trade 2025 Review: Everything You Need to Know

Executive Summary

Supreme Forex Trade operates under Supreme Securities Limited. The company presents itself as a player in the competitive forex trading world with both good points and problem areas. User feedback shows the broker has built a presence with 13 positive reviews and 1 neutral review on different review platforms, which suggests most clients have good experiences with their services.

This supreme forex trade review shows a broker that seems to draw traders who want a reliable trading space. However, detailed regulatory and operational information stays limited in public sources. The broker's history shows they try to keep good client relationships, as proven by the mostly positive user feedback. Still, potential traders should know that detailed information about trading conditions, regulatory oversight, and specific services needs more research beyond standard review platforms.

The overall assessment suggests Supreme Forex Trade works as a functional trading service provider. Traders should do thorough research before putting money in, especially given the limited transparency in certain operational areas.

Important Disclaimers

Cross-Regional Entity Differences: The information summary does not give specific regulatory details for Supreme Forex Trade across different areas. Traders should be careful when looking at cross-regional trading risks and check regulatory compliance in their specific location before using the broker's services.

Review Methodology Statement: This comprehensive evaluation uses user feedback analysis and publicly available information sources. The assessment aims to give an objective analysis while acknowledging the limits imposed by the availability of detailed operational data. Readers should add to this review with additional research and direct contact with the broker for specific trading requirements.

Rating Framework

Broker Overview

Supreme Forex Trade operates under the corporate structure of Supreme Securities Limited. The company positions itself within the global forex trading industry. While the specific establishment date is not mentioned in available information sources, the broker has developed a client base that has created positive feedback across review platforms.

The company's business model appears to focus on providing forex trading services to retail and potentially institutional clients. However, comprehensive details about their operational scope remain limited in publicly accessible materials. The broker's market positioning suggests an emphasis on building client relationships and maintaining service quality, as shown by the positive user review ratio.

Detailed information about the company's founding principles, management structure, and strategic objectives requires additional research beyond the currently available summary materials. The organization appears to operate with a focus on client satisfaction, though specific metrics and operational philosophies are not detailed in accessible sources. Regarding platform infrastructure and asset coverage, the supreme forex trade review indicates that specific technical details about trading platforms, available currency pairs, and additional financial instruments are not comprehensively outlined in the provided information summary.

Similarly, regulatory oversight details, including primary supervisory authorities and compliance frameworks, require further investigation to provide accurate assessment for potential clients.

Regulatory Jurisdiction: The information summary does not specify particular regulatory regions or supervisory authorities overseeing Supreme Forex Trade's operations. This requires additional verification for compliance assessment.

