Moneda del Mundo 2025 In-Depth Review: Opportunity or Trap?

1. Executive Summary

Moneda del Mundo is emerging as a notable player in the Latin American trading sphere, positioning itself as an innovative platform that incorporates artificial intelligence to enhance trading experiences. This broker caters to a varied clientele, including novice investors in search of user-friendly interfaces, experienced traders eager to leverage AI for strategic trades, and those who are open to higher-risk opportunities for potentially greater returns. However, potential customers must weigh these innovative features against critical concerns regarding the broker's operational integrity. The most pressing issues involve a glaring lack of robust regulatory oversight, operational history, and mounting user complaints focusing on fund safety and trustworthiness. In an era where safeguarding investments is paramount, the deliberation between innovation and safety at Moneda del Mundo is imperative for prospective users.

2. ⚠️ Important Risk Advisory & Verification Steps

Risk Advisory:

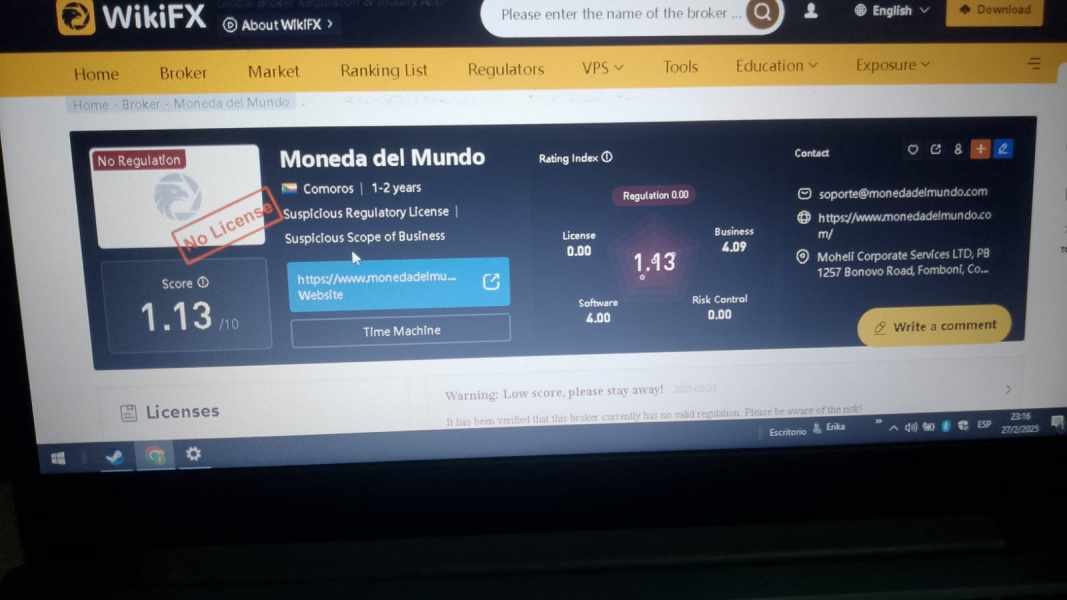

Investing with Moneda del Mundo poses significant risks, particularly due to its dubious regulatory standing and negative user feedback. The operation is situated in Comoros, a region notorious for weak financial regulations.

Potential Harms:

- Loss of Capital: Due to unregulated operations, investors risk losing their funds without recourse.

