SANKO SECURITIES Co.,Ltd Review 2

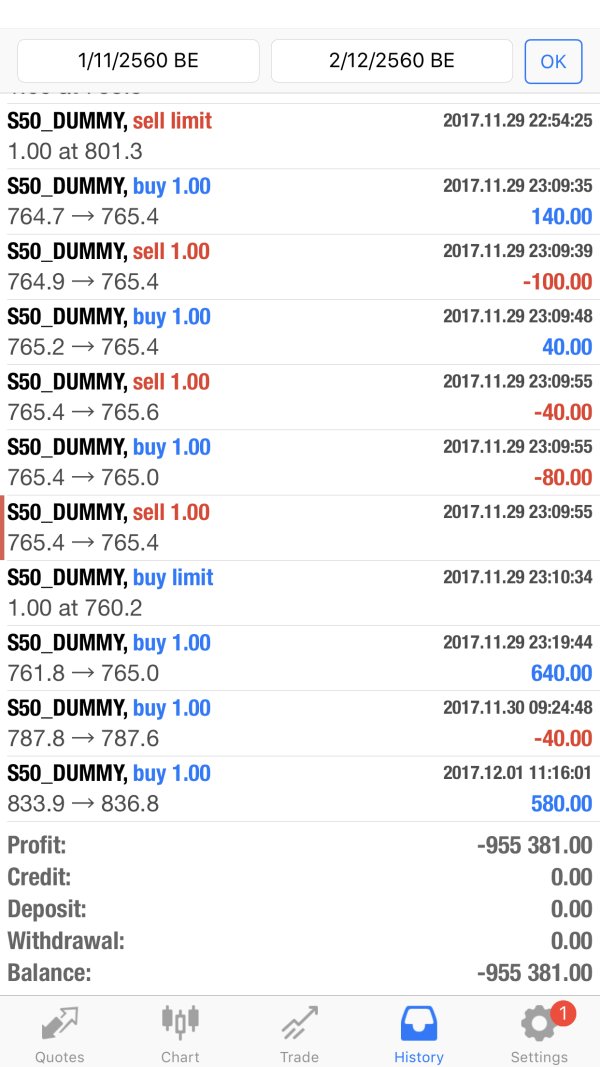

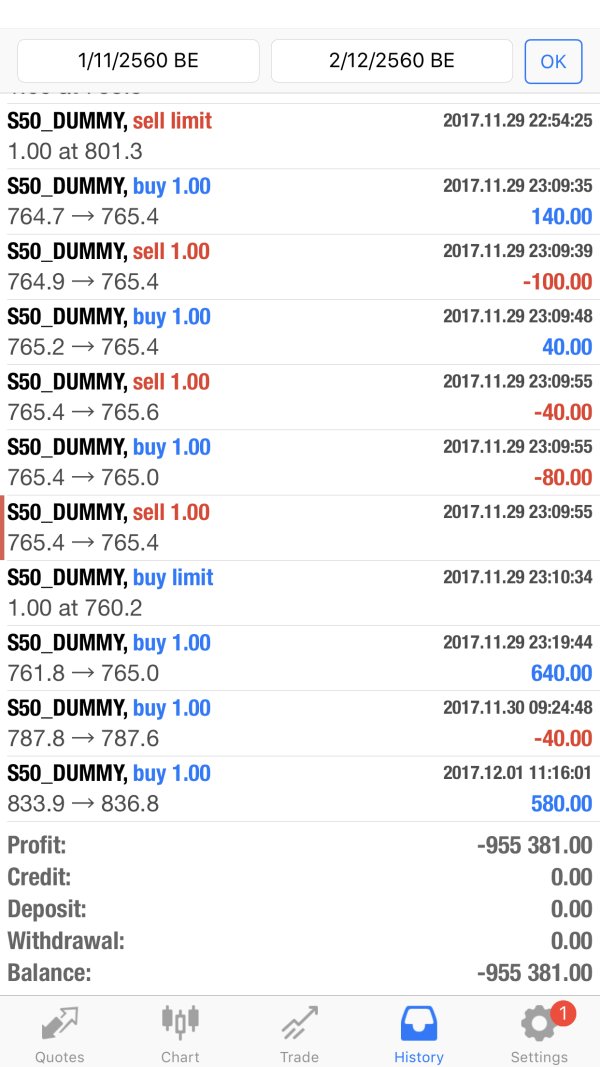

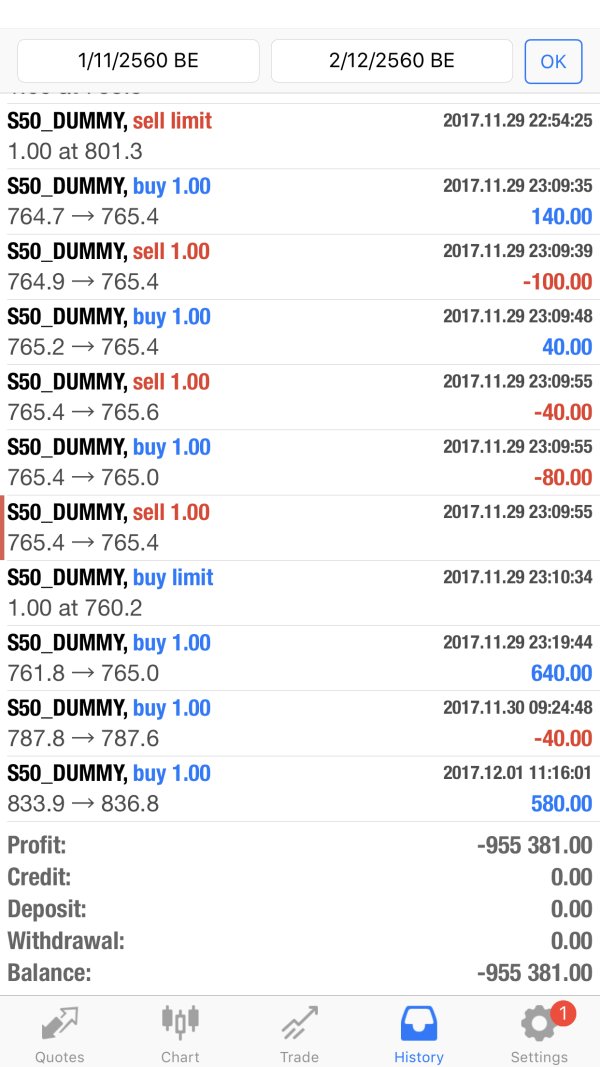

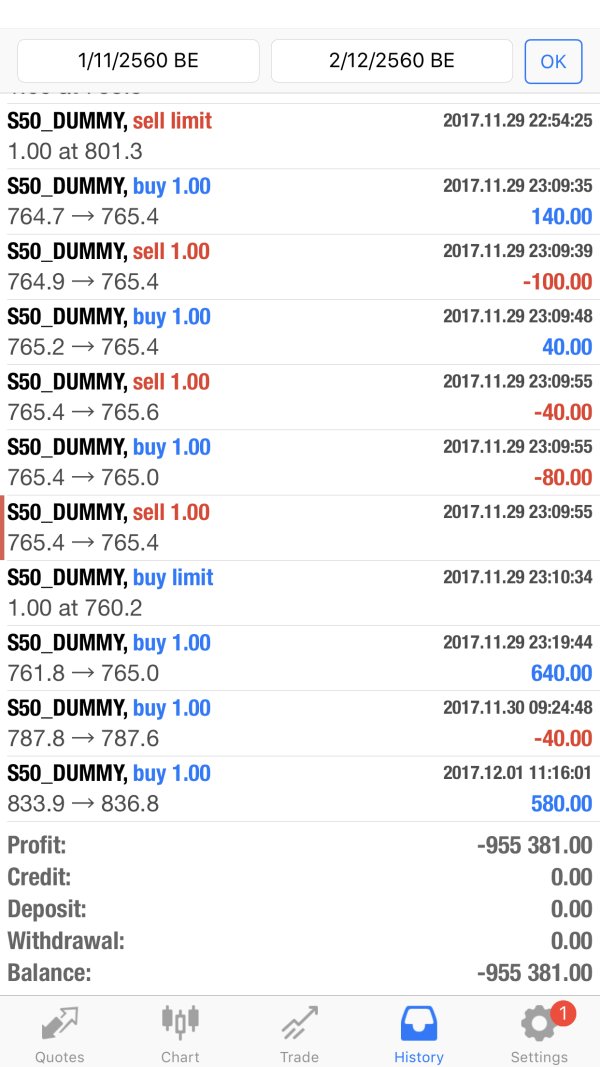

Is the picture right? Sometimes coin transaction lost.

I think this company should mainly target domestic users, because the website is only in Japanese.

SANKO SECURITIES Co.,Ltd Forex Broker provides real users with * positive reviews, 1 neutral reviews and 1 exposure review!

Is the picture right? Sometimes coin transaction lost.

I think this company should mainly target domestic users, because the website is only in Japanese.

