Rainbow Review 2

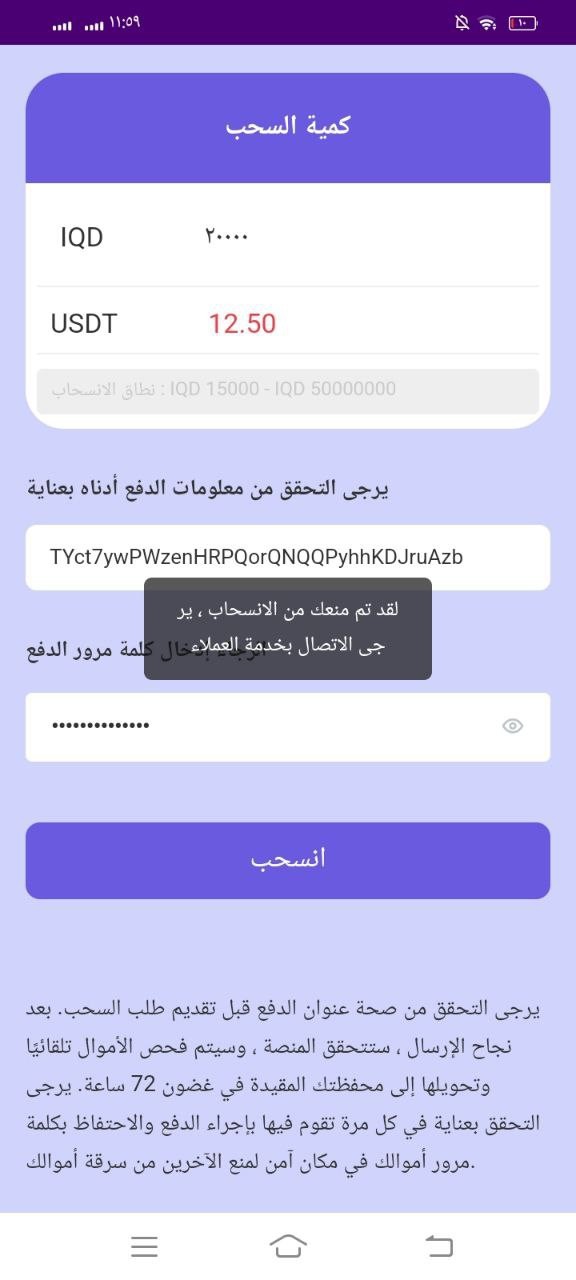

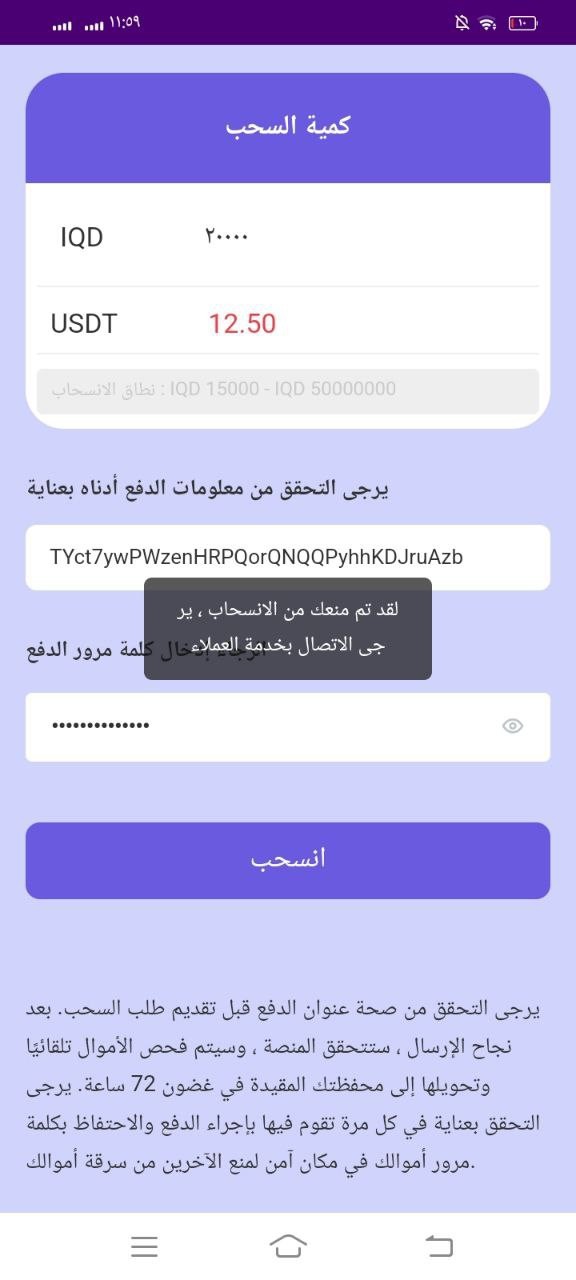

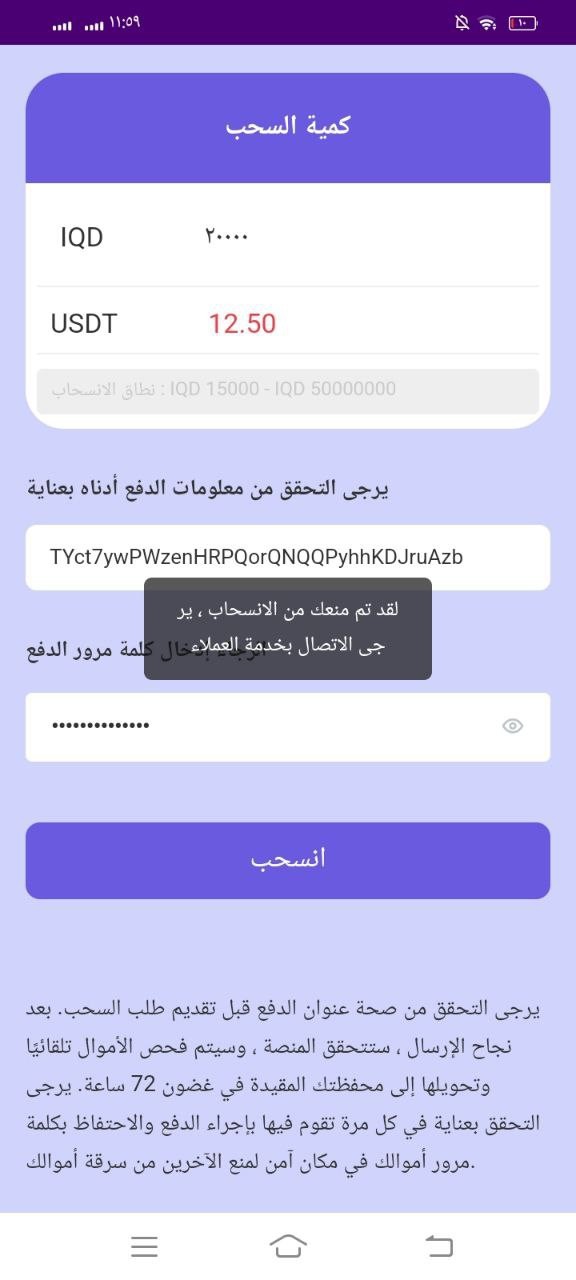

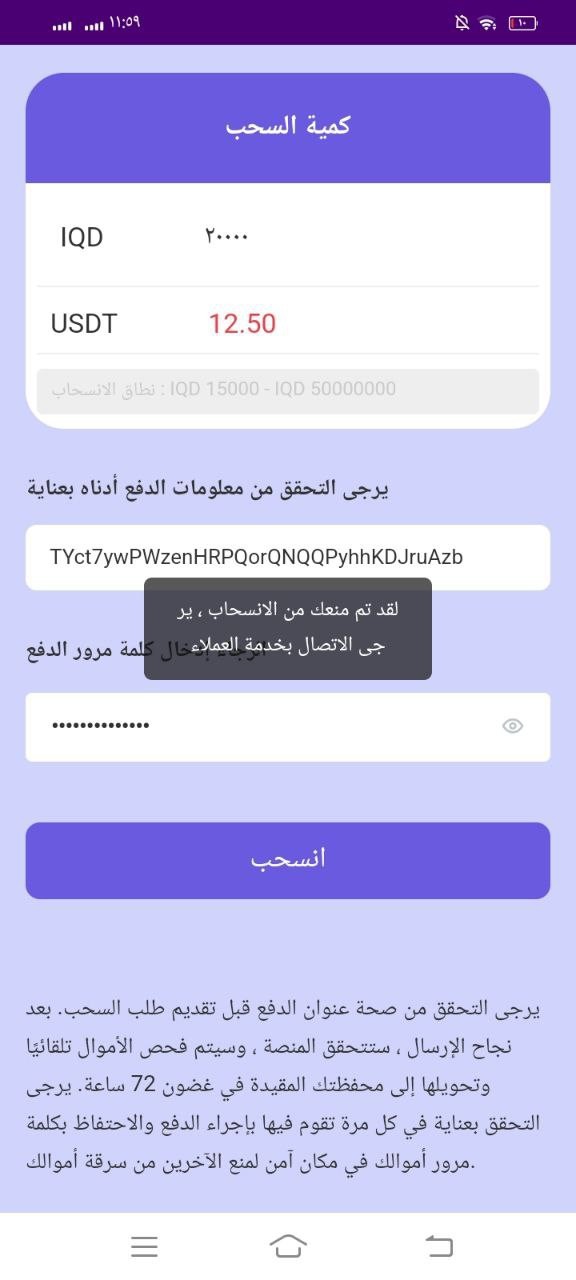

They wrote that payment has been made and no amount has reached the wallet

I was banned from withdrawing and my regional manager closed the account for more than 5 days

Rainbow Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

They wrote that payment has been made and no amount has reached the wallet

I was banned from withdrawing and my regional manager closed the account for more than 5 days

This detailed rainbow review gives you a complete look at Rainbow as a forex broker choice in 2025. Rainbow gets an overall rating of 4/10 based on what we found and user feedback, which means there are big problems that traders should worry about. The review shows that Rainbow doesn't give clear information about rules, trading conditions, and broker services that people need to make smart forex trading choices.

