M.Success FX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive M.Success fx review reveals significant concerns about M.Success FX as a forex broker. Based on available information and regulatory warnings, M.Success FX appears to be a potentially fraudulent platform that poses substantial risks to traders.

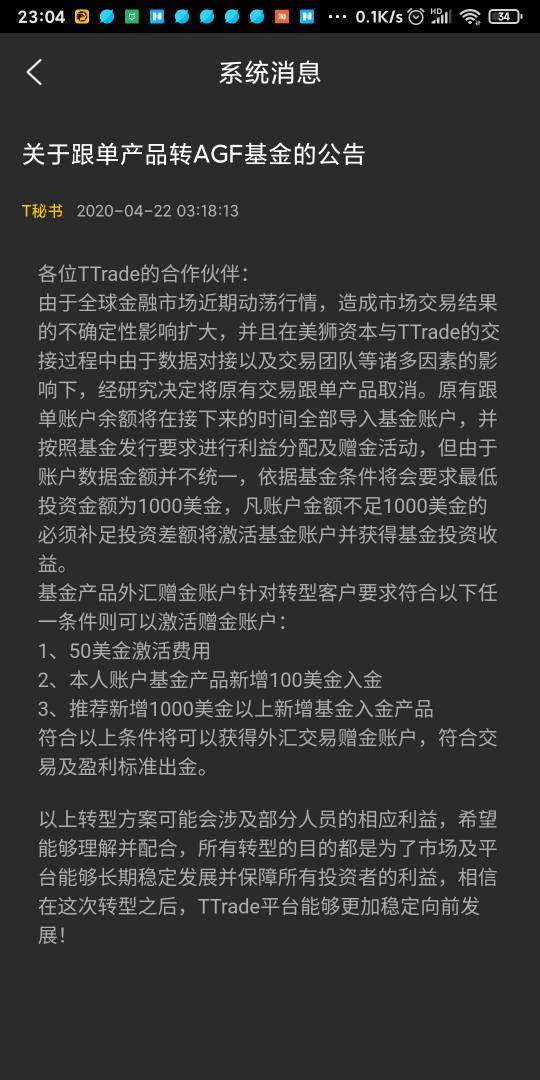

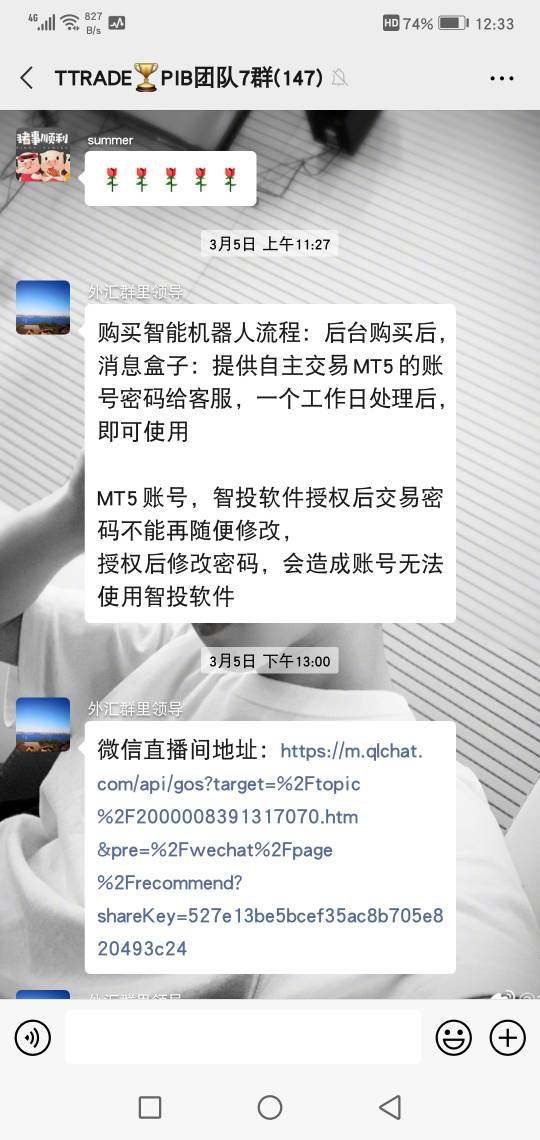

The broker claims to offer forex and CFD trading through the MetaTrader 5 platform and states its headquarters are located in New York. However, regulatory authorities have issued warnings suggesting this broker may be operating as a clone firm.

The Financial Conduct Authority has specifically warned that M.Success FX is not associated with the legitimate Equiti UK, raising serious red flags about potential cloning activities. This lack of proper regulatory oversight, combined with limited transparency regarding trading conditions, fees, and operational details, makes M.Success FX unsuitable for traders seeking a reliable and secure trading environment.

