Saen 2025 Review: Everything You Need to Know

Summary

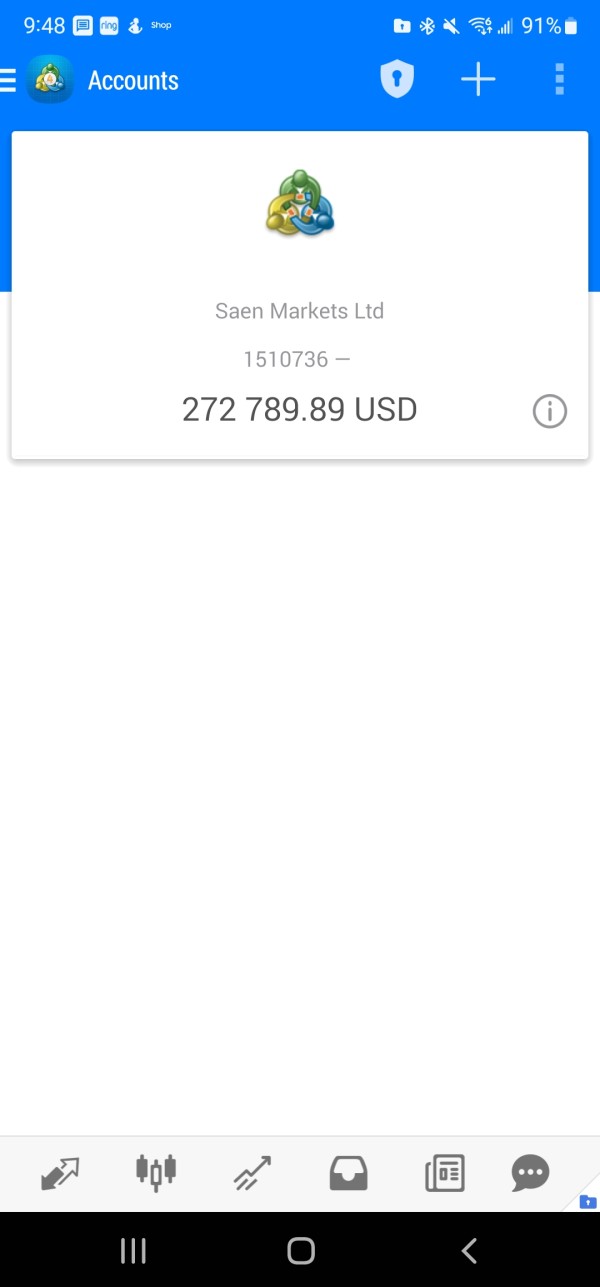

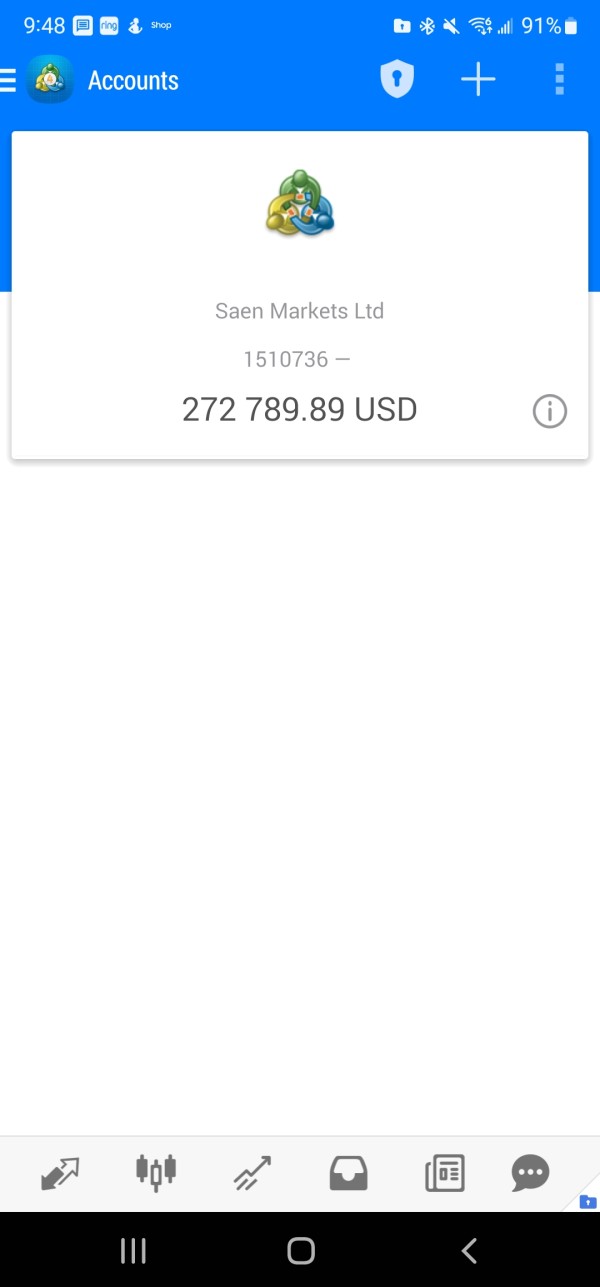

This comprehensive Saen review examines a privately held capital markets company based in the Netherlands. Saen Options operates as a financial services provider with an employee base ranging from 51-200 professionals, positioning itself within the competitive capital markets sector. While the company maintains a presence in the Dutch financial landscape, detailed information regarding specific trading conditions, regulatory oversight, and operational frameworks remains limited in publicly available sources.

The broker appears to target mid-tier investors seeking exposure to capital markets. However, specific service offerings and trading instruments require further investigation. Based on available information, Saen Options represents a moderate-sized financial entity within the European market, though comprehensive evaluation of its trading services, customer support infrastructure, and regulatory compliance status necessitates additional research.

Potential clients should exercise due diligence when considering this broker. This is particularly important given the limited transparency regarding operational specifics and regulatory oversight mechanisms.

Important Disclaimer

Investors should note that regulatory frameworks and operational standards may vary significantly across different jurisdictions. The limited information available in public sources regarding Saen Options' regulatory status requires potential clients to conduct thorough independent verification of the company's licensing and compliance credentials before engaging in any trading activities.

This evaluation is based on limited publicly available information and may not comprehensively reflect actual user experiences or operational realities. Prospective traders should seek additional information directly from the broker and verify all claims independently before making investment decisions.

Rating Framework

Broker Overview

