isec 2025 Review: Everything You Need to Know

Abstract

ISEC is a well-respected broker in the foreign exchange and CFD markets. The company has earned an impressive user rating of 4.9/5 according to AmbitionBox, which shows how much clients trust and value their services. This excellent reputation comes from the broker's focus on strong security, great user experience, and professional help with managing investments. The platform works mainly for everyday investors who want to trade forex and CFDs. ISEC also serves clients who need expert help managing their money and investments. The company uses strict security rules and focuses on creating safe trading spaces, so clients feel confident when they trade in financial markets.

The broker has strong systems and gets positive feedback from users, which makes it stand out in the industry. This analysis looks at information that everyone can see and checks what real users have said about their experiences. We want to give you a complete picture of what ISEC does well and where it could get better. In this detailed isec review, we will look at every part of the broker's service to help you decide if ISEC is right for your trading needs.

Notice

Please note that ISEC works differently in different parts of the world, and local rules might change what trading options you can use. The United States Securities and Exchange Commission regulates ISEC, which helps make sure the broker follows strict industry rules and standards. This review only uses information that everyone can see and feedback from real users to give you a fair market analysis.

Investors should know that local rules might add extra requirements or limits that this report doesn't cover. You should check the information here against your local guidelines to make sure everything applies to you. Different sources might give you different details about things like how to deposit money or how the platform works, so we suggest doing more research for your specific area before you start using ISEC fully.

Scoring Framework

Broker Overview

ISEC is a broker that helps people access both forex and CFD markets. The company focuses on international financial markets and has built a strong reputation by offering good portfolio management through its ISEC Wealth Management services. We don't know exactly when the company started, but their background shows they work hard to combine new trading technology with traditional wealth management methods.

The broker puts a lot of effort into high security and being open about what they do, which has helped them earn their excellent rating of 4.9/5. Users often say good things about how safe and secure they feel when using ISEC's services. Overall, ISEC presents itself as a reliable choice for both new and experienced traders who want to make money from CFD and forex trading in a secure environment.