The broker targets individuals interested in forex and CFD trading, but potential clients should exercise extreme caution before considering any engagement with this platform.

Important Notice

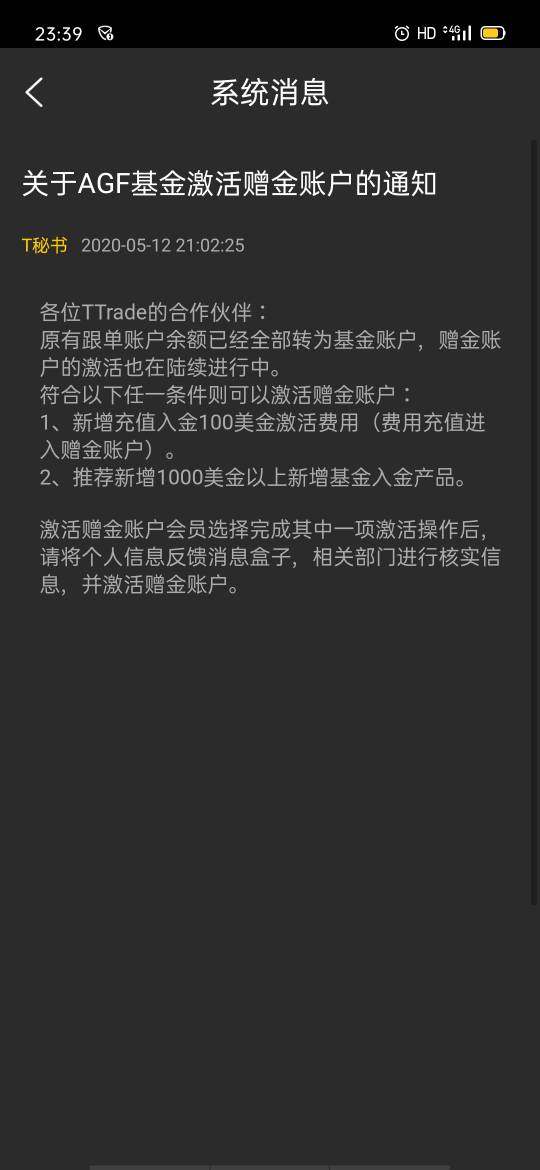

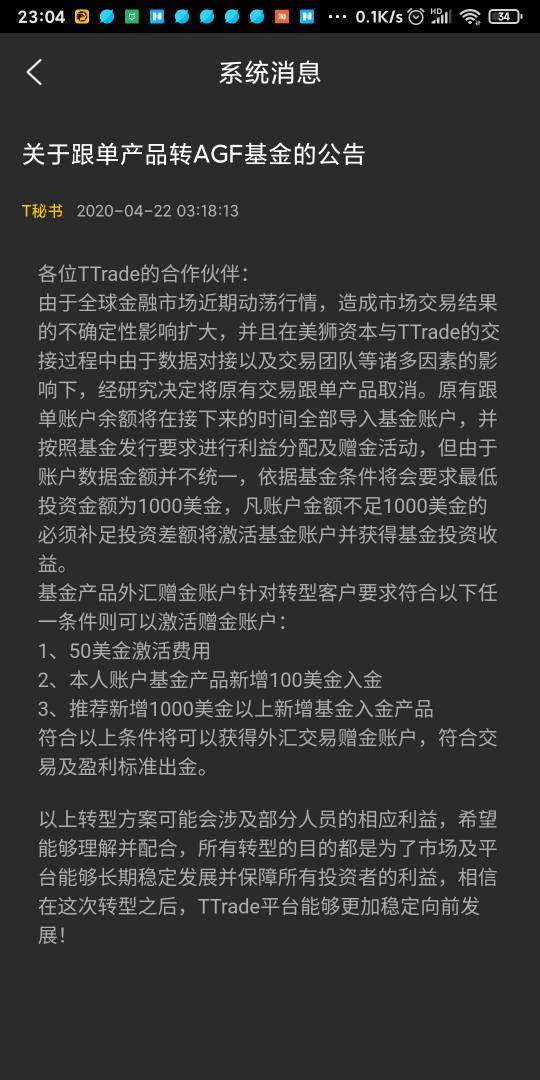

Regional Entity Differences: M.Success FX lacks clear regulatory information, and the FCA has issued warnings stating that this broker is not affiliated with Equiti UK, significantly increasing the possibility of clone risks. Traders should be aware that clone firms often impersonate legitimate brokers to deceive potential clients.

Review Methodology: This evaluation is based on publicly available information, regulatory warnings, and limited user feedback. No direct testing or on-site verification has been conducted due to the questionable nature of this broker's legitimacy.

Rating Framework

Broker Overview

M.Success FX presents itself as a forex and CFD broker claiming to be headquartered in New York. The company's establishment date is not mentioned in available sources, raising immediate concerns about transparency.

