Is SAEN safe?

Business

License

Is Saen Safe or Scam?

Introduction

Saen is a relatively new player in the forex market, claiming to offer a wide array of trading instruments and platforms. As the forex landscape continues to expand, it becomes increasingly crucial for traders to carefully evaluate the legitimacy and safety of brokers before committing their funds. The risks associated with trading can be significant, especially when dealing with unregulated or poorly regulated brokers. This article aims to provide a thorough analysis of Saen, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The investigation is based on multiple credible sources, including user reviews and regulatory databases, to ensure a well-rounded assessment of whether Saen is safe or a potential scam.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the forex industry. A broker's regulatory status can significantly impact the safety of traders' funds and the overall trading experience. Saen claims to operate out of the United Kingdom; however, it is essential to scrutinize its regulatory standing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Not Registered |

| NFA | N/A | United States | Not Registered |

Saen is currently unregulated, which poses a considerable risk to potential investors. The Financial Conduct Authority (FCA) mandates that all firms offering financial services in the UK must be registered. A search of the FCA's database reveals no record of Saen, indicating that it does not hold a valid license. Additionally, claims of being regulated by the National Futures Association (NFA) in the U.S. are also unfounded, as they are not a registered member. The absence of regulation raises significant concerns about the safety of funds and the operational integrity of the broker.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its credibility. Saen was reportedly established between 2021 and 2022, positioning itself as an experienced firm in the forex market. However, a lack of detailed information regarding its ownership and management raises red flags.

The company does not provide sufficient transparency about its operational history or the qualifications of its management team. This lack of clarity can be a significant warning sign, as reputable brokers typically disclose such information to build trust with their clients. Furthermore, the absence of legal documents, such as terms and conditions, further complicates the trustworthiness of this broker. Given its unregulated status and lack of transparency, it is fair to question whether Saen is safe for traders.

Trading Conditions Analysis

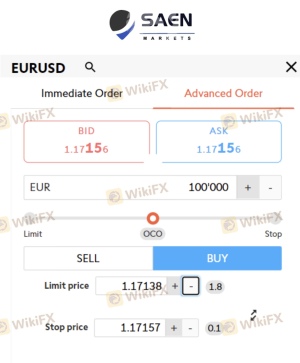

When evaluating a broker, understanding the trading conditions they offer is crucial. Saen claims to provide various trading instruments, including forex, CFDs, futures, and more. However, the overall fee structure and trading costs are essential factors that can affect profitability.

| Fee Type | Saen | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 0.3 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Saen advertises competitive spreads starting from 0.1 pips, the lack of clarity regarding commissions and overnight interest raises concerns. Traders have reported difficulties in withdrawing funds, suggesting that the broker may impose hidden fees or conditions that are not transparently disclosed. This lack of clarity further fuels speculation about the broker's legitimacy and whether Saen is safe for trading.

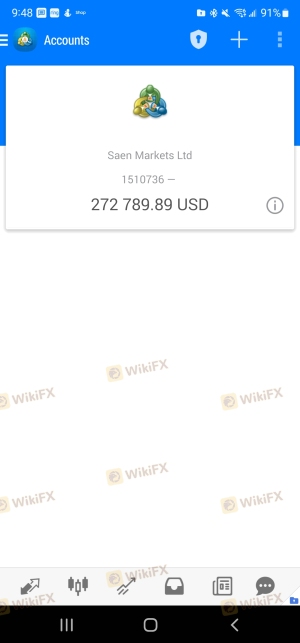

Client Fund Safety

The security of client funds is paramount when selecting a forex broker. Saen's lack of regulation is a significant concern, as unregulated brokers are not required to adhere to the same standards of fund protection as their regulated counterparts.

It is unclear whether Saen employs measures such as segregated accounts to protect client funds, which is a standard practice among regulated brokers. Furthermore, there are no indications of investor protection policies or negative balance protection, leaving clients vulnerable to significant financial losses. Historical complaints from traders regarding difficulties in accessing their funds further exacerbate concerns about the safety of investments with Saen. This raises the question: Is Saen safe for traders looking to invest their hard-earned money?

Customer Experience and Complaints

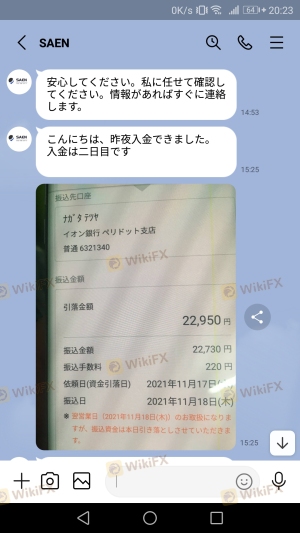

Customer feedback serves as a crucial indicator of a broker's reliability. In the case of Saen, numerous complaints have surfaced regarding withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Customer Support | Medium | Poor Communication |

| Transparency | High | Lacking Information |

Traders have reported instances of their withdrawal requests being delayed or denied altogether, leading to frustration and financial distress. In some cases, clients were asked to pay additional fees before they could access their funds, a common tactic used by fraudulent brokers. The lack of effective communication from customer support further compounds these issues, leading many to question whether Saen is safe for trading.

Platform and Execution

The trading platform is another critical aspect of the trading experience. Saen claims to offer the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, concerns have been raised regarding the platform's stability and execution quality.

Users have reported issues with order execution, including slippage and rejections, which can significantly affect trading outcomes. Furthermore, any signs of platform manipulation can be alarming for traders. Without a reliable trading environment, it becomes increasingly difficult to trust that Saen is safe for conducting trades.

Risk Assessment

Using an unregulated broker like Saen carries inherent risks that potential traders must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | Difficulty in accessing funds |

| Operational Risk | Medium | Potential for poor execution |

Given the high level of regulatory and financial risk associated with trading with Saen, potential traders should approach with caution. It is advisable to conduct thorough research and consider alternative brokers with established reputations and robust regulatory frameworks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Saen is not safe for traders. Its lack of regulation, transparency, and poor customer experiences raise significant concerns about the broker's legitimacy. For traders seeking a reliable and secure trading environment, it is recommended to explore alternative brokers that are well-regulated and have positive user feedback.

Overall, while Saen may offer attractive trading conditions, the risks associated with trading through an unregulated broker far outweigh the potential benefits. Traders should prioritize their safety and consider brokers with proven track records in the forex market.

Is SAEN a scam, or is it legit?

The latest exposure and evaluation content of SAEN brokers.

SAEN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SAEN latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.