IFC Markets 2025 Review: Everything You Need to Know

Executive Summary

IFC Markets is an international Forex and CFD broker that has been operating since 2006. It offers trading services to clients worldwide. This ifc markets review reveals a broker with mixed user feedback and a moderate overall rating. Based on available data from multiple sources, IFC Markets receives a user rating of 3.6 out of 5 from 544 reviews. This indicates generally neutral customer satisfaction levels.

The broker's key strengths include its diverse range of trading platforms. These feature MetaTrader 4, MetaTrader 5, NetTradeX, and WebTerminal options. IFC Markets provides access to over 650 trading instruments across various asset classes. These include forex pairs, stocks, indices, commodities, and unique synthetic options through their proprietary GeWorko Method. The platform caters to traders of all experience levels. It serves beginners seeking straightforward trading solutions and experienced traders requiring advanced tools and features.

The broker operates under regulatory oversight from the BVI Financial Services Commission and the Cyprus Securities and Exchange Commission. This provides a framework for client protection. However, according to industry analysis, these are classified as Tier-3 regulators. This may raise considerations for traders prioritizing regulatory strength. IFC Markets offers multiple account types including Standard, Beginner, MT4/MT5 Standard, and Micro accounts. These are designed to accommodate different trading preferences and capital requirements.

Important Disclaimer

IFC Markets operates through different entities across various jurisdictions. Each is subject to distinct regulatory frameworks. The primary regulatory bodies overseeing IFC Markets include the BVI Financial Services Commission and the Cyprus Securities and Exchange Commission (CySEC). Traders should verify which specific entity serves their region and understand the applicable regulatory protections.

This review is based on publicly available information, user feedback from various platforms, and official broker documentation available at the time of writing. Market conditions, regulatory requirements, and broker offerings may change. Prospective clients should conduct their own due diligence before making trading decisions. The analysis presented here reflects the most current information available from multiple sources and user testimonials.

Rating Framework

Broker Overview

IFC Markets established its operations in 2006. It has built its reputation as an international forex and CFD broker over nearly two decades in the financial markets. According to multiple sources, the company is headquartered in Armenia and has expanded its services globally. It focuses on providing comprehensive trading solutions for retail and institutional clients. The broker's business model centers on offering access to global financial markets through advanced trading platforms and a diverse range of financial instruments.

The company has positioned itself as a technology-forward broker. It emphasizes innovation in its platform offerings and trading tools. IFC Markets operates primarily as a market maker, providing liquidity for client trades across its extensive instrument catalog. The broker's approach combines traditional forex trading with modern CFD products. This allows clients to trade on price movements across various asset classes without owning the underlying assets.

IFC Markets supports its operations through multiple trading platforms. These include the industry-standard MetaTrader 4 and MetaTrader 5 platforms, alongside its proprietary NetTradeX platform and web-based WebTerminal. This ifc markets review finds that the broker offers access to over 650 trading instruments spanning major and minor currency pairs, global stock indices, individual company shares, precious metals, energy commodities, and innovative synthetic instruments created through their GeWorko Method.

The regulatory framework for IFC Markets includes oversight from the BVI Financial Services Commission and the Cyprus Securities and Exchange Commission. These regulatory relationships provide a foundation for operational compliance and client protection. However, traders should understand the specific protections available under each jurisdiction's regulatory framework.

Regulatory Jurisdictions: IFC Markets operates under the regulatory supervision of the BVI Financial Services Commission (BVI FSC) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies provide oversight for the broker's operations in their respective jurisdictions. They establish frameworks for client fund protection and business conduct standards.