According to limited information, M.Success FX operates primarily as a forex and CFD trading platform, targeting individual traders seeking exposure to currency markets and contracts for difference. The broker's business model centers around providing access to forex and CFD trading, though specific details about their operational structure, company history, and management team remain undisclosed.

This lack of fundamental corporate information is particularly concerning for potential clients seeking to verify the legitimacy of their chosen broker. The absence of clear founding information and corporate background details significantly impacts the credibility assessment in this M.Success fx review.

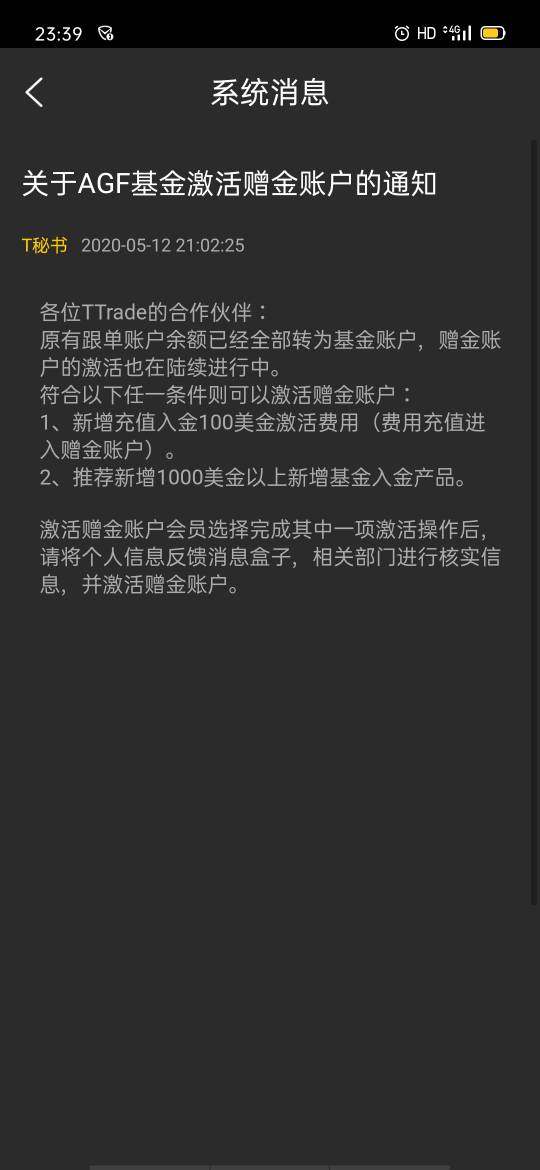

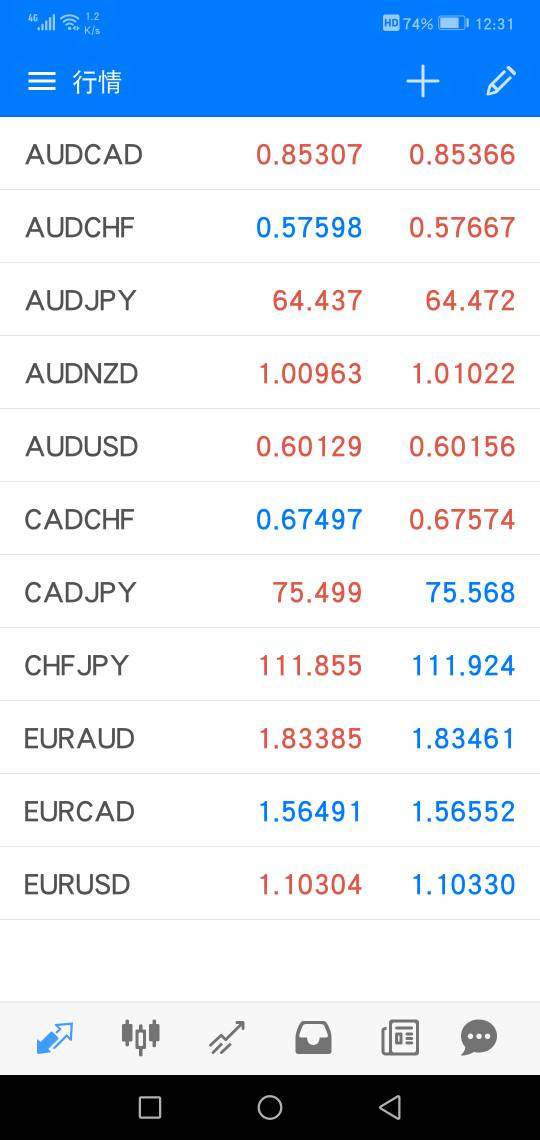

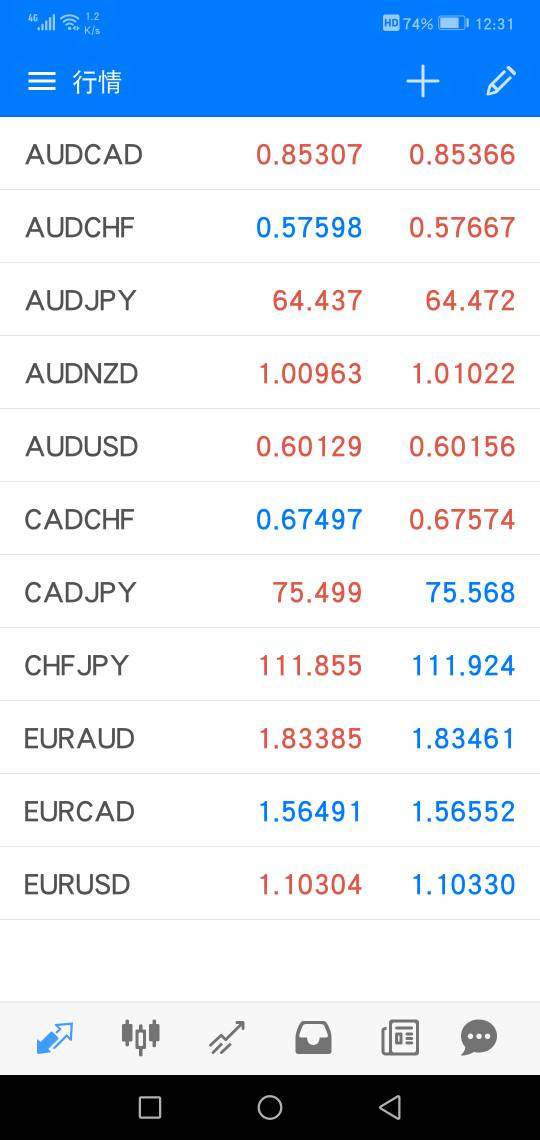

Regarding trading infrastructure, M.Success FX claims to offer the MetaTrader 5 platform for executing trades across forex and CFD markets. However, the range of available assets, specific trading conditions, and platform customization options are not clearly outlined in available documentation.