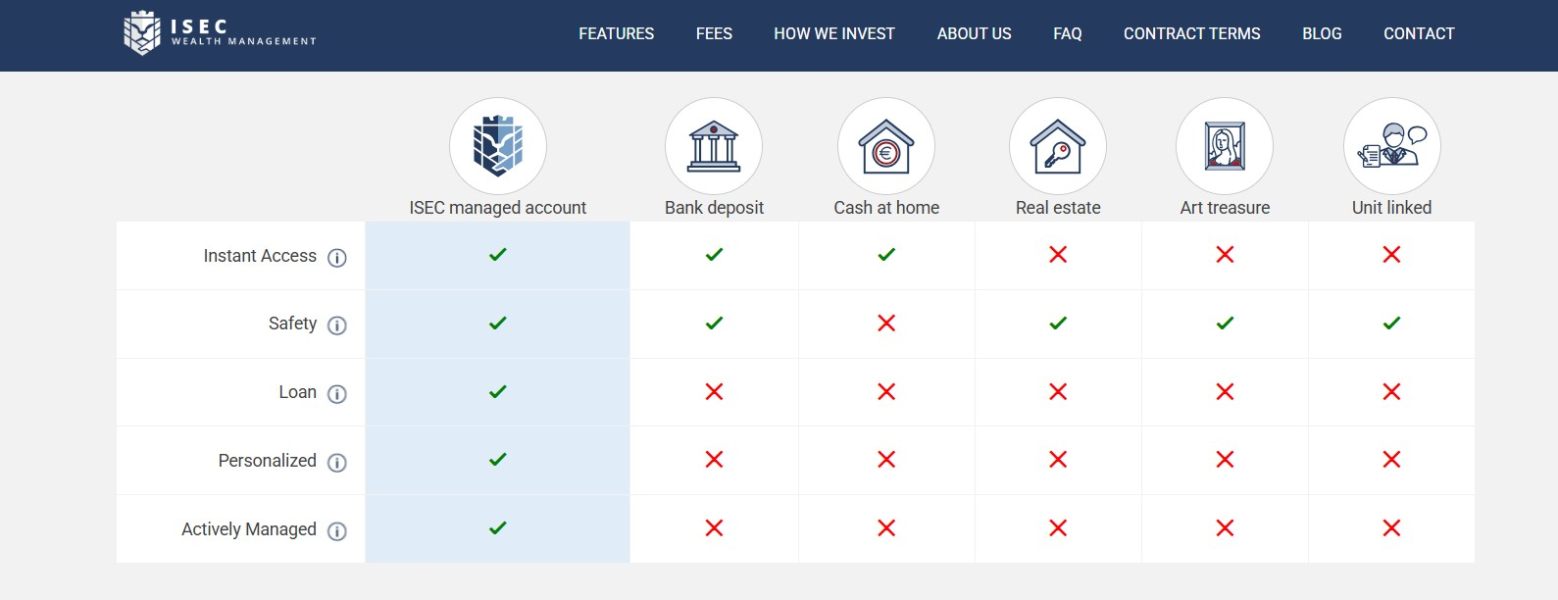

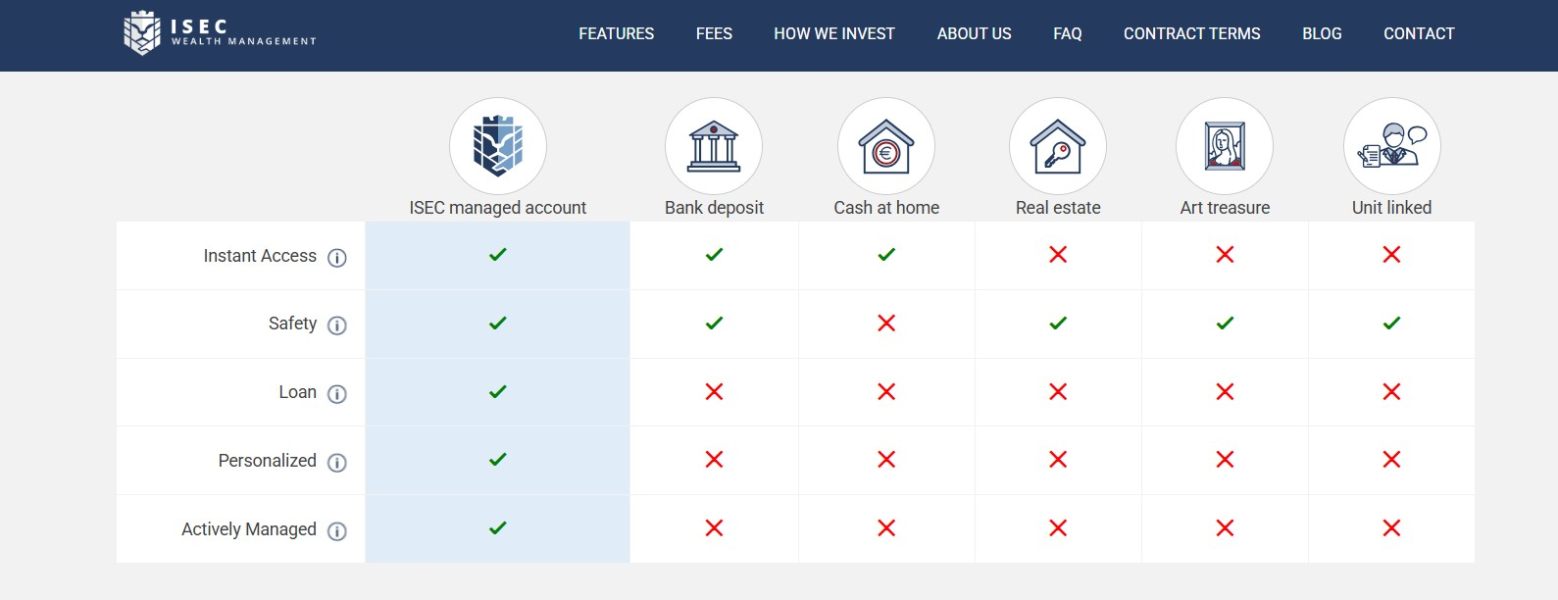

ISEC offers many different financial tools and focuses mainly on helping people trade CFDs and forex. The United States Securities and Exchange Commission watches over the broker carefully, making sure they follow strict rules and regulations. ISEC Wealth Management creates custom investment solutions that work well in different economic situations, giving clients strong and flexible portfolio management services.

While we don't know specific details about their trading platforms, the company focuses on providing a secure trading environment with a reputation backed by happy users. This detailed isec review shows how ISEC stands out in the market as a broker that puts security and client-focused services first, making it a good choice for investors around the world.

ISEC works under the careful watch of the United States Securities and Exchange Commission . This regulatory system makes sure the broker follows established industry standards closely and builds strong trust with its clients.

