MEEFX 2025 Review: Everything You Need to Know

Summary

MEEFX is an online forex and CFD broker that was established in 2020. It claims registration in the United Kingdom but operates without regulatory oversight, which presents certain risks for potential traders. This meefx review examines a broker that positions itself in the competitive online trading space with some attractive features alongside significant concerns.

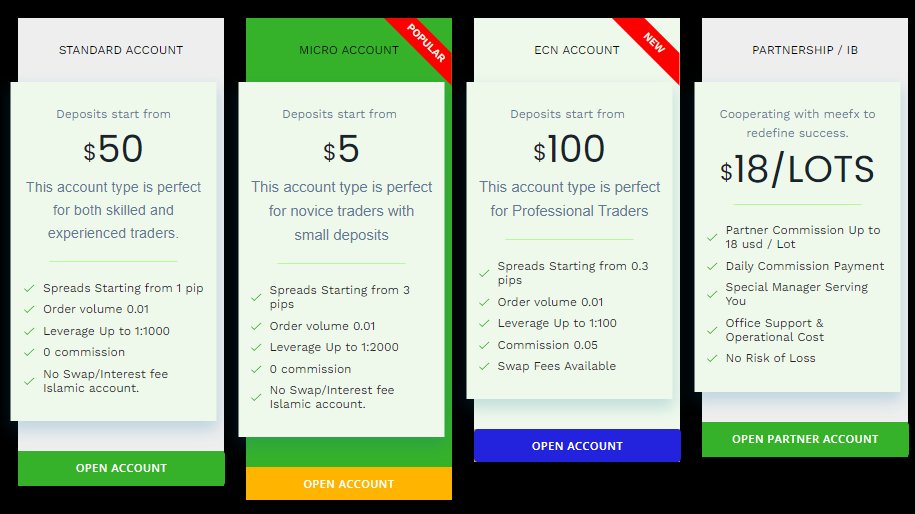

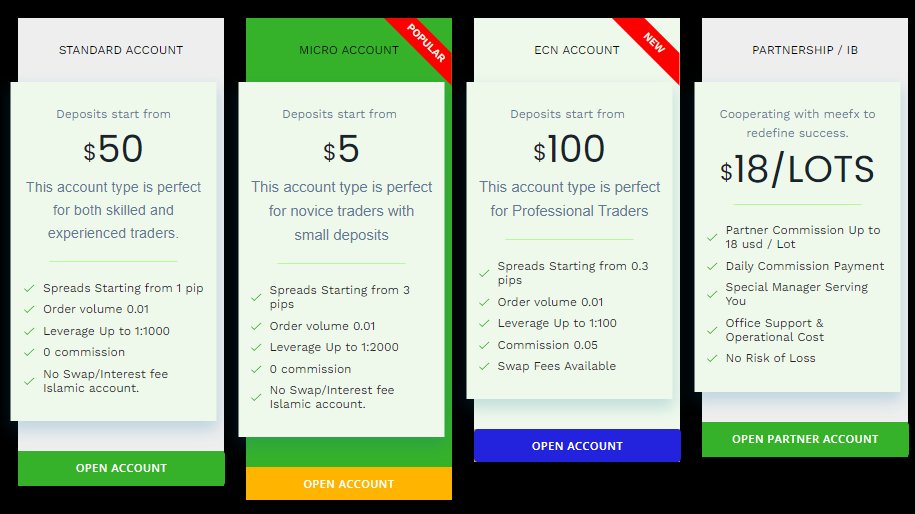

The broker's main highlights include an exceptionally low minimum deposit requirement of just $5. It also offers leverage ratios reaching up to 1:2000, making it potentially appealing to retail traders with limited capital. MEEFX offers trading across multiple asset classes including forex, precious metals, indices, energy commodities, stocks, and cryptocurrencies through the widely-used MetaTrader 4 platform.