The FCA's warning about potential clone activities further complicates the assessment of this broker's actual capabilities and legitimate operational status.

Regulatory Jurisdiction: M.Success FX does not clearly specify which regulatory authority oversees its operations. The FCA has issued warnings indicating potential clone risks, suggesting the broker may be operating without proper authorization.

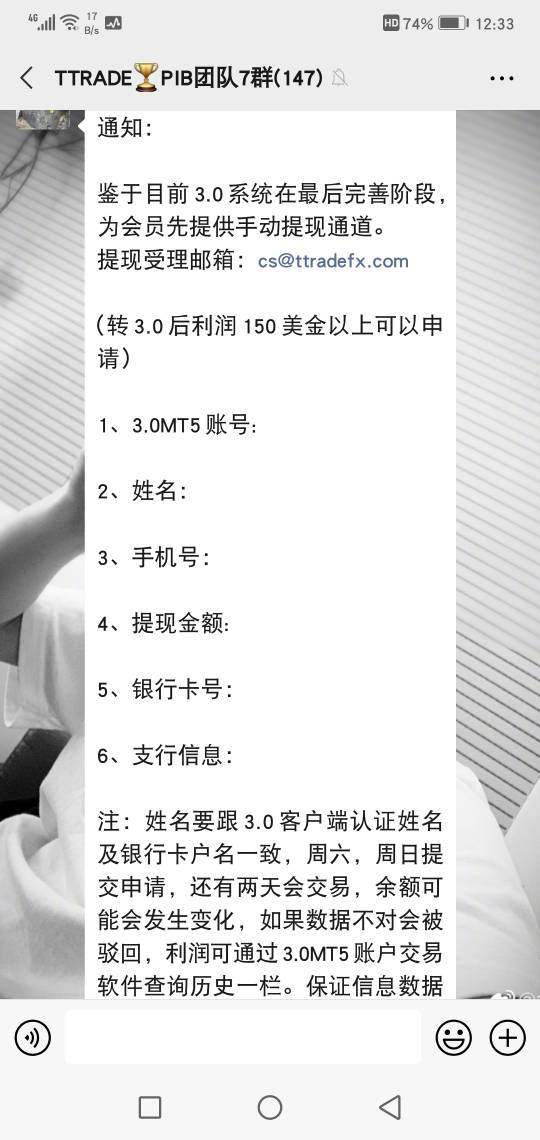

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not mentioned in available sources.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts for different account types, making it difficult for potential clients to assess affordability.

Bonus and Promotions: No information is available regarding promotional offers, welcome bonuses, or ongoing incentive programs.

Tradable Assets: The platform focuses on forex and CFD trading, though the specific range of currency pairs, indices, commodities, and other instruments remains unspecified.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available documentation, preventing accurate cost analysis in this M.Success fx review.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not mentioned in available sources.

