Standard Chartered 2025 Review: Everything You Need to Know

Executive Summary

This complete standard chartered review looks at one of the world's established banking institutions that has expanded into online trading services. Standard Chartered positions itself as a legitimate broker offering investment opportunities, particularly focusing on stock trading services that help retail investors access equity markets. However, our analysis reveals significant concerns regarding customer service quality that potential clients should carefully consider before opening accounts.

The bank provides what it describes as a "one-stop service" for stock investment, catering primarily to retail investors seeking equity trading opportunities. While Standard Chartered maintains its status as a regulated financial institution with global reach, customer satisfaction data presents a mixed picture that raises important questions about service delivery. According to available consumer feedback platforms, the institution faces notable challenges in service delivery, with Complaints Board ratings showing a concerning 2.2-star average, indicating widespread customer dissatisfaction with banking services.

Employee satisfaction metrics from platforms like AmbitionBox and Glassdoor show ratings of 3.6/5 and 4.2/5 respectively. These ratings suggest internal operational challenges that may impact service quality for trading clients. These ratings reflect the experiences of staff members who directly interact with clients and manage trading operations, providing insight into the institution's operational effectiveness and potential service delivery issues.

For potential traders considering Standard Chartered's services, it's essential to weigh the institution's legitimacy and comprehensive service offerings against documented customer service shortcomings. The bank targets investors seeking stock market exposure but may not be suitable for those prioritizing responsive customer support or requiring extensive trading tools beyond basic equity investments that most established brokers typically provide.

Important Notice

Standard Chartered operates across multiple jurisdictions worldwide, and services, regulations, and offerings may vary significantly between different regional entities. The availability of specific trading products, account types, and regulatory protections depends on your local jurisdiction and the specific Standard Chartered entity serving your region, which can create confusion for international clients. Potential clients should verify which regulatory framework applies to their account and what protections are available in their specific location.

This review is based on publicly available information, customer feedback, and industry reports available as of 2025. The assessment aims to provide a comprehensive evaluation perspective, but individual experiences may vary based on location, account type, and specific service needs. Prospective clients should conduct their own due diligence and consider their specific trading needs, risk tolerance, and regulatory requirements before making any investment decisions.

Rating Framework

Broker Overview

Standard Chartered Bank has established itself as a significant player in the global financial services sector. The institution extends its traditional banking operations to include online trading services for retail clients who want to access stock markets. The bank's business model centers on delivering integrated financial solutions, with its online trading division focusing primarily on stock market investments that appeal to traditional investors.

The company's approach to retail trading emphasizes simplicity and accessibility. Standard Chartered markets itself as providing a "one-stop service" for stock investment needs that eliminates the complexity many traders face with multiple platforms. This positioning suggests Standard Chartered aims to serve investors who prefer consolidated financial services rather than specialized trading platforms. However, the scope of available trading instruments appears limited compared to dedicated forex or CFD brokers, with the primary focus remaining on equity markets that may not satisfy diverse trading strategies.

Standard Chartered operates its online trading services through the SC Online Trading platform. This platform serves as the primary interface for retail trading activities and reflects the bank's traditional approach to financial services. The platform's design and functionality prioritize stability and regulatory compliance over advanced trading features that professional traders typically require. While specific details about asset classes beyond stocks are not extensively documented in available materials, the bank's primary strength lies in its established financial infrastructure and institutional credibility rather than specialized trading technology or diverse instrument offerings.

The regulatory framework under which Standard Chartered operates varies by jurisdiction. Specific regulatory details for the trading division are not comprehensively outlined in available source materials, which creates uncertainty for potential clients. This standard chartered review notes that potential clients should verify regulatory protections and oversight mechanisms applicable to their specific region and account type.

Regulatory Landscape: Specific information regarding the detailed regulatory framework governing Standard Chartered's trading operations is not comprehensively detailed in available source materials. Prospective clients should independently verify regulatory oversight applicable to their jurisdiction to ensure proper protection.

Deposit and Withdrawal Methods: Available source materials do not provide specific details about deposit and withdrawal options, processing times, or associated fees for trading accounts. This lack of transparency may concern clients who need predictable funding procedures.

Minimum Deposit Requirements: Specific minimum deposit requirements for opening trading accounts are not detailed in the available information sources. Potential clients should contact the bank directly to understand entry requirements.

Bonus and Promotional Offers: No information regarding bonus structures, promotional offers, or incentive programs is available in the source materials reviewed. This absence suggests either no promotional programs exist or limited marketing transparency.