However, the lack of regulatory supervision raises substantial questions about trader protection and fund security. The broker appears to target low-capital investors and traders seeking high-leverage opportunities. The absence of regulatory oversight means traders lack the typical protections associated with licensed brokers. According to available information from various review platforms, MEEFX operates in a regulatory gray area that requires careful consideration from potential clients.

Important Notice

MEEFX operates as an unregulated broker claiming registration in the United Kingdom. This means traders in different jurisdictions may face varying degrees of legal protection and recourse options. The absence of regulatory oversight from recognized financial authorities means that typical investor protection schemes and compensation funds may not apply to MEEFX clients.

This review is based on publicly available information from various online sources and industry databases. We have not conducted direct user experience testing with MEEFX services. Traders should conduct their own due diligence and consider the regulatory status carefully before engaging with any unregulated broker. The lack of oversight may impact fund security and dispute resolution processes.

Rating Framework

Broker Overview

MEEFX was established in 2020 as an online forex and CFD broker. It targets the global retail trading market. According to available information from industry review platforms, the company claims registration in the United Kingdom but operates without regulatory supervision from the Financial Conduct Authority or other recognized financial regulators. The broker positions itself as a provider of multi-asset trading services, offering access to various financial markets through online trading platforms.

The company's business model focuses on providing retail traders with access to foreign exchange markets, precious metals, stock indices, energy commodities, individual stocks, and cryptocurrency trading. MEEFX appears to target traders seeking high leverage ratios and low entry barriers. This is evidenced by their minimum deposit requirement and maximum leverage offerings.

MEEFX operates primarily through the MetaTrader 4 platform. This platform is widely recognized in the forex industry for its functionality and user interface. The broker offers trading across multiple asset classes including major and minor currency pairs, gold and silver, popular stock indices, crude oil and natural gas, individual company stocks, and various cryptocurrencies. However, the lack of regulatory oversight means that standard investor protections typically associated with licensed brokers may not apply to MEEFX clients.

Regulatory Status: MEEFX claims registration in the United Kingdom but operates without supervision from the Financial Conduct Authority or other recognized regulatory bodies. This creates potential legal and financial risks for traders.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available sources. This raises concerns about transparency regarding funding processes.

Minimum Deposit Requirements: The broker requires a minimum deposit of only $5. This makes it accessible to new traders and those with limited starting capital.

Bonuses and Promotions: Available information does not specify any particular bonus structures or promotional offerings from MEEFX.

Tradable Assets: The broker provides access to forex currency pairs, precious metals including gold and silver, major stock indices, energy commodities, individual company stocks, and cryptocurrency markets.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in the reviewed sources. This impacts transparency regarding total trading expenses.

Leverage Ratios: MEEFX offers leverage up to 1:2000. This is significantly higher than many regulated brokers and suitable for traders seeking high-risk, high-reward strategies.

Platform Options: Trading is conducted through the MetaTrader 4 platform. This is a widely-used and generally reliable trading interface in the forex industry.

Geographic Restrictions: Specific information about geographic limitations or restricted territories was not detailed in available sources.

Customer Support Languages: Details about supported languages for customer service were not specified in the reviewed materials.

This meefx review finds that while some basic information is available, many crucial details about trading conditions and service quality remain unclear.

Account Conditions Analysis

MEEFX's account structure appears relatively straightforward. However, detailed information about different account types and their specific features is limited in available sources. The most notable aspect of their account conditions is the exceptionally low minimum deposit requirement of $5. This positions the broker as accessible to traders with minimal starting capital. This low barrier to entry could appeal to beginners or those wanting to test the platform with limited financial exposure.

However, the lack of detailed information about account tiers, features, and benefits represents a significant transparency concern. Most reputable brokers provide clear documentation about different account types, their respective benefits, minimum deposit requirements, and any restrictions or limitations. The absence of such detailed information makes it difficult for potential traders to understand what they can expect from their trading account.

Available sources do not specify whether MEEFX offers specialized account types such as Islamic accounts for traders requiring swap-free trading conditions. They also don't indicate whether there are different account tiers with varying features based on deposit amounts. The account opening process, verification requirements, and documentation needed are also not clearly outlined in publicly available information.

