Midasama 2025 Review: Everything You Need to Know

Executive Summary

This midasama review gives you a complete look at a Malaysian forex broker that has gotten a lot of negative attention from traders. Midasama started in 2012. It works without any rules watching over it and faces serious claims that it might be a Ponzi scheme.

The broker offers the popular MT4 trading platform and many different trading tools like forex, precious metals, commodities, indices, and stocks. But it has big problems with trust. The platform mainly targets people who want to trade forex, especially those who don't mind high risks.

Many sources worry about whether this broker is real and safe. BehindMLM reports call Midasama a "Malaysian forex trading Ponzi scheme," which really hurts how people see it. The broker does give access to different trading products through MT4. However, it has no rules protecting traders and gets many bad reviews, making it a very questionable choice for serious traders who want reliable and secure trading.

Important Notice

Regional Entity Differences: Midasama is registered in Malaysia but works without any real oversight from recognized financial authorities. This lack of rules creates big risks to traders' money and legal protections.

Review Methodology: This review looks at user feedback, industry reports, and available market data in detail. The broker itself doesn't share much information, so most of this assessment uses third-party sources and user experiences from various platforms.

Rating Framework

Broker Overview

Midasama entered the forex market in 2012 as a Malaysian-registered company. It positions itself as a provider of diverse trading opportunities. The company's business model focuses on giving access to multiple asset classes including foreign exchange, precious metals, commodities, indices, and stocks.

But the broker's way of working has raised big concerns in the trading community, especially about its regulatory status and business practices. The broker's lack of proper regulatory oversight is a major weakness in how it operates. WikiBit reports say Midasama works without supervision from any recognized financial regulatory authority, which leaves traders without important protections that regulated brokers usually provide.

This regulatory gap has led to widespread doubt about whether the broker is legitimate and has been a main factor in various negative reviews. Midasama's trading setup is built around the MetaTrader 4 platform, which gives users access to technical analysis tools and automated trading capabilities. The broker offers trading across multiple asset categories, trying to serve different trading preferences.

However, the lack of clear information about trading conditions, fees, and operational procedures has made it hard for potential clients to make informed decisions about the broker's services.

Regulatory Status: Midasama works without valid regulation from any recognized financial authority. This creates big risks for trader protection and fund security.

Deposit and Withdrawal Methods: Specific information about payment methods and processing procedures is not detailed in available documentation.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not clearly specified in accessible materials. Details about promotional offers or bonus structures are not mentioned in available sources.

Bonuses and Promotions: The platform provides access to forex pairs, precious metals, commodities, stock indices, and individual stocks across multiple markets.

Tradeable Assets: Specific information about spreads, commissions, and other trading costs is not transparently disclosed in available materials.

Cost Structure: Maximum leverage ratios and margin requirements are not clearly specified in accessible documentation.

Leverage Options: The broker primarily offers the MetaTrader 4 trading platform for client access.

Platform Choices: Information about regional trading restrictions is not detailed in available sources.

Geographic Restrictions: Specific details about multilingual support options are not mentioned in accessible materials.

Customer Support Languages: This midasama review shows the big information gaps that potential traders face when looking at this broker, which itself raises concerns about transparency and operational standards.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions that Midasama offers present serious concerns for potential traders. The broker fails to give clear information about account types, minimum deposit requirements, or specific trading terms. This represents a basic failure in industry standards.

TheForexReview reports say the lack of clear account details makes it impossible for traders to properly evaluate the broker's offerings or compare them with industry alternatives. User feedback consistently points out the absence of detailed information about account features and trading conditions. The broker's failure to clearly outline spreads, commissions, overnight fees, or other essential trading costs creates uncertainty that is wrong for serious trading activities.

This lack of transparency is especially concerning given the broker's unregulated status. When compared to established, regulated brokers that provide complete account information and transparent fee structures, Midasama's approach appears deliberately unclear. The absence of educational materials about account features and the lack of clear terms and conditions make these issues even worse.

This midasama review must emphasize that the poor account conditions transparency represents a big red flag for potential traders. The combination of unclear terms, lack of regulatory protection, and absence of transparent pricing makes Midasama's account offerings unsuitable for traders seeking reliable and predictable trading conditions.

Midasama's provision of the MetaTrader 4 platform represents one of the few positive aspects identified in this analysis. MT4 is a widely recognized and respected trading platform that offers complete charting tools, technical indicators, and automated trading capabilities. The platform's reliability and feature set provide users with access to professional-grade trading tools that are standard across the industry.

However, the broker's offering of tools and resources appears limited beyond the basic MT4 platform access. Available sources do not show the provision of additional research resources, market analysis, or educational materials that are typically expected from complete broker services. The absence of proprietary tools or enhanced platform features suggests a minimal approach to trader support and development.