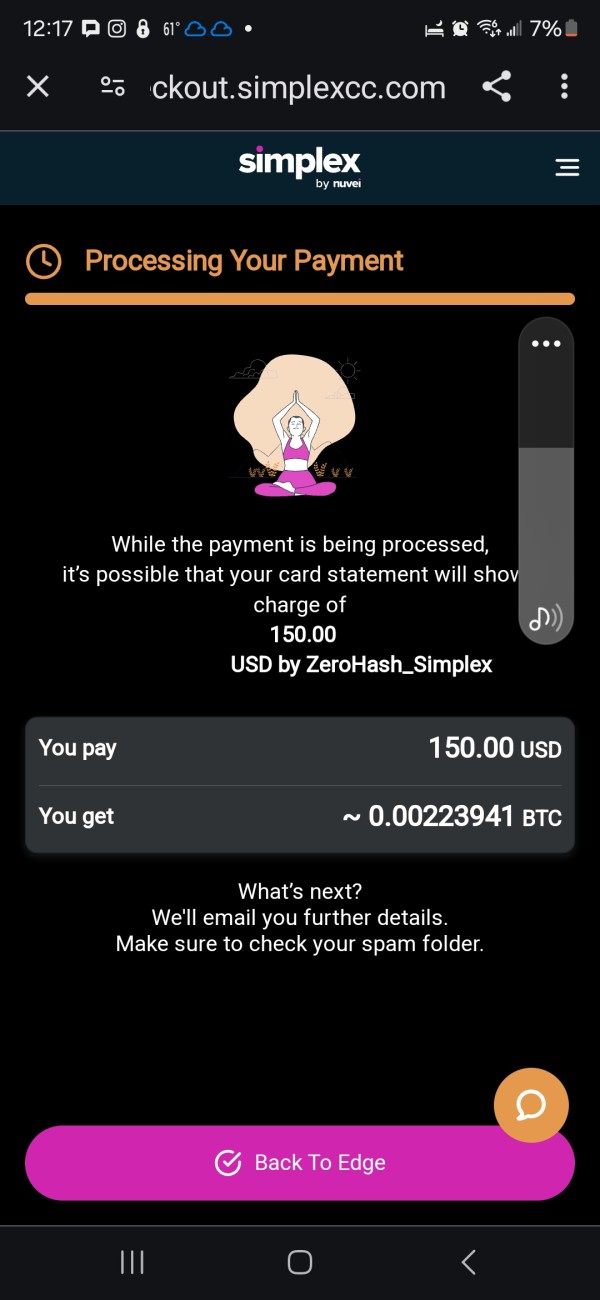

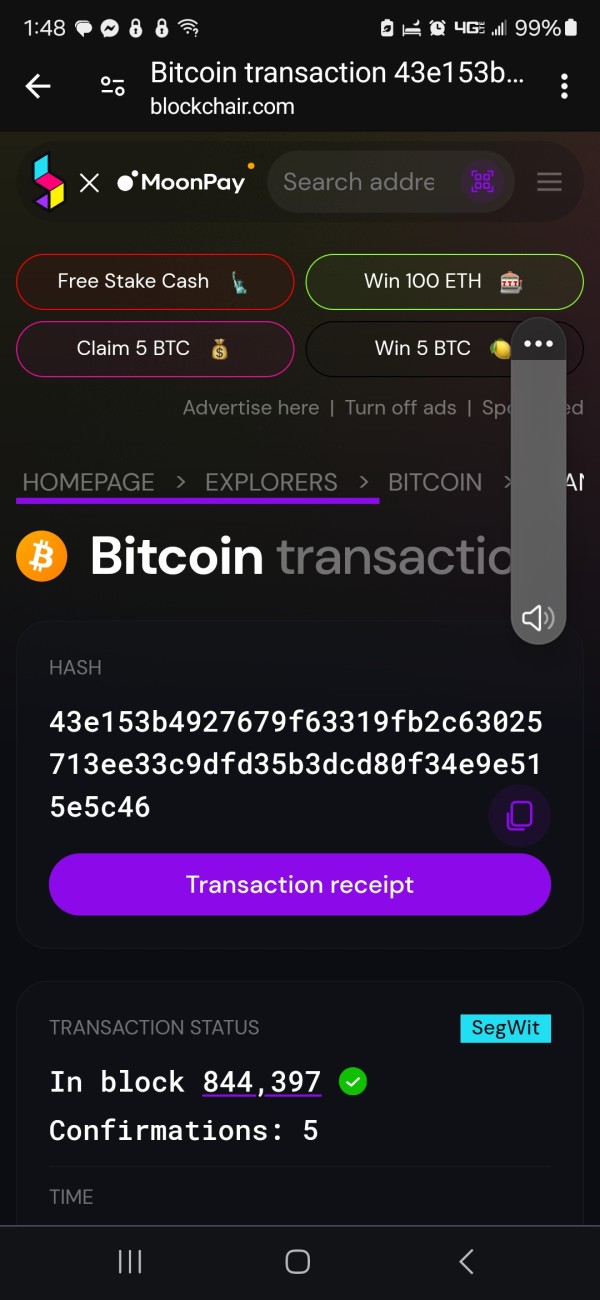

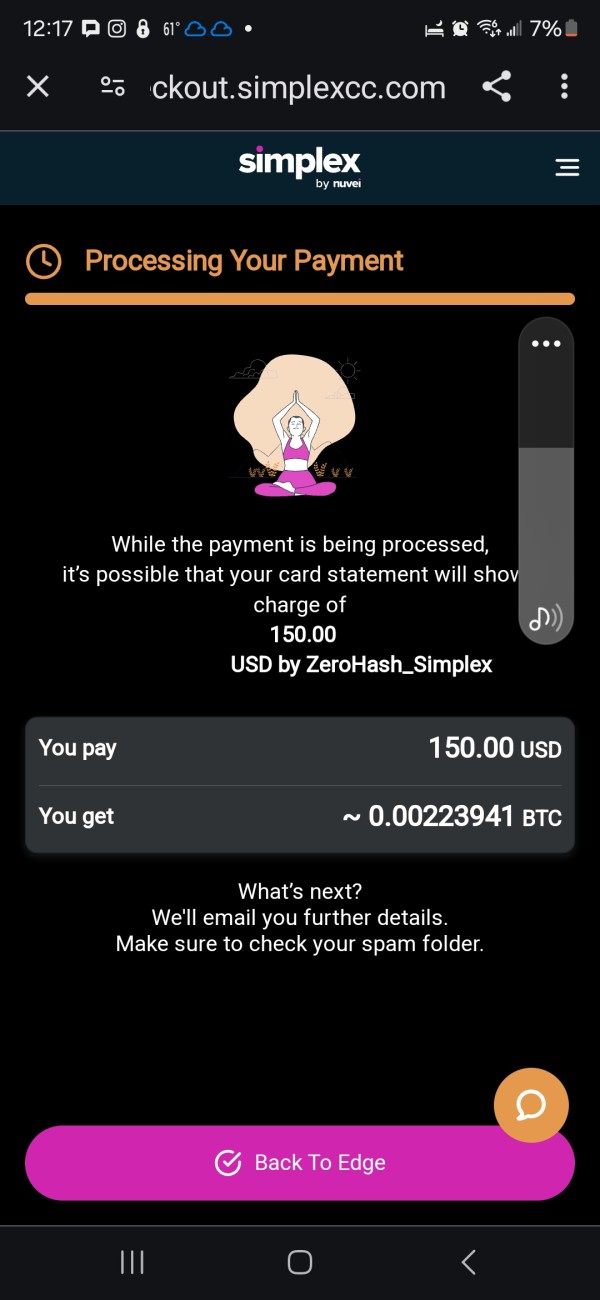

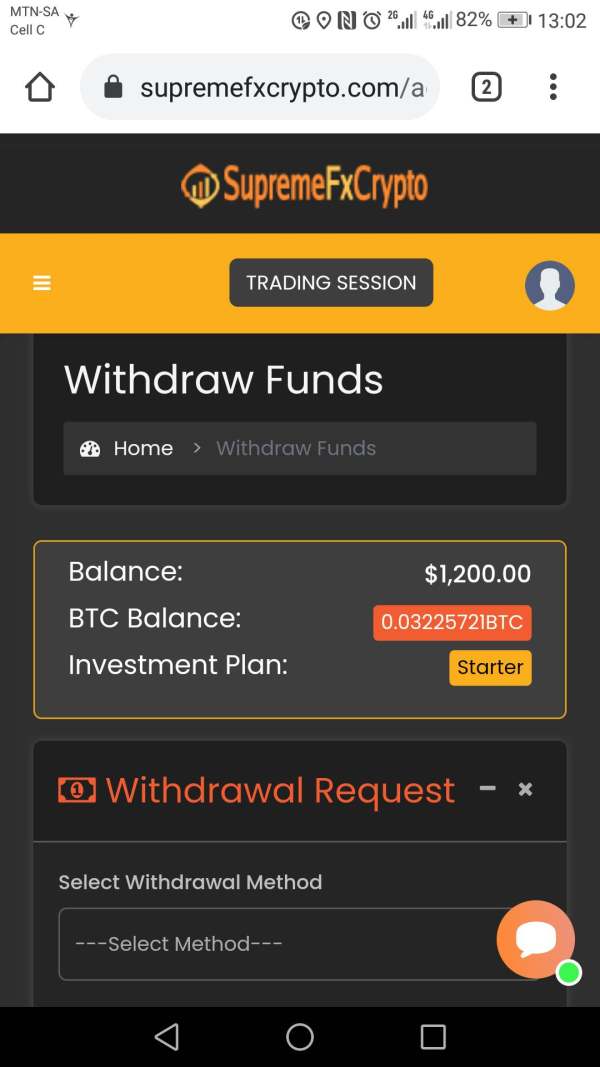

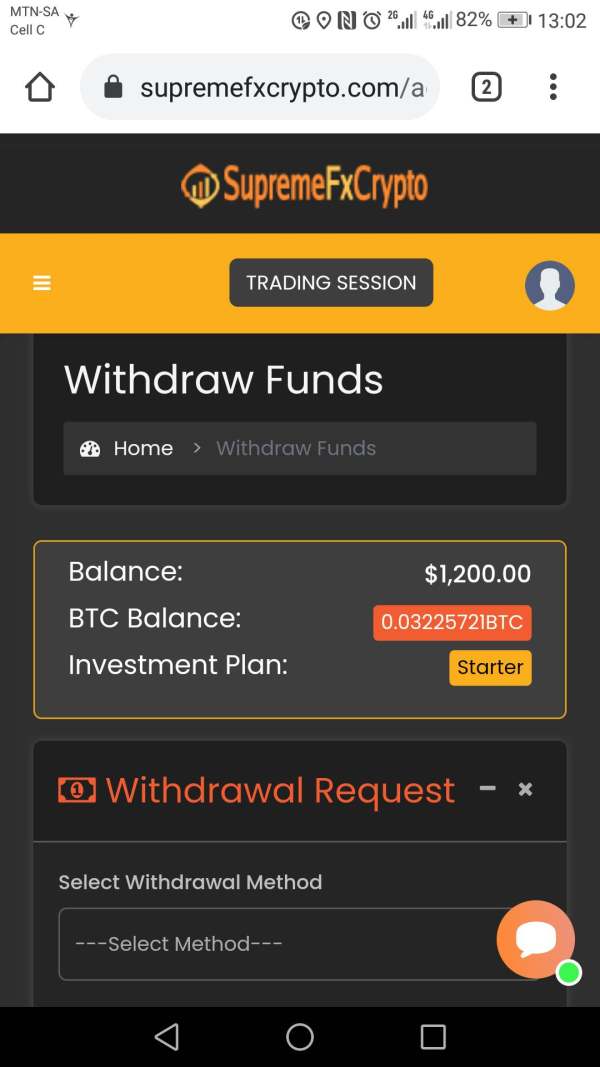

Deposit and Withdrawal Methods: Available sources do not detail the specific payment processing options, transaction timeframes, or associated fees for funding account operations.

Minimum Deposit Requirements: Specific minimum deposit thresholds for different account types are not mentioned in the provided information materials.

Bonus and Promotional Offers: Details regarding welcome bonuses, deposit incentives, or ongoing promotional programs are not specified in accessible summary information.

Tradeable Assets: The range of available trading instruments, including major and minor currency pairs, commodities, indices, or other financial products, is not detailed in source materials.

Cost Structure Analysis: Comprehensive information about spread ranges, commission structures, overnight financing charges, and other trading-related fees is not provided in the available summary. This supreme forex trade review cannot assess the competitiveness of trading costs without specific pricing data.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in the provided information sources.

Platform Options: Details about available trading platforms, including proprietary software or third-party solutions like MetaTrader, are not mentioned in accessible materials.