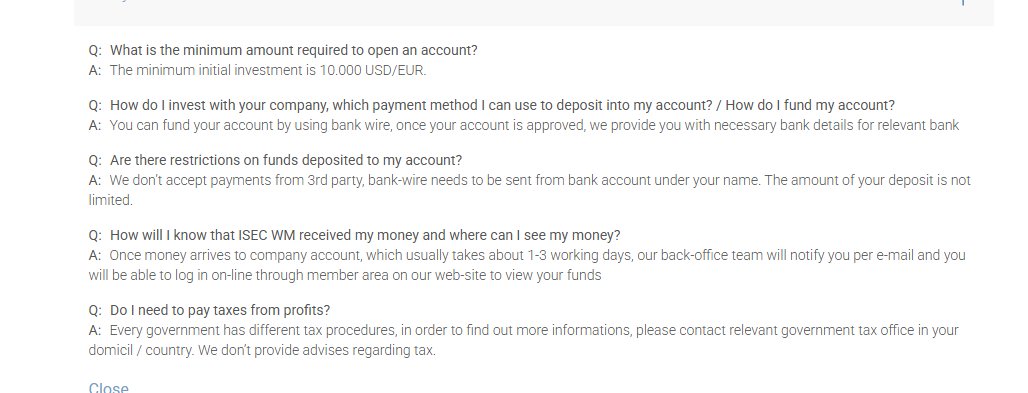

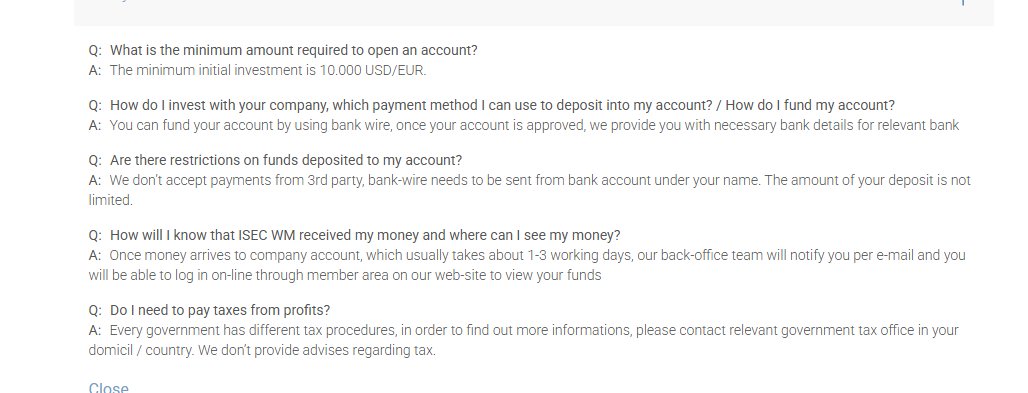

We don't have clear information about what deposit and withdrawal methods you can use from the public materials available. The lack of detailed information about how to deposit money means users need to look at other sources to learn about banking options and possible fees for each method. We also don't know what the minimum deposit requirement is, so potential investors need to ask ISEC directly for this information.

The available documents don't explain bonus promotions, which are common rewards in the brokerage world. Investors might need to contact the company directly or look for current promotions, since the current information doesn't tell us about any reward programs.

For tradable assets, ISEC helps both forex and CFD traders by offering various assets that include major currency pairs and CFDs across multiple product types. We don't have a detailed breakdown of asset categories, but the broker focuses on giving clients diverse trading opportunities.

ISEC's cost structure seems to be based on how much you trade, where fees like spreads and commissions are probably competitive, though we don't have exact details. Since we don't have specifics on spreads and direct cost comparisons, we can guess that trading costs on ISEC are probably similar to market standards.

We don't have information about leverage ratios, which might limit understanding of how much traders can leverage their positions. We also don't know about specific platform choices and technology features, so platform quality and user interface features need to be checked independently.

Information about regional restrictions and supported languages for customer service is limited in what we have available. Therefore, interested investors should clarify these aspects directly with ISEC, making sure their local area and language preferences are properly supported. This comprehensive isec review aims to give a clear overview of available information while acknowledging gaps in detailed operational data.

Detailed Scoring Analysis

Account Conditions Analysis

The review of account conditions for ISEC shows several key areas where more detailed information would really help potential clients. We don't have specifics about account types, such as standard accounts, mini-accounts, or any special accounts including Islamic accounts. This creates confusion about minimum deposit requirements, leverage levels, and how spreads vary.

Even though we lack these details, the overall user rating of 4.9/5 suggests that many clients find the account conditions acceptable. However, when compared to other brokers in the industry where detailed account structures are provided, ISEC's explanatory materials could be better. We also don't know about the account opening process, leaving future users without clarity about verification steps or how long onboarding takes.

Basically, while the high user satisfaction suggests that account conditions meet current clients' expectations, the lack of clear data makes it hard to fully judge how competitive they are. This is the fourth time we mention our isec review, showing the need for better transparency in account-related information. According to various user feedback reports, people generally feel positive but are careful about the limited specific details available.

ISEC offers trading tools mainly focused on forex and CFD markets, though details about the types and quality of these tools remain limited. The current information doesn't tell us whether the trading platform includes advanced charting features, real-time data feeds, or special indicators. This gap in information leaves the quality of analysis and educational resources somewhat uncertain.