Saen Options operates as a privately held company within the capital markets industry. The organization maintains its headquarters in the Netherlands. The organization employs between 51-200 professionals, suggesting a mid-sized operational structure capable of supporting diverse financial services activities.

According to available corporate information, the company focuses on capital markets operations. However, specific details regarding founding dates, executive leadership, and historical development remain undisclosed in public documentation.

The broker's positioning within the Dutch financial services sector indicates potential access to European Union regulatory frameworks. Nevertheless, specific licensing details and supervisory oversight mechanisms are not clearly documented in accessible sources. The company's employee range suggests sufficient operational capacity to support trading infrastructure, customer service functions, and regulatory compliance activities typical of capital markets participants.

Trading platform specifications, asset class offerings, and technological infrastructure details are not comprehensively outlined in available materials. Similarly, information regarding the company's business model, whether market-making or agency-based, requires clarification through direct inquiry.

This Saen review notes that potential clients should seek detailed operational information directly from the broker to understand service capabilities fully.

Regulatory Jurisdiction: Specific regulatory oversight details are not clearly documented in available sources. However, the Netherlands location suggests potential supervision under Dutch financial authorities.

Deposit and Withdrawal Methods: Payment processing options and fund transfer mechanisms are not detailed in publicly accessible information.

Minimum Deposit Requirements: Entry-level investment thresholds are not specified in available documentation.

Promotional Offers: Bonus structures and incentive programs are not outlined in current public materials.

Tradeable Assets: Specific financial instruments and market access options require clarification through direct broker contact.