Geographic Restrictions: Specific information about service availability or restrictions in particular countries or regions is not detailed in the summary.

Customer Support Languages: Available customer service language options are not specified in the provided information materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Supreme Forex Trade's account conditions faces significant limitations due to the absence of specific details in available information sources. Standard account structure analysis typically examines multiple account tiers, each designed for different trader profiles ranging from beginners to professional investors.

However, the current supreme forex trade review cannot provide definitive assessment of account variety, minimum balance requirements, or tier-specific benefits. Account opening procedures, verification requirements, and documentation standards represent crucial factors for potential clients, yet these operational details are not specified in accessible materials. The absence of information about Islamic account availability, corporate account options, or managed account services limits the comprehensive evaluation of the broker's account infrastructure.

Without specific data about account-related fees, maintenance charges, or inactivity penalties, traders cannot accurately assess the total cost of account ownership. Additionally, details about account funding requirements, currency options, and withdrawal procedures remain unspecified, requiring direct broker contact for clarification.

The assessment of Supreme Forex Trade's trading tools and analytical resources encounters limitations due to insufficient detail in available information sources. Modern forex trading requires comprehensive charting capabilities, technical analysis tools, and market research resources to support informed decision-making.

However, specific information about the broker's analytical offerings, including chart types, technical indicators, and drawing tools, is not detailed in accessible materials. Educational resource availability represents a critical factor for trader development, particularly for newcomers to forex markets. The current evaluation cannot assess the presence of educational webinars, trading tutorials, market analysis reports, or other learning materials due to information limitations in source materials.

Automated trading support, including expert advisor compatibility, algorithmic trading capabilities, and copy trading services, requires specific technical infrastructure that cannot be evaluated without detailed platform information. Similarly, mobile trading capabilities, notification systems, and cross-platform synchronization features remain unassessed due to limited available data.