Rainbow's biggest problem is that it doesn't share clear information about regulations and detailed trading details that professional traders need. User feedback shows that people have bad experiences with many parts of their service, especially with how trades work and how good their customer support is. Rainbow seems to have different business parts like insurance and review services, but what they offer for forex trading is unclear and not well explained.

This broker might not be what you expect from forex trading since the information we found suggests they focus on other services instead of complete foreign exchange trading solutions. Traders who want regulated, clear, and well-documented trading conditions should think carefully about these problems before moving forward.

Rainbow doesn't share much regulatory information, so users in different countries may have different levels of legal protection and service options. The regulatory status and compliance measures are not clearly explained in available sources, which creates possible risks for international traders.

This review uses public information, user feedback, and market data that we could access when writing this. We have not tested their trading platforms or services directly, and traders should do their own research before making any investment decisions. You should carefully think about the lack of complete trading condition details and regulatory transparency when evaluating this broker.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 2/10 | Very Poor |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 3/10 | Poor |

| Trust Factor | 2/10 | Very Poor |

| User Experience | 3/10 | Poor |

| Overall Rating | 4/10 | Below Average |

Rainbow's business seems spread across many different areas, with parts including Rainbow Book Reviews that focuses on LGBTQ literature, Rainbow Vacuum that provides cleaning equipment, and Rainbow insurance brokerage that offers commercial insurance solutions. But the specific forex trading operations and company structure are unclear from the documentation we could find. The lack of a clear start date and complete company background makes us question what the broker's main focus is and how committed they are to forex services.

