BSFX 2025 Review: Everything You Need to Know

Executive Summary

This bsfx review shows major concerns about BSFX as a trading platform. BSFX operates under Boisil Group Limited and claims to be a global trading broker that offers diverse trading instruments including forex, stocks, CFDs, and commodities. Our analysis shows major regulatory problems that create big investment risks.

BSFX lacks proper oversight from known financial authorities. This raises serious questions about trader protection and fund security. The platform claims to provide various trading tools and good trading conditions, but there is no clear information about spreads, commissions, and specific trading terms. This creates more uncertainty.

The broker targets investors who want diverse trading products. However, the regulatory gaps and user complaints in our research suggest that traders should be very careful. Available information shows that BS Forex Broker has received mixed user feedback with some positive reviews but also neutral assessments and exposure reports that highlight potential issues.

This bsfx review concludes that BSFX may offer multiple asset classes, but the lack of proper regulatory framework makes it a high-risk choice for traders who want security and transparency.

Important Notice

This evaluation focuses on the regulatory and operational aspects of BSFX and notes the absence of oversight from major financial authorities such as the NFA or ASIC. Traders should know that regulatory differences across jurisdictions may create different levels of legal protection and options for getting help.

Our assessment uses publicly available information, user feedback, and industry standard evaluation criteria. This review aims to provide objective analysis while highlighting areas where information transparency could be improved. Since there is limited regulatory oversight, investors should do additional research before using this platform.

Rating Overview

Broker Overview

BSFX operates under the management of Boisil Group Limited. The company has been in the trading industry for about 5 to 10 years. BSFX claims to be a United States-based trading broker that serves global clients through its online trading platform, but the company's actual market presence and regulatory standing are questionable.

The broker's business model focuses on providing access to multiple financial markets including foreign exchange, equity markets, contracts for difference, and commodity trading. BSFX markets itself as offering complete trading solutions for both retail and possibly institutional clients, though specific details about client types and service differences are not clearly outlined in available materials.

BSFX's operational framework shows major gaps when it comes to platform infrastructure and regulatory compliance. The broker lacks authorization from major financial regulatory bodies such as the National Futures Association or the Australian Securities and Investments Commission. This regulatory problem represents a critical concern for potential clients because it means traders may have limited help in case of disputes or operational issues. The absence of proper regulatory oversight also raises questions about whether the broker follows industry standards for client fund protection and fair trading practices.

Regulatory Status: BSFX operates without valid licensing from recognized financial authorities including the NFA, ASIC, or other major regulatory bodies. This absence of regulatory oversight creates major compliance and safety concerns for potential traders.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees is not clearly disclosed in available documentation. This indicates potential transparency issues.

Minimum Deposit Requirements: The broker has not provided clear information about minimum deposit amounts for different account types. This makes it difficult for traders to plan their initial investment.

Promotional Offers: Details about bonus programs, promotional campaigns, or special trading incentives are not available in the broker's public materials.

Tradeable Assets: BSFX offers access to multiple asset classes including foreign exchange pairs, individual stocks, contracts for difference, and various commodity instruments. This provides traders with diverse market exposure options.

Cost Structure: The broker's fee schedule lacks transparency with no specific information provided about spreads, commission rates, overnight financing charges, or other trading-related costs that could impact profitability.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not clearly specified in available documentation.

Platform Options: Specific trading platform software and technology details are not fully outlined in accessible materials.

This bsfx review finds that the lack of detailed operational information represents a major transparency concern for potential clients.

Detailed Rating Analysis

Account Conditions Analysis

BSFX's account structure presents major transparency challenges that contribute to its poor rating in this category. The broker fails to provide complete information about available account types, their specific features, or the requirements for accessing different service levels. This lack of clarity makes it very difficult for potential traders to make informed decisions about which account option might suit their trading goals and capital requirements.