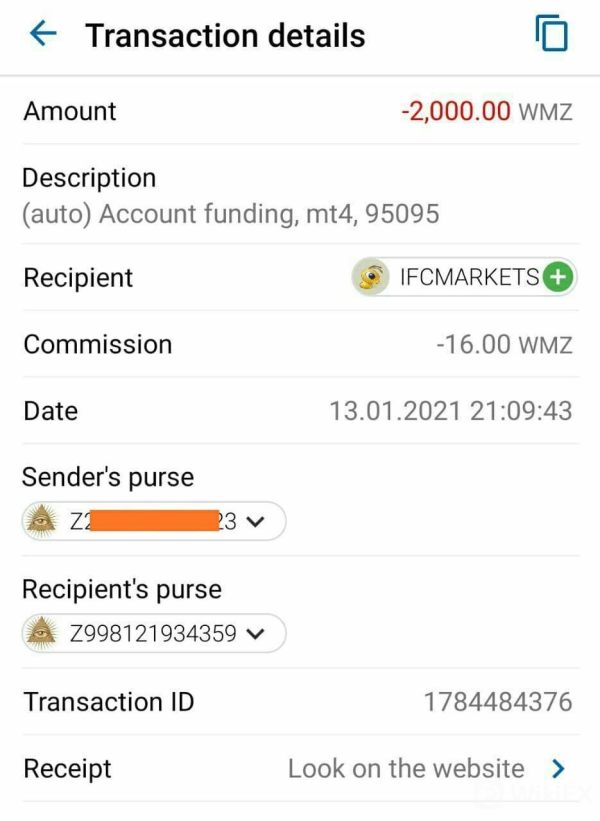

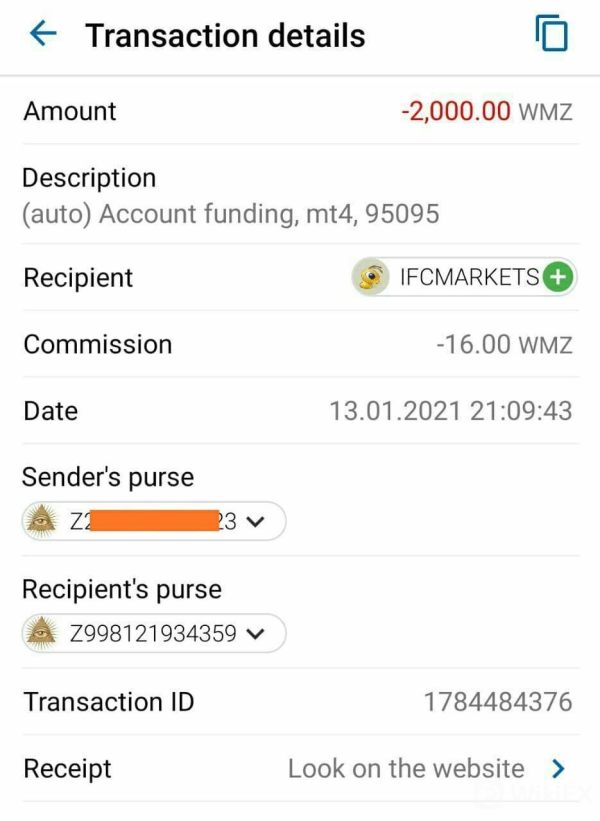

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. This requires prospective clients to contact the broker directly for comprehensive payment processing information.

Minimum Deposit Requirements: The minimum deposit requirements for different account types are not specified in the available documentation. This represents an area where potential clients would need to seek clarification directly from IFC Markets.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in the available information. This suggests that any such programs would need to be verified through direct broker contact.

Tradeable Assets: IFC Markets provides access to an extensive catalog of over 650 trading instruments. This includes major and minor forex currency pairs, global stock indices, individual company stocks from various international markets, precious metals such as gold and silver, energy commodities including oil and natural gas, and unique synthetic instruments developed through their proprietary GeWorko Method.

Cost Structure: According to available information, spreads begin from 0.0 pips. However, comprehensive commission structures and additional fees are not detailed in the source materials. This requires further investigation for complete cost analysis.

Leverage Ratios: Specific leverage ratios offered by IFC Markets are not detailed in the available information. This represents another area requiring direct clarification with the broker.