When compared to regulated brokers in the industry, MEEFX's $5 minimum deposit is notably low. Most established brokers require deposits ranging from $100 to $500. However, the lack of regulatory oversight means that the typical account protections and guarantees associated with licensed brokers may not apply. This meefx review suggests that while the low deposit requirement is attractive, the limited transparency about account features raises concerns about overall service quality.

MEEFX provides trading services through the MetaTrader 4 platform. This is a widely recognized and generally reliable trading interface used throughout the forex industry. MT4 offers standard functionality including real-time price charts, technical analysis tools, automated trading capabilities through Expert Advisors, and mobile trading applications. The platform's familiarity and robust feature set represent one of MEEFX's stronger offerings.

However, available information suggests significant limitations in terms of additional tools and resources beyond the basic trading platform. Most established brokers supplement their trading platforms with comprehensive research materials, market analysis, economic calendars, and educational resources to support trader development and decision-making. The absence of detailed information about such resources from MEEFX raises questions about the depth of support provided to traders.

Educational resources are particularly important for retail traders. This is especially true for those attracted by the low minimum deposit who may be new to forex trading. Quality brokers typically offer webinars, tutorials, trading guides, and market analysis to help traders improve their skills and understanding. The lack of visible educational offerings from MEEFX represents a significant gap in their service portfolio.

Research and analysis tools are equally crucial for informed trading decisions. Professional brokers usually provide daily market commentary, technical analysis, fundamental analysis, and economic insight. Without access to such resources, traders using MEEFX may need to rely on third-party sources for market intelligence. This could impact their trading effectiveness and overall experience with the broker.

Customer Service and Support Analysis

Information about MEEFX's customer service capabilities is notably limited in available sources. This raises concerns about the quality and accessibility of support for traders. Professional forex brokers typically provide multiple communication channels including live chat, email support, telephone assistance, and sometimes social media support to ensure traders can receive help when needed.

The absence of detailed information about customer service channels, operating hours, response times, and supported languages represents a significant transparency gap. Quality customer support is crucial in the forex industry, where traders may need immediate assistance with technical issues, account problems, or trading-related questions. This is particularly important given the 24-hour nature of forex markets.

Most reputable brokers provide clear information about their support team's availability. This includes whether they offer 24/5 support during market hours, weekend support capabilities, and emergency contact procedures. They also typically specify which languages their support staff can communicate in, which is important for international brokers serving diverse client bases.

The lack of visible customer service information from MEEFX is particularly concerning given their unregulated status. Without regulatory oversight, traders have limited recourse if they experience problems with customer service or dispute resolution. Regulated brokers are typically required to maintain certain standards for customer support and complaint handling procedures.

Available sources do not provide user feedback about MEEFX's customer service quality, response times, or problem resolution effectiveness. This absence of user testimonials or reviews about customer service experiences makes it difficult to assess whether the broker provides adequate support to its clients when issues arise.

Trading Experience Analysis

The trading experience with MEEFX centers around the MetaTrader 4 platform. This provides a generally solid foundation for forex and CFD trading. MT4 is known for its stability, comprehensive charting capabilities, and extensive technical analysis tools, which should provide traders with a functional trading environment. The platform supports automated trading through Expert Advisors and offers mobile applications for trading on the go.

However, crucial aspects of the trading experience remain unclear due to limited available information. Order execution quality, which is fundamental to successful trading, has not been documented in available sources. Factors such as slippage rates, requote frequency, and execution speed are critical for traders but are not addressed in publicly available information about MEEFX.

The broker's spread competitiveness and overall cost structure also lack transparency. Without clear information about typical spreads for major currency pairs, commission structures, or other trading costs, potential traders cannot accurately assess the total cost of trading with MEEFX compared to other brokers in the market.

Platform stability and server reliability are essential for consistent trading. This is especially important for traders using automated systems or those trading during high-volatility periods. Available sources do not provide information about server uptime, platform stability, or technical infrastructure quality. This makes it difficult to assess the reliability of the trading environment.