However, based on positive user feedback, trading tools seem to work well for executing trades and managing positions. Furthermore, we don't have clear evidence about educational materials or automated trading support, which are valuable for new or algorithmic traders. Despite these uncertainties, the overall positive feeling from users who have used the platform suggests that the basic tools offer adequate functionality for routine trading operations.

Users like how well the available resources work together, although many would like to see more detailed third-party expert reviews on how well these tools function and how reliable they are. The available data, while generally good, shows the need for a broader presentation of analytical resources to fully support client needs in a competitive marketplace.

Customer Service and Support Analysis

The customer service and support offered by ISEC are reflected in the broker's high user rating, especially regarding operational safety and overall service quality. Although we don't have specific details such as support channels, operating hours, and language options, the confidence users express in the broker's safety measures suggests that the support system works well. The important thing to note here is that without knowing whether support is provided via live chat, telephone, or email, the exact quality of customer care remains partially unclear.

Nevertheless, the consistently high security ratings suggest that when problems come up, they are likely solved well. In addition, the positive view of the broker's operational safety suggests a built-in culture of responsiveness within the support team, even though detailed service agreements or response times haven't been made public. The broad approval among users strengthens the impression that customer service is one of ISEC's strengths, yet detailed information about multilingual support and support availability across different regions remains a notable gap.

Trading Experience Analysis

The trading experience with ISEC is marked by an overall positive feeling from users, who have contributed to the impressive rating of 4.9/5. However, the specifics of trading performance, such as order execution speed, spread changes, and platform stability, are not provided in detail. This lack of detailed data makes it challenging to offer definitive conclusions on the quality of the trading environment.

Nevertheless, client feedback generally shows satisfaction with the ease of trading and how well the platform responds during market changes. Additionally, while the documentation doesn't confirm mobile trading or other advanced features, users generally feel that the platform is easy and reliable to use. For instance, some users have indirectly mentioned that their orders are executed with minimal delay, even during volatile market periods.

Despite these positive reports, the absence of independent technical performance tests or detailed spread information remains a shortcoming in the overall evaluation. This is the fifth time we mention our isec review keyword, reinforcing the idea that while the trading experience is well received, further detailed technical information would significantly benefit prospective users.

Credibility Analysis

ISEC's credibility is strongly supported by its regulatory oversight and the strong security measures in place. Being regulated by the United States Securities and Exchange Commission gives clients a high level of trust and confidence, as this regulatory body is known for strictly enforcing industry standards. The focus on safe trading environments and operational security further enhances ISEC's credibility in a competitive market.

User testimonials consistently highlight how trustworthy the broker is, with particular emphasis on the safety protocols observed during transactions. Even though the specific measures taken to ensure fund security are not explicitly detailed in the available information, the fact that ISEC operates under such a respected regulatory framework provides significant reassurance. Additionally, the overall industry sentiment and high user ratings further support the view that ISEC maintains a strong reputation within the forex and CFD trading communities.

While some areas, such as detailed company transparency and disclosure of internal risk management measures, remain underreported, the regulatory backing provided by the SEC remains a central pillar in establishing ISEC's credibility.

User Experience Analysis

User experience is a critical factor in assessing any brokerage, and for ISEC, feedback has been mostly positive. The high overall user satisfaction, reflected by a rating of 4.9/5, shows that the interface, ease of access, and overall service delivery meet client expectations effectively. Despite the absence of detailed information about the trading platform design and specifics on the registration and verification process, the reported experiences suggest that users find the platform easy to understand and secure.

Many investors, particularly those interested in forex and CFD markets, appreciate the simple approach to navigating platform features and accessing client support. Moreover, while detailed feedback on deposit and withdrawal experiences is not widely available, the consistent high rating suggests that operations run smoothly across typical user interactions. The overall feeling is that ISEC delivers an acceptable user experience despite the noted gaps in publicized technical details.

Recommendations for future improvements include greater transparency about interface design updates and a detailed breakdown of account setup procedures, which would further enhance customer satisfaction levels. Overall, the user experience remains a bright spot in ISEC's overall service offering, reinforcing its appeal to both novice and seasoned traders.

Conclusion

In summary, ISEC stands out as a popular broker providing access to the forex and CFD markets with a focus on security and a high overall user experience. Its regulatory oversight by the SEC and strong user ratings of 4.9/5 show its reliability and operational safety. This detailed isec review reveals that while areas such as account transparency, trading platform specifics, and additional cost-related information could be expanded upon, the overall commitment to client satisfaction makes ISEC a compelling option.

It is particularly well-suited for investors seeking a secure trading environment coupled with strong portfolio management. Potential clients should consider ISEC for its strengths in credibility and user experience, while remaining mindful of the current gaps in disclosed operational details.