The absence of clearly stated minimum deposit requirements across different account levels represents a basic transparency issue. Most reputable brokers provide detailed account comparison tables showing minimum deposits, maximum leverage, spread types, and additional features for each account level. BSFX's failure to provide this basic information suggests either poor operational organization or deliberate lack of transparency in their service structure.

Account opening procedures and verification requirements are similarly unclear with no detailed information available about documentation requirements, processing timeframes, or verification standards. This uncertainty can lead to unexpected delays and complications for traders attempting to begin their trading activities. Additionally, there is no mention of specialized account options such as Islamic accounts for traders requiring swap-free trading conditions.

The overall account conditions framework at BSFX appears to lack the professional standards expected from established trading brokers. This contributes significantly to the poor rating in this bsfx review category.

Despite other operational concerns, BSFX demonstrates relative strength in its range of available trading instruments and earns a good rating in this category. The broker provides access to multiple asset classes including foreign exchange pairs, individual stocks, contracts for difference, and commodity markets. This diversification allows traders to use varied trading strategies and portfolio approaches across different market sectors.

The forex offering appears to include major, minor, and potentially exotic currency pairs. This gives traders exposure to global currency markets. Stock trading capabilities suggest access to individual equity instruments, though specific market coverage and available exchanges are not detailed. The CFD selection likely covers indices, commodities, and potentially cryptocurrency instruments and provides leveraged exposure to various underlying assets.

Commodity trading access enables participation in precious metals, energy markets, and agricultural products and offers portfolio diversification opportunities. However, while the range of instruments appears complete, specific details about trading conditions, minimum contract sizes, and market hours for different asset classes remain unclear.

The main limitation in this category stems from insufficient information about analytical tools, research resources, educational materials, and automated trading support. Most professional trading platforms provide market analysis, economic calendars, and educational content to support trader decision-making, but these resources are not clearly outlined in BSFX's available materials.

