MaxiMarkets 2025 Review: Everything You Need to Know

Executive Summary

MaxiMarkets is an online forex broker that has been operating in the financial markets since 2008. The company offers trading services across multiple asset classes. This maximarkets review reveals a broker with moderate trust credentials. MaxiMarkets provides access to over 170 trading instruments across forex, stocks, indices, commodities, and cryptocurrencies. The broker operates through MetaTrader 4 and XCritical trading platforms. These platforms cater to traders seeking diversified market exposure.

Based on available user feedback, MaxiMarkets receives a user rating of 3.5 out of 5 from 108 reviews. The company has a Trust Score of 58, indicating moderate reliability in the competitive forex brokerage landscape. The broker positions itself as suitable for traders looking to diversify their portfolios across various financial markets. However, some user feedback suggests exercising caution. With 24-hour customer support and multiple asset offerings, MaxiMarkets attempts to serve both novice and experienced traders. The overall user experience appears mixed based on available reviews.

Important Notice

Due to limited regulatory information available in public sources, trading experiences with MaxiMarkets may vary significantly across different regions and jurisdictions. Potential clients should conduct thorough due diligence regarding regulatory compliance in their specific location before opening an account. This review is based on comprehensive analysis of user feedback, market research, and publicly available information about the broker's services and offerings. Traders should be aware that regulatory oversight and consumer protection measures may differ depending on their geographical location and the specific entity they are dealing with.

Rating Framework

Broker Overview

MaxiMarkets established its presence in the online trading industry in 2008. The company positions itself as a multi-asset broker serving clients across various financial markets. The company has built its business model around providing comprehensive trading solutions through established platforms while offering access to a broad spectrum of financial instruments. According to available information, MaxiMarkets focuses on delivering trading opportunities across forex, equity markets, commodities, indices, and the growing cryptocurrency sector.

The broker's operational approach centers on platform diversity and asset variety. MaxiMarkets utilizes both the industry-standard MetaTrader 4 platform and its proprietary XCritical trading system. This dual-platform strategy aims to accommodate different trading preferences and experience levels. MaxiMarkets has structured its services to support over 170 trading instruments, reflecting its commitment to providing comprehensive market access. The company's business model emphasizes multi-market trading capabilities. However, specific details about its corporate structure and ownership remain limited in publicly available sources.

Regulatory Status: Specific regulatory information for MaxiMarkets is not detailed in available sources. This represents a significant consideration for potential clients evaluating the broker's compliance framework.

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal options is not comprehensively detailed in available materials. This requires direct inquiry with the broker.

Minimum Deposit Requirements: Specific minimum deposit amounts are not specified in available sources. This suggests potential clients need to contact the broker directly for this information.

Bonus and Promotions: Details about promotional offers and bonus structures are not mentioned in available sources. This indicates either absence of such programs or limited public disclosure.

Tradeable Assets: MaxiMarkets provides access to over 170 trading instruments spanning forex pairs, stock CFDs, market indices, commodity contracts, and cryptocurrency products. The broker offers substantial market diversity.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in available sources. This represents an important gap for cost-conscious traders.

Leverage Options: Leverage ratios and margin requirements are not specified in available materials. This requires direct consultation with the broker.

Platform Selection: The broker offers MetaTrader 4 and XCritical trading platforms. These provide both industry-standard and proprietary trading solutions.

Geographic Restrictions: Specific regional limitations are not detailed in available sources.

Customer Support Languages: Available support languages are not specified in current materials.

This maximarkets review highlights the need for potential clients to conduct direct inquiries for many operational details.

Detailed Rating Analysis

Account Conditions Analysis

MaxiMarkets' account conditions present a mixed picture based on available information. The broker appears to offer multiple account types, though specific details about account tiers, their respective features, and minimum balance requirements are not comprehensively documented in public sources. This lack of transparency regarding account structures represents a significant limitation for potential clients attempting to evaluate whether the broker's offerings align with their trading capital and objectives.

