Türkiye Review 1

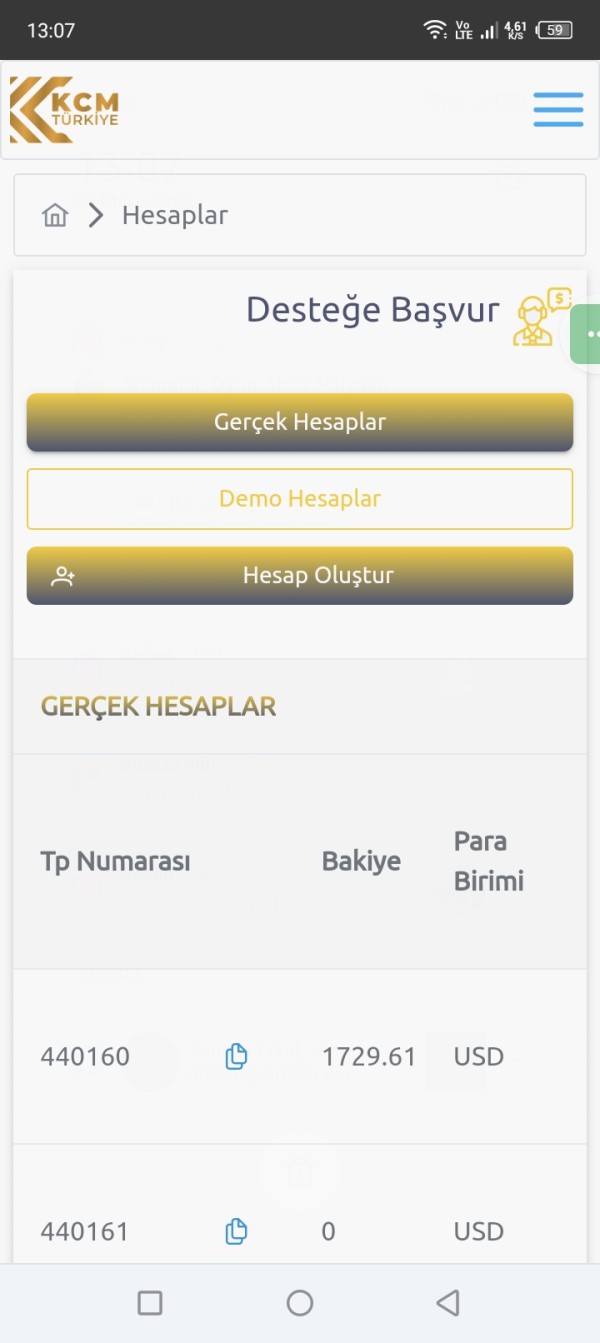

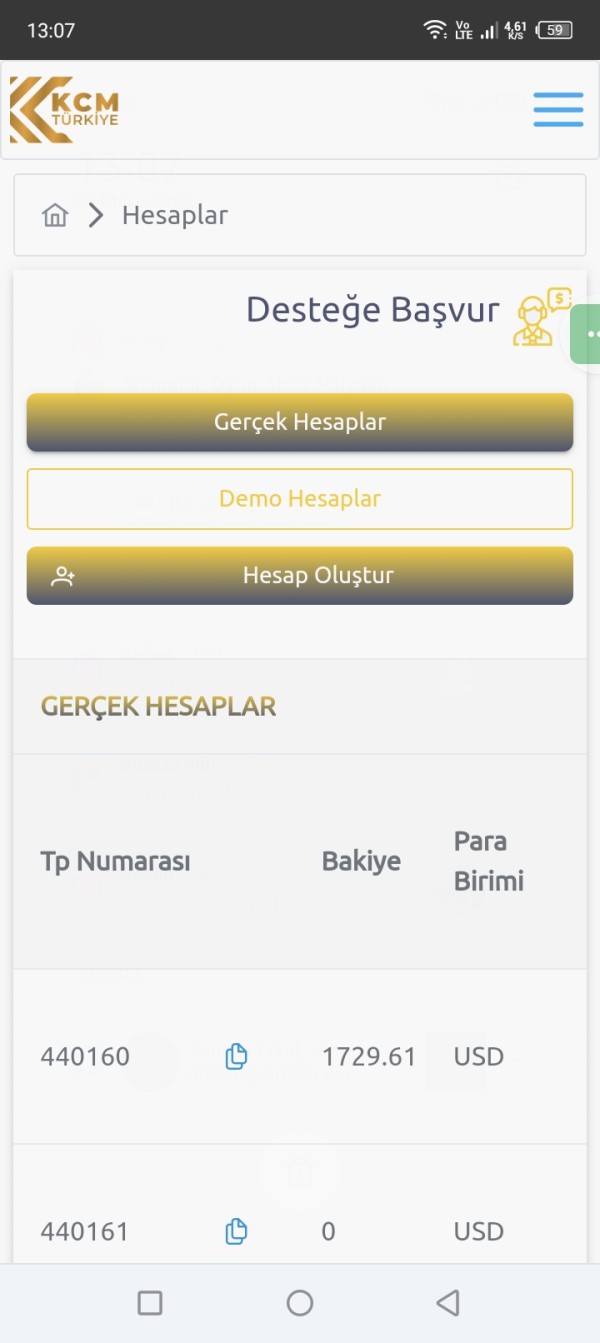

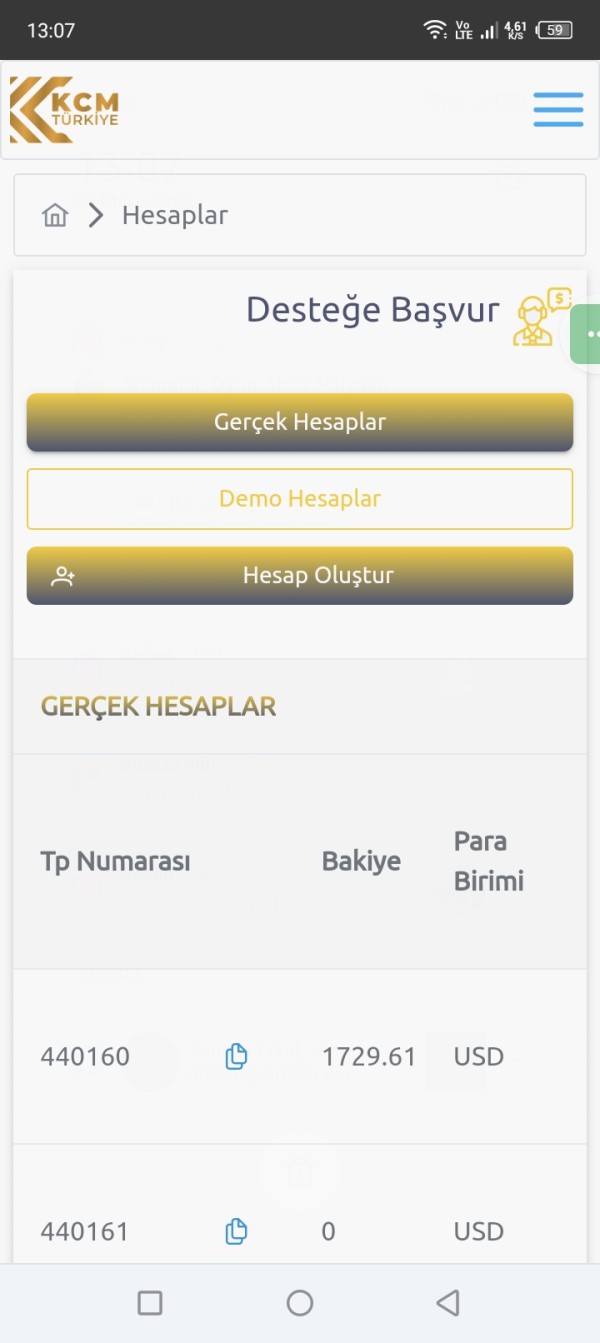

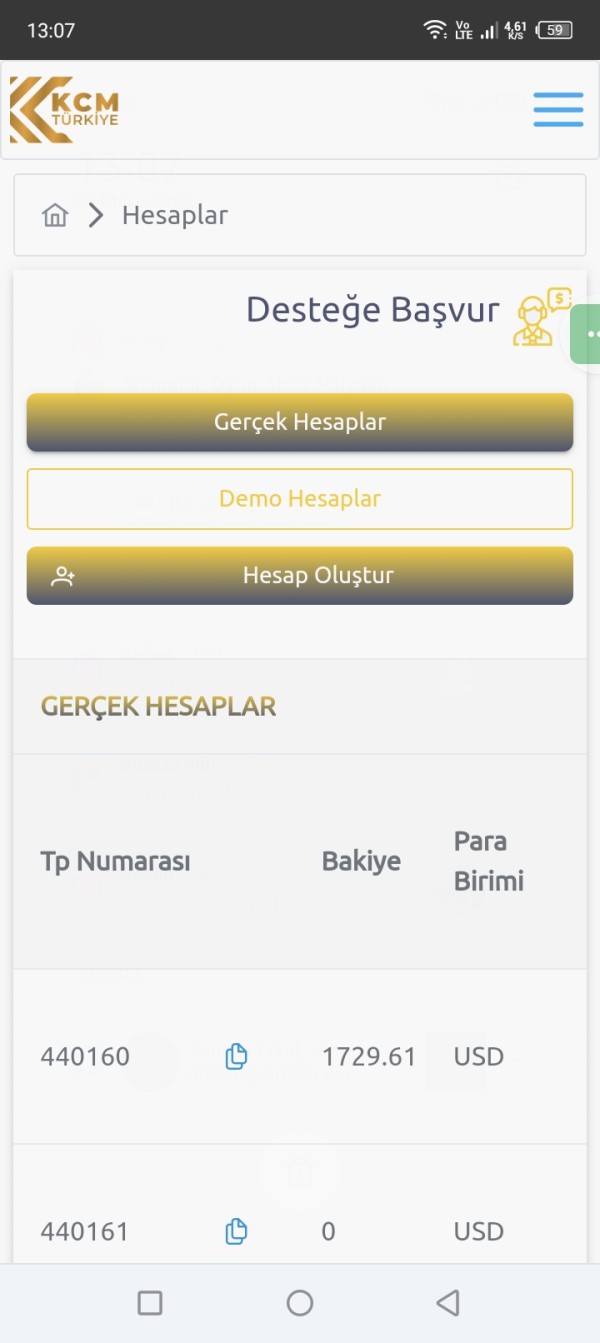

We were literally deceived, they took the money saying they were going to invest, and now there is no one to contact them, they are defrauding people.

Türkiye Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

We were literally deceived, they took the money saying they were going to invest, and now there is no one to contact them, they are defrauding people.

The Turkish forex market is characterized by a robust regulatory framework, overseen by the Capital Markets Board (CMB), which aims to protect traders and ensure market integrity. At the same time, this regulation presents significant obstacles for prospective investors. The stringent entry barriers, particularly the high minimum deposit requirement set at ₺50,000 (approximately $8,360) and strict leverage limits capped at 1:10, may discourage novice traders from entering the