Customer Service and Support Analysis

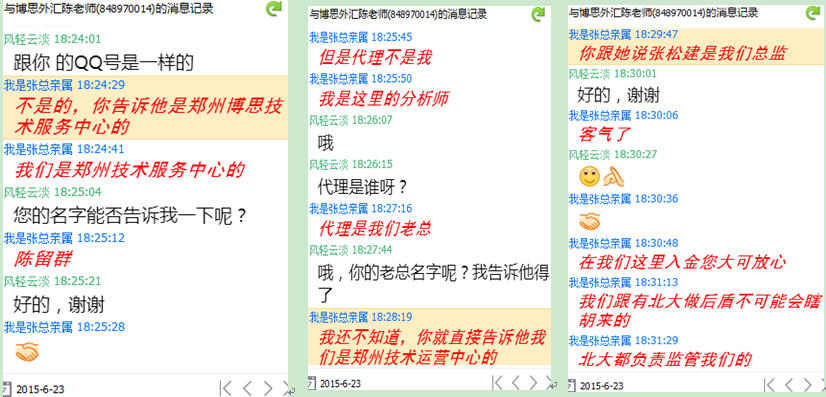

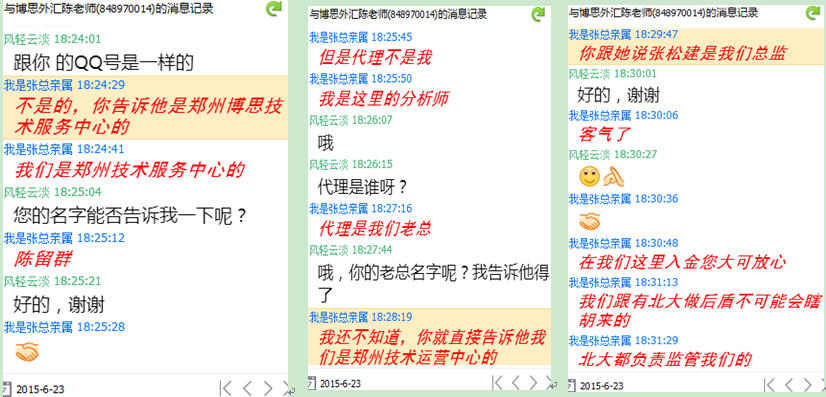

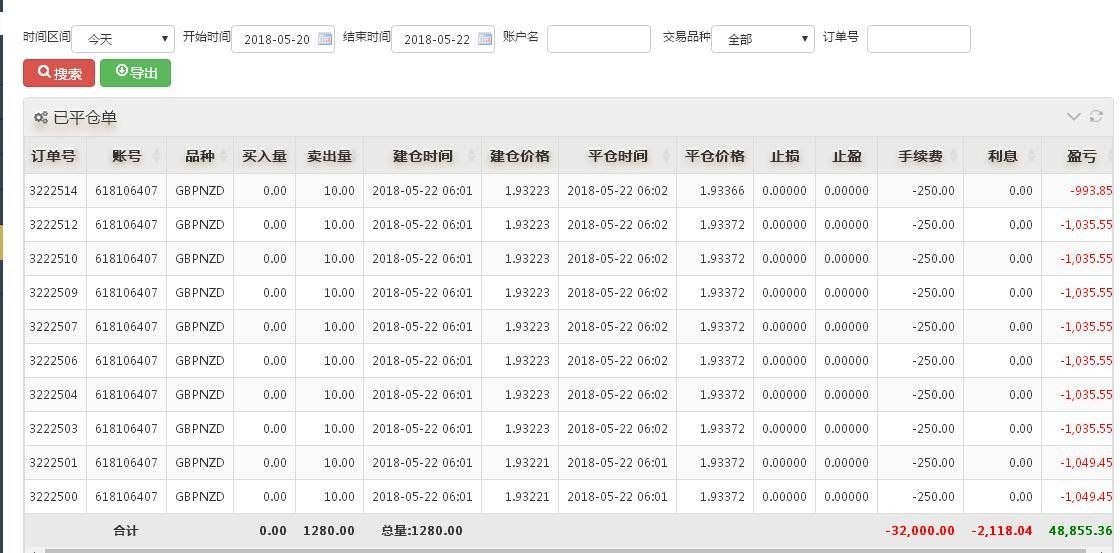

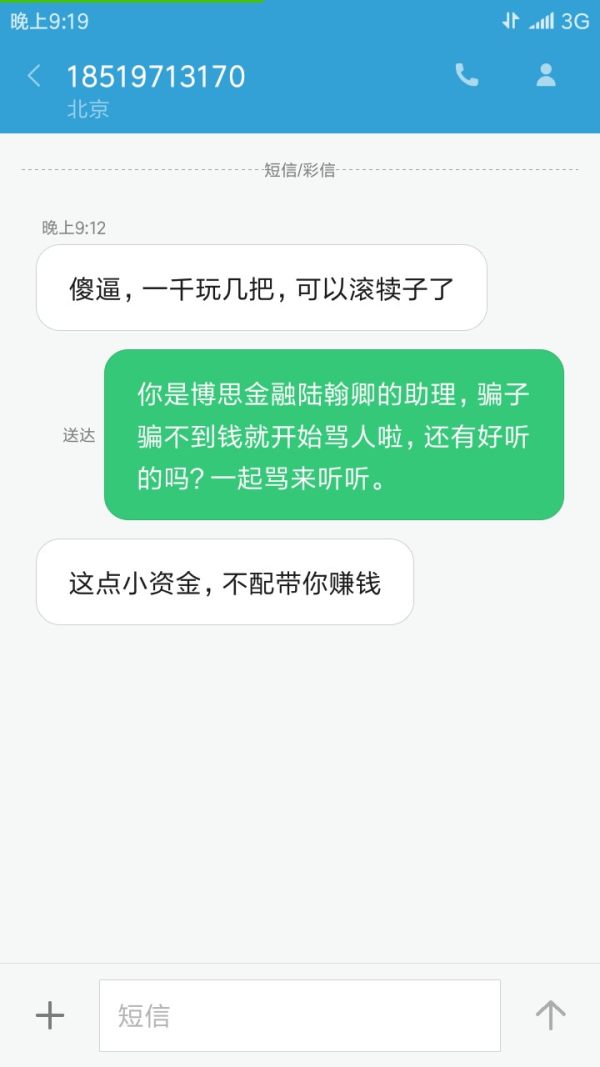

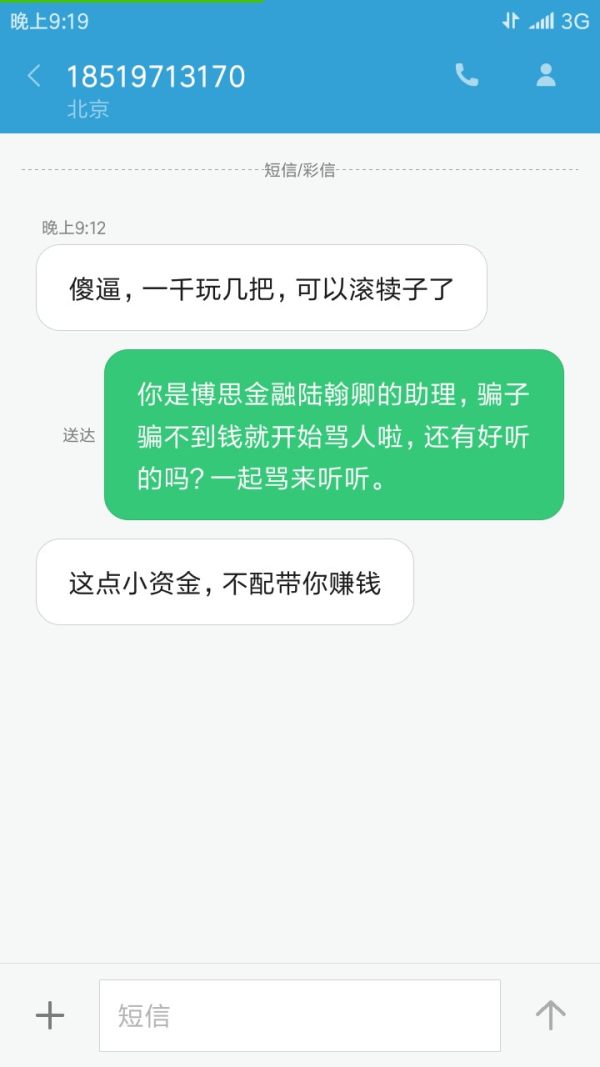

Customer service represents a major weakness for BSFX with documented user complaints and exposure reports indicating serious service quality issues. The below-average rating reflects both the absence of complete support infrastructure information and negative user feedback about service responsiveness and problem resolution.

Available information does not clearly outline the customer support channels offered by BSFX such as live chat, telephone support, email assistance, or help desk ticketing systems. Most professional brokers provide multiple contact methods with clearly stated availability hours and expected response timeframes. The lack of this basic information suggests either inadequate support infrastructure or poor communication about available services.

Response time commitments and service level agreements are not specified. This leaves traders uncertain about when they might receive assistance with account issues, technical problems, or trading-related questions. This uncertainty becomes particularly problematic when traders encounter urgent issues requiring immediate resolution.

The existence of user complaints and exposure reports mentioned in available documentation indicates that some clients have experienced major service problems. These negative experiences, combined with the lack of transparent support procedures, suggest systematic customer service problems that could impact trader satisfaction and problem resolution effectiveness.

Trading Experience Analysis

The trading experience at BSFX receives an average rating due to insufficient information about platform performance, execution quality, and technology infrastructure. While the broker offers multiple tradeable instruments, the actual trading environment's effectiveness remains unclear based on available documentation.