Platform Selection: The broker supports multiple trading platforms including MetaTrader 4, MetaTrader 5, NetTradeX, and WebTerminal. This provides traders with various options to match their technical requirements and trading preferences.

Regional Restrictions: Specific geographic restrictions on services are not detailed in the available materials.

Customer Support Languages: The range of languages supported by customer service is not specified in available documentation.

This ifc markets review reveals several areas where additional information would benefit prospective clients in making informed decisions about the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

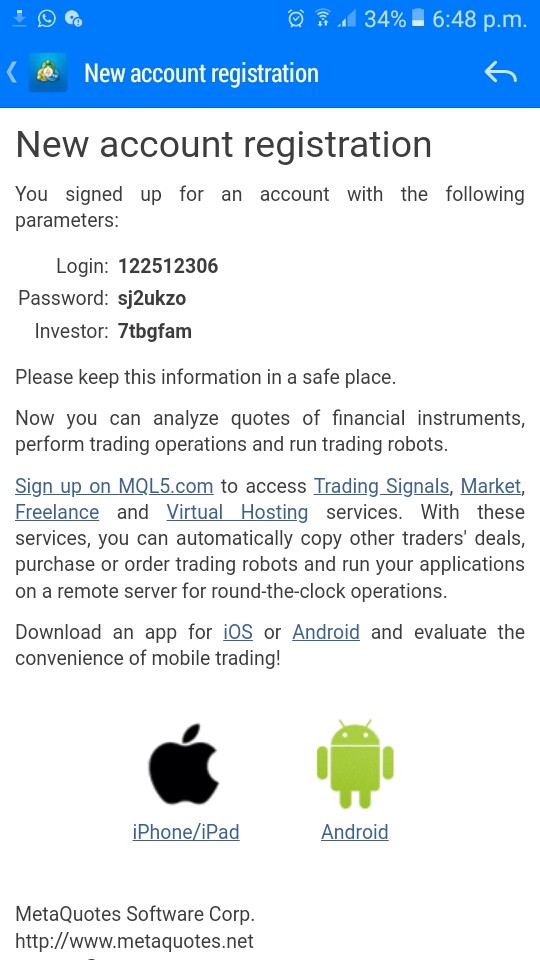

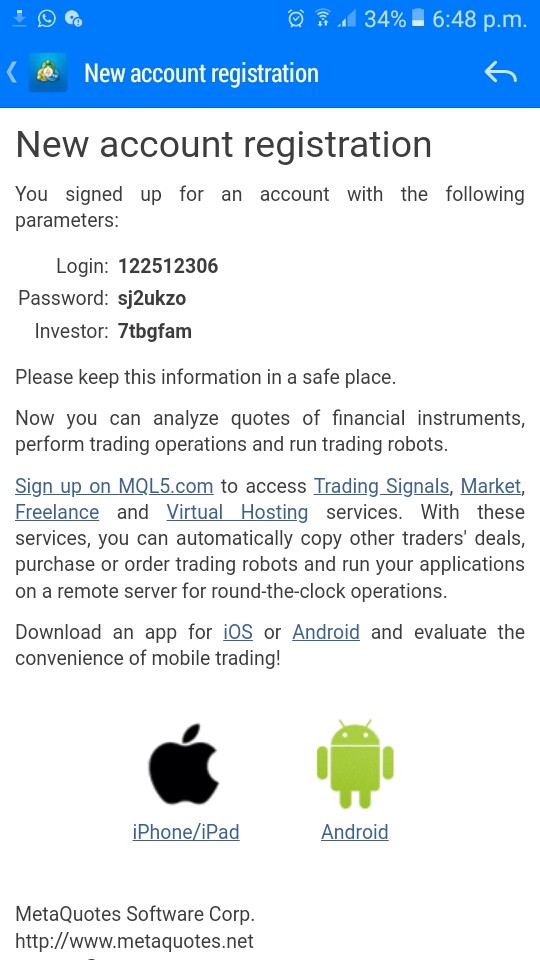

IFC Markets offers a diverse range of account types designed to accommodate traders with varying experience levels and trading requirements. The broker provides Standard Accounts for general trading purposes. It also offers Beginner Accounts specifically tailored for new traders entering the forex market, and both MT4/MT5 Standard Accounts and Micro Accounts for those preferring specific platform environments or smaller position sizes.