Sanko represents a unique proposition in the brokerage landscape. The company operates primarily as the captive broker of Madagascar's largest private group. This sanko review reveals an organization with a distinctive regional focus and specialized risk management expertise that sets it apart from traditional brokers. Founded in 1988 as Sanko Electronics America, the company has evolved significantly over the decades. The business has transformed from providing electronic products and services to becoming Madagascar's only dedicated risk management specialist.

With a compact team of 6 professionals as of 2019, Sanko offers a more personalized service approach. This smaller structure contrasts sharply with larger international brokers that often rely on automated systems and standardized processes. The company's dual heritage combines American electronic product expertise with Madagascar's insurance and brokerage needs. This unique combination creates an interesting and specialized market position that few competitors can match. According to available information, Sanko maintains operations in Antananarivo. The company positions itself strategically within the Madagascar financial services sector.

The broker primarily serves retail and institutional clients in Madagascar and surrounding regions. Sanko leverages its status as the exclusive risk management specialist in the country to attract clients seeking specialized services. While the company demonstrates solid industry experience spanning over three decades, challenges exist in comprehensive evaluation. The limited availability of detailed trading conditions and regulatory information presents obstacles for thorough assessment. Customer feedback indicates mixed experiences across different service areas. Some clients praise product quality and customer service excellence, while others provide more neutral assessments of their interactions.

This evaluation focuses on Sanko's operations primarily within Madagascar and its surrounding markets. Due to the broker's regional concentration, significant differences may exist compared to international brokers. These international brokers typically operate under different regulatory frameworks with varying standards and requirements. Traders from other jurisdictions should carefully consider these regional variations. Understanding these differences is crucial when evaluating Sanko's services for potential use.

The assessment methodology relies on available company information, employee feedback, and market positioning data. Given the limited public disclosure of specific trading conditions and regulatory details, some evaluation aspects require alternative approaches. Some assessment areas are based on general industry standards and available corporate information rather than detailed trading specifications. This limitation affects the depth of analysis possible in certain areas.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 5/10 | Limited information available on specific account types and conditions |

| Tools and Resources | 4/10 | Insufficient data on trading tools and analytical resources |

| Customer Service and Support | 6/10 | Based on employee feedback and regional service focus |

| Trading Experience | 5/10 | No specific user experience data available |

| Trust and Reliability | 4/10 | Absence of clear regulatory information affects confidence |

| User Experience | 5/10 | Neutral performance based on available employee and customer feedback |

Sanko's journey began in 1988 with the establishment of Sanko Electronics America, Inc. The company initially focused on electronic products and related services for its target market. Over more than three decades, the company has built substantial expertise in serving both retail and institutional clients across various sectors. The transition into Madagascar's financial services sector represents a strategic evolution that demonstrates adaptability and market awareness. This shift positioned Sanko as the captive broker for the country's largest private group.

The company's business model centers on risk management specialization. This niche focus sets it apart in the Madagascar market where few competitors offer similar expertise. With its headquarters located at Bâtiment Arianne 5B, Zone Galaxy Andraharo in Antananarivo, Sanko maintains close proximity to Madagascar's financial center. The strategic location provides easy access to key clients and regulatory bodies. The leadership team, including General Director Guynn Chuttoo and Operations Manager Olivia Raveloson, brings regional expertise and operational experience to the organization. Their combined knowledge helps navigate local market conditions and client requirements effectively.

This sanko review indicates that the broker's approach differs significantly from typical international forex brokers. Rather than competing in the global retail trading space, Sanko has carved out a specialized role within Madagascar's financial ecosystem that leverages local knowledge and relationships. The company's association with Brokerslink combines global broking capabilities with a worldwide network of professionals. This partnership suggests access to broader international markets and expertise while maintaining its regional focus and specialized service approach.

Regulatory Jurisdiction: Specific regulatory information is not detailed in available materials. The company operates within Madagascar's financial services framework.

Deposit and Withdrawal Methods: Available documentation does not specify the deposit and withdrawal options offered to clients. Potential users would need to contact the company directly for this information.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in accessible company information. This suggests a customized approach to client onboarding.

Bonus and Promotions: No information regarding promotional offers or bonus structures is available in current materials. The company may focus on service quality rather than promotional incentives.

Tradeable Assets: The specific range of tradeable instruments and asset classes is not detailed in available documentation. Asset availability likely depends on client needs and market conditions.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in accessible materials. As a specialized risk management broker, the fee structure likely differs from standard retail forex brokers significantly.

Leverage Options: Specific leverage ratios offered to clients are not mentioned in available company information. Leverage terms may be negotiated individually with each client.

