Redfinance 2025 Review: Everything You Need to Know

In this comprehensive review of Redfinance, we explore the numerous concerns raised about this broker, which has been flagged as potentially fraudulent by various sources. With a lack of regulation and numerous user complaints, Redfinance appears to be a risky choice for traders looking for a reliable forex broker.

Note: The discrepancies between different entities operating under the same name across various regions are a significant concern. This review aims to provide a balanced and accurate overview based on available information.

Rating Overview

We evaluate brokers based on their regulatory status, user feedback, and the overall trading experience they offer.

Broker Overview

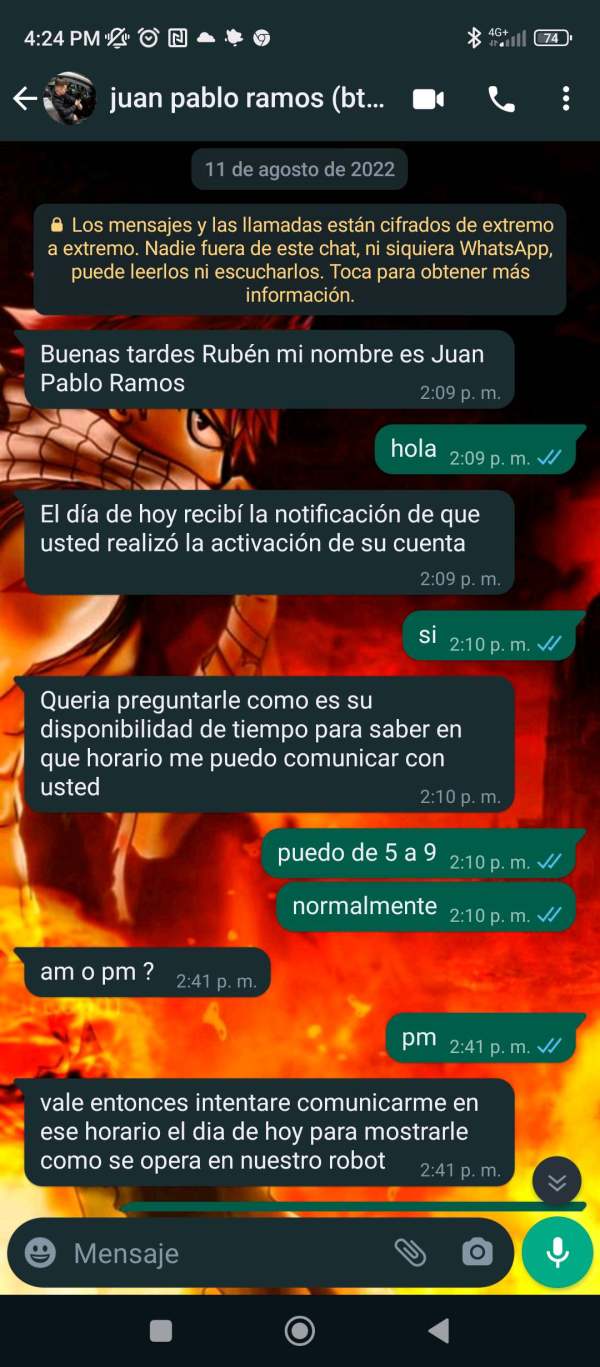

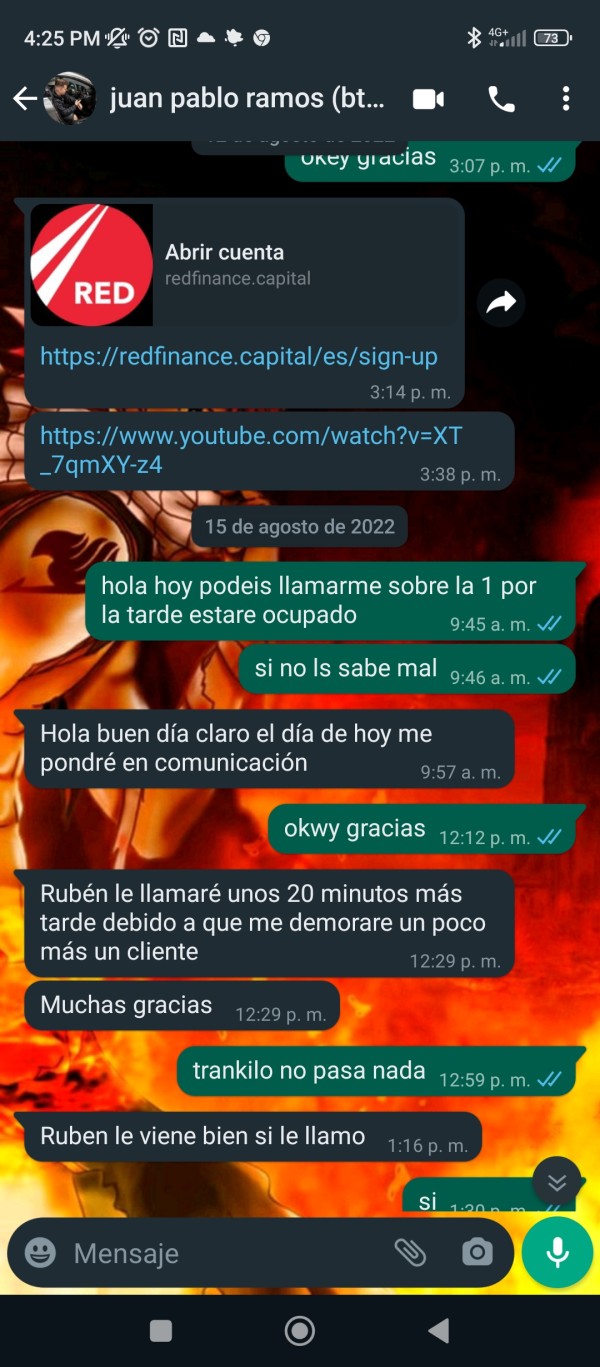

Redfinance, operated by Shenanigans Consulting Ltd, is based in Saint Vincent and the Grenadines. Established within the last few years, it has not obtained a license from any reputable regulatory authority, raising significant red flags regarding its legitimacy. The broker claims to offer a web-based trading platform, but it lacks the advanced features commonly found in industry-standard platforms like MetaTrader 4 or MetaTrader 5. Users can trade various asset classes, including forex, commodities, and equities, but the absence of a robust regulatory framework leaves clients' funds unprotected.

