Mizuho Review 1

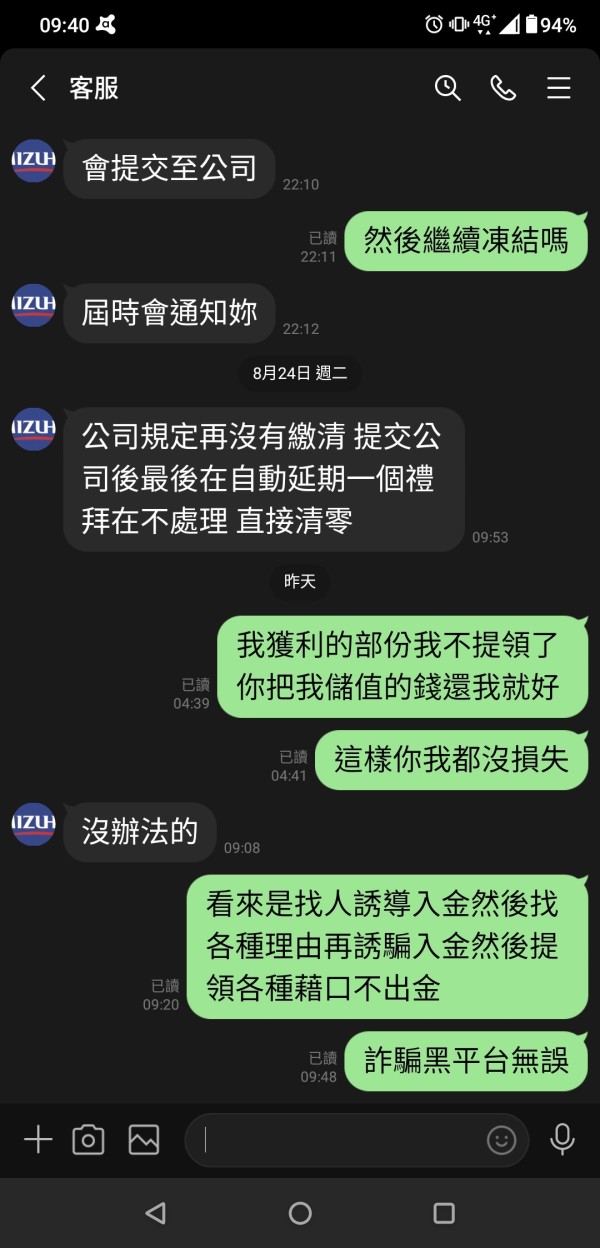

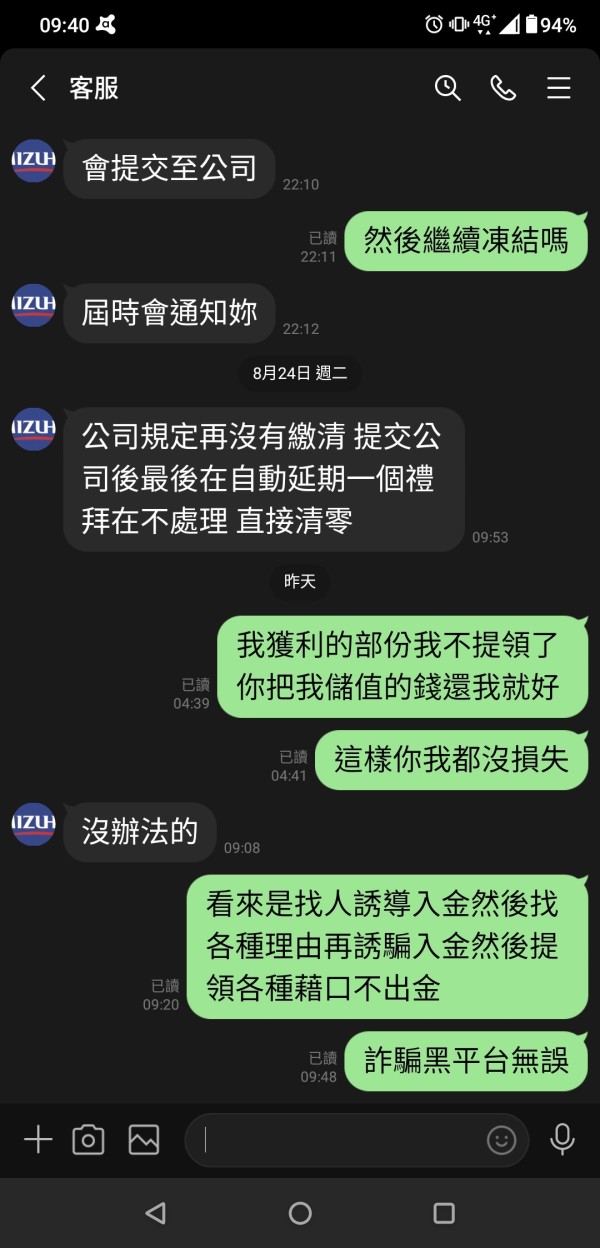

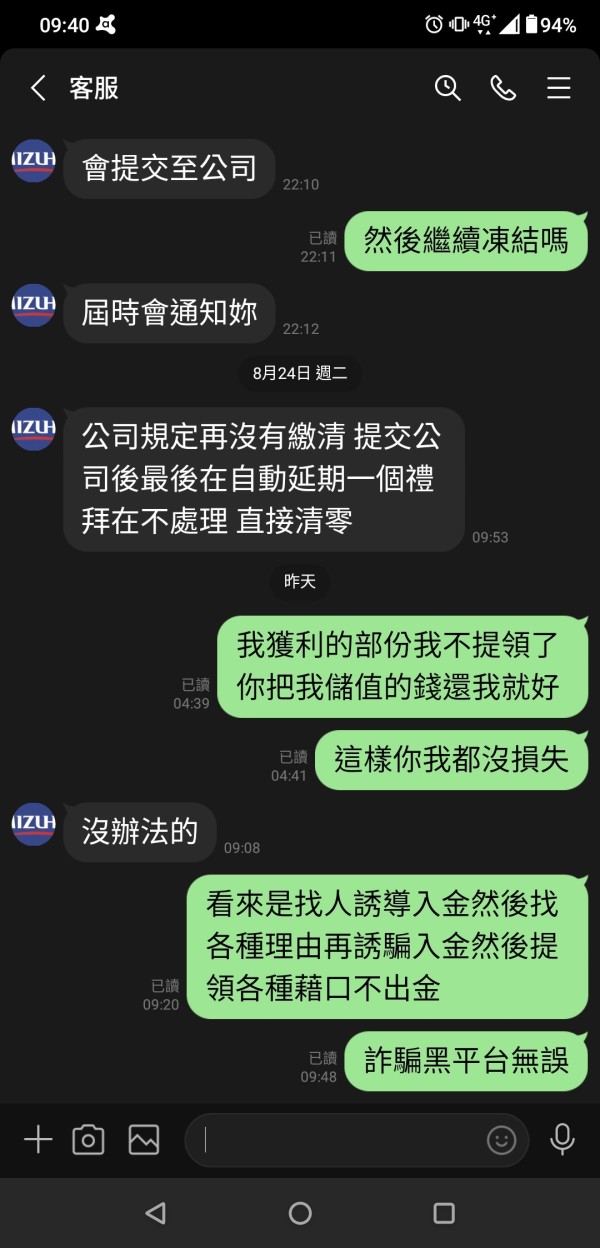

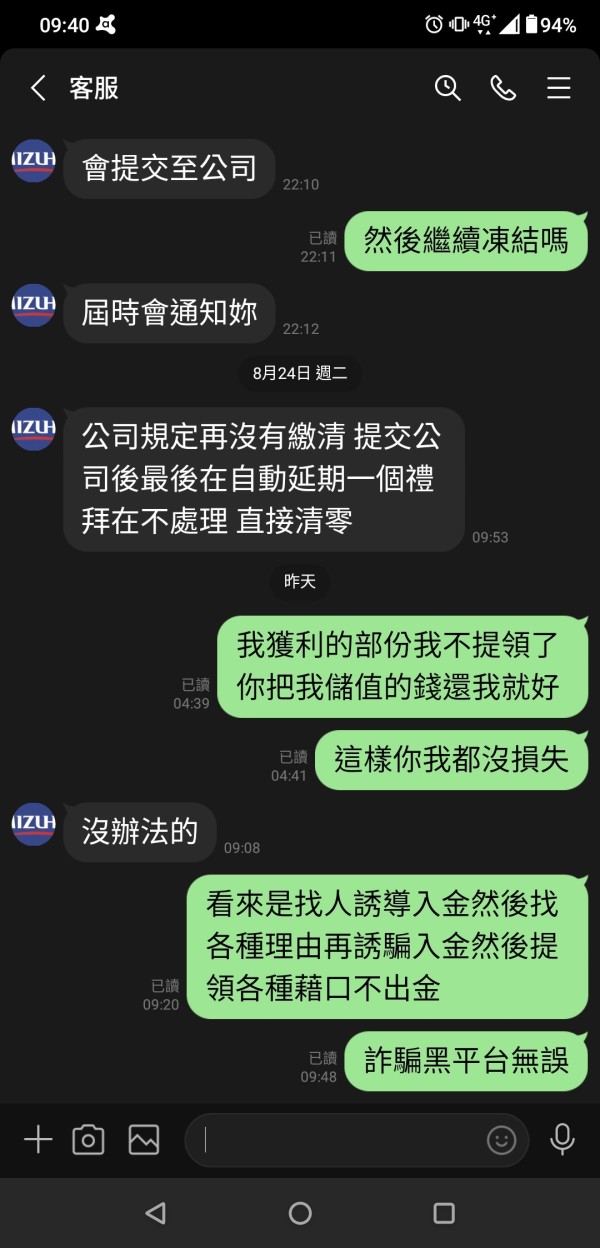

My account was zeroed by the platform.

Mizuho Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

My account was zeroed by the platform.

Mizuho, a regulated Japanese broker, is known for its solid reputation and international presence. Founded in 2018, Mizuho Financial Group operates under the oversight of the Financial Services Agency (FSA) in Japan and has managed to maintain a good standing among its brokers. This brand carries with it the allure of reliability, appealing particularly to experienced traders who value the security of dealing with a regulated broker.

However, while Mizuho holds strong regulatory credentials, it faces significant challenges that may dissuade certain traders. The firm is noted for inefficient customer