User feedback about the platform experience shows mixed results, with some appreciation for MT4's functionality but concerns about the overall service quality and support. The lack of additional resources such as economic calendars, market news, or research reports limits the platform's utility for traders seeking complete market analysis tools. While the MT4 platform itself is reliable, the overall tools and resources package appears basic and lacks the complete support systems that characterize leading broker offerings in the current market environment.

Customer Service and Support Analysis (Score: 2/10)

Customer service represents a critical weakness in Midasama's operations. Multiple sources report big concerns about support quality and responsiveness. User feedback consistently shows difficulties in getting adequate assistance and resolution for trading-related issues.

The broker's customer service setup appears inadequate for addressing the complex needs of forex traders. The availability and quality of customer support channels are not clearly documented, which itself represents a service failure. Professional brokers typically provide multiple contact methods, clearly defined support hours, and multilingual assistance.

The absence of transparent information about these basic service elements suggests a substandard approach to customer care. Response times and problem resolution capabilities appear to be big issues based on user reports. The lack of effective customer support becomes especially problematic when combined with the broker's unregulated status, as traders have limited recourse for addressing disputes or service failures.

This creates an environment where customer issues may remain unresolved. The overall customer service experience appears to fall well below industry standards, contributing to the negative perception of the broker's operations and reliability in the trading community.