Customer Service and Support Analysis

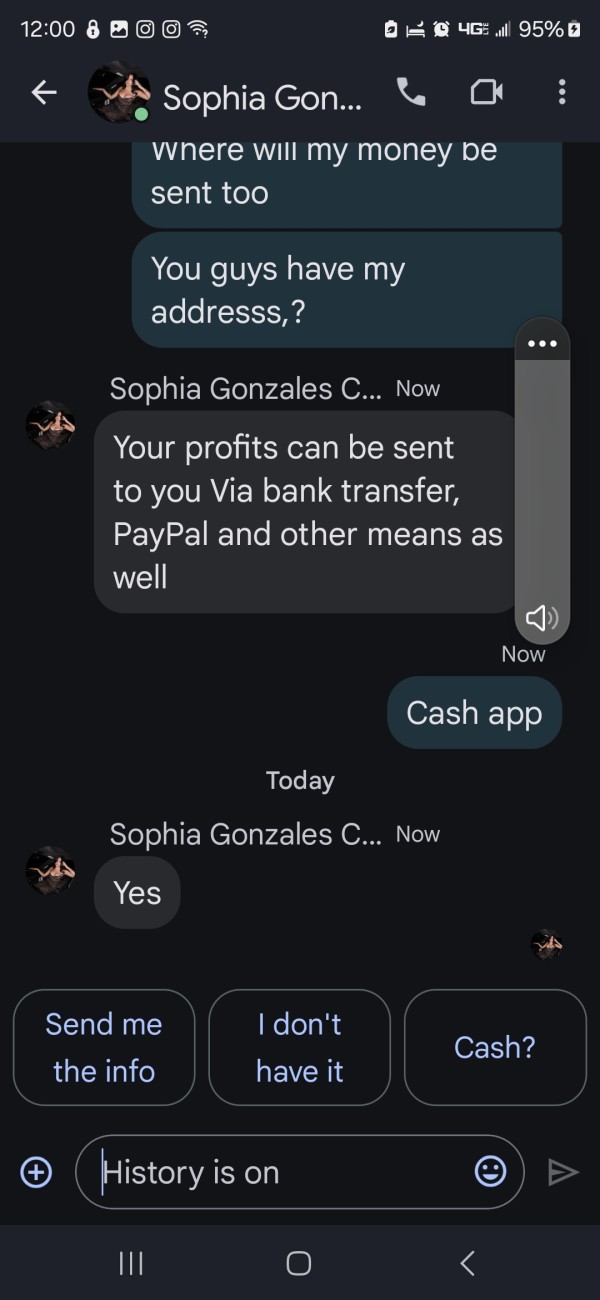

Evaluating Supreme Forex Trade's customer service infrastructure faces constraints due to limited specific information in available sources. Effective customer support typically encompasses multiple communication channels, including live chat, telephone support, email assistance, and potentially social media engagement.

However, detailed information about available contact methods, response timeframes, and service quality metrics is not specified in accessible materials. Support availability hours, timezone coverage, and multilingual assistance represent important considerations for international traders, yet these operational details are not outlined in the provided information summary. The absence of specific data about support team expertise, problem resolution procedures, and escalation processes limits comprehensive service assessment.

User feedback integration and complaint handling mechanisms are crucial for maintaining client satisfaction, though specific protocols and effectiveness measures are not detailed in available sources. Additionally, information about dedicated account management, VIP support services, or premium client assistance remains unspecified in accessible materials.