Platform Selection: Trading platform options and technological infrastructure details are not specified in current documentation. The company may use proprietary or specialized platforms suited to its client base.

Geographic Restrictions: While primarily focused on Madagascar, specific geographic limitations are not detailed in available materials. International clients may face certain restrictions or requirements.

Customer Support Languages: Supported languages for customer service are not explicitly mentioned. Regional operations suggest local language support is likely available.

This sanko review highlights the limited public disclosure of specific trading conditions. The lack of detailed information may reflect the company's focus on institutional and captive brokerage services rather than retail client acquisition strategies.

The evaluation of Sanko's account conditions faces significant limitations due to insufficient publicly available information. Unlike traditional retail forex brokers that typically offer multiple account tiers with varying features, Sanko's role as a captive broker suggests a different approach. The company serves Madagascar's largest private group, which indicates a more customized approach to account management that focuses on specific client needs.

Given the company's specialization in risk management and its institutional focus, account conditions likely vary significantly. Terms probably depend on client requirements and relationship scope rather than standardized packages. The absence of standard retail account information such as minimum deposits, account types, and basic trading conditions indicates a relationship-based model. This approach suggests that terms are negotiated individually with clients rather than offered through preset packages.

The account opening process details are not specified in available materials. This lack of information may reflect the broker's preference for direct client relationships rather than online account opening procedures. Traditional retail brokers commonly use automated online procedures, but Sanko appears to favor personal consultation. For potential clients interested in Sanko's services, direct contact with the company would be necessary. Understanding specific account conditions and requirements requires individual consultation rather than relying on published materials.

This sanko review suggests that account conditions are likely tailored to the unique needs of Madagascar's financial market participants. The lack of transparent information makes it difficult for potential clients to assess suitability without direct consultation and detailed discussions with company representatives.

The assessment of Sanko's trading tools and resources reveals limited publicly available information about technological infrastructure. As a specialized risk management broker operating primarily in Madagascar, the company's tool portfolio likely differs significantly from standard retail forex broker offerings. The regional focus and institutional client base suggest different technological priorities and resource allocation compared to mass-market brokers.

Given Sanko's association with Brokerslink's global network, there may be access to international broking tools and resources. However, specific details about trading platforms, analytical tools, or research capabilities are not disclosed in available materials currently. The company's focus on risk management suggests that tools may be oriented toward institutional needs rather than retail trader requirements. Professional clients typically require different analytical capabilities and risk management tools compared to individual traders.

Educational resources and training materials, commonly provided by retail brokers, are not mentioned in accessible company information. This absence may reflect the broker's institutional focus, where clients are expected to have existing market knowledge and expertise. Professional clients typically do not require the educational support that retail brokers commonly provide. The lack of specific information about automated trading support, mobile applications, or web-based platforms indicates direct inquiry requirements. Potential clients would need to contact Sanko directly to understand the available technological offerings and their suitability for specific trading requirements.

Sanko's customer service approach appears to be built around its small, specialized team structure. With 6 professionals providing personalized attention to clients, this intimate team size potentially allows for more direct relationships. The smaller structure enables customized service delivery compared to larger international brokers with extensive support departments that often rely on standardized procedures.

The company's leadership structure features General Director Guynn Chuttoo and Operations Manager Olivia Raveloson. This organizational approach suggests a hands-on management style where senior executives remain accessible to clients directly. The structure may facilitate faster decision-making and more flexible service delivery, which is particularly important for institutional clients. Specialized risk management solutions often require quick responses and customized approaches that larger organizations may struggle to provide.

Available feedback indicates mixed experiences with customer service quality across different client interactions. Some clients have praised the exceptional nature of customer service, particularly in relation to product quality and support responsiveness that exceeds expectations. However, the limited scope of available feedback makes it difficult to establish comprehensive patterns in service delivery quality. More extensive client testimonials would be needed for thorough assessment.

The regional focus on Madagascar likely means that customer support is tailored to local market conditions. Support teams understand regulatory requirements and business practices specific to the region. This localization can be advantageous for clients operating within the region but may present challenges. International clients requiring support across different time zones or regulatory frameworks might face limitations in service availability.

The evaluation of Sanko's trading experience faces significant constraints due to the absence of specific user feedback. As a captive broker specializing in risk management for Madagascar's largest private group, the trading experience likely differs substantially from typical retail forex trading environments. The institutional focus suggests different priorities in platform design and execution capabilities compared to retail-oriented brokers.

Platform stability and execution quality information is not available in accessible materials. This lack of information makes it impossible to assess the technological reliability that traders might expect from the system. The company's institutional focus suggests that trading infrastructure may be designed for larger transaction volumes and more complex risk management requirements. High-frequency retail trading capabilities may not be the primary focus of platform development efforts.