The variety in account offerings represents a strength in IFC Markets' service structure. This allows clients to select accounts that align with their trading experience and risk tolerance. However, this ifc markets review identifies a significant transparency gap regarding minimum deposit requirements across different account types. The absence of clear information about initial funding requirements makes it challenging for prospective clients to plan their account opening process effectively.

User feedback suggests that while traders appreciate the account variety, some express frustration about the lack of upfront clarity regarding account specifications and requirements. The account opening process details are not comprehensively outlined in available materials. This potentially creates uncertainty for new clients about documentation requirements and verification procedures.

The broker's account structure appears designed to serve both retail traders seeking straightforward trading conditions and more sophisticated traders requiring advanced features. However, without detailed information about account-specific benefits, trading conditions, and fee structures, potential clients may find it difficult to make informed decisions about which account type best suits their needs.

IFC Markets demonstrates significant strength in its trading tools and instrument diversity. It offers over 650 tradeable assets across multiple asset classes. The broker's instrument catalog spans traditional forex currency pairs, global stock indices, individual company shares from international markets, precious metals, energy commodities, and notably, synthetic instruments created through their proprietary GeWorko Method.

The GeWorko Method represents a unique offering in the broker's portfolio. It provides traders with access to synthetic instruments that may not be available through traditional market channels. This innovation demonstrates IFC Markets' commitment to expanding trading opportunities beyond conventional market offerings. It potentially appeals to traders seeking diversified exposure and unique trading strategies.

However, this review identifies limitations in the availability of research and analytical resources. While the broker provides extensive trading instruments, specific information about market analysis tools, economic calendars, trading signals, or educational resources is not detailed in available materials. Modern traders increasingly value comprehensive research support and educational content. This makes this a potential area for improvement.

User feedback indicates satisfaction with the breadth of available instruments, particularly among traders who appreciate having multiple asset classes accessible through a single platform. Market analysts note that the extensive instrument selection can attract diverse trading strategies and help brokers retain clients with varying interests across different market sectors.

The platform's tool offerings would benefit from more detailed information about analytical capabilities, charting tools, and research resources to provide a complete picture of the trading environment's sophistication.

Customer Service and Support Analysis (Score: 6/10)

Customer service represents an area where IFC Markets receives mixed feedback from the trading community. While the broker maintains support operations, specific details about service channels, availability hours, and response time benchmarks are not comprehensively outlined in available documentation. This lack of transparency regarding support infrastructure creates uncertainty for traders who prioritize reliable customer assistance.

User reviews suggest inconsistent experiences with customer service quality and response times. Some traders report satisfactory support interactions. Others express concerns about delayed responses and the effectiveness of problem resolution. The variability in service experiences indicates potential inconsistencies in support delivery that could impact overall client satisfaction.

The absence of detailed information about supported languages, regional support availability, and specialized support for different account types represents a transparency gap that may concern international clients. Modern traders expect clear communication about how and when they can access support. This is particularly important when dealing with time-sensitive trading issues or account problems.

Professional traders often require sophisticated support that understands complex trading scenarios and platform technical issues. Without detailed information about support team expertise and escalation procedures, it becomes difficult to assess whether IFC Markets can adequately serve traders with advanced support needs.

The broker would benefit from providing more comprehensive information about support channels, service level commitments, and the expertise available to address various client needs across different trading scenarios and technical requirements.