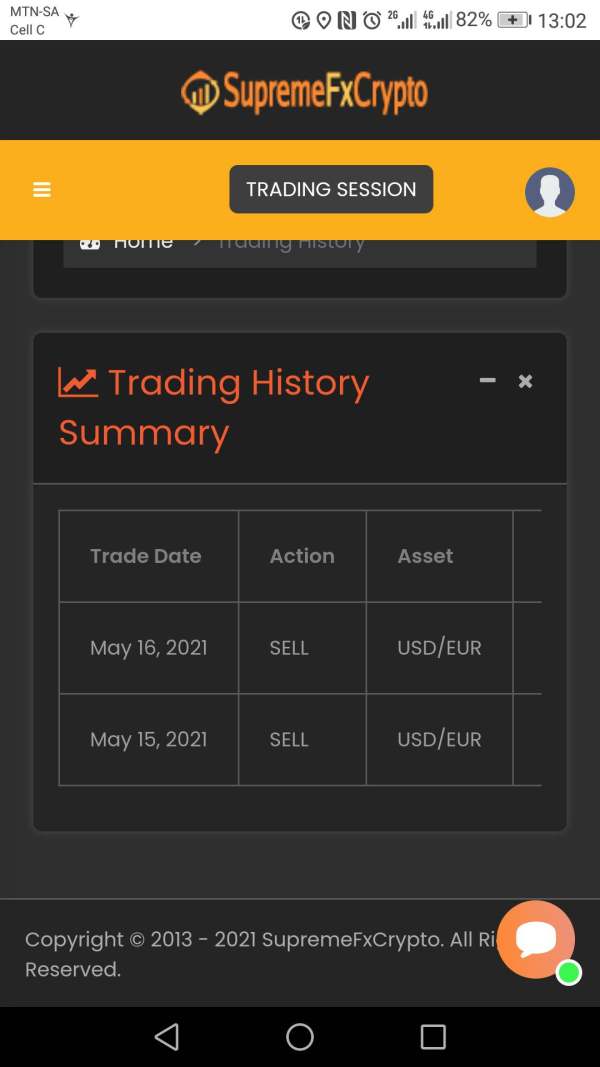

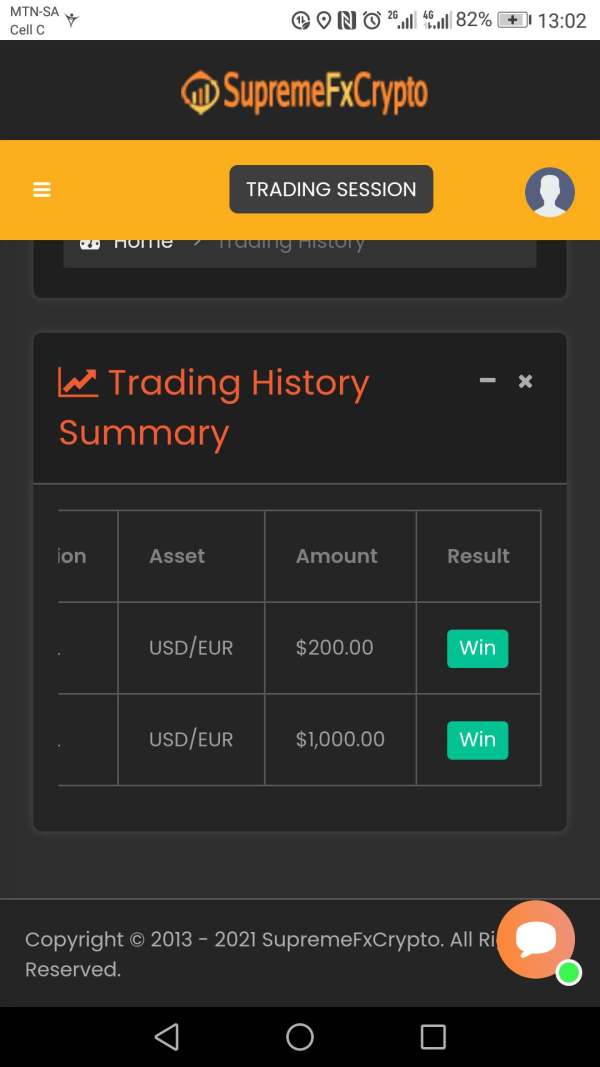

Trading Experience Analysis

The evaluation of Supreme Forex Trade's trading experience requires specific technical performance data that is not provided in available information sources. Platform stability, order execution speed, and system reliability represent fundamental aspects of trading infrastructure that directly impact client success.

However, detailed performance metrics, uptime statistics, and execution quality measurements are not specified in accessible materials. Order management capabilities, including pending order types, partial fills, and advanced order features, require specific platform documentation for accurate assessment. The current supreme forex trade review cannot evaluate these technical aspects without comprehensive platform information.

Mobile trading functionality, cross-device synchronization, and offline capability assessment requires detailed technical specifications not available in source materials. Similarly, platform customization options, workspace saving features, and user interface adaptability remain unassessed due to information limitations.

Trust and Reliability Analysis

Assessing Supreme Forex Trade's trustworthiness and reliability faces significant challenges due to limited regulatory and operational transparency in available information sources. Regulatory oversight, including licensing authorities, compliance frameworks, and supervisory reporting, represents the foundation of broker credibility.

However, specific regulatory details are not provided in accessible summary materials. Client fund protection measures, including segregated account policies, deposit insurance coverage, and bankruptcy protection protocols, are crucial for trader security but are not detailed in available sources. The absence of information about auditing procedures, financial reporting transparency, and third-party oversight limits comprehensive trust assessment.