Platform Options: M.Success FX claims to provide access to the MetaTrader 5 trading platform, though details about platform features and customization options are limited.

Geographic Restrictions: Information about restricted jurisdictions and regional limitations is not specified in available documentation.

Customer Support Languages: Available customer service languages are not mentioned in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis

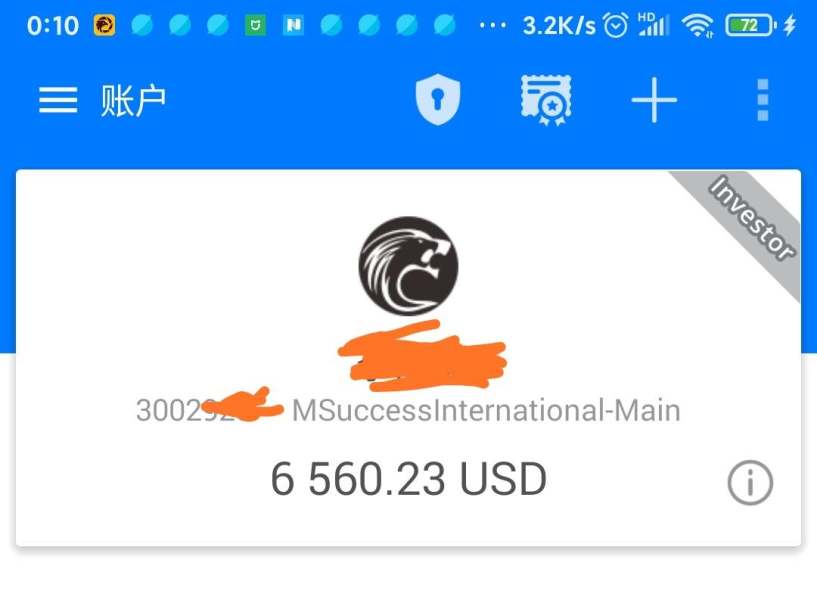

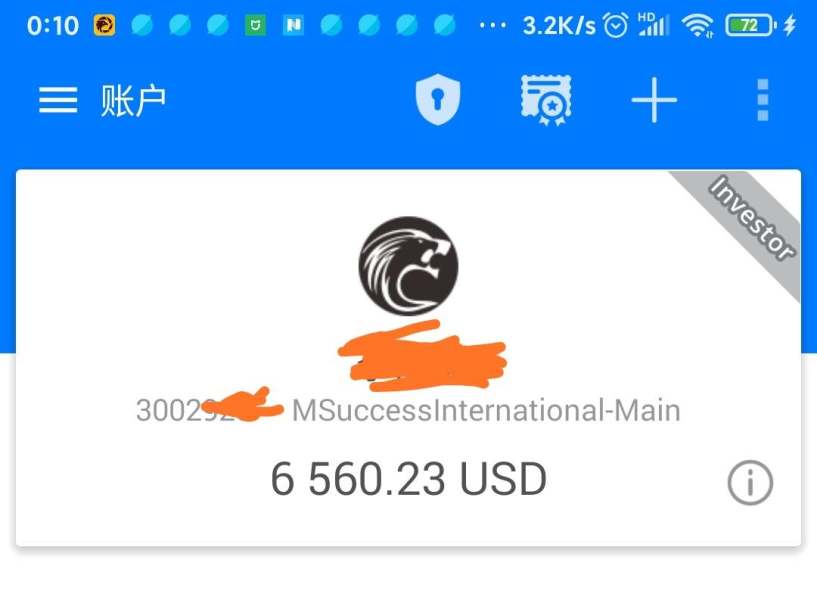

The account conditions offered by M.Success FX remain largely undisclosed, creating significant transparency issues for potential clients. Without specific information about account types, minimum deposit requirements, or special features, traders cannot make informed decisions about suitability.

The absence of details regarding Islamic accounts, professional trading accounts, or beginner-friendly options suggests either limited offerings or poor communication practices. Account opening procedures are not outlined in available documentation, raising questions about verification requirements, documentation needs, and processing timeframes.

This lack of clarity extends to account maintenance fees, inactivity charges, and closure procedures. The missing information about deposit and withdrawal methods further complicates the account management assessment.

Compared to established brokers who provide comprehensive account condition details, M.Success FX's opacity represents a significant disadvantage. Legitimate brokers typically offer multiple account tiers with clearly defined features, costs, and benefits.

The absence of such transparency in this M.Success fx review highlights the questionable nature of this broker's operations and commitment to client service.

M.Success FX claims to provide the MetaTrader 5 platform, which is generally considered a robust trading environment. However, the broker has not provided detailed information about platform customization options, available indicators, or expert advisor support.

