LTFX 2025 Review: Everything You Need to Know

Executive Summary

This ltfx review gives you a complete look at LTFX, a forex broker that competes in the online trading market. LTFX shows a mixed profile that needs careful thought from potential traders based on what we know right now.

LTFX works with several key features including their own LTFX app plus the popular MetaTrader 4 and MetaTrader 5 platforms. They claim to offer zero-spread trading with 0ms execution speed, which sounds great for traders who want cheap and fast trading. But there are big gaps in what we know about their rules, company history, and what users think about them.

The broker has a user rating of 0 out of 1500, which means either no one is rating them or they're not collecting feedback well. We also can't find clear information about who regulates them, which makes us wonder about their legal status and how open they are about their business. LTFX seems to target forex traders who care most about low costs and fast trades, but the missing information means traders should be very careful before choosing this broker.

Important Notice

This review has big limits because we don't have enough information about LTFX. The missing regulatory details might affect your trading choices depending on where you live, since rules change a lot between countries and directly impact how safe your money is.

This assessment uses only the information we can find right now and doesn't have complete user feedback or detailed regulatory checks. You should verify all information yourself and think about talking to financial advisors before making trading decisions. The limited data makes it impossible to fully evaluate all the trading aspects that usually help people choose brokers.

Rating Framework

Broker Overview

LTFX works as a forex broker in a very competitive online trading world. We don't know when the company started or who founded it, but the broker focuses on technology and claims to offer fast, cheap trading.

The company's main business is forex trading services, though we can't find details about how they operate, where their headquarters are, or their company history. This lack of openness might worry traders who want to check a broker's background before choosing them. LTFX offers several platform options including their own LTFX mobile app plus the well-known MetaTrader 4 and MetaTrader 5 platforms.

This ltfx review shows that having different platforms can help traders who like different trading interfaces and features. But we still don't have clear details about what assets they offer, who regulates them, or what their full services include. The broker says they focus on competitive trading conditions, especially zero-spread trading and fast execution speeds, but the missing information about regulations, company structure, and transparency creates uncertainty for users who want a complete broker evaluation.

Regulatory Status: We can't find specific information about who regulates LTFX or what financial authorities oversee them. This missing regulatory information is a big concern for traders who want regulated brokers and the protections that come with them.