Detailed Section

Regulatory Status

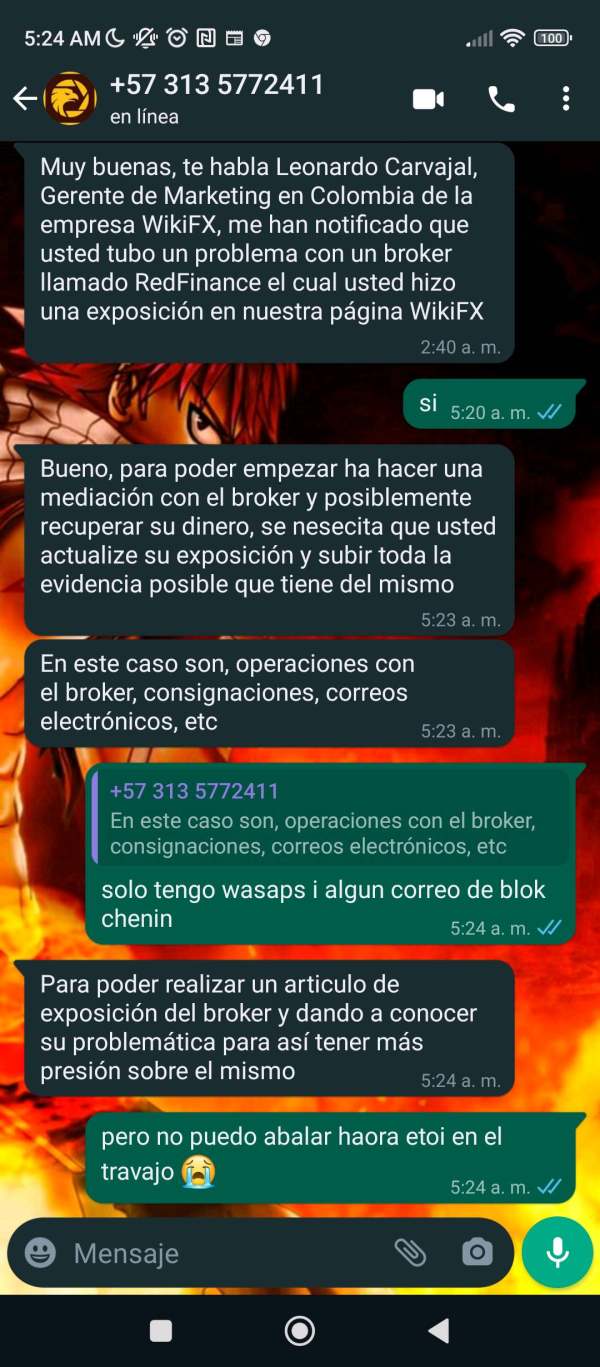

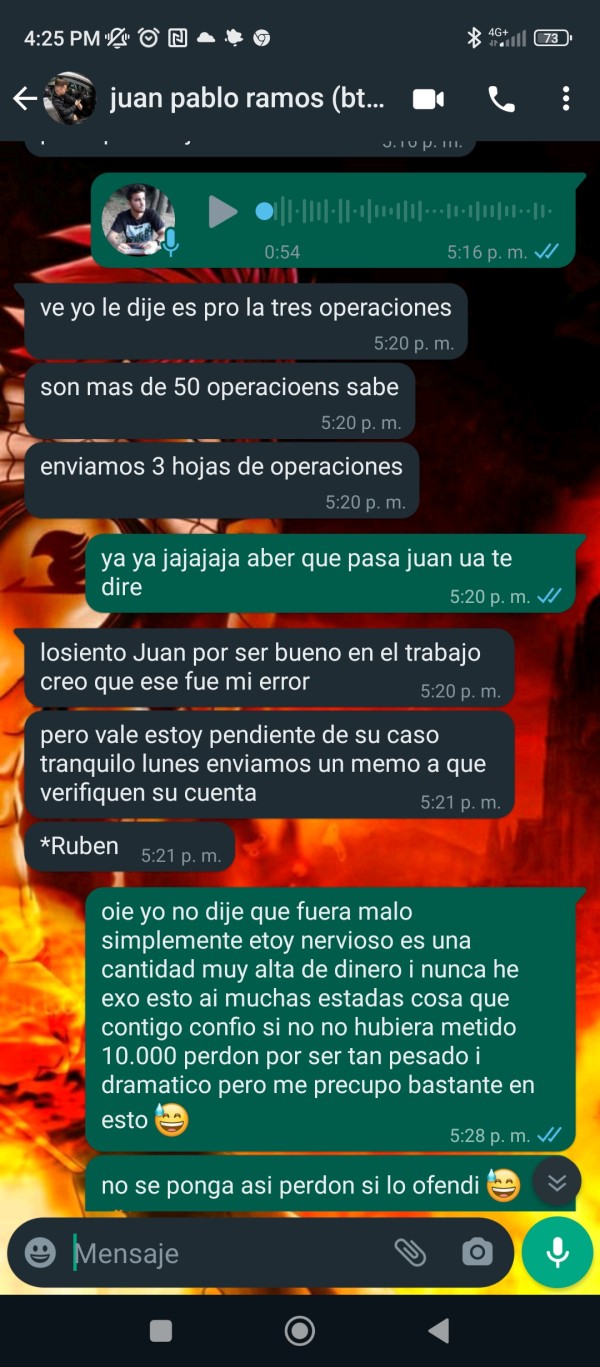

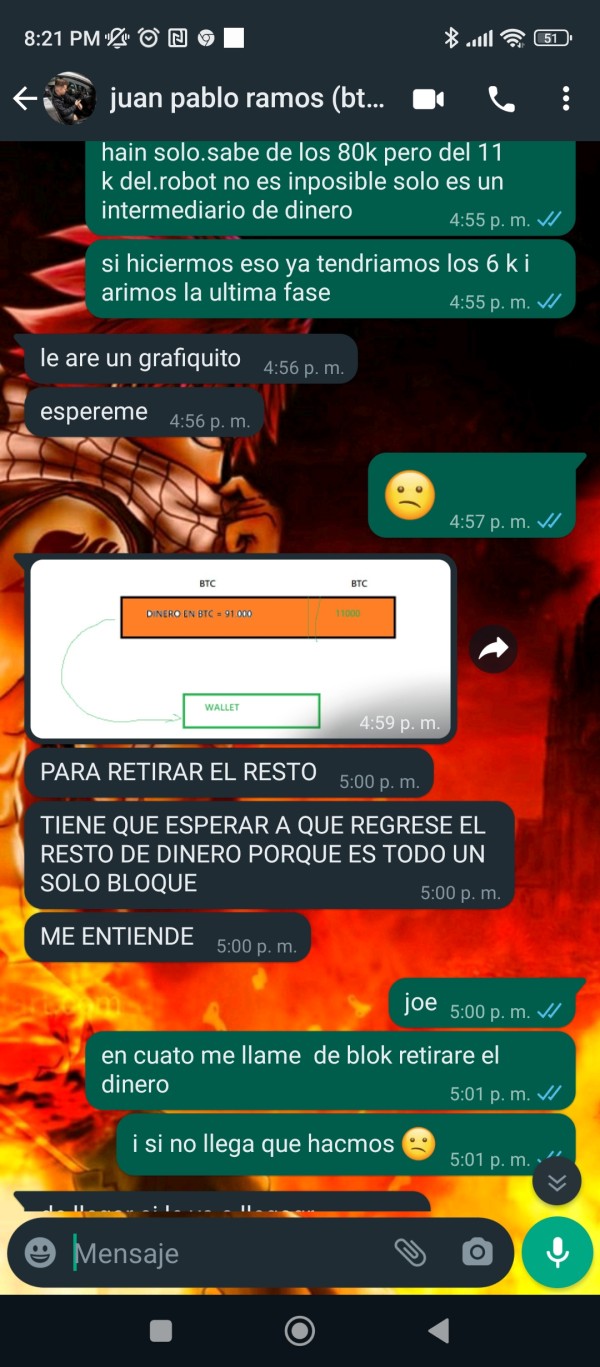

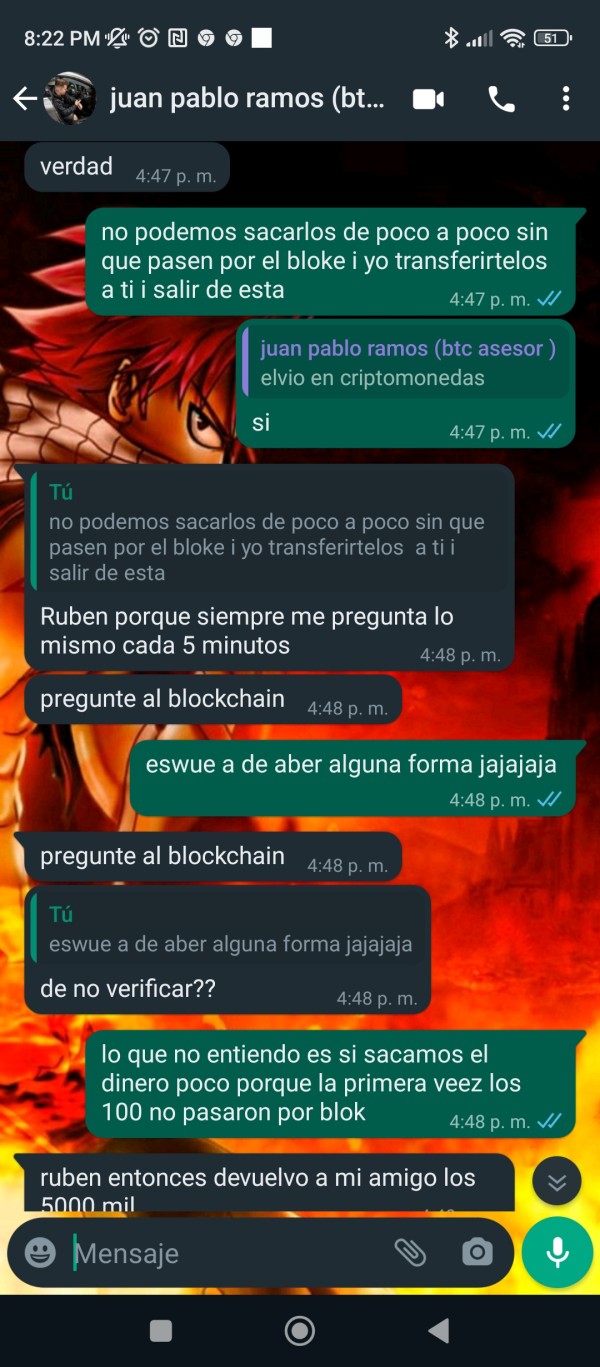

Redfinance operates as an unregulated broker, which poses serious risks for potential investors. According to multiple sources, including WikiFX, the broker is not licensed by any recognized financial authority, making it susceptible to fraudulent activities. The lack of regulatory oversight means that clients have limited recourse in the event of disputes or financial loss.