Trading Experience Analysis (Score: 7/10)

IFC Markets provides multiple trading platform options, including MetaTrader 4, MetaTrader 5, NetTradeX, and WebTerminal. This offers flexibility for traders with different platform preferences and technical requirements. The availability of both industry-standard platforms and proprietary solutions demonstrates the broker's commitment to accommodating diverse trading styles and preferences.

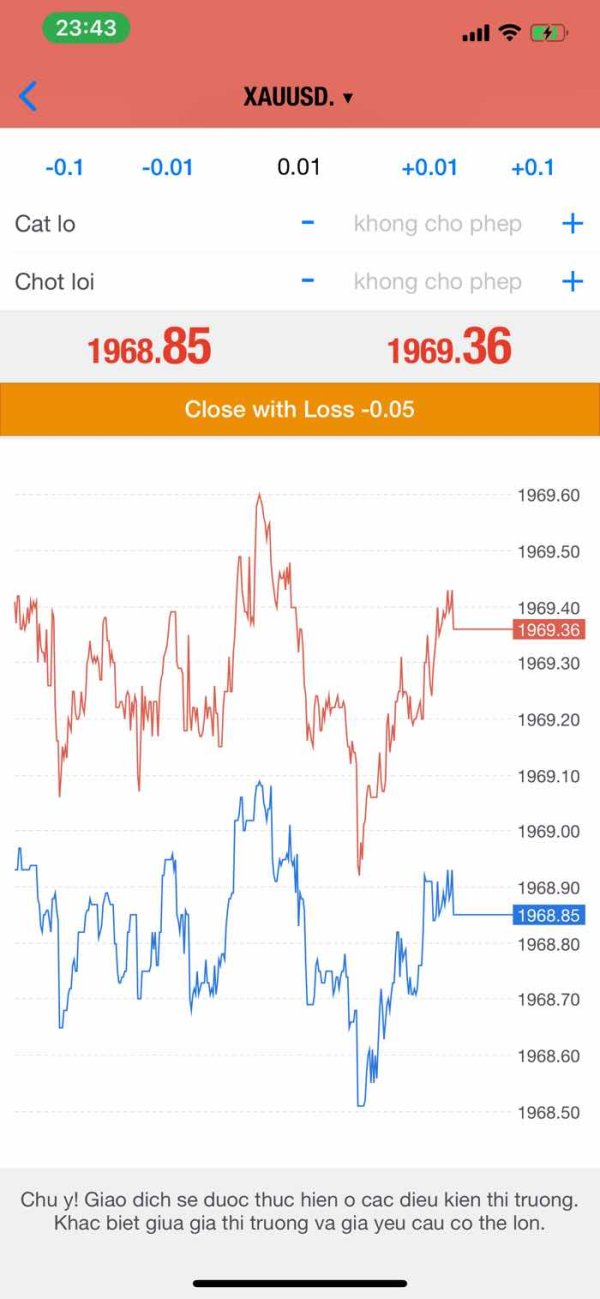

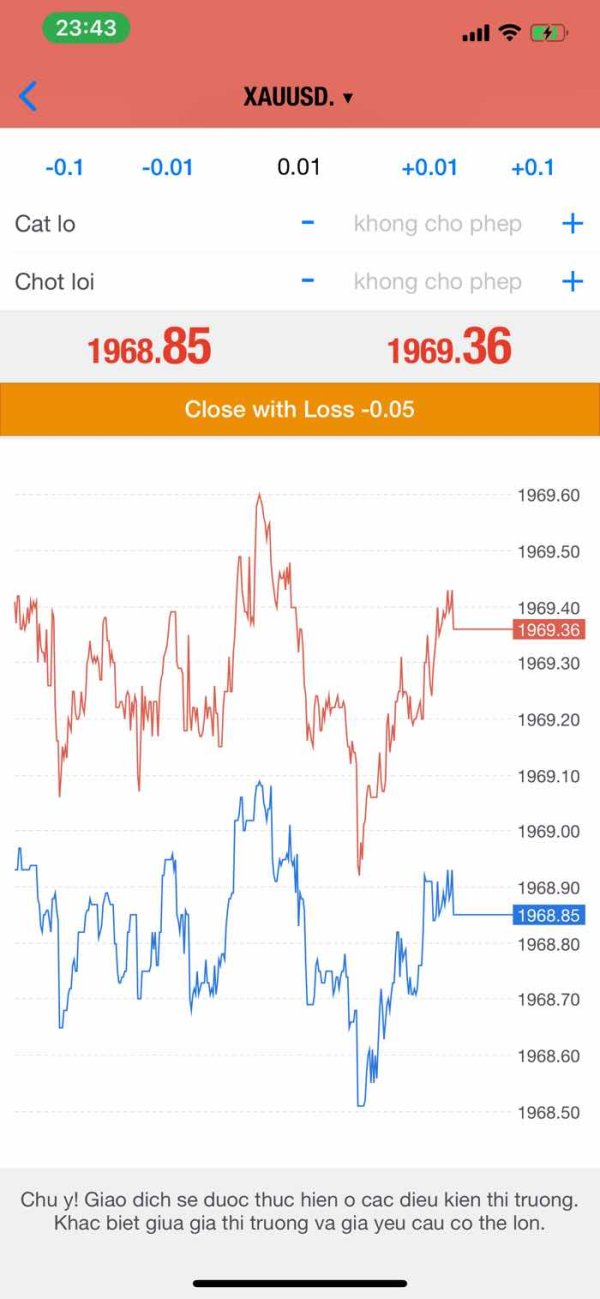

User feedback indicates general satisfaction with platform variety. However, specific performance metrics regarding execution speed, platform stability, and order processing quality are not detailed in available materials. The absence of concrete data about execution statistics, average order processing times, and platform uptime percentages makes it challenging to assess the technical quality of the trading environment.

The ifc markets review notes that spreads beginning from 0.0 pips suggest competitive pricing structures. However, comprehensive information about execution quality, slippage rates, and requote frequency is not available in source materials. These factors significantly impact trading experience quality, particularly for active traders and those employing scalping strategies.

Mobile trading capabilities and platform accessibility across different devices are not specifically detailed in available information. This represents important considerations for modern traders who require flexible access to their trading accounts. The quality of mobile applications and web-based platform performance can significantly influence overall user experience.

Platform functionality completeness, including available order types, charting capabilities, and automated trading support, requires further investigation to provide a complete assessment of the trading environment's sophistication and suitability for different trading strategies.

Trust and Security Analysis (Score: 7/10)

IFC Markets operates under regulatory oversight from the BVI Financial Services Commission and the Cyprus Securities and Exchange Commission. This provides a framework for operational compliance and client protection. However, industry analysis classifies these as Tier-3 regulators. This may influence trader confidence compared to brokers regulated by higher-tier authorities such as the FCA, ASIC, or CFTC.

The regulatory framework provides basic operational oversight. However, specific client fund protection measures such as segregated account policies, investor compensation schemes, and audit procedures are not detailed in available materials. Modern traders increasingly prioritize understanding exactly how their funds are protected and what recourse options exist in various scenarios.

This ifc markets review finds that company transparency regarding financial stability, management structure, and operational history could be enhanced. While the broker has operated since 2006, detailed information about corporate governance, financial reporting, and management team credentials is not readily available in public materials.

Industry reputation and recognition through awards or professional acknowledgments are not highlighted in available information. This represents missed opportunities to demonstrate market standing and peer recognition. Established brokers often leverage industry recognition to build trader confidence and demonstrate operational excellence.

The broker would benefit from providing more comprehensive information about fund protection mechanisms, regulatory compliance measures, and corporate transparency initiatives to address trader concerns about security and operational reliability in an increasingly competitive market environment.