market. As such, Turkey's forex landscape offers an appealing environment for compliant trading while simultaneously posing challenges that can limit participation, notably for those with limited investment capabilities or experience.

The ideal demographic for Turkish forex brokers includes seasoned traders who can meet minimum investment thresholds and are interested in regulated environments that may facilitate adherence to specific trading principles, such as Islamic accounts. This market, however, may not be suitable for new traders or those seeking high leverage, particularly given the rising risk of falling prey to unregulated brokers amid a backdrop of strong regulatory pressure.

Risk Awareness:

Self-Verification Steps:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Regulatory Compliance | 4.5 | Strong oversight by CMB ensures a safer trading environment. |

| Trading Costs | 3.5 | Fees can be higher than average, impacting profitability for traders. |

| Platform Usability | 4.0 | Availability of popular platforms like MT4 and MT5 varies across brokers. |

| Customer Support | 4.2 | Many brokers provide strong support, but availability may vary. |

| Account Conditions | 3.0 | High minimum deposits are a barrier for many new investors. |

| Market Variety | 4.0 | Various asset classes available but not all brokers offer deep liquidity. |

Since its establishment, Türkiye has become a central hub for forex trading in the region, largely due to its strategic geographical location bridging Europe and Asia. However, the regulatory landscape has evolved significantly since 2017, imposing stricter guidelines to safeguard the interests of retail traders. The CMB oversees forex operations, ensuring only licensed brokers can operate within the market.

Given the economic fluctuations and high inflation affecting the Turkish Lira, regulatory bodies have focused on enhancing the safety and reliability of forex trading, though this has led to higher barriers for entry that may restrict broader participation in the forex market.