Mobile trading capabilities, while supported through MT4's mobile applications, lack specific details about MEEFX's implementation or any custom features they may have added. The absence of user reviews about the actual trading experience means this meefx review cannot provide insights into real-world performance, execution quality, or overall trader satisfaction with the platform's functionality.

Trust and Safety Analysis

The trust and safety profile of MEEFX presents significant concerns that potential traders must carefully consider. The broker's unregulated status is the most critical issue, as it operates without oversight from recognized financial regulatory authorities such as the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or other established regulators in major financial jurisdictions.

Operating without regulatory supervision means that MEEFX is not subject to the capital adequacy requirements, client fund segregation rules, and operational standards that regulated brokers must maintain. This absence of oversight creates substantial risks for trader funds, as there are no regulatory guarantees about how client money is handled, stored, or protected.

Available online discussions and reviews raise questions about MEEFX's legitimacy. Some sources question whether the broker operates as a legitimate business or potentially engages in questionable practices. These concerns are compounded by the limited transparency about the company's ownership structure, management team, and operational details.

The lack of information about fund security measures, such as segregated client accounts, insurance coverage, or participation in compensation schemes, further undermines confidence in the broker's safety profile. Reputable brokers typically provide clear information about how they protect client funds and what measures are in place to safeguard trader interests.

Company transparency is another area of concern. Detailed information about MEEFX's corporate structure, physical address verification, and management team is not readily available. This lack of transparency, combined with the unregulated status, creates an environment where traders have limited recourse if problems arise with their accounts or funds.

User Experience Analysis

The overall user experience with MEEFX is difficult to assess comprehensively due to the limited availability of genuine user feedback and reviews from verified traders. This absence of user testimonials and experience reports is concerning, as established brokers typically have substantial online presence with trader reviews, forum discussions, and user-generated content about their services.

The broker's website interface and user registration process details are not well-documented in available sources. This makes it challenging to evaluate the ease of account opening and platform navigation. User-friendly design and intuitive processes are important factors for trader satisfaction, particularly for those new to forex trading who may be attracted by the low minimum deposit requirement.

Account funding and withdrawal experiences, which are crucial aspects of user satisfaction, lack detailed documentation. Traders typically value quick, reliable, and cost-effective methods for depositing and withdrawing funds. However, information about MEEFX's performance in these areas is not available in reviewed sources.

The presence of online discussions questioning MEEFX's legitimacy suggests that some users may have had concerning experiences. However, specific details about user complaints or issues are not well-documented. This uncertainty about user experiences, combined with the lack of positive testimonials, raises questions about overall customer satisfaction.

The target user profile for MEEFX appears to be traders seeking low deposit requirements and high leverage ratios, particularly those with limited starting capital. However, without substantial user feedback, it's unclear whether the broker successfully serves this demographic or provides a satisfactory experience for its intended audience. The combination of unregulated status and limited user feedback creates an environment of uncertainty about the actual user experience quality.

Conclusion

MEEFX presents a mixed profile as an unregulated forex and CFD broker that may appeal to specific types of traders while raising significant concerns about safety and transparency. The broker's primary advantages include an exceptionally low $5 minimum deposit requirement and high leverage ratios up to 1:2000. This makes it potentially attractive to traders with limited capital seeking high-leverage opportunities.

However, the substantial drawbacks outweigh these benefits for most traders. The unregulated status creates fundamental risks regarding fund security and trader protection. The limited transparency about trading conditions, costs, and company operations raises additional concerns. The absence of comprehensive user feedback and the presence of online discussions questioning the broker's legitimacy further compound these issues.

For traders considering MEEFX, the lack of regulatory oversight should be the primary consideration. This means standard investor protections and compensation schemes do not apply. While the low deposit requirement may seem attractive, the potential risks associated with unregulated brokers generally outweigh the benefits of low entry barriers. This makes regulated alternatives a safer choice for most trading situations.