Order execution quality, spreads, and slippage data are not disclosed in available documentation currently. This lack of transparency may reflect the customized nature of institutional trading relationships where execution terms are negotiated individually. Standardized pricing across all clients may not apply in this specialized market segment. Mobile trading capabilities and platform functionality details are not specified in accessible materials. Potential clients would need to engage directly with Sanko to understand the available trading technology and its suitability.

This sanko review indicates that trading experience evaluation requires direct consultation with the broker. Understanding platform capabilities, execution quality, and technological infrastructure suited to individual client needs requires personal discussion rather than relying on published specifications.

The assessment of Sanko's trustworthiness encounters significant challenges due to limited publicly available regulatory information. While the company operates as the captive broker for Madagascar's largest private group, specific regulatory authorizations are not detailed. License numbers and oversight mechanisms are not specified in accessible materials, which creates uncertainty about regulatory compliance.

The absence of clear regulatory information significantly impacts the ability to assess fund safety measures. Client protection protocols and compliance standards cannot be evaluated without proper regulatory disclosure. Traditional indicators of broker reliability, such as regulatory oversight, segregated client accounts, and investor compensation schemes, are not specified. These safety measures are typically important considerations for potential clients evaluating broker trustworthiness.

Company transparency appears limited, with minimal disclosure of operational details, financial information, or regulatory compliance status. This lack of transparency may be appropriate for a captive broker serving institutional clients but creates challenges for assessment. Potential retail clients seeking to assess reliability and safety face significant information gaps. The company's long-standing presence since 1988 and its role within Madagascar's largest private group provide some indication of operational stability. Market acceptance over several decades suggests established business relationships and operational competence.

Industry reputation information is not readily available, and there are no disclosed negative events in accessible materials. Regulatory actions or compliance issues are not mentioned in available documentation. The association with Brokerslink's global network may provide additional credibility, but specific details about this relationship's impact are not clarified. Client protection benefits from this partnership are not explicitly explained in available materials.

User experience evaluation for Sanko relies primarily on limited employee feedback and general organizational characteristics. Available employee ratings suggest neutral performance levels, with a 3-star rating indicating average workplace satisfaction that may reflect broader organizational culture. This internal perspective may provide insights into service delivery approaches and company culture that affects client interactions.

Interface design and platform usability information is not available in accessible materials currently. This prevents assessment of the technological user experience that clients might expect from the platform. The company's institutional focus suggests that user interfaces may be designed for professional users rather than retail traders. Consumer-oriented platforms typically prioritize intuitive design, while professional platforms focus on functionality and advanced features.

Registration and account verification processes are not detailed in available documentation. This likely reflects the broker's preference for relationship-based client onboarding rather than automated online procedures commonly used by retail brokers. This approach may provide more personalized service but could result in longer setup times. Clients accustomed to quick online registration may find this process different from their expectations.

Funding operation experiences are not documented in accessible materials. This makes it impossible to assess the efficiency and convenience of deposit and withdrawal processes that are crucial for client satisfaction. The absence of user feedback regarding transaction processing times, payment method variety, and fund security measures limits comprehensive evaluation. Common user complaints or satisfaction patterns cannot be identified from available information currently. Potential clients would need to seek direct references or conduct independent due diligence to understand typical user experiences with Sanko's services.

This comprehensive sanko review reveals a broker with unique positioning in Madagascar's financial services sector. The company operates as the captive broker for the country's largest private group, which provides a specialized market niche. While Sanko demonstrates solid industry experience dating back to 1988 and offers specialized risk management expertise unavailable elsewhere in Madagascar, evaluation challenges exist. The limited transparency regarding trading conditions, regulatory status, and operational details presents significant obstacles for thorough assessment.

The broker appears most suitable for institutional clients and traders specifically interested in Madagascar market exposure. Those requiring specialized risk management services may find Sanko's offerings particularly valuable given the lack of alternatives in the region. The small team structure may appeal to clients preferring personalized service relationships over standardized retail broker offerings. Direct access to senior management and customized solutions can be significant advantages for the right client profile.

However, the absence of detailed trading conditions, regulatory information, and user feedback creates limitations. These gaps make Sanko less suitable for retail traders seeking transparent, well-documented trading environments with clear cost structures. Regulatory protections and standardized procedures that many retail traders expect may not be readily apparent. Potential clients should engage in thorough due diligence and direct consultation with the company before making any trading decisions or commitments.

FX Broker Capital Trading Markets Review