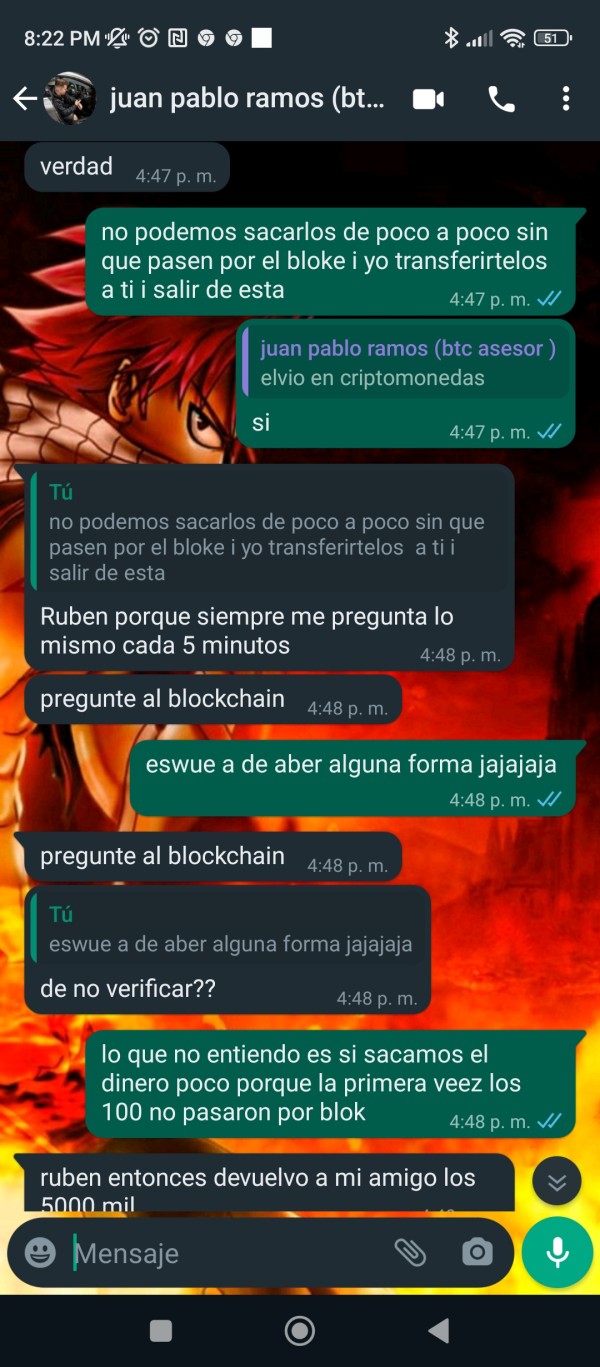

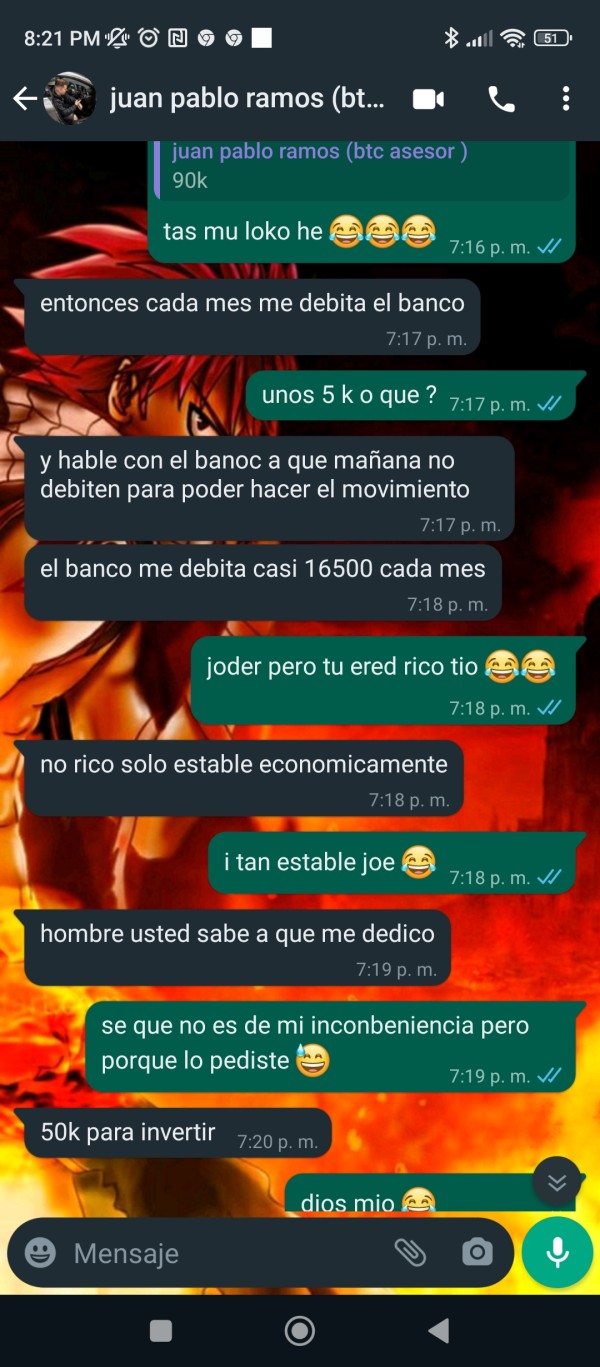

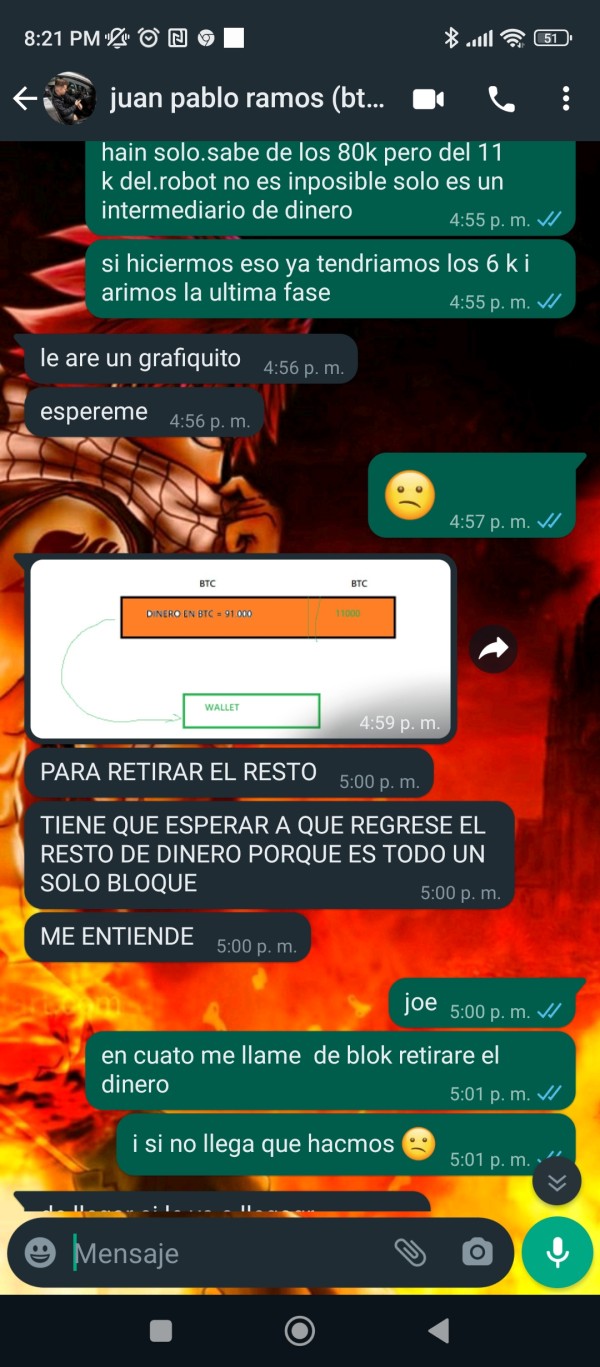

Deposit and Withdrawal Methods

Redfinance advertises multiple payment methods, including wire transfers and credit cards. However, sources indicate that the only functional method is cryptocurrency transactions, which are often irreversible and preferred by scammers to avoid chargebacks. According to Valforex, the absence of traditional payment options is concerning and limits users' ability to recover funds.