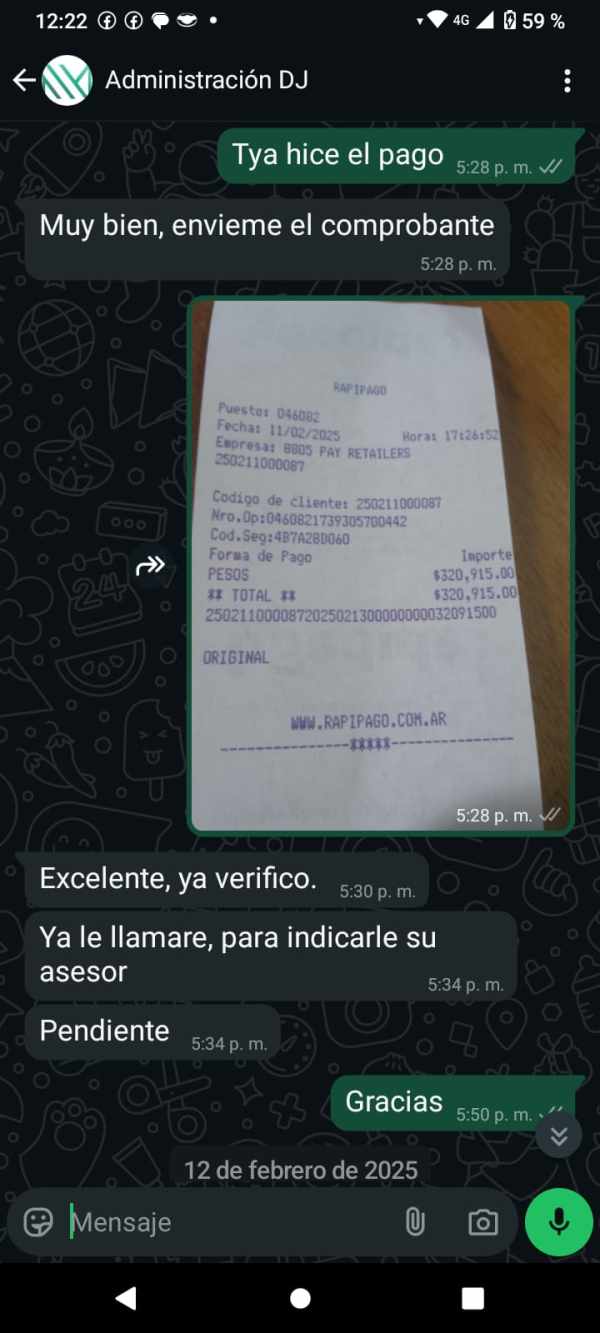

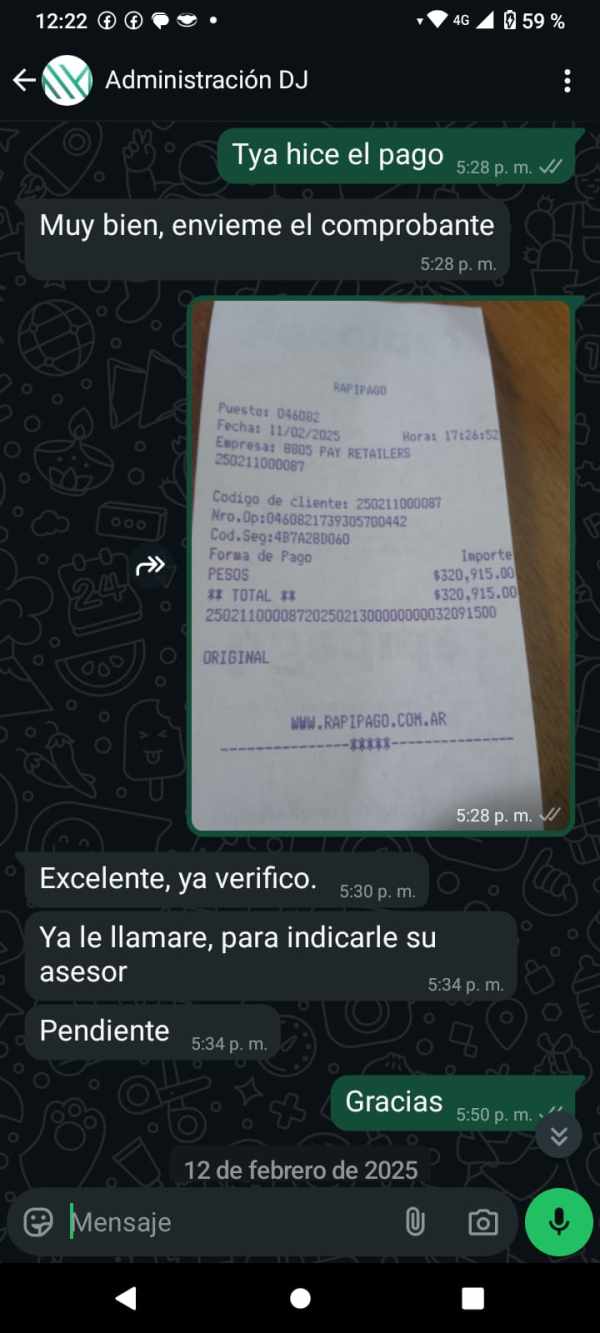