Industry reputation, regulatory history, and any past incidents or sanctions require specific documentation not available in the provided information summary. Additionally, details about company ownership, management background, and corporate governance structures remain unspecified in accessible materials.

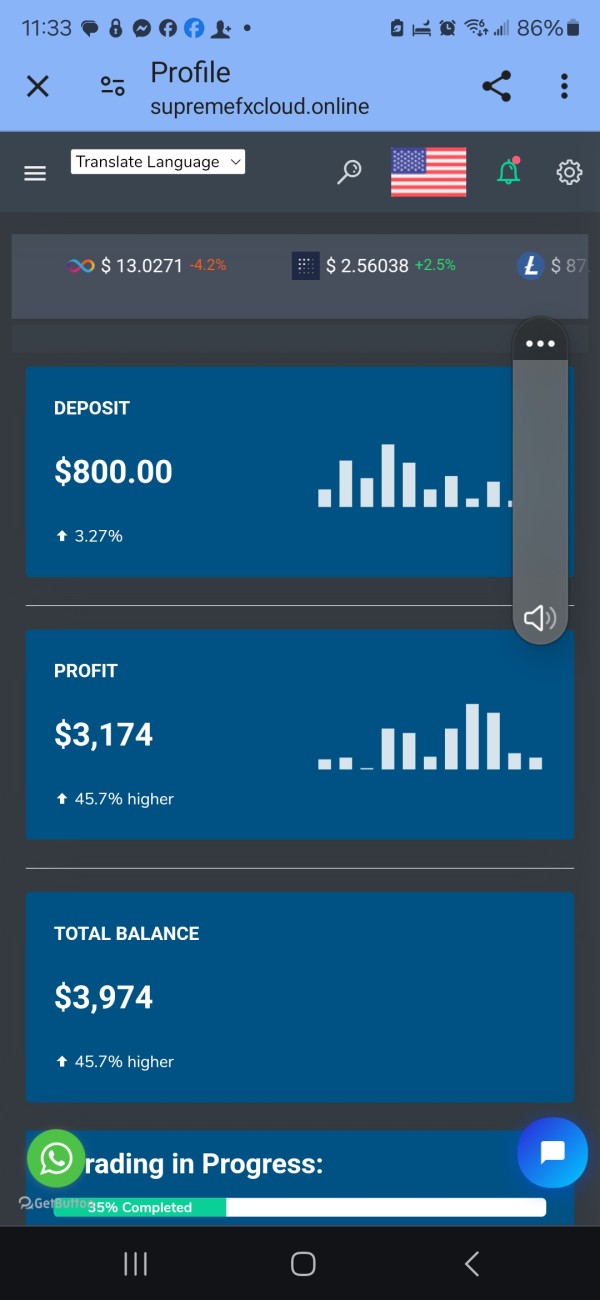

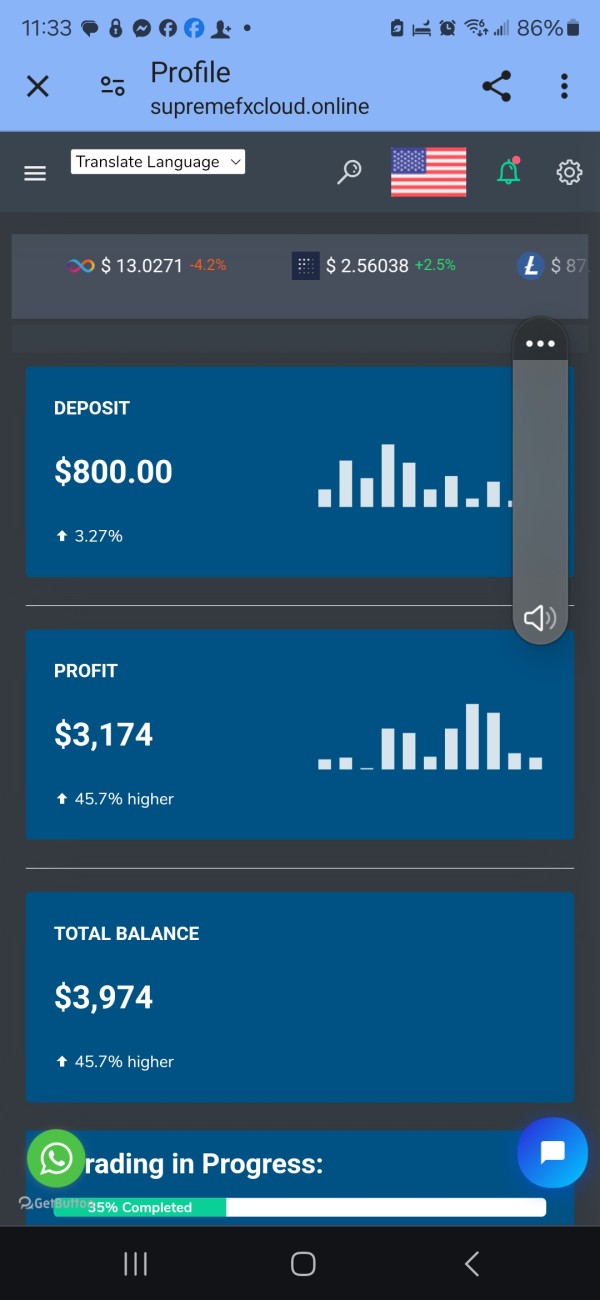

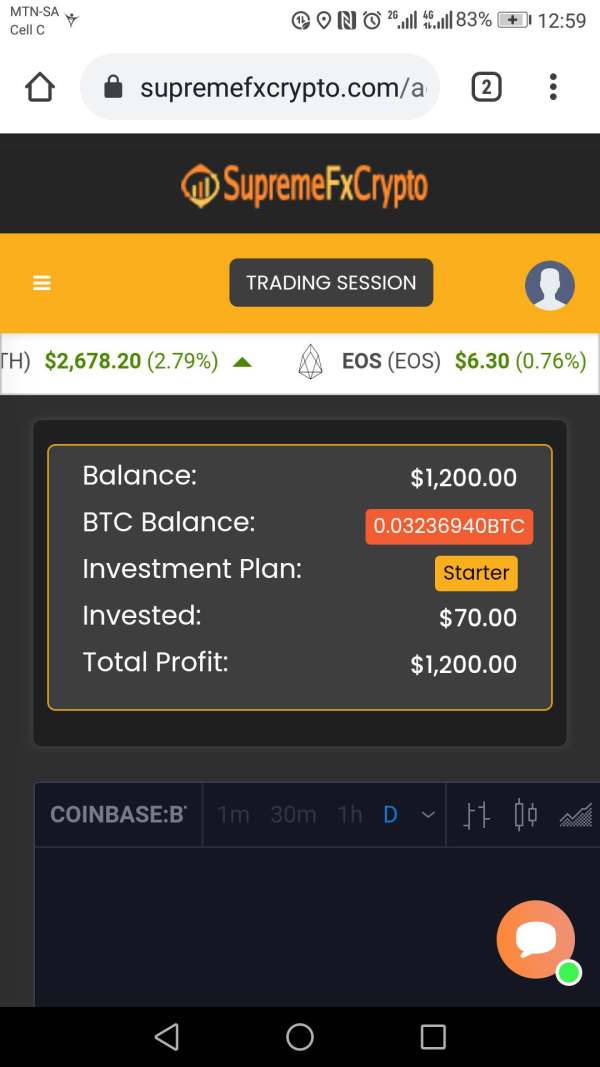

User Experience Analysis

Based on available feedback data showing 13 positive reviews and 1 neutral review, Supreme Forex Trade appears to maintain generally satisfactory user relationships. The positive review ratio suggests that existing clients experience adequate service levels, though specific satisfaction metrics and detailed feedback analysis are not provided in source materials.

Interface design quality, navigation efficiency, and overall platform usability require detailed user experience testing not available through summary information. Registration and account verification processes, including required documentation, approval timeframes, and user onboarding support, are not specified in accessible materials.

Fund management experience, including deposit processing times, withdrawal procedures, and transaction tracking capabilities, represents crucial user experience factors not detailed in available sources. The identification of common user concerns, recurring issues, or areas requiring improvement cannot be accurately assessed without comprehensive feedback analysis.

Conclusion

Supreme Forex Trade presents a mixed profile in this comprehensive evaluation, with limited transparency in operational details despite maintaining positive user feedback ratios. The broker appears suitable for traders seeking basic forex trading services, though the lack of detailed regulatory, technical, and operational information raises questions about transparency and comprehensive service assessment.

The primary advantages include generally positive user reviews and apparent client satisfaction. However, significant disadvantages center on limited public information about regulatory oversight, trading conditions, and service specifications. Potential clients should conduct additional due diligence and direct broker communication before making trading decisions.