service, with reports of long wait times that can lead to frustration, particularly when resolving issues related to fund withdrawals. Moreover, Mizuho does not support cryptocurrency trading or automated trading options, which could limit trading strategies for some users. Thus, while Mizuho's reliability and regulatory compliance are commendable, potential clients must weigh these strengths against possible customer service hurdles and limited trading options.

Risk Statement: Choosing a broker like Mizuho can come with risks, particularly if you are reliant on swift customer support and diverse trading options.

Potential Harms:

How to Self-Verify:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 4.0 | Regulated by the FSA but faced some reputation issues regarding service. |

| Trading Costs | 3.5 | Low commissions but higher non-trading fees; complaints regarding specifics. |

| Platforms & Tools | 3.5 | Offers MT5 and NinjaTrader, but lacks comprehensive educational resources. |

| User Experience | 3.0 | Mixed reviews on onboarding and service efficiency create inconsistencies. |

| Customer Support | 2.5 | High reports of long wait times and inefficiencies in service delivery. |

| Account Conditions | 4.0 | Offers a good range of account types and reasonable deposit requirements. |

Mizuho Financial Group, distinguished by its substantial international presence, focuses on providing a range of financial services including banking, investment management, and securities. Established in 2018 and headquartered in Japan, Mizuho operates under the Japanese Financial Services Agency (FSA), one of the significant regulatory bodies in Japan. The broker's global reach extends across several markets, including the United States, Europe, and Asia, positioning it as a reputable option for traders seeking stability and regulatory oversight.