The absence of detailed information about minimum deposit requirements across different account types makes it challenging to assess the broker's accessibility for various trader segments. Without clear documentation of account opening procedures, verification requirements, and the specific benefits associated with different account levels, potential clients face uncertainty about what to expect during the onboarding process.

User feedback suggests that account-related experiences have been variable. Some clients express concerns about the overall service quality. The limited availability of information about special account features, such as Islamic accounts for Muslim traders or institutional account options, further complicates the evaluation process. This maximarkets review indicates that prospective clients should directly contact the broker to obtain comprehensive details about account conditions, as publicly available information remains insufficient for thorough evaluation.

MaxiMarkets demonstrates reasonable strength in its platform and tool offerings. The company provides traders with access to both MetaTrader 4 and the XCritical trading platform. MetaTrader 4 remains an industry standard, offering comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The inclusion of this platform ensures that traders have access to familiar functionality and third-party tool integration that many experienced forex traders expect.

The XCritical platform represents MaxiMarkets' proprietary trading solution. However, detailed information about its specific features, advantages, and unique capabilities is not extensively documented in available sources. The dual-platform approach suggests an attempt to cater to different trader preferences and experience levels, potentially offering both standardized and customized trading experiences.

Information about additional research resources, market analysis tools, educational materials, and trading calculators remains limited in available sources. The absence of detailed information about economic calendars, market research reports, or educational content represents a gap in understanding the broker's commitment to trader development and market insight provision. While the platform selection appears adequate, the overall tools and resources ecosystem would benefit from more comprehensive documentation and transparency about available features.

Customer Service and Support Analysis

MaxiMarkets advertises 24-hour customer support. This represents a positive aspect of their service offering for traders operating across different time zones. However, user feedback presents a mixed picture regarding the actual quality and effectiveness of customer service interactions. Some user reviews suggest exercising caution when dealing with the broker, which raises questions about the consistency and reliability of support services.

The availability of round-the-clock support is commendable in the forex industry, where markets operate continuously throughout the week. The lack of detailed information about specific support channels, response times, and the languages supported by customer service representatives limits the ability to fully assess the support infrastructure. Understanding whether support is available through live chat, phone, email, or other channels would be crucial for traders who may need immediate assistance.

User experiences appear to vary significantly. Some feedback suggests that customer service quality may not meet industry standards consistently. The absence of detailed information about support team expertise, escalation procedures, and problem resolution timeframes represents areas where MaxiMarkets could improve transparency. For a comprehensive evaluation, potential clients should test the responsiveness and quality of customer support before committing to significant trading activity.

Trading Experience Analysis

The trading experience with MaxiMarkets appears to be moderate based on available user feedback. A user rating of 3.5 out of 5 suggests room for improvement in execution quality and overall platform performance. The broker's offering of MetaTrader 4 provides a familiar trading environment for experienced forex traders, while the XCritical platform may offer additional features, though specific performance metrics are not detailed in available sources.

Order execution quality, slippage rates, and requote frequency are critical factors that significantly impact trading experience. However, specific data about these performance indicators is not available in current sources. The stability and speed of platform performance during high-volatility market conditions remain unclear, which is particularly important for active traders and those employing scalping strategies.

The diversity of available instruments, with over 170 trading assets, suggests that traders can access comprehensive market exposure through a single broker. The quality of liquidity provision, spread competitiveness during different market sessions, and the overall reliability of trade execution require further investigation. This maximarkets review indicates that while the broker offers platform variety and asset diversity, the actual trading experience quality appears to be average based on user feedback, suggesting potential areas for operational improvement.

Trust and Safety Analysis

MaxiMarkets' trust profile presents several concerns that potential clients should carefully consider. With a Trust Score of 58, the broker falls into the moderate reliability category, which suggests neither strong confidence nor immediate red flags, but rather a need for cautious evaluation. The absence of detailed regulatory information in available sources represents a significant transparency gap that affects overall trustworthiness assessment.