Cost Structure: Fee schedules, spread configurations, and commission frameworks are not transparently disclosed in accessible sources. This necessitates direct inquiry for comprehensive pricing information.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified.

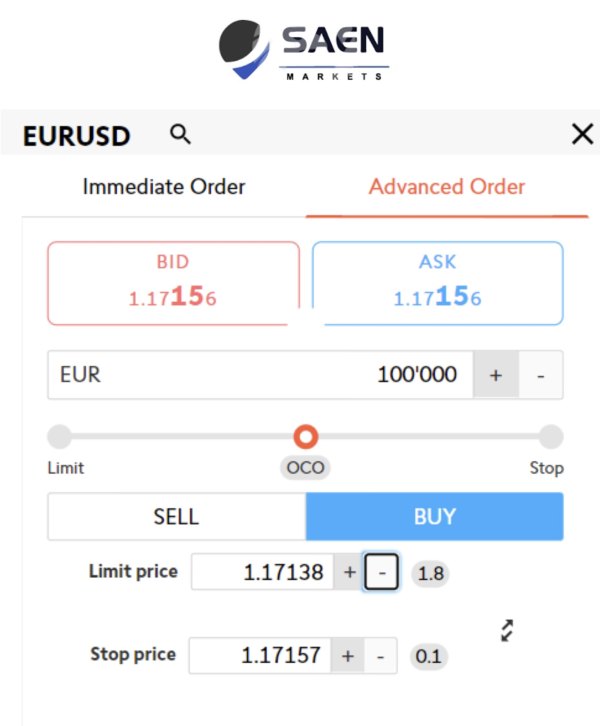

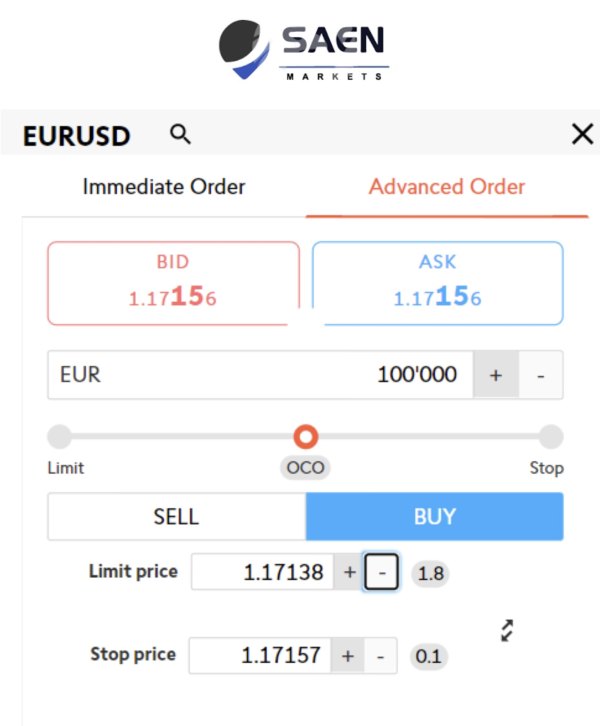

Platform Options: Trading software and technological infrastructure details are not comprehensively available.

Regional Restrictions: Geographic limitations and jurisdiction-specific access rules are not clearly outlined.

Customer Service Languages: Multi-lingual support capabilities are not detailed in current Saen review materials.

Account Conditions Analysis

The evaluation of Saen Options' account structures faces significant limitations due to insufficient publicly available information regarding specific account types, minimum deposit requirements, and associated features. Industry standards typically include multiple account tiers designed to accommodate varying investment levels and trading preferences. However, Saen's specific offerings require direct verification.

Account opening procedures, documentation requirements, and verification timelines are not detailed in accessible sources. Standard practice in the capital markets sector includes Know Your Customer protocols and anti-money laundering compliance measures. Nevertheless, Saen's specific implementation of these regulatory requirements needs clarification through direct contact.

Specialized account features, including Islamic-compliant trading arrangements, professional trader classifications, and institutional service tiers, are not documented in available materials. The absence of transparent information regarding account conditions represents a significant limitation for potential clients seeking to evaluate suitability.