Minimum Deposit

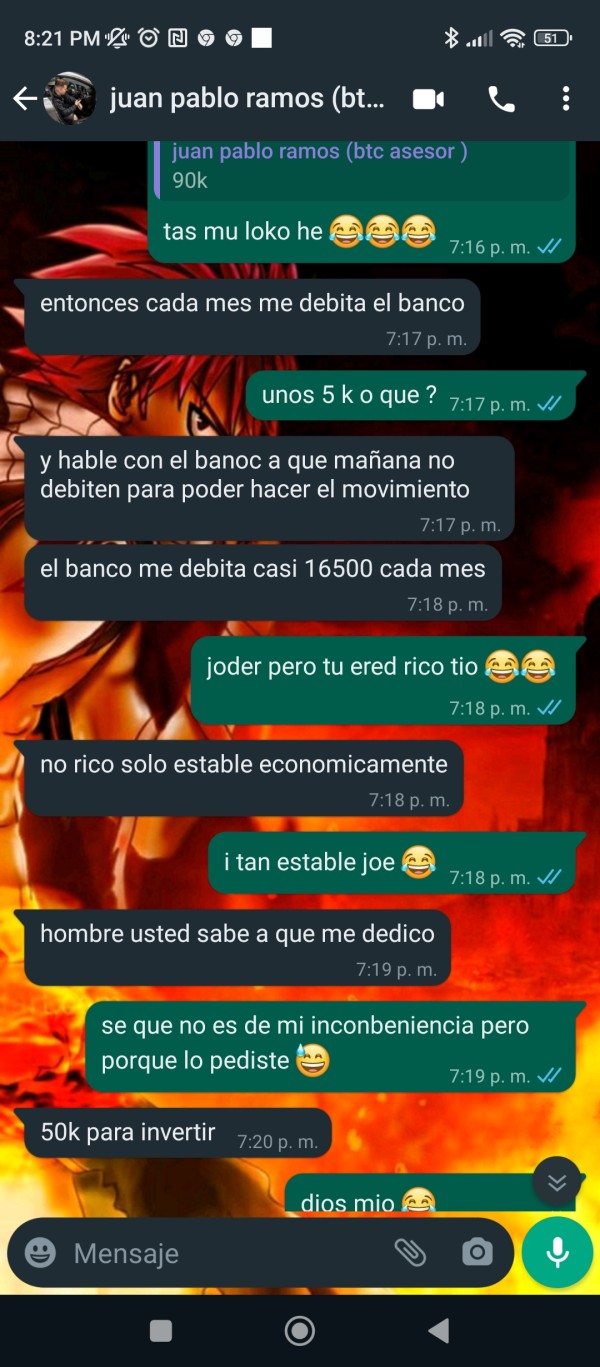

The minimum deposit required to open an account with Redfinance is $250, which is relatively standard for many brokers. However, this amount could be better spent with a regulated broker that offers similar or lower minimums with better protections. According to The Forex Review, the broker's high minimum deposit compared to its lack of services and regulatory backing is a significant drawback.

Redfinance's promotional offerings, including bonuses, come with stringent withdrawal conditions that are often deemed impossible to meet. Reports from Reliable Forex Broker indicate that clients may find themselves unable to withdraw their funds due to these excessive requirements, which is a common tactic employed by fraudulent brokers.

Asset Classes

Redfinance claims to offer a range of trading instruments, including forex pairs, commodities, and equities. However, the absence of cryptocurrencies, which are increasingly popular among traders, limits its appeal. According to Report Scam, this lack of diversity in asset classes further diminishes the broker's attractiveness to potential clients.

Costs (Spreads, Fees, Commissions)

The spreads offered by Redfinance are reported to be relatively high, with a typical spread of 3 pips on major currency pairs, which is more than double the industry average. This high cost of trading can significantly impact profitability, especially for retail traders who often rely on tight spreads to execute their strategies effectively. As noted by Valforex, the lack of transparency regarding fees and commissions is another red flag.

Leverage

Redfinance offers leverage up to 1:100, which is higher than what is permitted by many regulatory bodies in regions like the EU and UK, where leverage is capped at 1:30. While high leverage can amplify profits, it also increases the risk of substantial losses, making it a dangerous feature for inexperienced traders. According to WikiFX, this high leverage is a common tactic used by unregulated brokers to attract traders.

The broker utilizes a basic web-based trading platform, which lacks the advanced features and functionalities of leading platforms like MT4 or MT5. This limitation can hinder traders' ability to perform technical analysis and execute trades efficiently. As highlighted by The Forex Review, the platform's inadequacies are a significant concern for potential users.

Restricted Regions

Redfinance does not provide clear information regarding restricted regions, which is often a tactic used by unregulated brokers to avoid scrutiny. Potential clients should exercise caution, as trading with an unregulated entity can lead to significant financial losses.

Customer Support Languages

Customer support at Redfinance is reportedly lacking, with limited options for communication and no clear contact details provided. This absence of support can be detrimental for traders needing assistance, especially in a volatile market environment.

Rating Overview (Reiterated)

In conclusion, the overwhelming consensus from various reviews indicates that Redfinance is not a trustworthy broker. The lack of regulation, high trading costs, and numerous user complaints suggest that potential investors should exercise extreme caution and consider more reputable alternatives.