Murrentrade 2025 Review: Everything You Need to Know

Executive Summary

Murrentrade works as an offshore forex broker that offers trading services across many different assets. The company has loose rules watching over it, which makes it good for traders who want high leverage but need to check risks carefully. This murrentrade review shows that the broker gives leverage up to 1:500. It uses the popular MetaTrader 5 platform for trading forex, commodities, and cryptocurrencies.

The broker focuses on traders who have some experience with forex and CFD trading. It offers three different account types: VIP, Standard, and Classic accounts that fit different trading styles. With more than 15 forex currency pairs, oil, gold, silver, CFD indices, and cryptocurrencies like Bitcoin, Murrentrade tries to be a complete trading solution. This works best for investors who can handle risk.

However, traders should know that the broker follows rules from MWALI International Services Authority. These rules may create some risks that need careful thought before opening an account.

Important Notice

Murrentrade operates as an offshore company under the MWALI International Services Authority in Comoros. This authority has much easier rules compared to major financial regulators. The loose regulatory structure may increase risks for traders, so potential clients should think carefully about their risk tolerance before using the platform.

This review uses information that anyone can find and feedback from users. We want to give a complete evaluation of the broker's services so people can make smart decisions.

Rating Framework

Broker Overview

Murrentrade works as an offshore forex broker that focuses on foreign exchange and CFD trading services. The MWALI International Services Authority in Comoros watches over the company. The company has license number T2023286 and mainly provides high-leverage trading opportunities across many different types of assets. Their business plan centers on helping people trade forex currency pairs, precious metals like gold and silver, energy commodities like oil, CFD indices, and various cryptocurrencies including Bitcoin.

The broker builds its trading system around the MetaTrader 5 (MT5) platform. This gives traders access to advanced charting tools and technical analysis features. Murrentrade review information shows that the platform supports more than 15 major forex currency pairs along with commodity and cryptocurrency trading options. The company's offshore status allows for higher leverage ratios that reach up to 1:500, which appeals to traders who want bigger market exposure while accepting higher risk levels.

Regulatory Jurisdiction: Murrentrade operates under the MWALI International Services Authority in Comoros, which has easier rules compared to major financial centers. This could increase risks for traders.

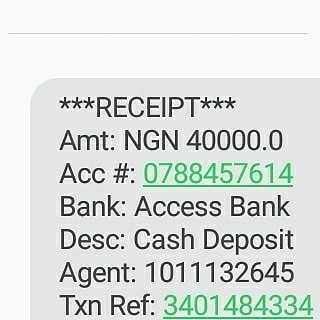

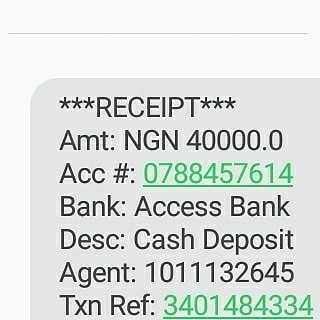

Deposit and Withdrawal Methods: The broker does not give specific information about deposit and withdrawal options in available materials. Potential clients need to contact the broker directly for payment processing details.

Minimum Deposit Requirements: Available documentation does not specify the minimum deposit needed to open an account. This makes it hard to know if different types of traders can access the service.

Bonus and Promotional Offers: Current promotional campaigns and bonus structures are not detailed in available broker information. This suggests the company offers limited marketing incentives.

Available Trading Assets: The trading portfolio includes more than 15 forex currency pairs, precious metals (gold and silver), energy commodities (oil), CFD indices, and cryptocurrency options including Bitcoin. This provides diverse market exposure opportunities.

Cost Structure: Available materials do not specify detailed information about spreads, commissions, and other trading costs. This could affect cost transparency for prospective clients.

Leverage Ratios: Maximum leverage reaches 1:500. This serves traders who want high-risk, high-reward trading opportunities with significant market exposure amplification.

Platform Options: The broker only uses MetaTrader 5 (MT5) as its primary trading platform. It offers user-friendly interfaces and comprehensive trading functionality.

Geographic Restrictions: Available documentation does not detail specific regional limitations and restricted territories.

Customer Support Languages: Current broker information does not specify the range of supported languages for customer service.

This murrentrade review shows several information gaps that potential clients should address directly with the broker before opening an account.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Murrentrade provides three different account categories - VIP, Standard, and Classic - that are designed to fit varying trader needs and experience levels. Each account type probably offers different features and benefits, but available documentation does not give comprehensive details about minimum balance requirements, account privileges, and tier-specific advantages.

The lack of clearly specified minimum deposit requirements creates a significant information gap for potential clients who want to evaluate account accessibility. Without clear entry-level funding requirements, traders cannot properly assess whether the broker's services match their available capital and investment strategies.

Available materials do not detail account opening procedures and verification processes. This makes it difficult to evaluate how efficient and user-friendly the onboarding experience is. Also, information about specialized account options such as Islamic or swap-free accounts for religious compliance is not available.

The lack of comprehensive account condition details suggests that prospective clients would need to contact the broker directly to get crucial information about fees, maintenance requirements, and account-specific features. This murrentrade review shows that while multiple account options exist, transparency about their specific characteristics needs improvement.

The broker's trading infrastructure focuses on the MetaTrader 5 platform. This gives traders access to advanced charting capabilities, technical analysis tools, and automated trading functionality. MT5's reputation as a robust and feature-rich platform helps create a positive overall trading environment by offering professional-grade tools for market analysis and trade execution.