This Saen review emphasizes that prospective traders should request comprehensive account documentation directly from the broker to understand available options, associated costs, and operational requirements before committing to any trading relationship.

Assessment of Saen Options' trading tools and analytical resources encounters substantial limitations due to insufficient public disclosure of platform capabilities and research infrastructure. Contemporary capital markets participants typically provide comprehensive charting software, technical analysis tools, and market research resources. However, Saen's specific offerings require direct investigation.

Educational resources, including webinars, trading guides, and market analysis content, are not detailed in available information. Professional-grade trading platforms often incorporate advanced order types, algorithmic trading capabilities, and risk management tools. Nevertheless, verification of Saen's technological infrastructure necessitates direct inquiry.

Research and analysis support, including fundamental analysis, economic calendars, and market commentary, represents crucial components of modern trading services. The absence of detailed information regarding these resources limits comprehensive evaluation of the broker's value proposition for active traders and investment professionals.

Automated trading support, expert advisor compatibility, and API access for institutional clients are not documented in publicly accessible materials. This requires direct verification for clients with specific technological requirements.

Customer Service and Support Analysis

Evaluation of Saen Options' customer service infrastructure faces significant constraints due to limited publicly available information regarding support channels, response times, and service quality metrics. Professional financial services providers typically maintain multiple contact methods, including telephone support, email correspondence, and live chat functionality. However, Saen's specific support architecture requires direct verification.

Response time expectations, escalation procedures, and problem resolution frameworks are not detailed in accessible documentation. Multi-lingual support capabilities, particularly important for international clients, are not specified in current materials.

Operating hours for customer service teams and regional support coverage remain unclear without direct broker contact. Service quality assessments typically rely on user feedback and independent reviews. Nevertheless, comprehensive customer testimonials and service evaluations are not readily available for Saen Options.

The absence of transparent information regarding customer service capabilities represents a notable limitation for potential clients evaluating broker selection criteria. Professional account management services, dedicated support representatives for high-volume traders, and specialized technical assistance programs require clarification through direct communication with the broker's service teams.