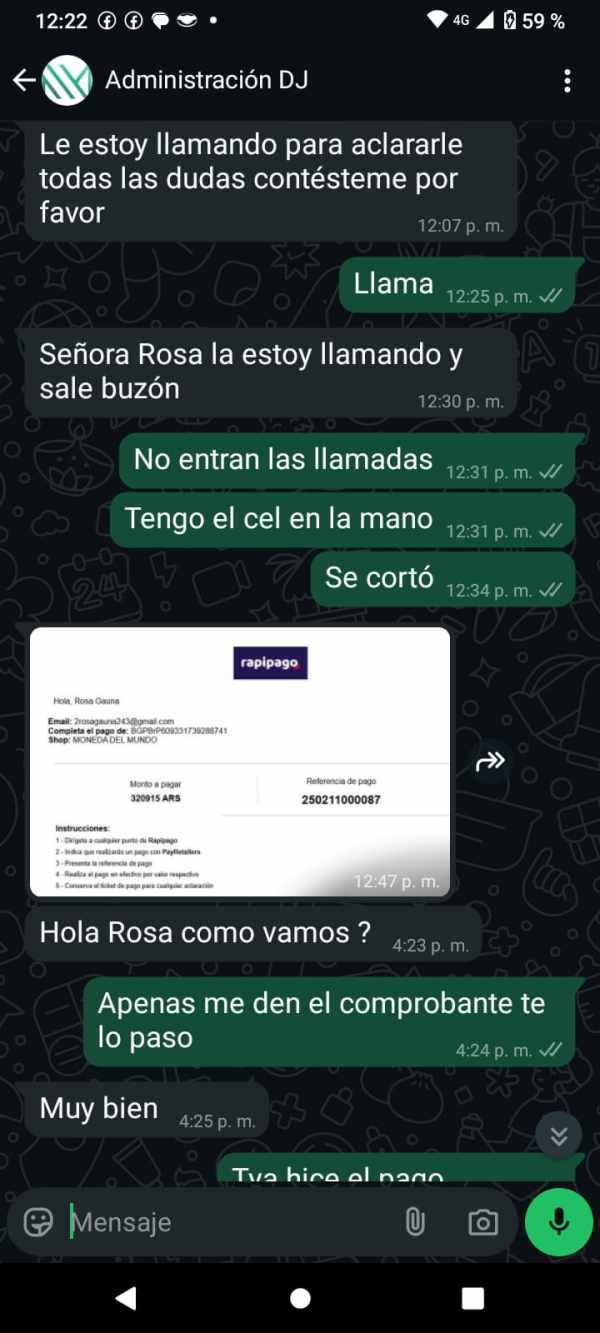

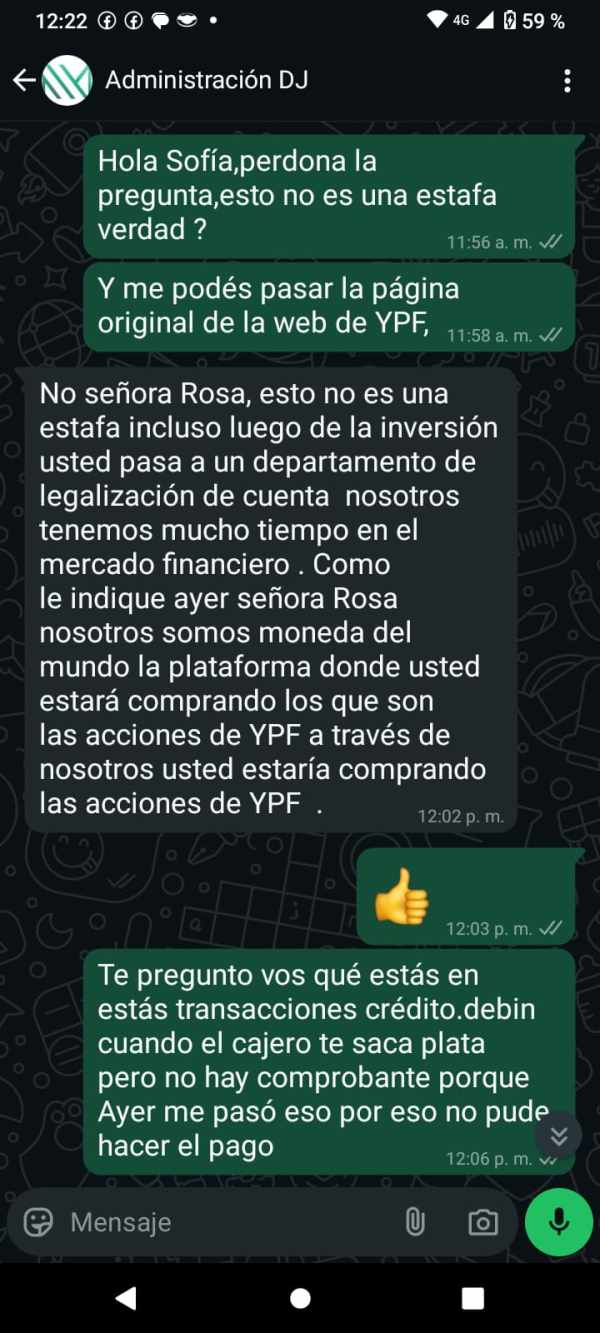

