Atlasfx 2025 Review: Everything You Need to Know

Summary: Atlasfx has garnered a largely negative reputation among users and financial experts alike, primarily due to its lack of regulation and potential fraudulent activities. Key findings suggest that users face significant challenges in fund withdrawals and encounter poor customer service experiences.

Note: It is crucial to recognize that Atlasfx operates under different entities across various regions, which can complicate regulatory oversight and accountability. This review employs a balanced approach to present the most accurate information available.

Ratings Overview

We score brokers based on a combination of user reviews, expert opinions, and factual data.

Broker Overview

Founded in an undisclosed year, Atlasfx operates as an offshore broker based in Saint Vincent and the Grenadines, a region known for its lax regulatory environment. The broker claims to offer access to popular trading platforms like MetaTrader 4 (MT4) and a web-based trading solution. The asset classes available for trading include forex, commodities, indices, and cryptocurrencies. However, the lack of a legitimate regulatory body overseeing its operations raises substantial concerns about the safety of client funds.

Detailed Review

Regulatory Environment

Atlasfx is not regulated by any major financial authority, which raises significant red flags for potential investors. The Financial Conduct Authority (FCA) has issued warnings regarding Atlasfx, identifying it as a clone firm masquerading as a legitimate brokerage. This lack of oversight means that clients have little to no recourse in case of disputes or financial losses.