The business model for forex trading services is not clearly explained in available sources, making it hard to judge the broker's approach to market making, ECN services, or other trading methods. This lack of basic business information is a big transparency problem for potential clients who want reliable trading partnerships.

Rainbow doesn't clearly specify what trading platforms they offer, like MetaTrader 4 or MetaTrader 5 integration, based on what information we could find. The range of assets you can trade, including major currency pairs, commodities, indices, or cryptocurrency options, is not documented in sources we could access. Also, no specific regulatory oversight from major financial authorities such as the FCA, ASIC, or CySEC is mentioned in available materials, which is a critical gap in essential broker credentials.

Regulatory Jurisdictions: Available sources do not specify regulatory oversight from recognized financial authorities, creating uncertainty about compliance standards and investor protection measures.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available documentation.

Minimum Deposit Requirements: The initial funding requirements for account opening are not specified in accessible sources, making it difficult to assess accessibility for different trader segments.

Bonus and Promotional Offers: Current promotional programs, welcome bonuses, or trading incentives are not documented in available materials.

Available Trading Assets: The range of tradeable instruments, including forex pairs, commodities, indices, and other financial products, is not clearly specified in accessible sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in available documentation, making cost comparison challenging.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible sources, which is crucial information for risk management planning.

Platform Choices: Specific trading platforms, mobile applications, and web-based trading solutions are not detailed in available materials.

Geographic Restrictions: Information about service availability in different countries and jurisdictions is not clearly documented.

Customer Support Languages: The range of supported languages for customer service is not specified in available sources.

This rainbow review highlights the significant information gaps that potential traders should consider when evaluating this broker option.

The account conditions review for Rainbow shows big transparency problems that hurt the overall assessment. Available sources don't give clear information about account types, their specific features, or the differences between different service levels. This lack of detail makes it impossible for potential traders to understand what they would get when opening an account.

Minimum deposit requirements are not specified in documentation we could access, which stops traders from understanding the financial commitment needed to start trading. The account opening process, including verification requirements, documentation needs, and timeline expectations, is not documented in available sources.

Special account features like Islamic accounts for Muslim traders, professional account options, or institutional services are not mentioned in available materials. This lack of detailed account information creates a big barrier for traders who want to understand their options before committing to the platform.

User feedback suggests general unhappiness with account-related services, though specific details about account management, funding processes, and account maintenance are not well-documented. The overall lack of transparency in account conditions adds to the low rating in this category and raises concerns about the broker's commitment to client service clarity.

This rainbow review emphasizes the importance of clear account condition documentation, which appears to be lacking in Rainbow's current offerings.

The tools and resources category gets one of the lowest scores in this evaluation because there's no information about trading tools, analytical resources, and educational materials. Available sources don't mention any proprietary or third-party trading tools that would make the trading experience better for clients.

Research and analysis resources, which are essential for smart trading decisions, are not documented in materials we could access. This includes no market analysis, economic calendars, news feeds, or expert commentary that traders typically expect from professional brokers.

Educational resources like trading guides, webinars, video tutorials, or market education programs are not mentioned in available sources. For new traders especially, the lack of educational support is a big disadvantage when compared to more complete broker offerings.

Automated trading support, including expert advisors, trading robots, or algorithmic trading capabilities, is not specified in available documentation. This absence limits the appeal for more advanced traders seeking sophisticated trading solutions.

The extremely low rating in this category reflects the apparent lack of value-added services that modern forex traders expect from their broker relationships.

Customer service evaluation for Rainbow shows mixed results based on limited available feedback. While this category gets a slightly higher score than others, big concerns remain about service quality and availability. User reports suggest that customer service responsiveness and effectiveness don't meet industry standards.

Available sources don't specify the customer service channels offered, like live chat, phone support, email assistance, or help desk systems. Response time expectations and service level agreements are not documented, making it difficult for potential clients to understand support availability.

Service quality feedback from users shows below-average experiences, with reports suggesting that issue resolution and customer assistance don't consistently meet client expectations. However, specific examples of service failures or success stories are not detailed in available sources.