Türkiye's forex market encompasses brokers offering various services including futures and options trading. These brokers typically provide access to major trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with various asset classes such as forex, stocks, commodities, and indices. Regulatory compliance is a critical selling point for these brokers, ensuring they adhere to the rigorous standards set by the CMB.

| Feature | Details |

|---|---|

| Regulation | Capital Markets Board (CMB) |

| Min. Deposit | ₺50,000 (~$8,360) |

| Leverage | Up to 1:10 |

| Major Fees | Variable spreads, up to $30 for withdrawals |

The conflict surrounding unregulated brokers targeting Turkish traders highlights the need for vigilance. Despite stringent regulations imposed by the CMB, there remains a palpable risk of scams and unlicensed firms attempting to exploit less informed investors. For instance, reports indicate that many traders have fallen victim to schemes promoted by foreign entities lacking appropriate regulatory oversight.

"I experienced a loss due to a scam broker promising unrealistically high returns. Always check for regulation!" - Anonymous Trader

User feedback generally emphasizes the importance of dealing with regulated entities. Regulated brokers are seen as safer, maintaining segregation of client funds and providing transparent information about the potential risks involved in trading.

Many brokers in Turkey provide competitive commission structures, with some offering accounts that feature low or even no commission depending on trading volume, thus allowing traders to maximize their profitability.

Some traders have reported unexpected charges, particularly high withdrawal fees. For example, an anonymous user noted, “I was charged $30 just to withdraw my earnings. It really dented my profits.”

The varying costs across different broker platforms cater to different trading strategies. For active traders, lower spreads and commissions can be advantageous, but beginners should review the full cost structure to ensure it aligns with their trading style.

Turkish brokers typically offer popular trading platforms such as MT4 and MT5, as well as proprietary platforms, catering to both novice and experienced traders. The reliability and execution speed of these platforms, however, varies between brokers.

Most brokers provide educational resources tailored to traders at different experience levels, from comprehensive instructional materials to market analysis, enabling traders to enhance their skills and understanding of market conditions.

User feedback indicates that while MT4 remains popular for its user-friendly interface, some traders find MT5s capabilities, such as advanced charting tools and enhanced analytics, particularly advantageous for complex trading strategies.

The user interface of a brokers platform heavily influences the trading experience. Platform intuitiveness is essential for both quick access to trading functions and for performing detailed analyses.

Feedback from users tends toward frustration with platforms that are not mobile-friendly or that do not allow seamless trading experiences during periods of high market volatility. Conversely, brokers that excel in this area tend to receive high marks from their customers.

Many users appreciate comprehensive customer service. Good systems for resolving issues can significantly impact user satisfaction.

"Having 24/5 support was a game changer when I needed help during a market crisis!" - Satisfied Trader

Customer service quality varies significantly among brokers. Many traders report frustration with long waiting times or slow responses from customer support teams, particularly during peak trading times.

Top brokers typically offer multiple channels for support, including live chat, email, and phone consultations, bolstering their reputation among traders who prioritize responsive customer service.

User experiences emphasize the necessity of effective communication channels. A responsive customer support service is critical for troubleshooting and can greatly enhance the trading experience.

While high minimum deposits can limit accessibility, many brokers offer flexible conditions for larger accounts, allowing seasoned traders to engage in a wider range of strategies.

Choosing the right account type is crucial depending on an investor's trading style and capital. Islamic accounts, swaps-free accounts, and various leverage options cater to different trader profiles.

Adherence to local regulations mandates that brokers provide clear, user-friendly policies concerning account operations, ensuring traders are fully informed.

The Turkish forex market presents a mixed bag of opportunities and challenges. While safety and regulatory adherence are prioritized, the restrictions can deter novice traders and limit overall market participation. As prospective traders consider entering this market, understanding the financial landscape is crucial—particularly regarding the regulations, required minimum deposits, and the unreliability of unregulated brokers. By focusing on established, compliant brokers and leveraging educational resources, Turkish investors can navigate this market effectively. Those looking to enter must be wary, prepared, and informed to make their trading ventures successful.

In sum, Türkiye offers a regulated trading environment that prioritizes safety, but that safety comes at considerable costs. It is vital for traders to weigh these factors as they decide whether the Turkish forex market is indeed an opportunity or a trap.

FX Broker Capital Trading Markets Review