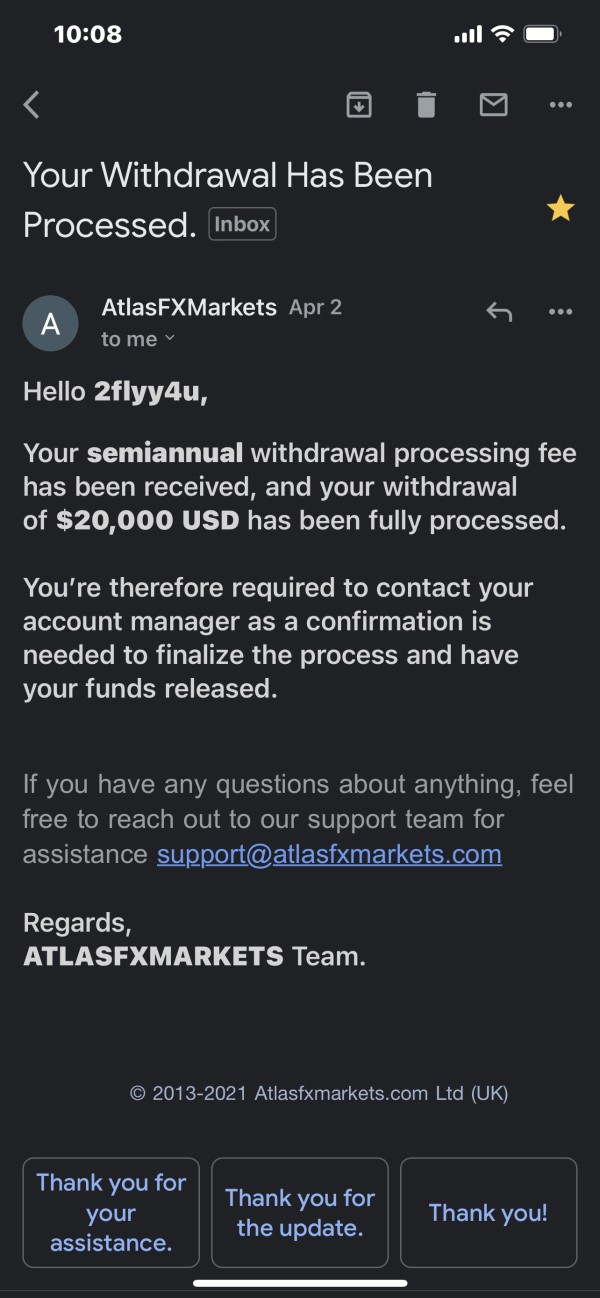

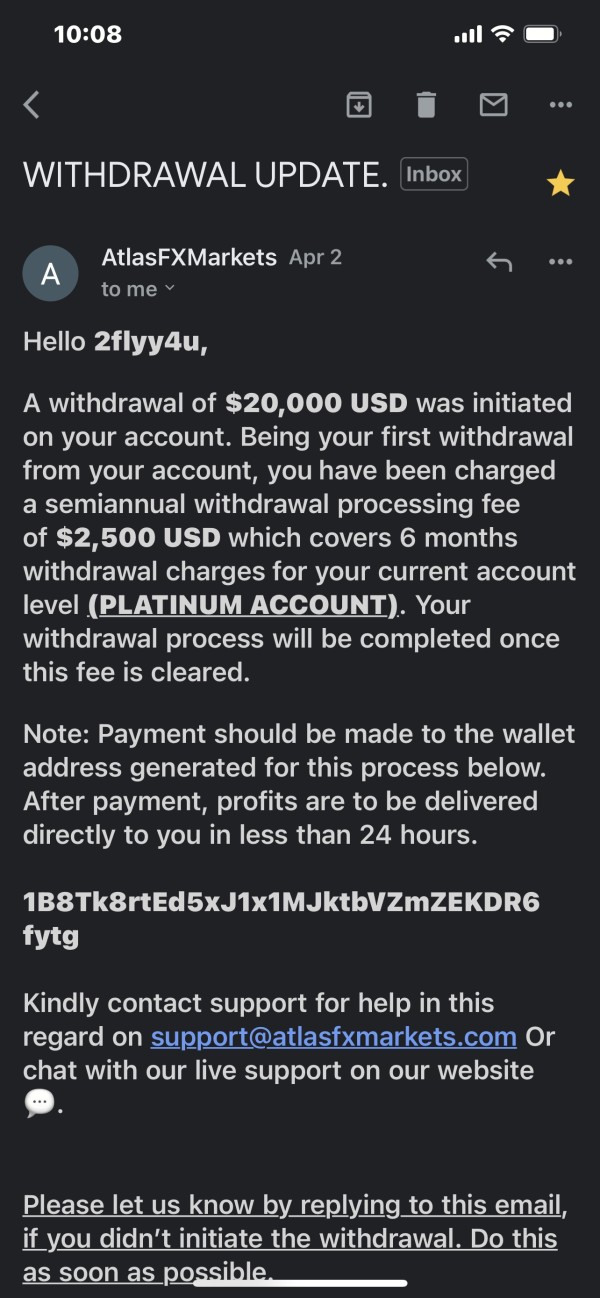

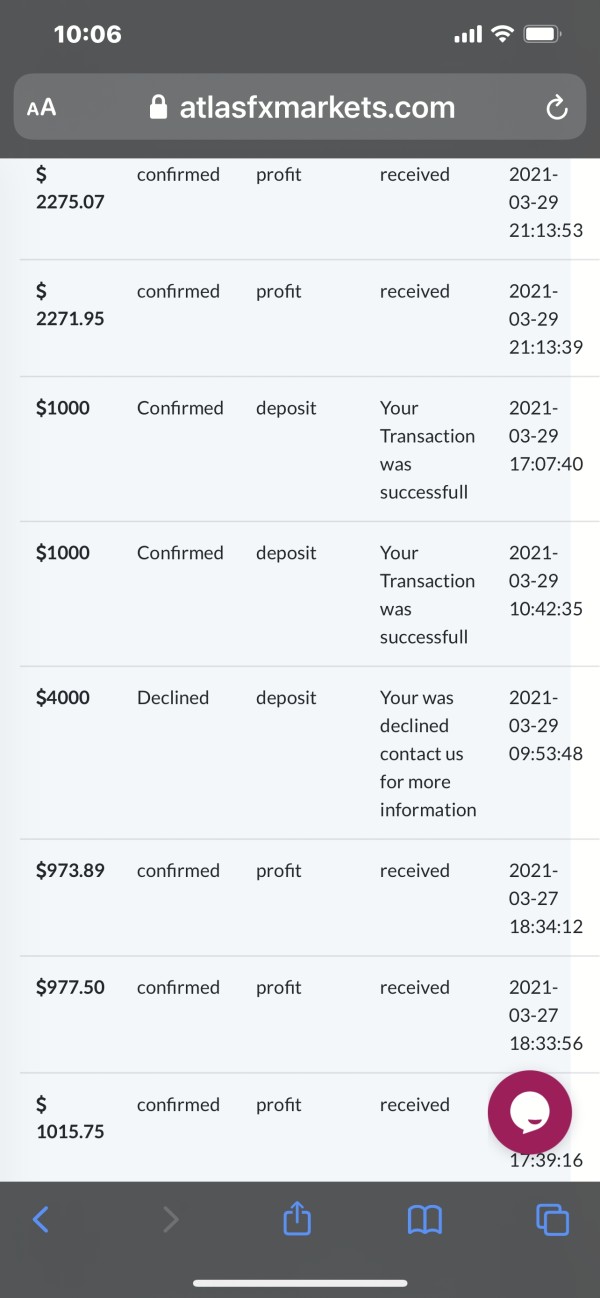

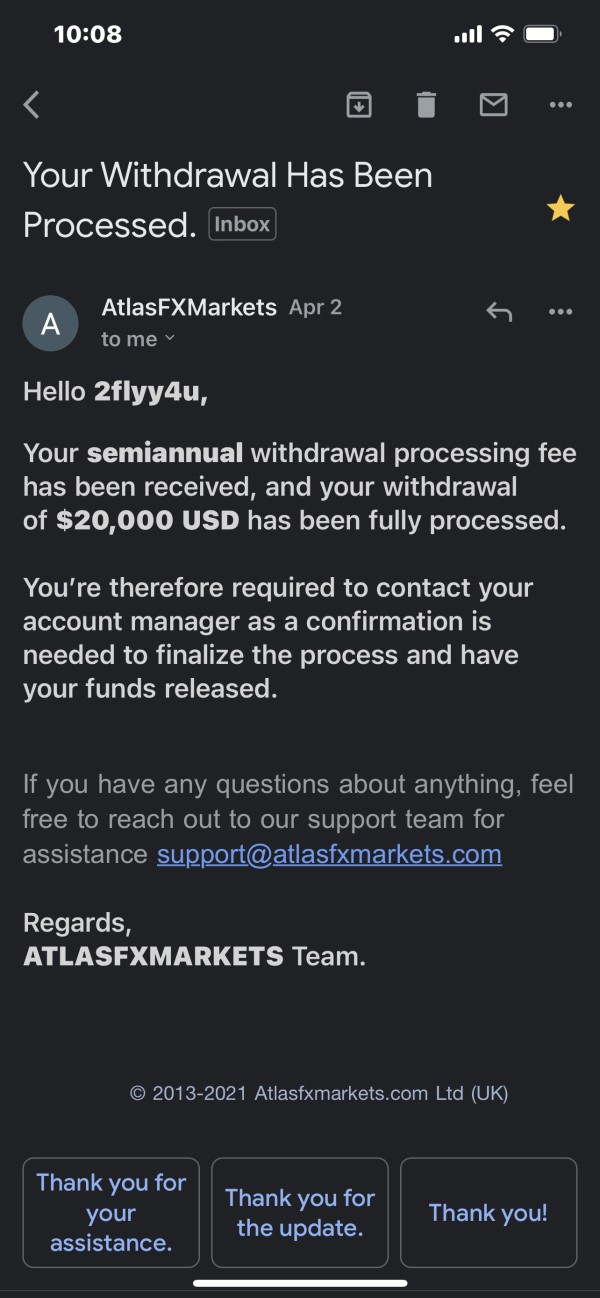

Deposit/Withdrawal Methods

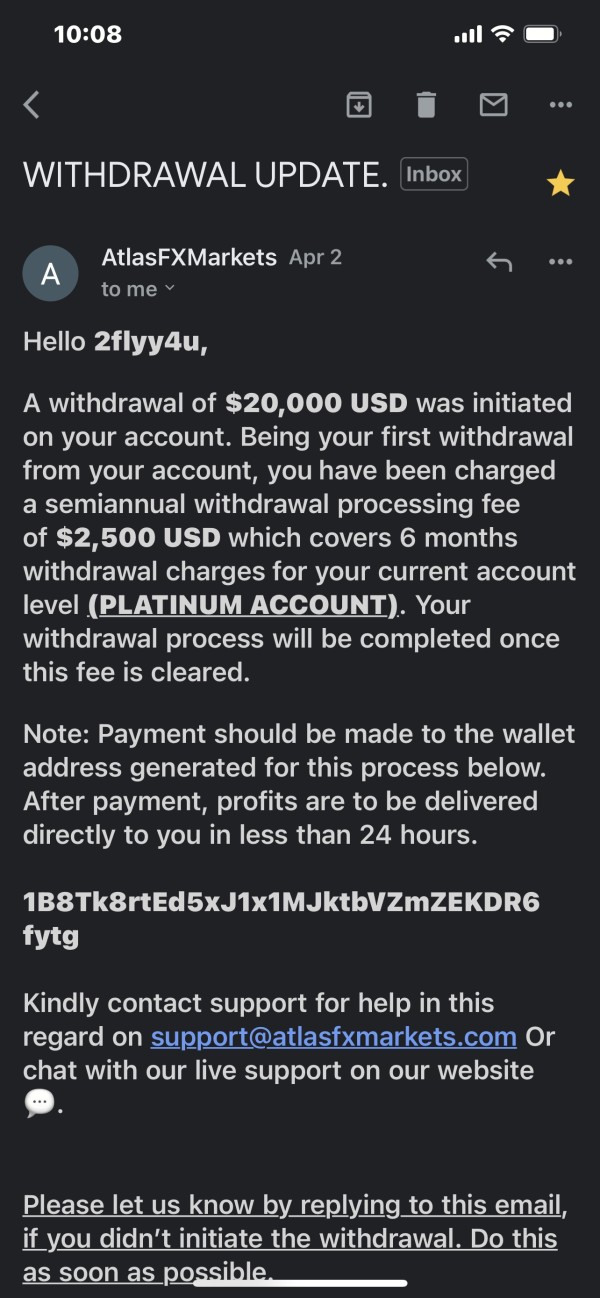

The broker requires a minimum deposit of $250 to open a starter account, which is notably high compared to many legitimate brokers that allow deposits as low as $1. Users have reported issues with fund withdrawals, often citing delays that can stretch for months. According to The Forex Review, the withdrawal process involves cumbersome steps that can frustrate clients.

While Atlasfx may advertise bonuses, it is essential to approach these offers with caution. Many of these promotions come with stringent conditions that can complicate withdrawal processes, making it difficult for traders to access their funds. Legitimate brokers typically do not offer such bonuses, which is a hallmark of potentially fraudulent operations.

Trading Costs

There is a lack of transparency regarding trading costs, such as spreads and commissions. Users have noted that the absence of clear information on costs further complicates the trading experience, as potential traders are left guessing about the true cost of trading with Atlasfx.