Trading Experience Analysis

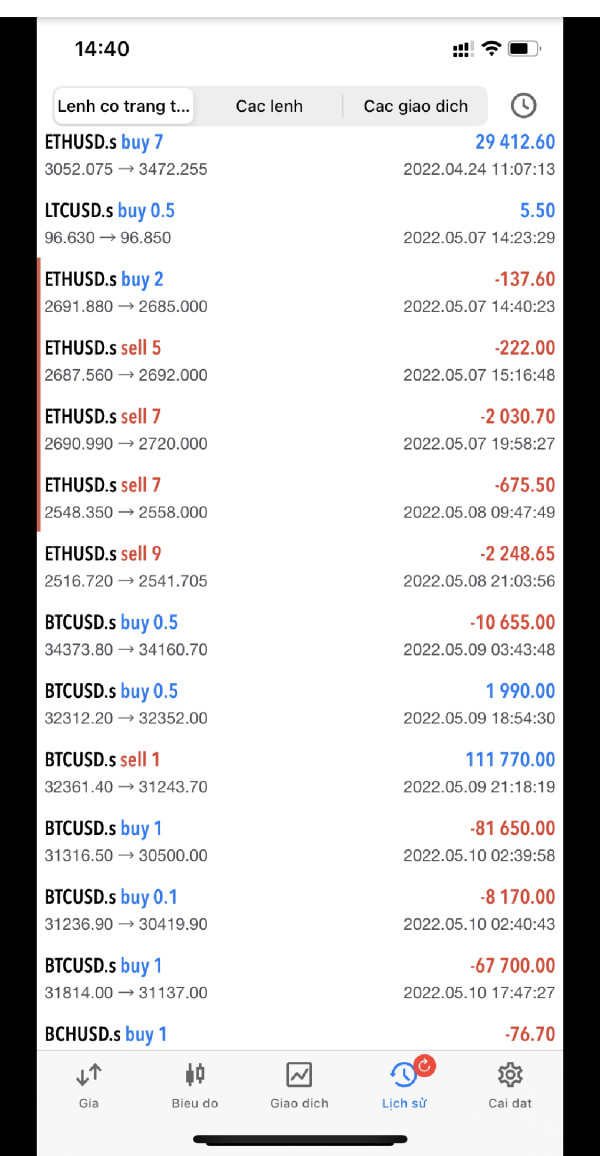

Assessment of the trading experience with Saen Options encounters substantial limitations due to insufficient information regarding platform stability, execution quality, and technological performance metrics. Modern trading platforms typically provide real-time market data, rapid order execution, and comprehensive charting capabilities. However, verification of Saen's specific technological infrastructure requires direct investigation.

Order execution quality, including fill rates, slippage characteristics, and rejection frequencies, represents crucial performance indicators for active traders. Platform stability during high-volatility periods and system uptime statistics are not documented in available sources. This limits comprehensive evaluation of operational reliability.

Mobile trading capabilities, cross-platform synchronization, and offline functionality are increasingly important for contemporary traders. Nevertheless, details regarding Saen's mobile infrastructure are not publicly available. User interface design, navigation efficiency, and customization options require direct platform evaluation to assess suitability for individual trading preferences.

This Saen review notes that trading environment quality, including market depth visibility, advanced order types, and risk management tools, necessitates hands-on platform evaluation to determine compatibility with specific trading strategies and operational requirements.

Trust Factor Analysis

Evaluation of Saen Options' trustworthiness encounters significant challenges due to limited publicly available information regarding regulatory oversight, compliance history, and industry standing. Trust assessment typically relies on regulatory licensing verification, financial stability indicators, and track record analysis. However, comprehensive documentation of these factors requires direct investigation.

Regulatory compliance status, including licensing authorities and supervisory oversight mechanisms, is not clearly detailed in accessible sources. Client fund protection measures, including segregated account structures and deposit insurance coverage, require verification through direct broker communication and regulatory database searches.

Company transparency regarding ownership structure, financial reporting, and operational governance is not comprehensively available in public materials. Industry reputation indicators, including regulatory actions, customer complaints, and professional recognition, are not documented in readily accessible sources.

Third-party verification of operational claims, independent auditing of financial statements, and regulatory filing compliance represent important trust indicators that require investigation through official channels and direct broker disclosure.

User Experience Analysis

Assessment of overall user satisfaction with Saen Options faces substantial limitations due to insufficient publicly available user feedback and experience documentation. Comprehensive user experience evaluation typically incorporates interface design assessment, operational efficiency metrics, and customer satisfaction surveys. However, such information is not readily accessible for this broker.

Platform usability, including navigation intuitiveness, feature accessibility, and learning curve considerations, requires direct hands-on evaluation to assess suitability for different user types. Registration and account verification processes, including documentation requirements and approval timelines, are not detailed in available sources.

Fund management experiences, including deposit processing times, withdrawal procedures, and payment method reliability, represent crucial user experience components that require verification through direct user testimonials and broker communication. Common user concerns and frequently reported issues are not documented in accessible review sources.

User demographic analysis and satisfaction metrics across different trader types would provide valuable insights for potential clients. However, such comprehensive feedback data is not currently available in public sources for meaningful analysis.

Conclusion

This Saen review reveals a capital markets company with limited publicly available information regarding operational specifics, regulatory oversight, and service offerings. While Saen Options maintains a presence in the Netherlands with a moderate employee base, the absence of comprehensive disclosure regarding trading conditions, platform capabilities, and regulatory compliance represents significant limitations for potential clients.

The broker may suit investors interested in exploring emerging or lesser-known market participants. However, such engagement requires exceptional due diligence and direct verification of all operational claims. Prospective clients should prioritize regulatory verification and comprehensive service documentation before considering any trading relationship.

Primary advantages include the company's established presence and moderate organizational scale. However, significant disadvantages encompass limited transparency, insufficient regulatory information, and minimal user feedback availability for informed decision-making.