Regarding the legitimacy of LTFX forex brokers, it provides ASIC and WikiBit, .

Is LTFX safe?

Business

License

Is LTFX markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

BTCDANA AUST PTY LTD

Effective Date: Change Record

2004-05-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'TOWER 5 COLLINS SQUARE' L 23 727 COLLINS ST DOCKLANDS VIC 3008Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is LTFX Safe or Scam?

Introduction

LTFX is a forex broker that positions itself within the competitive landscape of online trading platforms. Established in 2017, it aims to cater to traders looking for access to various financial instruments, including forex, commodities, and indices. However, with the rise of fraudulent activities in the forex market, traders must exercise caution when selecting a broker. Evaluating the legitimacy of a trading platform is crucial, as it directly impacts the safety of funds and the overall trading experience. This article investigates whether LTFX is a safe broker or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and more.

To conduct this investigation, we utilized a framework that includes a thorough review of regulatory information, customer feedback, and historical performance. We also analyzed the broker's operational practices and the transparency of its offerings to form a well-rounded perspective on the safety of trading with LTFX.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Regulation ensures that brokers adhere to strict operational standards, which helps to protect traders from potential fraud. In the case of LTFX, the broker claims to operate under the auspices of the Australian Securities and Investments Commission (ASIC). However, scrutiny reveals that LTFX may be a suspicious clone of a licensed entity, raising red flags about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 269820 | Australia | Suspicious Clone |

The lack of a valid regulatory framework raises concerns about LTFX's operations. While ASIC is known for its stringent regulations, the broker's questionable status indicates a high potential risk for traders. Moreover, there have been no significant negative disclosures against LTFX, but the absence of a solid regulatory foundation makes it challenging to trust the broker fully.

Company Background Investigation

LTFX, officially registered as LT Markets Pty Ltd, has been operational for several years. However, the details surrounding its ownership and management team are sparse. The broker's website provides limited information about its leadership, which is a significant concern when assessing transparency. A reputable broker typically discloses information about its founders and management team, including their qualifications and experience in the financial sector.

The company's history indicates that it was established in Australia, but there is little information available regarding its operational practices or any notable milestones achieved since its inception. The lack of transparency regarding ownership and management can lead to distrust among potential customers and raises the question of whether LTFX is genuinely committed to providing a secure trading environment.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for evaluating its overall trustworthiness. LTFX offers various trading instruments, but the costs associated with trading can significantly impact a trader's profitability. The broker utilizes the MetaTrader 4 platform, which is widely recognized but also shows signs of being outdated.

The overall fee structure at LTFX appears to be competitive, but there are some unusual fee policies that warrant attention. For instance, while the broker advertises low spreads, there have been reports of hidden fees that can catch traders off guard.

| Fee Type | LTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The potential for hidden fees combined with an unclear commission structure raises questions about the broker's transparency. Traders should be cautious and thoroughly review the terms and conditions before committing funds.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. LTFX claims to implement various measures to protect customer deposits, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

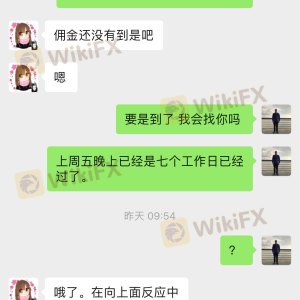

Traders should be aware that the absence of robust regulatory oversight increases the risk associated with fund safety. Historical complaints suggest that some users have experienced difficulties withdrawing their funds, which is a significant red flag. It is essential for traders to investigate any past incidents related to fund security before deciding to trade with LTFX.

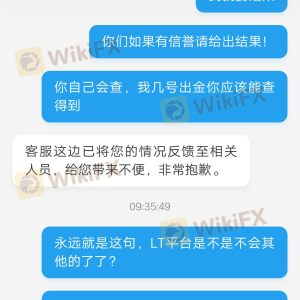

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's credibility. LTFX has received mixed reviews, with some users reporting positive experiences while others express dissatisfaction. Common complaints include difficulty withdrawing funds, unresponsive customer service, and issues with order execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Fair |

For instance, several users have reported that their withdrawal requests went unanswered for weeks, leading to frustration and concerns about the broker's reliability. This pattern of complaints raises significant doubts about whether LTFX is a safe trading option.

Platform and Execution

The trading platform is a critical aspect of the trading experience. LTFX utilizes the widely popular MetaTrader 4 platform, which offers various features and tools for traders. However, user experiences indicate that the platform may suffer from stability issues, including slippage and rejected orders.

The quality of order execution is particularly concerning, as traders expect timely and accurate transactions. Reports of slippage, especially during volatile market conditions, further exacerbate the doubts surrounding LTFX's operational integrity. Additionally, any indications of platform manipulation should be taken seriously, as they can lead to significant financial losses.

Risk Assessment

Trading with LTFX involves several risks that potential clients should be aware of. The combination of regulatory concerns, customer complaints, and platform issues creates an environment of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation |

| Fund Safety Risk | High | Historical complaints |

| Execution Risk | Medium | Reports of slippage |

To mitigate these risks, traders should consider using a demo account to test the platform before committing real funds. Additionally, conducting thorough research and reading customer reviews can provide valuable insights into the broker's reliability.

Conclusion and Recommendations

In conclusion, the investigation into LTFX raises several concerns regarding its legitimacy and safety. The broker's suspicious regulatory status, lack of transparency, and history of customer complaints suggest that traders should approach with caution. While there are no definitive signs of outright fraud, the potential risks associated with trading on this platform cannot be ignored.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of positive customer experiences. Brokers regulated by top-tier authorities, such as ASIC or the FCA, typically offer greater assurances regarding fund safety and operational integrity.

Ultimately, if you are considering trading with LTFX, it is crucial to conduct thorough research and weigh the risks against your trading objectives.

Is LTFX a scam, or is it legit?

The latest exposure and evaluation content of LTFX brokers.

LTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LTFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.