Tradeable Assets: The primary focus appears to be on stock investments through the one-stop service model. Comprehensive details about additional asset classes, market coverage, or specific instruments are not extensively documented, which may limit trading diversity.

Cost Structure: Detailed information about trading fees, spreads, commissions, or other cost components is not specified in available source materials. This represents a significant information gap for potential clients who need to understand total trading costs.

Leverage Options: Leverage ratios and margin requirements are not detailed in the available information sources. Traders requiring leverage should inquire directly about available options and associated risks.

Platform Alternatives: Information about alternative trading platforms or mobile applications beyond SC Online Trading is not comprehensively covered in source materials. This limitation may affect traders who prefer multiple platform options.

Geographic Restrictions: Specific geographic limitations or availability restrictions are not detailed in available sources. International clients should verify service availability in their region.

Customer Service Languages: Supported languages for customer service are not specified in available materials. Multilingual support requirements should be confirmed directly with the institution.

This standard chartered review highlights significant information gaps that potential clients should address through direct inquiry with the institution.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Standard Chartered's account conditions faces significant limitations due to insufficient information in available source materials. This lack of transparency regarding account types, minimum deposit requirements, and specific account features represents a notable concern for potential clients seeking detailed information before making trading decisions that could affect their financial future.

Without comprehensive details about account structures, it becomes challenging to assess whether Standard Chartered offers differentiated service levels. Features such as premium accounts with enhanced capabilities or basic accounts for beginning traders remain unclear. The absence of clear information about account opening procedures, required documentation, or verification processes may indicate either limited online disclosure or a preference for direct client consultation that could delay account setup.

Potential clients interested in specialized account features cannot determine availability based on publicly accessible information. Islamic accounts complying with Shariah principles, professional trading accounts, or corporate trading solutions may be available but are not documented in accessible materials. This information gap extends to understanding what account management tools, reporting features, or portfolio management services might be included with different account types.

The lack of detailed account condition information also makes it difficult to compare Standard Chartered's offerings with other brokers in the market. Prospective clients should directly contact the institution to obtain comprehensive account details before proceeding with account opening procedures that may involve significant time commitments.

This standard chartered review recommends that potential clients specifically inquire about account minimums, maintenance fees, inactivity charges, and any account-specific benefits or restrictions during their initial consultation with Standard Chartered representatives.

Standard Chartered's approach to trading tools and resources appears to emphasize simplicity over comprehensive functionality. This strategy aligns with its positioning as a "one-stop service" for stock investment that appeals to traditional investors. While this approach may appeal to investors seeking straightforward equity trading without complex analytical tools, it may not satisfy traders requiring advanced technical analysis capabilities or automated trading systems that professional traders typically demand.

The available information suggests that Standard Chartered's tool suite focuses primarily on basic trading functionality rather than sophisticated analytical resources. This limitation may impact traders who rely on detailed market research, advanced charting capabilities, or comprehensive fundamental analysis tools for their investment decisions that require extensive data analysis. Educational resources and training materials are not extensively detailed in available sources, which could present challenges for novice traders seeking to develop their market knowledge and trading skills.

Many modern brokers provide comprehensive educational programs, webinars, and market analysis to support client development. Standard Chartered's offerings in this area remain unclear, potentially leaving new traders without adequate learning resources. The absence of detailed information about automated trading support, algorithmic trading capabilities, or third-party platform integrations suggests that Standard Chartered may not cater to traders requiring advanced automation features.

This positioning aligns with the bank's apparent focus on traditional investment approaches rather than sophisticated trading strategies. For clients prioritizing comprehensive analytical tools and extensive educational resources, Standard Chartered's apparently limited tool suite may not meet their requirements for professional-level trading. However, investors seeking basic trading functionality within an established banking relationship may find the simplified approach suitable for their needs.