Leverage

Atlasfx offers leverage of up to 1:100, which is relatively standard in the industry. However, the absence of detailed information about the leverage structure raises further questions about the broker's transparency.

The primary trading platform offered by Atlasfx is MT4, a popular choice among traders for its robust features. However, some users have reported issues with accessing the platform due to broken links on the broker's website, which undermines the overall trading experience.

Restricted Regions

Atlasfx operates in various regions, but without proper regulation, it poses a risk to traders in jurisdictions where it is not authorized to operate. This lack of clarity regarding operational regions can lead to complications for users attempting to seek recourse.

Customer Support Languages

Customer support is reportedly lacking, with numerous users expressing dissatisfaction with the responsiveness and helpfulness of the support team. The absence of a physical address and direct contact numbers further exacerbates concerns regarding the broker's legitimacy.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions: The minimum deposit of $250 is unreasonably high for a broker with such a dubious reputation. Users have reported limited account types and poor conditions overall.

Tools and Resources: While the broker claims to offer useful tools, many users have found the resources inadequate and not user-friendly.

Customer Service and Support: This is perhaps the most glaring issue, with numerous reports of unresponsive and unhelpful support staff, leaving clients frustrated and without assistance when needed.

Trading Setup: The overall trading experience is marred by technical issues and a lack of transparency regarding costs, which can lead to unexpected losses.

Trustworthiness: Given the unregulated status and numerous negative reviews, Atlasfx is viewed as a high-risk option for traders.

User Experience: The combination of poor customer service, high deposit requirements, and a lack of regulatory oversight contributes to a negative user experience.

In conclusion, the Atlasfx review paints a concerning picture of a broker that operates with little regard for user safety or satisfaction. Potential investors are strongly advised to exercise caution and consider more reputable, regulated alternatives.