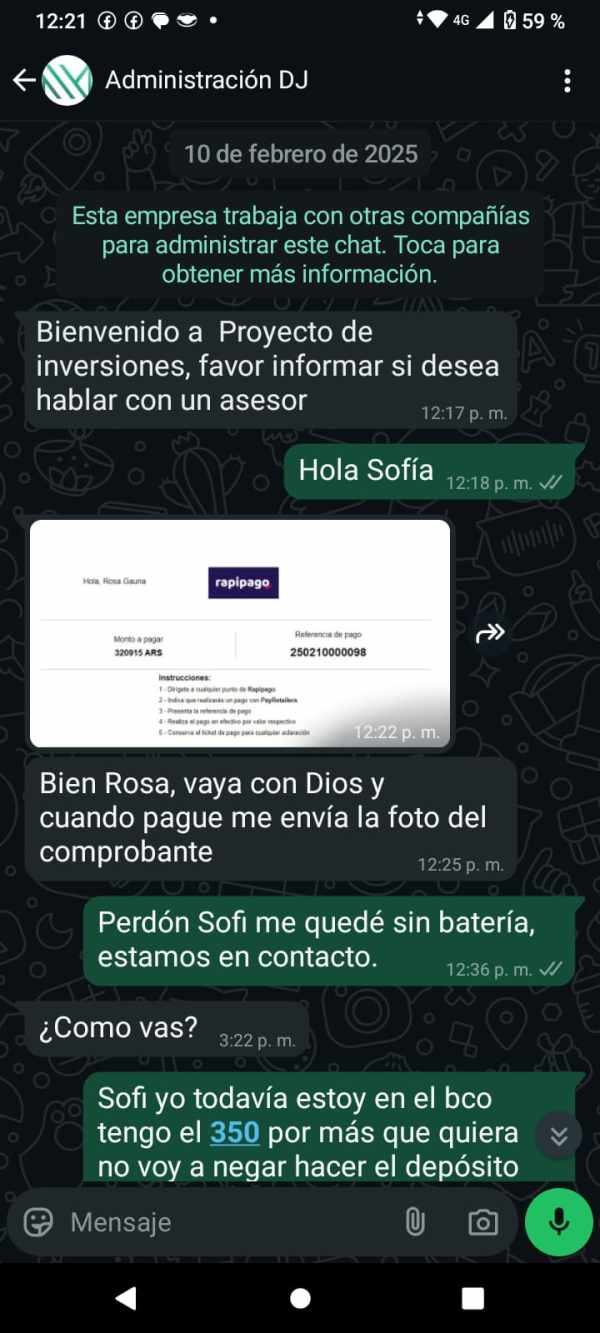

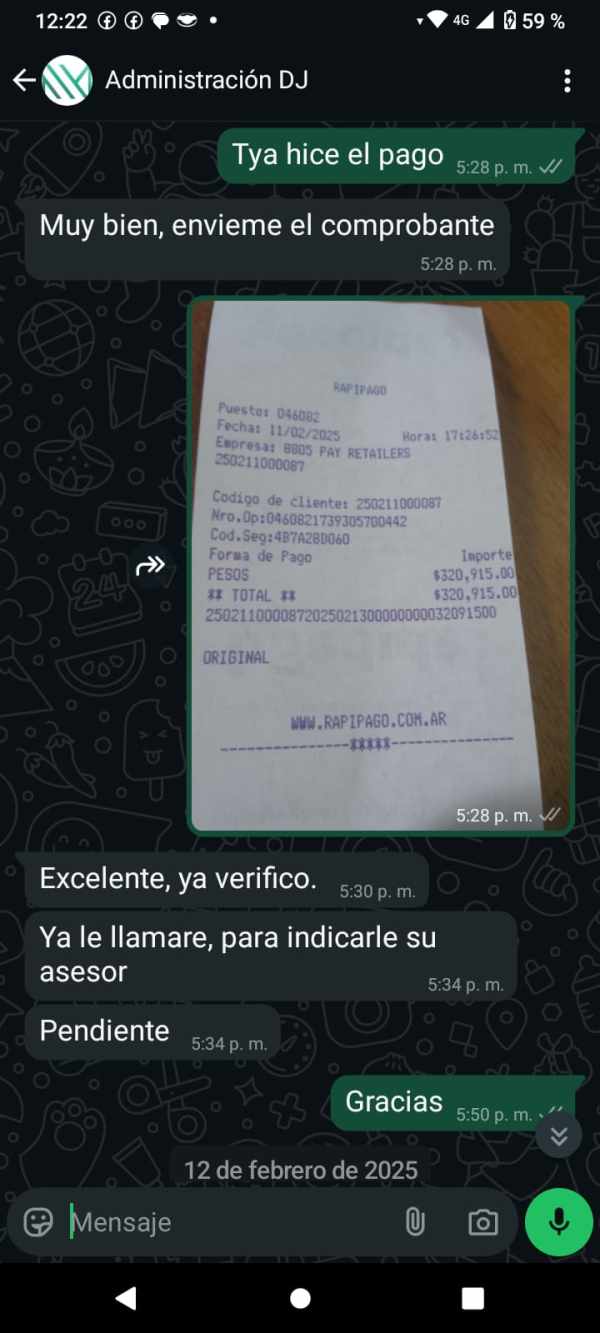