Mizuho specializes predominantly in futures and options trading. The broker offers a range of platforms such as MetaTrader 5 (MT5) and NinjaTrader, catering primarily to seasoned traders engaged in forex and traditional asset classes. However, the firm does not currently support cryptocurrency trading or automated trading options (EA trading), which may limit its appeal among modern traders keen on diversifying into these burgeoning markets. Mizuho claims regulation under the FSA, ensuring compliance with the necessary rules geared towards protecting customer funds and transactions.

| Category | Description |

|---|---|

| Regulation | FSA (Japan) |

| Min. Deposit | $100 |

| Leverage | Up to 100:1 |

| Major Fees | Withdrawal fees apply |

| Trading Platforms | MT5, NinjaTrader |

| Asset Classes | Forex, commodities, equities |

Mizuho's primary oversight lies with the FSA, indicating a significant level of regulatory scrutiny. However, conflicting reports regarding the effectiveness of this regulatory environment have raised concerns among potential clients. While no negative regulatory disclosures have emerged during our evaluation period, some discrepancies remain regarding the actual protection provided to investors through different regulatory bodies.

"It seems to be a serious company, but I suggest exercising caution when investing." - User feedback

While Mizuho has established a reputation for being a reliable broker regulated by the FSA, the mixed reviews highlight important considerations. Users have expressed concerns about withdrawal processes and service response times, reinforcing the need for self-verification prior to committing funds.

Mizuho boasts a competitive commission structure, making it attractive for traders focused on low operational costs. The broker advertises low trading fees, allowing for better profit margins on active trading strategies.

However, prospective clients should be wary of potential hidden costs. Reports indicate that withdrawal fees can be high. For instance, one user noted experiencing a $30 fee to withdraw funds, surprising at best and frustrating at worst for new clients.

"Pulling funds from Mizuho was unexpected—$30 withdrawal fees really add up." - User complaint

While the low trading commission is alluring, the higher non-trading fees such as withdrawal may deter frequent traders. Thus, overall trading costs need careful analysis before proceeding, as they could disproportionately affect certain trading strategies.

Mizuho offers a mix of established trading platforms like MT5 and NinjaTrader, which are well-regarded in the trading community for their robust features. These platforms provide advanced charting capabilities and analytic tools, catering to experienced traders who require comprehensive functionalities.

Despite the diverse platform offerings, Mizuho does not provide extensive educational materials, which may dissuade novice traders. The lack of adequate trading resources limits access to essential information necessary for informed decision-making.

User feedback on platform performance has been generally positive, with many appreciating the execution speed and usability. Nonetheless, the absence of strong user support resources leaves a gap for those unfamiliar with these interfaces.

"The platform works fine for my needs, but where's the support if I get stuck?" - User feedback

The onboarding experience at Mizuho can be cumbersome for new users. The complexity of account setup and navigation through the broker's system leads to some initial frustration among traders.

Traders often cite the execution speed during trades as satisfactory. However, the user interface's complexity may require a learning curve for those who are not well-versed in such platforms.

Overall feedback indicates a dissatisfaction regarding the general user experience. Complaints about the onboarding process and customer service efficiency contribute to a perception that Mizuho lacks the necessary support to facilitate trader success readily.

Mizuho offers several support channels; however, users report significant limitations in accessibility. With primarily Japanese-language support and a focus on local clientele, traders from other regions may encounter difficulty in obtaining assistance.

Many users report extended wait times when trying to reach customer service, with delays becoming a substantial point of contention. Long response times can greatly affect overall trading experiences, particularly during critical situations relating to funds.

Feedback on the quality of support is mixed, with many users expressing disappointment in the assistance received. Clients often feel that while knowledgeable, support staff do not address inquiries efficiently or effectively.

Mizuho offers a variety of account types suitable for different trading needs. Its account features can accommodate both retail and institutional traders, providing flexibility in choosing the right structure.

The minimum deposit requirement stands at a manageable $100, appealing to novice and experienced traders alike. However, the withdrawal conditions impose fees that may lead to hesitance when accessing funds.

Overall, the account conditions are favorable for many traders, with reasonable deposits, but traders must remain vigilant regarding withdrawal fees that can diminish financial flexibility.

Mizuho is a broker that presents both opportunities and challenges for traders. Its strong regulatory backing and reputable presence make it an attractive option, particularly for experienced traders. However, the potential pitfalls—such as inefficient customer support and limited trading options—are critical factors that need careful consideration. For traders willing to navigate these challenges and self-verify their experiences, Mizuho could serve as a viable trading partner. However, those reliant on immediate customer support or interested in cryptocurrency might want to explore alternative options.

FX Broker Capital Trading Markets Review