The absence of proprietary trading tools or platform enhancements suggests a basic offering without value-added features. Research and analysis resources appear to be non-existent based on available information.

Legitimate brokers typically provide market analysis, economic calendars, trading signals, and research reports to support client decision-making. The lack of such resources indicates either minimal investment in client support or inadequate disclosure of available services.

Educational resources, including webinars, tutorials, trading guides, and market education materials, are not mentioned in accessible documentation. This absence is particularly concerning for novice traders who rely on broker-provided education to develop trading skills.

The limited information about automated trading support and algorithmic trading capabilities further reduces the platform's appeal to advanced traders.

Customer Service and Support Analysis

Customer service information for M.Success FX is notably absent from available sources, creating significant concerns about support accessibility and quality. Without details about available communication channels, response times, or service hours, potential clients cannot assess whether adequate support will be available when needed.

The lack of information about multilingual support capabilities suggests limited international service capacity. Established brokers typically provide support in multiple languages and through various channels including phone, email, live chat, and social media.

The absence of such details in this evaluation raises questions about the broker's commitment to client service. Response time expectations, problem resolution procedures, and escalation processes are not outlined in available documentation.

This lack of transparency about customer service standards makes it impossible to evaluate service quality or reliability. The missing information about dedicated account managers or personalized support options further suggests limited service offerings.