Customer Service and Support Analysis

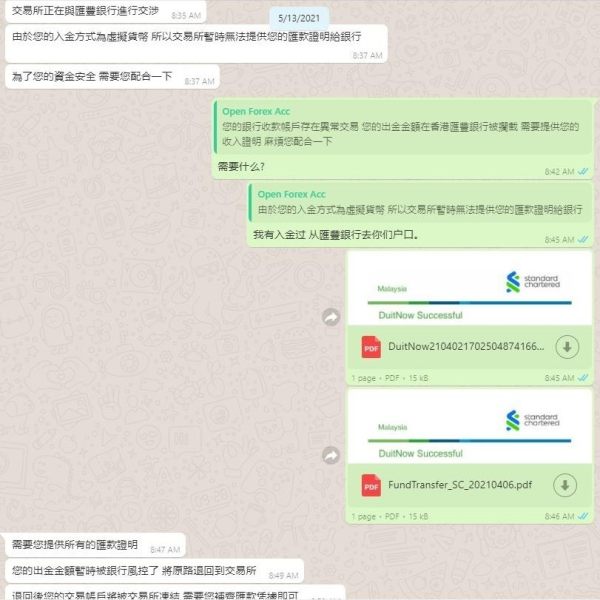

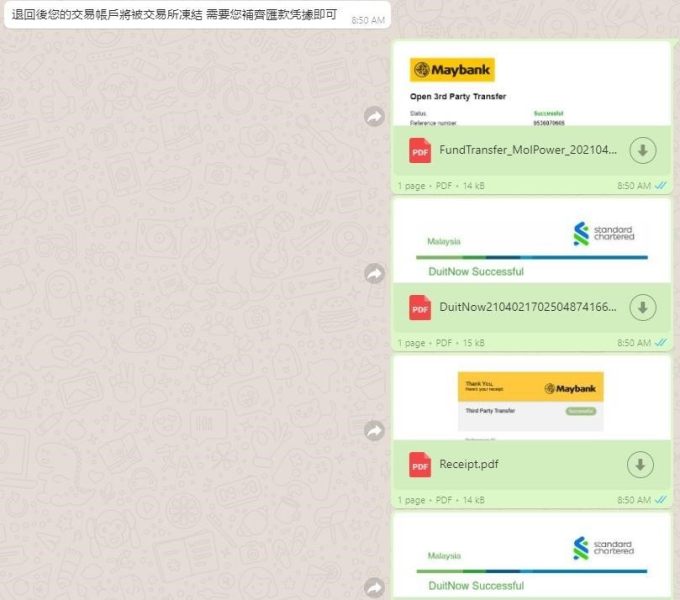

Customer service quality emerges as a significant concern in this standard chartered review. Available data indicates substantial challenges in service delivery and client satisfaction that could affect trading activities. The 2.2-star rating on Complaints Board represents a particularly troubling indicator of widespread customer dissatisfaction, suggesting systematic issues in service quality rather than isolated incidents that might be expected with any large institution.

This low satisfaction rating becomes especially concerning when considering that effective customer service is crucial for financial services. Clients need reliable support for account issues, trading problems, or urgent financial matters that can affect their investments. The poor rating suggests that clients frequently encounter difficulties in resolving issues, obtaining timely responses, or receiving satisfactory solutions to their concerns that can impact their trading success.

The impact of poor customer service extends beyond mere inconvenience. These issues can potentially affect trading activities, account management, and overall client confidence in the institution during critical market periods. For active traders who may require prompt support during market hours or immediate assistance with trading platform issues, inadequate customer service could result in missed opportunities or financial losses that directly impact their portfolio performance.

While specific details about customer service channels, response times, or support availability are not detailed in available sources, the consistently poor ratings suggest problems. Existing support mechanisms are failing to meet client expectations across multiple service areas. This pattern indicates that Standard Chartered may need significant improvements in staffing, training, or service delivery processes.

Prospective clients should carefully consider their tolerance for potential service issues and whether they have alternative support mechanisms available before committing to Standard Chartered's trading services. The documented service quality concerns represent a substantial risk factor that should weigh heavily in any decision-making process.

Trading Experience Analysis

The evaluation of Standard Chartered's trading experience faces limitations due to insufficient detailed information in available source materials. Platform performance, execution quality, and user interface design remain unclear to potential clients. This lack of comprehensive trading experience data makes it challenging to assess how the platform performs during different market conditions or how effectively it serves various types of trading strategies that modern investors employ.

Platform stability and execution speed are critical factors for any trading operation. These factors become particularly important during volatile market periods when rapid order execution can significantly impact trading outcomes. Without specific performance metrics or user feedback about platform reliability, potential clients cannot adequately assess whether Standard Chartered's infrastructure meets their trading requirements for consistent market access.

The mobile trading experience represents another area where information is lacking. Modern traders increasingly need market access while away from desktop computers for flexible trading opportunities. This information gap prevents assessment of whether Standard Chartered provides comprehensive mobile functionality or how the mobile experience compares to desktop platform capabilities that competitors typically offer.