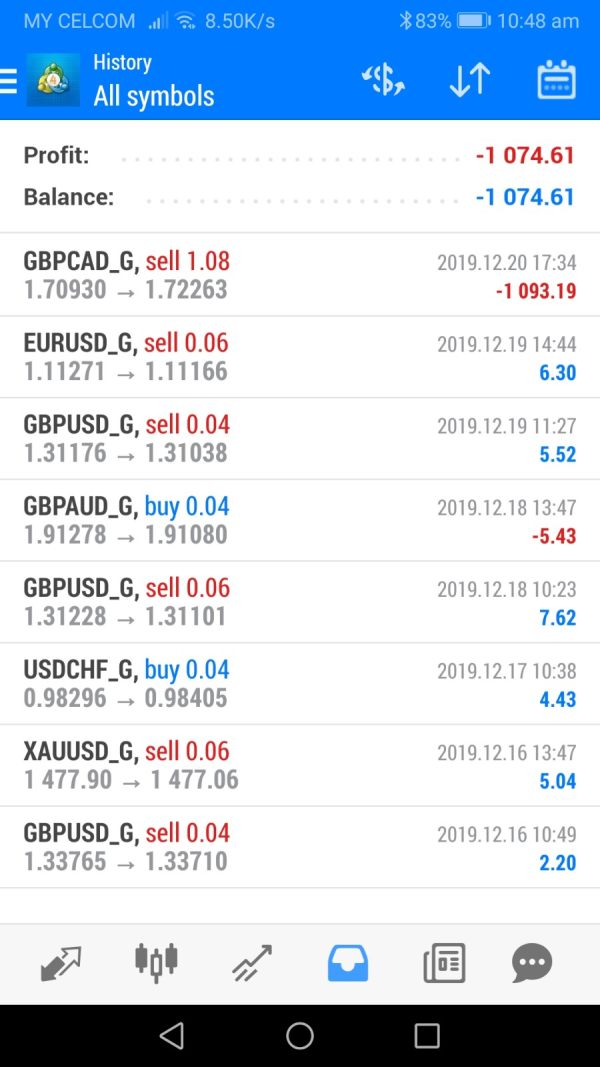

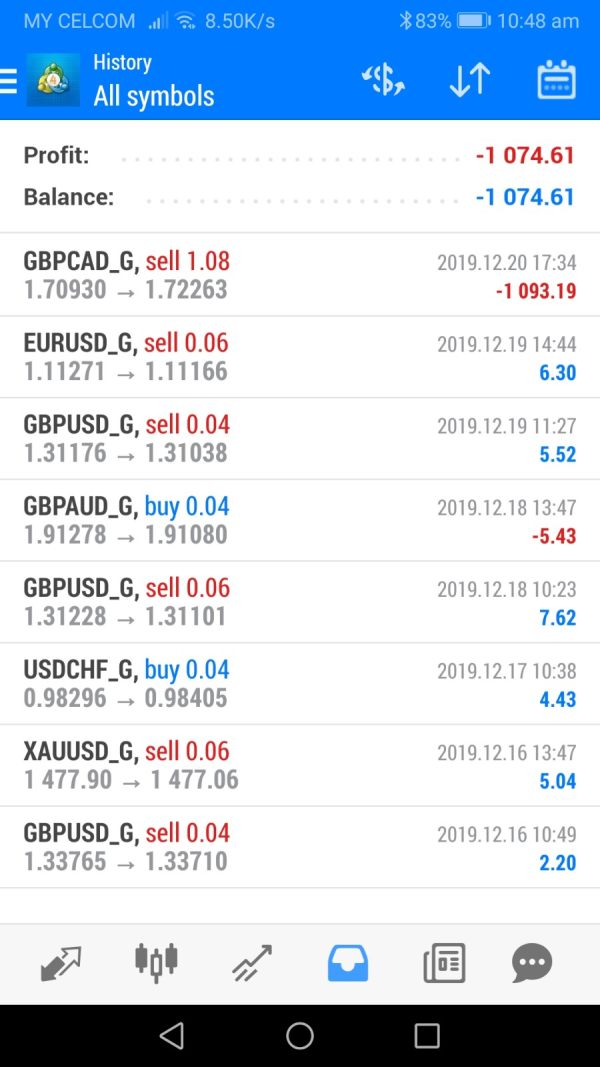

Trading Experience Analysis (Score: 4/10)

The trading experience with Midasama presents a mixed picture. Some technical capabilities are offset by big operational concerns. The MT4 platform provides basic trading functionality and access to multiple asset classes, which offers some utility for traders seeking diverse market exposure.

However, user feedback shows various issues that impact the overall trading environment. Platform stability and execution quality are areas where specific performance data is not readily available, making it difficult to assess the technical reliability of the trading infrastructure. The absence of transparent information about execution speeds, slippage rates, or server uptime statistics raises questions about the broker's commitment to providing professional-grade trading conditions.

Mobile trading capabilities and platform accessibility appear to be standard through the MT4 mobile applications, though specific enhancements or optimizations by the broker are not documented. The trading environment lacks the advanced features and tools that characterize leading broker platforms in the current market. User experiences reported across various sources suggest inconsistencies in trading conditions and concerns about the overall reliability of the trading environment.

This midasama review shows that while basic trading functionality exists, the overall experience falls short of professional standards expected in the forex industry.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most critical weaknesses in Midasama's operations. The broker's complete lack of regulatory oversight from recognized financial authorities creates basic risks that cannot be overlooked. BehindMLM reports explicitly characterize the broker as a "Malaysian forex trading Ponzi scheme," which represents the most serious possible allegation against a financial services provider.

The absence of regulatory protection means traders have no recourse through official channels in case of disputes, fund recovery issues, or operational problems. Regulated brokers are required to maintain segregated client accounts, provide compensation schemes, and follow strict operational standards - none of which apply to Midasama's operations. Company transparency is severely lacking, with limited information available about corporate structure, ownership, financial statements, or operational procedures.

This opacity is inconsistent with legitimate broker operations and raises serious questions about the company's intentions and business model. The combination of no regulatory oversight, serious fraud allegations, and lack of operational transparency creates a risk profile that is unacceptable for serious traders. The negative industry reputation and documented concerns from multiple sources reinforce the assessment that this broker cannot be considered trustworthy or reliable for forex trading activities.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Midasama appears to be significantly poor based on available feedback and reviews. The negative assessments from multiple sources show widespread dissatisfaction with various aspects of the broker's services. User complaints consistently focus on concerns about legitimacy, safety, and operational reliability rather than typical trading-related issues.

The registration and account opening process lacks the transparency and security measures that users expect from legitimate brokers. The absence of clear verification procedures and account protection measures creates uncertainty about fund security and account integrity. These concerns are amplified by the broker's unregulated status and negative industry reputation.

Common user complaints center around the basic question of the broker's legitimacy rather than specific service issues. This pattern of concern is highly unusual and shows systemic problems with the broker's operations and reputation. The focus on safety and legality concerns rather than trading conditions suggests that users recognize the basic risks associated with this broker.

The user experience is further compromised by limited customer support options and lack of educational resources. Professional brokers typically provide complete support systems to help users navigate their platforms and improve their trading skills, but such resources appear to be absent or inadequate in Midasama's offering.

Conclusion

This complete analysis reveals that Midasama presents unacceptable risks for forex traders seeking reliable and secure trading conditions. The broker's complete lack of regulatory oversight, combined with serious allegations of fraudulent operations, makes it unsuitable for legitimate trading activities. While the provision of MT4 platform access and multiple trading instruments might appear attractive, these features cannot make up for the basic safety and reliability concerns.

The broker is not recommended for any category of trader, including those with high risk tolerance. The absence of regulatory protection, transparent operational procedures, and positive user feedback creates a risk environment that extends beyond typical trading risks to basic questions of fund security and operational legitimacy. Serious traders should focus on regulated alternatives that provide appropriate protections and transparent operations.