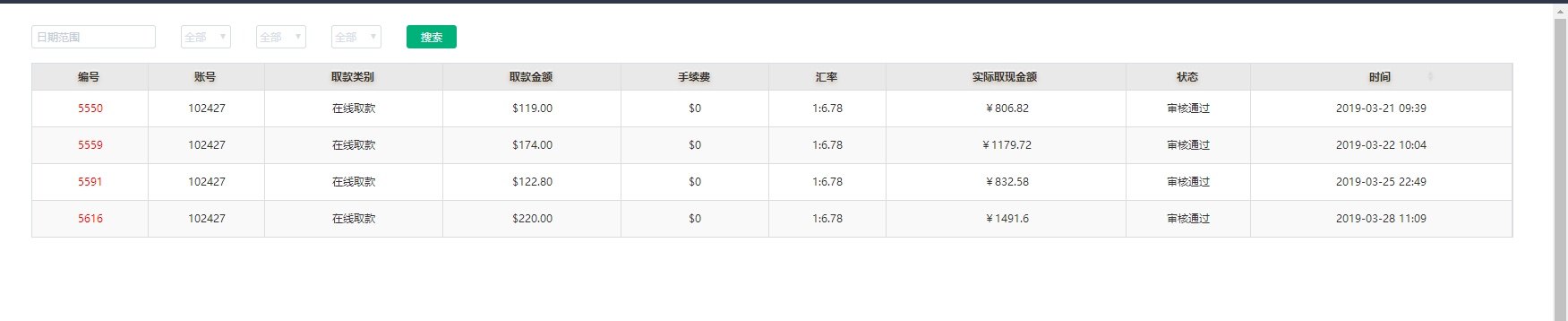

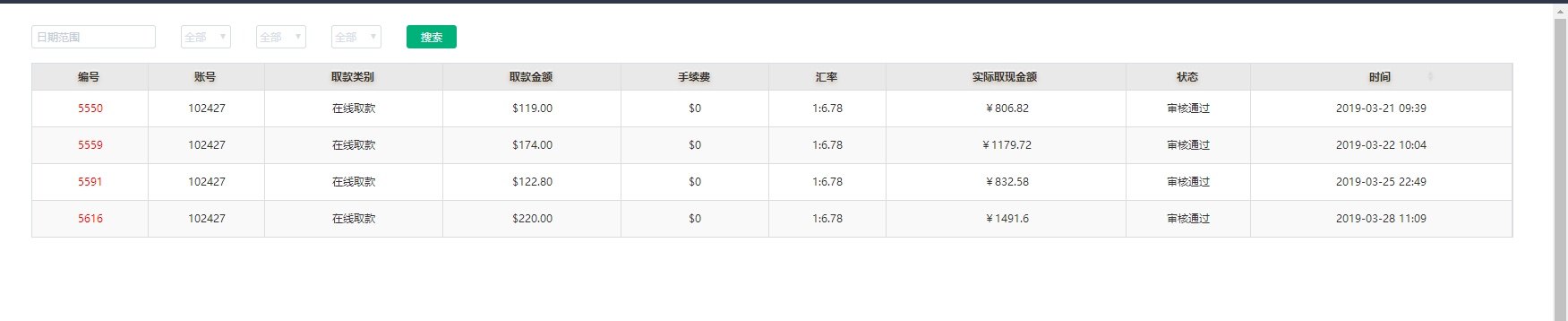

Deposit and Withdrawal Methods: We don't have details about funding methods, how long processing takes, or what fees they charge. This lack of transparency about money transactions might affect how users decide about funding their accounts.

Minimum Deposit Requirements: We don't know the minimum deposit amounts for different account types, so we can't tell if the broker works for traders with different amounts of money. Promotional Offers: We can't find details about bonuses, promotional campaigns, or incentive programs, which limits our understanding of potential extra value.

Tradeable Assets: While the broker works in the forex market, we don't have complete information about available currency pairs, asset variety, or market coverage. Cost Structure: LTFX claims to offer zero-spread trading, which would be a competitive advantage for cost-conscious traders, but we don't know about other potential fees, commissions, or hidden costs for a complete cost analysis.

Leverage Options: We don't have details about specific leverage ratios and margin requirements, so we can't assess trading flexibility and risk management options. Platform Features: The broker provides LTFX app and MetaTrader 4/5 platforms, offering both their own and established trading environments, but detailed platform functionality isn't well documented.

Geographic Restrictions: We don't know about service availability in different countries or regional limitations. Customer Support Languages: We don't have details about available support languages and communication options.

This ltfx review shows that these big information gaps create challenges for complete broker evaluation and informed decision-making.

Account Conditions Analysis

Looking at LTFX's account conditions is hard because we don't have enough information. We can't find detailed specifications about account types, tier structures, or different service levels that professional forex brokers usually have.

We don't know the minimum deposit requirements, so we can't tell if the broker works for traders with different amounts of money. This information gap is especially important because deposit requirements often determine if a broker suits retail or institutional traders. Without clear deposit thresholds, potential users can't accurately assess whether LTFX fits their financial capacity and trading goals.

We don't have details about account opening procedures and verification processes. Modern forex trading needs smooth onboarding while following compliance standards, yet LTFX's approach to customer verification and account activation isn't clear. This lack of transparency might concern traders who want efficient account setup experiences.

We can't find information about specialized account features like Islamic accounts for Sharia-compliant trading, VIP services for high-volume traders, or demo accounts for practice trading. These features often help brokers stand out in competitive markets, and their absence from available information suggests either limited service variety or poor information sharing. The ltfx review process shows that evaluating account conditions needs much more detailed information than we currently have, and traders usually consider account conditions as key factors in broker selection, making this information gap a notable limitation.