Order execution quality includes factors such as slippage, rejection rates, and fill quality. These technical performance aspects directly impact trading profitability and user satisfaction, making their absence from public information a notable concern for serious traders. The overall trading environment, including factors such as market data quality, charting capabilities, and order management features, cannot be thoroughly evaluated based on available information.

This standard chartered review emphasizes the need for potential clients to request detailed platform demonstrations or trial access to properly assess trading experience quality.

Trust and Security Analysis

Standard Chartered's trust and security profile benefits from its status as an established banking institution with a global presence. This institutional foundation provides credibility that many standalone brokers cannot match in terms of financial stability. The recognition as a legitimate broker establishes basic trust parameters, though detailed security measures and regulatory protections require further investigation by potential clients.

The institutional backing of a major bank typically provides enhanced financial stability compared to smaller, independent brokers. This stability potentially offers greater security for client funds and continuity of service during market disruptions. However, the specific mechanisms for client fund protection, segregation practices, and insurance coverage are not detailed in available source materials, leaving important security questions unanswered.

Regulatory oversight varies by jurisdiction, and the specific regulatory framework governing Standard Chartered's trading operations is not comprehensively outlined in available sources. This lack of detailed regulatory information makes it difficult to assess the level of protection available to clients or the oversight mechanisms ensuring fair trading practices that protect investor interests. The bank's transparency regarding its trading operations, fee structures, and conflict of interest policies is not extensively documented in publicly available materials.

This limited transparency may concern clients who prioritize full disclosure of trading conditions and potential conflicts that could affect their trading outcomes. While Standard Chartered's established institutional presence provides a foundation for trust, the lack of detailed information about specific security measures, regulatory protections, and operational transparency represents an area where potential clients should seek additional clarification before opening trading accounts.

User Experience Analysis

The overall user experience with Standard Chartered presents a mixed picture that reveals important operational concerns. Employee satisfaction ratings from AmbitionBox and Glassdoor show moderate scores, while customer satisfaction ratings tell a different story. The significantly lower customer satisfaction rating from Complaints Board indicates substantial disparities between internal operations and client-facing service delivery that affect the overall user experience.

The poor customer satisfaction ratings suggest that users frequently encounter frustrating experiences when interacting with the bank's services. These difficulties potentially include problems with account management, trading platform issues, or problem resolution processes that impact daily trading activities. These negative experiences appear to be systematic rather than isolated incidents, indicating fundamental challenges in service delivery that affect multiple aspects of the client relationship.

Interface design and platform usability information is not extensively detailed in available sources. This lack of information makes it difficult to assess whether user experience issues stem from poor platform design, inadequate functionality, or service delivery problems that could be addressed through system improvements. Modern traders expect intuitive interfaces and seamless user experiences, and any deficiencies in these areas could significantly impact satisfaction and trading effectiveness.

The registration and verification processes represent crucial first impressions for new clients. These procedures are not detailed in available materials, but complex or lengthy onboarding procedures could contribute to negative user experiences from the outset of the client relationship. Common user complaints, based on the poor satisfaction ratings, likely include service responsiveness issues, problem resolution difficulties, and potentially inadequate communication from the institution.

These experience challenges suggest that Standard Chartered may be better suited for clients who prioritize institutional stability over responsive service delivery. The user profile best suited for Standard Chartered appears to be investors who value the security of an established banking relationship and can tolerate potential service delivery limitations in exchange for institutional credibility and basic stock trading functionality.

Conclusion

This comprehensive standard chartered review reveals a complex picture of an established banking institution offering basic trading services. The institution maintains legitimacy and provides integrated banking solutions, but documented service quality challenges present substantial concerns for potential clients. While Standard Chartered maintains legitimacy as a regulated financial institution and provides a one-stop service approach for stock investments, the documented customer service issues present substantial concerns for potential clients who expect responsive support.

The institution appears most suitable for investors who prioritize the security and stability of an established banking relationship over responsive customer service or advanced trading features. Clients seeking basic stock investment capabilities within their existing banking relationship may find Standard Chartered's simplified approach acceptable, provided they can tolerate potential service delivery limitations that could affect their trading experience. However, active traders requiring responsive customer support, advanced trading tools, or comprehensive market analysis resources may find Standard Chartered's offerings insufficient for their needs.

The poor customer satisfaction ratings suggest that clients should have realistic expectations about service quality and consider alternative support mechanisms before committing to the platform. The main advantages include institutional legitimacy and integrated banking services, while significant disadvantages center on documented customer service quality issues and limited transparency regarding trading conditions and costs that could impact trading decisions.