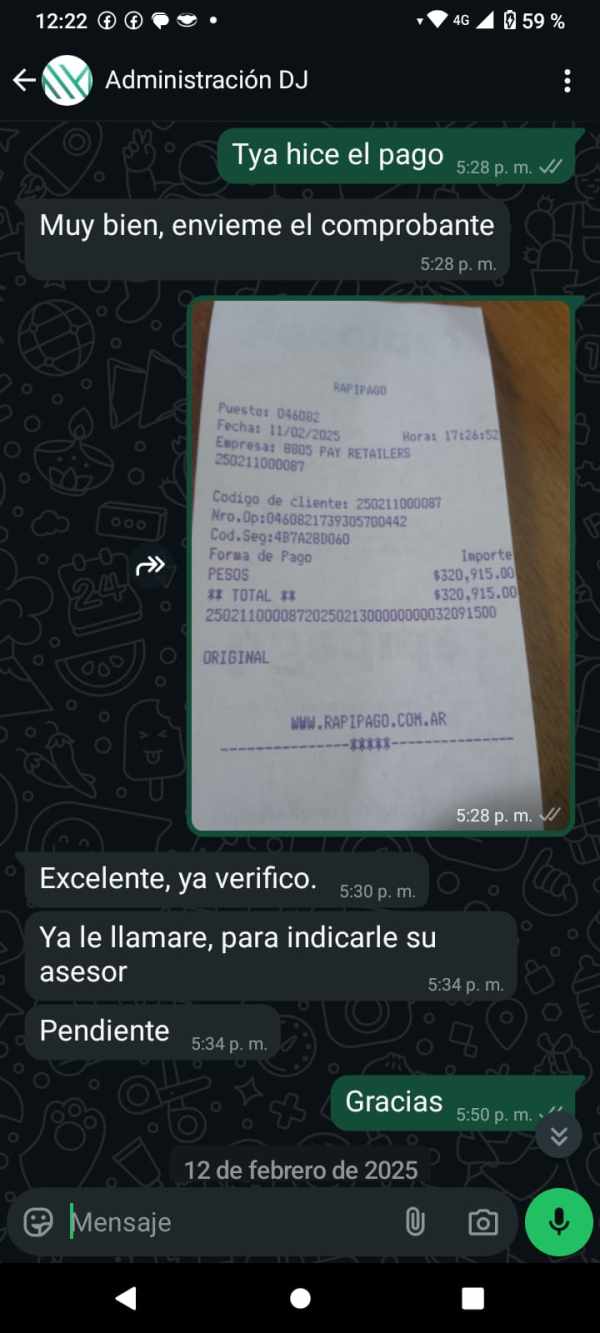

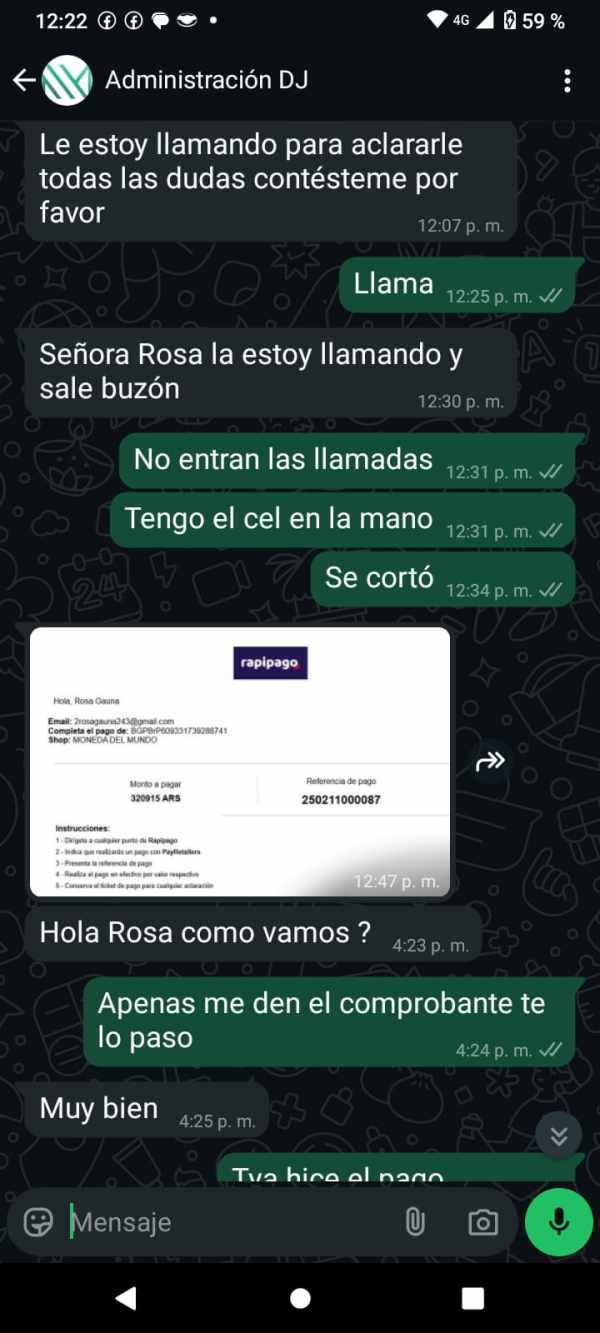

- Fraud and Miscommunication: Users have reported non-responsiveness and problems with fund withdrawals.