LTFX's trading setup focuses on their own LTFX application combined with the established MetaTrader 4 and MetaTrader 5 platforms. This combination might offer traders both innovative mobile-focused trading and traditional desktop trading environments with comprehensive analytical capabilities.

The MetaTrader platforms give access to extensive technical analysis tools, automated trading capabilities through Expert Advisors, and customizable trading environments. But we don't have specific information about how LTFX implements these platforms, including available indicators, custom tools, or enhanced features.

We don't know about research and market analysis resources. Professional forex trading usually requires access to economic calendars, market news, fundamental analysis, and technical research. The missing information about LTFX's analytical offerings limits our assessment of their support for informed trading decisions.

We can't find information about educational resources, including webinars, tutorials, trading guides, or market education materials. Educational support often helps brokers stand out, particularly for developing traders who want skill enhancement and market understanding. Automated trading support through the MetaTrader platforms suggests some algorithmic trading capabilities, though we don't have details about specific features, limitations, or additional automation tools.

The proprietary LTFX app's functionality and feature set also lack comprehensive documentation. The tools and resources evaluation shows significant information gaps that prevent complete assessment of LTFX's trading support infrastructure and value-added services beyond basic platform access.

Customer Service and Support Analysis

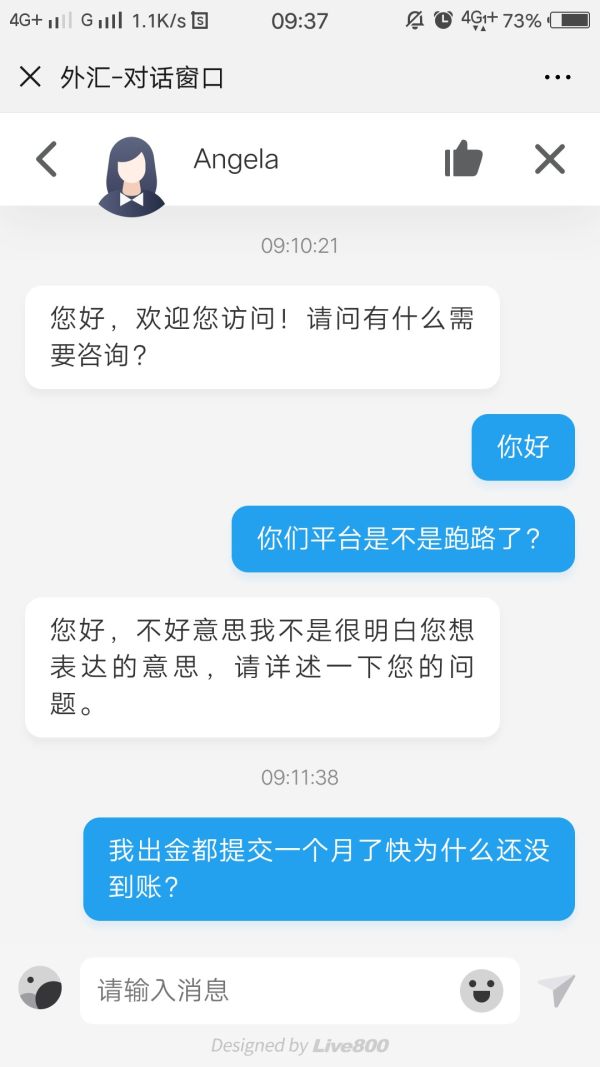

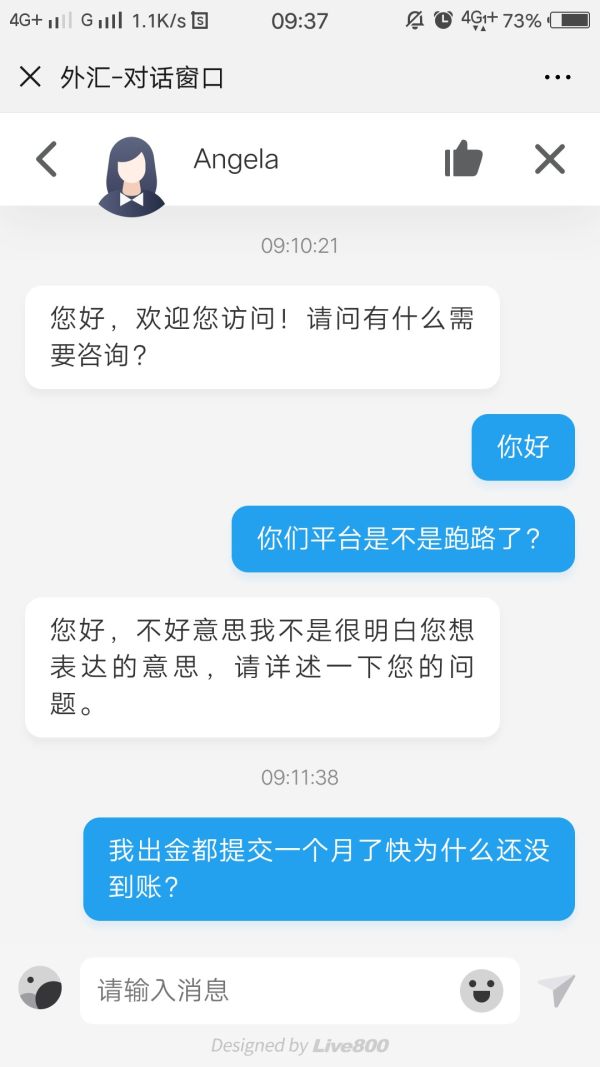

Evaluating customer service for LTFX is hard because we don't have detailed information about support infrastructure, availability, and service quality. We can't find information about available customer service channels, whether they include phone support, live chat, email assistance, or help desk systems.

We don't know about response time expectations and service level commitments. Professional forex brokers usually provide specific response time guarantees and 24/7 support availability during market hours. The lack of such information prevents assessment of LTFX's commitment to customer support quality and accessibility.

