SG Review 6

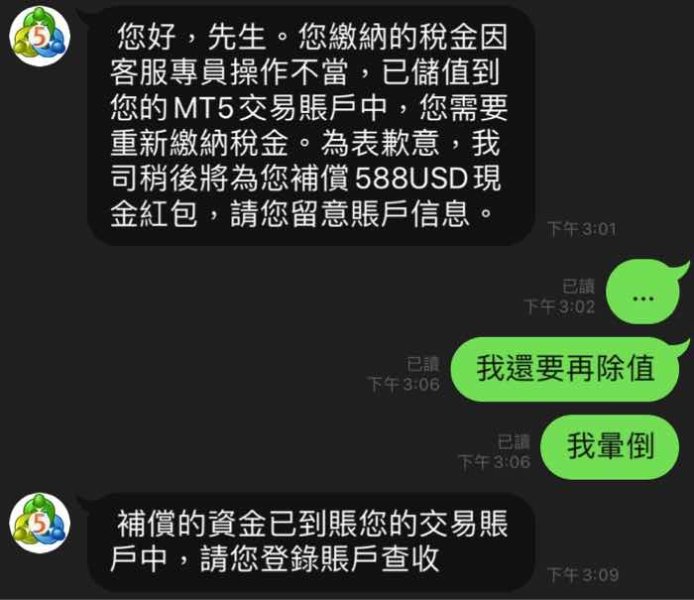

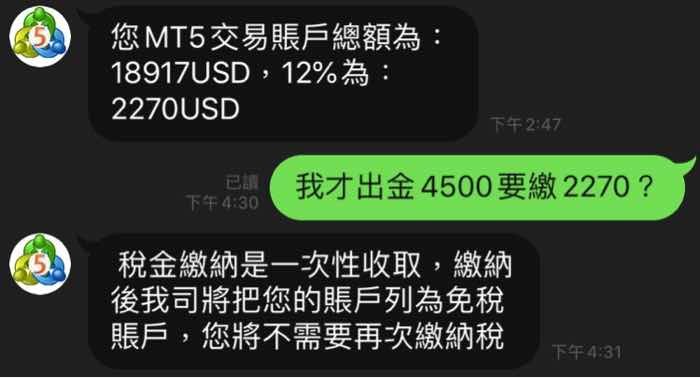

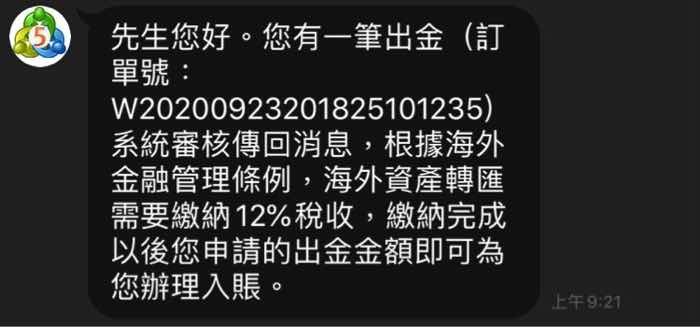

They add customer on LINE first. After gaining trust, they ask customer to deposit and invest, saying that they can make more money. When customer finds something wrong and wants to withdraw money, they would ask for a payment before withdrawal. Later, they would ask for one more payment because the first goes into wrong account. Then, they threaten customer to pay back the money that they borrowed from you. Customer will be blocked at last, and the money never comes back. They control all the accounts and deceive customers.