Multi-language support capabilities are not specified in documentation we could access, which may limit service accessibility for international clients. Additionally, customer service hours and timezone coverage are not clearly communicated.

The moderate rating in this category reflects the general user dissatisfaction while acknowledging that some level of customer service appears to be available, though its quality and scope remain questionable.

The trading experience evaluation shows big concerns based on available user feedback and the lack of detailed platform information. Users report issues with order execution quality, including problems with slippage and requoting that can negatively impact trading performance and profitability.

Platform stability and execution speed appear to be problematic based on user reports, though specific performance metrics and uptime statistics are not available in sources we could access. These technical issues can be particularly problematic for active traders who require reliable platform performance.

The completeness of platform functionality cannot be properly assessed due to the lack of detailed platform specifications in available documentation. Essential features like one-click trading, advanced order types, and risk management tools are not clearly described.

Mobile trading experience and application quality are not documented in available sources, which is increasingly important for traders who require on-the-go access to their accounts and positions. The overall trading environment appears to receive negative feedback from users, contributing to the low rating in this category.

The combination of execution issues and limited platform information creates significant concerns about the quality of the trading experience. This rainbow review highlights that trading experience represents one of the most critical areas needing improvement for Rainbow's forex services.

The trust factor evaluation gets the lowest rating due to fundamental concerns about regulatory oversight and transparency. Available sources don't provide information about regulatory licenses from recognized financial authorities, which represents a critical gap in essential broker credentials.

Fund security measures, including client money segregation, deposit protection schemes, and financial safeguards, are not documented in sources we could access. This absence of security information raises significant concerns about client fund protection and operational safety.

Company transparency regarding ownership, management, financial statements, and operational procedures is notably lacking in available documentation. Professional traders typically require this information to assess broker reliability and stability.

Industry reputation and third-party recognition are not evident in available sources, with no mention of awards, certifications, or positive industry acknowledgments that would support credibility claims. The handling of negative events, complaints, or regulatory issues is not documented, making it impossible to assess how the company manages challenges or disputes.

This lack of transparency contributes significantly to the very low trust factor rating.

User experience evaluation shows consistently negative feedback across available sources, though specific details about interface design and usability are limited. Overall user satisfaction appears to be below industry standards based on the available rating of 4/10 from user feedback.

Interface design quality, navigation ease, and platform usability are not specifically detailed in available sources, making it difficult to assess the technical quality of user-facing systems. Modern traders expect intuitive, well-designed interfaces that facilitate efficient trading activities.

Registration and account verification processes are not clearly documented, which can create uncertainty for potential clients about onboarding requirements and timelines. Smooth account opening procedures are essential for positive first impressions.

Fund management operations, including deposit and withdrawal experiences, are not detailed in available sources. User experiences with money movement processes significantly impact overall satisfaction and platform usability.

Common user complaints appear to focus on general service quality issues, though specific feedback categories are not well-documented. The negative user feedback contributes to the low rating in this category and suggests systemic issues with service delivery.

The user demographic appears to potentially include individuals seeking LGBTQ-related resources rather than traditional forex trading services, which may indicate a mismatch between service offerings and trader expectations.

This comprehensive rainbow review reveals significant concerns about Rainbow as a forex broker option for 2025. With an overall rating of 4/10, the evaluation highlights substantial transparency issues, lack of regulatory clarity, and below-average user experiences across multiple service categories. The absence of detailed trading conditions, platform specifications, and regulatory oversight creates considerable uncertainty for potential clients.

Rainbow may be more suitable for individuals seeking LGBTQ-related resources or alternative services rather than professional forex trading solutions. Traditional forex traders should carefully consider the documented limitations before proceeding with this broker option.

The primary disadvantages include lack of regulatory transparency, absence of detailed trading conditions, poor user feedback, and insufficient documentation of essential broker services. Until these fundamental issues are addressed, traders may benefit from exploring more established and transparent broker alternatives in the competitive forex market.

FX Broker Capital Trading Markets Review