We can't find service quality indicators, including customer satisfaction ratings, complaint resolution procedures, and support staff expertise levels. User feedback about support experiences is notably missing, with the 0/1500 user rating providing no insight into actual customer service performance. We don't know about multilingual support capabilities, though this feature is crucial for international forex brokers serving diverse geographic markets.

The missing language support information might indicate limited international service capacity or insufficient information sharing. We can't find support availability schedules, including business hours, holiday coverage, and emergency contact procedures. Forex markets operate continuously during weekdays, making comprehensive support availability essential for active traders.

The customer service analysis shows that insufficient information prevents meaningful evaluation of LTFX's support capabilities, representing a significant gap in comprehensive broker assessment for this ltfx review.

Trading Experience Analysis

LTFX's trading experience centers around their claim of zero-spread trading combined with 0ms average execution speed, which would be exceptionally competitive trading conditions if verified. These specifications suggest a focus on providing cost-effective and rapid trade execution that could benefit scalpers and high-frequency traders.

We don't have details about platform stability and performance metrics beyond execution speed. While 0ms execution claims are impressive, comprehensive trading experience requires consistent platform uptime, reliable connectivity, and stable performance during high-volatility market conditions. Order execution quality involves multiple factors beyond speed, including slippage rates, requote frequency, and fill accuracy, but we don't have detailed information about these execution quality metrics.

The combination of LTFX app and MetaTrader platforms potentially offers diverse trading experiences suited to different user preferences. Mobile trading through the proprietary app may appeal to traders seeking on-the-go market access, while MetaTrader platforms provide comprehensive desktop trading functionality. However, we don't have specific performance comparisons and feature availability across platforms.