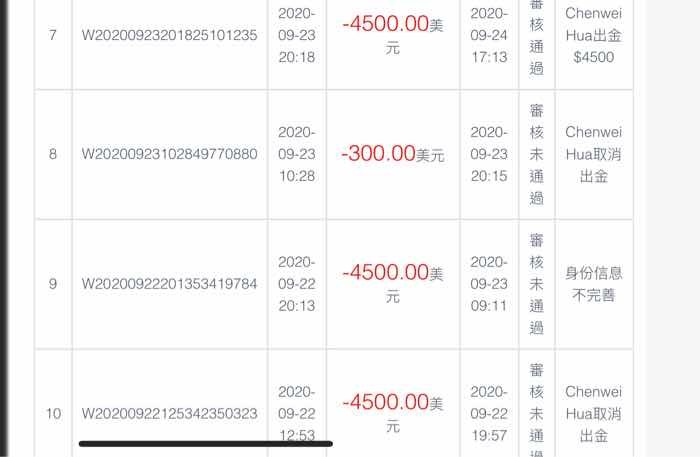

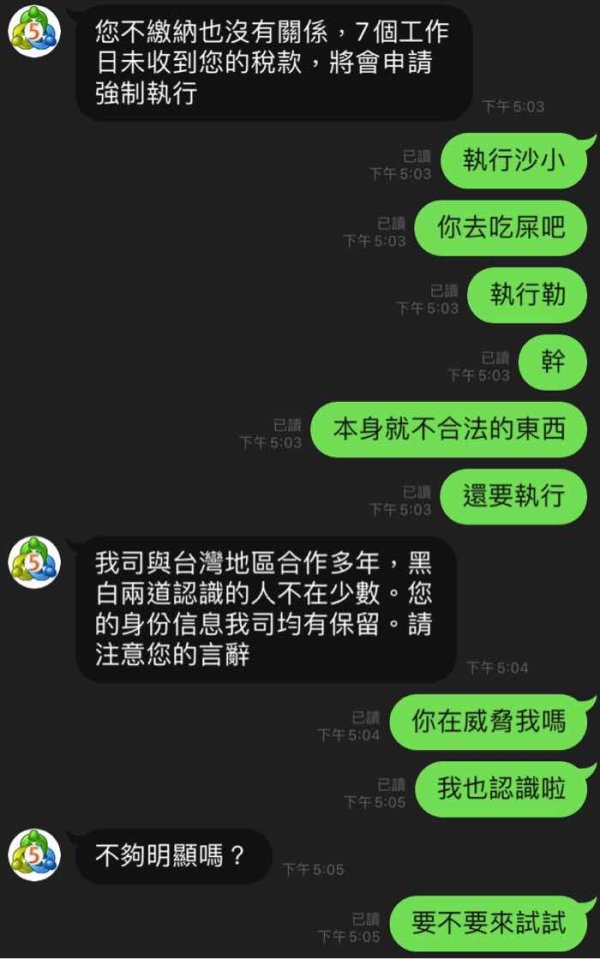

I knew a male net friend via Pairs. She said she want to add my Line to chat. Then she said that she taught me to invest Forex after a period of time. At first, I opened a demo account and e-wallet so that I can deposit or withdraw easily. I profited when I followed her operations. Then she said the market will be in a bullish mood after the release of US NFP and asked me to open an account and deposit. Then I followed her to manage my account. There was a severe loss one time, I want to close my position but she said if I hang on I can profit. I said I didn’t have money to deposit. She asked her uncle to lend me NT$1 million. I should return NT$100,000 next day and NT$800,000 next week. I profited after that so I didn’t suspect. I transferred 6000usdt to the MT5 account that she designated through e-wallet. It weirds me out more and more after that. I searched on the internet, which said it was a famous platform. I knew the deposit account of this company was listed as a warning account after I had called the police on 9/11. I applied for withdrawal at the same time and told that girl she was cheating me. She denied and asked me to return NT$800,000 on 9/14 or her uncle would play rough. The customer service contacted me today, 9/14 and said I had loan dispute with that girl. If I can’t solve this matter properly, my account would be frozen. Of course I didn’t coordinate with them, so my account was frozen by that fake customer service in the end.

I tried to log in to their website in the morning, but I found out my account was deleted. I could log in several weeks ago. They don't want to handle the problems so they delete my account.

The wrong information on last July 11 made me fell afflicted. The withdrawal process was smoothly during July to November. But they deleted me on 22nd and then the withdrawal becomes unavailable after 28th.