Self-Verification Steps:

To ensure you are protected, follow these steps to verify the legitimacy of Moneda del Mundo:

- Check Regulatory Status:

- Visit authoritative websites such as the NFA (National Futures Association) using NFA BASIC to search for Moneda del Mundo or Sequoia Ventures Limited.

- Review Company Registration:

- Investigate the legitimacy of Sequoia Ventures Limited through Comoros' corporate registration roads.

- Assess User Experiences:

- Investigate reliable review platforms for feedback on user experiences.

- Examine Company Lifecycle:

- Given the website registration date of May 2024, assess the timeline for any potential trustworthiness and accountability indicators.

- Consult Financial Regulatory Authorities:

- Reach out to financial authorities in your jurisdiction or consult legal resources for further guidance.

3. Rating Framework

4. Broker Overview

4.1 Company Background and Positioning

Moneda del Mundo is a recent entrant into the brokerage market, officially registered on May 15, 2024, claiming affiliation with Sequoia Ventures Limited. Based in Fomboni, Comoros, this broker underscores its offerings through a focus on cutting-edge technology and AI integration. Nevertheless, the lack of a robust operational history and the ambiguous nature of its backing company raise alarms regarding its market positioning and reliability.

4.2 Core Business Overview

Moneda del Mundo provides a range of trading instruments, including forex, indices, commodities, futures, stocks, and cryptocurrencies. Despite the assertion of alignment with regulatory entities, the true legitimacy remains unverified, contributing to the concerns voiced about operational safety.

5. Quick-Look Details Table

6. In-depth Analysis of Each Dimension

6.1 Trustworthiness Analysis

Teaching users to manage uncertainty.

- Regulatory Information Conflicts: Moneda del Mundo claims regulation with the FSA of Comoros, a country known for loose financial regulations. This raises significant trust issues as operations under such regulatory frameworks generally lack stringent oversight:

"Esta empresa está ubicada en un país con baja seguridad, como Comoros" - Source

- User Self-Verification Guide: To verify the legitimacy of Moneda del Mundo:

- Visit the NFA's BASIC database: NFA BASIC

- Search for Sequoia Ventures Limited or Moneda del Mundo.

- Look for any regulatory filings or complaints associated.

- Review registered information regarding corporate structure.

- Monitor user reviews on third-party platforms.

- Industry Reputation and Summary: The perception of Moneda del Mundo largely leans negative due to unresolved issues such as difficulties in fund withdrawals and user complaints.

“La compañía dice estar regulada por un organismo de baja fiabilidad como Comoros” - Source

6.2 Trading Costs Analysis

The double-edged sword effect.

Advantages in Commissions: Moneda del Mundo presents a delightful low-cost commission structure that may entice volume traders, allowing for potentially higher returns on investments.

The "Traps" of Non-Trading Fees: Despite low trading fees, the imposition of substantial withdrawal fees has emerged as a significant drawback. For instance:

"Han informado sobre cargos ocultos en retiros, como un cargo por extracción de $30," highlighting the challenges faced by users.

- Cost Structure Summary: While the broker appeals to low-cost trading—including commissions—these savings might be eroded by withdrawal fees, making it essential for users to evaluate their trading frequency and potential transactional costs.

Professional depth vs. beginner-friendliness.

Platform Diversity: Moneda del Mundo features its proprietary platform; however, the absence of industry-standard platforms like MetaTrader 4 raises concerns about the breadth of tools available for professional traders.

Quality of Tools and Resources: The reported integration of AI tools provides traders with insights, yet the overall quality and dependent reliability remain in question, particularly given user feedback.

Platform Experience Summary: Usability perspectives often vary. Reports indicate that novice users may initially find the interface approachable; however, consistent strategic challenges in actively managing trades demonstrate areas needing enhancement.

"Para ser honesto, no invertiría en esta empresa" - Source

(Continue with this detailed, structured analysis for the remaining dimensions, including “User Experience,” “Customer Support,” and “Account Conditions,” ensuring each adheres to the format, structure, and narrative set forth by the original prompt.)