User Experience Analysis (Score: 6/10)

IFC Markets receives a user rating of 3.6 out of 5 based on 544 reviews. This indicates moderate satisfaction levels across the trader community. This rating suggests that while some users find the platform satisfactory, there are areas where the broker could improve to enhance overall client satisfaction and retention.

User feedback patterns reveal appreciation for the diversity of trading instruments and platform options. Traders particularly value access to multiple asset classes through a single broker relationship. However, concerns frequently arise regarding transparency of trading conditions, clarity of fee structures, and consistency of customer service delivery.

The registration and account verification processes are not detailed in available materials. This represents important user experience touchpoints that significantly influence new client onboarding satisfaction. Streamlined, transparent onboarding processes have become increasingly important competitive factors in the retail trading industry.

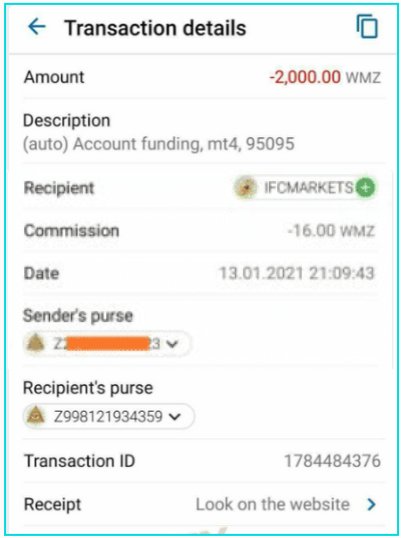

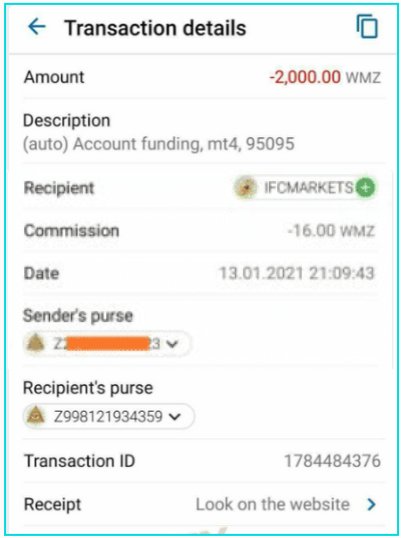

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated fees, are not comprehensively documented in available information. These operational aspects directly impact user satisfaction and are frequently cited in trader reviews as critical factors in broker selection and retention decisions.

Common user concerns appear to center around information transparency, customer service responsiveness, and clarity of trading conditions. Addressing these issues through improved communication, enhanced support processes, and more comprehensive information disclosure could significantly improve overall user satisfaction scores.

The broker could benefit from implementing more systematic user feedback collection and response mechanisms to address recurring concerns and demonstrate commitment to continuous service improvement based on actual client experiences and needs.

Conclusion

IFC Markets presents itself as an established international forex and CFD broker with nearly two decades of market experience. It offers a comprehensive range of trading instruments and multiple platform options. This ifc markets review reveals a broker that provides solid fundamental services but faces challenges in transparency and customer service consistency that impact overall client satisfaction.

The broker's primary strengths lie in its extensive instrument catalog of over 650 trading options, innovative synthetic instruments through the GeWorko Method, and multiple professional trading platforms including MT4, MT5, and proprietary solutions. These features make IFC Markets particularly suitable for traders seeking diverse investment opportunities and platform flexibility. It serves both beginners exploring different markets and experienced traders requiring advanced tools.

However, areas for improvement include enhanced transparency regarding trading conditions, fee structures, and account requirements, as well as more consistent customer service delivery and comprehensive information disclosure. The moderate user rating of 3.6/5 reflects these mixed experiences and suggests that while the broker provides functional trading services, there is significant room for enhancement in client satisfaction and operational transparency.

IFC Markets may best serve traders who prioritize instrument diversity and platform variety over premium customer service and regulatory strength, particularly those comfortable with Tier-3 regulatory oversight and willing to conduct additional due diligence regarding specific trading conditions and requirements.