Regulatory oversight is fundamental to broker credibility. The limited information about specific regulatory authorities, license numbers, and compliance frameworks makes it difficult to verify the broker's legal standing and consumer protection measures. This lack of regulatory transparency is particularly concerning in an industry where client fund protection and operational oversight are paramount.

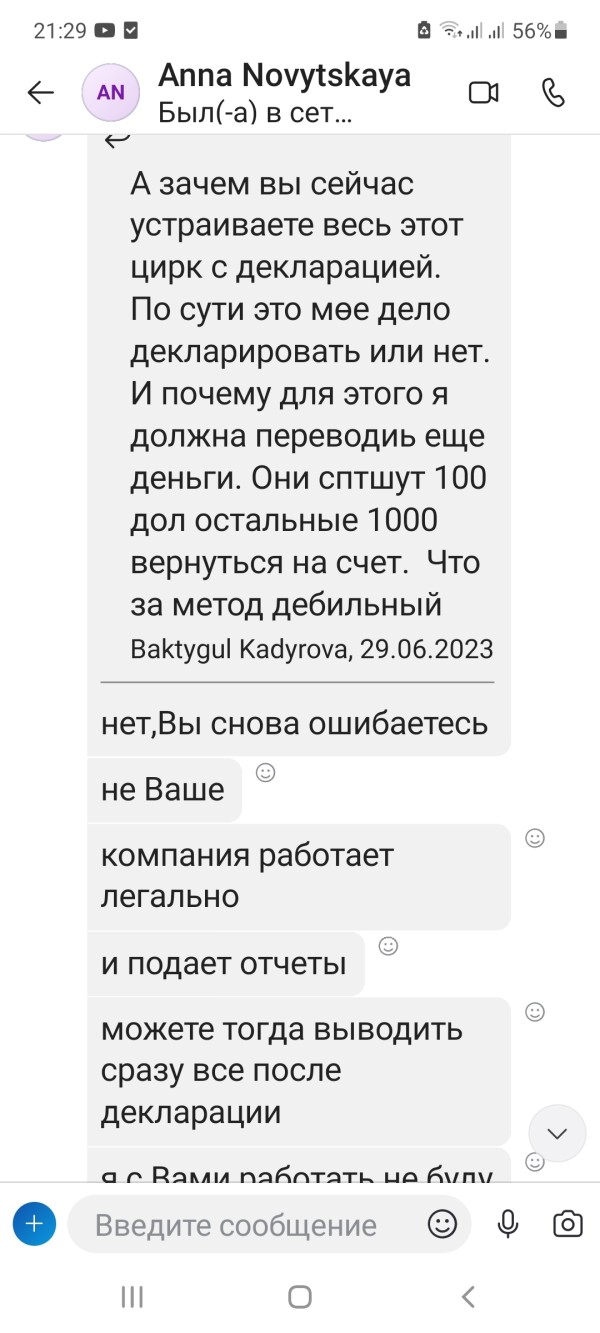

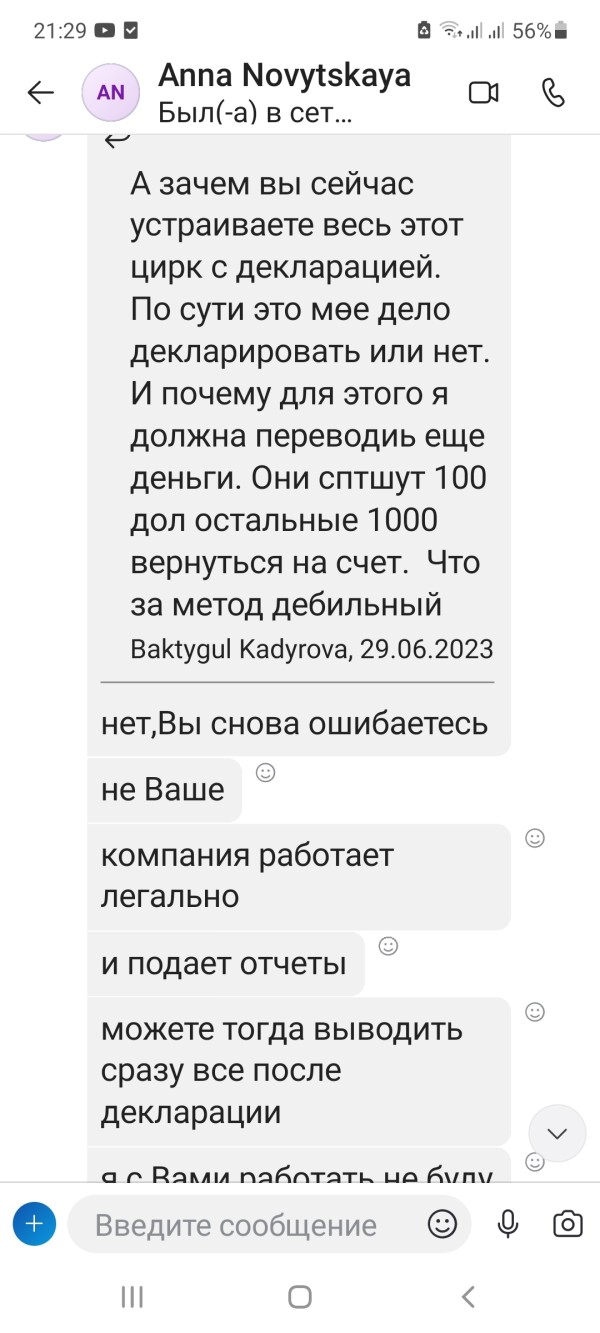

User feedback includes recommendations to avoid the broker. This raises additional concerns about operational reliability and client satisfaction. While not all negative feedback necessarily indicates systematic problems, the pattern of cautionary user comments suggests that potential clients should conduct thorough due diligence. The absence of information about client fund segregation, compensation schemes, and dispute resolution mechanisms further complicates the trust evaluation. Financial transparency, including published financial statements or third-party audits, is not evident in available sources.

User Experience Analysis

The overall user experience with MaxiMarkets reflects a mixed satisfaction level. A user rating of 3.5 out of 5 based on 108 reviews indicates moderate performance across various service aspects. This rating suggests that while some clients find the service acceptable, there are consistent areas where the broker fails to meet user expectations or industry standards.

User feedback patterns indicate variability in service quality. Some clients express satisfaction with certain aspects of the service while others recommend avoiding the broker entirely. This inconsistency in user experiences suggests potential issues with service standardization, quality control, or operational reliability that could affect client satisfaction and retention.