Available trading instruments cover multiple asset classes, including foreign exchange pairs, precious metals, energy commodities, and cryptocurrency options. This gives traders diverse market exposure opportunities. The multi-asset approach allows for portfolio diversification and various trading strategies across different market sectors.

However, available documentation does not detail specific information about research and analysis resources, market commentary, economic calendars, and educational materials. The lack of comprehensive educational resources may limit the broker's appeal to new traders who want learning opportunities and market insights.

Automated trading support through MetaTrader 5's Expert Advisor functionality gives advanced traders algorithmic trading capabilities. However, specific details about custom indicator availability and third-party tool integration are not specified. The platform's mobile accessibility ensures trading flexibility across different devices and locations.

Customer Service and Support Analysis (Score: 5/10)

Available information about customer service channels, response times, and support quality is notably limited. This makes it challenging to assess the broker's commitment to client assistance and problem resolution. The lack of detailed customer service information represents a significant transparency concern for potential clients.

Current documentation does not comprehensively outline communication channels, including phone support, email assistance, live chat availability, and support ticket systems. Without clear information about how to contact support representatives, traders may face difficulties when they need help with account issues or trading questions.

Response time expectations and service level commitments are not specified. This makes it impossible to evaluate whether the broker maintains adequate support standards for timely issue resolution. The lack of information about support operating hours and timezone coverage further complicates assessment of service accessibility.

Available materials do not clarify multilingual support capabilities and the availability of native-language assistance for international clients. This information gap may particularly concern traders from non-English speaking regions who need support in their preferred language.

Trading Experience Analysis (Score: 7/10)

The MetaTrader 5 platform foundation gives traders a stable and feature-rich trading environment. It offers comprehensive charting tools, technical indicators, and order management capabilities. The platform's proven reliability and widespread industry adoption contribute positively to the overall trading experience.

High leverage availability up to 1:500 appeals to traders who want amplified market exposure, though this also significantly increases risk levels and requires careful risk management strategies. The leverage options serve experienced traders who are comfortable with higher-risk trading scenarios.

Available materials do not specifically detail order execution quality, spread stability, and liquidity conditions. This makes it difficult to assess the broker's performance during various market conditions. Information about slippage rates, execution speeds, and fill rates would be valuable for evaluating trading quality.

Mobile trading capabilities through MetaTrader 5's mobile applications provide flexibility for traders who need market access while away from desktop computers. However, specific performance metrics and user experience details for mobile trading are not comprehensively documented.

This murrentrade review suggests that while the platform foundation is solid, more detailed performance information would make traders more confident in the execution environment.

Trust and Safety Analysis (Score: 6/10)

Murrentrade operates under the regulatory supervision of the MWALI International Services Authority in Comoros and holds license number T2023286. While this provides some regulatory oversight, the MWALI jurisdiction is generally considered less strict than major financial regulatory bodies, which could affect the level of client protection and operational standards.

Available documentation does not detail fund security measures, segregated account policies, and client money protection protocols. This represents important information gaps about asset safety. Traders typically want clear information about how their deposits are protected and whether client funds are separated from operational capital.

Current materials show limited company transparency about ownership, management structure, and operational history. This makes it difficult to assess the organization's stability and credibility. Additional information about the company's background and track record would help with trust evaluation.

User trust ratings show approximately 80% confidence levels, which suggests generally positive sentiment among existing clients. However, specific feedback details and satisfaction metrics are not comprehensively documented. Third-party verification and independent reviews would provide additional credibility assessment opportunities.

User Experience Analysis (Score: 6/10)

Available documentation shows limited overall user satisfaction information. This makes it challenging to assess the broker's performance from a client experience perspective. Specific feedback about platform usability, service quality, and overall satisfaction levels would provide valuable insights for potential clients.

The MetaTrader 5 interface offers a professional and user-friendly trading environment with intuitive navigation and comprehensive functionality. The platform's established design and widespread industry adoption generally contribute to positive user experiences for traders who know MT5's interface.

Current materials do not detail registration and account verification procedures. This prevents assessment of the onboarding process efficiency and user-friendliness. Streamlined account opening and verification processes are important factors in overall user experience evaluation.

Available documentation does not specify fund management experiences, including deposit and withdrawal convenience, processing times, and transaction efficiency. These operational aspects significantly impact user satisfaction and require clear information for proper evaluation.

Available materials do not document common user concerns and frequently reported issues. This limits insight into potential problem areas and the broker's responsiveness to client feedback and concerns.

Conclusion

Murrentrade presents itself as a high-leverage forex broker that works well for experienced traders willing to accept elevated risk levels in exchange for amplified market exposure opportunities. The broker's use of the MetaTrader 5 platform and diverse asset class offerings provide a solid foundation for multi-asset trading strategies.

The broker appears most suitable for intermediate to advanced traders who want high-risk, high-reward trading opportunities with significant leverage capabilities. However, the limited regulatory oversight and information transparency may not appeal to conservative traders or those who prioritize maximum client protection.

Key advantages include high leverage ratios up to 1:500 and comprehensive asset class availability spanning forex, commodities, and cryptocurrencies. Primary concerns center on the relatively lenient regulatory framework and limited transparency about costs, customer service, and operational procedures. Potential clients should carefully evaluate these factors against their individual risk tolerance and trading requirements.