Trading Experience Analysis

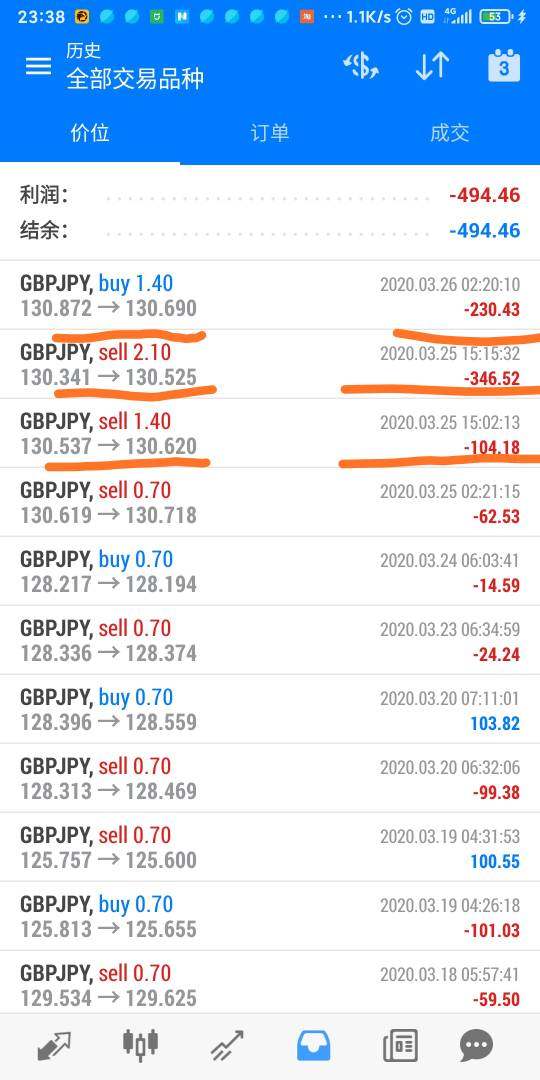

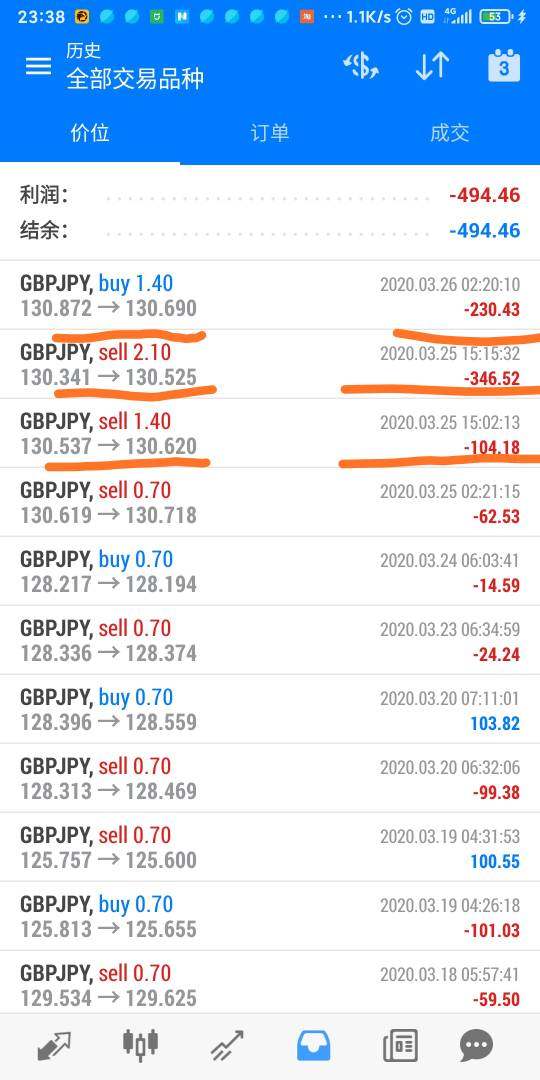

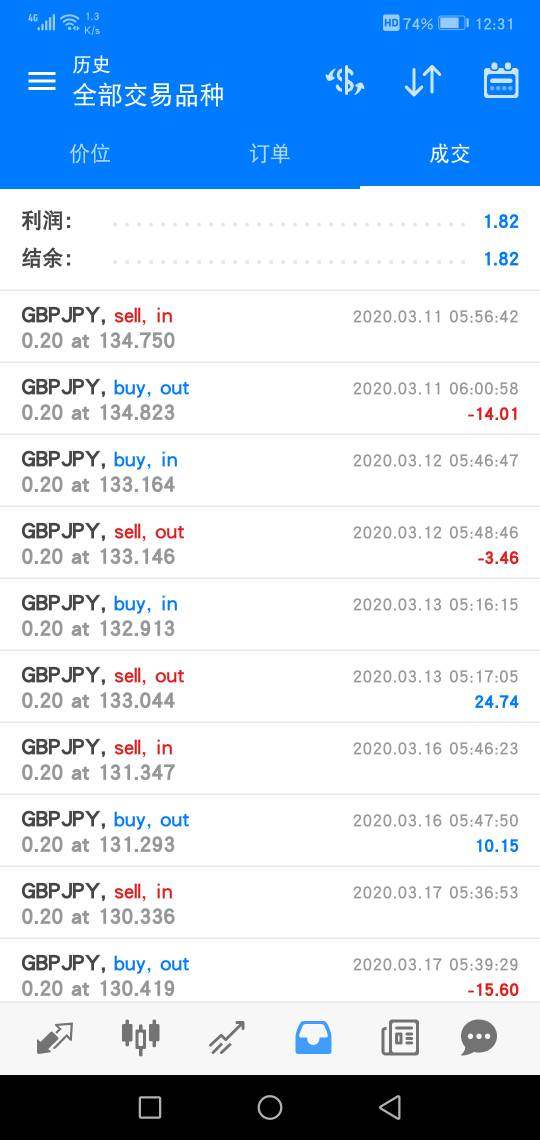

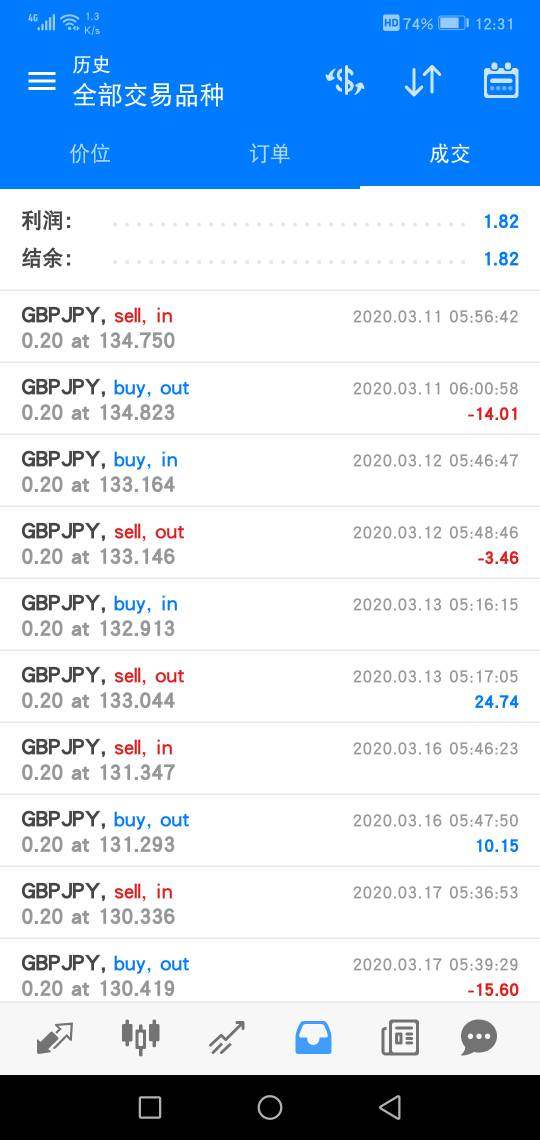

The trading experience offered by M.Success FX cannot be adequately assessed due to the absence of user feedback and performance data. Without specific information about platform stability, execution speeds, or order processing quality, potential clients cannot evaluate the technical reliability of the trading environment.