The platform interface and navigation experience, while utilizing established systems like MetaTrader 4, may not fully compensate for other service deficiencies that users have identified. The registration and account verification process experiences are not well-documented, making it difficult to assess the onboarding efficiency and user-friendliness of initial interactions with the broker.

Deposit and withdrawal experiences, which significantly impact user satisfaction, lack detailed documentation in available sources. The absence of comprehensive user testimonials about fund processing times, method availability, and transaction transparency represents a significant gap in understanding the complete user journey with MaxiMarkets.

Conclusion

MaxiMarkets presents itself as a multi-asset broker with moderate credentials in the competitive online trading landscape. While the broker offers access to over 170 trading instruments through established platforms like MetaTrader 4 and XCritical, several significant limitations affect its overall appeal. The Trust Score of 58 and user rating of 3.5 out of 5 indicate a service that falls short of excellence, with notable gaps in transparency and user satisfaction.

The broker may be suitable for traders seeking diverse market access and familiar platform functionality. This applies particularly to those comfortable with moderate-trust brokers and willing to conduct extensive due diligence. However, the mixed user feedback, limited regulatory transparency, and absence of detailed operational information suggest that potential clients should exercise considerable caution and thoroughly research alternatives before making a commitment.

The primary advantages include platform variety and asset diversity. Significant disadvantages encompass limited transparency, mixed user reviews, and insufficient publicly available information about critical operational aspects. Prospective clients should prioritize direct communication with the broker to clarify important details before proceeding with account opening.