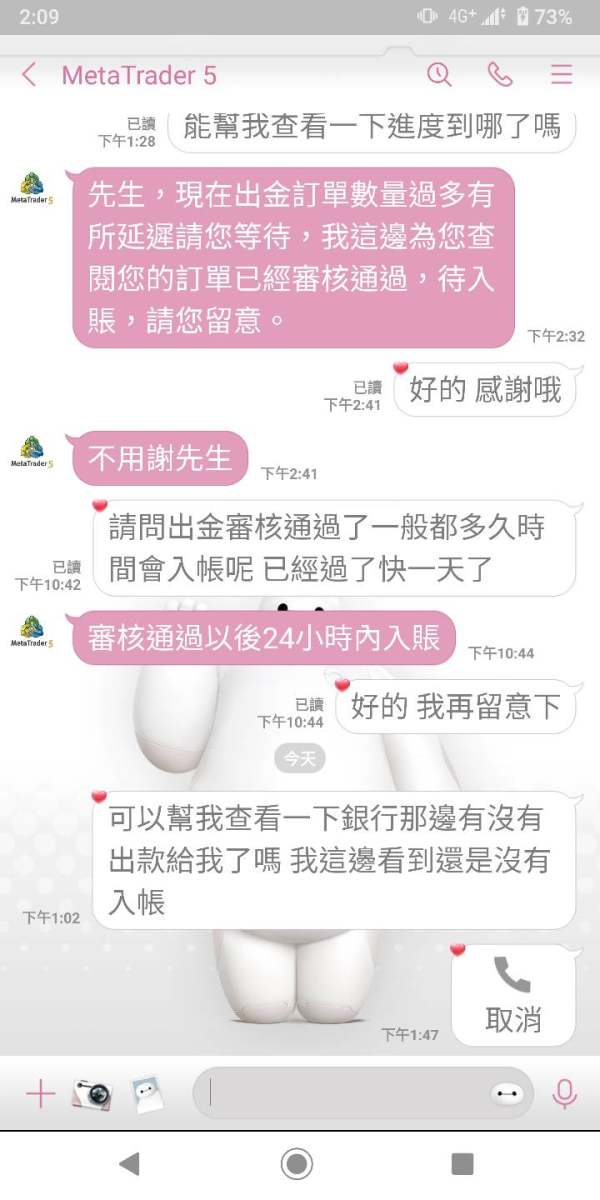

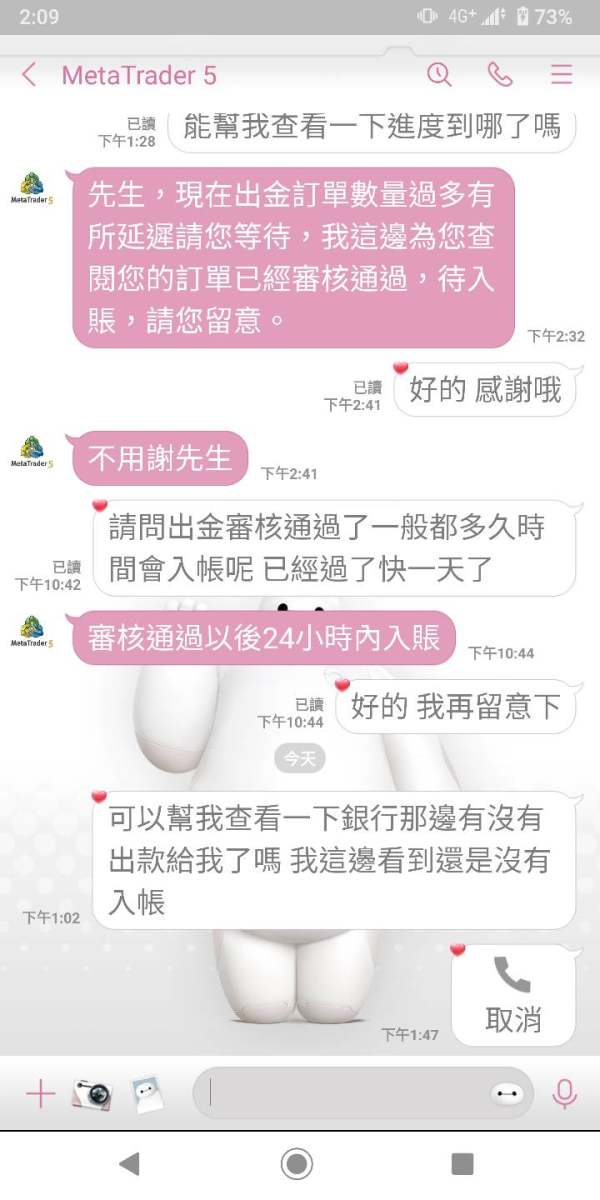

The withdrawal applied on July 2nd was approved on 7th. But the fund is yet to be received. I caution you against it.