Platform stability and execution speed are critical factors for successful trading, particularly in fast-moving markets where price slippage can significantly impact profitability. However, BSFX has not provided specific information about their trading infrastructure, server locations, execution policies, or performance statistics that would allow traders to assess the quality of their trading environment.

Order execution procedures including fill policies, slippage management, and requote handling are not clearly documented. Professional traders require detailed information about how their orders will be processed, especially during volatile market conditions when execution quality becomes crucial for maintaining trading strategy effectiveness.

Mobile trading capabilities and cross-platform synchronization features are increasingly important for modern traders who need flexibility in managing their positions. The absence of detailed information about mobile applications, platform compatibility, and feature parity across different devices represents a major information gap.

This bsfx review finds that while the broker may provide functional trading access, the lack of detailed performance information and transparency about trading conditions creates uncertainty about the actual trading experience quality.

Trust and Safety Analysis

Trust and safety represent BSFX's most significant weakness and earn a very poor rating due to fundamental regulatory and transparency problems. The broker's lack of authorization from recognized financial authorities creates substantial safety concerns that should be carefully considered by potential traders.

The absence of regulatory oversight from established bodies such as the NFA, ASIC, FCA, or other major financial authorities means that BSFX operates outside the protective frameworks designed to safeguard trader interests. Regulated brokers must comply with strict capital adequacy requirements, client fund segregation rules, and operational standards that provide important protections for traders.

Client fund protection measures are not clearly outlined. This raises questions about how trader deposits are safeguarded and whether adequate insurance or compensation schemes exist. Reputable brokers typically maintain client funds in segregated accounts at tier-one banks and provide detailed information about their fund protection procedures.

The broker's claims of being a "global leading trading broker" lack proof through verifiable achievements, industry recognition, or third-party validation. Such unsupported claims, combined with the regulatory problems, suggest potential credibility issues that warrant careful consideration.

User complaints and exposure reports mentioned in available documentation further undermine confidence in the broker's trustworthiness and operational integrity.

User Experience Analysis

User experience at BSFX receives a poor rating based on documented user complaints and the overall lack of transparency in operational procedures. The combination of regulatory concerns and negative user feedback suggests major challenges in the overall client experience.

User satisfaction appears to be compromised by various operational issues as evidenced by the existence of complaint reports and exposure documentation. These negative experiences indicate potential problems with service delivery, account management, or trading conditions that have impacted client relationships.

Website design, navigation, and information accessibility show room for improvement, particularly regarding the transparency of trading conditions, fee structures, and operational procedures. Professional brokers typically provide complete information about their services and make it easy for potential clients to understand costs, procedures, and expectations.

Registration and account verification processes lack clear documentation. This potentially creates confusion and delays for new clients. The absence of detailed onboarding information suggests that the user journey may be less streamlined than industry standards would suggest.

Fund management procedures including deposit and withdrawal processes are not clearly outlined. This can create uncertainty and frustration for traders attempting to manage their account funding efficiently.

Conclusion

This comprehensive bsfx review reveals major concerns that potential traders should carefully consider before engaging with this broker. While BSFX offers access to multiple trading instruments across forex, stocks, CFDs, and commodities, the fundamental lack of regulatory oversight creates substantial risks that overshadow these potential benefits.

The broker's operational transparency problems, combined with documented user complaints and the absence of clear information about trading conditions, fees, and procedures, indicate serious professional standards gaps. These issues are particularly concerning given the financial services industry's emphasis on client protection and regulatory compliance.

BSFX might appeal to traders seeking diversified trading product access, but the regulatory problems and transparency issues make it suitable only for extremely risk-tolerant investors who fully understand the potential consequences of trading with an unregulated entity. The main advantages include instrument diversity, while significant disadvantages include regulatory absence, transparency problems, and documented user complaints that collectively create an unfavorable risk-reward profile for most traders.