Platform functionality assessment is hampered by the lack of detailed information about available features, customization options, and user interface design. The absence of mobile trading app details or web-based platform capabilities suggests either limited technological offerings or poor information disclosure practices.

Order execution quality, including slippage rates, requote frequency, and fill rates, is not documented in available sources. These technical performance metrics are crucial for traders to assess platform suitability, and their absence represents a significant information gap in this M.Success fx review.

The lack of trading environment details further prevents comprehensive experience evaluation.

Trust and Reliability Analysis

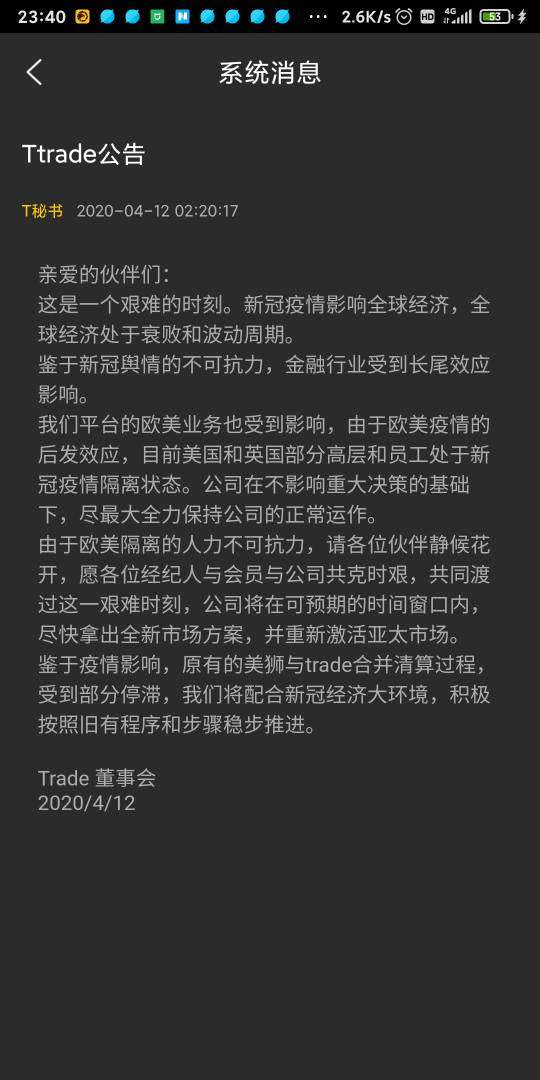

Trust and reliability represent the most concerning aspects of M.Success FX operations. The FCA warning about potential clone risks significantly undermines confidence in this broker's legitimacy.

Clone firms often impersonate established brokers to deceive clients, and regulatory warnings should be taken seriously by potential traders. The absence of clear regulatory authorization information raises fundamental questions about operational legitimacy and client protection.

Legitimate brokers typically display regulatory licenses prominently and provide detailed information about oversight authorities. The lack of such transparency suggests either unlicensed operations or deliberate concealment of regulatory status.

Fund safety measures, including segregated accounts, deposit insurance, and investor compensation schemes, are not mentioned in available documentation. These protections are essential for client security, and their absence represents a significant risk factor.

The lack of information about company transparency, audited financial statements, and operational disclosures further diminishes trustworthiness.

User Experience Analysis

User experience assessment for M.Success FX is severely limited by the absence of client feedback and satisfaction data. Without specific user reviews, testimonials, or satisfaction surveys, it is impossible to evaluate the overall client experience or identify common issues.

Interface design and usability information is not available in accessible sources, preventing assessment of platform user-friendliness and navigation efficiency. Registration and verification process details are similarly absent, making it difficult to evaluate onboarding experience and account setup complexity.

Fund operation experiences, including deposit and withdrawal procedures, processing times, and associated difficulties, are not documented in available sources. Common user complaints, resolution procedures, and improvement initiatives are not mentioned, preventing comprehensive user experience evaluation.

The absence of user demographic information and satisfaction metrics further limits the assessment scope.

Conclusion

This comprehensive M.Success fx review reveals significant concerns about M.Success FX as a forex broker. The platform appears to pose substantial risks to traders, with regulatory warnings suggesting potential fraudulent activities.

The lack of transparency regarding trading conditions, fees, regulatory status, and operational details makes this broker unsuitable for traders seeking secure and reliable trading environments. M.Success FX is not recommended for any traders, particularly those prioritizing safety and regulatory protection.

The absence of proper oversight, combined with FCA warnings about clone risks, creates an unacceptable risk profile. Traders should seek established, properly regulated brokers with transparent operations and positive track records.

The primary disadvantages include questionable legitimacy, lack of regulatory protection, absence of transparent information, and potential clone risks. Until M.Success FX addresses these fundamental concerns and obtains proper regulatory authorization, potential clients should avoid this platform entirely.