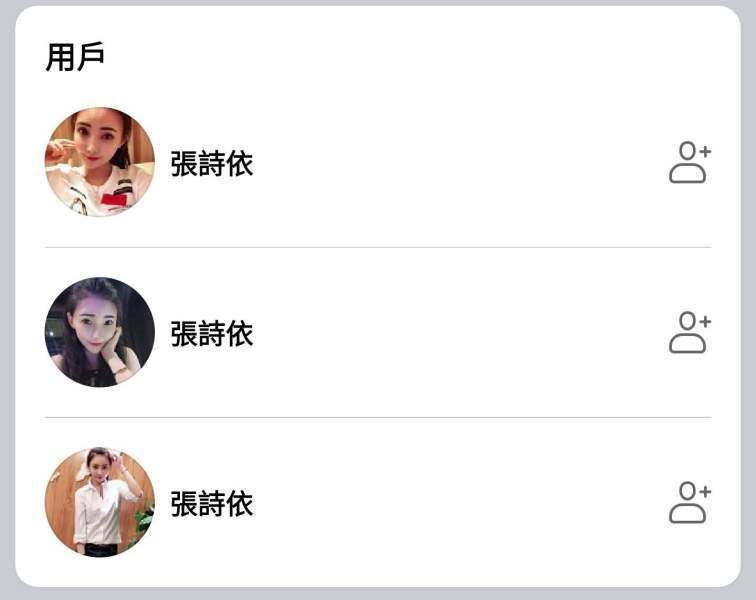

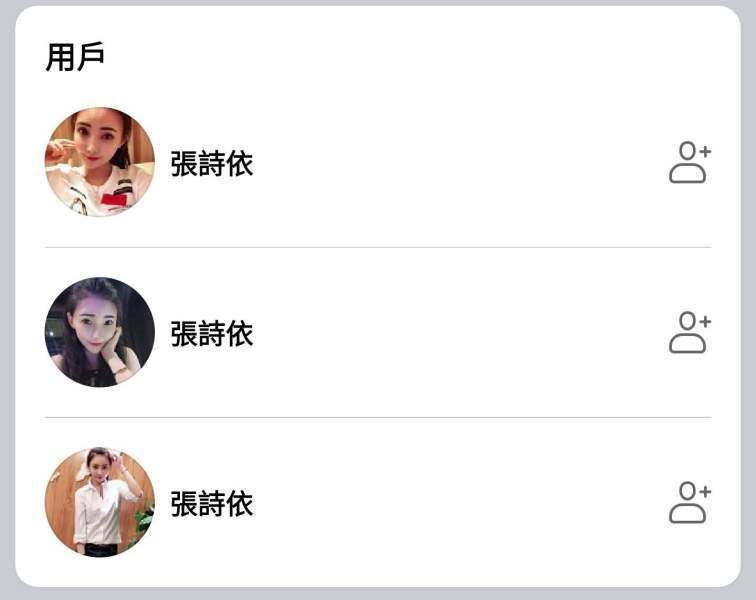

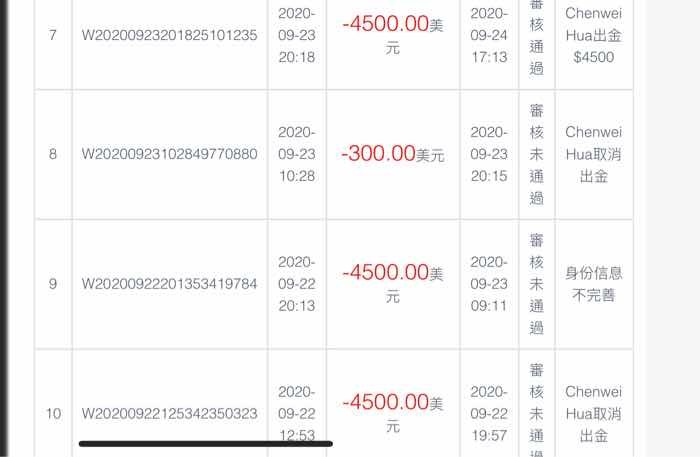

The withdrawal applied on June 20th is yet to be received, albeit successful process. The person in the following pic, used different accounts, only to covet your fund.