We can't find details about market depth, liquidity provision, and pricing transparency. Professional trading requires understanding of liquidity sources and market depth availability, particularly for larger trade sizes and institutional trading approaches. The zero-spread claim requires careful verification, as sustainable zero-spread trading typically involves alternative fee structures or specific market conditions, and without detailed cost structure information, complete trading experience assessment remains limited in this ltfx review.

Trust and Safety Analysis

Trust and safety evaluation for LTFX shows significant concerns because we can't find clear regulatory information and there's limited transparency about operational oversight. Regulatory compliance represents a fundamental aspect of broker trustworthiness, yet we can't find information about oversight by recognized financial authorities.

We don't have details about fund security measures, including client fund segregation, deposit protection schemes, and financial safeguards. Professional forex brokers usually maintain clear policies about client fund protection and regulatory compliance, making this information gap particularly concerning for potential users. Corporate transparency about company ownership, management structure, and operational history is notably limited.

Traders usually seek comprehensive background information about broker leadership and corporate governance as part of trust assessment, yet such details aren't readily available for LTFX. Industry reputation and third-party evaluations are limited, though WikiBit's investigation into LTFX's safety represents some external scrutiny. However, we can't find comprehensive industry ratings, regulatory actions, or professional assessments.

We can't assess negative event handling and crisis management capabilities because of insufficient historical information and limited operational transparency. Professional brokers usually maintain clear procedures for handling market disruptions, technical issues, and customer disputes. The trust and safety analysis shows substantial information gaps that prevent confident assessment of LTFX's reliability and regulatory compliance, representing a significant consideration for risk-conscious traders.

User Experience Analysis

User experience evaluation for LTFX faces substantial limitations because of the 0/1500 user rating, which indicates either minimal user engagement or insufficient feedback collection. This absence of user feedback prevents meaningful assessment of actual customer satisfaction and service quality.

We don't have details about interface design and usability information for both the LTFX app and MetaTrader integration. Modern trading requires intuitive interfaces and seamless user experiences, yet we can't find specific design philosophy and usability testing results. We don't know about registration and account verification processes, so we can't assess onboarding efficiency and user convenience.

Streamlined account opening while maintaining compliance standards represents a crucial user experience factor for modern forex brokers. We can't find details about funding operations including deposit and withdrawal experiences, processing times, and transaction convenience. User experience heavily depends on smooth financial operations and transparent fee structures.

We can't identify common user complaints and feedback patterns because of the absence of substantial user reviews and feedback collection. Professional brokers usually address recurring user concerns and implement improvements based on customer feedback. We can't determine user demographic analysis and trader profile suitability from available information.

Different trading platforms serve varying user types, from beginner retail traders to professional institutional clients. The user experience analysis shows that comprehensive evaluation requires significantly more user feedback and detailed service information than currently available for LTFX assessment.

Conclusion

This ltfx review concludes with a neutral assessment because of significant information limitations that prevent comprehensive broker evaluation. While LTFX presents potentially attractive trading conditions including zero-spread claims and rapid execution speeds, the absence of crucial information about regulatory oversight, company background, and user feedback creates substantial uncertainty.

The broker may appeal to traders specifically seeking low-cost trading conditions and fast execution speeds, particularly those comfortable with limited regulatory transparency. However, the information gaps about safety, customer service, and operational reliability suggest that LTFX may be more suitable for experienced traders who can independently assess and manage associated risks. Primary advantages include the claimed zero-spread trading environment and multiple platform options through LTFX app and MetaTrader integration.

However, significant disadvantages include unclear regulatory status, limited transparency about company operations, and insufficient user feedback for service quality assessment. Potential traders should conduct extensive independent research, verify all claims, and consider their risk tolerance before engaging with LTFX. The absence of comprehensive regulatory information and limited operational transparency require careful consideration of whether this broker aligns with individual trading requirements and risk management preferences.